Have you ever heard the phrase “Don’t put all your eggs in one basket”? It applies to your stock portfolio, too.

If you’re just getting started investing in the stock market, it’s easy to chase returns and invest in trendy stocks. We’ve all been there before, and the hype can be intoxicating.

However, if you invest this way, you’re a speculator, not an investor. The stock market is not a slot machine. When used correctly, it’s an instrument for creating long-term wealth.

Diversification is a primary tenet of long-term, intelligent investing. Diversification is the process of spreading your investments across multiple stocks from different industries, sectors, risk profiles, and more. By diversifying, you can lower the overall risk of your portfolio.

So how can you build your own diversified stock portfolio?

In this article, I’ve included 7 of the most popular diversified stock portfolios you can emulate or use to inspire your own custom portfolio.

Before you can diversify, you need a trading platform.

If you’re in the market for a brokerage, my top suggestion is eToro. In terms of tradable assets, diversification is at your fingers from the get-go — you can trade stocks, ETFs, cryptocurrencies, and more all from the same account.

eToro also provides thematic portfolios which are perfect for new investors looking to diversify. You can invest based on market segments, industries, investment philosophies, and more.

What’s more, eToro offers CopyTrader — a novel social trading feature that lets you follow (and mirror, if you choose) the trades of the top investors on the platform.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

What is a Stock Portfolio?

A stock portfolio is a collection of public companies which may vary in size, industry, sector, and location (domestic or international).

There are many ways to allocate assets in a portfolio, regardless of whether you want to invest 50K, 500K, or 5K. Building a portfolio depends on your risk tolerance, investment philosophy, and interests.

For example, most risk-averse investors are focused on safety and preserving capital, and tend to allocate more of their portfolios toward safer stocks like Kellogg (NYSE: K) or Johnson & Johnson (NYSE: JNJ). On the other hand, if you’re a young investor with an appetite for risk, you may invest more heavily in high-growth companies like Tesla (NASDAQ: TSLA) or Block (NYSE: SQ).

When you start creating your portfolio, make sure to use the best stock platform for beginners.

How to Diversify Your Stock Portfolio

Diversifying a portfolio involves spreading your money across multiple stocks and sectors.

Let’s say you own $5,000 worth of TSLA and that’s your only investment. In the last month, Tesla’s stock has fallen 30%, which would reduce your $5,000 to $3,500, a $1,500 loss.

Instead, if you owned equal amounts of TSLA, SQ, K, and JNJ which have 1-month returns of -30%, -12%, +1%, and +0.2% respectively, your initial $5,000 investment would still be worth $4,490, a $510 loss.

This is diversification. The goal is to not overexpose yourself to one any stock or sector.

Want a free tool to analyze your portfolio?

Empower’s Portfolio Analyzer, part of its FREE dashboard, will assess your portfolio risk, analyze past performance, and create a personalized target allocation.

And it’s completely free.

It’s not only the number of stocks that helps you achieve diversification, it’s also about investing in a variety of sectors. For instance, your portfolio is not well-diversified if it contains 15 high-growth tech stocks.

A stock’s sector refers to its industry and the part of the economy it represents. One of the easiest ways to diversify your portfolio is across multiple sectors.

There are 11 different sectors to choose from:

- Communication services

- Consumer discretionary

- Consumer staples

- Energy

- Financials

- Healthcare

- Industrials

- Information technology

- Materials

- Real estate

- Utilities

You can also choose between different investment styles, such as growth and value.

Growth investing focuses on growth stocks—typically early-stage or small companies with earnings and profits expected to outgrow their sector and the overall market. On the other hand, value investing focuses on finding overlooked and undervalued companies trading at a discount relative to their intrinsic value.

Building a portfolio focused on a particular investment style is common, however, a well-diversified portfolio typically has some blend. Personally, I invest in both high-growth stocks and dividend-payers.

Invest like a HNWI…

Echo Trade allows you to follow the investments of professional trading portfolios from top registered investment firms.

This “bolt-on” service links up to your existing brokerage account (Supported brokers include Robinhood and many more). With your subscription, you get real-time trade notifications, and trades are made on your behalf, automatically. You can also track portfolio positions and see real-time performance, with regular commentary.

Historically, this type of expertise has not been available to just anyone — it has been reserved for HNWIs. Now, Echo Trade lets you follow these experts and copy their trades for a fraction of the price of a professional advisor. Start your FREE 14-day trial now.

Diversified portfolios can also hold other assets like ETFs, mutual funds, bonds, fixed-income instruments, commodities, real estate, and cash. If stocks are performing poorly, one of the other asset classes is likely performing better, balancing overall returns.

All this talk of diversification can be a lot. If you feel like you’re in over your head, here are 3 tools to help simplify the portfolio diversification process:

1. Betterment

Best for: Hands-off diversified investing.

Betterment is a robo-advisor that automatically creates diversified portfolios that are tailor-made for its users’ financial goals, time horizons, and risk profiles. After filling out a brief questionnaire, you can set up monthly auto-deposits to fund your balanced portfolio and put your investing on autopilot.

Even as an investing nerd, I’ve strongly considered putting all of my money in Betterment – it’s the single easiest way to start building long-term wealth.

2. eToro

Best for: Slightly more hands-on diversification.

eToro is my favorite brokerage. You can buy stocks, cryptocurrencies, and other assets all from one account.

It also provides thematic portfolios which are perfect for new investors looking to diversify. You can invest based on market segments, industries, investment philosophies, and more.

eToro also offers CopyTrader which allows you to copy the portfolios of experienced investors on its platform.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

3. M1 Finance

Best for: Active investors who want to easily diversify.

M1 Finance is the best brokerage when it comes to automatically diversifying a portfolio of hand-selected stocks.

After creating your “Pie”, you can turn on auto-deposits and auto-rebalances so your portfolio never goes out of alignment. Simply set your allocation targets and let M1 Finance do the rest.

Read my full M1 Finance review.

Investment Portfolio Examples

Before jumping straight into the diversified stock portfolio examples, it’s important that you understand MPT.

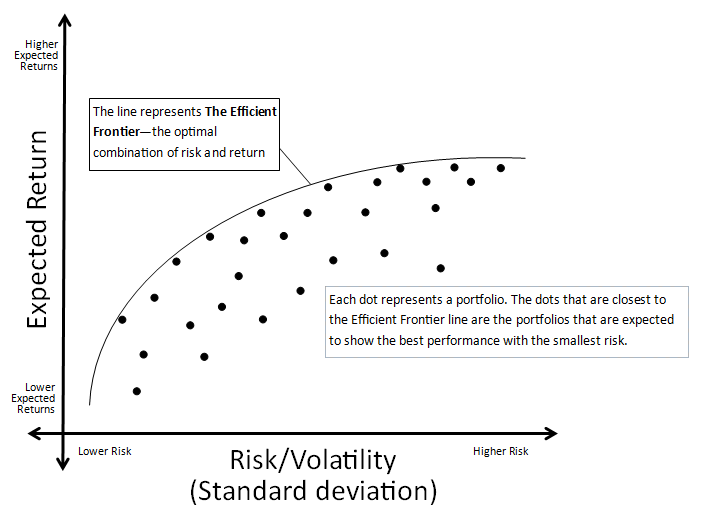

Much of what we know about proper diversification stems from Modern Portfolio Theory (MPT).

MPT states that investors should be rewarded relative to the amount of risk they undertake. The more risk you take on, the higher the potential payoff should be. The lower the risk, the lower the reward.

The MPT gets to the heart of investing: Each investment you make comes down to balancing risk and reward. One of the best ways to tilt this in your favor is via diversification.

Below, we’ve provided several investment portfolio examples that hopefully help point you in the right direction. Be sure to read through all 7 to determine which portfolio best suits your goals as an investor.

It should be noted: #1 on this list isn’t “better” than #7 – these are 7 equal options.

7 Diversified Stock Portfolio Examples for Beginners

1. 60/40 Portfolio

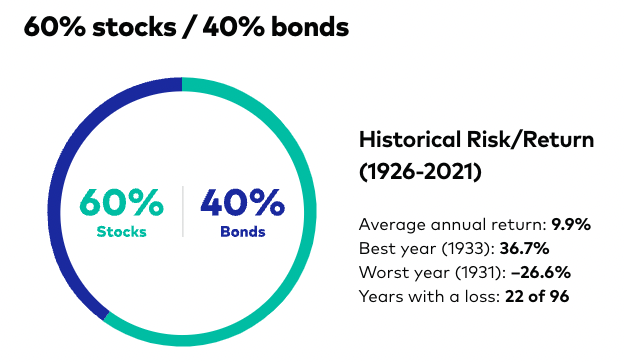

The 60/40 Portfolio allocates 60% of its assets to stocks and 40% to bonds. Generally speaking, portfolios with over 70% allocated to stocks are considered higher risk.

Bonds are safer investments than stocks – their returns are much more predictable.

When stocks sell off during economic downturns, investors flee to safer assets like bonds, cash, and gold.

The 60/40 Portfolio is a better portfolio for older investors who are worried about capital preservation, whereas younger investors are usually better off with higher exposure to stocks (closer to 100% of their portfolio). (If that’s you, you may want to check out our article on the top money apps for teens.)

If you’re in a wealth accumulation phase and still have more than 20 years until retirement, bonds are usually an unnecessary investment except for the most conservative investor.

As noted earlier, some investors are rethinking the classic 60/40 allocation and gravitating toward a 40/30/30 portfolio (including real estate, infrastructure, and private credit assets)…

The latter — private credit — has traditionally only been available to a small and elite group of investors. Percent is changing that.

Percent makes private credit investment opportunities available to accredited investors. As an investor, you’ll gain access to a wide variety of high-yield, short-duration (9-month average) offerings that have historically paid over $28 million in interest.

You can invest as little as $500 and unlock yields up to 20% APY. Check it out today.

2. 25/25/25/25 Portfolio (The Permanent Portfolio Allocation)

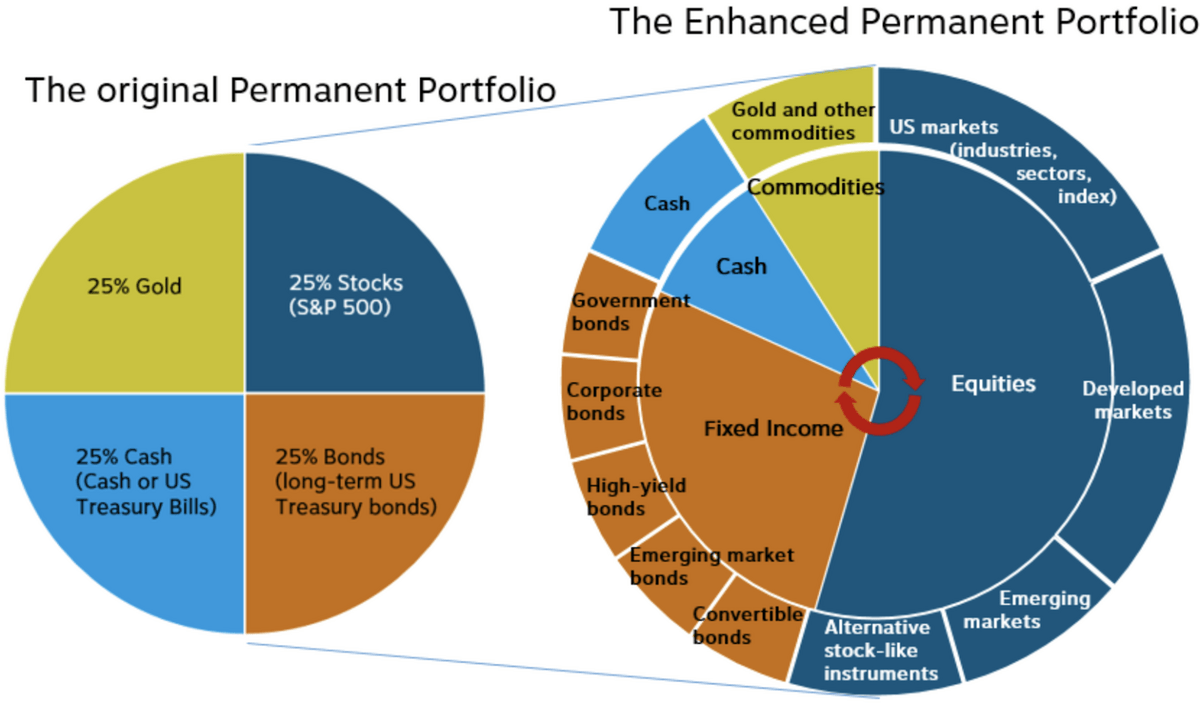

The Permanent Portfolio Allocation, otherwise known as the 25/25/25/25 portfolio, takes the 60/40 portfolio’s concept of diversifying between stocks and bonds a step further. This example of a stock portfolio holds equal portions of cash, commodities, stocks, and bonds.

The Permanent Portfolio is designed to limit losses during market downturns by hedging against a variety of market risks by evenly allocating its weight between different asset classes.

Commodities are tangible, physical assets and essential materials. Commodities include metals like gold, silver, copper, platinum, and aluminum, and agricultural products such as cotton or wool, energy sources like crude oil and natural gas, and building materials like lumber.

Adding commodities to your portfolio can especially be shrewd during periods of high inflation. Since inflation is a measure of increasing prices, rising commodity prices are often what is driving higher inflation, which is good news for commodity investors.

Gold has been a favorite of commodity investors and is used as an inflation hedge and store of value during turbulent and unpredictable market conditions.

3. Ray Dalio All Weather Portfolio

Ray Dalio is one of the best investors of all time and founded Bridgewater Associates, the world’s largest hedge fund.

From 1991 to 2005, Bridgewater lost money in only three calendar years and never more than 4%. Moreover, while the market sputtered during H1 2022, Bridgewater Associates gained 32% and found a way to exploit the market’s volatility.

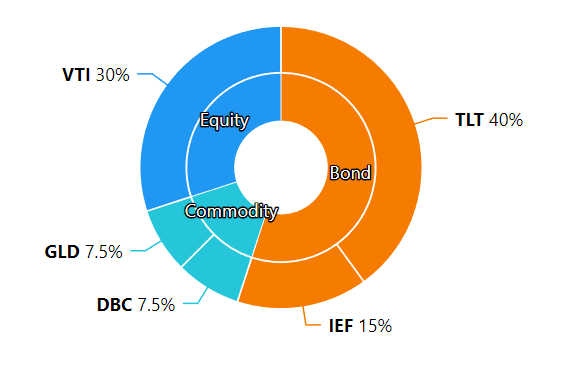

Dalio created the “All-Weather Portfolio”, his version of The Permanent Portfolio.

Dalio wanted to create one portfolio designed to perform well under any market condition (hence the name).

It allocates portfolio assets as follows:

- 40% Long-Term Government Bonds

- 30% Stocks

- 15% Intermediate Government Bonds

- 7.5% Gold

- 7.5% Commodities

You can easily replicate the portfolio with 5 ETFs:

- Long-Term Government Bonds = iShares 20+ Year Treasury Bond ETF ($TLT)

- Stocks = Vanguard Total Stock Market ETF ($VTI)

- Intermediate Government Bonds = iShares 7-10 Year Treasury Bond ETF ($IEF)

- Gold = SPDR Gold Trust ETF ($GLD)

- Commodities = Invesco DB Commodity Index ($DBC)

Read more: The Best Brokerages for ETFs

While the All Weather Portfolio has performed strongly since its inception, it has still underperformed the S&P 500 over the long term. However, its volatility is lower than the S&P’s, which is why many investors are willing to take the lower returns.

That risk/reward trade-off shouldn’t surprise you, given what you know about MPT. Head over to our Ziggma review to learn more about tracking the risk factors and fundamentals of your portfolio.

Personally, the All Weather Portfolio is one of my favorite diversified stock portfolios for beginners.

BONUS: Gold IRAs

Buying an ETF-version of gold is great, but most serious gold investors want to own the physical commodity.

Gold is a long-term inflation hedge and a natural alternative to fiat currencies.

Plus, over the last 20 years, gold has returned 9.6% per year.

If you want physical ownership of gold (without needing to store it and maintain it yourself), consider using a gold IRA. Gold IRAs store and maintain your gold within a tax-efficient vehicle. Since you’re using it as a long-term hedge anyways, there’s no reason not to use an IRA like Silver Gold Bull or Noble Gold.

Check out more top gold IRA providers:

Gold has given investors stable, inflation-hedged returns for a long time.

4. Large-Cap Blue-Chips (the Best Stocks for Beginners)

Warren Buffett is one of the most successful investors of all time and a pioneering value investor.

“It’s far better to buy a wonderful company at a fair price,” says Buffet, “than a fair company at a wonderful price.”

Large-cap, blue-chip U.S. companies are often considered the best stocks for beginners and foundational pieces of a beginning portfolio.

These massive, financially-sound companies offer well-established earnings, various products, and proven long-term resilience during downturns and recessions. Their businesses are typically growing steadily and have wide business moats, making them exceptionally safe stock investments.

Some of the best stocks for beginners starting a portfolio could include companies like:

- Apple Inc. (NASDAQ: AAPL)

- Berkshire Hathaway Inc. (NYSE: BRK.B)

- Alphabet Inc. (NASDAQ: GOOGL)

- Microsoft Corp. (NASDAQ: MSFT)

- McDonald’s Corp. (NYSE: MCD)

- Costco Wholesale Corp. (NASDAQ: COST)

- Coca-Cola Co. (NYSE: KO)

- Verizon Communications Inc. (NYSE: VZ)

The list above is diversified across various industries like technology, software, food, and other consumer staples.

Read more: How to Learn About Stocks

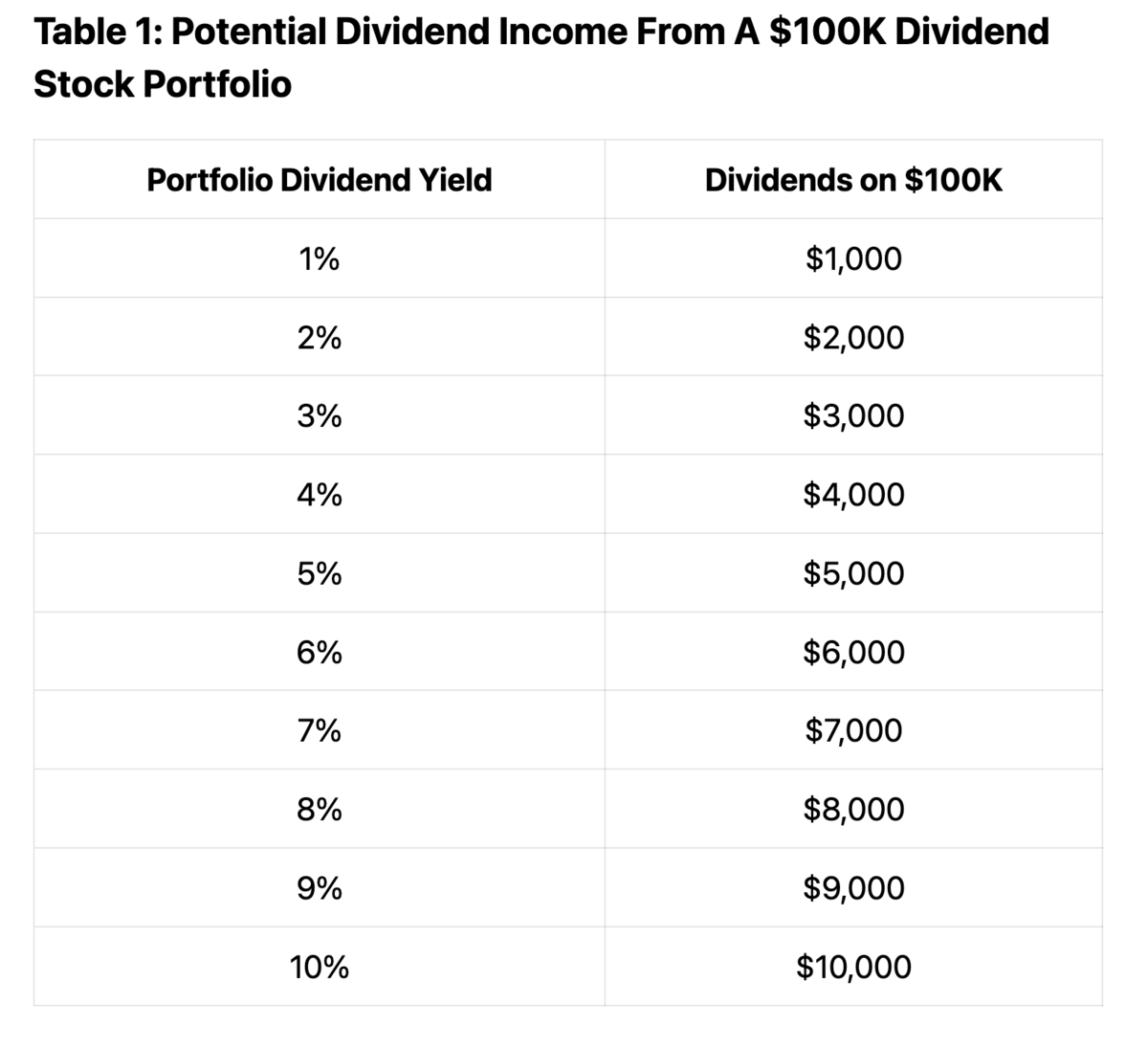

5. Dividend Portfolio

Many well-established public companies offer shareholders a dividend. These blue-chip companies have ample cash flow and can afford to pay some of it out by means of a dividend.

A dividend is a cash payment that a public company distributes from its profits to shareholders.

On the other hand, many high-growth companies use all of their spare cash to reinvest back into the company for future growth.

An income-focused or dividend portfolio focuses on stocks that pay substantial dividends to shareholders. Many risk-averse investors prefer to receive steady income streams by building a portfolio around strong dividend-paying stocks without chasing the risk and returns of non-dividend-paying growth stocks.

Some dividend investors take it a step further and buy only “Dividend Aristocrats” – companies who have hiked dividends for 25+ years consecutively.

Any company that can consistently grow its dividend for more than 25 years is exceptionally strong and will likely continue to show strong cash flows for the foreseeable future.

Some of the market’s best-known dividend aristocrats are:

- Caterpillar Inc. (CAT)

- Chevron Corp. (CVX)

- Johnson & Johnson (JNJ)

- Lowe’s Cos. Inc. (LOW)

- McDonald’s Corp. (MCD)

- PepsiCo Inc. (PEP)

- Procter & Gamble Co. (PG)

- Target Corp. (TGT)

- Walgreens Boots Alliance Inc. (WBA)

- Walmart Inc. (WMT)

Most Dividend Aristocrat portfolios have a dividend yield of 4% or more.

You can construct an income portfolio with stocks that have even higher dividend yields, such as Real Estate Investment Trusts (REITs). REITs, on average, have a 5% dividend yield. Because REIT dividends mirror consistent income streams of a physical real estate asset, they are top-rated picks during inflation and when constructing an income-focused portfolio.

6. Value Portfolio

Value investing is a philosophy focused on spotting undervalued and overlooked stocks. It involves fundamental research that spots stocks trading for less than their intrinsic value.

If value investing sounds like it’s up your alley, Warren Buffett is a good role model to follow.

In fact, many of WallStreetZen’s fundamental analysis tools were inspired by Buffett’s (and his mentor, Benjamin Graham’s) models and investing philosophy.

Berkshire Hathaway is Buffett’s holding company, and it’s basically one giant value stock portfolio.

As of May 2024, Berkshire Hathaway’s ten largest stock holdings were:

-

- Apple (NASDAQ: AAPL)

- Bank of America (NYSE: BAC)

- American Express (NYSE: AXP)

- Coca-Cola (NYSE: KO)

- Chevron Corp. (NYSE: CVX)

- Occidental Petroleum (NYSE: OXY)

- Moody’s (NYSE: MCO)

- Kraft Heinz Co. (NYSE: KHC)

- Mitsubishi Corp. (TYO)

- Chubb Ltd. (NYSE: CB)

Click on any of the links above to start performing your own fundamental analysis.

7. Growth Portfolio

A growth portfolio focuses on stocks expected to see their earnings outgrow their respective industries and broader market.

Many growth stocks are younger and smaller companies on the riskier and more speculative side. When investing in growth stocks, you’re investing in their futures which are largely unknown. Growth stocks can rise quickly and fall quickly – be sure you can stomach the volatility and are confident in the company’s prospects before investing.

Forming a “Magnificent 7” portfolio is an excellent example of a stock portfolio geared to growth investors looking for some margin of safety.

-

- Microsoft (NASDAQ: MSFT)

- Facebook (now Meta) (NASDAQ: META)

- Apple (NASDAQ: AAPL)

- Amazon (NASDAQ: AMZN)

- Nvidia Corp. (NASDAQ: NVDA)

- Google (Alphabet) (NASDAQ: GOOGL)

- Tesla Inc. (NASDAQ: TSLA)

These companies are some of the fastest-growing in history. These companies have proven to be long-term winners in growth portfolios.

FEATURED OFFER: Masterworks

Want an investment that won’t collapse like a bank? Try art.

Since 1995, contemporary art has appreciated 14% annually on average. That’s even more than you’d get with the S&P 500 (with less volatility). After all, there’s a reason why many billionaires invest 10-30% of their wealth in art.

Want in? You can invest in shares of million-dollar paintings with Masterworks, the world’s premier art investment platform.

For a limited time, you can skip the waitlist here

*See important disclosures at masterworks.com/cd

Final Word: Example of a Stock Portfolio

There’s no right or wrong way to create a perfect stock portfolio.

Constructing a solid portfolio depends on a few principles, such as diversification and understanding your risk tolerance, investment goals, and investing in the sectors you know best.

At WallStreetZen, we aim to streamline your stock-picking process and portfolio construction. We believe independent investors deserve the best tools to analyze and research stocks and find buying opportunities to build strong, long-term portfolios.

You need cash to invest. If you’d like to invest inline with one of the portfolio examples above but don’t have the funds, you should look into downloading one of the best money saving apps. It’s never been easier to accumulate the funds necessary to start building your nest egg.

FAQs:

What should a stock portfolio look like?

A well-rounded portfolio may have blue-chip large-caps, more speculative growth stocks to add some pop, and value stocks. There could also be other asset classes included, such as bonds, index funds, cash, and commodities.

The answer to “what should a stock portfolio look like” is subjective and depends on your investment goals, philosophies, and risk tolerance.

However, you shouldn't overly concentrate an investment portfolio on one stock, sector, or investment style.

How do I make a stock portfolio?

Making a stock portfolio is not as complicated as it sounds. Just follow these five steps:

Step 1: Decide if you want to do it yourself in a brokerage account, go with a robo-advisor (like Betterment), or work with a financial advisor.

Step 2: Identify your investment philosophy, strategy, and risk tolerance.

Step 3: Identify your goals - are they long-term or short-term?

Step 4: Research stocks and asset classes then select your investments.

Step 5: Start your portfolio and rebalance as needed.

What is a portfolio? Give an example.

A stock portfolio is a collection of assets, of all shapes and sizes, across different industries or sectors, domestic and international. There are many ways and styles to allocate assets in a portfolio, depending on risk tolerance, investment philosophy, and interests.

An example of a stock portfolio could be the more traditional 60/40 portfolio, where 60% is allocated to stocks, and 40% is allocated to bonds.

Another example of a stock portfolio could be a higher-risk portfolio consisting of over 70% stocks or higher-risk growth-oriented equities.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.