Tekion is not publicly traded.

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies like Tekion who want to sell their shares.

Sign up with Hiive here and get access to Tekion before its IPO.

Tesla (NASDAQ: TSLA) is an undeniable force in today’s auto industry.

Oh yeah, and it hasn’t been a shabby long-term investment.

So when investors catch wind of a tech company focused on automobiles and with a former Tesla exec at the helm, many are chomping at the bit to throw money at it.

Tekion is the company in question, and it may provide investors with an intriguing way into the automotive sector — that is, if they know how to invest in Tekion stock.

Learn what all the “Tekion talk” is about and how to buy Tekion stock, for accredited investors through Hiive as well as options for retail investors.

What is Tekion?

Tekion wants to make buying and selling cars a breeze with its end-to-end cloud platform.

This California tech company has its roots in 2016 when Jay Vijayan took his experience as Chief Information Officer at Tesla and poured it into Tekion’s tech.

Vijayan incorporated the latest in AI and machine learning to make his software even smarter when handling tasks like inventory management, CRM, and service and parts.

Auto dealerships quickly took notice of the benefits Tekion brought to the table, and the company achieved unicorn status in 2020 with a $1 billion valuation.

More recent funding rounds suggest Tekion is closer to a $4 billion valuation, and companies as large as Hyundai have a significant stake in the brand.

Can You Buy Tekion Stock? Is Tekion Publicly Traded?

With such an impressive history, many investors are dying to know how to buy Tekion stock.

Here’s the bad news: Tekion stock isn’t currently available on the stock market because it’s a private company.

However, just because Tekion is private doesn’t mean all hope is lost for investors.

How to Buy Tekion as an Accredited Investor

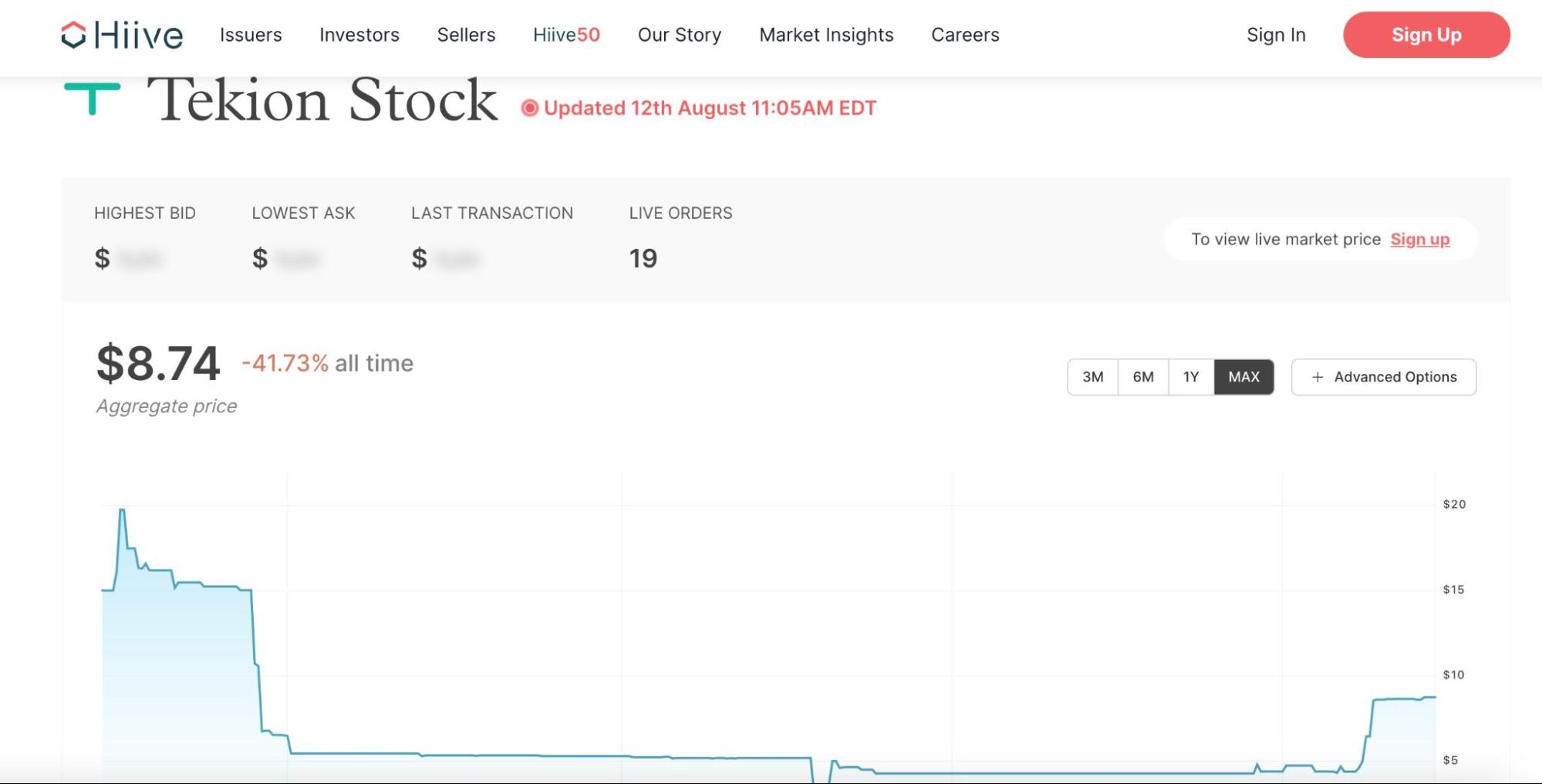

Tekion is not publicly traded, but accredited investors can invest in private companies — including Tekion — through Hiive.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares to accredited investors.

With no buying fees, the ability to negotiate, and a robust marketplace with thousands of companies, Hiive is a great way to invest in companies before they IPO.

Currently, there are 18 listings for Tekion on Hiive:

Sign up with Hiive, check out Tekion, add it to your watchlist, and get notified about any new listings and trades.

How to Buy Tekion as a Retail Investor

Retail investors who know about Tekion may look for the Tekion stock symbol on their favorite brokerage.

Alas, there’s no Tekion ticker at this time.

Because Tekion is private, the only people with Tekion stock are employees, VC firms, and accredited investors.

Retail investors looking to learn how to invest in Tekion need to find public companies that may offer indirect exposure. But to understand where to look, we need to cover a few basics, such as…

Who Owns Tekion?

We don’t know the complete breakdown of Tekion stock ownership because this company is private. Therefore, figuring out who “owns” Tekion is pure speculation.

However, CEO Jay Vijayan most likely has a lot of Tekion stock in his portfolio because, well, he created the company.

Along with other executives and employees, we know some of the biggest firms and companies that invested in Tekion.

Hyundai Motor Company, Durable Capital Partners, and Dragoneer Investment Group are big names with significant amounts of Tekion stock.

Does Hyundai Own Tekion?

As one of the crown jewels of the South Korean economy, Hyundai is one of the largest companies investing in Tekion stock.

Starting in 2021, Hyundai formed a strategic partnership with Tekion, pouring $9.5 million into the cloud company.

While this hefty deal gave Hyundai a big stake in Tekion, it doesn’t mean Hyundai owns Tekion.

Since Tekion is privately held, we don’t know how much Tekion stock Hyundai holds, but it’s not in control of this Cali company.

Alternatives to Tekion for Retail Investors

Retail investors who want Tekion stock can’t trade this cloud company just yet.

Unless Tekion announces an IPO, there won’t be a Tekion stock price chart soon.

However, there are a few ways to get close to Tekion by looking for alternative investments.

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

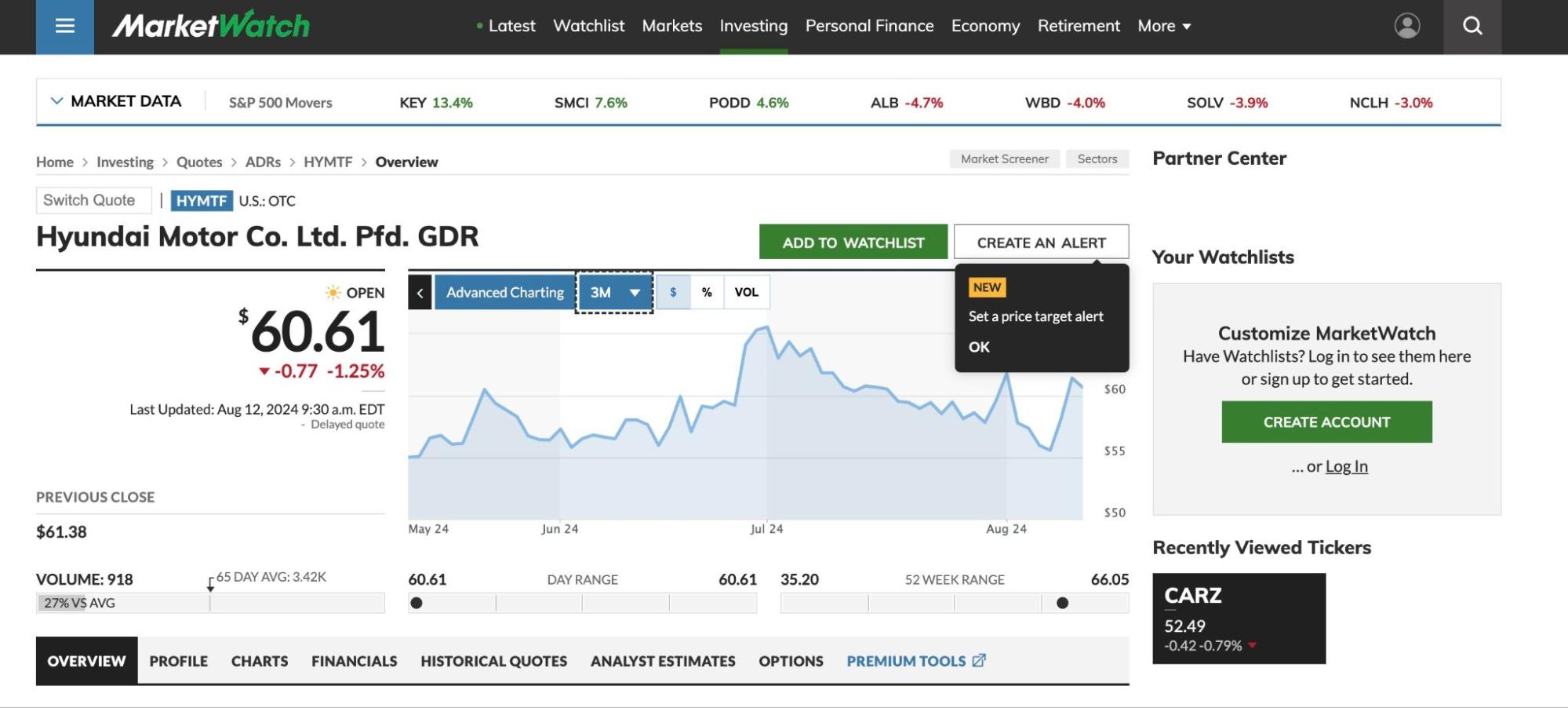

Considering Hyundai has a significant stake in Tekion, it would make the most sense to buy some Hyundai stock, right?

While it’s true Hyundai investors get Tekion exposure, it takes more work for American investors to buy Hyundai stock.

Because Hyundai is on the Korean Stock Exchange, you’ll need to deal with headaches like foreign fees, lower liquidity, and the OTC markets to get HYMTF shares.

It’s much simpler for US-based investors to consider American automotive stocks simply because they’re easier to access.

True, manufacturers like Ford (NYSE: F) and General Motors (NYSE: GM) don’t have the same stake in Tekion stock, but these dealerships play a role in its cloud ecosystem.

Another idea: Why not explore Tesla (NASDAQ: TSLA)?

Since Jay Vijayan used to work at Tesla (NASDAQ: TSLA), he has connections at the company, which opens the door for potential synergies.

Also, Tesla (NASDAQ: TSLA) is another automaker that could benefit from integrating with Tekion’s technology, potentially becoming a big part of its cloud platform.

Aside from automakers, retailers like AutoNation (NYSE: AN), Carvana (NYSE: CVNA), and CarMax (NYSE: KMX) also offer ways to enter Tekion’s niche.

How to Buy the Tekion IPO

Tekion’s CEO Jay Vijayan has gone on record saying he’s interested in an IPO.

Unfortunately, we don’t have any more details on when Tekion stock might hit the public market.

In case Tekion ever goes IPO, here are the basic steps on how to buy Tekion stock:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Tekion

- Select how many shares you want to buy

- Place your order

- Monitor your trade

Tekion Stock Price Chart

You can’t look at a Tekion stock price chart yet because it’s not a publicly-listed company.

However, you can see the current aggregate price for Tekion* on the pre-IPO platform Hiive.

Otherwise, you could track ETFs monitoring the auto industry or solo companies like Ford (NYSE: F), AutoNation (NYSE: AN), and General Motors (NYSE: GM).

Watching this data could give you a sense of the car retail market and guess how Tekion would fare in this environment.

Conclusion

Tekion is a part of the wave of digitization spreading in the automotive industry, and it has already reached a multi-billion-dollar valuation.

For retail investors who want to get in on the ground floor, there’s no direct way to buy Tekion stock.

Only accredited investors can purchase Tekion stock on the pre-IPO platform Hiive.

On a positive note, Jay Vijayan hasn’t ruled out an IPO, so retail investors might one day see the Tekion stock symbol on their favorite trading platform.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How can I buy Tekion stock?

There's no way for retail investors to buy Tekion stock because this company is private. Only accredited investors on the Hiive platform have access to pre-IPO shares of Tekion.

How much is Tekion stock?

There's no Tekion stock price chart, and there's no way to know what each share is worth on the public market.

What is the Tekion stock symbol?

A Tekion stock symbol doesn't exist yet because Tekion is a private company. You'll only see a Tekion stock symbol if the company goes IPO.

Who owns Tekion stock?

Founder and CEO Jay Vijayan likely holds the largest share of Tekion stock, but we can only say for sure once it goes public. Other prominent investors, like Hyundai, Durable Capital Partners, and Dragoneer Investment Group, also likely hold a large percentage of Tekion stock.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.