Overall rating: 4.5/5

Why we gave it this rating: Empower is reliable, offers flexible options for a variety of different investing styles, and offers a variety of great tools for investors. Plus, it offers lower fees than many other IRA and wealth management accounts (for proof, see our Fisher Investments review).

But while Empower earns high marks for its user-friendly platform and reputation as the second-largest 401k provider, the push toward higher-fee mutual funds can be a downside for some users who choose to go with the Premier service or use an advisor.

Below, I’ll cover its standout features, potential drawbacks, and customer reviews to help you decide if Empower is the right partner for your retirement planning. Let’s get to it…

Have you tried Empower‘s FREE dashboard?

If you want to see what Empower has to offer before opening a retirement account, I strongly recommend trying out its FREE dashboard.

Empower’s free dashboard allows you to track your finances and portfolio in a user-friendly format, giving you a bird’s eye view of everything from your current budgeting to your total net worth and even forecast your retirement, education, and savings goals.

It also gives you access to a variety of great financial calculators. I’m a huge fan of Empower’s free retirement planner calculator – its free to use and is helpful for understanding how your investment choices now can impact your investment in 10, 20, 30 or more years. Try it here.

What is Empower?

Empower is one of the largest and most established financial services companies in the United States. They specialize in retirement solutions like 401k management, traditional and Roth IRAs, and wealth management services.

While the modern Empower brand was officially launched in 2014, its origins trace back to 1891, when its parent company was founded as an insurance firm on the Canadian prairie. The legacy highlights over 130 years of experience in financial services.

So if you’re wondering “is Empower Retirement legit?” The answer is yes. They’ve been around a long time.

Plus, Empower is the second-largest retirement plan provider in the U.S., offering tailored tools and services for individuals, small businesses, and corporations. It serves more than 17 million individual customers and supports over 69,000 organizations, managing a staggering $1.4 trillion in assets.

Empower Retirement Services

Empower is also one of the biggest names in retirement planning, offering tools and accounts to help people save for the future.

Whether you’re new to investing or already confident in managing your money, Empower’s retirement services are designed to give you flexibility, tax advantages, and expert guidance when you need it.

Let’s continue our Empower review by taking a closer look at some of their offerings and answer common questions.

Does Empower Offer Roth or Traditional IRAs?

Empower lets you choose between Roth IRAs and Traditional IRAs, so you can pick the option that fits your tax strategy:

If you’re not familiar with the differences, here’s quick overview:

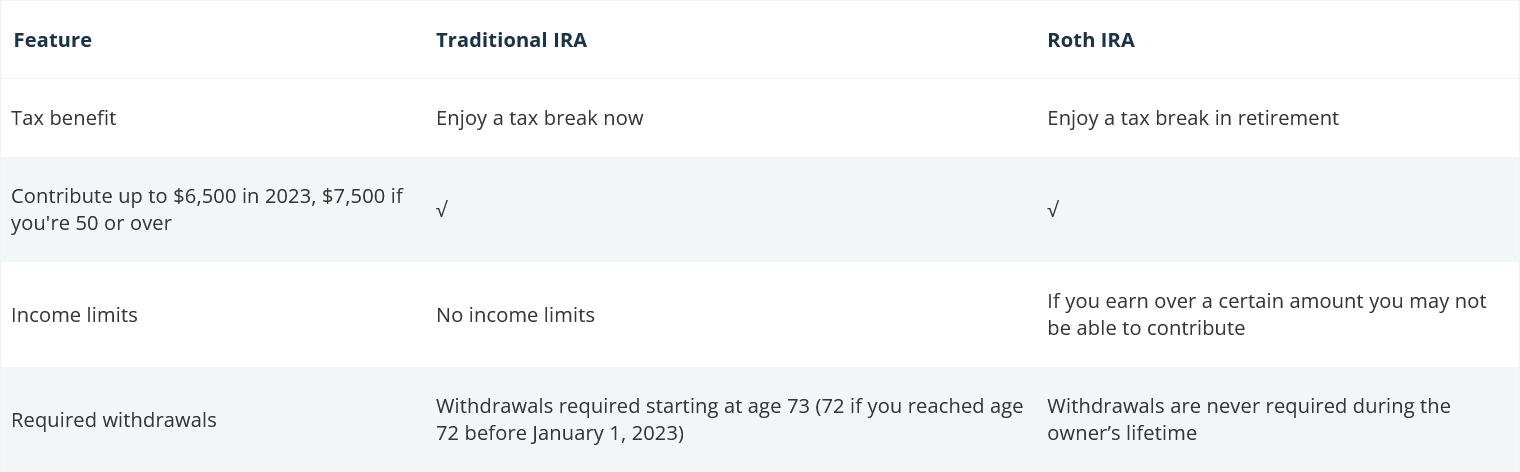

- Traditional IRA: This is all about saving on taxes now. You might be able to deduct contributions from your taxable income, and your money grows tax-deferred. You’ll pay taxes later when you withdraw funds, usually after age 59½, and required withdrawals kick in at age 73.

- Roth IRA: This works the other way around. You contribute after-tax money, but the payoff is that your withdrawals in retirement are completely tax-free. Plus, Roth IRAs have no mandatory withdrawals, so you can let your savings keep growing.

Both accounts have a yearly contribution limit of $7,000 (or $7,500 if you’re 50 or older) as of 2024, but Roth IRAs have income limits, so higher earners might not qualify.

Once you’ve decided whether to go with Roth or Traditional (or if you already have one or the other) there’s one more choice to make if you want to invest with Empower Retirement: Empower’s Premier IRA, or a Brokerage IRA?

Here are the differences.

Empower Premier IRA

The Empower Premier IRA is like a retirement toolkit with professional advice built in.

It’s great if you want some guidance but still like having control over your investments.

- Who’s it for? It works well for people who either want to manage their accounts with some advice on the side or want a completely hands-off experience with professional management.

- What can you invest in? You’ll get access to over 130 mutual funds, giving you plenty of options to match your goals. Plus exchange traded funds (ETFs), individual equities and fixed-income securities.

- Need help? You can work with Empower advisors or try their “My Total Retirement™” option, where pros handle everything for you (it even comes with a 90-day trial).

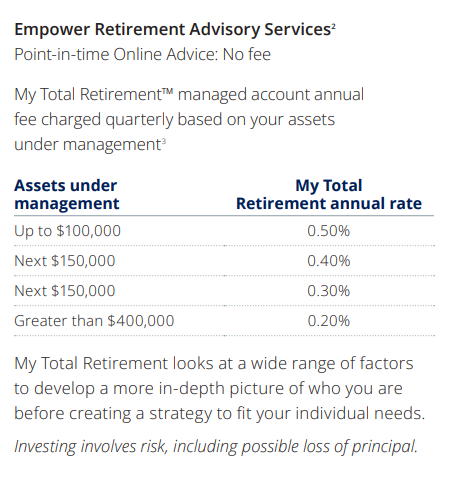

- What does it cost? There are no setup or transaction fees, and mutual fund trades are commission-free. However, there are tiered AUM (assets under management) fees. See more below.

- Bonus features: They throw in online tools and planning resources to help you track your goals.

If you’re looking for a low-cost, straightforward way to save for retirement while having access to expert help, this could be a great fit.

However, make sure you’re clear on how the fee structure works:

Empower Premier charges Asset Under Management fees which get cheaper as your investment account grows.

For example, you’ll pay an annual 0.5% fee on up to $100,000. That means if you had an account of exactly $100,000, you’d pay $500 annually.

If you prefer to work with a financial advisor, or even to take a completely hands-off approach, this is one of the most cost-effective options I’ve seen. Compare it to Edward Jones, for example, where annual fees start at 0.89% for up to the first million dollars invested.

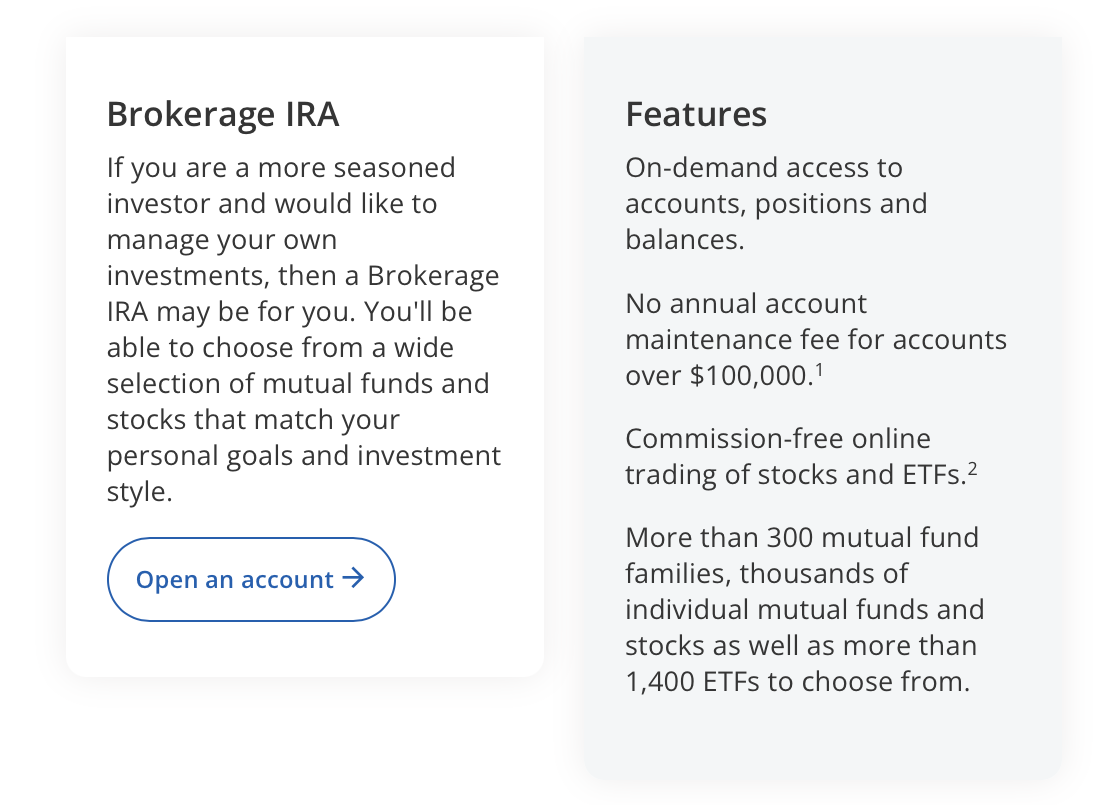

Brokerage IRA

The Empower Brokerage IRA is all about flexibility and independence. If you like being in the driver’s seat and have experience picking investments, this might be your go-to account.

- Who’s it for? Seasoned investors who are confident in making their own decisions.

- What can you invest in? Pretty much everything: thousands of mutual funds, stocks, ETFs, and bonds. You even get access to over 1,400 ETFs with commission-free trading.

- Need help? There’s no professional management here—this is a DIY account all the way.

- What does it cost? No maintenance fee if your account balance is over $100,000. Less than $100,000, and you’ll pay a $35 annual maintenance fee. Also, the first 1,000 trades of the year are free, but it’s $6.95 per trade after that.

- Bonus features: Powerful tools and resources to manage your portfolio, plus the option to work with a financial planner if you want to.

The Brokerage IRA is perfect for experienced investors who want access to a wide range of investment choices without being tied to a professional manager.

Bottom line? If you prefer working with a financial advisor, go with Empower Premier. If you prefer a self-directed approach with no AUM fees, go with the regular Brokerage IRA.

Note: 1,000 free trades a year may sound like a lot, but that can add up quickly. If you’re a trader, I recommend opening an account elsewhere. Empower is better-suited for long term investors.

Empower is a powerhouse in the investment and retirement planning spheres.

But here’s what you might not know: Empower also offers a “Personal Cash” portal where you can earn 4.2% APY on savings without minimums or fees.

Empower also has aggregate FDIC insurance of up to $5 million — so, you can rest assured that your funds are safe.

What About Empower 401ks?

No Empower review would be complete without mentioning that the company is also one of the biggest players in the 401k space, second only to Fidelity in terms of scale in the United States.

As of 2024, the Empower manages retirement plans for over 69,000 organizations and millions of participants, making it a go-to option for both employers and employees looking for comprehensive retirement solutions.

Empower’s focus is on offering flexible, user-friendly retirement plans that can be customized to meet the needs of companies of all sizes.

Accessing Your Empower 401k

Empower provides an intuitive online platform and mobile app where employees can log in to manage their 401k accounts. Participants can view their account balances, adjust contribution levels, change investment allocations, and track performance—all with just a few clicks.

For added convenience, Empower’s customer service team is available for support if needed.

Is Empower a Good Retirement Plan Provider?

Empower’s 401k plans stand out for their robust investment options, which include mutual funds, target-date funds, and other asset classes. The plans also offer educational resources, planning tools, and access to financial advisors, making it easier for participants to make informed decisions about their retirement savings.

Empower also supports employers with administrative tools to streamline plan management.

Cashing Out or Rolling Over a 401k

If you’ve left your job or need to access funds, Empower allows participants to roll over their 401k to another retirement account or withdraw funds directly.

Keep in mind that early withdrawals (before age 59½) are typically subject to taxes and penalties unless you qualify for specific exemptions.

Empower’s website and support team can guide you through the process if you decide to roll over your 401k into an IRA or another employer-sponsored plan.

Who Uses Empower for Their Retirement Plans?

Empower works with a wide range of businesses, from small startups to large corporations. Companies across industries choose Empower because of its ability to tailor plans to meet specific needs while offering top-tier resources for employees.

According to 6sense, large organizations from the University Of Colorado Boulder to the Chicago Transit Authority use Empower.

In short, Empower 401k plans are a solid option for individuals and employers alike. They provide flexibility, a variety of investment choices, and tools to help participants stay on track toward their financial goals, all supported by a user-friendly platform.

Empower Retirement Reviews: What Do Customers Say?

Empower Retirement reviews are generally positive.

Many participants on Reddit highlight a seamless experience, with comments like, “My very big company has been using them for the last few years. They are one of the top 2 or 3 administrators of 401k plans. Web site seems decent. Never had any issues.”

Others note that Empower’s platform is easy to navigate, and they haven’t encountered significant problems with account management or accessing their retirement funds.

However, not all reviews are entirely glowing. Some users mention that Empower’s advisors or services may steer participants toward higher-fee mutual funds. This is especially the case in Empower 401k reviews.

This upselling of high fee mutual funds is common in the financial services industry, but can be easily avoided. One could avoid these fees by simply insisting on low-cost ETFs or utilizing self-directed investment accounts, like Empower’s Brokerage IRA.

Is Empower a Good Company?

Still wondering “is Empower a good company?” or asking “is Empower Retirement legit?”

The answer is yes, Empower is a good and legit company.

Empower Retirement is one of the most trusted names in the retirement world, and it’s easy to see why:

- They manage over $1.4 trillion in assets

- They serve more than 17 million people

- They’re the second-largest 401k provider in the U.S.

- They’ve gained the trust of some of the biggest companies out there

Overall, Empower is a legit company with a long history, strong reputation, and solid tools for managing retirement and investments.

If you’re looking for a reliable platform to grow your nest egg, Empower has a lot to offer, but it’s always smart to know your options and fees before diving in.

Another nice thing about Empower is they do offer other services and tools besides their retirement programs. So it’s possible to try their user interface and services via their budgeting app or cash management tools.

Just look into a good Empower budget app review or Empower personal cash review, and go from there.

Empower: Necessary Details

Account minimum | $100K (wealth management) / $0 for FREE dashboard |

Fees | $100,000 to $1 million: 0.89% First $3 million: 0.79% Next $2 million: 0.69% Next $5 million: 0.59% Over $10 million: 0.49% |

Financial advisor available? | Yes:$100,000 to $250,000: Work with the team of advisors $250,000 and up: 2 dedicated financial advisors |

Available assets | Mostly ETFs, but also stocks, bonds, REITs, gold, commodities, and private equity |

APY on cash balances | 4.2% through Empower Personal Cash |

Ability to customize portfolio? | Yes |

Customer support? | Phone and email |

Tax-loss harvesting? | Yes |

Mobile App? | Yes – Android and IOS |

Final Word:

Overall, Empower Retirement is widely regarded as a reliable and established retirement account broker and advisor.

It can be a great choice for several people, whether you’re looking for a completely hands-off approach to retirement investing, want to consult a financial advisor occasionally, or prefer to be more hands-on and avoid management fees.

Empower is not a great choice if you’re looking to trade many stocks actively, as you’ll start paying a fee after 1000 trades.

Overall, though: if you prefer simplicity, Empower’s tools and resources provide an accessible way to stay on top of retirement savings, with minimal complaints about its overall functionality and support.

I hope you’ve enjoyed this Empower app review!

Click here to explore Empower Retirement.

FAQs:

Is Empower a good company?

Empower is widely regarded as a good company, as reflected in numerous positive Empower Retirement reviews that highlight its reliability, user-friendly tools, and flexible investment options.

As the second-largest retirement plan provider in the U.S., Empower’s comprehensive services and long history of serving customers make it a trusted choice for retirement savings.

What do negative Empower retirement reviews say?

A negative Empower Retirement review will often focus on issues like high fees for mutual funds or perceived pressure from advisors to opt into costly investment options.

However, these Empower Retirement complaints can be avoided by choosing low-fee ETFs or utilizing self-directed investment options.

Is Empower a good IRA company?

Empower stands out as a solid option for IRA accounts, offering both Roth and Traditional IRAs with no account minimum and a range of investment tools.

An Empower Retirement review will often praise its Premier IRA for providing access to advisors, while its Brokerage IRA appeals to experienced, hands-on investors.

Does Empower have high fees?

Empower’s fees are competitive for wealth management but can feel high in certain areas, as some Empower 401k reviews and Empower retirement complaints highlight the cost of actively managed mutual funds.

However, fees can be minimized by opting for ETFs or self-directed investment choices, as noted in a typical Empower app review.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.