The covered calls strategy is one of the simpler option trading strategies out there, which makes it a great starting point for beginners looking for exposure to calls.

Although the covered call option strategy is relatively straightforward, it’s critical to understand its nuances. For example, the difference between a covered call strategy and one using naked calls may be subtle, but it can mean survival versus a portfolio blowup.

As such, it’s crucial to have a full understanding of the strategy before you trade. Because when dealing with options, uncertainty is, well … not an option.

Let’s bring you up to speed to ensure you understand precisely what a covered call entails, how it works, and why some traders regularly implement them as part of a lucrative daily strategy.

Want pro-level options training?

Hands down, Benzinga’s option alert service is the best way to trade and learn about options.

This top-rated options alert service is led by professional options trader and mentor Nic Chahine.

With Benzinga Options, you’ll get alerts to Chahine’s high-conviction trades. But that’s not all. He also offers detailed analysis of the “why” behind the trade so you can learn as you go. Here’s what you get:

- High-probability option trades

- Transparent access to trade explanations and analysis

- Market analysis

- Top-tier education

That’s not all! For a limited time, you can score FREE access to the next Benzinga Boot Camp. Don’t delay!

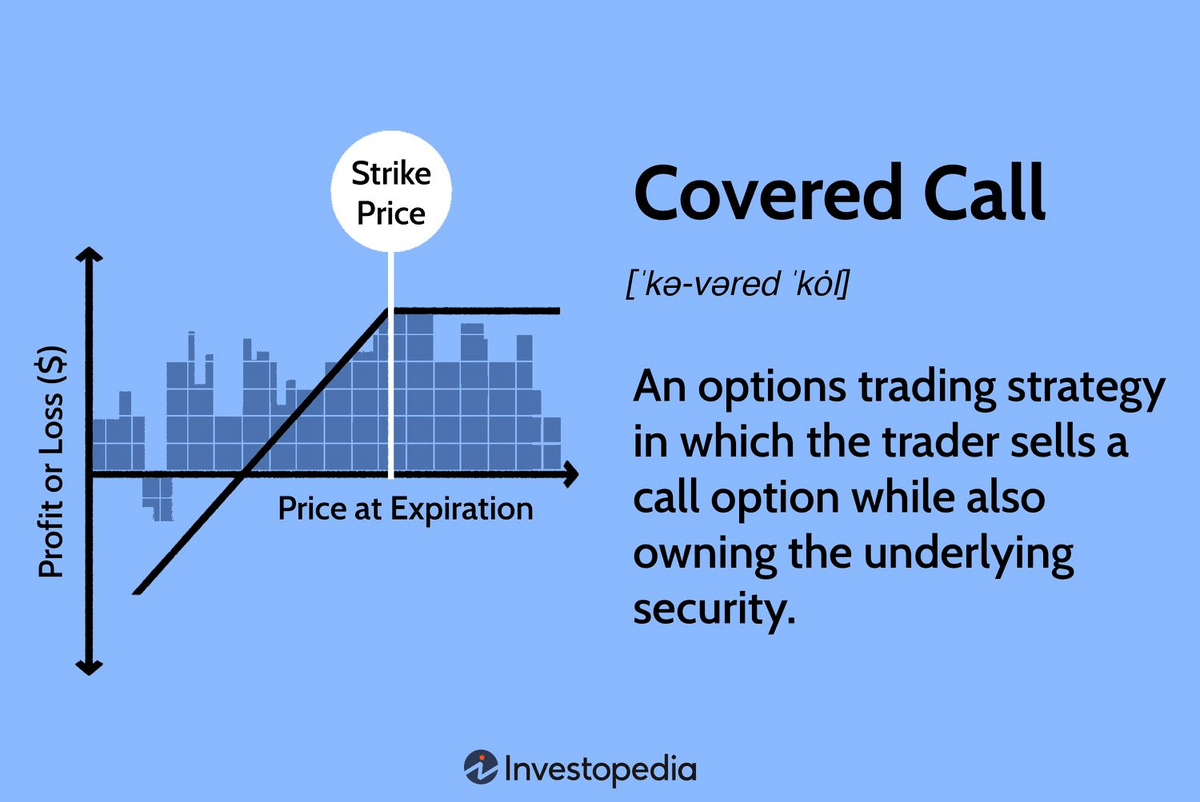

What is a Covered Call?

A covered call starts with a call option.

The owner of a call option has the right but not the obligation to buy the underlying reference security if the option is exercised.

Need a refresher on the different types of options? Check out this article.

Alternatively, the seller of a call option receives a premium payment to give the buyer this right but is obligated to sell the underlying security at the strike price if the option is exercised.

What, then, is explicitly meant by a “covered call”?

A covered calls strategy is the act of selling a call option while owning a corresponding position in the underlying security.

We know that one call option contract equals 100 shares of the underlying stock.

For example, 1 Apple call option = 100 shares of Apple (NASDAQ: AAPL) stock. Therefore…

- To sell one covered Apple call option, you must first own 100 shares of Apple.

- If you do not own the underlying shares, we call this a naked call (i.e. ‘uncovered’).

How a Covered Call Works

Like all options contracts, covered calls involve a buyer and a seller.

From the buyer’s perspective, there is no difference between a covered call and a naked call. That’s why, when you talk about a covered call option strategy, you’re explicitly referring to the seller of the contract.

To implement the trade, the seller of the call option must own 100 shares for each contract they intend to sell on that particular name.

- Often, traders already own the name before selling call options.

- In other instances, the trader may need to buy the security.

Important note: The underlying security must be purchased before the call option is sold; otherwise, there would be a period where the call is naked and opens the trader to unlimited losses.

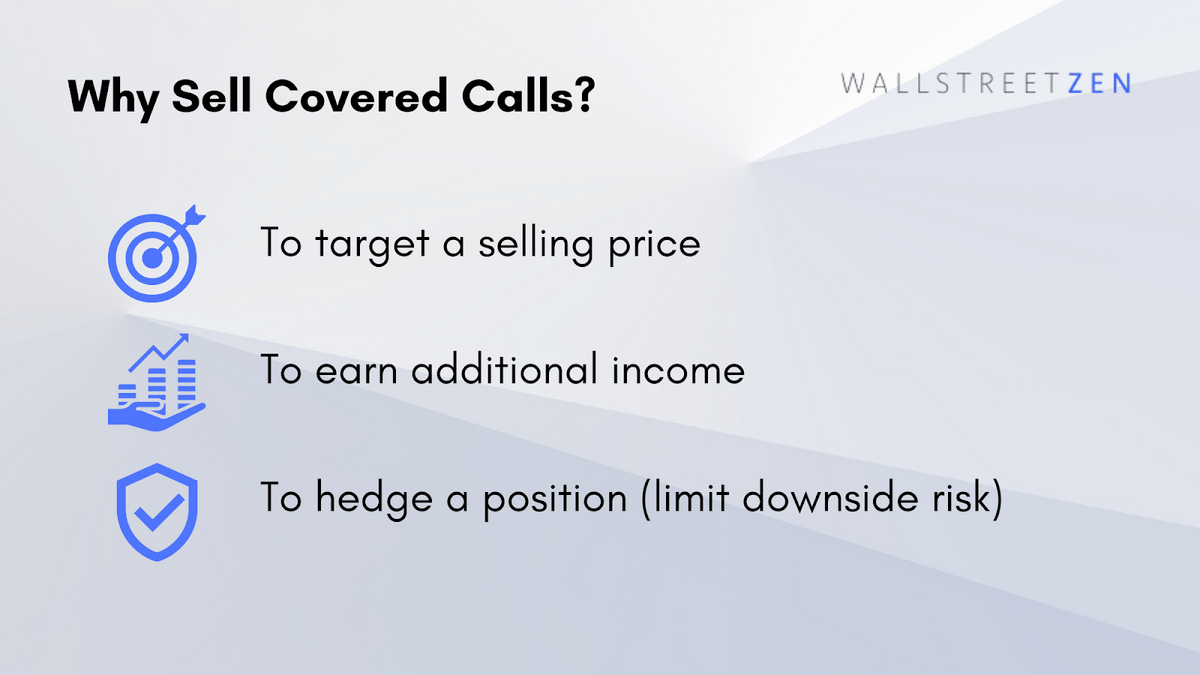

Why Sell Covered Calls

A trader might decide to sell covered calls for several reasons.

1. Target a selling price

A covered call option strategy allows traders to target a selling price for shares they own.

For example, imagine you own shares of Apple (NASDAQ: AAPL), currently trading at $165. You want to target a sale price of $175, so you sell call options with a strike price of $175.

If Apple crosses $175, the buyer will likely exercise the option, closing your position (i.e. prompting you to sell Apple for $175 per share).

2. Earn additional income

Anytime you sell an option, you receive a premium. A premium is simply the payment the buyer gives the seller for the benefit of owning the option.

Many traders regularly implement covered call strategies to earn consistent income.

3. Hedge portfolio

Covered calls strategies can help limit downside risk. When selling call options, you receive a premium payment.

Looking back at the example in #1, imagine you sold one call option contract on Apple (NASDAQ: AAPL) for $5. In total, you earned $500 ($5 premium x 100 shares).

Now, imagine the option expires worthless because Apple never exceeds $175.

One month later, you decide to sell Apple when it’s trading at $160 because you fear it may lower further.

The premium received pads your sale price. While you sold shares for only $160, you also received a $5 premium per share. Therefore, it’s as if you obtained $165 per share.

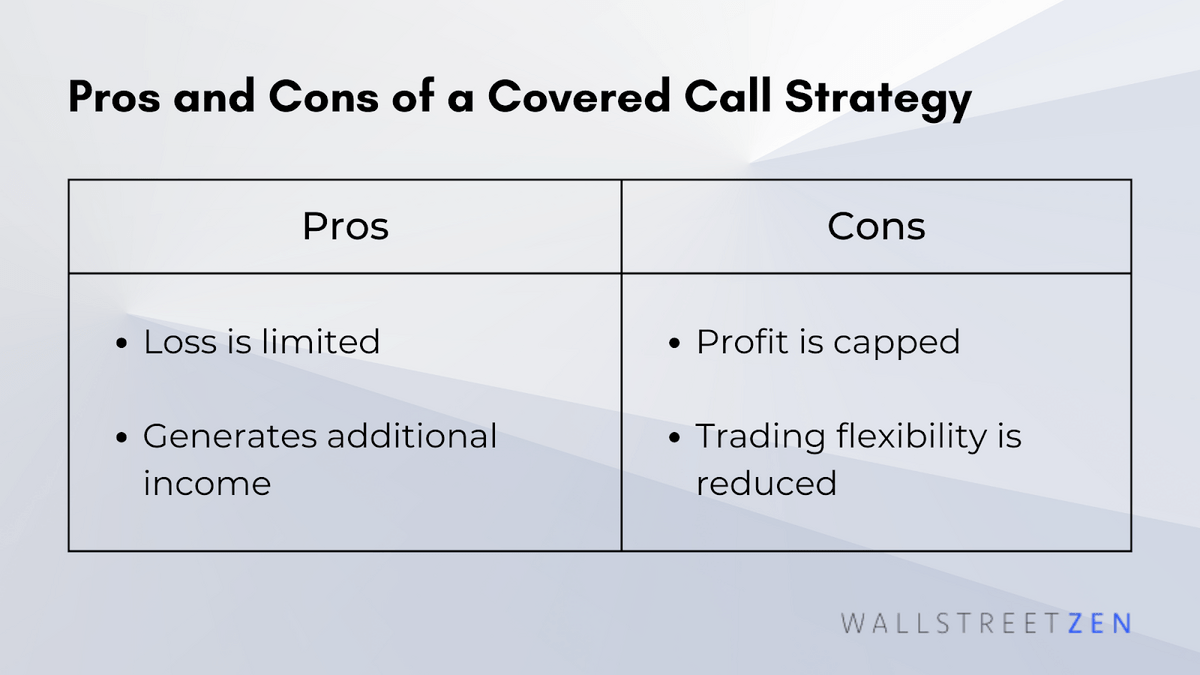

Pros and Cons of Covered Call Strategy:

Pros:

- Loss is limited. Alternatively, with naked calls, there exists an unlimited potential for loss since you must buy the underlying security if the option is exercised, no matter how high the underlying stock is currently trading.

- Generates income. A covered call strategy can be an effective way to earn additional income by collecting premiums.

Cons:

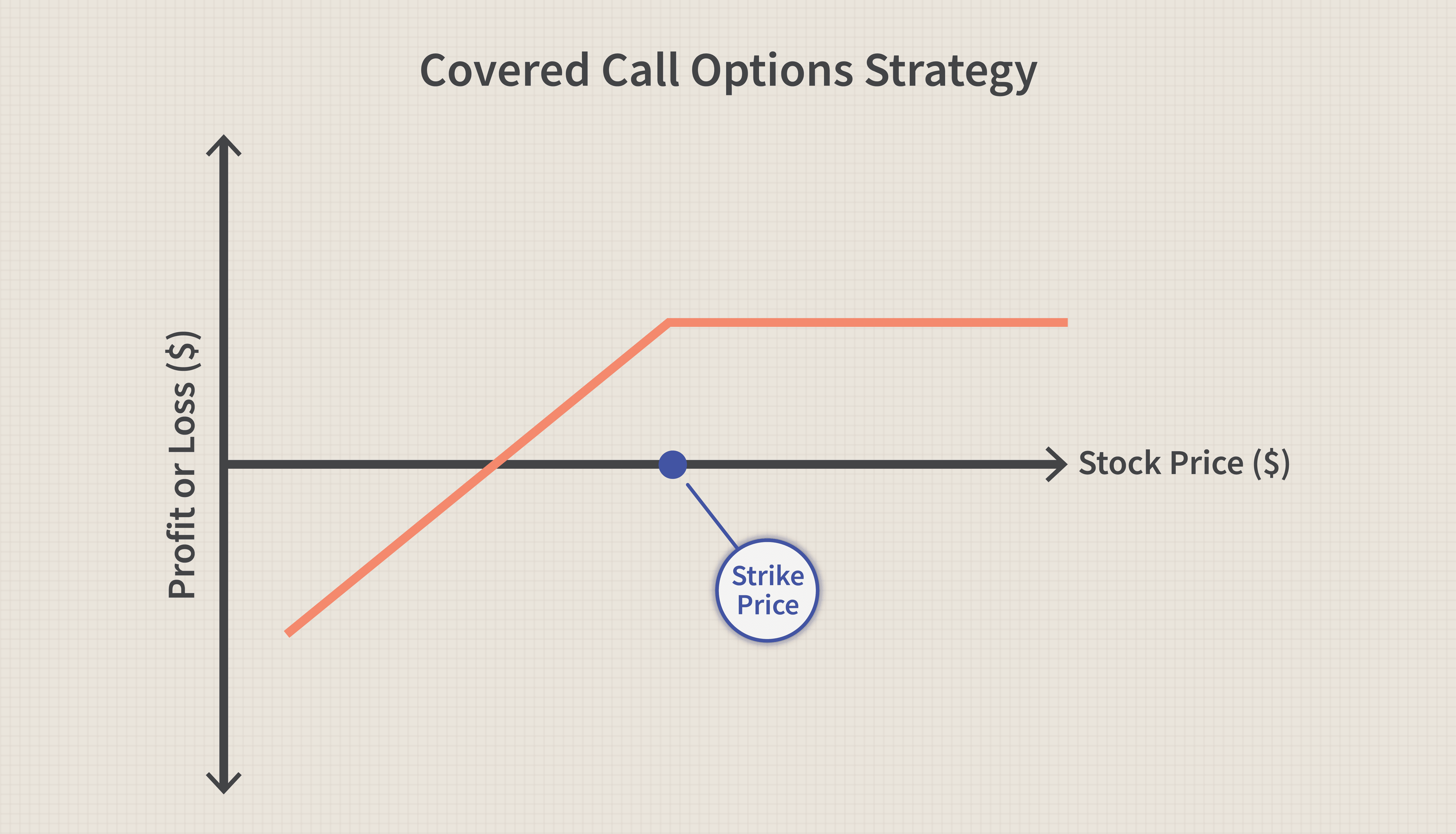

- Profit is capped. While a covered call strategy limits the downside, it similarly limits the upside.

For example, imagine you purchased shares of Apple (NASDAQ: AAPL) for $160 and decided to sell a covered call with a strike price of $175 for a $5 premium.

Now imagine Apple’s price surging to $200. If the call is exercised, you must deliver the Apple shares to the call buyer. While you get to keep the $5 premium, you missed out on selling the Apple shares at a higher price, which could have netted a $25 profit per share ($200 market price less $175 purchase price).

- Reduced flexibility. When implementing a covered call strategy, you must own the underlying shares. Therefore, if you sell a call option that expires in three months, you must maintain ownership of the underlying shares for the entire period.

While this might be fine much of the time, it does limit the option seller’s flexibility as they cannot sell the stock even if they expect it to fall.

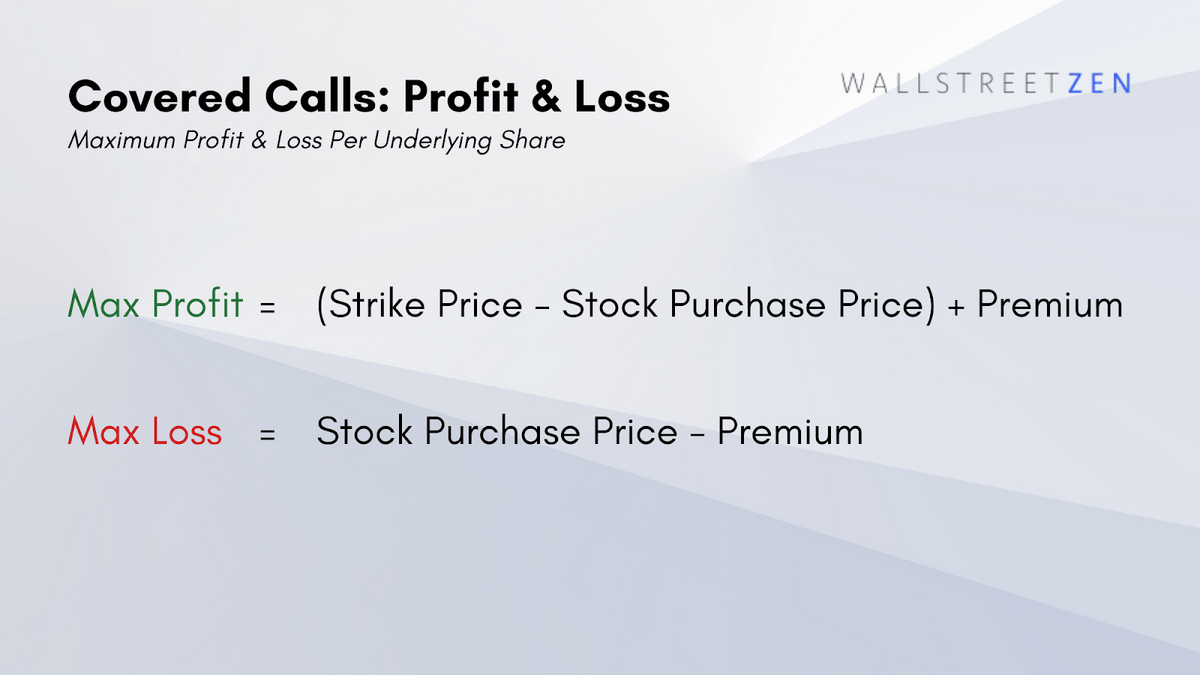

Profit and Loss of Covered Calls Strategy

Covered Call Maximum Profit:

- Maximum Profit Per Underlying Share = (Strike Price LESS Stock Purchase Price) + Option Premium Received

Covered Call Maximum Loss:

- Maximum Loss Per Underlying Share = Stock Purchase Price LESS Option Premium

What is a Covered Call Example?

Are you wondering … what is a covered call example? Let’s walk through a hypothetical covered call option example using Apple (NASDAQ: AAPL).

Imagine you purchase Apple stock for $100 per share. Although you expect the share price to appreciate in the long term, you believe the price will be relatively flat over the next three months.

As a result, you decide to sell a covered call to generate additional income.

You sell a call option with a $5 premium and $110 strike price. If your assessment is correct, you’ll receive the $5 per share premium, and the option will expire worthless.

As you predicted, Apple’s share price barely moved over the three months and never crossed the strike price. The option, therefore, expires worthless, with Apple closing at $102 per share on the expiration date.

Once the dust settled, you kept the $500 premium ($5 x 100 shares) and maintained possession of your original Apple shares since the option expired worthless.

Should You Become a Covered Call Seller?

Covered calls are an excellent strategy for beginners or more risk-averse traders.

While there are still risks associated with the strategy, if implemented properly, your losses are capped.

The bottom line? If you’re looking to expand your options trading repertoire, it’s worth considering selling covered calls to potentially earn additional income, target a selling price for a particular stock, or add a small hedge to a current position.

Must-have options trading resources

- The best options trading brokerage: eToro*

- The best options alerts + educational resources: Benzinga Options

- The best digital options ecourse: Selling Options for Income

- The best charting platform for options + beyond: TradingView

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Final Word: Covered Call Option Strategy

It’s easy to see why the covered call option strategy is so popular among traders.

It’s a simple and relatively conservative approach that offers beginners a much safer way to expose themselves to options than selling naked calls.

Covered calls can offer traders a straightforward and effective method to improve performance by collecting premium payments. In fact, selling covered calls is the primary strategy some traders implement daily.

There are still risks associated with this strategy, but if you own the underlying security, your losses are capped.

Moreover, when used responsibly, this strategy has the potential to provide a lucrative income stream that can substantially improve your bottom line.

FAQs:

What is a covered call?

A covered call is when you sell call options while maintaining ownership of the corresponding number of underlying reference securities.

Is covered call a good strategy?

A covered call strategy is good for new traders or those looking to limit potential losses or earn additional income. However, it’s crucial to understand the nuances of the strategy.

What is the best strategy for covered calls?

The best strategy for covered calls is to ensure you own the correct underlying reference shares before selling the call option. If you do not own the underlying shares, you might have to buy the underlying shares in the open market regardless of how high they are currently trading.

Can you lose money with covered calls?

Yes, you can lose money when the underlying shares you own fall below the breakeven price (stock purchase price less the premium received), but this loss is capped (the stock price cannot lower below $0 per share).

What is covered call option with example?

A covered call option refers to selling a call option when the seller owns the corresponding underlying stock. A covered call option example would be selling a single call option contract on Apple when you already own 100 shares of the company.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.