You’re looking for some extra income. You can get it from the stock market.

But how much can you make from stocks in a month?

It depends on whether you’re day trading, long-term investing, or investing for dividends.

Each of these 3 approaches carries different levels of risk and opportunity to generate monthly income. In addition to which approach you take, how much you can make from stocks in a month depends on:.

- Your starting capital

- Your appetite for risk

- How active or passive your investments are

I’ll cover each of the 3 approaches and examine how much money you can make with stocks by day trading, long-term investing, or dividend investing, and how much money you’ll need to invest to make $1,000 per month.

To start investing in the stock market, you’ll need a brokerage account.

Buy stocks, index funds, and ETFs commission-free on Public.com.

Plus, buy fractional shares of art, NFTs, and other collectibles on the best brokerage for alternative investing. Check out Public here.

Day Trading vs Long-Term Investing vs Dividend Investing

First off, let me explain what I mean by day trading, long-term investing, and dividend investing (which are 3 of the most popular ways to start investing for a monthly income).

Day trading is the buying and selling of stocks on the same day, usually within minutes. Traders look for potential price fluctuations which they can enter and exit quickly.

For example, a trader might buy ABC at $1.49 and sell it minutes later at $1.62 for a profit of $0.13 per share. This may not seem like much, but if he bought 10,000 shares he would have made $1,300 in a few minutes.

Day trading is the hardest, most active, riskiest, and potentially most profitable of the 3 approaches. If you’re interested in buying and selling stocks quickly, on the same day, and chasing fast profits, this strategy is for you. However, the degree of difficulty is extremely high and you must be patient and conservative with the amount of money you’re willing to risk.

For a more passive route to investing for monthly income, consider long-term investing and/or dividend investing.

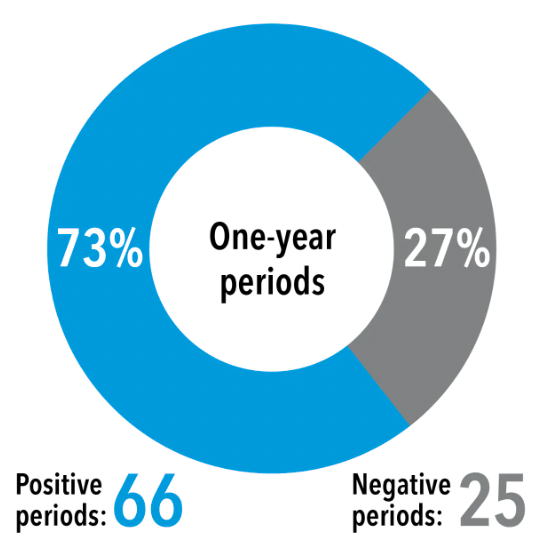

Long-term investing refers to purchasing stocks and holding them for several years. By extending your time horizon, you dramatically increase your chances of positive returns.

In any particular year, historically, there has been a 73% chance of positive returns:

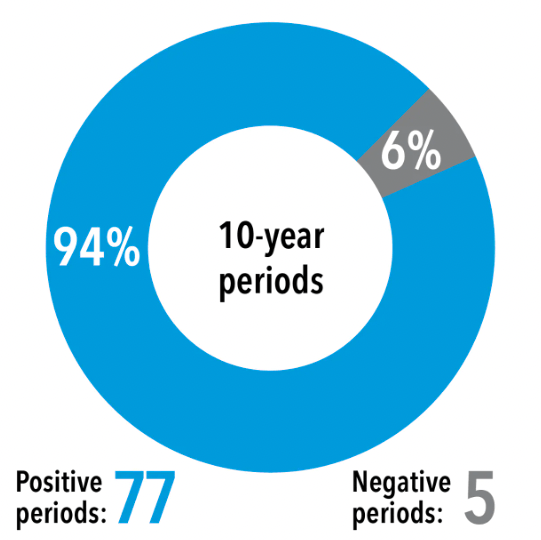

But over a 10-year period, historically, the probability of a positive return increases to 94%:

And over a 20-year period, historically, the probability of a positive return is 100%.

The historical evidence is clear: The longer your holding period, the higher the likelihood of a positive return. Thus, the case for long-term investing.

But long-term investing doesn’t create reliable monthly cash flow. While your 20-year returns will be positive, there are no guarantees of returns in shorter time frames. Some months may be positive, other months may be negative.

So many passive investors looking for monthly income turn to dividend investing.

Some companies pay out a portion of their profits to shareholders in the form of dividends. These distributions are typically paid once per quarter, however, some companies and most real estate investment trusts (REITs) may pay monthly dividends.

Now that we’ve laid the groundwork, let’s cover how much you can make with stocks through each of these 3 approaches.

Day Trading: How much can you make from stocks in a month?

How much money can you make from stocks? Consider day trading for a higher risk, higher reward strategy.

When you day trade, you buy and sell stocks within a day, sometimes within seconds. You trade based on news, price movements, or technical signals.

Day trading is not easy by any means. It’s hard work and takes experience and learning from mistakes. Moreover, day traders are traditionally well-funded and are willing to risk a lot of money.

You may find the rush of day trading exhilarating or the stomach-churning volatility terrifying.

When starting out, a good rule of thumb is to never risk more than 2% of your account on any given trade and aim to make 1.5x the money off the money you risk. With a portfolio of $10,000, you’d want to invest $200 per trade and aim to profit $100.

Be conservative in the beginning. Even if you hit this small target, the compounding results in massive gains after 1 year.

Let’s say you trade 10x per month and win 6/10 trades:

- 6 winning trades, and you make $100 per trade = $600

- 4 losing trades, and you lose $67 per trade = $268

At the end of the month, you netted $332, 3.3% of your total account.

And don’t forget about the compounding!

- After month 1, a 3.3% return is $330.

- After month 12, a 3.3% return is $471.

Based on these figures, if your goal is to make $1,000 per month from day trading, you’d need a $30,000 account or to take 30x trades per month.

Start slow and work your way up.

Long-Term Investing: How much money can you make from stocks in a month?

You increase your likelihood of success when you buy, hold, and invest for the long term. For instance, if you invest as little as $100 a month over several years, this money and its returns will compound over time.

Let’s say you start investing $100 monthly in an S&P 500 index fund 20 today. Since its inception, the S&P 500 has had a long-term annualized average return of around 11.88%.

Fast forward 20 years. You’ve contributed $24,000. With an 11.88% annualized return, your portfolio is worth $98,405.

Your $74,405 gain divided by 240 months is a monthly income of $310.

For this math to work, you could not be withdrawing your money along the way. If you want monthly income investments you can use to pay bills or have extra money to spend, you should focus on day trading or dividend investing.

For the best place to start investing for the long term, head over to our article on Ally ETFs.

Dividend Investing: How much can you make with stocks in a month?

In the example above, the dramatic effect of compound interest is obvious. With dividend investing, you can take advantage of compound interest while simultaneously spinning off monthly income from stocks.

Many dividend-paying companies pay quarterly dividends and between a 2% and 5% dividend yield. A dividend yield is the portion of its stock price that it pays out in dividends.

For example, Apple (NASDAQ: AAPL) pays a $0.92 dividend per share per year. At its current price of $142.46, that gives it a dividend yield of 0.65%.

You will need a lot of capital to generate substantial dividend income.

The S&P 500 ($SPY) has a current dividend yield of 1.56%. To make $1,000 monthly, you will need to invest $769,230 ($12,000/0.0156).

If you buy a dividend-focused ETF like the Schwab US Dividend Equity ETF ($SCHD), the dividend yield will be higher, 3.21% in this case.

To make $1,000 monthly from $SCHD, you will need to invest $373,831 ($12,000/0.0321).

Another place to look for strong dividends are Real Estate Investment Trusts (REITs). These real estate holding companies typically pay 5% or more in dividends.

At a 5% yield, you will need $240,000 to earn $1,000 per month in dividends.

If you’re wondering how much do I need to invest to make 1000 a month from dividends, I would aim for about $350,000. A portfolio full of REITs would be too heavily concentrated in one area, but you can probably beat the yield of SCHD.

If you have the capital, dividend investing is the most passive and reliable form of investing for monthly income with stocks.

Final Word: How Much Can You Make from Stocks in a Month

How much can you make from stocks in a month?

The answer to this question depends on how much money you invest, your risk tolerance, and your investment strategy.

There are obvious pros and cons to each approach mentioned above. Pick the one best suited to your financial situation and personality.

Whichever strategy you choose, be patient and let compounding work its magic.

FAQs:

How much money can you make from stocks?

The amount of money you can make from stocks is only limited by the amount of money you invest, your risk tolerance, your investment strategy, and how long you invest.

How much do I need to invest to make $1,000 a month?

If you’re day trading and take 10 trades per month, you will need an account of about $30,000.

If you take more trades or earn returns higher than 36% per year you may need substantially less capital.

If you want to make $1,000 a month ($12,000 a year) from long-term investing, divide $12,000 by the S&P 500’s 11.88% average annualized return. The result indicates you would need to invest about $101,010.

Remember, 11.88% is an average return - there’s no guarantee this will be your return each year.

If your goal is to earn $1,000 per month from dividends, you will need around $350,000 (based on a portfolio yield of 3.43%).

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.