Warren Buffett famously said, “Make money while you sleep or work until you die.” It sounds harsh, but it’s true. Passive income is the holy grail of investing. You need to stop trading your time for money if you want to become wealthy, and the way to do that is through passive income investments.

Passive income is all about making money without continuously expending effort. There are various degrees of passive income, with some requiring more effort upfront than others.

But they all share the common characteristic that once everything is set up, you don’t have to do much to reap the benefits.

In this article, I’m going to cover what I believe are some of the best passive income investments. These passive income investment ideas cover a range of risk-reward profiles, so you should be able to find one that suits your investment goals.

At-a-Glance: Best Passive Income Investments

Investment | How Passive? | Suggested Platform |

|---|---|---|

Dividend Stocks | ⭐⭐⭐⭐⭐ | |

Fractional Real Estate | ⭐⭐⭐⭐⭐ | |

REITs | ⭐⭐⭐⭐⭐ | |

Invest in Businesses | ⭐⭐⭐⭐ | |

High-Yield Savings Account | ⭐⭐⭐⭐⭐ | |

Recurring Investments | ⭐⭐⭐ | |

Spare Change | ⭐⭐⭐⭐ | |

Government Bonds | ⭐⭐⭐⭐ | |

Rent out Your Stuff | ⭐ | |

Peer-to-Peer Lending | ⭐⭐⭐ | |

Lend/Stake Cryptocurrency | ⭐⭐⭐⭐⭐ | |

Invest in Businesses | ⭐⭐⭐⭐ | |

Create a Course | ⭐⭐⭐⭐⭐ (after it’s created) | |

Invest in alternative assets | ⭐⭐⭐⭐⭐ |

Note: We earn a commission for this endorsement of Fundrise.

1. Dividend Stocks

How passive? ⭐⭐⭐⭐⭐

Dividend stocks are one of the purest passive income assets because they require almost zero effort on your part besides buying the stock.

Most dividend stocks pay investors a fixed amount per share quarterly, so you get predictable recurring income above and beyond any appreciation gains you get when the stock price increases.

There are tons of dividend stocks out there for you to choose from. My favorite way to research dividend stocks to find good investment opportunities is to use Wallstreetzen’s stock screener to filter by companies that offer dividend yields.

Once you find a few dividend stocks you’re interested in, you can use a retail-friendly broker like moomoo to buy and sell shares.

I like moomoo because its user interface is easy to use but still high-powered enough to keep track of your investments. Plus, its intro special is second to none — you can get up to 30 free stocks when you sign up, and an 8.1% APY on uninvested cash for a limited time. (Terms and conditions apply — get the offer here.)

The platform also gives you access to dividend ETFs and lets you mirror the investment strategies of investors you believe are making the right calls, so you can achieve passive income here more easily than you can on many other platforms.

2. Rental Income

How passive? ⭐⭐ as a property owner; ⭐⭐⭐⭐⭐ for fractional ownership

Rental income is passive until it’s not. When your tenants don’t need anything, rental income is truly passive.

But when something goes wrong and needs repairing, managing a rental property can quickly turn into a headache. One way to avoid the hassle of owning your own rental property is to use a crowdfunding platform like Yieldstreet or Arrived.

Arrived is one of the best ways to make passive income through real estate for non-accredited investors. The platform lets you buy shares of an income-generating property the same way you buy shares of a company on the stock market.

The learning curve is very shallow, and it’s a great place for beginners to start.

Want to learn more? Check out our Arrived (formerly Arrived Homes) review.

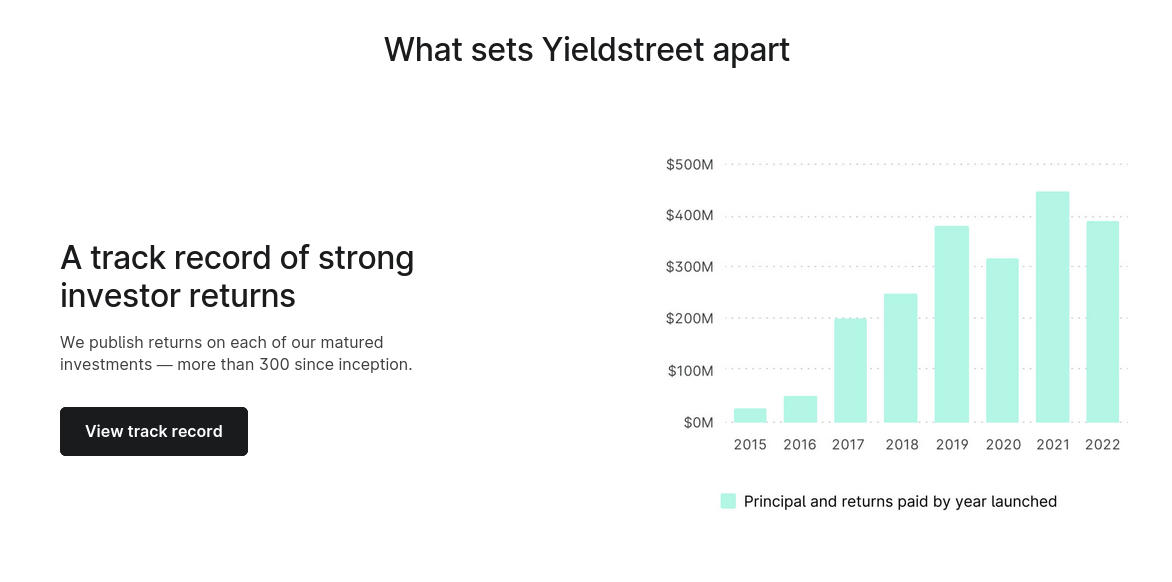

Yieldstreet is a better way to invest in private real estate projects. It’s only available to accredited investors, although the company does offer the YieldStreet Prism Fund for non-accredited investors.

Regardless of how you invest on the platform, it provides access to tons of unique private real estate investment opportunities you can’t get anywhere else.

3. REITs

How passive? ⭐⭐⭐⭐⭐

If owning your own rental property is too much work, and you’re not interested in crowdfunded real estate, Real Estate Investment Trusts (REITs) might be right up your alley.

REITs are traded on public exchanges just like index funds and sector funds, so buying them is as easy as buying stocks.

You can purchase a whole host of REITs through moomoo.

If you want to do your own research, Wallstreetzen has tools to help you compare different REITs and choose the one that’s best for you.

4. Invest in Pre-IPO Companies

You can become an investor in private companies like Stripe, Discord, and Databricks.

Hiive gives accredited investors access to hundreds of high-growth, VC-backed startups. By funding employee stock options, investors like you can gain exposure to private companies at past valuations. In exchange for funding the options, you will receive a percentage of future proceeds from successful liquidity events.

Start investing in private companies on Hiive.

How passive? ⭐⭐⭐⭐

Hiive is a potentially good way to become an investor in private companies like Groq, Tekion, and Waymo.

Hiive gives accredited investors access to thousands of high-growth, VC-backed startups. By buying shares from employees, venture capital firms, or angel investors, accredited investors can own stakes in private companies.

In addition to Hiive, there are a few online brokers who invest in pre-IPO companies and will sell them to their customers as a perk for having an account with them. Not all brokers invest in private companies, and the ones that do won’t provide access to every new IPO.

Here are a few brokers that provide access to pre-IPO stocks:

-

- TradeStation (my #1 choice)

- Fidelity

- TD Ameritrade

5. Open a High-Yield Savings Account

How passive? ⭐⭐⭐⭐⭐

One of the best investments for passive income you can make is opening a high-yield savings account (HYSA).

When interest rates are high — like they are now — HYSAs are one of the best ways to make passive income because they are virtually risk-free. Most HYSAs are FDIC-insured, up to $250,000.

I recommend checking out CIT Bank, which offers some of the highest HYSA rates available, at over 4%. They also offer a 5% return on their 6-month CD accounts, which have a $1,000 minimum investment.

6. Set Up Recurring Investments

How passive? ⭐⭐⭐

Setting up recurring investments is one of my favorite passive income investment ideas. It’s not as passive as an HYSA since you’ll need to periodically reassess your allocation to make sure your portfolio is performing as expected, but it requires much less maintenance than actively managing your investments.

Fundrise has an auto-invest feature that lets you automatically dollar cost average into your positions. You can schedule payments on a weekly, bi-weekly, or monthly basis.

The money you invest automatically gets allocated to the investment plan you choose when you sign up with Fundrise, so you don’t need to do anything to make sure your recurring investments get allocated to the right assets.

Fundrise has a bunch of different investment types to choose from, including real estate and private credit investments.

If you’re looking for passive income and diversification beyond your traditional stock portfolio, Fundrise can help you kill two birds with one stone.

Note: We earn a commission for this endorsement of Fundrise.

7. Invest Your Spare Change

How passive? ⭐⭐⭐⭐

Consider rounding up your everyday purchases to invest your spare change. It’s effortless, and if you stick with it for several years, chance are you’ll have built an impressive investment account.

With Acorns, you can link all of your debit and credit cards. After every purchase, you can set aside a few dollars or cents to invest in high-quality ETFs. You’ll also start earning dividend income right away.

Acorns is one of the most creative, powerful ways you can start earning passive income today.

8. Buy Government Bonds

How passive? ⭐⭐⭐⭐

Another one of the best passive income investments is U.S. government bonds. Treasury notes and bonds return fixed yields when they mature, so you don’t have to do anything once you choose which terms you want. Bond yields fluctuate with interest rates but historically return between 2% and 5%.

The interest you earn on government bonds is paid semi-annually, and it is truly passive income; you don’t have to lift a finger once you purchase the bond.

You can buy government bonds using Public as a broker, or you can purchase them through TreasuryDirect. In either case, the process is easy, and keeping track of your bond investments is straightforward.

Some people prefer to invest in bond funds through their regular brokerage account, so you can also ask your investment broker how you can go about buying T-bills.

9. Rent Out Your Stuff

How passive? ⭐

A less common way to generate passive income is to rent out some of your stuff. Most people don’t realize that property rentals aren’t the only way to make passive income.

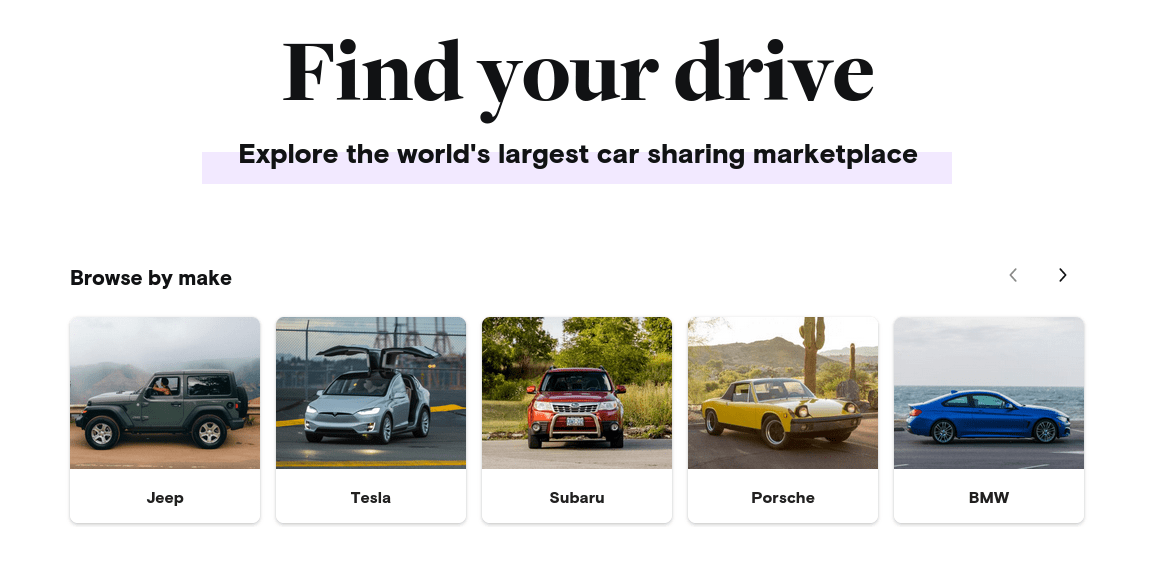

Apps like Turo let you rent your car out when you’re not using it, which is easier to manage and more flexible than renting a property on Airbnb or through a local real estate marketplace.

Renting your car through Turo is not the most passive form of passive income since you need to organize the rental with the person renting your car.

You need to keep track of pickups and dropoffs and make sure your car is clean and well-maintained. Still, if you don’t use your car all the time, renting it out to travelers is a great way to earn some extra cash on the side.

More interested in investing in Turo than renting out your car through the service? Check out our article on How to Buy Turo Stock.

10. Peer-to-Peer Lending

How passive? ⭐⭐⭐

Peer-to-peer lending is one of the best investments for passive income because it has higher returns than other options without requiring more work. It’s not unusual for a portfolio of peer-to-peer loans to accrue 10% or more per year.

Yieldstreet gives you access to peer-to-peer lending through its online platform. Unfortunately, Yieldstreet is only open to accredited investors, so you might not be eligible.

What’s an accredited investor — and what are the best investments for accredited investors? Click the link to find out more.

Peer-to-peer lending is moderately hands-off, but some products have relatively short terms, which means you’ll have to spend more time selecting new investments than you would with something like a government bond.

11. Lend or Stake Cryptocurrencies

How passive? ⭐⭐⭐⭐⭐

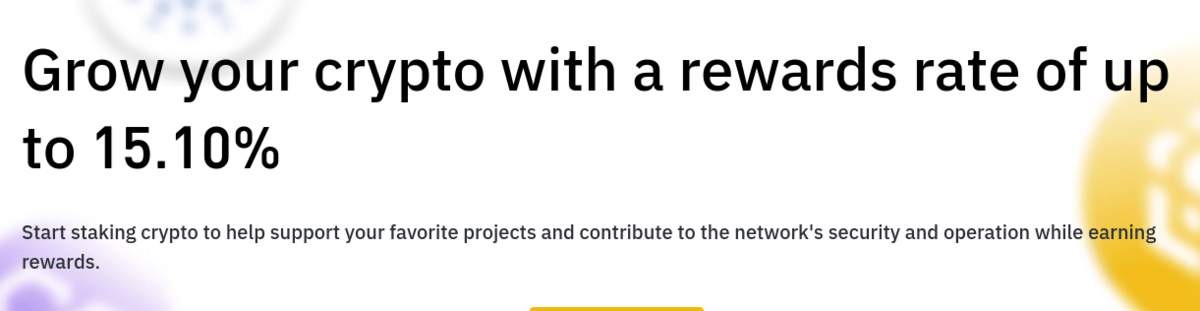

Cryptocurrencies that allow staking are some of the best passive income assets you can invest in. Staking rewards have much higher returns than even the highest-return HYSAs, often reaching 10–15% or higher.

Staking earns you guaranteed APY on your crypto in addition to whatever appreciation you get from price changes, so it’s a great way to add some stability and predictability to your crypto portfolio.

Not all cryptocurrencies can be staked or lent, and not all crypto platforms allow staking. I recommend Binance if you’re interested in staking because the company offers a wide range of different tokens with different rewards.

You can use the platform to stake a variety of coins with different risk-reward profiles to create a balanced portfolio designed for steady income.

12. Create a Course

How passive? ⭐ during creation / ⭐⭐⭐⭐⭐ after it’s done

Creating an online course can generate a lot of passive income, but it requires a ton of upfront work. The best online courses generate hundreds of thousands to millions of dollars for their creators, but the amount of work they require to make is staggering.

Once the course is made, however, you don’t have to do anything to reap the rewards.

Posting a course on an online learning platform like Skillshare exposes your course to millions of people worldwide, giving you the reach you need to generate serious passive income.

I recommend going with an established company like Skillshare rather than trying to sell a course yourself on your own website.

Keep in mind that some types of courses are less passive than others. Fields like web development and programming evolve quickly, so you’ll have to intermittently update your course’s material to stay relevant and continue generating income.

13. Invest in Alternative Assets

How passive? ⭐⭐⭐⭐⭐

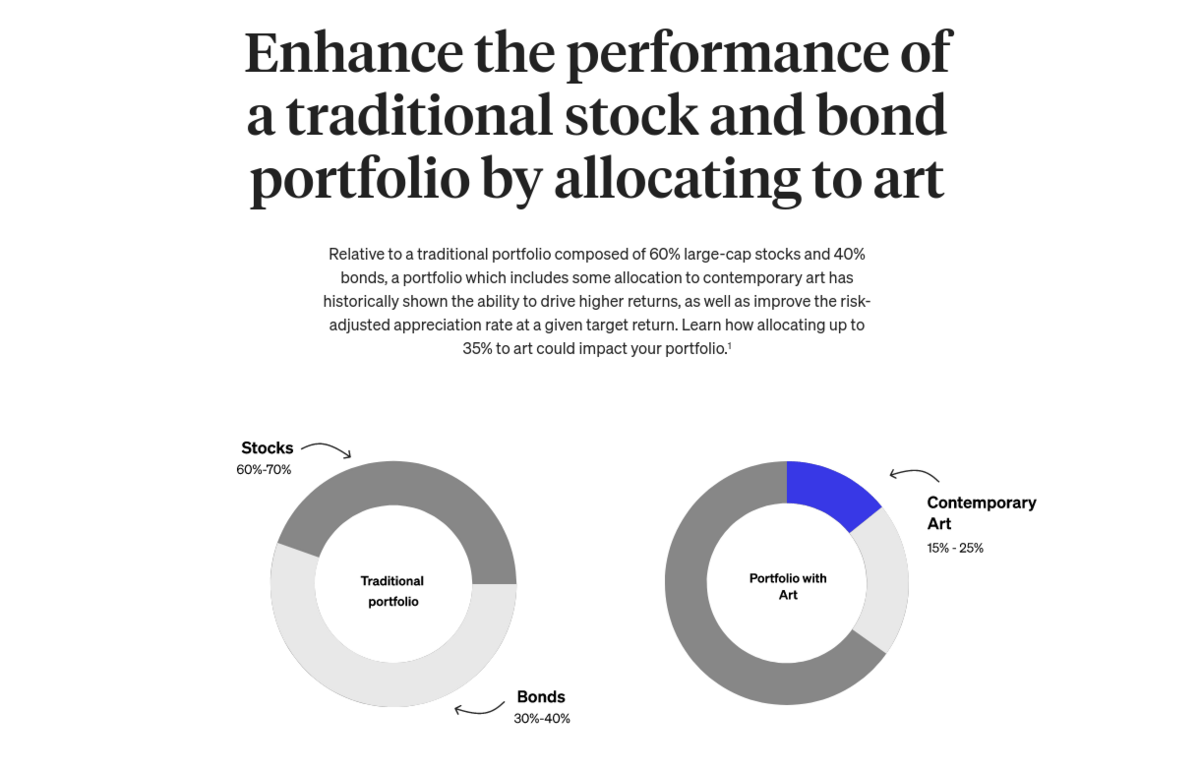

Let’s end with a fun one: alternative assets. Most people think of dividend stocks or rental properties when they think of passive income assets, but alternative investments like fine art and collectibles are also some of the best passive income investments.

Now, I know what you’re thinking: I can’t afford a $10M piece of art. Neither can I, but platforms like Masterworks make investing in fancy artwork as easy as stock investing.

You buy shares of expensive pieces of art on Masterworks. When the piece appreciates, you make money proportional to the number of shares you own. It’s that easy.

Besides being one of the best passive income investment ideas, investing in art through Masterworks also helps diversify your portfolio.

Final Word:

Generating passive income isn’t as complicated as most people think. Tried and true options like dividend stocks and REITs form a good basis for a passive income investment portfolio, but there are other options you should be aware of.

Crowdfunding real estate investments are far more passive than managing your own rental property, and private equity investing offers more upside than investing in public companies despite requiring the same amount of work.

If you want something unique that can still generate passive income, consider investing in art through Masterworks. Another unique option is to create an online course and host it on Skillshare, but that takes a lot of work upfront, so it’s not the best option if you want to start generating passive income as soon as possible.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How can I make $1000 a month in passive income?

Making $1,000 a month in passive income will require a sizable investment. I recommend spreading your investment out between dividend stocks, real estate crowdfunding projects, and peer-to-peer lending. By mixing several different passive income sources, you’re more likely to earn a consistent amount each month. Assuming an average return of between 5% and 10% annually, you will need to invest $120,000–$240,000 to reach $1,000 monthly returns.

How to make $5,000 a month passively?

Making $5,000 per month passively will require a sizable investment of around $600,000, assuming a modest return of 5% annually from typical sources like dividend stocks and REITs. You could, however, generate $5,000 with less starting capital if you invest in assets with higher returns, like cryptocurrencies, fine art, and private businesses.

How can I make $2000 a month in passive income?

You can make $2,000 a month on approximately $250,000 by investing it in dividend stocks, REITs, and HYSAs. In high-interest rate environments, HYSAs offer steady returns between 3% and 5%, on average. Dividend stocks and REITs have potentially higher returns, but they can also lose money, so you should diversify your investments and consider including less common assets like artwork or peer-to-peer lending.

How to earn $1,000 a month investing?

Investing in individual stocks — especially dividend stocks with a reinvestment plan — is an excellent way to reach $1,000 a month. Index funds have lower returns than individual stocks but offer greater stability since they track a diversified basket of stocks.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.

![10 Investments That Earn A High Return [10% ROI or more]](https://www.wallstreetzen.com/blog/wp-content/uploads/2022/10/10-Investments-That-Earn-A-High-Return-10-ROI-or-more-scaled-e1666197396945.jpg)