You found your dream house … It costs $600,000. Cue the feverish Googling — what’s the income needed for $600k mortgage?

Well, that depends. Down payments (or lack thereof) are key when it comes to mortgage rates. The bigger the down payment, the easier it is to get a mortgage. On the flip side, the income needed for $600k mortgage goes up exponentially if you don’t make a down payment.

It can be tough to figure out what you can afford — in this article, I’ll explain several of the most confusing aspects, like what types of loans you need with a smaller down payment, considerations when buying a house, and ways to beef up your savings so you can afford more.

So, how much do you need to make to get a $600,000 mortgage? Let’s explore…

How will your house payment fit into your monthly budget?

It can be tough to know — Empower (formerly Personal Capital) can help you figure it out.

While the platform is known as an investment and portfolio management tool, here’s a secret — it’s also loaded with plenty of FREE resources and calculators, including a no-cost Budget Planner and free Financial calculators.

Many users go for the free tools but are so impressed that they upgrade to Empower’s investment accounts or wealth management services. See for yourself what they have to offer…

Income Needed for 600K Mortgage: The Bottom Line

How much mortgage can I afford?

When considering the income needed for 600k mortgage, you need to consider a few things, like your down payment (or lack thereof).

For instance…

- To buy a 600k home with a zero downpayment would require an income of around $196k based on Capital One’s Home Loans Calculator.

- To buy a 600k home with a 20% downpayment would require an income of $144k.

So when considering the whole income needed for $600k mortgage question, you need to consider your specific situation. That will differ for everyone based on existing financial obligations such as credit card debt, student loans, and retirement savings.

How Much Do You Need to Make to Get a $600K Mortgage?

The table below shows the income needed for a 600k mortgage loan with no downpayment, which is around $196k.

But for comparison, you’ll also see how much the same home would cost with various down payments. The table assumes the following:

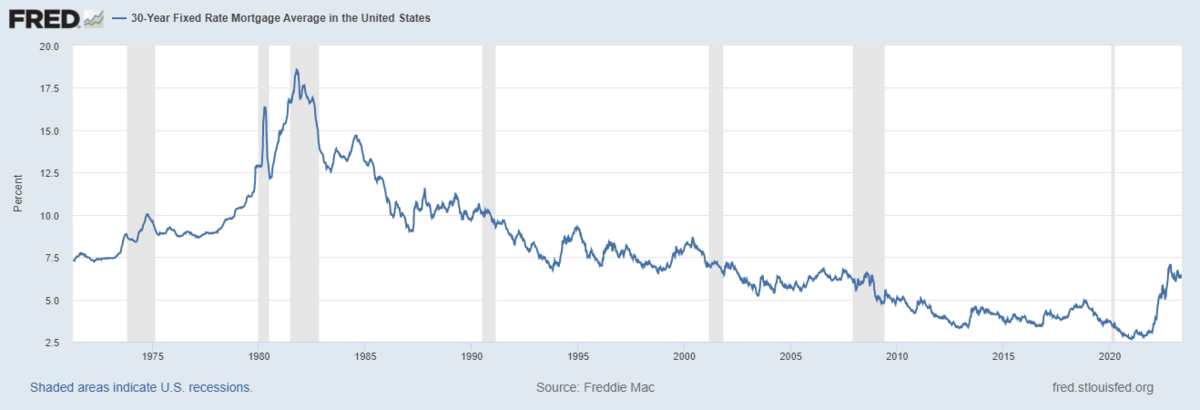

- An interest rate of 7% with a 30-year term with monthly liabilities of $1,500 (auto loans, credit cards, student loans, etc.)

- Monthly housing expenses of $650 (property taxes, hazard insurance, private mortgage insurance (PMI), etc.)

House cost | Down Payment | Total Loan Amount | Maximum approximate Monthly Payment | Approximate Income Required |

$600K | 0% | $600K | $4,391.81 | $196,394 |

$600K | 10% | $540K | $4,242.63 | $191,421 |

$600K | 20% | $480K | $3,843.45 | $178,115 |

$600K | 25% | $450K | $3,643.86 | $171,462 |

Can You Buy a $600K Home With No Money Down?

Is no down payment possible?

Probably, but your monthly payments will be high. Basically, the lower your down payment the higher your salary needs to be to cover the monthly costs.

Most people can expect to put at least 3% to 3.5% down, which is the minimum for a conventional or FHA loan. VA loans and USDA loans both allow zero dollars down, but you must meet specific qualifications. VA loans are for military and veterans only, and USDA loans serve low-income buyers.

Here are some options if you need help to afford a down payment.

VA Loan

The VA loan is a U.S. Department of Affairs-backed mortgage available to the U.S. military, veterans, and their surviving spouses. They do not require a down payment, have no maximum, and offer lower rates and easier requirements to borrowers who meet the guidelines.

To qualify, you will need a credit score of between 580 to 620 and a two-year employment history. These loans do not charge private mortgage insurance (PMI). PMI is a monthly charge added to conventional loans when the downpayment is below 20% of the home’s purchase price.

No PMI to pay could lower your monthly payment by hundreds of dollars.

USDA Loan

The U.S. Department of Agriculture offers a “Rural Housing Loan ” that requires no money down, often with lower rates than other mortgages with no or low down payment. The good news? These loans cover some suburban neighborhoods and rural areas. To qualify for a USDA loan, you must show a two-year employment history and have a credit score of at least 640.

Down Payment Gift

Another way to pay for a down payment is to ask relatives for a downpayment gift. You will need to show a gift letter from the donor and show documentation proving where the funds came from and when they were deposited into your account.

Down Payment Assistance

State and local governments offer down payment assistance (DPA) of up to 5% of a home’s price through grants or loans. To qualify, you typically need to be a low-income first-time buyer. Your local housing finance authority or a mortgage lender can help you determine if you qualify.

Lender Credits

You could ask your lender to pay your closing costs or to extend lender credits. With this payment plan, you pay a higher interest rate, and the lender gives you money to offset your closing costs. In other words, you pay less upfront but more over time with the higher interest rate. Also, the more lender credits you receive, the higher your rate will be.

Seller Concessions

Sometimes, your seller might be willing to pay for some of the closing costs. These are called seller concessions. After negotiation, the seller agrees to pay a percentage of the total closing costs. You stand more chance of seller concessions if the property has been on the market for a long time and the seller is motivated.

Considerations — $600K Mortgage With No Money Down

You might think you have the income needed for a 600k mortgage with no money down, but there are other considerations where your budget is concerned.

In addition to your mortgage payments, you may also have property tax, PMI, homeowners association (HOA) fees, and retirement savings obligations.

Many mortgage calculators don’t factor in the additional costs of property taxes, PMI, and HOA fees.

Property Tax

Local governments charge homeowners property taxes to pay for amenities like schools, emergency services, and garbage collection. The tax is calculated based on an appraisal of your home’s market value. There are some exemptions for property taxes, such as homestead exemptions, where property owners get a discount if they live in the property full-time, senior citizen exemptions, and homeowners with disability exemptions.

You can check with your local government what exemptions there are and if you qualify.

Private Mortgage Insurance (PMI)

If you have a conventional mortgage, unless you pay a downpayment of 20% or more, you will likely have to pay private mortgage insurance (PMI).

PMI protects the lender if you default on the mortgage payments. It is typically added to your monthly mortgage payment.

Homeowners Association (HOA) Fees

Some neighborhoods, condos, and coops have a homeowners association (HOA) that charges fees. These fees pay for the maintenance of the surrounding property and amenities, such as the parking lots, swimming pool, and other common areas.

Monthly payments can range from $100 to $1,000 per month. If you don’t pay the fees, you may face late fees, a lien on your property, and sometimes foreclosure.

IRA/401k Retirement Savings

A general rule of thumb for saving for retirement is to save 10 to 15% of your pretax income annually. So, if your pretax income is 50k a year, you need to save around $5,000 a year, which is around $400 a month.

How much you will need for retirement depends on the lifestyle you want, how long you have to save, and your life expectancy. The 80% rule is to generate 80% of your pre-retirement income when you retire using Social Security, pensions, and savings.

Can’t Afford a 600K Mortgage With No Down Payment?

Supercharge Your Savings

Here are a few easy ways to level up your savings game…

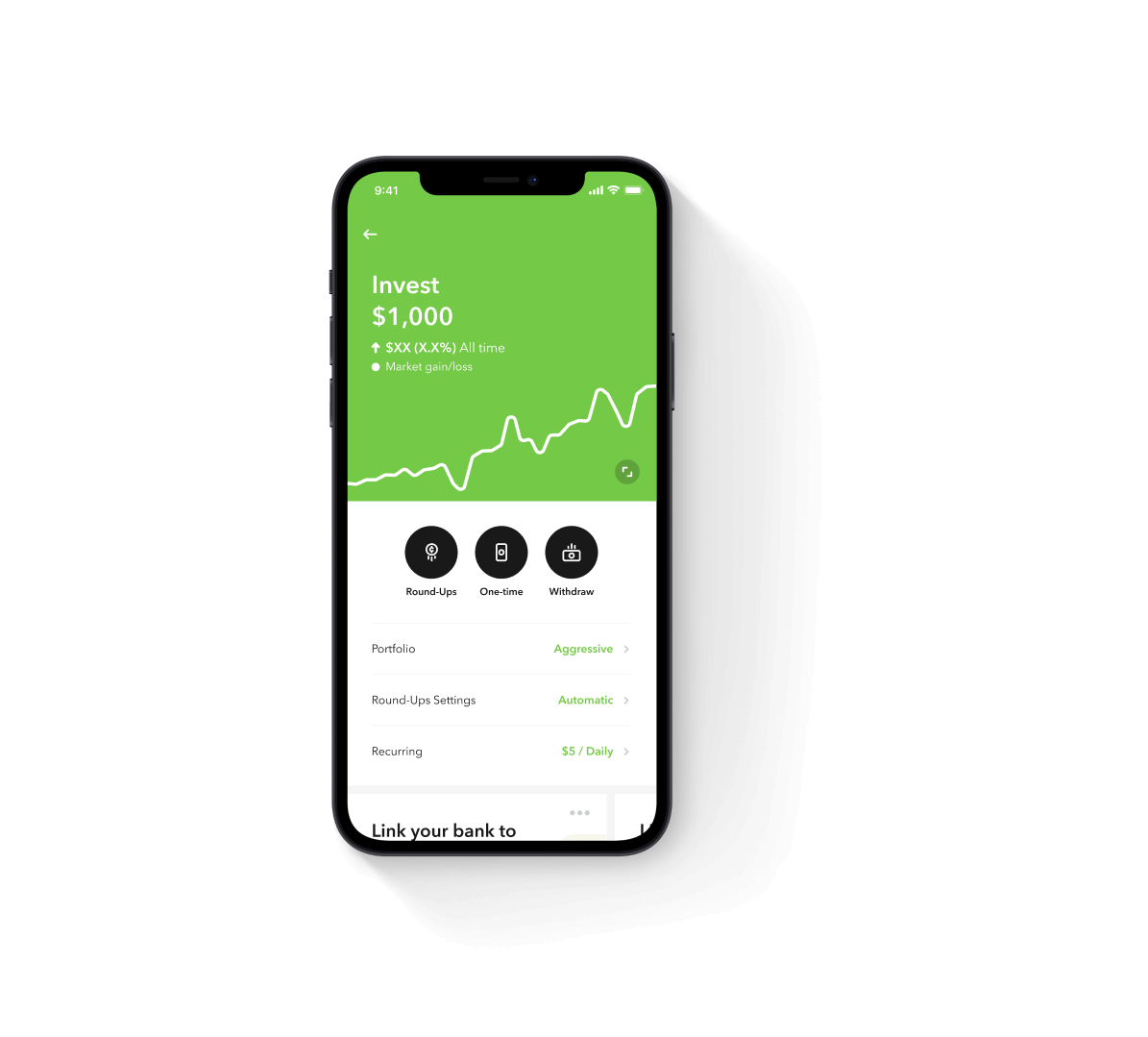

Acorns

Acorns is a banking app that helps you save and invest by saving your spare change and helping you build an investment portfolio.

Let’s say you buy a coffee for $4.25, the app will automatically put 75 cents into your savings account. You get a diversified portfolio of ETFs, a retirement account, and banking services.

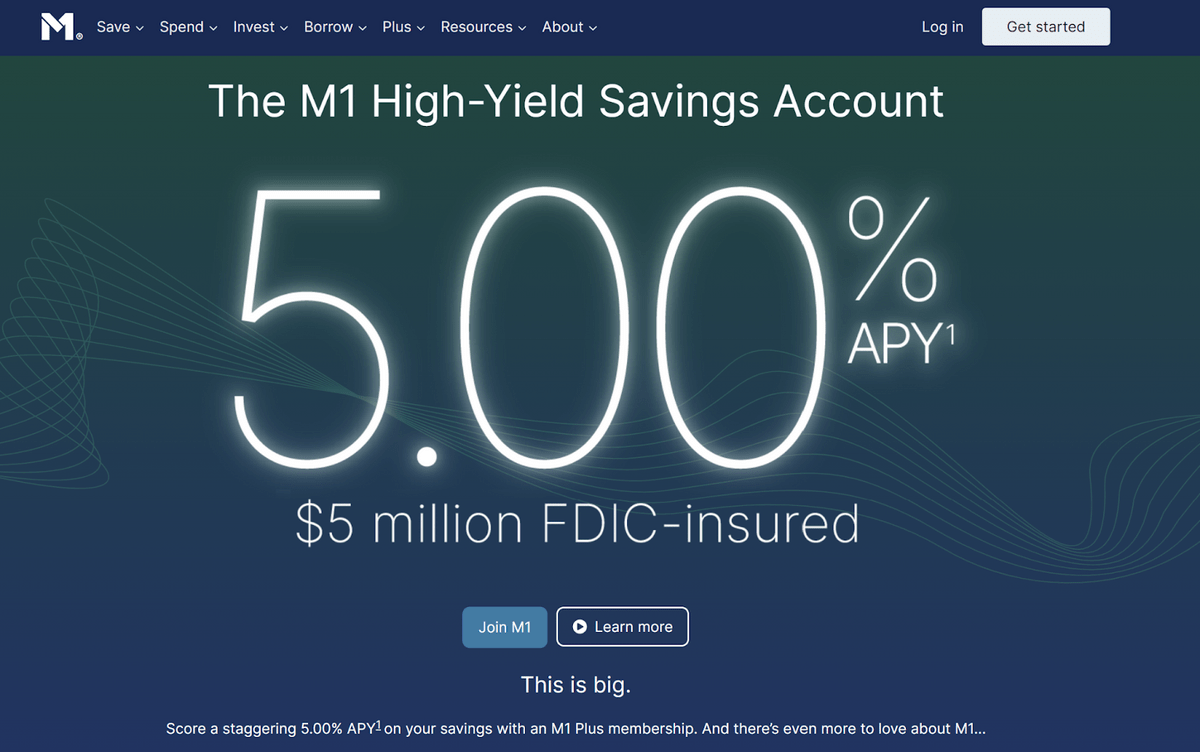

M1 Finance

M1 Finance is another great option for boosting your savings. The platform offers digital checking accounts and brokerage accounts. Right now, the platform is offering an impressive 5% APY on high-yield savings accounts — that’s a lot better than the average (regular) savings account APY, which is currently about 0.40%…

Get Smart About Budgeting

Sitting down with a Google or Excel spreadsheet to map out your spending isn’t the most fun thing to do, but budgeting is crucial to manage your finances and save for a downpayment. So, why not use an app to help you?

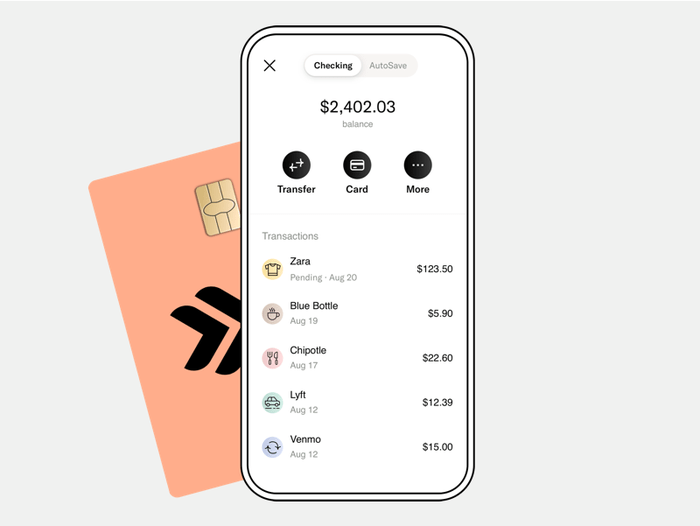

Empower

Empower is a personal finance app that connects to your checking account and helps you cut unnecessary expenses, manage your bills, and plan your financial future.

They offer varying account levels, everywhere from no-minimum investment accounts to IRAs to money management for accounts of $100K+.

One of my favorite features? An AutoSave feature that looks at your spending and automatically saves for you when you have extra funds available.

Empower also has plenty of amazing budgeting tools and free calculators that can help you make sense of your finances and make a smarter game plan for the future.

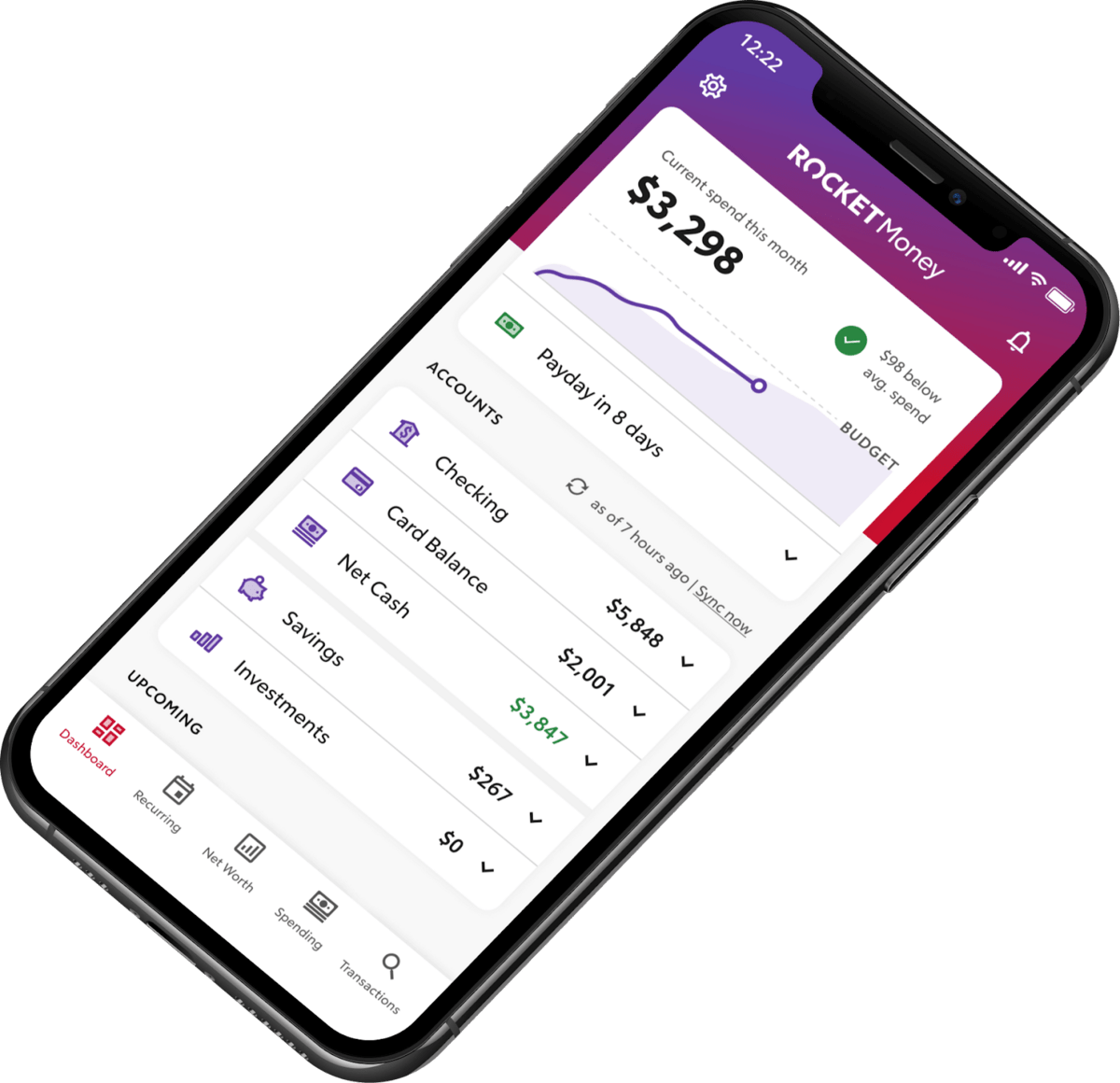

Rocket Money

Rocket Money is another tool that helps you track your spending and budgeting. This app will scan your account to find unwanted subscriptions and cancel them. If you want that downpayment, perhaps you really can do without Blue April or Hulu for a while.

Pay Off Debt

Paying off debt can help you in two ways.

- First, once your debt is paid off, the interest you would have been paying can now go toward a downpayment.

- Second, as you pay down your debt, your credit score will improve, which means you’ll qualify for better mortgage loan terms.

Look into First-Time Homebuyer Programs

There are grants, special loans, and downpayment assistance programs (DAPs) for first-time borrowers looking. State agencies offer these home buyer programs, and most allow you to use gifted money or DPA money to cover the down payment and closing costs. Check with a lender or real estate agent to find programs in your state.

Build Up Your Credit

Your credit standing is everything when it comes to a mortgage loan. Without good credit, you’ll pay a higher interest rate, and the loan will be costly. The better your credit, the lower the cost of the loan and the less downpayment you will need.

You can build credit by paying off debt, using a debit or credit card wisely, and making regular payments.

One of the easiest ways to build up credit with minimal effort? Chime, a banking app that offers a bank card and a new secured credit card that builds credit. According to Chime, their secured credit card can increase your FICO score by an average of 30%.

To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits.

Final Word: 600K Mortgage With No Down Payment

How much do you need to make to get a $600,000 mortgage?

If you don’t have a nest egg, bummer news: you’ll need a salary close to $200k to afford a conventional 600k mortgage with no down payment.

That may not be in the cards for everyone. If you don’t have the cash right now…

- Pay off as much debt as you can.

- Build your credit score so you qualify for better loan terms.

- Save for a downpayment.

That way, you’ll have lower monthly payments, and you’ll build equity faster when you do buy your home.

FAQs:

Can I afford a $500k house on a $100K salary?

You can probably only afford a $500K house on a $100K salary if you make a very large down payment. A $100,000 salary can more comfortably afford a home in the range of $300 to $400k.

How much do you have to make to afford a $650k house?

To afford a $650K home will depend on various factors. Assuming an interest rate of 6.45%, a 10% downpayment, annual property taxes of $5,720, monthly debt of $1,000, and annual home insurance of $1,200, you would need to earn around $175k to afford a $650k home.

How much income is needed for a $500k mortgage?

The income needed for a $500K mortgage will depend on various factors. Assuming an interest rate of 6.45%, a 10% downpayment, annual property taxes of $5,720, monthly debt of $1,000, and annual home insurance of $1,200, you would need to earn around $156k to afford a $500k mortgage and a home priced at $550k.

How much income do you need to qualify for a $700k mortgage?

The income needed to qualify for a $700K mortgage will depend on various factors. Assuming an interest rate of 6.45%, a 10% downpayment, annual property taxes of $5,720, monthly debt of $1,000, and annual home insurance of $1,200, you would need to earn around $199k to afford a $700k mortgage and a home priced at $770k.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.