What asset can’t be in a bubble and always has value, regardless of whether inflation is high or civilization is collapsing?

That’s not a riddle. The answer is land.

Land will always have value because we simply cannot live without it. It’s necessary for basic human needs like food and shelter.

When it comes to performance, farmland in the U.S. has outperformed the S&P 500 in the past three decades. Other raw land investments can work just as well or better — if you know how to approach them, what to look for, and where to invest.

So is land a good investment? It certainly can be. In this article, I’ll explain why it’s such a valuable and reliable asset — and guide you through popular investment options, how they work, and what to know before buying land.

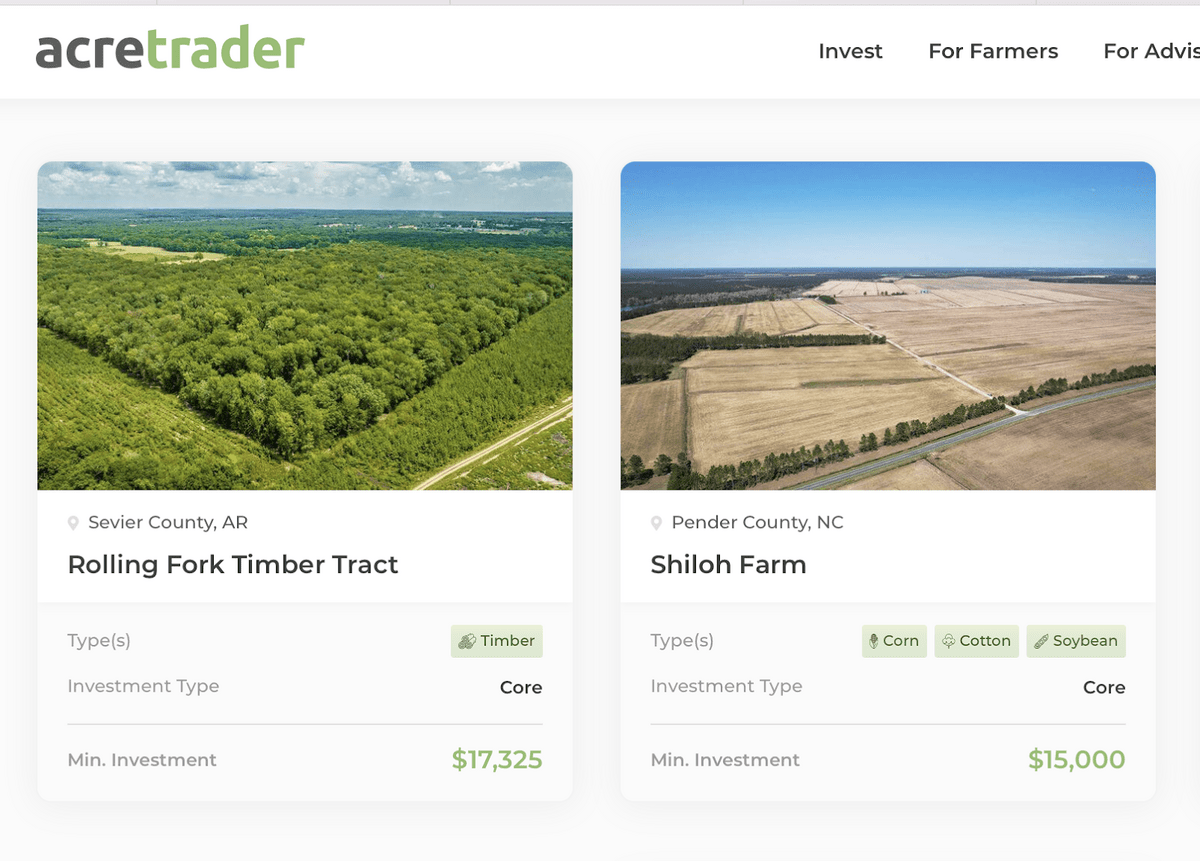

Our top platform for investing in farmland…

Don’t worry. You don’t need to know how to operate a backhoe to invest in farmland. AcreTrader makes it easy for accredited investors to invest in fractional shares of farmland without the hassle of actually owning or operating a farm.

Want to learn more? Check out our AcreTrader review.

What is Raw Land?

Raw land, a.k.a. undeveloped land is simply a plot with nothing on it.

It has not been prepared for building or growing crops. It’s land that hasn’t been given a purpose yet.

As an investment, raw land is dramatically cheaper than developed land. Its value comes from its potential.

Is Buying Land a Good Investment?

So, is land a good investment? It can be — if you correctly gauge its potential.

For instance, if you buy a cheap plot of land and in a few years a construction company wants to make a 10-story building there, you can make a serious profit.

Alternatively, even if you can’t find cheap land in an area that will become more developed in the future, you can find a more common plot of land and use it as a store of value or a place to build something yourself.

Generally speaking, land doesn’t lose value, unless you overpay in the first place or buy something in a completely undesirable area with few buyers.

Want to buy land directly? Don’t make the mistake of buying land that can’t be built on or used for your desired project! Be sure to check the land you’re eyeing in the local cadastre database and consult with an expert in property law before buying.

Why is Land a Good Investment?

Why is land a good investment compared to things like stocks and bonds? Let’s take a look:

There is Limited Supply

The Federal Reserve can’t print up more land! Maybe when we start living in the Metaverse, but not yet.

Valuable land is more limited than you think, and land with construction potential is usually located in or near populated areas. Since cities and towns take decades or centuries to develop, you don’t have to worry about land inflation.

Good agricultural land is also fairly rare. Most of it is in use by farmers and food companies. Therefore, there can and will be more bubbles in debt, stocks, and real estate, but not land itself.

It is a Tangible Asset

Assets like stocks, bonds, and crypto can theoretically be lost in the case of a catastrophe (like a company going bankrupt or the government defaulting on its debt).

Although events like this don’t happen every day, they do happen. With land, you can rest assured that your investment won’t simply disappear.

The Market is Less Competitive

Wall Street folks use trading algorithms to trade stocks, bonds, and such with incredible efficiency. It makes the financial markets super-competitive.

It’s a different story with land. Not every plot is in a constant, endless bidding war (like most products on the stock market).

That means overall, it’s easier to find favorable raw land deals — especially if you’re looking in an area you know well.

Flexibility

With most assets, you only have two options — buy and sell. Not so with land. You can also:

- Build something: If you buy land and build a house, you can price in the work you put into the project and turn a profit by selling later. You can also use what you build.

- Rent it out: Agricultural land can be rented out easily enough. You can also rent out non-agricultural land for public events and other projects.

- Split the land into multiple smaller plots and sell individually: If you have a large plot with construction potential, you can consider splitting it into multiple lots and selling each one to individual contractors or investors. Multiple reasonably-sized plots are usually more valuable than a single large one.

- Give the land construction potential: If the land isn’t ready for construction because it is ruined or lacks infrastructure, you can buy it cheaply, take care of those problems, and increase the land’s value dramatically.

- Make a deal with a construction company: If a company wants to make a building on your land, you can make a deal — for instance, they might give you an apartment or two as payment — after they’ve finished construction.

Types of Land Investments:

1. Farmland

Fertile farmland will always be necessary, and therefore, it will always be valuable.

Considering how quality farmland is becoming more and more scarce due to countless ecological problems we have, it is very reasonable to assume that arable land will become more scarce (and valuable) in the future.

No wonder institutional investors have put serious capital into fertile land over the years — like Bill Gates, who owns more than 270,000 acres of farmland.

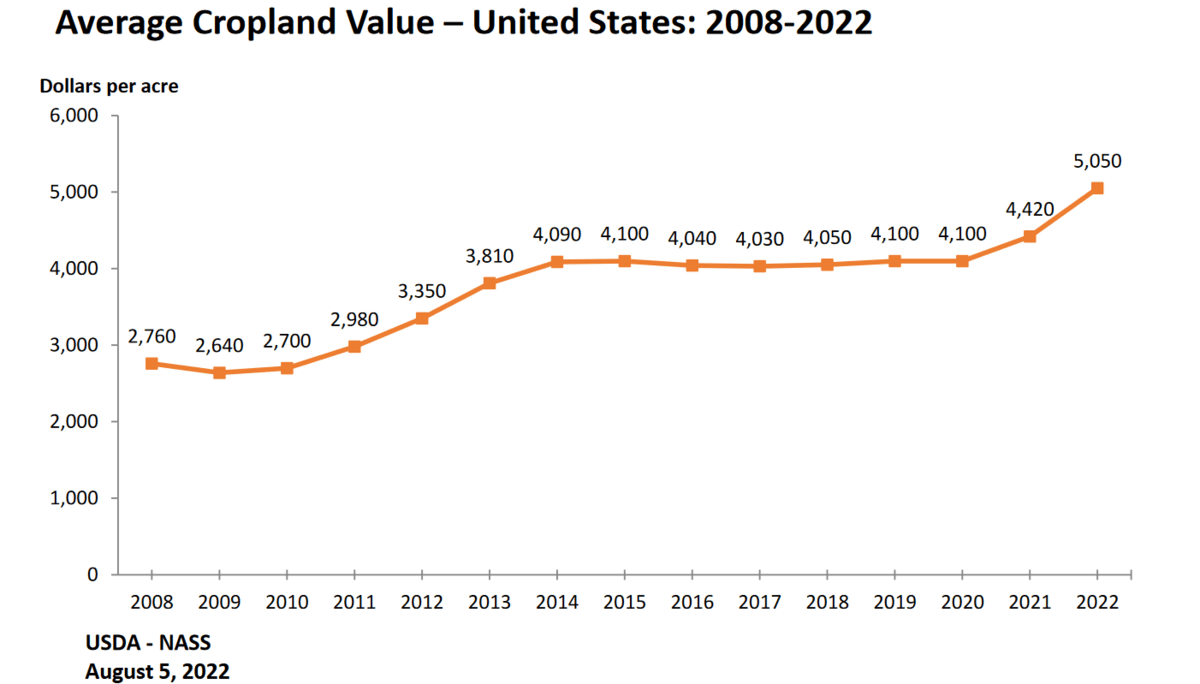

Plus, the value of average cropland has nearly doubled between 2008 and 2022. This is not incredible growth, but arable land almost never depreciates.

But finding farmland is tough, and it can be expensive.

That’s where a service like AcreTrader comes in.

With AcreTrader, accredited investors have the chance to buy a stake in highly-vetted farmland projects at a fraction of the cost of buying land outright.

2. Residential & Commercial Development Land

As long as you don’t mind the potential administrative hassles and waiting to cash in, investing in land suited for construction projects offers many potentially profitable options, such as:

- Land banking: If you buy land in an area that is expected to grow, you can simply wait for investors to come to you without even touching the land. When investing like this, pay attention to future zoning changes and infrastructure projects because they tell you what onstruction projects are coming up.

- Rezoning and entitlement: If you buy land that cannot be used for construction because of zoning rules and other regulations, you can work with the local government to get the permissions you need. This can be a lot of hassle but if you can get the paperwork ready, you can sell the same land afterward for a good profit.

- Repurposing and redeveloping: As cities grow, the suburbs of yesterday may become the downtowns of tomorrow. If you buy land in an area that will be repurposed like this, you can turn a major profit when investors come rolling in.

- All of the above through a fund: To avoid all the hassle and let your capital do all the work, simply invest in a fund where professionals develop major projects for you.

Don’t have the funds to develop land yourself?

Fundrise offers all investors the opportunity to invest in land development through their proprietary eREITs, which pool investor funds to buy and develop land.

Note: We earn a commission for this endorsement of Fundrise.

3. Recreational Land

This includes parks, nature trails, hunting grounds, etc. — land that can be used for recreational activities.

Recreational land is one of the lowest-stress land investments because you don’t need various permissions and administrative work to get it running. The land cannot be developed.

You can use it for campsites, communal gardens, and a hundred other projects. You can either invest in the project yourself or simply rent out the land.

Here are some benefits and drawbacks of investing in recreational land as opposed to farmland and potential construction land:

Pros | Cons |

|---|---|

Alternative revenue streams, such as hunting leases, timber production, or eco-tourism | It is harder to sell recreational land |

Lower entry cost compared to farmland and construction land | Limited income potential |

Potential tax easements via donating the land to governmental nature conservation projects | Very difficult to repurpose due to legal development restrictions |

Very low maintenance costs, if any | Since recreational land is more of a luxury property, it will be even more difficult to sell for a good price in the case of a broad economic downturn |

What are the Risks of Buying Land?

Is owning land a good investment? It has incredible potential — but there are still risks and drawbacks you should be aware of:

Sneaky legal and regulatory issues | Raw land is subject to endless laws and regulations. Checking all your investment ideas with a legal expert before buying is highly advised. |

Access to utilities | The local authorities are your only way to get basic utilities like water and electricity to your land. Make sure to check this before investing. |

Zoning rules | If a plot of land isn’t designated for a particular use by the local government, you will have a hard time changing that. |

Environmental issues | There might be toxic elements like asbestos and radon under the plot, or just underground water that makes construction dangerous. |

Low liquidity | Depending on what you buy, it may be very difficult to find a buyer quickly should you decide to sell. |

What You Should Know Before Buying Land

What to know before buying land in 7 boring but necessary steps:

- Make sure the land is legally OK: Depending on what your plan is, you need to check if the plot is zoned properly, has access to roads and utilities, and if the land is safe to use and build on. Consulting with a legal expert is usually a very good idea if you are new to the market.

- Be ready for a trickier loan process: In the eyes of lenders, raw land isn’t worth as much as a house. So lenders are stricter with their requirements and require a downpayment between 20% to 50% — even if you have a good credit rating.

- Additional and unexpected expenses are guaranteed: As a rule of thumb, all land investors should be prepared for extra expenses due to paperwork, legal advice, and other unexpected costs.

- Factor in taxes: Raw land is subject to property tax, and other taxes come into play if the land is generating cash flow. You need to include this in any financial plans you have.

- Check for easements and subsidies: You can lower your tax burden through various easements that are hard to get a grasp on if you are not a tax expert or an experienced landowner. Be sure to research your options.

- Be ready for potential legal issues: Some sellers aren’t completely honest about everything regarding the plot they are selling. You need to check if there are any legal issues surrounding the purchase, whether other people and neighbors have some sort of a claim to the plot, and if the project you envisioned is possible due to regulations.

- Prepare to wait a long time for your returns: Land generates good returns dependably, but only in long time frames—possibly a few years or more. Plus, it isn’t easy to liquidate so only invest if you are thinking years ahead.

Is Buying Land a Good Investment for You?

As an investment, land isn’t for everyone—especially when there are so many other options. Here are a few general characteristics that every land investor needs:

Risk Tolerance

Land appreciates slowly. It’s not immune to risks. Sometimes, investors need to wait years to make a profit and the very process of selling land can be very drawn-out and complicated compared to other assets.

- If you can hold for a long time and expect the journey that comes before you can turn a meaningful profit, land investing may be for you.

- If you are looking for something that can yield results fairly quickly and doesn’t require a lot of effort, land is probably not for you.

Financial Discipline

Land investments can be challenging. As such, you need to have good financial discipline. Ask yourself…

- Do you have the spare capital to hold the investment as long as needed?

- Do you have the time to keep an eye on your investment and make sure all your taxes are in order?

If you are patient, and meticulous with your finances, the investment is much more likely to pay off.

Research and Due Diligence

Land isn’t cheap, so careful research should come before any investment:

- Is the land legally clean?

- Is it zoned for the use you intend it for?

- Is the land safe to build on or grow crops on?

- Are you aware of all the taxes, legal restrictions, available road access, and public utilities?

These are some of the questions that need to be answered before any purchase. Otherwise, if something doesn’t check out, you may get stuck with a lemon…

Financial Backup and Partners

Land investments can pay off, but typically not quickly.

As a safety measure, make sure you have enough financial backup. If the land investment isn’t working out as expected, you need to have enough money to be safe if your project fails.

Also, entering the deal with a partner or a family member will reduce your individual risk and make this potentially long investment journey much easier to handle—both financially and effort-wise.

Final Word: Is Land a Good Investment?

Land investments can be very lucrative and much less volatile than going into stocks and most other assets.

However, unless you are investing through a fund, you need to be prepared for a lot of research and paperwork — plus, you will likely need to hold the land for a long time before it pays off.

If your finances are in order and you can be patient for the potential payoff, investing in land might be perfect for you.

FAQs:

Is Investing in Land a Good Idea?

Land is valuable because it is necessary for food and shelter and because it is in limited supply. As long as you are prepared to go through the loops associated with land investing (or buy land through a company like AcreTrader or Fundrise) it can be among the safer long-term investments out there.

Is Land a Better Investment than Stocks?

From 1992 to 2020, farmland in the U.S. has had an average annual return of 11% compared to the S&P 500’s 8%. Land is also less volatile, making it a good long-term investment. However, land is much more difficult to sell than stocks, and some stocks have dramatically better growth potential.

Is Land a Good Investment During Inflation?

Yes, but that depends on the type of land. Farmland is always in high demand so inflation will inevitably increase the price of farmland across the board. However, volatile land intended for speculative commercial building projects might be less desirable during high inflation because investors value price stability more during these periods.

Is There a Downside to Buying Land?

There are many downsides to buying land over other, more convenient investments like stocks, bonds, and gold. Buying land is a fairly long and complicated process, plus, it requires a lot of capital and is much more difficult to sell. So, land should be viewed as a very long-term investment as it takes time for it to generate significant returns.

Is now a Good Time to Buy Land?

Over long periods, land always performs well, and often better than the S&P 500—and it generally performs better than stocks during a recession. However, the price of land (especially farmland) in general can heavily depend on other factors such as market cycles and interest rates.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.