With tax-free growth, the ability to access your principal investment at any time, and tax-free withdrawals at retirement, the Roth IRA is a cornerstone of a well-planned retirement.

But while the Roth IRA is a great retirement account, it is not an investment itself.

The Roth IRA lets you invest on a tax-free basis, but you still need to pick the investments inside the account. From stocks, to bonds, to ETFs, to crypto, there’s a wide range of investments to choose from.

Want to know the best Roth IRA investment strategy?

We’ll break down the best Roth IRA investments, how risky they are, who they are best for, and where to open a Roth IRA.

At-a-Glance: Best Roth IRA Investments in 2025

The bottom line:

Investment type | Risk level (1-5) | Minimums + fees | Who it’s best for | Suggested platform |

|---|---|---|---|---|

Stocks | 4 | No minimum, $0 fees | Long-term investors | |

Bonds / Fixed Income | 2 | Varies | Low-risk investors | |

Crypto | 5 | 0.1% to 3% | High-risk investors / Speculative investing | |

ETFs | 3 to 5 | Price of one ETF share | Diversified investors | |

Mutual Funds | 3 to 4 | $1,000 minimum, 0% to 3% fees | Actively Managed Investing | |

Real Estate | 4 to 5 | $10 minimum, fees vary | Real Estate Investors | |

Gold | 4 to 5 | Varies | Alternative Asset Investors |

Note: We earn a commission for this endorsement of Fundrise.

1. Stocks – Best for Long-Term Investors

- Risk level: 4

- Minimums + fees: No minimums, $0 fees

- Who it’s best for: Long-term investors

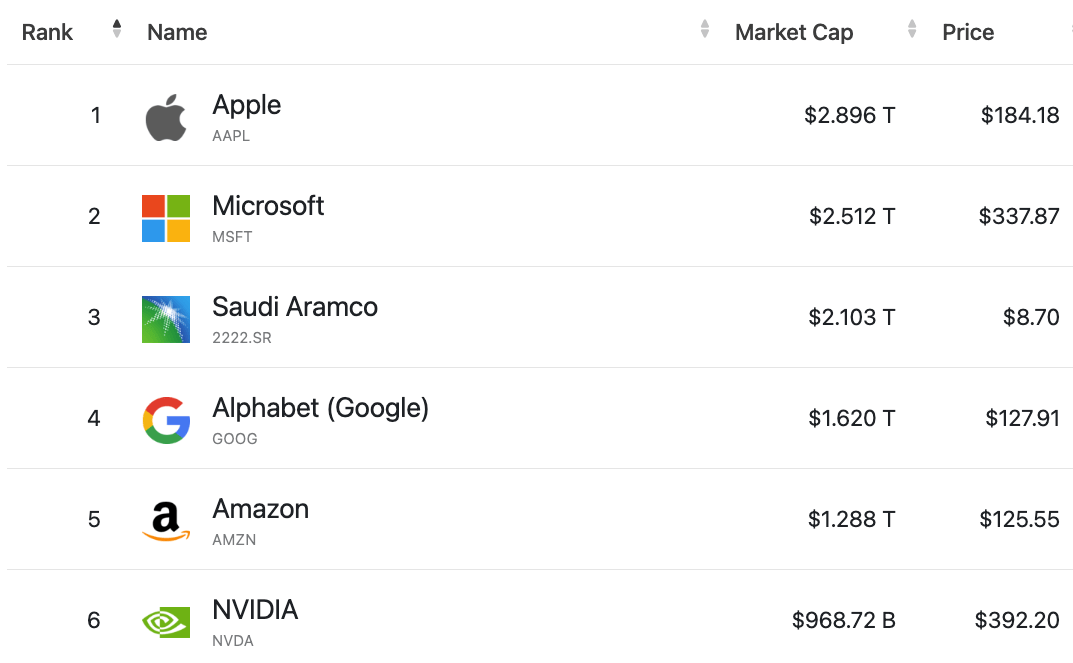

Investing in stocks allows you to own equity in a publicly-traded company, earning money when the share price increases and if the company pays out dividends to shareholders.

Stocks are shares of equity ownership in a company that allows you to participate in the growth of that company. They’re traded on the public stock market, such as the New York Stock Exchange.

Most Roth IRA platforms allow you to buy and sell stocks within your account without any commissions. And you don’t have to pay capital gains when you make a profit, because your stocks are protected by the Roth IRA account. This makes them one of the best investments for Roth IRA accounts, period.

Investing in individual stocks is a higher-risk investment, as a company can go completely out of business and the price can drop to zero. But there is also tremendous potential upside, and some company stocks can double or triple in value over time.

You can buy and sell stocks through most online brokers, such as M1 Finance, and opening a Roth IRA can be done in just a few minutes. Just make sure you do your research before investing in any stocks, and don’t put all your money in a single company, or you run the risk of losing it all.

One of the hardest parts of stock market investing? Choosing the right stocks.

WallStreetZen offers one of the top stock-picking services out there.

WallStreetZen’s Top Analysts is our most frequently visited page — here’s why:

Other stock-picking services constantly brag about their winning stock picks — but fail to mention when they’re wrong.

Instead of providing direct picks, we built a service that aggregates the research and recommendations from nearly 4,000 Wall Street analysts — then backtests their performance over multiple years.

Based on this research, analysts are ranked based on average return, frequency of ratings, and win rate — so you can rest assured you’re only following top performers.

2. Bonds / Fixed Income – Best for Low-Risk Investors

- Risk level: 2

- Minimums + fees: No minimums, 0% – 3% fees

- Who it’s best for: Low-Risk Investors

Bonds, U.S. Treasuries, and other fixed-income investments are great investment options for investors who want steady growth with minimal downside.

Fixed-income investments usually pay out a fixed amount of interest when held to maturity. They are meant to be a safe investment with a guaranteed rate of return. You can also buy and sell these investments on the open market, and their value can rise and fall, depending on economic conditions.

- Fixed-income investments include:

- Government and corporate bonds

- U.S. Treasuries

- Certificates-of-Deposit (CDs)

- Money Market Funds.

You can also earn a steady yield with a high-yield savings account (HYSA), as those pay out a fixed rate in interest. For risk-averse investors, these are some of the best investments for Roth IRA accounts.

Many brokers offer fixed-income investments, but some online platforms don’t. Large brokers like Vanguard, Schwab, or Fidelity offer access to a wide range of fixed-income investments with very low fees. Fidelity is possibly the best place to open Roth IRA accounts due to fees and investment choices.

3. Crypto – Best for Speculative Investing

- Risk level: 5

- Minimums + fees: No minimums, 0.1% – 3% fees

- Who it’s best for: Speculative investors

Cryptocurrency is a type of digital currency that is highly volatile in price, but can potentially be very profitable for high-risk investors.

Cryptocurrency, such as Bitcoin, has become one of the fastest-growing asset classes on the planet, with huge gains being realized for early investors. And new crypto assets are being created on a regular basis, making them a great opportunity for speculative investors.

While most retirement accounts don’t allow crypto investing (yet), there is one way you can invest in crypto within a Roth IRA. A Self-Directed IRA account lets you invest in alternative assets, and there are several platforms that allow you to invest in crypto within a Roth IRA account structure.

Platforms like iTrustCapital, Bitcoin IRA, and Alto CryptoIRA offer a simple way to access Bitcoin and dozens of other popular cryptocurrencies. These are the best Roth IRA accounts for crypto investing.

4. ETFs – Best for Low-fee Investing

- Risk level: 3 to 5

- Minimums + fees: 0% trade fees, 0.05% expense ratio

- Who it’s best for: Investors seeking low fees

Exchange-Traded Funds (ETFs) are similar to mutual funds and index funds, but they come with lower fees and are easy to trade, making them great for investing with low fees.

ETFs have become a popular investment over the past decade as they make investing in a diversified fund much easier. ETFs bundle together stocks and other assets into a single investment and allow you to trade them through your favorite broker. Easy accessibility and built-in diversity make them one of the best investments for Roth IRA accounts.

Most online brokers don’t charge fees to trade stocks or ETFs, and there are very low expense ratios to maintain most ETFs. For example, the Vanguard S&P 500 indexed ETF (VOO) allows you to own the entire S&P 500 index within a single fund, and it has a low annual expense ratio of 0.03%.

You can buy and sell ETFs within a Roth IRA using most online brokers. Apps like M1 Finance allow you to create custom portfolios of stocks and ETFs with no charge to buy and sell them. M1 Finance is one of the best Roth IRA accounts for building an ETF portfolio.

5. Mutual Funds – Best for Actively Managed Investing

- Risk level: 3 to 4

- Minimums + fees: $1,000 minimum (usually), 0% to 3%

- Who it’s best for: Active Investment Management

Mutual Funds hold multiple investments in a single fund, and are typically managed by a professional team of fund managers with an aim to beat the market.

Mutual funds have been a popular investment option for nearly 100 years, and are still a great way to diversify your investments. Mutual funds own a wide range of investments and allow you to purchase through a single fund instead of everything individually.

Mutual funds are actively managed in most cases, with fund managers selecting the investments inside the mutual fund to help get the best returns and manage the risk as well. The aim of most actively-managed mutual funds is to beat their respective investment benchmarks. Mutual funds are one of the best long-term investments for Roth IRA accounts.

Mutual funds do typically have higher fees than passive index funds. And there are usually higher minimum investments compared to an individual stock or an ETF. The best mutual funds for Roth IRA accounts have low fees and a strong track record of returns.

You can invest in mutual funds at most major brokers, though some investing apps don’t offer them. Establishments like Vanguard or Schwab offer access to a large selection of mutual funds.

6. Real Estate – Best for Earning Real Estate Income

- Risk level: 4 to 5

- Minimums + fees: $10 minimum (lowest), 1% to 3% fees

- Who it’s best for: Real Estate Investors

You can invest in real estate within your Roth IRA through REITs or through platforms like Fundrise, which can help you save on taxes and access the growth of real estate assets.

Investing in real estate has always been a great long-term investment. With housing price appreciation, the ability to rent out a home for income, and tax savings, real estate is one of the best ways to build wealth.

But until recently, you couldn’t own real estate within your Roth IRA. Now you can invest in public or private (that’s what Fundrise offers) Real Estate Investment Trusts (REITs), which are funds that own real estate assets. With a self-directed IRA account (SDIRA), you can even own a rental property inside your retirement account.

Investing in real estate within a Roth IRA can give you even more diversification and tax savings, and the returns can be good as well. If you are looking to invest in private REITs, platforms like Fundrise make it easy. Fundrise is one of the best Roth IRA accounts for real estate investing.

Note: We earn a commission for this endorsement of Fundrise.

7. Gold – Best for Alternative Asset Investing

- Risk level: 4 to 5

- Minimums + fees: Varies

- Who it’s best for: Alternative Asset Investors

Gold is one of the oldest investments on the planet, offers a way to hedge against inflation, and can be held inside a Roth IRA for additional tax savings.

Physical gold has been around as a currency and investment for thousands of years, and more recently, you can invest in gold ETFs as well. Gold typically is seen as an investment that can help you maintain your purchasing power in an inflationary environment.

While you can’t hold physical gold in a regular IRA account, there are platforms that let you invest in gold within a self-directed IRA account. This lets you invest in physical gold without paying capital gains tax when you buy and sell the investment. And since gold is taxed at a higher rate than stocks, it’s one of the best investments for Roth IRA accounts.

Platforms like iTrustCapital and Silver Gold Bull help you set up an IRA account and purchase gold, as do the below companies:

You can even take custody of the physical gold investments once you hit retirement age in the IRA account (currently set to age 59.5). These platforms offer the best Roth IRA accounts for alternative assets.

What is a Roth IRA vs. Traditional IRA?

A Roth IRA allows you to invest post-tax money into the account, and the investments grow tax-free. You can then pull out the investments in your Roth IRA tax-free in retirement.

A traditional IRA allows you to invest pre-tax dollars into the account, and the investments also grow tax-free. But when you withdraw the funds in retirement, you will pay taxes based on your tax rate.

In short: Both accounts help you save on taxes, but Traditional IRAs save on taxes now, while Roth IRAs save on taxes later.

Pros and Cons of Roth IRA Accounts

Roth IRA accounts are a fantastic investment vehicle for retirement, but they aren’t perfect. Here are some great things about Roth IRAs, and some limitations as well:

Pros | Cons |

|---|---|

Tax-free growth and withdrawals at retirement | Low income limits ($144k if single, $228k if married filing joint) |

Can access principal investment at any time | Can only invest $6,500 per year ($7,500 if age 50 or older) |

SDIRA allows investing in alternative assets | No tax deduction on contributions |

No required minimum distributions |

What are the Best Stocks to Buy With a Roth IRA?

If you want to invest in individual stocks inside your Roth IRA, investing in dividend-paying stocks is one of the best ways to take advantage of tax savings. These stocks pay out dividends throughout the year, and in a regular brokerage account, these dividends are taxed at your regular income tax rate. But in the Roth IRA, you avoid taxes on dividend payments forever.

Key tools for building a dividend stock portfolio

On WallStreetZen, you can easily filter and search dividend stocks to find the picks that best align with your strategy. Plus, check out our article on how to build a dividend portfolio.

M1 Finance also makes it easy to locate and buy dividend stocks. On M1 Finance, you can create a customized pie that includes dividend companies and/or ETFs, or you can simply invest in an expert M1 Dividend Pie.

This also applies to payments from bonds or other fixed-income investments. This makes income-focused securities one of the best Roth IRA investments.

How to Track Multiple IRAs

You can open more than one IRA account, but it can be cumbersome to track them all. There are some great tools that help you track all of your investments in one place, making it easy to see your overall portfolio holdings and balances.

Empower (formerly Personal Capital) offers investment tracking tools that can connect to all of your IRA accounts and actively monitor them. You can see your overall asset allocation, investment holdings, and even analyze the fees you are paying. The Empower mobile app also lets you monitor all of your investments on the go.

Final Word:

The Roth IRA is one of the best retirement accounts available today, with massive tax advantages and flexibility to access funds. And you can invest in almost anything within your Roth IRA, as long as you set up the right account. Saving for retirement is up to you, and the Roth IRA can help you get there quicker as long as you pick the best Roth IRA investments!

FAQs:

What is the best way to invest in a Roth IRA?

If you’re learning how to invest Roth IRA funds, first, you need to open one as soon as possible! With free investing apps like M1 Finance, you can do it within just a few minutes, and start investing for retirement in the next few days. The longer you let your money grow in a Roth IRA account, the more tax savings you will realize, and the sooner you can reach financial independence.

How should a beginner invest in a Roth IRA?

If you are a beginner and looking for what are the best investments for a Roth IRA, one of the most popular options is to choose a broadly-diversified index fund. These funds own hundreds (or even thousands) of stocks and other investments, and give you instant market diversification in your portfolio. They also come with extremely low fees, and are typically less volatile than investing in individual stocks. A good Roth IRA portfolio example would be stock market funds like Vanguard’s VOO, and a total bond market fund like BND.

How much money do you need to invest in a Roth IRA?

You can open a Roth IRA with most major brokerage firms with very little money, but some brokers require a minimum investment. For example; M1 Finance requires a $500 deposit to open a Roth IRA account. Once the account is open, you can usually buy fractional shares of stocks and ETFs for as little as $1.

What are the best stocks to buy with a Roth IRA?

The best stocks to buy in your Roth IRA depend on your investing goals, risk tolerance, and timelines. While we could recommend some good growth stocks, tech, stocks, or dividend-paying stocks, it’s up to you to research what fits best with your investment goals. The Roth IRA investment strategy that fits your personal preferences is best.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.