Robinhood is an online brokerage which caters to the new generation of investors, providing easy access to trade stocks, ETFs, and cryptocurrency.

Robinhood’s stated mission since its founding is to democratize finance for all. The platform pioneered commission-free trading, but it didn’t stop there. These days, Robinhood offers an IRA match, high APY on uninvested cash, and more.

But Robinhood’s trajectory hasn’t been straightforward. It’s experienced some growing pains including complaints and outages since its 2013 founding — and it has new investors wondering, Is Robinhood safe?

In this Robinhood review I will answer that question, list the pros and cons, and lay out who Robinhood is best for so you can determine if it’s the right brokerage app for you.

Is Robinhood Safe & Legit?

The Bottom Line: Yes, Robinhood is safe and legit. But before we dig in deeper, it may be helpful to explain why Robinhood’s safety is a question at all.

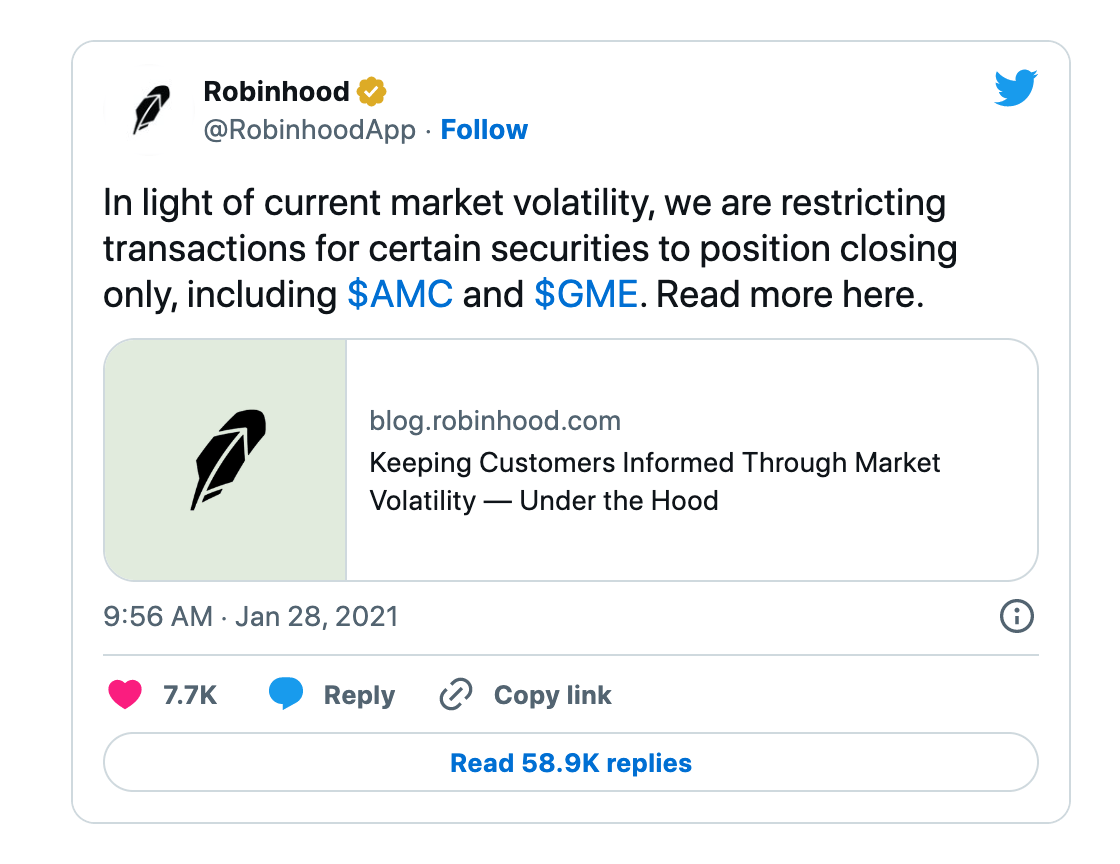

To understand, we need to go way back to January 28, 2021, when Robinhood became the center of controversy after preventing users from buying stock in several companies, including GameStop (NYSE: GME), AMC Entertainment (NYSE: AMC), and Nokia Corp. (NYSE: NOK). It cited issues with stock volatility and regulatory requirements, resulting in major frustrations from users and lawmakers.

This event was unprecedented, and it certainly put Robinhood’s safety and ethics under scrutiny.

While Robinhood harps on democratizing finance and investing on your own terms, any new investor would want to be assured another GameStop incident doesn’t happen again.

As of 2024, Robinhood has not had another major event like that. So far so good.

What is Robinhood?

These days, commission-free stock trading is the norm. We have Robinhood to thank for that.

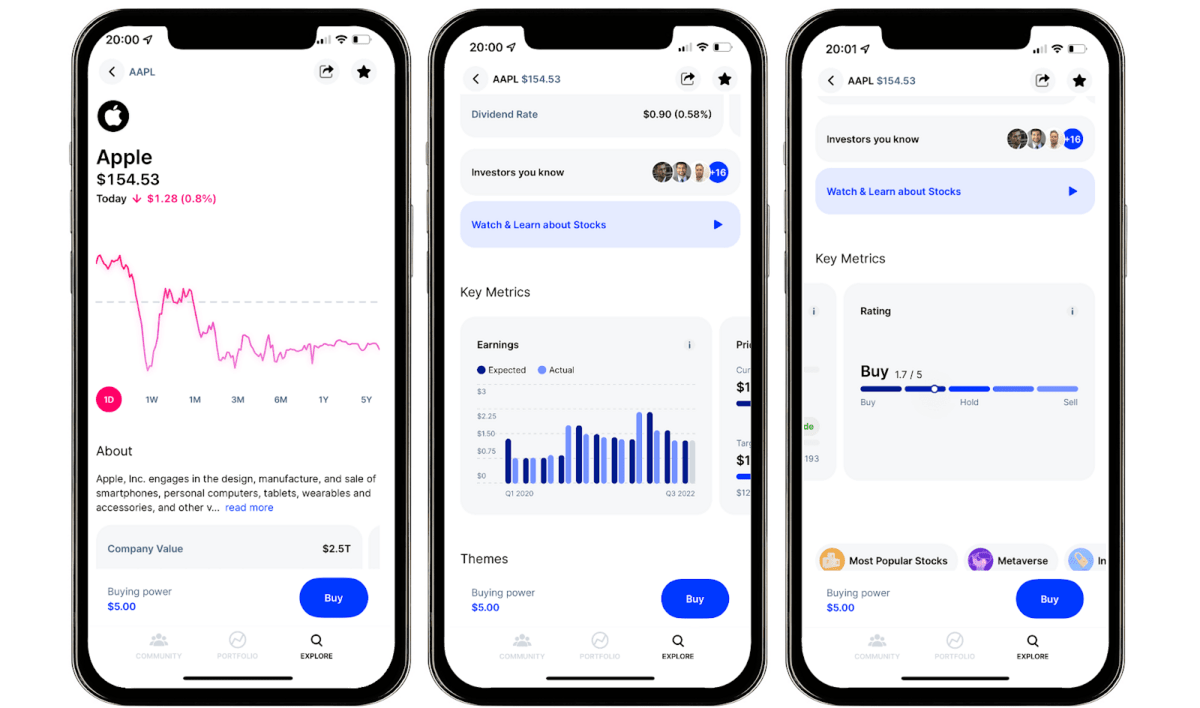

Robinhood was the first brokerage to offer commission-free stock, ETF, and option trading. In addition to low fees, it also boasts an extremely intuitive easy-to-use interface and low investment minimums that reduce the barrier to entry for stock market investing.

As you might imagine, it caught on like wildfire. Here’s a brief summary of Robinhood’s trajectory:

- 2013: Robinhood is launched.

- 2016: The app has over 1 million users.

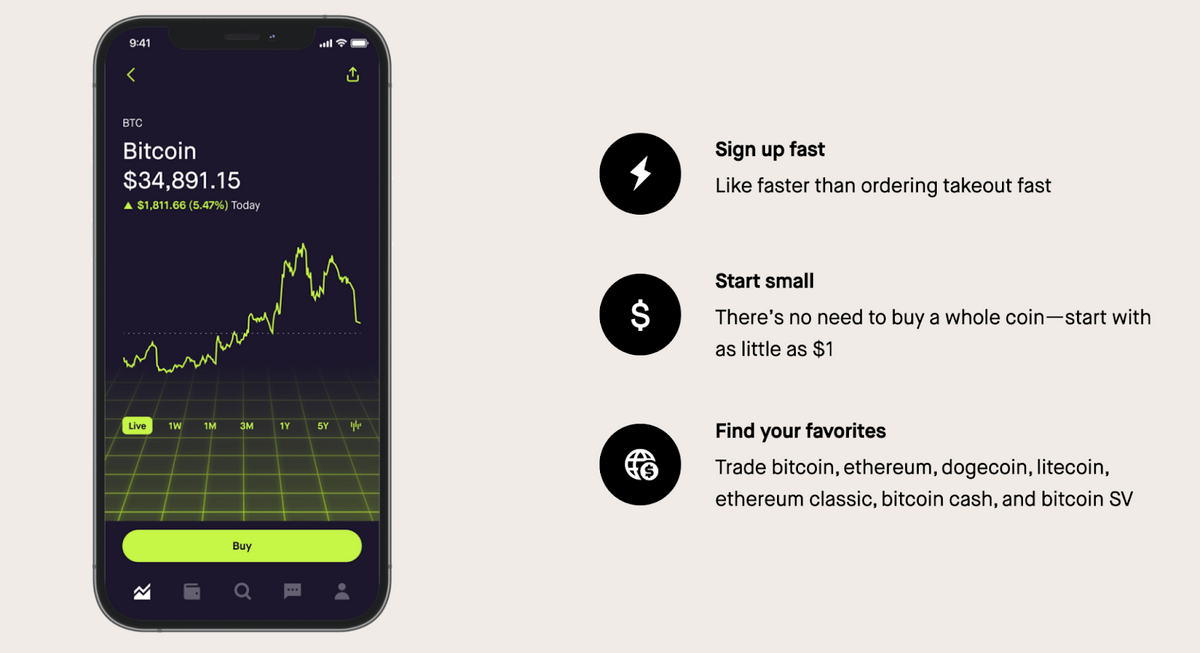

- 2018: Robinhood launches crypto trading

- 2020: Robinhood reaches over 13 million users as retail trading surged during the COVID-19 pandemic.

- 2021: In addition to the aforementioned GameStop debacle, Robinhood goes public this year. It is currently publicly traded: Robinhood (NASDAQ: HOOD)

- 2023: Robinhood reaches $89,700 million in AUM

- 2024: Robinhood is reported to have 23 million funded accounts, and 10.8 monthly active users.

As you can see, Robinhood has grown and changed a lot over the years. Is it still any good? Yes.

For new investors, Robinhood is my most-recommended brokerage app.

Robinhood is a great platform for new investors looking for a simple user experience, mobile-friendly trading, and zero trading fees.

That said, Robinhood may not be the best fit for every investor. For instance, day traders may find Robinhood’s technical tools lacking and may prefer a platform like TradeStation. Investors who are interested in a few more asset classes in one place might be interested in Public, which offers stocks, ETFs, and crypto, but also offers the ability to invest in treasury bills and a high-yield bond account.

But if you’re just getting started, Robinhood is a pretty solid place to start. You can take advantage of their fractional share sign-up bonus ($5-200 of free stock for signing up!) and invest in companies with as little as $1. Other platforms charge up to 4% just to buy and sell crypto. With Robinhood, you can dive into Bitcoin or Ethereum for just $1.

Plus, Robinhood also has a lot of great services that may be of interest. For instance, they offer IRA accounts (traditional and Roth) with up to 3% matching (for members of Robinhood Gold, the platform’s premier subscription), a credit card, and high-yield savings.

Robinhood’s Safety & Security

There have been some valid concerns about Robinhood’s safety in the past.

Robinhood has faced scrutiny over its handling of the GameStop surge. It has also faced scrutiny over a 2021 data breach and its payment-for-order-flow practices.

Does all of that scare you off? That’s valid. It might interest you to know that Public, a competing brokerage, has not had any major scandals — and it discontinued PFOF in 2021.

However, the platform has demonstrated that it is willing to learn and adapt, and takes pride in being a safety-first brokerage. Consumer confidence and security is a top priority, demonstrated by their six core commitments:

- No commission fees – Regardless of the amount invested, you will not be charged an account minimum or commission to buy or sell stocks, ETFs or options.

- Extra protection – Robinhood Financial is an SIPC member, which protects customer securities up to $500,000.

- High security standards – They will cover 100% of direct losses due to unauthorized account activity.

- Dedicated support – 24/7 live customer support

- Transparency – They break down how they make money so they can continue to offer commission – free trading and low cost services.

- Quality execution – Committed to seeking quality execution on every order, regularly reviewing factors like price, speed and market conditions.

Is Robinhood legit? I’d say so.

If you’re still wondering how safe is Robinhood, here are 3 more security measures they have in place:

- Password safety – Passwords are stored using a hashing algorithm – meaning they are stored in a scrambled format to add a layer of protection.

- Encryption – Server communication uses Transport Layer Security (TLS) protocol to ensure anything sent to their servers remains private.

- Two-factor authentication – Two sources of verification are required to sign in to your account.

Robinhood Gold

If you want to up level your Robinhood account, Robinhood Gold is a premium subscription service that gives you access to a variety of benefits for $5 a month. A few highlights?

- Access to Margin Trading: Gold users can borrow money to trade on margin. The first $1,000 of margin is included in the subscription, but if you borrow more than that, you’ll pay an interest rate (currently 12% as of 2023) on the amount over $1,000.

- Professional Research: With Robinhood Gold, you gain access to in-depth stock research reports from Morningstar.

- Level II Market Data: This feature gives more detailed information on the supply and demand of a stock.

- Bigger Instant Deposits: With Robinhood Gold, you get higher instant deposit limits, allowing quicker access to funds Your limit increases depending on the size of your account balance.

- Access to the Robinhood Gold card (see below section).

- High-yield cash: As a Gold member, you earn 4.5% APY on uninvested cash, FDIC-insured up to $2.5 million at partner banks.

- IRA match boost: Earn 3% extra on every annual contribution to your IRA when you subscribe to Robinhood Gold.

If you’re going to make use of all of these added tools, then the $5 / month fee is completely worth it. But you can see for yourself — get your first month free using the link below.

Robinhood Gold Card

The Robinhood Gold Card is a premium offering reserved for Gold members.

Gold Card benefits include no annual fee (but you do have to be a Gold member, which comes with a fee), no foreign transaction fees, 3% cash back, and up to 5% cash back on select travel purchases. It’s also a cool card, but note that you’ll default to a “regular” plastic card unless you opt to pay an added fee for the stainless steel one pictured:

Pros and Cons of Robinhood:

Pros | Cons |

|---|---|

Commission-free trades for stocks, ETFs, options, and cryptocurrency* | Makes money via payment-for-order-flow |

No account minimum | Has had multiple outages and trade restrictions |

Invest in fractional shares | |

User-friendly mobile app | |

IRA match** | |

*Crypto trading – Is it safe to buy crypto on Robinhood? Yes. Robinhood Crypto is licensed to engage in virtual currency business activity by the NY State Department of Financial Services. Get peace of mind with Robinhood’s crime insurance against cybersecurity breaches, and crypto cold storage for the majority of customers’ coins.

**Robinhood Retirement IRA match – In December 2022, Robinhood launched the first ever IRA match. Typically match funds are only accessible through employer-sponsored plans. Robinhood Retirement offers a match – no employer necessary. You do not have to work for Robinhood in order to receive the match.

As of 2024, Robinhood offers two tiers of IRA matching. Whether you start by a new account, transfer an existing IRA, or start to roll over an old 401(k), you’ll get 1% on top — regardless of how much you transfer. Or with Robinhood Gold, you’ll get 3% on annual contributions.

Why I Prefer Public

I love Robinhood, but I prefer Public overall. There are two main reasons why.

First, as I noted above, Public stopped payment for order flow a few years ago.

I also like the variety. On Public, you can invest in stocks, ETFs, and crypto, just like on Robinhood. Now, they also offer access to U.S. Treasuries, a high-yield bond account, and a high-yield cash account (which currently pays a bit more than Robinhood’s).

Two key things Public doesn’t have? A retirement account, and free stock for signing up. So if those are major selling points for you, you might be better off with Robinhood.

Final Word: Robinhood Review

Robinhood is great for the newer investor looking to test the trading waters on a user-friendly platform. Commission-free trades, fractional shares, and no account minimums make it simple to get started.

Despite any backlash, Robinhood is actively working to provide a solution for the overall crises facing the new generation of investors. People are taking on part time jobs, multiple jobs and side hustles and financial benefits are no longer accessed in a traditional manner.

If you’re ready for a platform with the tools you can build a sophisticated investment portfolio in, check out Public.

That’s a wrap on my Robinhood app review!

FAQs:

What is the downside to Robinhood?

Untimely outages and trade restrictions will have any new investor concerned with a platform’s reliability. If Robinhood wants to pave the way for providing saving solutions for the modern worker, reliability and trust are critical.

Is Robinhood safe for beginners?

Yes. Robinhood is safe for the beginner investor. They are regulated by the Securities and Exchange Commission (SEC), similar to other popular brokers. In addition to their individual account security measures, Robinhood is also a member of the SIPC, so securities are protected up to $500,000 (up to $250,000 for cash).

Is Robinhood safe to give my SSN?

Yes. Sensitive information, like your Social Security number, is encrypted before it’s stored. In addition TSL (Transport Layer Security) protocol is used to ensure anything communicated to their servers remains private.

How do I get my money out of Robinhood?

For bank accounts you can make up to 5 withdrawals per business day. Withdraw up to $50,000 to a linked account, or up to $5,000 via instant transfer (1.5% fee).

For debit cards you can withdraw up to $5,000 daily.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.