Artificial intelligence has taken over the public discourse in practically every field.

Investing is no exception. Given the many trades and constant decisions based on numbers and metrics, it only makes sense to get help from computers, artificial intelligence, automated trading systems, and anything that can calculate much faster than humans.

You, too, can potentially benefit from AI in the form of automated trading strategies, trading bots, systems, and software.

While they have been mostly associated with cryptocurrencies, AI trading systems can be used to trade stocks, ETFs, and most other assets.

Evaluating such artificial intelligence trading systems can be tough, but some have clear advantages and lead the pack.

Prefer to follow real people?

If so, consider eToro’s CopyTrader.

It’s a system unlike any other that lets you follow the trades of top investors.

There’s good reason why it’s such a popular feature: many of the top traders on the platform have two-year returns of more than 50%. It’s one of the most dynamic ways to to watch and learn how to trade in real time.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

The 7 Best AI Trading Systems in 2025

Let’s get down to it. Here are the best AI trading systems in 2025

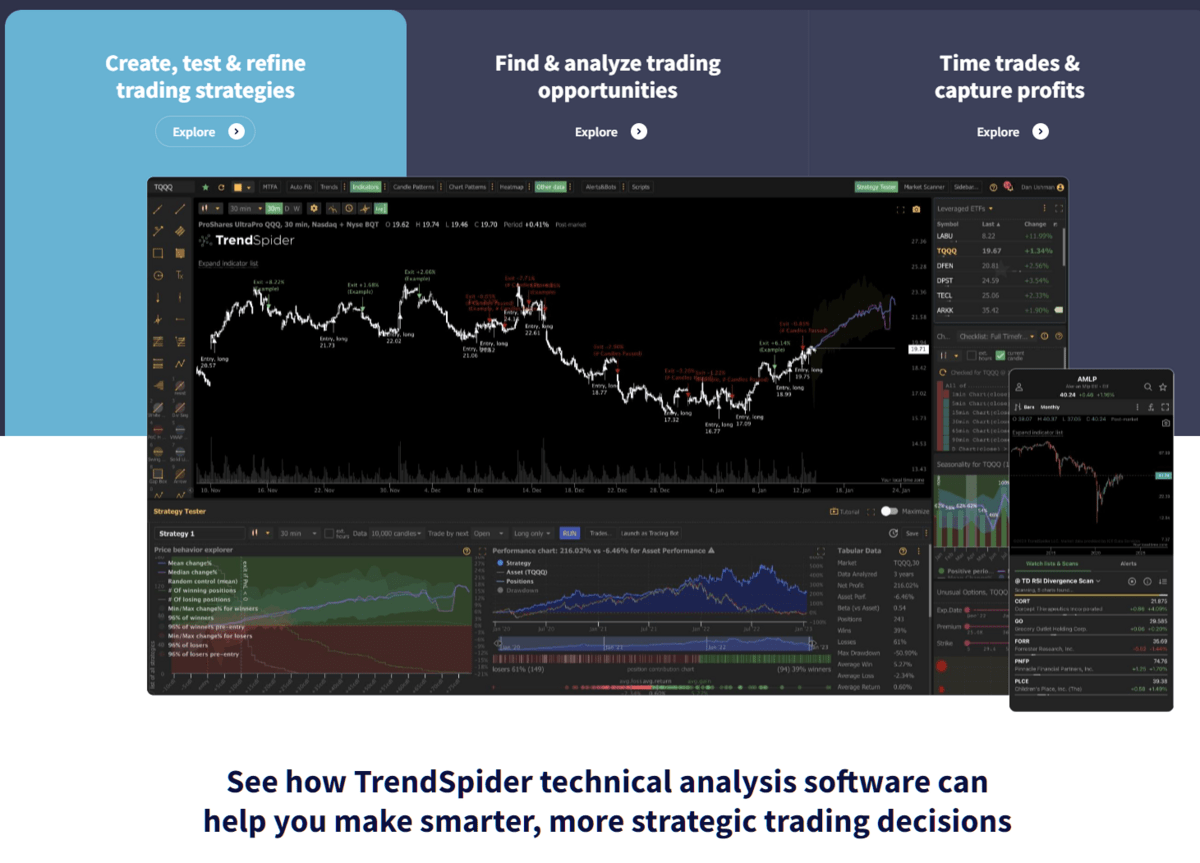

1. TrendSpider – Best for Charts and Technical Analysis

- Rating: 4.5/5

- Key Features: Extensive charting options, excellent automated trendlines and heatmaps, fast analysis

- Pricing: $22.11/mo. – $64.99/mo.

Regarding detecting trends and giving you options for charts, Trendspider is hard to beat, whatever asset class you analyze. If you are a professional, it will save you time on your technical analysis.

TrendSpider is designed to notice trendlines, Fibonacci patterns, and more. It will also point out the most prominent and likely trends for you.

It is also a powerful tool to help you put your skills to work: the “strategy tester” lets you input your testing targets freely. TrendSpider handles the coding, enabling users to test strategies to see if they align with their investing goals. While coding knowledge is beneficial, it is not required.

Although TrendSpider can be more complex than other AI trading systems, its comprehensive guides and tutorials (TrendSpider University) help new users navigate its features.

2. Trade Ideas – Best for Experienced Traders

- Rating: 5/5

- Key Features: Advanced backtesting, Holly AI entry and exit signals, extensive customization, and comparison options

- Pricing: $118/mo. Standard; $228/mo. premium

Trade Ideas offers a wealth of information. It could be overwhelming, but the platform does a great job of presenting the information in a straightforward way that makes key recommendations easy to understand.

The main AI feature/standout with Trade Ideas is Holly AI. It scans after-hours and historical market data, trading and action from the last day, performs backtests, and does further asset analysis. Holly AI intelligently provides trade suggestions from this information.

Additional features include stock racing, charts with integrated tools such as risk/reward analysis based on your previous behavior, and connectivity with brokers like E-Trade and Interactive Brokers.

If you love information and can swim in an ocean of it, Trade Ideas might be the best stock trading bot for you.

Important note: Trade Ideas focuses heavily on stocks and options. Those looking for other assets or investment and trading opportunities want to check out another AI trading system. Additionally, is only supported in U.S. and Canadian markets.

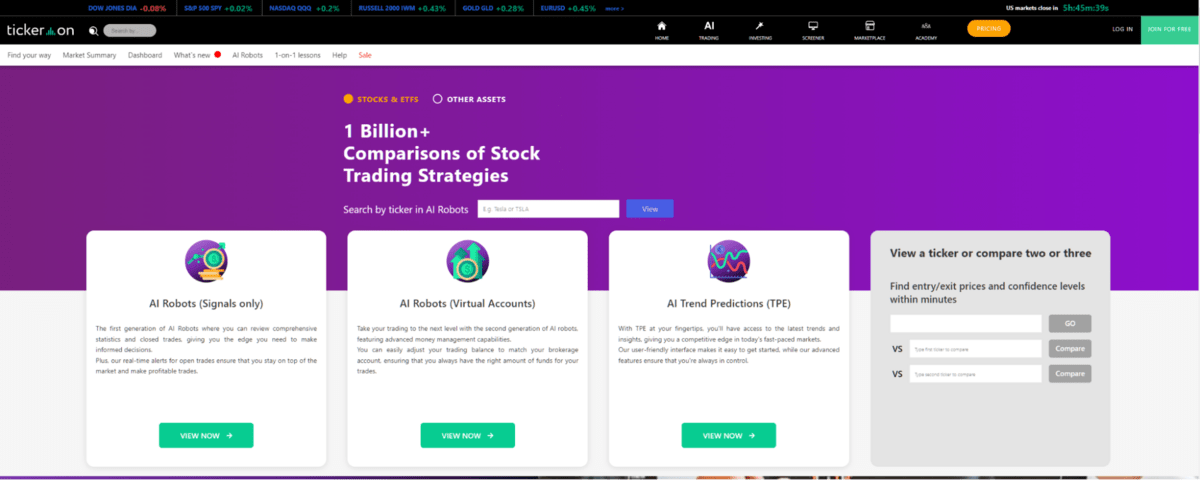

3. Tickeron – Best for Day Trading

- Rating: 3.5/5

- Key Features: Constant information, information reliability, preset screen options

- Pricing: $90+/mo.

Tickeron offers more than just AI trading software; it’s a comprehensive platform filled with information on potential trades, expert advice, and more. The goal is to provide investors with actionable insights.

Tickeron’s AI is part of a larger package that includes various tools and features. Its AI focuses on live data, predicting market rallies in advance, and ensuring data reliability.

The AI bot scans stocks based on user-defined filters, and Tickeron also offers bots that operate automated trading rooms powered by multiple neural networks.

Once you move past the flashbang of information and potential services, you’ll find their bots are some of the best for day trading and making quick trading decisions.

One thing that stood out to me is that it will not only make predictions about financial markets and provide information to users on how those predictions got made, but it will also analyze and report how accurate its past predictions on a potential investment were.

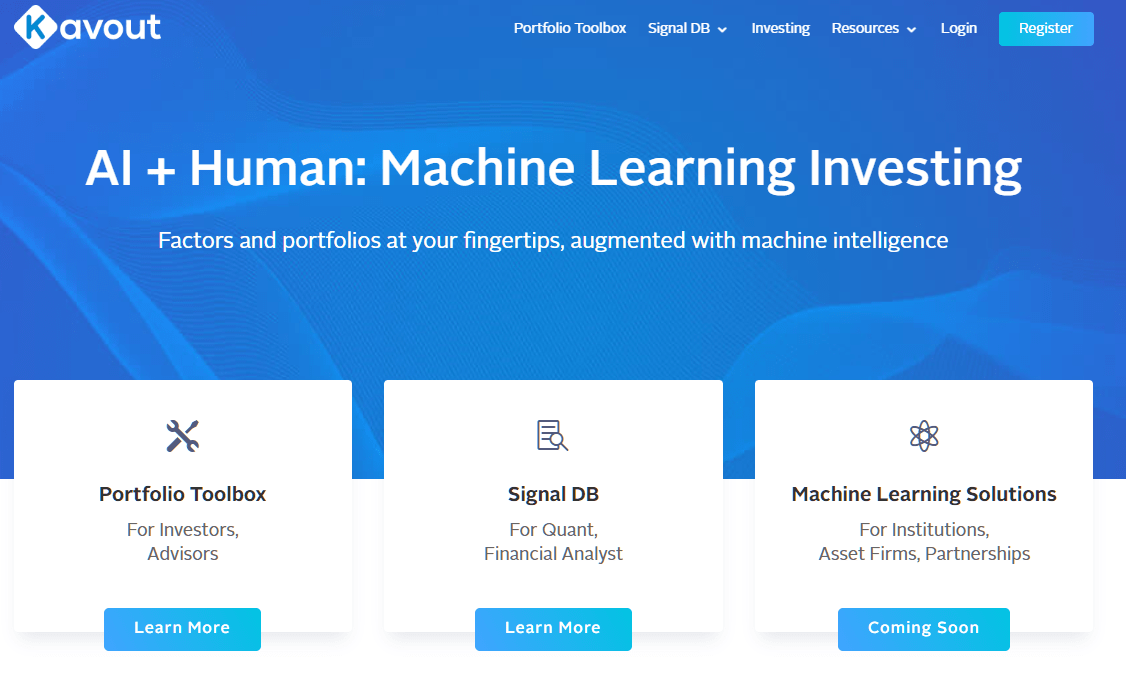

4. Kavout – Best for Learning and Pattern-Finding

- Rating: 3.5/5

- Key Features: Paper trading portfolio, analysis of millions of data points, Kai machine learning, K Score

- Pricing: $49/mo.

Kavout relies upon its Kai machine learning program, which it claims can outperform the index with lower risk in simulations. The software analyzes data through hundreds of metrics using millions of data points, ranking stocks and other assets for easier personal scanning and decision-making.

Their software will analyze data via hundreds of metrics, using millions of data points. This can sound like a lot, but it will rank the stocks and other assets for easier personal scanning and decision-making.

Kavout is best for professionals who want to learn more or average investors who may want to experiment with their ideas. If you’re careful about your strategies, their testing options will give you peace of mind.

One standout feature of Kavout is its K Score, a proprietary equity rating system that ranks stocks on a scale from 1 to 9, indicating the likelihood of a stock outperforming the market based on AI analysis of over 200 factors such as quality, value, growth, momentum, profitability, and volatility.

That said, you need to make your own decisions. If you want “you should do this” recommendations or a bot that does your investing for you, Kavout might not be the best choice.

If you want to understand why the bot chose its options and how you can improve as an investor, Kavout can be a great pick.

Kavout only works with US stock market data and may not analyze as many different points as other AI trading systems.

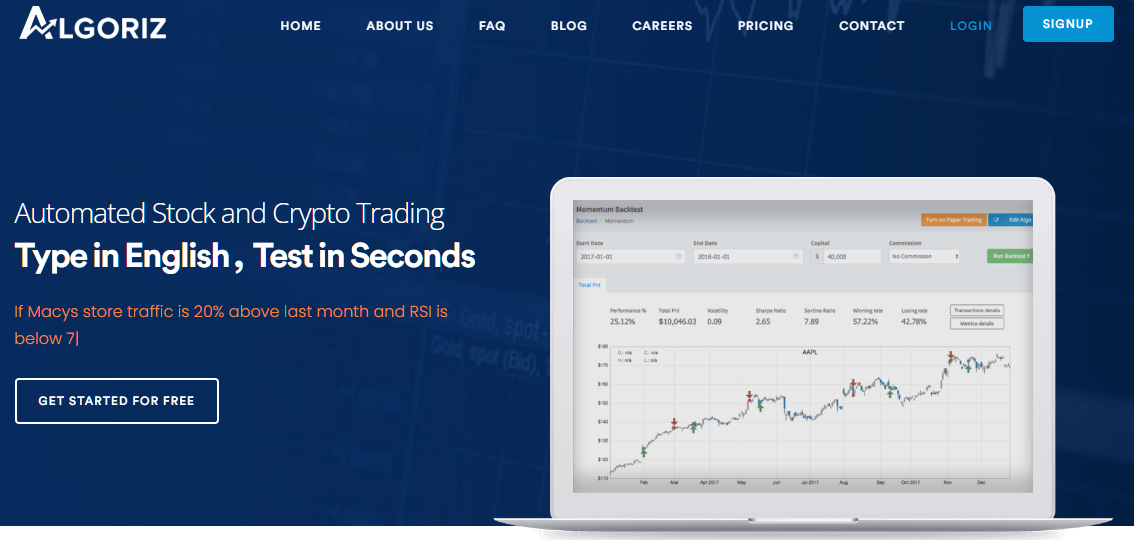

5. Algoriz – Best for Easy Strategizing

- Rating: 4/5

- Key Features: Ease-of-use, built-in brokerage services, many potential strategies, strategy creation features

- Pricing: Free, $29/month for the Professional plan, and $69/month for the Premium plan, with custom pricing for the Enterprise plan

If you have trading expertise but aren’t too strong with programming, Algoriz is a great artificial intelligence trading system. Everyone needs to know what they want, consider their trading scenarios and larger goals, and let Algoriz provide recommendations from there.

Want to test a trading or investment strategy yourself? They have a simulated matching engine to help you. You only need to type in that strategy in relatively plain language. Algoriz takes care of the programming and provides results.

Backtesting is available with their algorithm, the UI is easy to use compared to other AI trading software, and there are AI tools with 10,000+ different strategies one can use on it.

When strategizing, you can connect it directly with your broker and work alone or with vendor data.

Algoriz supports many cryptocurrencies and stocks.

6. Stoic – Best for Cryptocurrency

- Rating: 4.5/5

- Key Features: Understandable strategies, cryptocurrency specialization, automated trading, track record of results

- Pricing: $9/mo.-$25/mo.; 5% annual deposit for larger accounts

Cryptocurrency trading is growing and is one of the key factors behind the recent boom in AI trading programs. While we could have a whole piece on crypto trading bots, for this piece, we wanted to focus on just one, Stoic.

Stoic typically has three greater strategies depending on your investing goals and risk tolerance: Meta, Long Only, and Fixed Income.

Further tuning can be done, but in all cases, the goal is to remove manual trading from the picture and trust the trading process the AI. That’s a big ask, but thousands currently trust it.

It is designed to choose the right trade at the right time, and execute trades, regardless of the market conditions. Stoic can remove much of the anxiety (or adrenaline rush) from crypto trading, handling things so you don’t make a bad move out of emotion.

And while it’s not perfect, it claims a 2,143% return since March of 2020 and an overall high APY%. That said, you know what they say about past performance — it’s no guarantee of future results.

Stoic only works with Binance.

7. Black Box Stocks – Best for Beginners

- Rating: 4.5/5

- Key Features: East-of-use, learning options, live charting, real-time opportunity alerts

- Pricing: $99.97/mo.

Black Box Stocks focuses on ease of use, UI, and intuitive usage. If you’ve looked at the other AI trading systems and had a minor existential crisis, Black Box Stocks might be a pick for you. The filtering tools are strong and easy to use, making it more beginner-friendly.

Note that the filters don’t reduce the total information available to users. It just makes the platform easier to manage. It’s one thing to scan the markets several times a second and come up with thousands of potential recommendations and bits of data. It’s another to make that information accessible and actionable for a human being.

Its automatic functions might not be as strong or numerous as other platforms, but it has a large database, many resources to learn from, and pre-market analysis features.

Black Box Stocks is one of the oldest platforms or companies on this list, going back to 2014 (indeed, things have changed a lot with AI robots since then). They’re stable enough to rely on.

Alternative to AI Trading – eToro’s CopyTrader

You might not think that AI trading is there yet or trust it enough to place fiscal faith in it, and that’s entirely understandable.

Still, there’s something to be said for taking advice and data from the top traders in the world and using that information for yourself to make informed trading decisions. Automation can save you time and potentially make you better returns since automation doesn’t hesitate.

For that reason, you might want to check out eToro’s CopyTrader, which will automatically copy the trades of top investors to the best of its ability.

You select a popular investor to copy (some of which have two-year returns of more than 50% — though past performance is not an indication of future results, and the system does the rest of the work for you.

You can learn more about the process in our eToro CopyTrader review.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

What is an Artificial Intelligence Trading System?

An AI trading system is a program or automated trading system that uses machine learning, AI, and computer algorithms to recommend or make trades on behalf of an investor.

It analyzes available data, new and old, to find trends, then will often mimic the behaviors of traders, albeit faster and more accurately.

What’s the Difference Between AI Trading Systems and Algorithmic Trading?

Many will use these two terms and ideas interchangeably, often incorrectly.

- Algorithmic trading systems will work via a series of rules and commands. If/then rules are common and control the full process. It’s helpful, but it doesn’t learn. A human must adjust the rules if there is an error.

- AI trading systems are supposed to learn and adapt. In an ideal scenario, an AI trading system will not make the same mistake twice. It adjusts and changes its own algorithms automatically according to its programming. Essentially, it’s on a higher level of automation.

Which one is better? It depends. Algorithmic trading has more human input, with the pros and cons that implies. AI trading systems can learn more independently, but the goals best be well defined.

Benefits of AI Trading Software

- Analysis: An AI stock trading bot can review and analyze massive amounts of data quickly and make it more accessible for humans, pointing out what’s important to consider in the best cases. It might detect what humans cannot.

- Automated Trading: Some AI trading software can make deals or trades for you based on rules you set for them. It can feel risky but save you a lot of time and stress.

- Affordability: AI trading software is far more affordable than a traditional financial advisor or investment manager. It’ll either cost less per month or take less of a cut. An AI doesn’t need to pay rent or feed itself (yet).

- Impartiality: AI trading software doesn’t care, and that is best when making mathematical and data-based decisions. AI, to my confident knowledge, doesn’t experience adrenaline rushes when faced with new data. It simply analyses and provides results.

- Speed: While a human can be more creative and think outside the box, an AI wins whenever simply processing information. It can act before humans can.

- Self-Improvement/Learning: The best artificial intelligence trading bot continually updates and improves itself, learning from market trends. It’s less likely to make the same mistake multiple times.

What Features Should I Look for in AI Trading Software?

- Past Results: While past returns cannot predict future returns, it’s hard to bet on something that has never performed well.

- Ease-of-Use: If you’re disincentivized from using software because it’s unnecessarily complicated, that’s a problem.

- Transparency: I don’t expect trade secrets, but I want to know about the basic principles behind AI and how it operates. The only good decision is an educated decision.

- Cost: Don’t just pick the cheapest one; understand the cost of using a certain product.

- Customer Support: You still want to be able to talk to actual humans if something seems or goes wrong.

- Adaptability: The AI should be able to learn and learn quickly from changing market trends. It should also accommodate your unique investing plans and needs.

- Available Data: The trading software should make its information and real-time data available to you.

Final Word: AI Trading Software

AI trading bots for stocks and artificial intelligence are complex topics that are constantly evolving. They absolutely can provide you with great returns, even if the learning curve can be steep with some programs.

However, while AI can be useful, remember it isn’t perfect (at least yet). It can track a CEO’s performance, but it cannot necessarily track how well a CEO will keep the top talent at a company that makes it successful.

Use an AI stock trading app like TrendSpider if you think will help, but be careful. Use additional resources and your own critical thinking when picking your investments.

You’ll find the greatest chance of investing success by using as many tools, trading strategies, and resources as you reasonably can.

FAQs:

What is an AI trading system?

An AI trading system automatically uses artificial intelligence and analytics to buy and sell stocks, build portfolios, etc. It employs machine learning, analysis of historical data and trends, algorithms, and more to make or recommend trades at the best price/time.

Can I use AI for trading?

Yes. Nothing stops you, and AI can provide some excellent ideas and models for investing.

However, you should be cautious about relying completely on AI. If AI always provided the best returns, we would have completely abandoned normal investment and risk management practices by now. AI is still developing and it can make mistakes.

Are AI trading bots legal?

Yes, AI trading bots are legal. Some people or organizations have ethical concerns about AI trading tools or bots and what they can or should do, so this could change.

But remember: AI trading bots and those that use their recommendations still have to follow the respective markets' rules, laws, and regulations.

What is the best AI trading bot?

The best AI trading bot depends on your goals. In this age of AI advancement, today’s AI trading bot might not be next week’s best AI trading bot. The top competitors will likely stay at the top for a while, but the positions will often change. Additionally, the best AI trading bot for cryptocurrency may not be the best for day trading. Many specialize.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.