Don’t give up hope! If you want to know how to buy a house with bad credit, this article is for you.

Just because you have bad credit doesn’t necessarily mean you can’t purchase a home. Countless individuals successfully pursue home ownership despite sometimes years of poor financial management.

We’ll explain what “bad credit” means, how you can work to improve your credit score, and the different types of home loans you can expect to find in the market.

Don’t want to buy a house with bad credit? Check out these top-rated resources to help you save, build credit, and potentially earn money…

- Smarter budgeting (FREE calculators and tools): Empower (formerly Personal Capital)

- Credit-building card: Chime’s Credit Builder VISA Card

- High-yield savings accounts: CIT Bank (4.85% interest) and M1 Finance (5% interest)

- Crowdfunding real estate platforms: Our top picks are Arrived Homes and Fundrise

How to Buy a House With Bad Credit

The bottom line: If you have bad credit, don’t despair. You have options.

While lower credit scores can make it more challenging to obtain credit and buy a house, it’s well within reach for many people.

Many types of loans have lower credit requirements and many lenders offer financing to individuals with lower credit scores. Let’s get into it all…

What is “Bad Credit”?

A credit score is a reflection of an individual’s debt repayment history. It’s a grading applied to borrowers that tell a lender how effectively they paid back debt obligations in the past. While there are other factors, bad credit is typically the result of:

- Failure to pay back debt obligations on time (like monthly car financing payments).

- Lack of a long track record. A one-month history of credit doesn’t tell a bank too much. Therefore they prefer clients with long track records, all else equal.

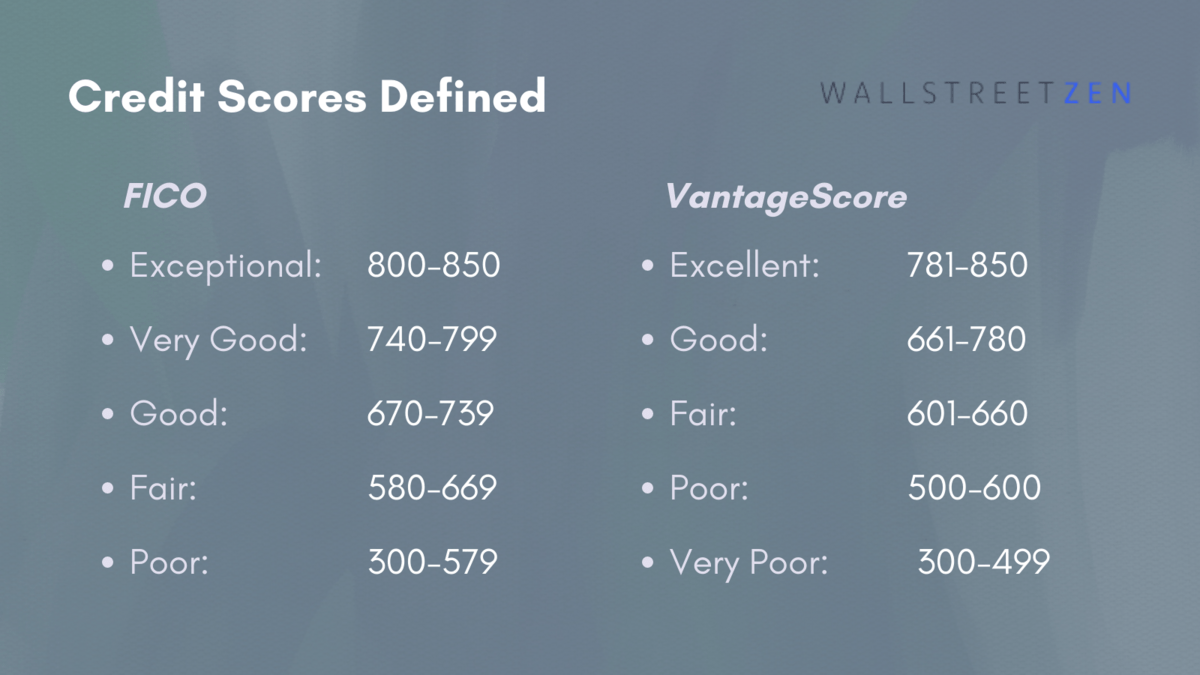

In the United States, credit scores are typically determined using the VantageScore or FICO models. Roughly speaking, poor or very poor credit would be considered a score of 600 or below.

FICO model:

- Exceptional: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

VantageScore model:

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 500-600

- Very Poor: 300-499

Why does bad credit matter to a financial institution?

That’s simple: lenders prefer clients with a long history of timely debt repayments. Clients with bad credit have a poor history which lenders fear could persist. As a result, lenders will often deny financing to clients with poor credit.

Avoid a Bad Credit Mortgage: Improve Your Credit

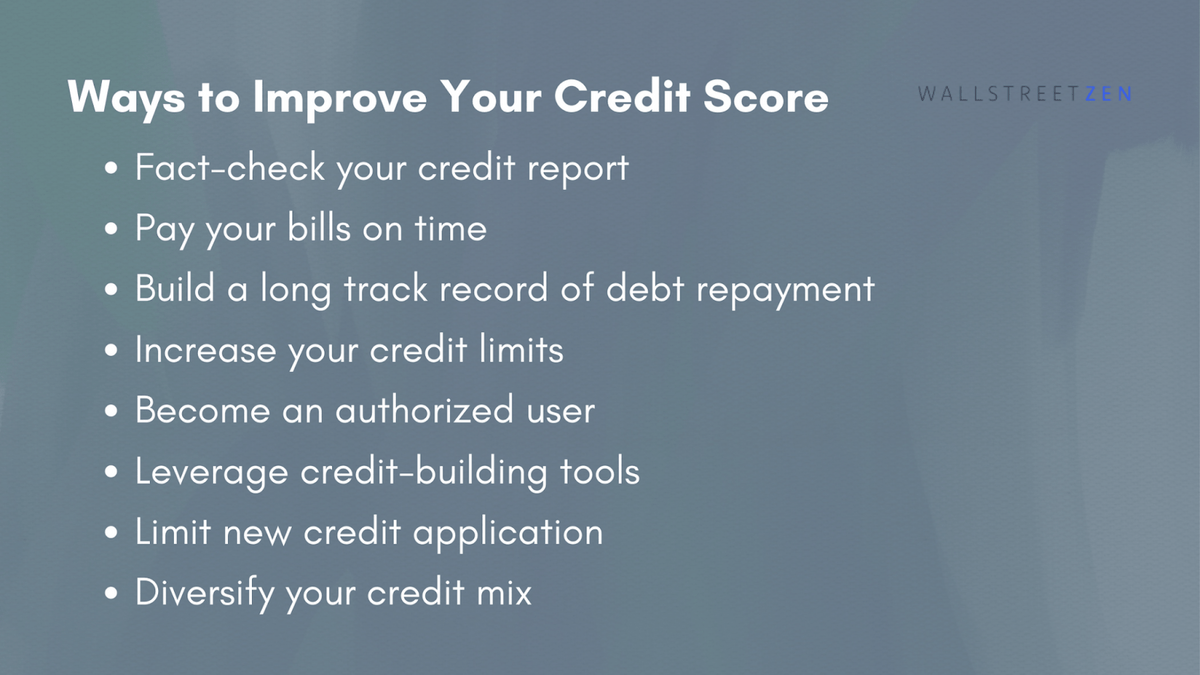

Fact-Check Your Credit Report

To avoid a bad credit mortgage, it’s prudent to take some time to review your credit report for any inaccuracies. The credit report may have errors in the data that suggest your credit is worse than it is in reality. Confirm the report looks accurate to the best of your knowledge.

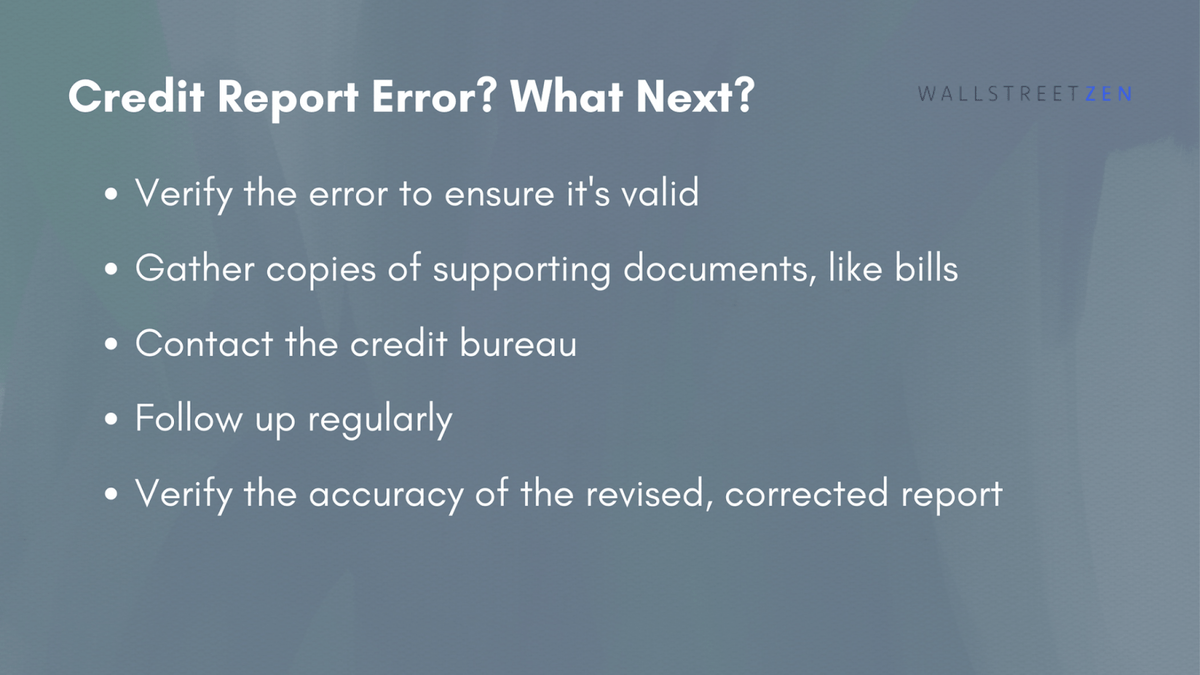

If you identify any errors, you should do the following:

- Verify the error: Ensure the discrepancy is valid.

- Gather supporting documentation: Locate any documents that can help support a resolution to the error, like a bank statement or payment record.

- Contact the credit bureau: Write a detailed letter to the reporting agency (i.e., Equifax). Include copies (not originals) of supporting backup material to help the agency resolve the issue.

- Follow up: Ensure you follow up with the letter if you have received no response within 30 days.

- Review the revised report: Carefully inspect the new report to ensure the error has been corrected (and ensure no new errors have emerged).

Pay Your Bills on Time

Late payments can substantially negatively affect your credit score. Lenders review potential borrower payment history to determine if they’ll be reasonably expected to repay the loan on time.

Making regular bill payments on time shows the lender you’re reliable. A great way to ensure this is done is to set up automatic or recurring payment reminders.

Need help budgeting?

Don’t snooze on Empower (formerly Personal Capital). The platform is perhaps best known as a portfolio management tool, but what you may not know is that it has a ton of FREE tools and calculators that can help you create (and maintain) a budget, save for future goals, and more.

Build a Track Record

The longer you maintain timely credit payments, the better it reflects on your credit score. In other words, the person with a longer history of timely payments will have a better credit score than the person with a shorter history, all else equal.

Increase Your Credit Limits

Don’t get the wrong idea; the point is not to use more credit. Instead, you simply want to increase your potential borrowing amount.

Why?

All else equal, lenders prefer borrowers with lower credit utilization rates. The credit utilization rate is simply the percentage of credit being used. For example, if you have a limit of $5,000 and your balance is $1,000, your credit utilization rate is 20%.

However, if you have a limit of $2,000 and your balance is similarly $1,000, your credit utilization rate is much higher at 50%.

Ultimately, lenders don’t want borrowers on the cusp of utilizing all their credit.

Become an Authorized User

Becoming an authorized user on another person’s credit card can also help boost your score. Typically, lenders will look favorably upon this action if the borrower is added to a credit card with a high credit limit and a long history of timely payments.

Think of it this way. Associating with someone with good credit is a sort of endorsement of your ability to make timely payments. It’s like a referral to the lender: “Hey, I trust this person, so I’m comfortable adding them as an authorized user on my credit card.”

Use Credit Building Tools

Credit-building tools can be an effective way to help improve your credit score. Tools like Chime’s Credit Builder VISA Card make it exceptionally easy to maintain prudent credit card spending.

So, how does a tool like Chime’s Credit Builder VISA work?

- Transfer Money: First, you transfer money into your Credit Builder-secured account at Chime. You can do this manually or set up recurring transfers to move cash from your checking account to your Credit Builder account each time you get paid.

- Spend: You must spend money on credit to build your history. The problem is, sometimes we spend too much. Thankfully, the Credit Builder card limit is capped by the amount of money in your Credit Builder account. That is, you can’t spend more on your VISA than you already have available in cash. Perfect!

To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits.

Limit New Credit Applications

Sometimes, applying for new credit can actually help your credit score (i.e., obtaining a Chime Credit Builder VISA could eventually help lower your score through an improved track record).

That said, by and large, you want to limit how frequently you apply for new credit. Frequent credit applications indicate to borrowers that you cannot effectively manage your debt finances.

As much as possible, limit new applications.

Diversify Your Credit Mix

While you certainly don’t want to apply for new credit frequently, it’s not a bad idea to have access to multiple sources of credit. Being able to pay off a credit card, mortgage, and car payment in a timely fashion is a positive attribute in the minds of lenders.

It goes without saying, but it’s important to reiterate: multiple sources of credit are only helpful if you actually pay the debt off promptly. Otherwise, more sources of credit will be detrimental to your overall score.

What if You Don’t Qualify for a Loan?

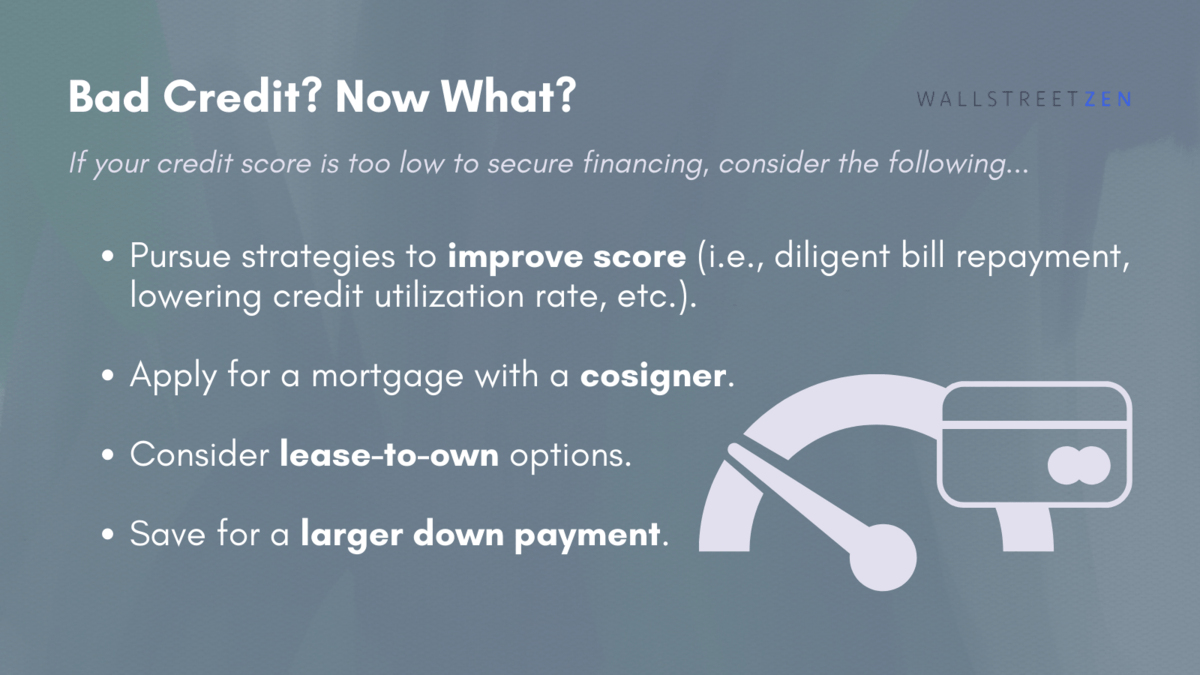

Mortgage lenders typically require minimum credit scores of between 500 and 640, considered poor to fair.

In some cases, your credit score may be even lower than the minimum, and that’s okay. You have other options.

- For one, you can begin pursuing some of the strategies we listed earlier to boost your credit today. The earlier you start building a solid financial track record, the better.

- You can also consider applying for a loan with a cosigner with better credit. In many cases, people will use a family member, like a parent.

- You might even want to consider lease-to-own options. Individuals who lack the creditworthiness to secure a mortgage can often pursue a lease-to-own alternative.

- If possible, you can also save for a larger down payment. In some instances, you may be able to secure a loan from a family member to help supplement the down payment.

- Whatever the case may be, don’t give up. There are many ways to obtain a home, even with bad credit.

Supercharge your savings…

Want to build up your savings fast? Don’t let your money sit around in your checking account or any old savings account.

Instead, harness the power of a high-yield savings account!

Right now, at least two establishments we trust are offering extremely high HYSA interest rates:

- CIT Bank: 4.85% interest

- M1 Finance: 5% interest

Terms and conditions apply.

5 Best Bad Credit Home Loans

Looking for a loan? Here are five of the most common types, including how they stack up for bad-credit borrowers.

Conventional Loan

Minimum credit score: 620

How it works: Conventional loans are offered through private lenders, credit unions, and banks. These loans are not insured by the government, unlike FHA, USDA, and VA loans). Conventional loans generally required 3% to 20% of the home’s purchase price as a downpayment.

USDA Loan

Minimum credit score: 640

How it works: USDA loans are offered by the United States Department of Agriculture and designed to assist low- to -moderate-income Americans in rural regions.

USDA loans offer 100% financing (no down payment is required). These loans typically enjoy lower rates than many conventional loans.

FHA Loan

Minimum credit score: 500 with a 10% down payment or 580 with a 3.5% down payment

How it works: FHA loans are insured by the Federal Housing Administration. FHA loans are intended for low- to moderate-income borrowers who may struggle to procure a large downpayment.

VA Loan

Minimum credit score: 620

How it works: VA loans are offered by the U.S. Department of Veteran Affairs and are intended for veterans, military service members, and eligible surviving spouses. While the VA gives no official minimum credit score, lenders typically require a minimum score of 620. VA loans can be obtained without a down payment (100% financing) and do not require private mortgage insurance (PMI).

Home Buyer Assistance Loans

Minimum credit score: 640

How it works: There are numerous home buyer assistance loans that borrowers can access. These types of loans are often offered by state or local governments, nonprofits, or traditional lenders. They are designed to help low- to middle-income first-time home buyers. In certain instances, these loans can also come with closing cost assistance, down payment assistance, and lower interest rates, among other unique benefits.

Invest in Crowdfunded Real Estate

Some people don’t necessarily need to buy a home to live in; they want the home as an investment. Luckily, you can obtain exposure to home ownership without directly owning an entire house yourself.

Crowdfunded real estate is one such method. It allows you to invest in real estate by pooling capital with multiple investors to finance a property. Often, this is done through a simple online platform.

Our favorite platforms if you’re just getting started? Arrived Homes and Fundrise, which both have very low minimums.

This method of investing can be particularly beneficial for individuals who can’t afford an entire property on their own or those who don’t wish to concentrate too much money on a single investment property.

Important note: Crowdfunding real estate is not recommended for everyone. If the reason you’ve got bad credit is that you’re behind on your bills or payments, it’s suggested that you focus on paying off debt and building up your savings first — investing can come later.

Platform | Minimum investment | Best for |

$100 | Individuals looking for a low-cost, easy-to-use platform to begin investing in real estate. | |

$10 | Individuals looking to invest in rental homes with a very low barrier to entry. | |

$1 | Individuals looking to invest in REITs with very low minimums. |

Final Word: Fastest Way to Buy a House with Bad Credit

You came here to learn how to buy a house with bad credit, and hopefully, we’ve helped.

Individuals with poor credit can follow the strategies outlined in this article on their quest for homeownership.

You need to focus on actions that improve your credit score, like investing in crowdfunded real estate projects. You also need to consider pursuing loan types with lower requirements. Lastly, consider working with lenders more willing to provide loans to borrowers with lower credit scores.

Ultimately, the fastest way to buy a house with bad credit and zero down is to leverage as many of these strategies as possible. The more positive actions you take – and the longer you take them – the more likely you are to secure financing to purchase your dream home.

FAQs:

What is the lowest credit score to buy a house?

While it can vary widely, the lowest credit score that you can buy a house with is typically 500.

Is 500 credit score enough to buy a house?

Yes, in many cases, a 500 credit score is enough to buy a house, though it depends on the lender.

Can I get an FHA loan with a 500 credit score?

Yes, it is possible to get an FHA loan with a 500 credit score. Typically, you’ll require a 10% down payment to be approved for financing.

Can you buy a house with 400 credit score?

Yes, you can buy a house with a 400 credit score, but you likely won’t be able to obtain any financing. Generally, a 500 credit score is needed to secure financing from most lenders.

Are there any first-time home buyer loans with bad credit and zero down?

Yes, there are first-time home buyer loans with bad credit and zero down, like those offered by the U.S. Department of Agriculture. USDA loans offer low- to middle-income borrowers in rural areas with bad credit the ability to secure financing with zero down. A minimum credit score of 640 is usually needed.

Additionally, VA loans can be obtained with bad credit and zero down payments. Typically VA loans will require a minimum credit score of 620 and are only available to veterans, military service members, and eligible surviving spouses.

How to buy a house with bad credit?

You can buy a house with bad credit by improving your credit score, choosing bad credit home loans with typically lower lending requirements, and working with lenders that are willing to lend to borrowers with lower credit scores.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.