Are you sitting on significant cash savings and unsure where to deploy it? If you’re trying to decide what to do with 10 million dollars, you’re in the right place.

By the end of this article, you’ll be armed with some of the most popular investments high-net-worth individuals use. Not only that, you’ll learn some lesser-known but highly-valued investments that HNWIs (High-net-worth-individuals) leverage.

Keep reading to learn what to do with 10 million dollars:

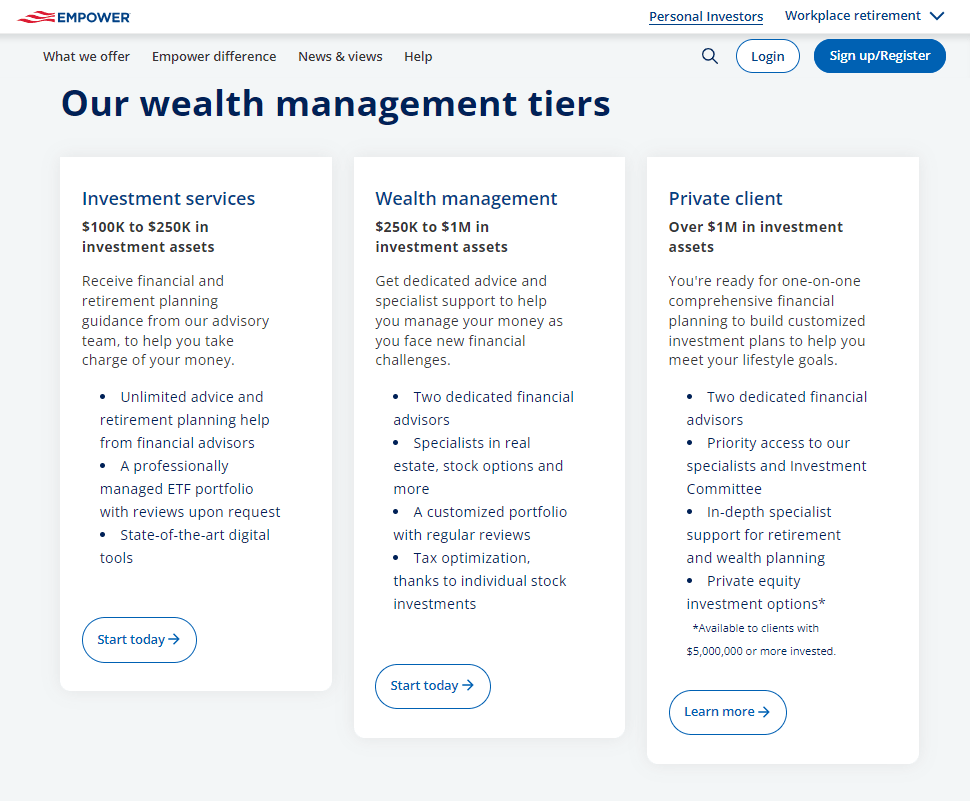

Empower’s (formerly Personal Capital) service fees are impressive compared to the competition.

For the first $1 million, the fee is 0.89%. Compare that to big-name brokers like Fisher Investments that charge 1% or more.

As your account size goes up, the fees go down. For instance, if you were to invest $5 million, the fee would be 0.69%. Compare that to Fisher Investments’ 1.12% fee for the same amount:

$5 million invested

- 1.12% legacy broker fee for one year: $56,000

- 0.69% Empower fee for one year $34,500

Now, think about how that adds up over the years…

The 9 Best Ways to Invest $10 Million in 2025

From money management to stocks and bonds and beyond, here are the best ways to invest $10 million in 2025.

1. Professional Money Management

Professional money managers offer several benefits.

- Expertise: Professional money managers have extensive training and experience. This means they can analyze and interpret complex financial data and make informed decisions. They can often identify opportunities regular individuals may not have the skills or resources to spot.

- Time-Saving: Comprehensive asset management can take a lot of time, too much for most people.

- Emotional Detachment: Leaving your investments in the hands of a professional can remove your emotions from decision-making and prevent impulsive investing.

- Discipline and Consistency: Money managers militantly adhere to investment strategies.

What you need to know:

- Fees: Ensure you understand how the manager is compensated. Fees can vary widely between money managers.

Suggested platform: Empower

Empower is the second-largest retirement plan provider in the United States. It’s specifically tailored for mass affluent investors who desire high-quality service.

To become a client, you require a minimum of $100,000 — not a problem if you’re working with $10 million.

Empower (formerly Personal Capital) offers wealth management services at significantly lower fees than many big-name brokers like Fisher Investments and Charles Schwab.

Plus, with Empower, the service level is quite high, including access to live financial planners.

2. Invest in Stocks and ETFs

Purchasing stocks and ETFs are among the most common uses for large amounts of investable capital. And for good reason.

- Growth: Historically, equities have been one of the best-performing asset classes.

- Dividends: Some stocks and ETFs can pay dividends, providing a more predictable income stream. Depending on various factors, dividend-paying stocks can receive beneficial tax treatment.

- Diversification: Stocks and ETF allocations can help diversify your portfolio.

- Liquidity: They are typically much easier to buy and sell than other assets.

- Ownership: They provide shareholders partial ownership of the company.

- Hedge: Stocks and ETFs can often provide an effective hedge against inflation which would otherwise eat away at your savings.

What you need to know:

- Volatility: Certain stocks, especially those with smaller market caps, can experience substantial volatility (risk).

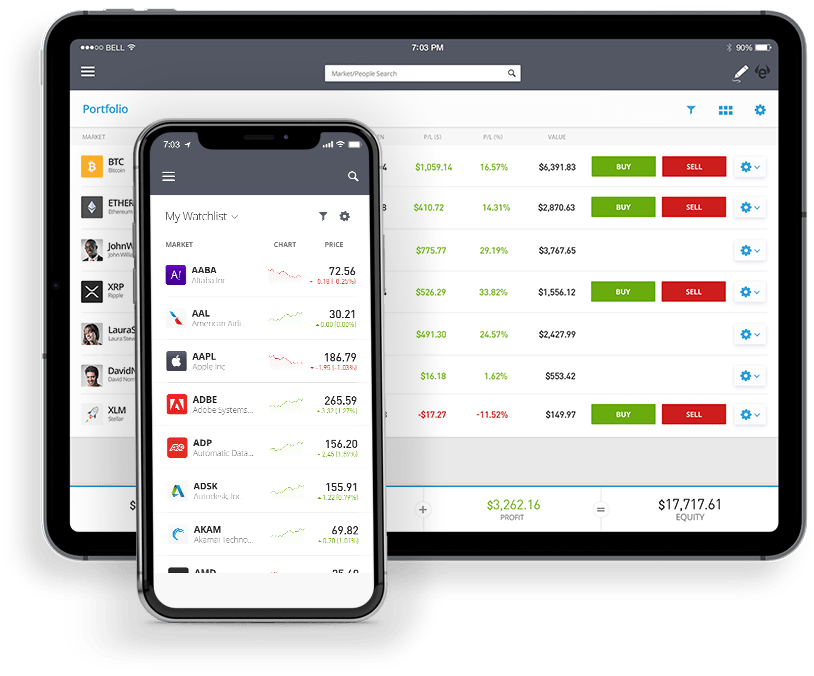

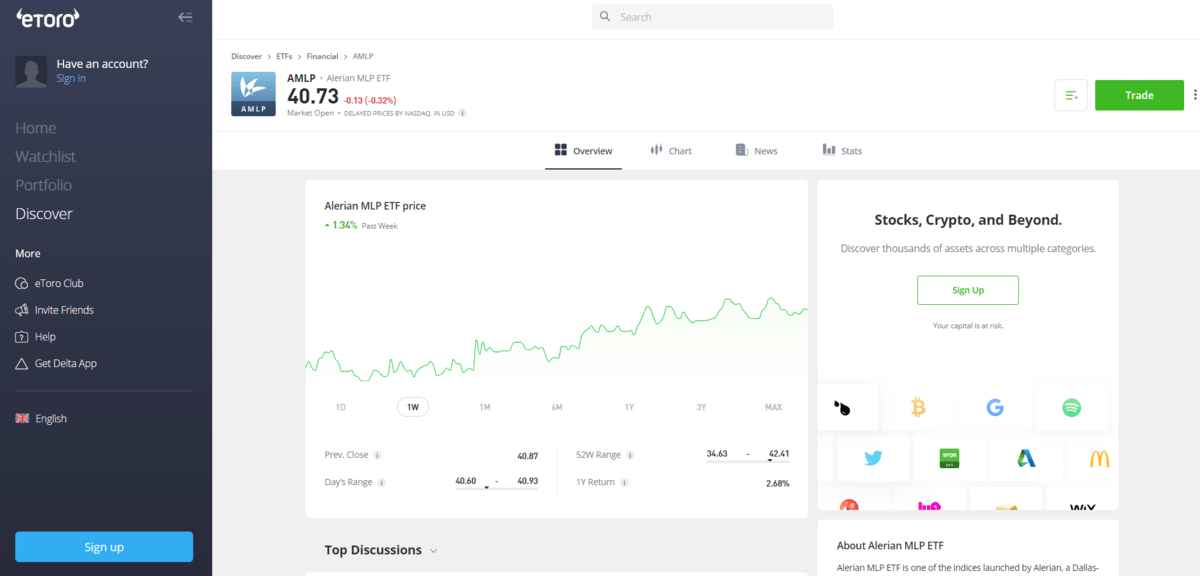

Suggested platform: eToro is an exceptional platform that allows you to trade stocks and ETFs easily.

Its vast feature set and straightforward user interface make it one of my favorite platforms. With over 20 million users in more than 140 countries, eToro has become a favorite of investors globally.

The best part of eToro is its CopyTrader feature. It allows anyone to mirror the trades of some of the top traders in the world. Not only that, it can be automated with a capped dollar value.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Interested in automated stock investing?

If you’d prefer an exclusively automated platform with extensive portfolio customization, consider checking out M1 Finance. Choose from the over 80 pre-built portfolios or create your own from scratch.

While it’s a great platform, it’s best for experienced investors wanting to automate their investments.

3. Invest in a Hedge Fund

Hedge funds are typically the domain of higher net-worth individuals. While exceptions exist, minimum investments for retail-oriented hedge funds range from $100,000 to $500,000.

While they’re similar to mutual funds and ETFs, hedge fund managers typically enjoy a broader range of discretion and ability to take on riskier and more exotic opportunities, like short selling or investing in real estate.

The benefits of investing in a hedge fund include:

- Diversification: Investing in a hedge fund can provide investment opportunity exposure that is typically unavailable to regular retail investors.

- Potential for Higher Returns: Hedge funds are often known for delivering superior returns to other asset classes, regardless of the market environment.

- Risk Management: While this isn’t the case for all hedge funds, many are structured to hedge against market downturns, helping protect your portfolio.

- Top Talent: Hedge funds are known for employing some of Wall Street’s savviest traders and quantitative analysts. As a client, you benefit from these specialists helping manage your money.

What you need to know:

- Liquidity: Hedge funds are typically illiquid and often include lock-up periods where you cannot withdraw funds.

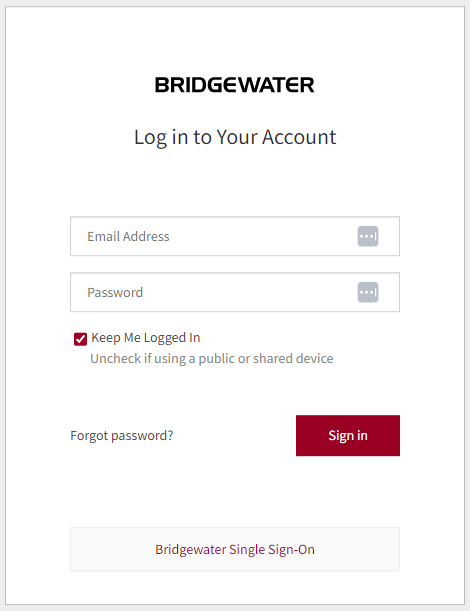

Suggested platform: Bridgewater Associates

Bridgewater Associates is the largest hedge fund in the world. It was founded by legendary investor Ray Dalio and enjoys assets under management of over $123 billion.

While it’s not a platform, per se, as a client of Bridgewater, you’ll have access to your investments via an online portal.

The firm offers three hedge funds:

- Pure Alpha: Bridgewater’s flagship fund launched in 1989. It invests across various asset classes and is designed to reduce volatility through non-correlated investments.

- All Weather: Launched in 1996, this fund reportedly holds roughly 40% inflation-linked bonds, 30% Treasury bills, 20% Treasury bonds, and 10% gold.

- Pure Alpha Major Markets: Similar to the Pure Alpha fund but with added liquidity.

4. Invest in Master Limited Partnerships (MLPs)

A Master Limited Partnership (MLP) is a unique type of investment most commonly seen in support of oil and gas projects. It offers a few specific benefits:

- Attractive Yield: MLPs typically provide a high distribution yield. This makes them ideal for investors seeking robust and recurring income.

- Tax Benefits: MLPs are widely used for tax-advantaged distributions (dividends). These distributions are usually treated as return on capital, not dividends. As a result, they are not immediately taxed but reduce the initial investment’s cost base. A taxable event is only triggered once the units are sold.

- Capital Appreciation Potential: MLPs, like stocks, can appreciate in value.

- Diversification: MLPs can provide investors with access to a unique diversification benefit.

What you need to know:

- Tax complexity: Investing in an MLP often results in more complicated investment tax returns.

- Sector Exposure: MPLs can offer diversification benefits in the right weight. However, if positions are too large, you can be too concentrated in a single sector.

Suggested Platform: eToro

Since MLPs trade on national exchanges, just like stocks, you can use my favorite platform, eToro, to gain access.

5. Invest in Fixed Income

Annuities

Depending on your financial goals, annuities can be an excellent option for someone with significant savings. Some benefits include:

- Guaranteed Income Stream: Annuities can provide a guaranteed income for life or a predefined period. This can appeal to those who want safe and secured income during retirement. It can also ensure you don’t outlive your assets.

- Tax Deferral: Interest, dividends, and capital gains inspired by a deferred annuity aren’t taxed until withdrawn.

- Protection from Creditors: Annuities are protected from creditors depending on your jurisdiction.

- Estate Planning: Assigning a beneficiary to your annuity can bypass probate.

What you need to know:

- Fees: Annuity fees can be steep.

- Solvency: Annuities are only guaranteed as long as the issuer remains solvent.

Suggested Platform: Charles Schwab

Gain access to competitively priced annuities from a large and trusted financial institution. A minimum of $100,000 is required for all annuity contracts obtained through Schwab.

The best part? Variable annuity fees on the platform can be up to 65% lower than the industry average.

Bonds

Like equities, bonds are among the most popular asset classes people choose. There are numerous reasons why they can make a great addition to your portfolio.

- Diversification: Bonds typically possess a low correlation with equities, providing diversification benefits.

- Predictable Income: Bonds provide investors with a steady and predictable income stream.

- Capital Preservation: Bonds are typically considered safer investments than many other assets. Bonds issued by developed nations are particularly known for their quality.

- Tax Benefits: Certain bonds, like municipal bonds in the United States, provide tax-free interest income.

What you need to know:

- Interest Rate Risk: As interest rates rise, bond prices fall.

- Credit and Default Risk: Fixed-income securities may be safer than stocks but are not guaranteed. There is always a risk the issuer cannot repay the principal or cover interest obligations.

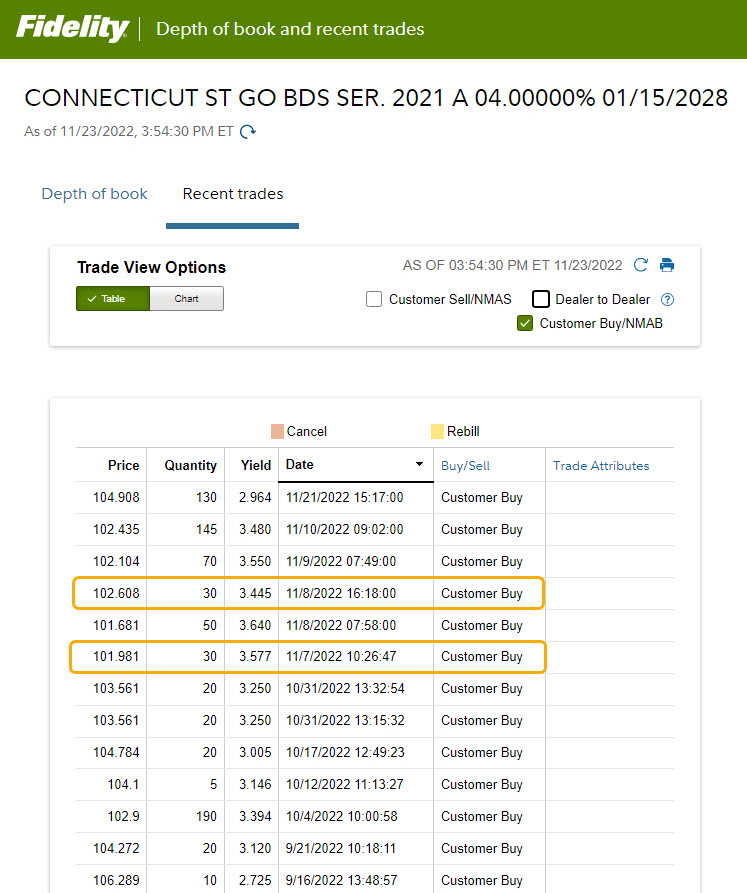

Suggested Platform: Fidelity Investments

Fidelity provides customers with broad access to government and corporate fixed income. You can also purchase certificates of deposit, bond mutual funds, bond ETFs, and money market funds.

The platform also provides robust fixed-income research and tools and a library of bond educational resources.

For those who want white glove service, you can access their fixed-income products via Fidelity’s wealth management line, Fidelity Wealth Services.

6. Invest in Alternative Assets

Private Credit

Investing in private credit is another way for high-net-worth individuals to access an asset with little correlation to other investments.

Some of the benefits of private credit include:

- Potential for Higher Returns: Private credit is attractive for its high return potential compared to traditional fixed-income investments.

- Information Advantages: Direct lending via private credit often provides investors with deeper insights into a borrower’s financial health.

What you need to know:

- Liquidity concerns: Like many alternative investments, private credit can be illiquid.

- Credit Risk: Higher-yielding credit may come with higher credit risks.

Suggested Platform: Percent

Percent offers one of the most straightforward pathways if you’re interested in accessing private credit. Formally called Cadence, Percent specializes in private credit investments to accredited investors.

Its vast selection of investible opportunities makes it one of my favorite platforms to secure private credit exposure.

Fine Art

Consider some less traditional investment opportunities when deciding how to invest 10 million dollars. Fine art can be a valuable asset class to include in your portfolio. Like private credit, it offers diversification benefits.

However, that’s not its only benefit.

- Tangible Asset: Investment in fine art provides exposure to physical assets. For many investors, this provides peace of mind.

- Potential for High Returns: Some art pieces have been known to produce exuberant returns far above the stock market.

- Inflation Hedge: Tangible assets like fine art can effectively hedge against inflation.

What you need to know:

- Illiquid: Fine art can be less liquid than other assets.

- High Transaction Costs: Buying and selling fine art can entail high fees.

- Maintenance: You must consider maintenance and insurance costs.

Suggested Platform: Masterworks

While you can certainly entertain purchasing a Rembrandt for your home office, you might prefer to use the services of a platform like Masterworks.

With Masterworks, you can invest in fine art from the comfort of your home. The best part? You don’t have to worry about someone spilling coffee on your Van Goh.

Masterworks take care of the logistics, and you enjoy a potentially lucrative asset class.

7. Invest in Private Companies (Private Equity)

Like private credit, private equity is another asset class that traditionally requires a higher initial investment, though that is beginning to change.

For many HNWIs, private equity might be a great option.

Investing in private companies comes with many advantages:

- High Potential Return: Private equity is often considered one of the most lucrative asset classes. It’s where many currently wealthy individuals built a substantial portion of their net worth.

- Early Access: Investing in private companies lets you gain early exposure to emerging industries and innovative ideas.

- Unique Opportunities: Private equity often entails unique investment opportunities not available in public markets.

- Tax Benefits: Some jurisdictions offer private equity investors tax benefits to encourage startup investment.

What you need to know:

- Liquidity: Private equity is often very illiquid and meant as a long-term investment.

- Higher Risk: Investing in private companies usually involves much greater risk than investing in well-established public companies.

- Regulatory Considerations: Regulatory or legal considerations sometimes limit private company investment in certain jurisdictions.

Our favorite platform for investing in private companies? Hiive.

Hiive acts as a matchmaker between accredited investors who want a stake in private and/or pre-IPO companies and employees, venture capital firms, or angel investors who want to sell shares.

Hiive has a lot of cool features — for instance, if you sign up for the platform, there’s a live pricing chart for each company which includes prevailing bids and asks, and you can create watchlists and get notified about price changes or new listings offered.

Additionally, you have flexibility. Buyers can either accept the asking price as listed, place a bid, or negotiate directly with the sellers. As an added perk for investors, for standard transactions, the sellers are the only ones who pay fees.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

8. Invest in Real Estate

Real estate is one of the most popular investments for individuals with large amounts of capital. The ability to scale real estate is nearly limitless. What can start as a single condo can evolve into owning a building with multiple units.

Real estate provides numerous benefits.

- Tangible Asset: Investing in real estate provides access to a physical asset.

- Appreciation: Over the long term, real estate can substantially appreciate in value. For many, real estate appreciation is a core component of their wealth-building strategy.

- Tax Benefits: Sometimes, tax incentives exist for owning real estate, like deductions for mortgage interest.

What you need to know:

- Maintenance and other ongoing costs: Real estate involves numerous recurring fees. Insurance, maintenance, and potentially property management are just some expenses you must consider.

Suggested Platform: Roofstock

You don’t need to go out and purchase a home in person. If you’d prefer, you can gain access to lucrative real estate opportunities through a service like Roofstock.

With Roofstock, you can buy and sell rental properties online. Often, these properties already have existing tenants. Not only that, Roofstock matches you with qualified property managers that will maintain the listing.

In short, Roofstock makes investing in real estate simple and hands-off.

9. Create a Trust

Individuals with substantial assets should consider the benefits of opening a trust.

- Estate Tax Benefits: Depending on where you live, assets that live in a trust may not be considered part of your taxable estate.

- Protection: Sometimes, trusts can protect your assets from creditors or legal judgments.

- Control: Trusts give you control over how your assets will be distributed to beneficiaries. This particular benefit is especially valuable if you have young child beneficiaries who are not yet financially savvy.

- Avoidance of Probate: When assets are held in a trust, you can skip the probate process. Probate can be expensive and lengthy. A trust ensures your beneficiaries obtain more of the assets faster.

What you need to know:

Management: Trusts require management. Knowing who is in charge (trustees) and their responsibilities is imperative.

How is Investing $10 Million Different Than “Regular” Investing?

Most people would agree: $10 million is a lot of money. Before we get into how to invest 10 million dollars, let’s talk about how it differs from “regular” (smaller-account) investing:

- Diversification: The more money you have, the greater your ability to diversify. This can potentially both improve returns and lower your portfolio’s risk. That is to say — it’s not just about loading up on stock shares on eToro or putting it all into gold. Instead, consider spreading your wealth among a variety of assets.

- Access to Investment Opportunities: Hedge funds, private equity, and other alternative investments often require substantial investment to gain access. With $10 million, you may have more options than the average investor.

- Customization: As portfolios grow, the ability to customize grows with it. This customization allows you to achieve specific financial goals or dictate particular mandate considerations. For example, tax implications can be managed with more nuance. Wealth management services like Empower can help you with this part.

- Estate Planning and Philanthropy: As savings expand, estate planning or potential philanthropic endeavors become more important. Planning estates properly is imperative to minimize the tax burden on beneficiaries and ensure money is used effectively for any charitable legacy objectives.

- Complexity: With more money comes more considerations. Larger portfolios demand more sophisticated financial management. This becomes an even greater requirement with investments diversified globally across numerous exotic asset classes.

- Negotiating Power: Money is power. The more you control, the better your bargaining position. For example, large portfolios often allow you to negotiate lower fees on investment management services.

- Professional Management: With $10 million, it might make sense to seek out dedicated managers or private bankers to help tend to your assets. This level of dedication wouldn’t be possible with smaller sums of money.

- Risk Tolerance and Time Horizon: The sheer size of a $10 million portfolio typically commands a different risk tolerance and time horizon compared to smaller ones. Some investors may deem $10 million more than they’ll ever need. As a result, they prioritize capital preservation using conservative investments. Conversely, others see $10 million as providing the ability to take on greater risk.

- Regulatory and Reporting Concerns: Awareness of special regulatory considerations when dealing with large portfolios is essential. Large asset bases may require additional reporting compared to smaller portfolios in some jurisdictions.

- Emotional Factors: Watching a $10 million portfolio closely can be anxiety-inducing. Even when the markets drop just 1%, you’re watching $100,000 in value evaporate from your account. The emotional weight of a $10 million portfolio is substantially higher than that of a much smaller one.

- Macroeconomic Impact: Incredibly, when portfolios get large enough, you must be conscious of your trades’ impact on the broader market. For example, $10 million would give an individual enough money to make a substantial investment in a microcap stock. Trading the position could result in significant swings in price.

How Important Are Tax-Advantaged Accounts?

Tax-advantaged accounts can be important for individuals with considerable wealth. They offer several benefits:

- Deferred Tax Growth: Tax-advantaged accounts like 401(k)s allow you to grow your money without taxation shrinking it every year. For those with substantial savings, this can be significant.

- Tax-Free Growth: Tax-advantaged accounts like Roth IRAs provide tax-free growth and withdrawals.

- Mitigating High Tax Rates: Tax-advantaged accounts sometimes allow you to reduce taxable income via contributions.

How to Invest $10 Million and Live Off the Interest

It’s no surprise that people want to know how to invest 10 million dollars to live off the interest.

While nothing is guaranteed, if you can generate an average 3% annual return — modest by many standards — across your portfolio, you can enjoy $300,000 of income yearly without depleting your initial $10 million investment.

Typically, people who pursue this strategy seek out lower-performing but less-risky assets, like fixed income. Fixed income also provides the benefit of delivering stable and regular income payments.

Ultimately, knowing how to invest 10 million dollars to live off the interest depends on the risk you’re willing to take and the return you’re hoping to achieve.

For example, it’s less risky to try and generate $100,000 annually off a $10 million portfolio than trying to earn $500,000. The latter will require greater risk-taking to achieve.

Final Word: Best Ways to Invest $10 Million Dollars

If you have $10 million, you have options. You also have added considerations and complexities. What to do with 10 million dollars depends on numerous unique factors.

How to invest 10 million dollars requires understanding your risk profile, current needs, and financial goals. From there, you can begin deciding on assets and allocation.

With this much money, it makes sense to diversify across a wide range of assets and even platforms. If you lack investment experience, consulting with a financial professional or firm like Empower for assistance is best.

FAQs:

How much interest does 10 million dollars earn per year?

The average annual expected return of wealthy investors in the United States is 17.5%, or $1.75 million annually.

How much income will 10 million generate?

10 million can generate substantial income. If earning 10% a year, 10 million dollars can generate $1 million in income.

Can I live off 10 million dollars?

Yes, most people can easily live off 10 million dollars.

What should I invest in if I have 10 million?

If you have 10 million dollars, you should invest in a diverse set of assets, like stocks, bonds, real estate, private investments, and other opportunities. The exact allocation will depend on your financial goals and risk tolerance.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.