Fun fact: The majority of WallStreetZen’s editorial team dabbles in real estate. Our team owns and/or manage over a dozen properties combined, all across the U.S. and abroad. And we can tell you that managing property is a lot easier with the right tools.

One of our must-haves? RentPrep, which offers easy-to-use tenant screening software so you can easily screen potential tenants and identify any red flags before signing any paperwork. It’s just $21 to get started, and it can save you money — and potential headaches.

Buying real estate is a big commitment. I’ve bought two properties, and, as a property manager, have managed the repairs and upkeep for around 1,000 properties over 5 years. So trust me when I say that you probably don’t want to go all in on a rental property only to discover five years down the line that the city you chose isn’t renter-friendly. Wouldn’t it be great if someone put together a list of the best places to buy rental property to help you decide? It would be. So I did it for you.

In this article, I cover the ten best cities to buy rental property. My analysis uses readily available data about the rental landscape in each city and the intuition I’ve developed over the years from my own real estate investments. Here’s what I’ve come up with.

At a Glance: 10 Best Cities to Invest in Real Estate & Buy Rental Property

Keep reading to learn more about each city and why it made the list.

- San Antonio, TX

- Indianapolis, IN

- Cleveland, OH

- Cincinnati, OH

- Oklahoma City, OK

- Charlotte, NC

- Birmingham, AL

- Houston, TX

- Ocala, FL

- Atlanta, GA

1. San Antonio, Texas

- Median home cost: $295K

- Average monthly rent: $1735

- Rental vacancy rate: 7.2%

San Antonio is one of the best places to buy rental property, thanks to its rising population, low vacancy rate, and below-average home cost.

The median home price in San Antonio is just under $300,000, while the rental rate is approaching $2,000, giving properties in the area excellent cash-on-cash return.

San Antonio is a popular place to move, with job growth in popular sectors like healthcare, cybersecurity, and tourism. It’s also a great place for military families and accessibility to nearby Austin and Houston.

Note from the Editor: How I Spend My Rental Income

Hey. As a landlord myself, I wanted to pass on how I make use of my rental income. To give you context, my mortgage is $700 (including taxes and insurance), and I charge $1400 a month in rent.

First, I use the rental income to pay the mortgage, and pay an extra $100 on the principal. ($800).

Next, I put $300 into a high-yield savings account (I use CIT Bank) — this money collects interest until I need it for a repair, new appliance, or anything else my tenants might need. Now we’re up to $1100.

Finally, I invest the last $300 in the stock market. I use eToro as my brokerage, and typically invest in blue chip stocks like Walmart (NYSE: WMT) or McDonald’s (NYSE: MCD) or ETFs with a long, proven track record like VTI. Over the years, these relatively small monthly investments have paid off both in stock growth and dividends. You can check out eToro and get a $10 bonus using the link below.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

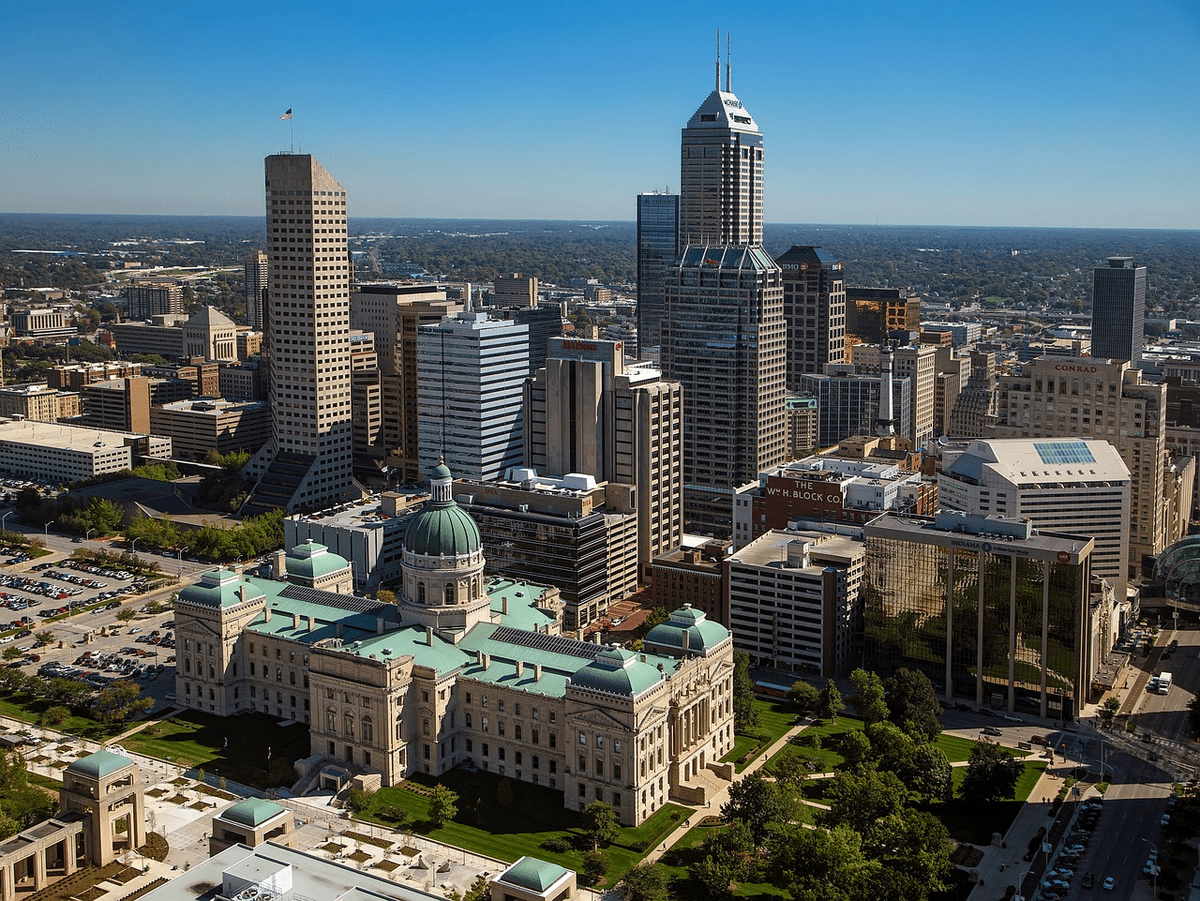

2. Indianapolis, Indiana

- Median home cost: $230,000

- Average monthly rent: $1,368

- Rental vacancy rate: 10.4%

Indianapolis’ numbers might not be as appealing as San Antonio’s, but that doesn’t mean that it’s not one of the best cities for rental properties in its own right. The median home price is a very reasonable $230,000. While the average monthly rent is listed at $1300 or so, that’s for apartments — a quick search revealed that a nice, 2 or 3-bedroom house can fetch as much as $2500 a month as a rental.

Assuming you purchased a $230K house with a 20% down payment, your monthly payments might be $1100 or so — if you were then able to rent it for $2,000 a month, that’s nearly $1,000 a month in profit.

One of my favorite things about Indianapolis — and one of the reasons I view it as one of the best cities to invest in real estate — is that the population skews young, with nearly 40% of residents under the age of 25. It’s also becoming a center for tech startups, which gives it solid growth potential in the future.

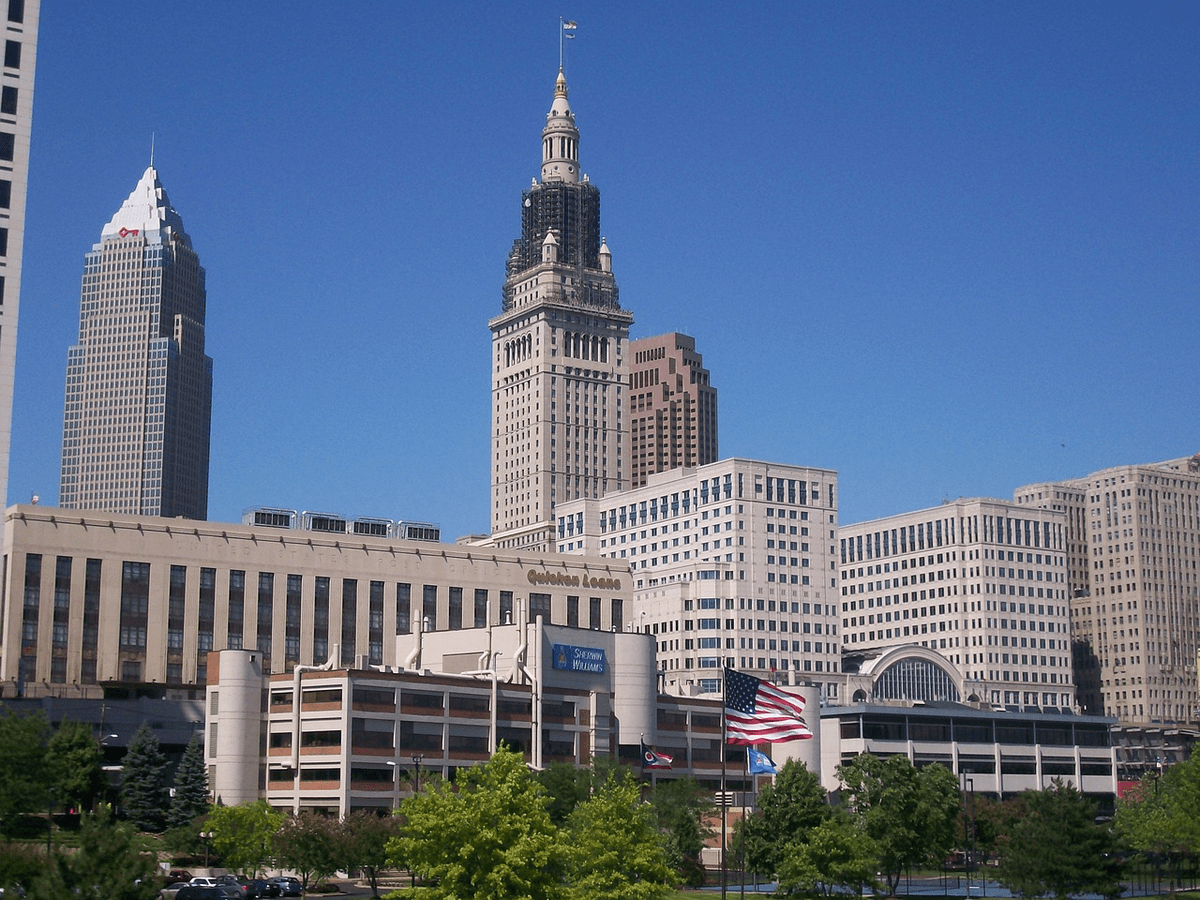

3. Cleveland, Ohio

- Median home cost: $110,545

- Average monthly rent: $1,300

- Rental vacancy rate: 4.6%

Another one of the best places to buy rental property is just next door to Indianapolis in the neighboring state of Ohio. Cleveland is one of the most affordable metropolitan areas in the country, which means it’s much easier for investors to get in the game than it is in a more expensive city.

To put that in perspective, I took a look around on Zillow and found a 3-bedroom, 2-bath house in seemingly great condition just minutes from downtown, in the Old Brooklyn neighborhood. The price tag? $149K. If you were to make a 40% down payment, which is comparable to a 20% down payment in more expensive cities, you could be looking at a monthly payment of just $900 or so. The rental estimate on the same property is $1700 a month. You do the math!

Cleveland has a lot going for it when it comes to investment properties, but its relatively low rental vacancy rate and high home appreciation rate really set it apart from similar cities and make it one of the best places to buy investment property.

4. Cincinnati, Ohio

- Median home cost: $260,000

- Average monthly rent: $1,390

- Rental vacancy rate: 5.8%

Sticking with the Ohio theme, Cincinnati has another one of the best rental markets in the US. Its homes are a bit more expensive than Cleveland’s, but the median sale price of homes in the Cincinnati area is still much lower than the national median of $436,800.

Cincinnati homes sell quickly, and the city was recently rated the number one place to live in Ohio by U.S News & World Report. As Cincinnati’s population and economy continue to grow, it will only become more attractive to real estate investors, making now an excellent time to buy in early.

5. Oklahoma City, Oklahoma

- Median home cost: $270,000

- Average monthly rent: $1295

- Rental vacancy rate: 6.9%

You might not expect Oklahoma City to be one of the best cities to buy rental property in, but it’s actually one of the best cities to invest in real estate. The average monthly rental price may be deceptive — when I took a look at single-family home rentals in the city, the prices skewed much more in the $2-3K range.

Oklahoma City is also on the up-and-up, with steady population increases of around 1% year-over-year for the last four to five years. The housing market is following suit — the average home price has gone up $10K in the past year. If the trend continues, the rental demand in the city will continue to increase, driving rental rates up and putting Oklahoma City on more investors’ radars.

Buying and renting property is hard work. Stessa’s tools make it easier.

Stessa offers mortgaging and refinancing services — but so much more. It also offers a VERY handy tax center that not only demystifies the sometimes-painful process of paying taxes on rental property but helps you aggregate your transactions into a single succinct tax package.

6. Charlotte, North Carolina

- Median home cost: $401,000

- Average monthly rent: $1,995

- Rental vacancy rate: 4.5%

Charlotte’s home prices are considerably higher than the other cities I’ve covered so far, but the city’s mind-boggling 120% home appreciation rate over the last eight years more than makes up for it. The city is one of the best cities for rental properties in 2025, with higher-than-average rental rates compared to similarly-sized cities.

Charlotte’s growth is its biggest asset. As more people pour into Charlotte, rental rates have continued to rise. For instance, a quick perusal of Zillow just revealed that 3-bedroom houses regularly fetch $3k or more in Charlotte. So if you were able to make a decent down payment (40% or so), it could be well worth your while.

Home prices are likely to rise, too, giving investors who pull the trigger now the potential for excellent returns for the foreseeable future.

Saving up for rental property?

Don’t let your savings stagnate in a regular savings account! A high-yield savings account offers better returns and turns you on to the magic of compound interest — meaning you can potentially reach your financial goals faster.

Right now, CIT Bank has rates up to 5% on high yield savings accounts. To put that in perspective, even big banks like Capital One only offer about 4.15%. That might not seem like a big difference, but consider the returns over time, factoring in compound interest:

- $10K account, 4.15% interest ➡️ 10 years: $15,017.33

- $10K account, 5% interest ➡️ 10 years: $16,288.95

That’s over 1,000 reasons to make a change!

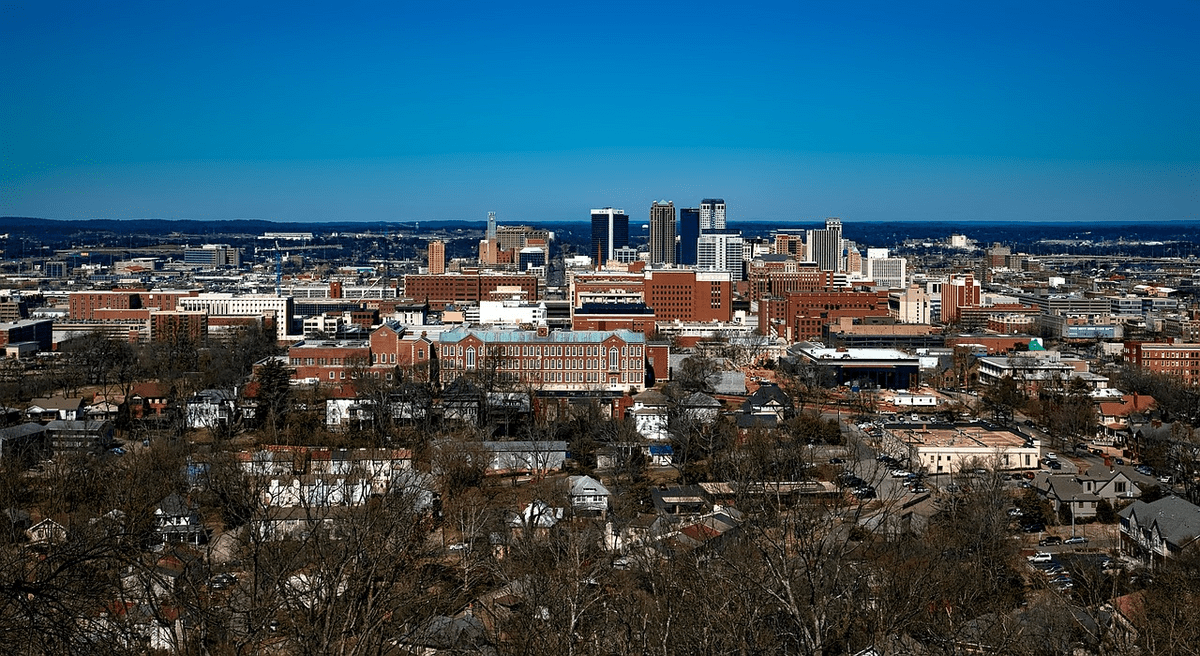

7. Birmingham, Alabama

- Median home cost: $190,00

- Average monthly rent: $1,100

- Rental vacancy rate: 8.5%

Birmingham, Alabama is another sleeper pick that I’m willing to bet wasn’t high on your list of the best cities for real estate investment. One thing I love about the city for real estate investing? The median sale price is going up fast it’s currently $190,000 which is 14.3% year over year. The combination of low median cost and relatively high monthly rents make it my “hidden gem” and one of the best places to buy investment property.

Birmingham is one of the economically healthiest cities in Alabama, with growth in healthcare, finance, and manufacturing sectors in the last three to five years. This growth is sure to bring more workers to the city, increasing the rental demand and lowering the city’s moderately high rental vacancy rate.

Don’t put your rental income potential in jeopardy. Screen your tenants properly!

RentPrep is the BEST tenant screening out there, allowing you to easily perform background checks. Find out about bankruptcies, judgments and liens, and more.

An ounce of prevention is worth a pound of cure. With plans starting at just $21, I firmly believe RentPrep is well worth the peace of mind you get as a landlord.

8. Houston, Texas

- Median home cost: $362,000

- Average monthly rent: $1,900

- Rental vacancy rate: 9.5%

The next city I want to highlight requires a trip back down south to the Lone Star State. Houston was one of the fastest-growing cities of the early 2000s during the dot-com craze. While it’s not quite hitting those rates again, its current growth puts it on my shortlist of where to buy rental property in 2025.

Houston’s home prices are below the national average, but its monthly rental rates are high, giving it the potential for excellent ROI right off the bat. The city’s rental vacancy rate and property taxes make it less desirable than other places on the list so far, but Houston’s current population growth and future job prospects make it a long-term favorite of mine.

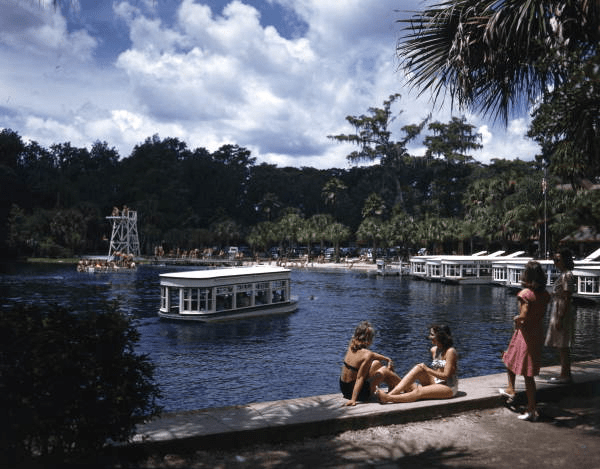

9. Ocala, Florida

- Median home cost: $277,000

- Average monthly rent: $2,340 (for a single-family house)

- Rental vacancy rate: 5.1%

My penultimate pick takes us to the Sunshine State. Ocala doesn’t have the name recognition of Florida’s other cities, but that’s what makes it such a good opportunity for real estate investors.

Ocala’s rental rates hover around $1,600 per month for apartments — but for single-family homes, it’s much higher — $2,340.

People are flocking to Ocala from other parts of Florida to take advantage of its comparatively low cost of living, making it an excellent time to invest in a rental property before prices catch up to demand.

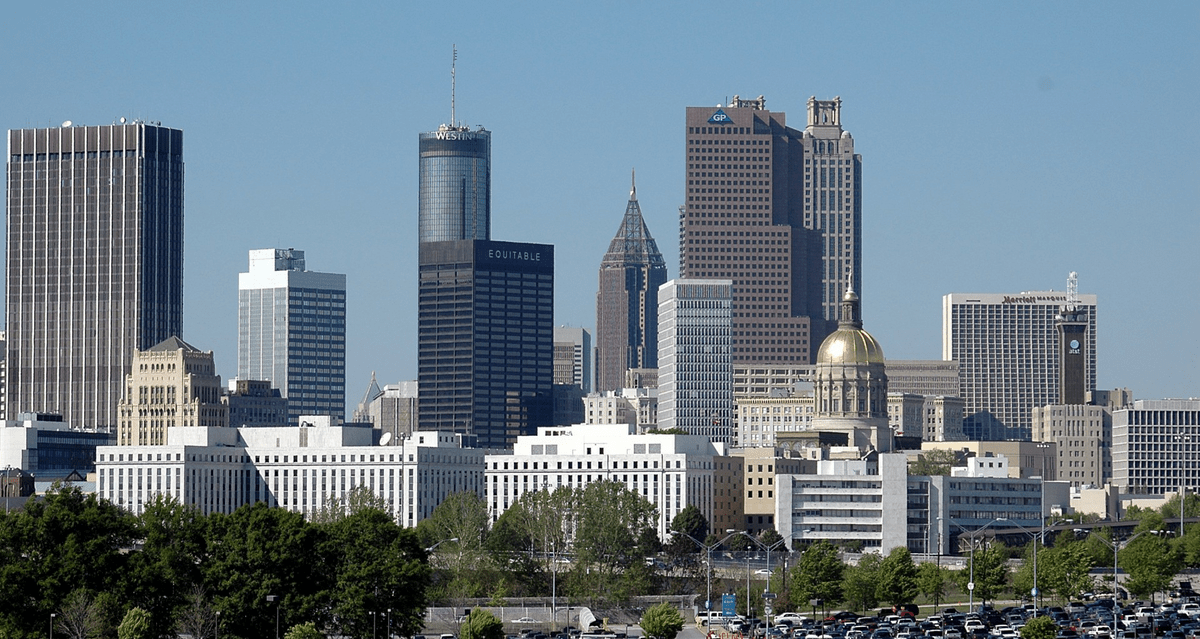

10. Atlanta, Georgia

- Median home cost: $399,879

- Average monthly rent: $2145

- Rental vacancy rate: 6.8%

The final city I want to cover sits just a few hundred miles north of Ocala. Atlanta is a bit unusual compared to the other cities I discussed thus far. For starters, its median home price fell by 3.2% over the last year, which might be concerning to some investors. However, despite this slight downturn, rental rates in Georgia remain high.

Atlanta’s job market continues to flourish, showing a 5% growth over the last year. The city’s economy also continues to grow, even after the impressive 30% growth it showed from 2010 to 2020.

The bottom line is that I think Atlanta is flying under a lot of real estate investors’ radars right now. The city’s rental rates are high compared to its property values, and its continued growth is a good sign for investors who are in it for the long haul.

Don’t Want the Hassle? Other Ways to Invest in Real Estate

While tools like Stessa can help, purchasing rental property is no small task. It takes a lot of time and effort to manage a rental property, time and effort that not everybody can spare.

If you want to invest in real estate but don’t want to own and manage a rental property yourself, here are some of my favorite alternative options.

REITs

One of the easiest ways to get into real estate investing is to purchase shares of a real estate investment trust (REIT). These work just like ordinary stocks, except the underlying is a basket of real estate investments instead of shares of a company.

You can invest in REITs on the stock market using a brokerage like eToro.

Real estate investment trusts are an asset class that lets you purchase shares of companies that manage real estate holdings that generate income. The vast majority of brokerages offer them — eToro is our favorite.

We already love eToro’s extensive offerings for traders — low or no-commission trades, a CopyTrader feature that lets you mirror the trades of pros, and a trading simulator that helps you test out strategies before you put money on the line.

But did you know that eToro also offers REITs? You can browse REITs or use eToro’s REIT Smart Portfolio.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

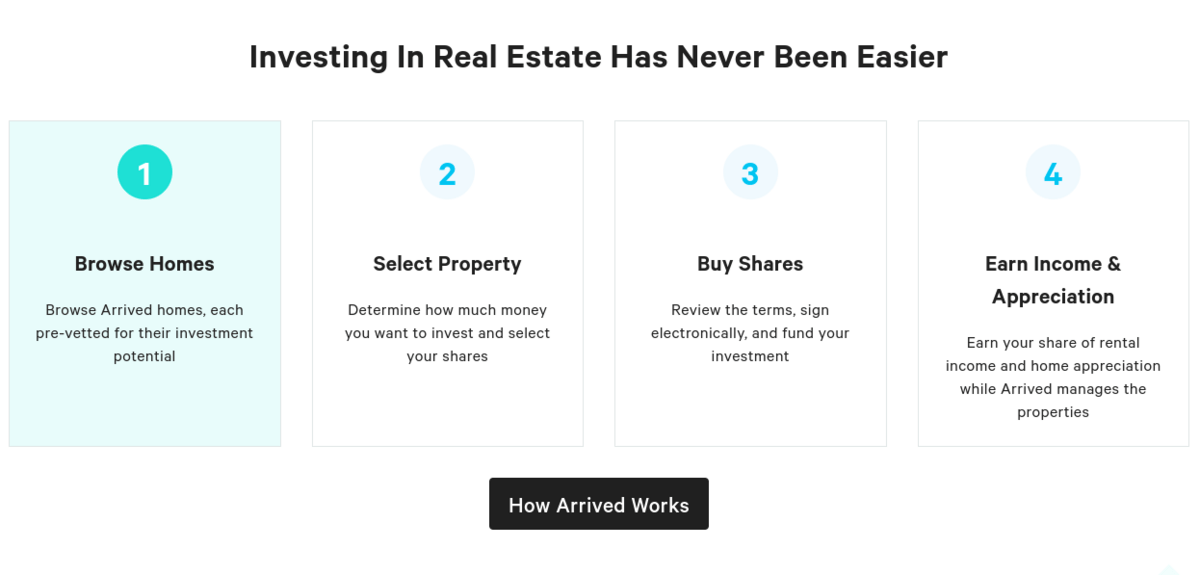

Crowdfunded Residential Rental Properties

Another great option for people who don’t know where to buy rental property is to diversify by investing in crowdfunded residential rental properties. Crowdfunding platforms like Arrived Homes let you buy shares of investment properties to earn part of the property’s rental income each month.

Purchasing shares in an investment property through Arrived Homes eliminates all of the hassles you would have managing your own property. It’s one of the best ways to add real estate exposure to your portfolio, and I recommend it to anyone who will listen.

Crowdfunded Commercial Real Estate

Arrived Homes specializes in crowdfunded residential real estate, but other platforms — like Yieldstreet — offer access to crowdfunded commercial real estate instead.

Yieldstreet works similarly to Arrived Homes, but many of the opportunities are limited to accredited investors. Investors purchase shares of properties and get to share in the property’s rental income and appreciation.

Commercial real estate investing is much more complicated than residential real estate and requires greater capital, so crowdfunding through Yieldstreet is the only feasible way to get involved for most people.

On Yieldstreet, you can browse individual deals — or you can diversify in a snap by investing in a fund, such as the Alternative Income Fund, which offers access to commercial real estate AND a variety of other assets within the same investment vehicle:

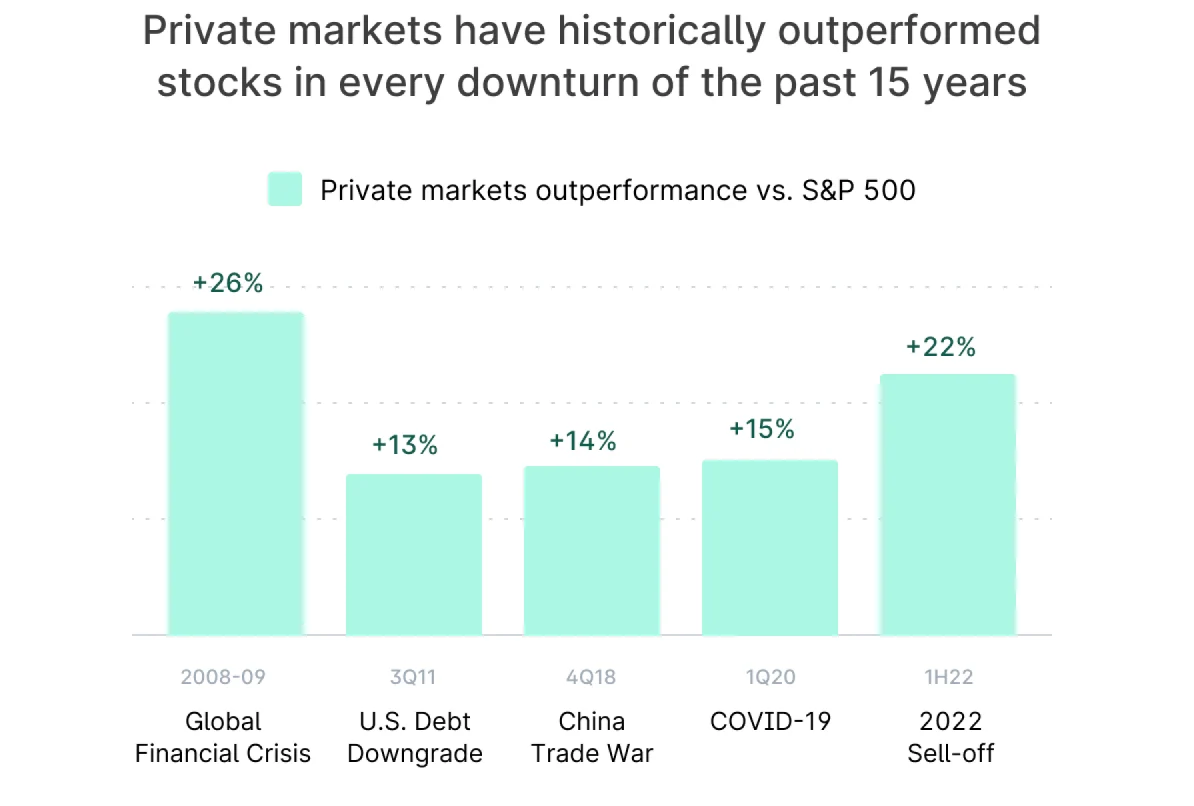

Why diversify into more markets than just real estate? Diversity. As you can see below, diversifying into private markets has proven an intelligent strategy over the past 15 years:

If you’re interested in gaining access to serious real estate deals — and alternative assets beyond just real estate — Yieldstreet is one of the best platforms out there.

Final Word:

In my opinion, San Antonio, Indianapolis, and Cleveland are three of the best places to buy rental property right now.

They offer a solid cost-benefit ratio right now but crucially have a lot of room to improve in the future. All three cities are experiencing population growth, which almost always goes hand in hand with increased demand for rental housing.

If you want to get into real estate investing but don’t want to own your own property, I recommend checking out a crowdfunding platform like Arrived Homes or Yieldstreet. If even that seems like too much, it’s hard to go wrong with a tried-and-true REIT through an established online broker like eToro.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs:

What rental properties are most profitable?

The most profitable rental properties are in good locations and are well-maintained. Even if you invest in a property in one of the best rental markets in the US, you need to make sure that the property is in good shape and won’t require endless maintenance work and repairs. Single-family homes also tend to be more profitable than other types of rental properties.

Where is the highest real estate ROI in the US?

As of the first quarter of 2023, the highest real estate ROI in the US is found in cities like Houma, Louisiana, Dothan, Alabama, and Johnstown, Pennsylvania. These are some of the best places to buy rental property due to their high rental rates and low property values.

What is the best real estate to invest in?

In my opinion, the best real estate to invest in is a single-family home in one of the best cities for real estate investment I covered in this article. Single-family homes have better ROI statistics than other types of properties and are easier to manage than multi-family homes or commercial properties.

What is the best rate of return on rental property?

In general, the higher the rate of return, the better. However, there are a few different ways to measure your rate of return, each with its own advantages and disadvantages. To get a full picture of a property’s value as a source of income, you should estimate its cash-on-cash return, gross rent multiplier, net operating income, and cap rate.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.