Do you ever wonder how some people amass huge portfolios of investment properties?

Hundreds, even thousands, in some cases.

How do they afford them? Often, it’s through investment property loans.

But what exactly are investment property loans? How do they differ from other loans, like a traditional mortgage?

You have questions. We have answers.

Among other details, the following article will:

- Define investment property loans.

- Detail the qualifications needed for a mortgage for investment property.

- Explain the difference between the various options.

- Describe the minimum requirements required for rental property loans.

- Detail the investment property loan rates you can expect.

- Explain how to obtain rental property loans.

Let’s do this:

Stessa is a one-stop-shop for investment property owners. It offerseverything you need to be a successful landlord, like:

- Rental applications

- Tenant screening

- Rent collection

…It even has a bunch of handy tools to help out with taxes.

Sign up for Stessa today and take some of the stress out of being a landlord.

What are Investment Property Loans?

Investment property loans are mortgages for investment property.

These rental property loans represent financing designed for individuals who intend on profiting from the property versus living in it.

Investment property loans differ from a traditional mortgage designed to finance an individual’s primary residence.

Investment property loans are often essential for aspiring landlords to obtain the financing needed to purchase an income property.

What Qualifies as “Investment Property”?

An investment property is a real estate holding you own with the objective of generating recurring income (rental payments) or appreciation of the property over time (or both).

Importantly, these properties are not intended as a primary residence for the owner. They are assets meant to generate a return.

Some common investment properties include:

- Traditional rental properties like houses or apartments that are rented to tenants.

- Vacation homes.

- Commercial properties like office buildings or warehouses that are leased to businesses or other organizations.

- Industrial properties leased to manufacturing firms.

- Mixed-use properties that combine commercial and residential spaces.

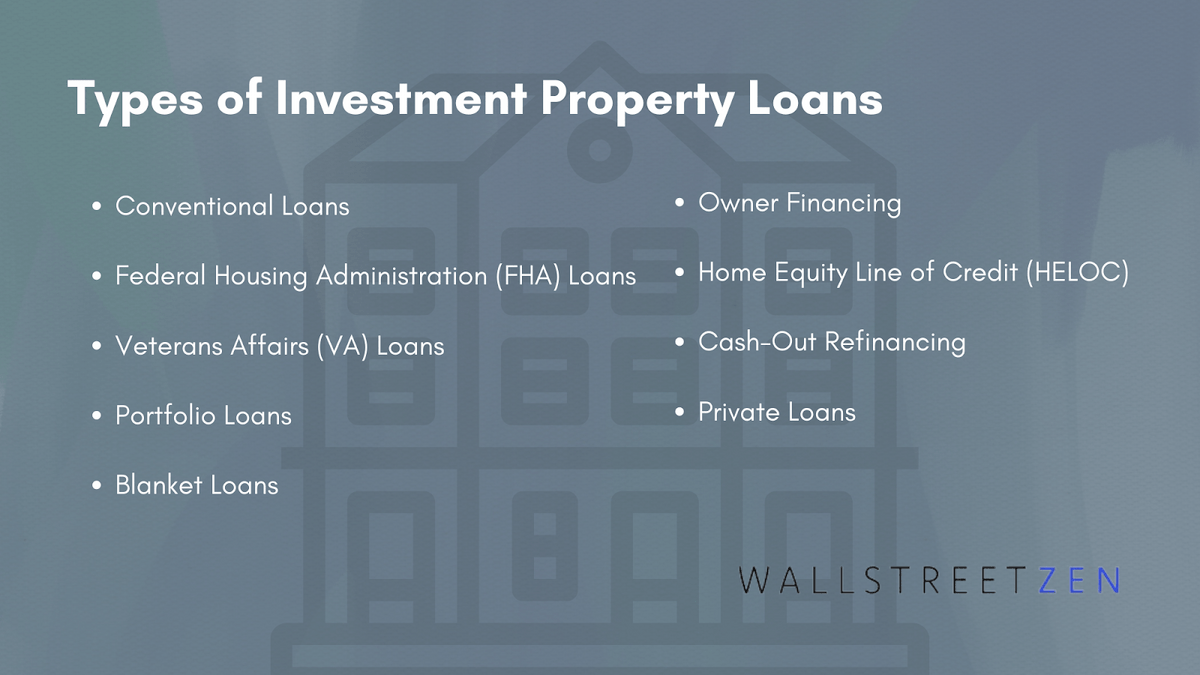

Types of Investment Property Loans

Conventional

Investment property loans are often structured as conventional mortgages. This is a similar structure to a traditional primary residence mortgage.

Usually, down payments of between 20% and 25% are required for traditional investment property loans, compared to the often much lower minimum range of between 3% and 5% needed for a primary residence.

FHA

FHA loans are insured by the Federal Housing Administration. While these loans are typically intended for primary residences, they can sometimes be used for rental properties.

Down payments are typically between 3.5% and 10%. While these loans have low credit requirements, they include upfront and annual mortgage insurance premiums.

VA Loan

These loans are backed by the U.S. Department of Veterans Affairs. They are intended for U.S. veterans, active service members, and qualifying spouses.

While typically intended for a primary residence, they can be accessed under certain conditions to finance an investment property. An example would be an investor purchasing a multi-unit property where they live in one unit and rent the remaining ones. Often no down payment is required unless the property’s purchase price exceeds its appraised value or the loan limit set by a county.

Portfolio Loan

Portfolio loans are loans that cannot be sold on the secondary market. They remain on a lender’s books.

Portfolio loans are considered non-conforming loans. This means they don’t meet the standard bank lending criteria. This can be due to a lack of good credit or simply because the funds will be used to finance an unorthodox real estate project.

This also means they don’t necessarily have to follow the same underwriting guidelines or loan terms. Still, often they demand higher down payments (usually a minimum of 20%) and include higher interest payments.

Blanket Loan

Blanket loans refer to a financing structure that covers multiple properties under one mortgage. It’s a method to simplify the management of numerous properties.

While the properties remain under one mortgage, borrowers can still sell one property without adversely affecting the overall loan. Down payments can vary widely, typically between 25% and 40%.

Owner Financing

With owner financing, the property seller supplies the buyer with the loan. This scenario often happens when the buyer (borrower) cannot qualify for traditional investment property loans. Down payments will usually range between 10% and 20%.

HELOC

A Home Equity Line of Credit, or HELOC for short, is a revolving line of credit based on the equity in a homeowner’s property. Cash can be accessed and used to fund an investment property. However, since the borrower’s home is used as collateral, it’s at risk if they cannot repay the HELOC. Since they are secured by the equity in the homeowner’s property, down payments are usually not required.

Cash-Out Refinancing

This refers to refinancing an existing mortgage. Following a cash-out refinancing, a borrower’s new loan amount will be larger than the existing mortgage.

This difference is cash that the borrower can use for investment. While no traditional down payment is required, borrowers must usually maintain sufficient home equity to qualify (typically a minimum of 20%).

Trying to decide whether to purchase or refinance? Stessa’s mortgage portal has great resources to help you figure it out.

Private Loans

Private institutions or even private individuals provide these loans. They can often be initiated quicker than other types of loans and typically have more flexible terms.

However, private loans usually come with higher interest rates and reduced repayment periods compared to more traditional loans. Down payments with private loans vary considerably, from 0% to 50% and beyond.

Minimum Requirements to Get an Investment Property Loan

Bigger Down Payments

Often, the down payments detailed above exceed that needed for a traditional primary residence mortgage.

This is because investment property loans are considered riskier to the lender, so they demand a higher interest rate in return for the financing.

While many exceptions exist, investment property loans usually require a minimum of 15% down for a single-family property and 25% for a multifamily property.

Higher Credit Score Requirements

Investment property loans usually require higher credit scores for the same reason they often demand higher down payments; added perceived risk to the lender. A minimum score of 620 is typically needed; primary residence mortgages can be obtained with scores as low as 500.

Investment property loans typically require a high credit score. Could yours use a little work? Build it up with these top-rated tools:

- Smarter budgeting (FREE calculators and tools): Empower (formerly Personal Capital)

- Credit-building card: Chime’s Credit Builder VISA Card

- High-yield savings accounts: M1 Finance (5% interest)

To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits.

Larger Mortgage Reserves

Lenders of investment property loans will often require higher mortgage reserves. These are the cash assets a borrower must hold in reserve following the loan closing process. It’s a way lenders can ensure borrowers are more likely to make loan payments.

Because investment property loans are considered riskier, the reserve is typically higher than a primary residence mortgage. While the amount varies, lenders usually want cash reserves sufficient to cover six months of mortgage payments without rental income.

Rental Income Proof

Lenders may demand proof of rental income. For example, if the property being purchased already has tenants, this can assure the lender of the level of rent the property can generate.

Potential Rental Income to Qualify for a Loan

If a property does not currently have tenants, a market rent analysis may be required to help determine the property’s rental income potential.

Property Management Experience

Some lenders may demand a track record of property management before providing financing. The ability to effectively manage properties tells the lender you are more likely to make consistent debt repayments. Poor property management experience may raise the risk of losing tenants and losing cash needed to repay the loan.

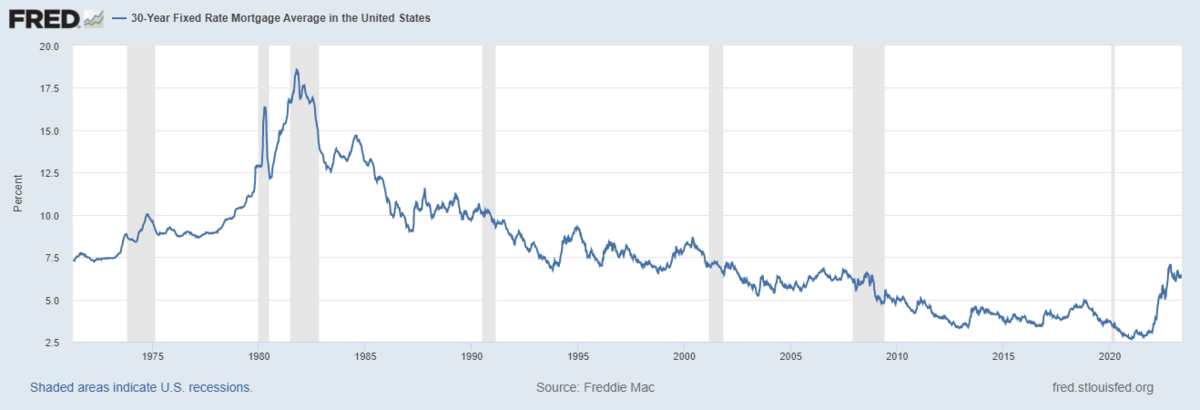

What You Need to Know: Investment Property Loan Rates

On balance, investment property loans will have higher interest rates than comparable primary residence mortgages. There are multiple reasons for the higher rates.

- Vacancy Risk: There’s a risk the property will be vacant and not generate rental income for an extended period. This can directly impact the borrower’s ability to make timely mortgage repayments.

- Default Risk: If the borrower runs into financial trouble, their primary residence mortgage will likely be prioritized over their investment property loans. This opens up the lender to more risk.

- Property Maintenance: Poor maintenance can result in lost tenants and deterioration of the property. A property that can substantially drop in value due to disrepair is a risk to the lender. If the lender ever needs to sell the property to cover the loan, it may not generate a sufficiently high sale price.

How to Get an Investment Property Loan

Want to fast-forward the process? Sign up for Stessa and get connected directly with investment property lending providers.

The steps needed for investment property loans are not unlike those required for traditional primary mortgages.

- Evaluate Your Financial Situation: Review your income, credit score, debt-to-income ratio, and available down payment cash.

- Determine the Type of Loan You Require: Identify the best loan structure given your unique considerations (i.e., the type of property you’re interested in purchasing, your current financial situation, available down payment, etc.).

- Shop Around with Multiple Lenders: Contact multiple lenders to compare a variety of offers.

- Prepare Necessary Documentation: Organize documents like proof of income, bank statements, tax returns, rental market assessments, etc.

- Apply for Pre-Approval: Officially apply for pre-approval once you have identified a potential lender with which you’d like to work.

- Locate a Suitable Investment Property: Locate an investment property that meets your needs. Consider your budget, the property’s condition, and its potential to generate rental income, among other items.

- Make an Offer: Deliver an offer to the property owner.

- Complete Necessary Due Diligence: Typically, a window of time will be given after an offer is accepted for the buyer to complete any required due diligence.

- Finalize Loan: At this stage, any final details of the income loan property will be completed, like the lender’s appraisal of the property value. A final check of the borrower’s finances is also typically completed at this step.

- Close the Deal: Should there be no issues with finalizing the loan, all documentation can be signed, and closing costs and down payment can be paid before loan funds are ultimately disbursed to facilitate the property purchase.

Prefer to Invest Passively?

Some investors don’t want the hassle of managing an investment property and dealing with sometimes unruly tenants. Fortunately, some platforms allow you to obtain passive exposure to rental income and avoid these headaches. First up?

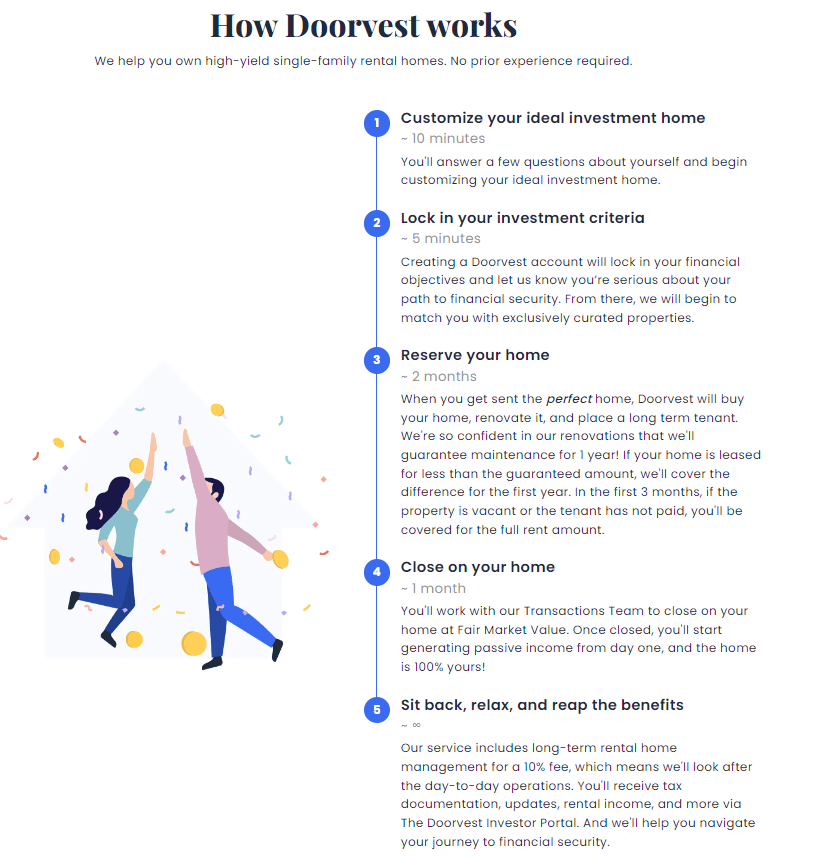

Doorvest

Turnkey rental property and management company Doorvest shines for investors who want to be more passive.

You still have to buy the property, but from there, pretty much everything else is taken care of.

With Doorvest, you fill out a questionnaire, and they do the rest: locate an investment property, complete renovations, and even find a suitable tenant! Doorvest’s interactive dashboard, allowing you to follow your real estate investments closely.

If you don’t have the cash for Doorvest, consider crowdfunded real estate platforms.

Crowdfunded Real Estate

These platforms allow you to invest in shares of rental properties, often with very low initial amounts. Often, your investment is pooled with other investors and managed by the platform. That means as a real estate investor, you can reap the benefits of rental income without the hassle of changing a toilet for your tenants!

Here are some suggestions…

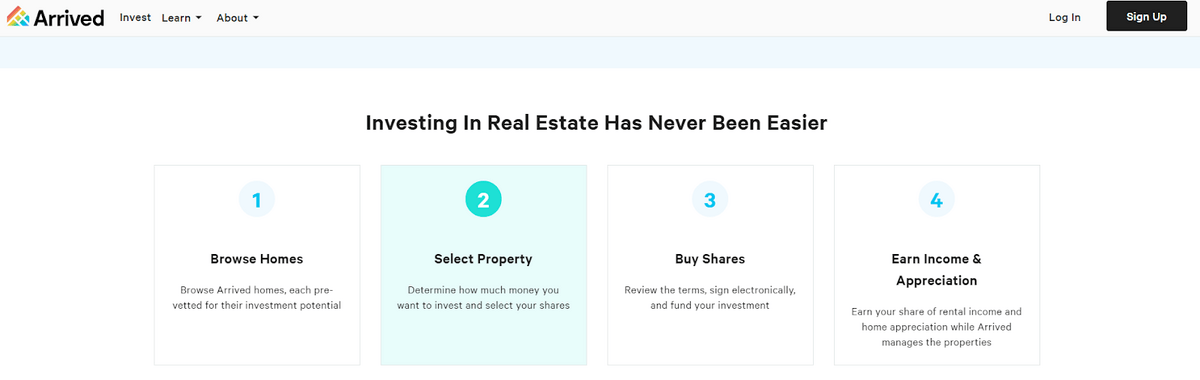

Arrived Homes

Arrived Homes is one of our favorite platforms for passive exposure to residential real estate investments. You know precisely what property your cash is funding, and the company boasts a portfolio of over 266 funded properties.

RealtyMogul

RealtyMogul allows you to browse a database of commercial real estate, conduct due diligence, invest in a property, and monitor the investment through their online dashboard. RealtyMogul stands out with nearly $6 billion in property value on its platform.

While there are opportunities for non-accredited investors, accredited investors will have the most options to choose from on this platform.

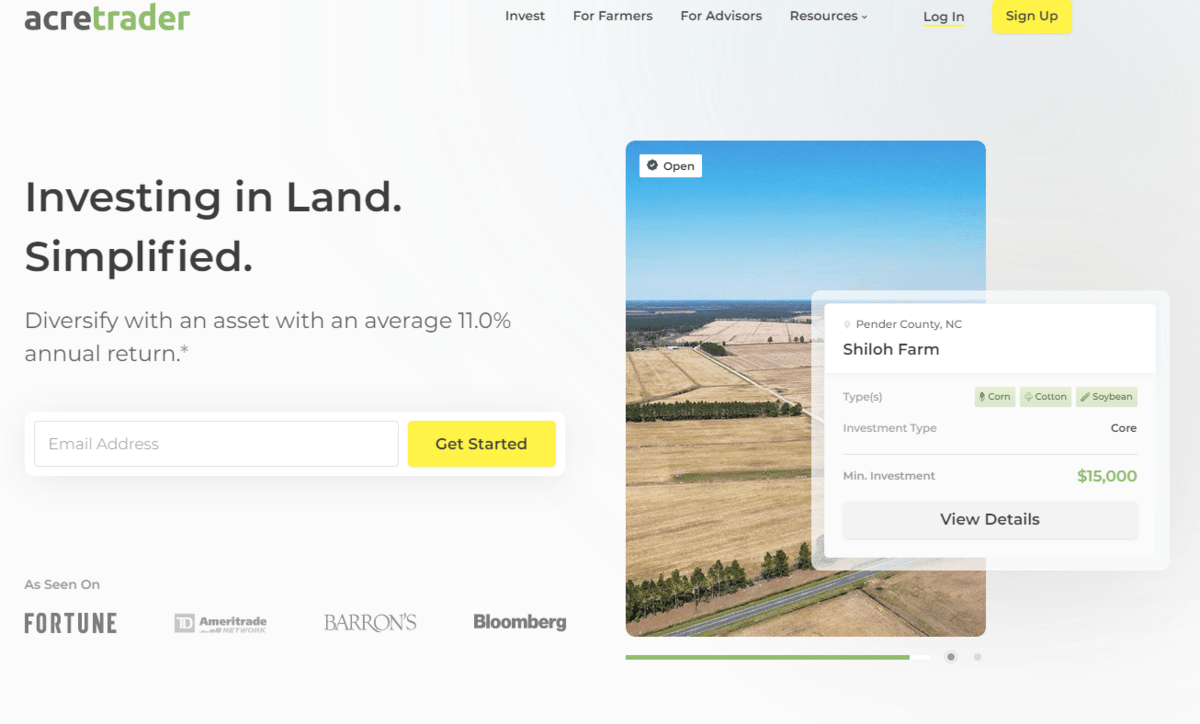

AcreTrader

AcreTrader is a unique platform that allows accredited investors to access passive farmland real estate. f you’re looking to diversify your real estate exposure, AcreTrader is an excellent platform to consider.

Even if you already, for example, actively manage residential properties, an allocation to passive farmland can help enahance your real estate holdings.

Are you an accredited investor? Great news — there are all sorts of cool opportunities available to you. Check out our article about the best investments for accredited investors.

Final Word:

While investment property loan rates and down payments are higher than comparable primary residence mortgages, they provide investors the opportunity to earn lucrative recurring income. For this reason, some ambitious investors even end up with portfolios comprised of thousands of rental properties.

If you’re in the market for a rental property, it’s critical to understand the various income loan property structures you have available. Not only that, it’s prudent to shop around with a variety of lenders to ensure you obtain a favorable offer.

And if fixing a washing machine on a Saturday morning isn’t for you, worry not; passive real estate investment opportunities are plentiful.

FAQs:

Are mortgage rates higher for an investment property?

Yes, typically, mortgage rates are higher for an investment property. An income loan property comes with greater risks for the lender, often translating to higher mortgage rates than traditional primary residence loans.

Can you get a lower interest rate on an investment property?

Yes, you can potentially get a lower interest rate on an investment property by using a different loan structure or a more competitive lender. You can also work to improve your overall credit score to help obtain more favorable income loan property interest rates.

What kinds of rental property loans are available?

There are numerous rental property loans available, including conventional loans, government-backed loans (FHA loans, VA loans), portfolio loans, and Home Equity Lines of Credit (HELOCs).

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.