Everyone wants to build wealth and have enough retirement savings to live comfortably in the later stages of life.

But it’s a tall order, and getting started can be daunting. Happily, it’s easier with a little information.

Ultimately, it comes down to planning and discipline. Want to know how to make retirement plans build wealth in your 30s and 40s? The discipline’s on you — but keep reading and we’ll help you figure out a plan.

How to Build Wealth in Your 30s and 40s

The bottom line: Want to save money and know how to build wealth in your 30s, 40s, and beyond? Here are the key things you need to do:

- Establish a plan as soon as possible.

- Include a diverse array of investment options.

- Most important … Stick to the plan.

As for the plan — let’s talk about how to make one.

From planning to investing and wealth management…

Empower (formerly Personal Capital) has you covered.

In one single app, you gain access to all sorts of tools to help you on your investing journey:

- FREE DIY tools — a retirement planner, net worth calculator, budget planner, financial calculators, and an investment check up tool

- Empower Personal Cash, a high-yield alternative to traditional checking or savings accounts that offers an aggregate of $5,000,000 in FDIC insurance coverage

- Bespoke, tailored wealth management and investment services offered for accounts of $100K and up

- And more…

Check out Empower today to work toward the healthiest financial future possible.

Investing in Your 30s and 40s: Crucial Tips + Habits

These tips and habits are well worth cultivating if you want to make the most of your wealth-building journey.

Have a Long-Term Plan

You can’t have a short-term mindset for long-term financial planning. You need to think about financial security in terms of years and decades, not months.

Overnight fortunes are rare and can be “easy come, easy go.” However, people with the discipline to build wealth over time are disciplined enough to keep it and enjoy it in retirement.

Having a long-term plan often means a few things:

- Emergency fund. Before anything else, build an emergency fund of at least $1000 for things like car troubles, sudden child expenses, or your dog swallowing something unexpected.

- A realistic mindset. Investment is not a get-rich-quick scheme. You will not make millions overnight.

- Diversified holdings. You can have risky assets like penny stocks or cryptocurrency. But don’t put all your wealth into them.

- Don’t get caught up in the little things. Once you make your plan, don’t abandon it for the shiny new thing. Staying the course, adjusting as needed even in rougher times, builds wealth. A financial advisor can be super helpful with this.

Ditch Your Debt

After your emergency fund, paying down your credit card debt should be the first thing you do.

Any form of consumer debt will have an interest rate higher than what you can reliably make investing and building wealth.

At writing…

- The average credit card interest rate is between 24-25%.

- The average car loan interest rate is 6.58% for new cars and 11.17% for used cars.

- The average personal loan interest rate is about 11.05%, though it varies wildly.

- The average interest rate among all borrowers is 5.8%. Federal interest rates are lower, but private student loans can reach interest rates of up to 14%.

- The current average interest rate for a 30-year fixed mortgage is 6.99%.

- A payday loan equates to a stomach-curling interest rate of about 400%.

This isn’t including the unique circumstances of medical debt, business debt, etc.

How many of these interest rates do you think your future investment strategy can beat? Not many, I bet.

And there’s no risk to paying down debt compared to most investment options.

Therefore, eliminate as much of your debt as possible before investing heavily and trying to build wealth. I don’t know how to build wealth in your 40s without at least getting rid of credit card debt first.

The only exceptions to this could be low-interest student loans and low-rate mortgages (slightly harder to find in recent years). Your investments might beat out the interest on those. Consider checking in with a certified financial planner or advisor before making these decisions.

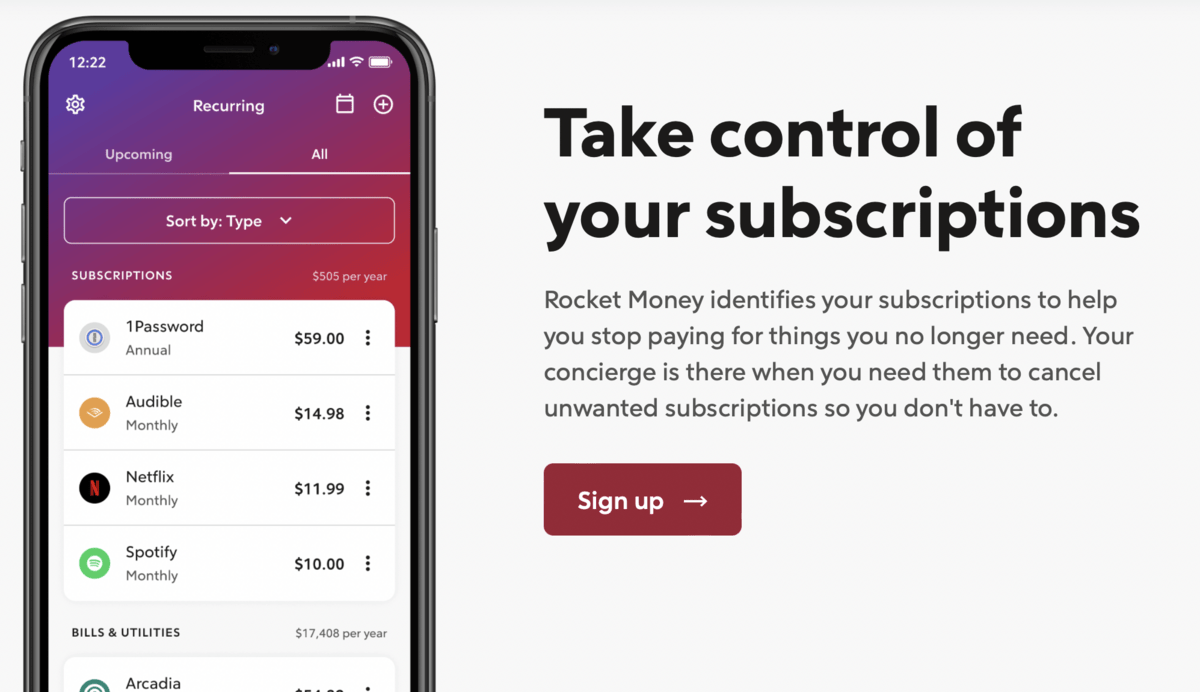

Eliminate unwanted expenses…

Oh hey. Did you know that the average person spends close to $300 per month on subscriptions? Chances are, there are a few you’re not even using — but they’re burning a hole in your wallet.

Rocket Money can help you find them — and get rid of them. Plus, it can help you manage your bills, build a budget, check your credit history, and even get lower rates on existing bills.

Establish a Budget

Before determining an investing strategy (or paying down debt), you need to figure out what you can afford and how much money you have coming in and going out.

Time to (finally) get to budgeting!

You can try to do your budget in a spreadsheet or on paper (if you’re feeling dangerous), but there are more efficient ways of tracking your spending and getting your budget done.

I recommend Empower (formerly Personal Capital) to help you budget and manage your money.

It can get all your accounts in one place, give you advice on your financial goals and situation, and provide tools like a no-cost Budget Planner and free Financial calculators that turn budgeting from a mountain to climb to a small weekly chore.

Empower isn’t just about free budgeting tools. If you have an account of $100K or more, Empower’s investment services and wealth management service can help you grow your money by building a portfolio tailored to your custom needs. Empower’s services are on par with venerable institutions like Fisher Investments, but the fees are a fraction of the price of the big managers.

Don’t have that much cash at your disposal yet? Empower also offers investing accounts, cash accounts, and IRAs.

Regardless of your method, without a budget, you’ll find your retirement savings slipping through your hands, and you won’t feel like you know how to build wealth in your 40s.

Build Up Your Credit

Too much debt is bad, yes. But you need a solid line of credit to gain access to things like mortgages, apartments, car loans, etc. Here are some best practices:

- Make sure bills are paid on time and in full.

- Use credit, but don’t max out your credit limits. This can make creditors nervous. Utilization of less than 10% is best. Less than 30% is fine.

- Only apply for the credit you need.

- Regarding your credit score, older accounts can be more valuable. Don’t switch just because of a fancy new perk or interest rate.

- Check your credit report regularly and dispute errors you find.

If you don’t want to use credit often but want to keep your score in its best shape, the Chime credit builder credit card can help boost your score through regular payments and is a no-nonsense card in the meantime.

Chime has customized tools that help you manage your spending and balance so they don’t work against your credit score.

Disclaimer: Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits.

Increase Your Savings

Increasing your retirement savings allows you to make better decisions and take on more risk. The car breaks down? No problem. The emergency fund has it covered.

That savings and emergency fund will be great when the agents of opportunity or dread knock. They will keep you on the right track when you have a plan and know how to build wealth in your 40s.

That being said, your emergency fund and savings can still work for you. There are fantastic opportunities, such as a high-yield savings account with M1 Finance. We’ve covered the details of it in our M1 Finance review. The short version is that it can provide an FDIC-insurance 5% APY savings account.

If you put $1000 into these accounts over 20 years (your 30s and 40s), compounding yearly, you will get:

- High yield account (5%): $2,653

- Big bank account (0.01%): $1,002

Those numbers will go up significantly depending on your starting balance. That’s the difference between a new computer when you need it and a candy bar (if it’s on sale).

How to Invest Money at 30: 6 Ways

If you can afford it, you should invest some of your income.

“Ok, that’s great. How should I do that?”

You have a few options:

Stocks (With Long-Term Goals in Mind)

- Why invest in stocks? The stock market has provided excellent returns over the years

- Minimum investment: ~$10

- Risk level: Medium; can vary

- Best for: People looking for a main asset for their portfolio; most people

Why are stocks one of the best assets to buy in your 30s? You can ride out the ups and downs of the market without worrying about needing to cash out soon.

Yet you have many options to choose from. Dividend stocks? High-risk stocks? Penny Stocks?

We have many posts and resources on the topic if you want to learn more about stocks. If you want to learn more about a specific stock, use our stock screener to get our review and learn everything you need to.

Overall, the stock market will return 10% annually on average, but each year will differ. Individual stocks will vary wildly. Therefore, don’t try to pick a single stock and go all in.

If you’re looking for a broker to use to buy stocks, check out moomoo for a commission-free trading platform that’s great for beginners, even those who don’t know (yet) how to invest money at 30.

Want to know more about moomoo, including how to get free stocks? Check out our moomoo trading review.

Funds

- Why invest in funds? You can get most of the returns of the stock market without the stress or level of risk of stock picking.

- Minimum investment: ~$500

- Risk level: Low, but can vary

- Best for: Providing relatively reliable returns with minimal management on your part.

Worry that you might pick the wrong stock or want to diversify more? Funds are the answer.

- Mutual funds are companies that pool investor money to diversify investments.

- Exchange-traded funds (ETFs) typically track an index and trade on exchanges

- Index funds seek to track the market index as closely as possible.

Want to invest in ETFs and funds? Our top pick is moomoo.

Max Out Your IRA Contributions

- Why max out your IRA? Outside of an employer-matched 401k, there isn’t a better way to save directly for retirement.

- Minimum investment: $0.01

- Risk level: Varies

- Best for: People expressly concerned about retirement

In terms of getting the best tax benefits, not much will beat out your IRA, assuming you’re already maxing out your 401k if you have one.

If your employer matches your 401k contributions, do that first. Show me an opportunity with better returns and less risk and I’ll show you a scam that is not how to build wealth in your 30s.

If you don’t have an IRA (or Roth IRA) for your retirement savings yet in your 30s or 40s, set one up today. You don’t need to contribute much to start saving now, it helps form a good habit, and your future self will thank you.

The maximum yearly contribution for your IRA will vary depending on your income, age, and a couple of other factors. Double-check what yours is using this resource.

If you want to set up an IRA, I recommend using M1 Finance. They’ll have all the tools you need, and other accounts they offer might interest you besides their IRA accounts.

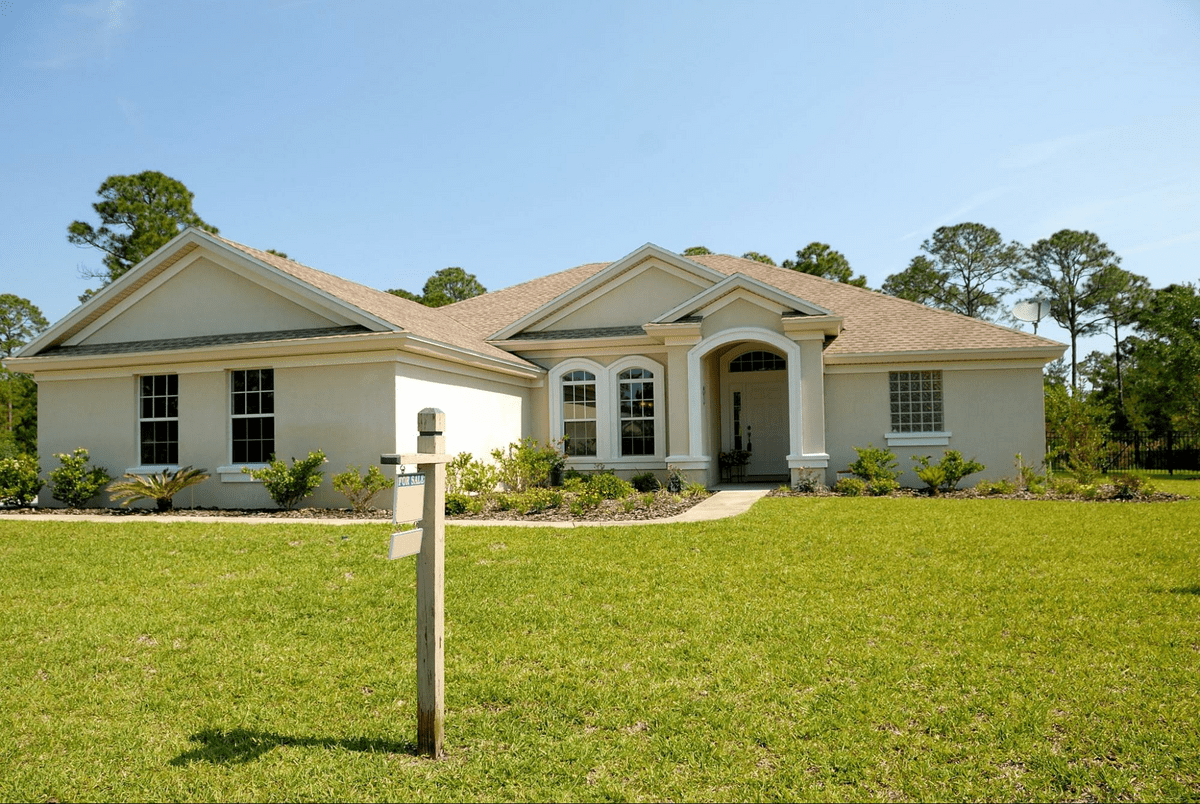

Invest in Real Estate

- Why invest in real estate? It is unlikely to lose all of its value, can provide great returns, and can build equity.

- Minimum investment: Varies

- Risk level: Varies

- Best for: People looking to diversify their holdings away from the market

You’ve heard about other people investing in real estate to build wealth. Why not you?

Investing in real estate doesn’t mean buying a whole rental property anymore, and you don’t need to be rich to do so. Though buying a property is vastly more complicated than anything else on this list, the property’s value appreciation can beat out most other investments.

If this seems too much, I 100% understand, and you may want to consider crowdfunded real estate to add it to your investment portfolio without the massive commitment.

Fractional Real Estate

- Why invest in fractional real estate? You can round out your portfolio without actually buying property.

- Minimum investment: $10 (more recommended)

- Risk level: Medium

- Best for: Those looking to round out their portfolio without making a massive commitment or investment.

People crowdfund everything else these days. Why not a real estate investment? That way, people can benefit from diversifying into real estate without dealing with a property management company or becoming a landlord. It’s a good way to start investing in your 30s.

Investments through these apps and services might be through REITs, focus on commercial or farmland investments, or something else entirely. Returns will also vary between 5% and 15%, with varying degrees of risk. But REITs are publicly-traded, so you’ll need a brokerage.

Fundrise is a great alternative to the stock market, with proprietary private eREITs and diversified investing. If you want to consider other options, check out our full article on the best real estate investing apps.

Note: We earn a commission for this endorsement of Fundrise.

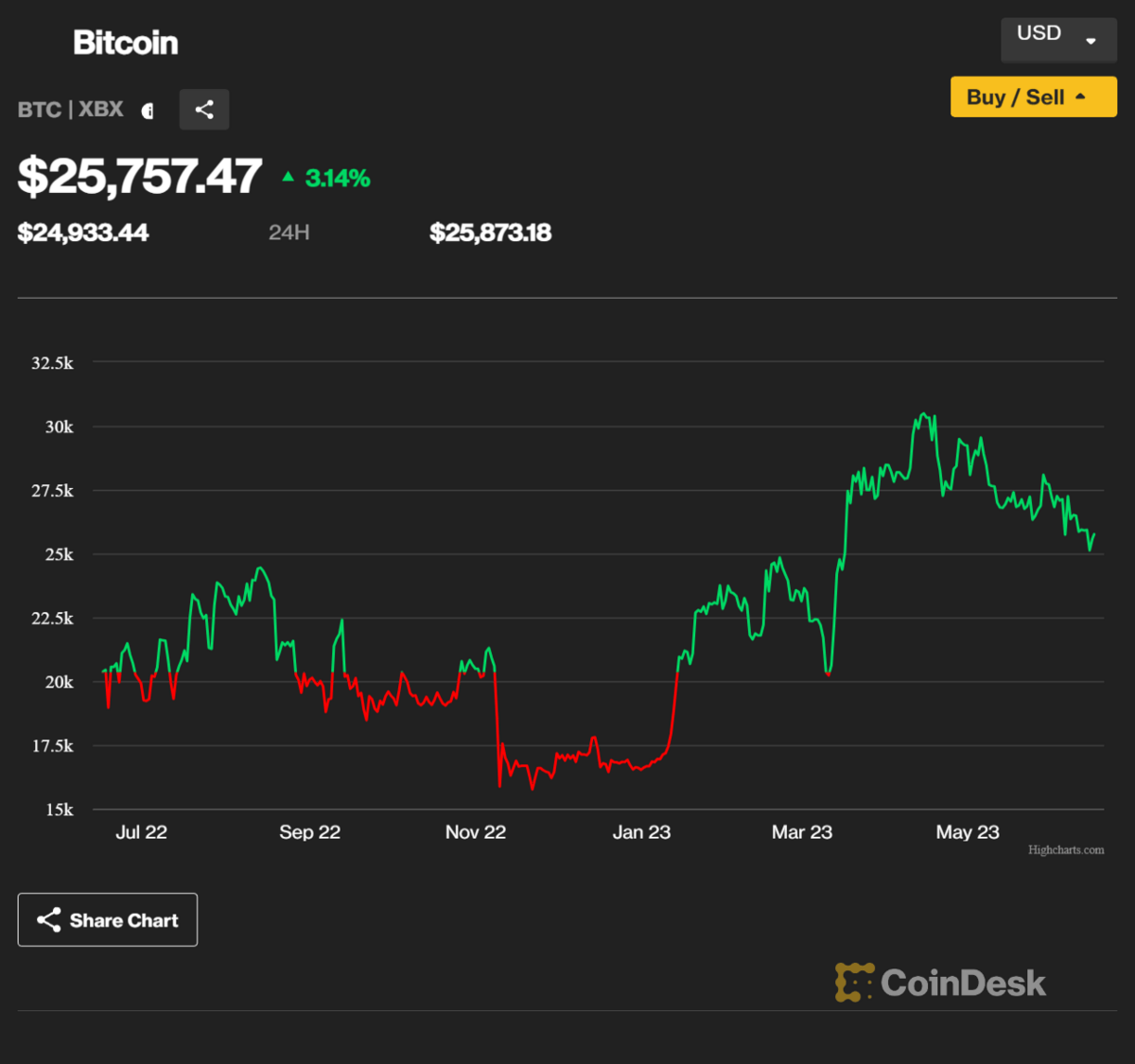

Consider Alternative Assets

- Why invest in alternative assets? The best alternative assets are typically not closely correlated to the stock market, which gives you instant diversification.

- Minimum investment: Varies

- Risk level: Varies

- Best for: Those looking for something outside the ups and downs of the market.

There are more than just normal investment products for assets to buy in your 30s. Some options include:

- Investing in wine through a service such as Vinovest. It holds value well outside of the market and can appeal to wine enthusiasts, though note that the market isn’t as active as Wall Street. Returns have been between 5.5-12%, depending on the year.

- Collectibles are performing well these days, and have low correlation with the stock market. Public is an excellent place to get started.

- Art has long been a way for people to invest and store their wealth over time. Services such as Masterworks allow people to crowdfund buying a piece of artwork. And the returns can be great overall, reaching, on average, 9% annual appreciation.

- Cryptocurrency is now somewhere between alternative and normal investment. While you might not want to put all your eggs in that nitroglycerin-laced basket (see the below chart), potential returns are high. And if you want the tax benefits an IRA offers, you can use Bitcoin IRA to add it to your overall retirement portfolio.

- P2P lending may differ from traditional investments, but it can be a great way to lend someone what they need and feel your money’s impact. You can use LendingClub for this, and it’s less risky than you’d think as long as you vet who you’re lending to. Returns have historically been between 3% and 8% annually.

Final Word: How to Invest for Retirement at Age 30

Investing for retirement sounds nebulous, but that time will come sooner than you think. By taking action now, you’re doing your future self a solid!

The best approach? Invest for retirement in your 30s and 40s using a diverse array of assets, a solid financial plan, discipline and budgeting, and most of all, patience, and you will build wealth over time.

I’ve given you a starting point and some ideas for investment with this list. It won’t be easy, but you’ll adjust well to your financial plan in due time and have greater peace of mind for your efforts.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation of a security or to engage in any investment strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results. U.S. residents trading in U.S. securities may trade commission-free using the moomoo app through Moomoo Financial Inc. (MFI). Please see our pricing page for other fees. Level 2 data is free to moomoo users that have an approved MFI brokerage account. Trading during Extended Hours Trading Sessions carries unique risks, such as greater price volatility, lower liquidity, wider bid/ask spreads, and less market visibility, and may not be appropriate for all investors.

FAQs:

Is it possible to become a Millionaire in your 30s?

Yes, it is possible to become a millionaire in your 30s. However, there are no guarantees. Typically, becoming a millionaire is the result of good saving and investing habits.

How to start saving for retirement in your 30s?

If you’re worried about how to invest for retirement at 30, take basic steps now. Open an account (401k or IRA to start) and then contribute regularly.

You'll max out your IRA if you automatically deposit about $125 into your account each week. This is a great way to start.

How rich is the average 30-year-old?

The median net worth of someone under 35 years old is 13,900. Note that a 30-year-old with debt who just finished their M.D. has a better outlook than a high-school dropout with a bit saved up. Net worth at 30 isn’t everything.

What should net worth be at 30?

There’s no exact answer to what your net worth should be at 30. You should, however, have an emergency fund that will last three to six months of living expenses, a retirement account set up, and the basic necessities for living sorted out.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.