There are tons of different ways to invest your money. So many ways, in fact, that it can be overwhelming when trying to decide what you should invest in to maximize your gains and achieve your financial goals. My goal for this article is to make your life a little easier by walking you through the main different types of investments.

I’ll first cover broad categories of investments, like equity investments, fixed-income investments, and cash equivalents, before diving into specific types of investments like stocks, bonds, crypto, and more.

The Bottom Line: Types of Investments

The bottom line is that there are three different broad categories of investments: equity investments, fixed-income investments, and cash and cash equivalents.

From there, each of these categories can be further subdivided. For example, stocks fall under equity investments, bonds under fixed-income investments, and cash is, well, cash.

In the following sections, I’ll go into more detail about specific types of investments and discuss which broad category each falls into.

At-a-Glance: Top Platforms for All Types of Investments

The table below provides a quick look at my favorite platforms for the different types of investments I cover in this article.

Asset | Preferred Platform |

|---|---|

Alternative Assets | |

Stocks | |

ETFs | |

Mutual Funds | |

Bonds | |

CDs | |

High-Yield Savings Accounts | |

Commodities | |

Derivatives (Options) | |

Annuities | N/A |

Retirement Plans | |

Hybrid Investments | |

Crypto |

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

The Three Main Types of Investments

There are many different types of investments out there, but most of them fall into one of three main categories: equity, fixed-income, and cash. Let me briefly walk you through each one before we get into more specific investments in the following sections.

Equity

Equity investments involve owning part of something. The classic example here is owning shares of a company, but you can also have equity in a real estate property or a physical item, like an expensive piece of art or a collectible.

Equity investments make you money when whatever you own shares of increases in value. When you buy shares of a company on the stock market, they cost you whatever the company’s share price is at that moment, times the number of shares you purchase. If the company does well and its share price increases, your shares become more valuable.

The same principle applies to all equity investments. If you own part of a rental property that appreciates in value, your investment is worth more than it was before. If you sell your shares to another partner or a new investor, you make money.

For many years, the key types of equity available to most retail investors were stocks and real estate. However, pioneering platforms are working to change that. Now, investors can gain access to worlds of equity that had previously been reserved for the deepest of pockets though fractional investing. You can invest in fine art through Masterworks, fine wine through Vinovest, and more. Keep reading to learn about some of the best investment platforms out there.

Fixed-Income

Fixed-income investments are different from equity investments because the money you make doesn’t depend on the asset’s performance. Bonds are the classic fixed income since they pay you a fixed rate on a fixed schedule, no matter what. Even though the price of the bond may fluctuate, the yield it returns on maturity is locked in when you buy the bond.

Bonds and other fixed-income investments are much safer than equity investments since you know how much money you’ll make at maturity from the beginning. This makes bonds extremely popular in retirement portfolios since it’s easier to manage living expenses when you know exactly how much money you’ll have.

Cash or Cash Equivalents

Experienced investors often say that cash is a position, and it’s true! Deciding to have some of your money in cash — or a cash equivalent like a money market account, short-term bond, or short-term CD — is a great way to ensure that you have money available when a great buying opportunity comes around. It’s also a great risk-free investment since CDs and money market accounts are FDIC-insured.

Many new investors overlook cash as an investment and try to allocate 100% of their portfolio to either stocks or bonds, which is generally a mistake. I like to think about cash as an investment in future opportunities, whatever they may be.

If you’re interested in CD investing, we strongly recommend CIT Bank.

13 Types of Investments to Explore in 2025

Here’s a closer look at 13 specific types of investments to consider in 2025.

1. Alternative Assets

My definition of alternative assets is anything that isn’t stocks, bonds, or commodities, but many people use slightly different definitions. Here’s a list of all the best alternative investments.

In this article, I’m focusing on alternative investments in the form of high-value individual items, like collectibles and artwork. High-end artwork is an excellent investment, but not many people have millions of dollars sitting around that they can spend on a painting.

How you potentially earn money: Alternative assets are a form of equity investment, so you earn money when the item you own appreciates in value.

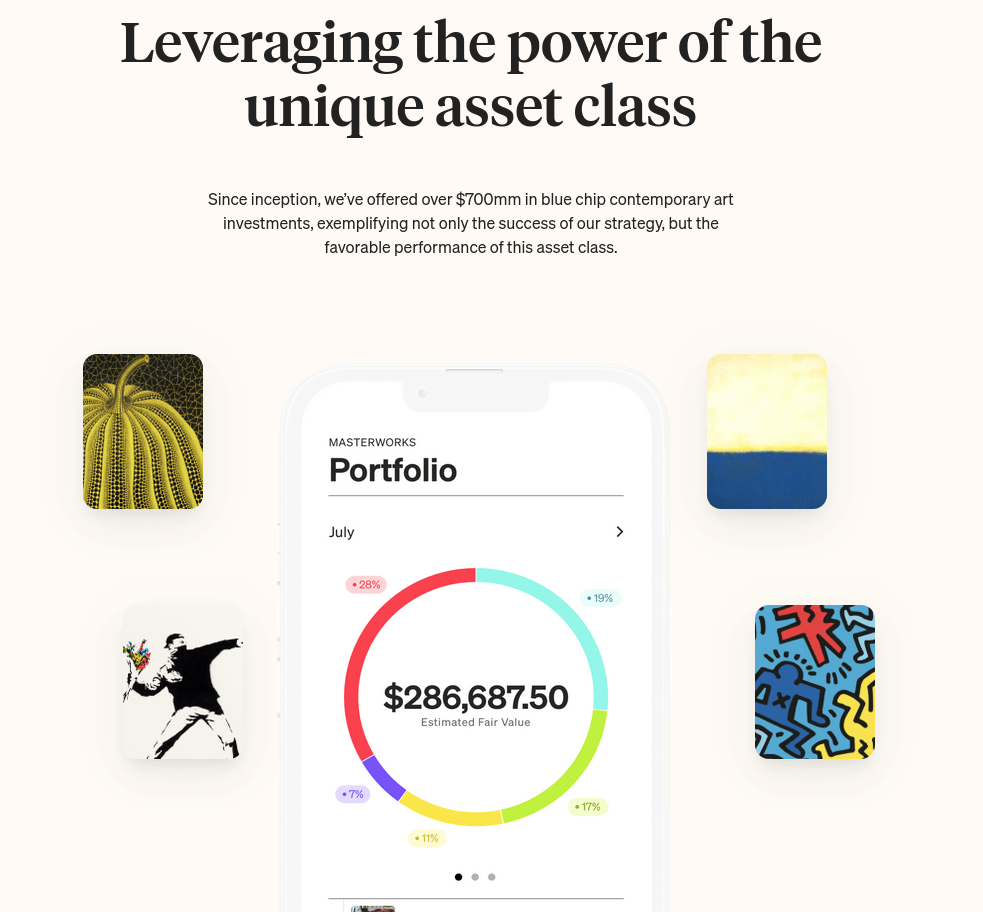

How to invest: If you ask me, one of the best ways to invest in alternative assets is through Masterworks, a platform that lets you buy and sell fractional shares of artwork.

Masterworks makes buying shares of expensive artwork simple.

The interface is clean and intuitive, and the number of alternative asset investments the company offers is impressive, as are the returns — their $1 billion collection includes works by greats like Banksy, Picasso, and Basquiat. In just the last few years, its investors have realized annualized net returns of 17.8%, 21.5%, 35%, and more from these opportunities.

If you want to add some uncorrelated assets to your portfolio, I highly recommend checking out Masterworks.

2. Stocks

Buying stocks gives you shares of a publicly traded company, making you a part-owner of the company with a tiny share of the company’s overall profits. Stocks are an equity investment.

How you potentially earn money: The main way you earn money through stocks is by eventually selling your shares when their price goes up. Some stocks also pay dividends, which are small payments that a company makes to all shareholders, typically on a quarterly basis.

How to invest: You can invest in stocks through an online broker that processes your buy and sell orders and passes them on to an exchange, like the New York Stock Exchange (NYSE). Moomoo is one of my favorite online brokers and the one I recommend to most new investors.

Right now is a great time to check out moomoo, because they’ve got a terrific offer — you can get up to 30 FREE stocks if you set up a qualifying account.

But you should stick around for more after you get that promo. moomoo offers $0 commissions on US stocks, ETFs, and options, which makes it a great place to get into equity investing since you can buy and sell most assets without incurring fees for every transaction. The company also offers free Level 2 data, which lets you visualize the order book and see what positions other investors are considering.

moomoo also gives you access to international stocks from Hong Kong markets. Opening a moomoo account doesn’t require a minimum balance, and there also isn’t a trade minimum, so you can take it as slowly as you like while you learn the ropes.

Sign up for moomoo using any of the links in this article and get up to 60 free stocks, potentially valued up to $2,000 each.

PLUS, you’ll also get an 8.1% limited-time APY on idle cash and a transfer-in bonus of up to $300. Don’t miss out on these rewards.

But don’t delay — this offer is only for a limited time.

3. ETFs

What they are: Exchange Traded Funds (ETFs) are collections of stocks that you can buy and sell as if they were individual stocks, making it easy to diversify your stock investments without buying a whole bunch of single stocks. Some ETFs track subsections of the stock market, like healthcare or renewable energy, while others track entire indexes, like the S&P 500 and the Nasdaq.

How you potentially earn money: Earning money through ETF investing works much the same way as earning money through investing in single stocks. The price of an ETF is set by some weighted average of the stocks that make up the fund. As the underlying stocks that comprise the ETF appreciate, the price of the ETF goes up, and you make money.

How to invest: moomoo is also my preferred broker for ETFs.

All of the advantages of moomoo I discussed in the previous section on stocks also apply to ETFs: no commissions, no account minimums, and no trade minimums. If you’re looking for a low-cost, easy way to try out ETF investing, moomoo is the best option, in my opinion.

4. Mutual Funds

Mutual funds are investment vehicles that pool together money from many investors to purchase a diversified portfolio of securities, such as stocks, bonds, or short-term debt. Each investor in the mutual fund owns shares, which represent a portion of the holdings of the fund. Mutual funds are typically managed by professional portfolio managers who make investment decisions based on the fund’s stated objectives, such as growth, income, or preservation of capital.

How you potentially earn money: Mutual funds work exactly like ETFs when it comes to how you make money. When the group of assets that make up the mutual fund collectively increases in value, the weighted average that determines the price of the mutual fund also increases. You earn money equal to the number of shares of the mutual fund you own, times its price increase.

How to invest: Many online brokers offer mutual funds, but Interactive Brokers is my favorite place for mutual fund investing.

Interactive Brokers gives you access to tons of mutual funds from some of the best financial institutions in the business. You can access products from Allianz, BlackRock, Fidelity, Invesco, Vanguard, and tons of other companies from one convenient account.

5. Bonds

When you invest in bonds, you are buying debt from some institution, like a government or company. Bonds typically have a rate that determines how much you earn for a given investment and a term that specifies how long you have to hold the bond before you get paid.

How you potentially earn money: Bonds make investors money through earned-interest payments called coupon payments. These payments are typically made a few times per year, and the total amount you earn in a given year is equal to the rate specified for the bond. Corporate bonds are riskier than government bonds but tend to come with higher rates.

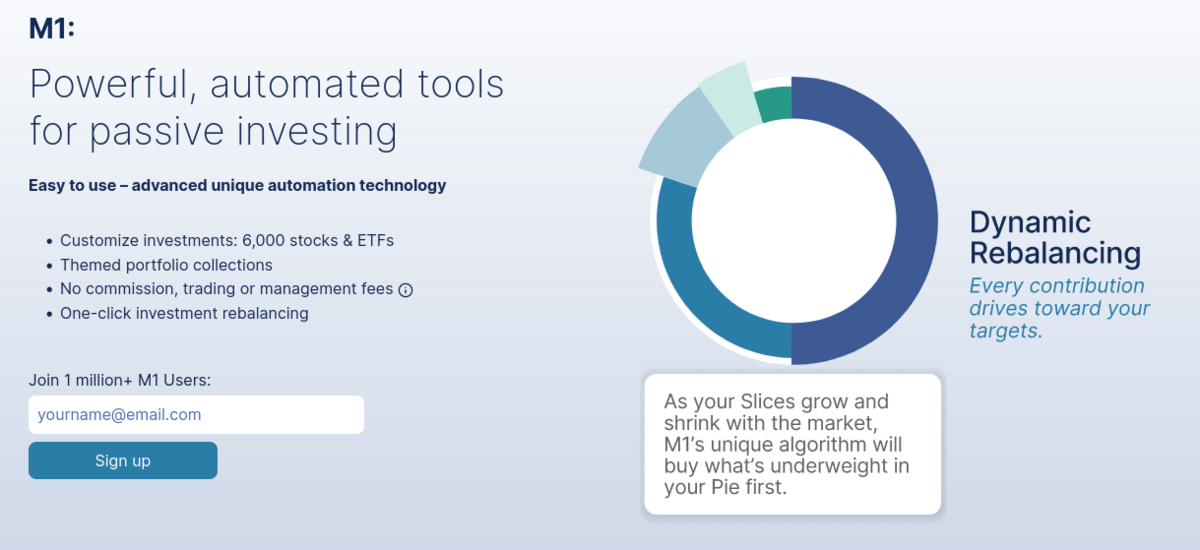

How to invest: The easiest way to invest in bonds is by purchasing shares of a bond fund through an online broker like M1 Finance. Bond funds are automatically diversified, so you don’t have to worry about manually selecting bonds with a variety of yields and maturity dates.

M1 Finance is a great platform for getting into bond investing through bond funds. It has a super convenient mobile app that makes it easy to keep track of your bond investments and tons of more advanced tools you can use as you gain experience.

6. CDs

Certificates of deposit (CDs) are essentially loans you give to a bank or credit union in exchange for interest. They offer fixed returns and typically lock your money up for some fixed amount of time.

How you potentially earn money: CDs earn you a fixed amount of interest over the course of the CDs’ term. When interest rates are high, you can earn 4–5% with zero risk, which makes CDs a great option for saving money for big purchases. CDs come with fixed terms. You can find CDs with terms as short as one month up to two or even five years in some cases.

How to invest: I like CIT Bank for CD investing. It has competitive rates with a range of terms to choose from, and its penalties for early withdrawal are reasonable.

CIT Bank offers the highest rates I’ve seen from any bank, and it has tons of different terms to choose from and low minimums.

7. High-Yield Savings Accounts

High-Yield Savings Accounts (HYSAs) are just like ordinary savings accounts, except they have much higher rates, usually around 3–5%.

How you potentially earn money: As long as you leave your money in the account, you earn money. HYSAs are FDIC-insured, so you can earn interest on up to $250,000 without taking on any risk whatsoever.

How to invest: I recommend Empower’s HYSAs since it has higher rates than many other options and a user-friendly platform that makes it easy to keep track of your money.

Empower offers one of the best HYSAs I’ve seen, with high rates, no account minimums, and no maintenance fees.

Plus, while you’re on the site, you should check out Empower’s FREE dashboard, which has a bunch of amazing tools like a budget planner, investment checkup calculator, and more to help you keep your financial goals in check.

8. Commodities

Commodities are raw materials and agricultural products like oil, natural gas, gold, silver, livestock, and wheat.

How you potentially earn money: The price of commodities fluctuates as supply and demand change, which gives investors an opportunity to make money by buying a commodity when its price is low and selling it when it’s high — which is easier said than done, of course.

How to invest: Commodity investing is not as easy as other forms of investing. Most retail traders invest in commodities indirectly through buying shares of a commodity ETF. If you want to purchase precious metals directly, however, you can use a site like Silver Gold Bull.

Silver Gold Bull is the best place to buy precious metal commodities like gold and silver online. It offers storage services for people who don’t want to have piles of gold in their homes, like Scrooge McDuck. The company also lets you buy gold or silver and hold it in an individual retirement account (IRA), which is not easy to do in an ordinary IRA.

Interested in exploring more gold and gold IRA companies? Here are some of our other favorites:

9. Derivatives (Options)

Derivatives are financial instruments that derive their value from the value of other securities. Options are by far the most popular type of derivative. Options are a contract between a buyer and seller for a transaction that will happen in the future. Options contracts give the person who buys them the right to purchase shares of a stock or fund at a certain price. Critically, someone who holds an options contract isn’t required to buy the stocks at the given date; they just can if they choose to.

How you potentially earn money: Options are more complicated than stocks, and a full treatment of how you make money with options is way beyond the scope of this article. Options (usually) increase in value when the price of the underlying asset goes up, but they also increase in value during times of high volatility.

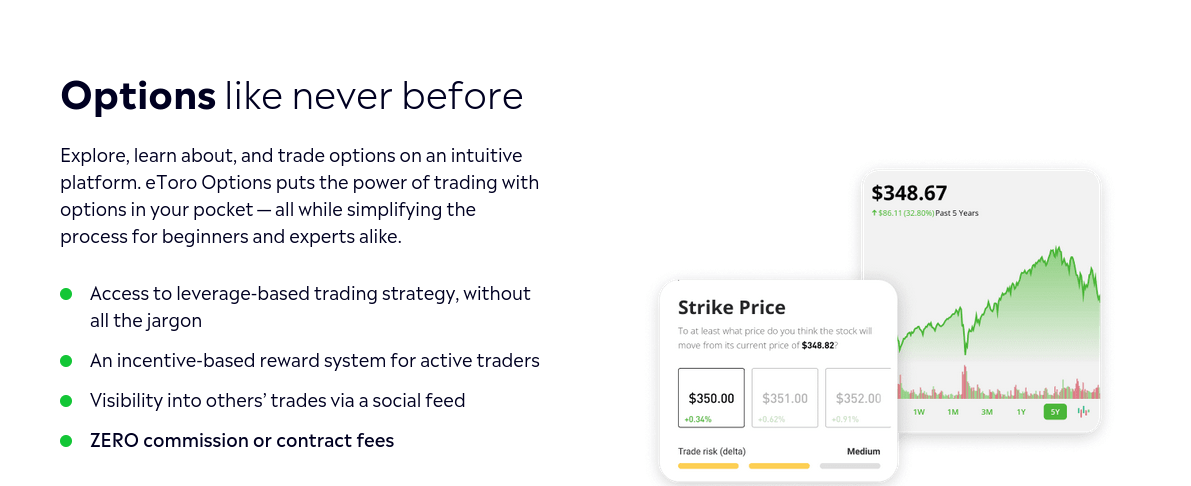

How to invest: My go-to platform suggestion for people looking to get into options investing is eToro.

eToro’s options trading is great for beginners because it comes with a simplified platform that makes it easier for new options traders to wrap their heads around how options work. The broker also doesn’t charge you commissions for options trades and it doesn’t have any hidden contract fees.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

10. Annuities

Annuities are insurance products that exchange money now for a steady stream of income in the future. Many people use annuities in retirement to convert a large lump sum of money into guaranteed cash flow.

How you potentially earn money: Annuities are kind of like bonds in that they’re a form of guaranteed, fixed income. The main difference is that the money is coming from an insurance company instead of another type of business or a government.

How to invest: Investing in annuities usually happens through insurance companies, but some brokerage firms and mutual fund providers also offer access to them.

Before you invest in an annuity, you need to decide what type of annuity you want. The first choice you need to make is whether you want a fixed annuity — which pays you periodically at a fixed rate in exchange for a lump sum payment — or a deferred annuity — which charges you premiums in exchange for payments at a later date. Which is right for you depends on your investment goals, with both options having their advantages and disadvantages.

If you’re interested in investing in annuities and already have a brokerage account, ask someone from your brokerage what they recommend. There’s a chance that your brokerage offers annuities, which makes your life much easier.

11. Retirement Plans

Retirement plans like IRAs and 401ks are tax-advantaged accounts that you can use to save money for retirement. Traditional retirement accounts defer taxes until you withdraw the money in retirement, which means you pay taxes on the gains. Roth retirement account contributions are post-tax, which means your money grows tax-free, and you don’t have to pay taxes when you withdraw the money.

How you potentially earn money: Earning money in a retirement account is just like earning money in any investment account. Your investment grows as the assets you include in your portfolio appreciate in value.

How to invest: There are tons of brokerages that offer retirement accounts, but Empower is my favorite.

Empower has all the tools you need to plan your retirement. It has an outstanding retirement planner tool that helps you figure out which of its accounts work best for you and what your contributions need to be in order to have financial security when you stop working. Empower’s Premier IRAs are great for people who want one of Empower’s retirement experts to manage their account, but the company also offers an ordinary self-run brokerage IRA for more seasoned investors.

12. Hybrid Investments

Hybrid investments are a — ahem — hybrid between stocks and bonds with some of the characteristics of each. There are many different types of hybrid investments, but they typically offer part ownership in some company or property, like a stock, along with some type of debt-related fixed-income stream, like a bond. Common types of hybrid investments are preferred stocks, REITs, and custom-built structured products like principal-protected notes.

How you potentially earn money: You earn money with hybrid investments when the asset increases in value but also on a fixed schedule determined at the time of purchase.

How to invest: Some hybrid investments are more complicated and require a significant amount of capital to invest in, but others are offered through most online brokerage firms. REITs and preferred stock are easily accessed by retail investors through most major brokerages.

I recommend looking into REITs if you want an easy introduction to hybrid investments. They’re traded on exchanges just like ETFs and are much simpler to wrap your head around than other types of hybrid investments. If you have a financial advisor, you could also consider asking them about preferred stock.

Interested in REIT investing? moomoo offers some of the top REITs in all sectors, ranging from industrial to hospitality to storage and beyond.

13. Crypto

Cryptocurrencies are unique digital currencies that are protected by cryptography. They’re a way to make global payments without having to exchange money with a government, although they’re primarily used for speculation and inflation hedging.

How you potentially earn money: Earning money in crypto works exactly the same way as earning money in the stock market. When you buy cryptocurrency “stocks,” which are called tokens or coins, you pay the market value. If the price of the tokens you purchase increases, you can sell your coins for a profit.

How to invest: There are plenty of dedicated cryptocurrency platforms out there, but I prefer using eToro for simplicity and security.

eToro’s crypto support is excellent. You can invest in all of the major coins, like Bitcoin, Ethereum, Cardano, Solana, and more. You can also practice with a $100,000 paper money account until you feel comfortable putting real money on the line.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Final Word:

There you have it! Thirteen of the most common types of investments you’ll encounter in the wild. I hope you learned some things and have a better idea of how you might diversify your portfolio beyond just buying a total market index fund. Investing in art through Masterworks is a great way to get an uncorrelated asset into your portfolio, as is including a dash of crypto if you’re feeling adventurous.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation of a security or to engage in any investment strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results. U.S. residents trading in U.S. securities may trade commission-free using the moomoo app through Moomoo Financial Inc. (MFI). Please see our pricing page for other fees. Level 2 data is free to moomoo users that have an approved MFI brokerage account. Trading during Extended Hours Trading Sessions carries unique risks, such as greater price volatility, lower liquidity, wider bid/ask spreads, and less market visibility, and may not be appropriate for all investors.

FAQs:

What are the 10 types of investments?

The ten main types of investments are stocks, bonds, ETFs, mutual funds, commodities, CDs, HYSAs, derivatives like options, annuities, and cryptocurrencies. Some people might include different types of investments, but these are the ten most common types of investments and represent most of what the average person will invest in throughout their lifetime.

What are the 3 main investment categories?

The three main investment categories are equity investments (like stocks and ETFs), fixed-income investments (like bonds), and cash and cash equivalents (like cash and money market accounts).

What are the 4 types of investment markets?

There are four types of investment markets: capital markets, commodity markets, money markets, and foreign exchange markets. Capital markets are for trading assets like stocks and bonds. Commodity markets are for trading raw materials like oil and gold. Money markets are for short-term debt vehicles like treasury bills, and Foreign Exchange markets are for exchanging currencies.

What are the 6 classifications of investments?

There are six main classifications of investments: equity, fixed-income, money market instruments, real assets, alternative investments, and derivatives.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.