If you look at any study about how profitable day trading is, only 10% – 15% of traders make money and an even smaller percentage consistently outperform the markets.

Day trading looks scary once you know the statistics – most traders are losers, especially beginners. But, there are ways around this statistical improbability!

There are trading platforms everyone can use to piggyback full-time traders. This is called copy trading, and it may be one of the safest and least time-consuming ways to trade (when used correctly).

Apps like eToro allow you to follow experienced traders – like they would social media profiles – and copy their trades which can be profitable and a great learning experience.

This eToro copy trading review will explain how the platform works, what its requirements are, and how to use it.

What is Copy Trading?

Some stock traders love attention. So much so that they post all their trades publicly and even advertise themselves so that people can see what they’re doing and copy their trades.

The problem with these traders is that they only ever post their winners – if you look at their profiles, they’ve never had a losing trade in their lives!

Instead of blindly following these traders who “never lose”, there are a few platforms that offer copy trading which allows you to find traders you like and subscribe.

Once you subscribe to your favorite traders, you can allocate a part of your trading balance to them and let the app run on autopilot, copying every trade they make in real time. Find a trader you like, click “COPY,” and let the app do the rest.

Trading like this can be easy and save a lot of time and effort, but there are usually extra commissions involved – the pro traders who offer this service usually charge a small fee for every trade you copy from them.

eToro’s CopyTrader, however, does not require additional charge. More on that below.

Pros and Cons of Copy Trading

Pros | Cons |

|---|---|

Most new traders lose a lot of money, so piggybacking off an experienced trader can be much safer. | Extra commissions – some copy trading platforms have commissions for copy trading. |

Saves a lot of time and effort – making a trade independently should be preceded by a lot of research. | Not all pros are successful – even a great trader can have a bad day or month, so even if you copy the best trader in the world, profits are not guaranteed. |

Can be used educationally – following and analyzing pro traders’ moves can give users insight into their strategy. | Vetting traders can be difficult – even if a trader has a good track record, that doesn’t guarantee future success. |

Over-reliance on help – trading is often very complex and using a copy trading feature might discourage traders from researching by themselves and learning. |

Now that we’ve covered the basics, here’s my eToro copy trading review.

What is eToro?

eToro is an online brokerage with an intuitive trading app that offers users access to stocks, ETFs, CFDs, forex, and more than 30 cryptocurrencies. eToro USA LLC does not offer CFDs, only real Crypto and Stocks/ ETFs assets available.

eToro is best known for its integration of social investing, a combination of investing and social media. Its features make it easy to exchange ideas with, trade alongside, and learn from other traders and investors all over the world.

eToro also has low trading fees, great educational materials, a powerful mobile app, technical and fundamental analysis capabilities, and more.

But its crown jewel is its CopyTrader.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

How does Copy Trading Work on eToro?

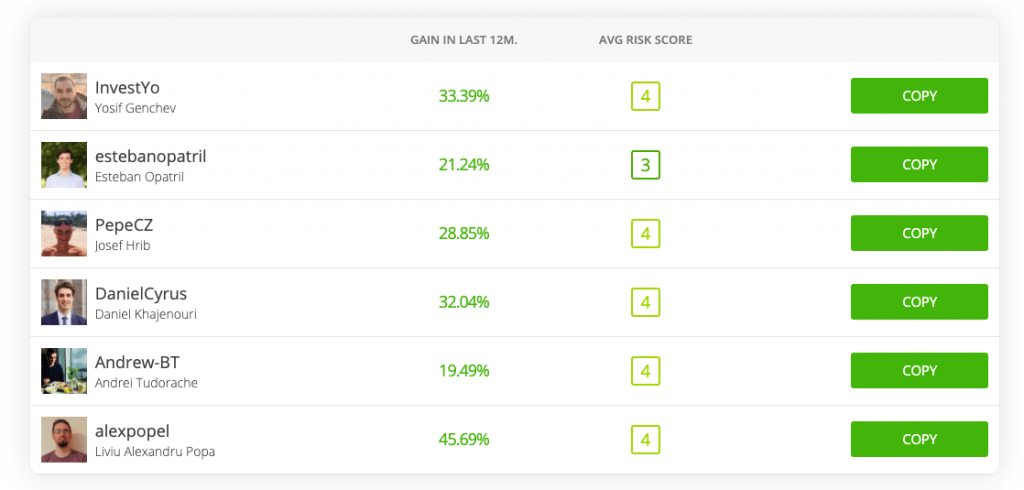

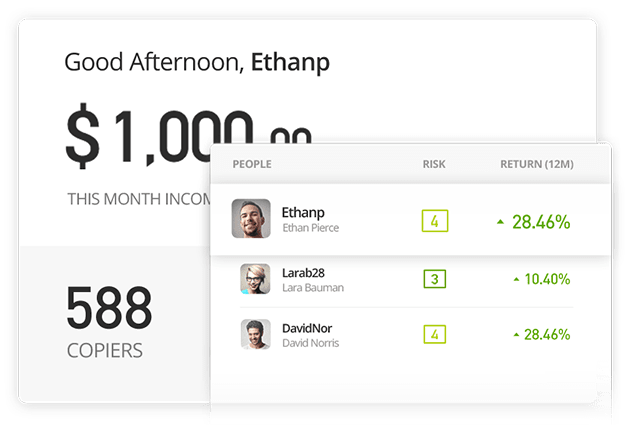

eToro has a list of experienced traders you can copy known as ‘copied traders’ or ‘Popular Investors’.

Each trader has a profile with a rating, performance history, risk profile, and more so you can easily compare traders to copy and find the ones best suited for your strategy.

When you decide to copy a Popular Investor, you can click on the “COPY” button on their profile and the app will use your money to copy the trader’s portfolio. You decide how much money to allot to each trader and the app will replicate their portfolio along with every new trade that they make.

If you don’t want to copy the trader’s entire portfolio, you can opt for just copying each new trade that they make from that point onwards.

Here is how to copy trade on eToro in 4 steps:

- Choose a trader or traders you like.

- Click on the “COPY” button on their profile.

- Choose the amount you wish to invest with them.

- Choose whether to copy their entire portfolio or simply copy each new trade they make.

You can manually close copied trades at any time. If you close a trade that has been opened by the copied trader, the money will go back to your ‘copy balance’—a.k.a. the money you have allocated to that trader.

In 2021, eToro’s 50 most copied traders averaged a 30.4% yearly profit.

How to Choose Who to Copy on eToro

Determining who you’re going to copy trade is the most important step.

Each trader you can copy has a profile. Here’s how to find a good trader in 3-ish steps:

- Pick a trader with a high star rating – there are 4 ratings: Cadet, Champion, Elite, and Elite Pro. The higher the level, the more advanced the trader’s investment management certification. For example, Elite Pro traders have a black star and advanced official investment certification.

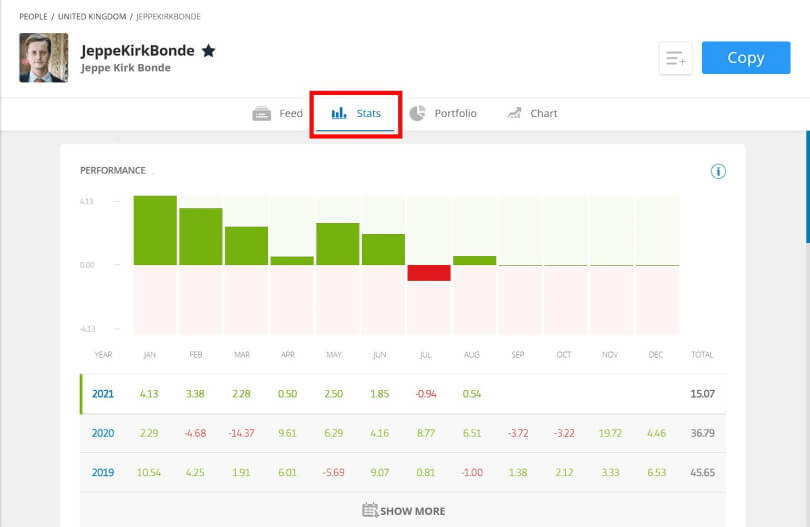

- Look at a trader’s historical performance. Note that the key to day trading is consistency. Everyone can have a good year, but if a trader has been doing well for more than 5 years or so, that indicates that they might be more than just lucky.

- Review the trader’s risk rating, which can be a number from 1 through 7 – the higher the number, the more aggressive the portfolio. If you simply want to safeguard your money, a more defensive trader is probably a better choice, and vice-versa.

You should also read what each trader says about their strategy and what their portfolio looks like.

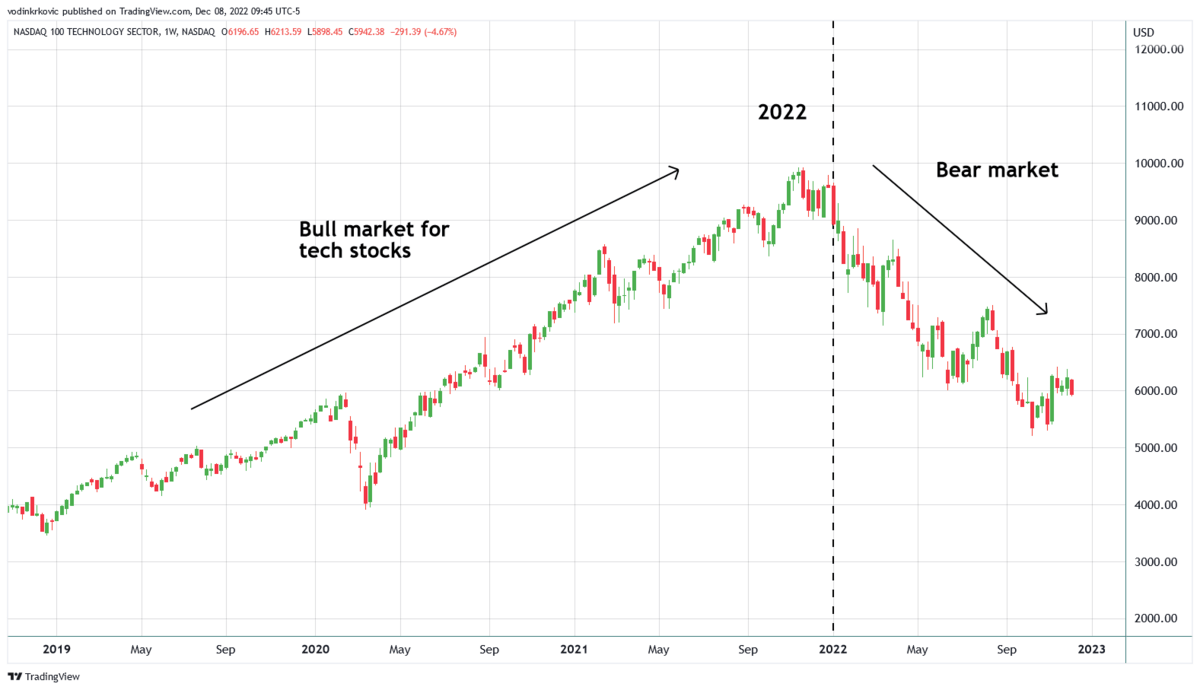

For instance, if a trader writes on their profile that they trade bullish high-risk, high-reward moves with just tech stocks, you shouldn’t expect them to be prepared if their favorite industry has a downturn.

Although most of these traders are experienced and you can view their performance history, there is no guarantee of success. You may want to diversify by following multiple traders with different strategies so no individual market event can blow up your portfolio.

In summary, to pick trader to copy, you should review the trader’s:

- Star rating and level of certification – this is a way to separate legit traders from untested newcomers.

- Historical performance – consistently good profits over a long period are the best resume a trader can have.

- Risk level – choose a trader with a risk tolerance that works with your financial goals.

- Trading strategy – look at the trader’s strategy and portfolio to see if it aligns with your financial goals.

And don’t forget to diversify by spreading your money across multiple traders with different strategies and risk profiles to safeguard your investments.

Should You Use eToro’s CopyTrader?

Should you copy traders on eToro?

Compared to other similar platforms, eToro has the largest community of traders and one of the lowest price structures for trading in general. If you’re interested in copy trading, you should at least try it on eToro.

The Risks of Using eToro’s CopyTrader

The biggest potential danger of following eToro traders (other than following a bad trader and losing money) is becoming reliant on them without ever learning why they do what they do.

In other words, you shouldn’t blindly invest your money.

For example, maybe a Popular Investor has a great record because they traded tech stocks and crypto during the tech boom in the late 2010s, but have no clue what to do in a bear market like the one we saw in 2022:

You should know what you’re investing in, even if you’re not the one making the buy/sell decisions.

Pro traders play the long game. A great trader may have a bad day or they may be in the red for an entire month, but they will still end up making a profit over 12 months. This might be nerve-wracking, but it is important to consider following a trader over a longer period – through the good times and the bad – in order to be profitable in the long run.

Pros and Cons of eToro’s CopyTrader

Pros | Cons |

|---|---|

Popularity – eToro is the most populated copy trading platform, so it offers access to a huge number of competent traders. | Many low-skill traders – the app’s popularity also means that many copied traders are not skilled enough and are dangerous to copy. |

Pricing – there are no additional charges for eToro’s copy trader, stock and ETF trades are free, and forex and CFD fees are low compared to the industry average. | Execution delay – a small delay between a copied trader executing their trade and the trade being copied by your account is possible. This lag can be costly if you are following a day trader with a quick-paced strategy that relies on fast execution. |

Simple and accessible – eToro’s CopyTrader can be used through an intuitive app after a quick and undemanding application process. | |

Returns – the top Popular investors on the app regularly outperform the markets. It is not uncommon to see traders with 20%+ yearly returns. |

CopyTrader Requirements and Fees

There are a few requirements before you can start using eToro’s CopyTrader:

- The minimum amount invested in a single trader is $200

- Users cannot copy more than 100 traders simultaneously

- The maximum amount invested in a single trader cannot be more than $2,000,000

- The minimum amount invested in a single trade cannot be less than $1

- Should you close a copied trade manually, the funds will go back to your copy balance with that trader

How to Get Started Copying Traders on eToro

To start using eToro, you need to open an account and get verified – this takes about 5 to 10 minutes of clicking and a day of waiting. The website has a few forms you need to fill and it will ask you for a photo of your ID to verify your identity.

Your account will usually be created and verified in 24 hours. To start trading, you must fund your account – the minimum deposit is $100 in the UK and US.

The final step is depositing enough money into your account to be able to copy trade. The minimum amount you can copy a Popular Investor with is $200, but this number can be higher based on the copied trader’s requirements – these personal requirements will be listed on each trader’s profile.

An Alternative to Consider

If eToro’s CopyTrader doesn’t precisely suit your needs, you may want to consider Echo Trade.

Echo Trade is not a broker like eToro. Rather, it’s a “bolt-on” service that you can link to your existing brokerage account. (Supported brokers include E*TRADE, Schwab, Fidelity, and Robinhood.) So if you already like your brokerage account, this makes for an easy addition.

With Echo Trade, once you set up your account you can then select a portfolio to follow by choosing from professional trading portfolios from top registered investment firms.

Here’s what makes this service unique.

Historically, this type of expertise has not been available to just anyone — it has been reserved for HNWIs. Now, Echo Trade lets you follow these experts and copy their trades.

The most popular plan is $40/month, which gives you access to one professional portfolio. From there, you get real-time trade notifications, and trades are made on your behalf, automatically. You also gain the ability to track portfolio positions, see real-time performance, and you’ll get regular commentary.

So, it’s a bit different from CopyTrader, but if you’re looking for a professional level of expertise, it might be a good fit. Start your FREE 14-day trial now.

Final Word: eToro Copy Trading Review

eToro’s CopyTrader is the best way to start copy trading in 2025.

Copying traders on eToro is straightforward – the number of experienced traders you can copy and the systems eToro has built around their feature are great for getting started in copy trading.

Don’t forget to do your homework first.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

FAQs:

Is eToro copy trading worth it?

It depends on the Popular Investors you choose to follow.

There are no fees for using eToro’s CopyTrader fees, so copying a trader who regularly outperforms the market is worth it.

Can you lose money on eToro copy trading?

Yes. There is no guarantee that the trades you copy will be profitable and there is no insurance against failure. This is why it is important to vet traders whom you wish to copy, and better still, you should analyze their trades and hedge against potential downturns.

Is copy trading good for beginners?

Yes and no - it depends on how copy trading is used. Trading is notoriously difficult, so beginners can benefit from following experts and analyzing their moves. However, completely relying on others to make decisions for you can result in trading blindly and not becoming more skillful over time.

Is copy trading a good strategy?

Copy trading saves time and can be very profitable, but only under the condition that you follow the right traders. Copying multiple traders with different strategies is also important, as it can limit your losses in case someone slips up.

How do eToro’s Popular Investors make money?

eToro traders make money through commissions provided by the brokerage, with no extra expenses to the users who copy them. Copied traders can also link to their websites and blogs, which allows them to upsell their services directly to their followers.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.