Trying to make sense of selling a call in options trading? Your fevered “what is sell call option” Googling can now come to an end. Here’s what it means…

Selling a call simply refers to selling the right, but not the obligation, to purchase shares of an underlying stock at a set price by a specified expiration date.

Still not sure what that means or why it matters? Keep reading — I promise it’s not as complicated as it seems.

In this article, I’ll guide you beyond basics like what does selling a call mean so you can gain a better understanding of this basic options trading strategy.

You’ll learn the mechanics of selling a call, precisely what happens when you sell a call, and why selling calls is a great way to add some income to your portfolio.

150.4% average annualized returns…

Prefer to have someone else do the heavy lifting on your options trading journey? Stock Market Guides offers more than just alerts – they offer real data on how each trade setup has historically performed.

You’ll receive up to 40 alerts per month via email or text, showing the exact option to buy, with expiration and strike price details.

For just $69 a month, you get pre-market and regular market-hour picks, allowing you to tailor the service to your trading schedule. With the ability to customize based on price or holding time, this service gives you flexibility, transparency, and no upsells – just clear, actionable trade insights.

* Average annualized return in backtests of all the option picks featured in this service.

Buying vs Selling a Call Option

Before we get to what does it mean to sell a call, let’s go over a few basics.

First, what is a call option?

A call option is the right but not the obligation to purchase shares at a predetermined price by a specified date, known as the expiration date.

Like when stocks trade, there is a buyer and a seller for call option contracts.

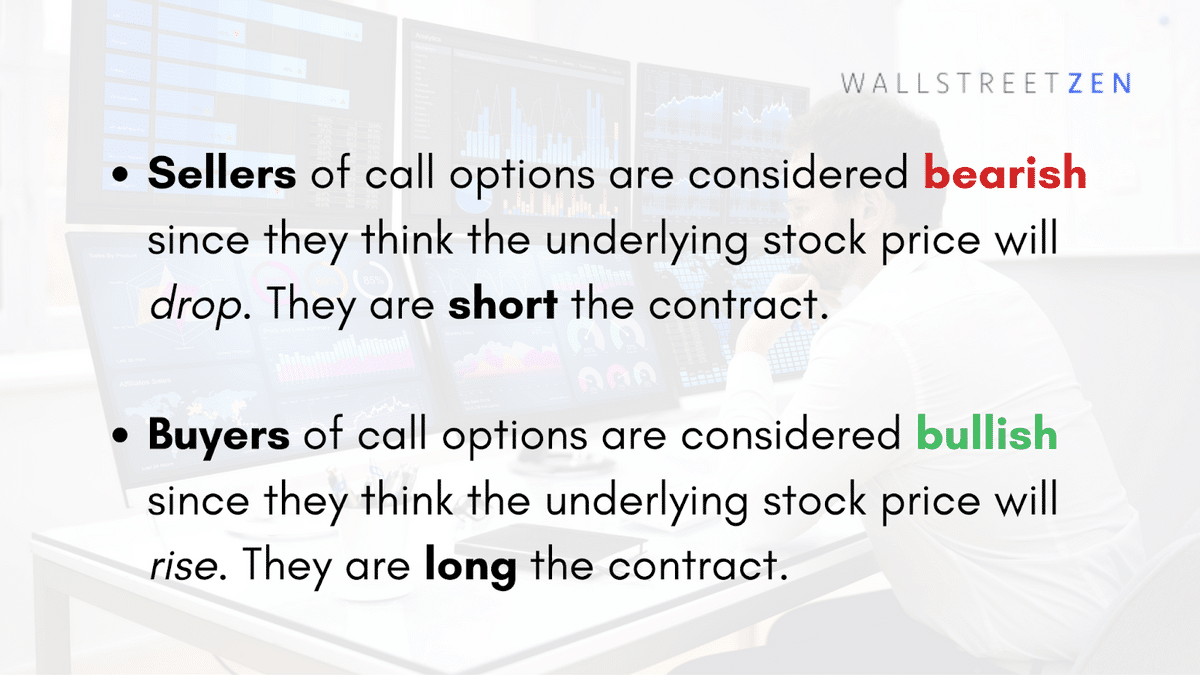

- Buyers of call options are considered bullish since they anticipate the underlying stock’s price is likely to rise.

- Sellers of call options are considered bearish since they anticipate the underlying stock’s price is likely to fall.

To put that in context, it may help to understand a few more basic mechanics of options trades.

When you sell a call option, you receive a payment from the option buyer. This payment is referred to as the premium.

This premium is the buyer’s cost to gain the “option” to purchase a stock at a predetermined price.

Similarly, the premium is the income the seller receives for taking on the risk of selling a call.

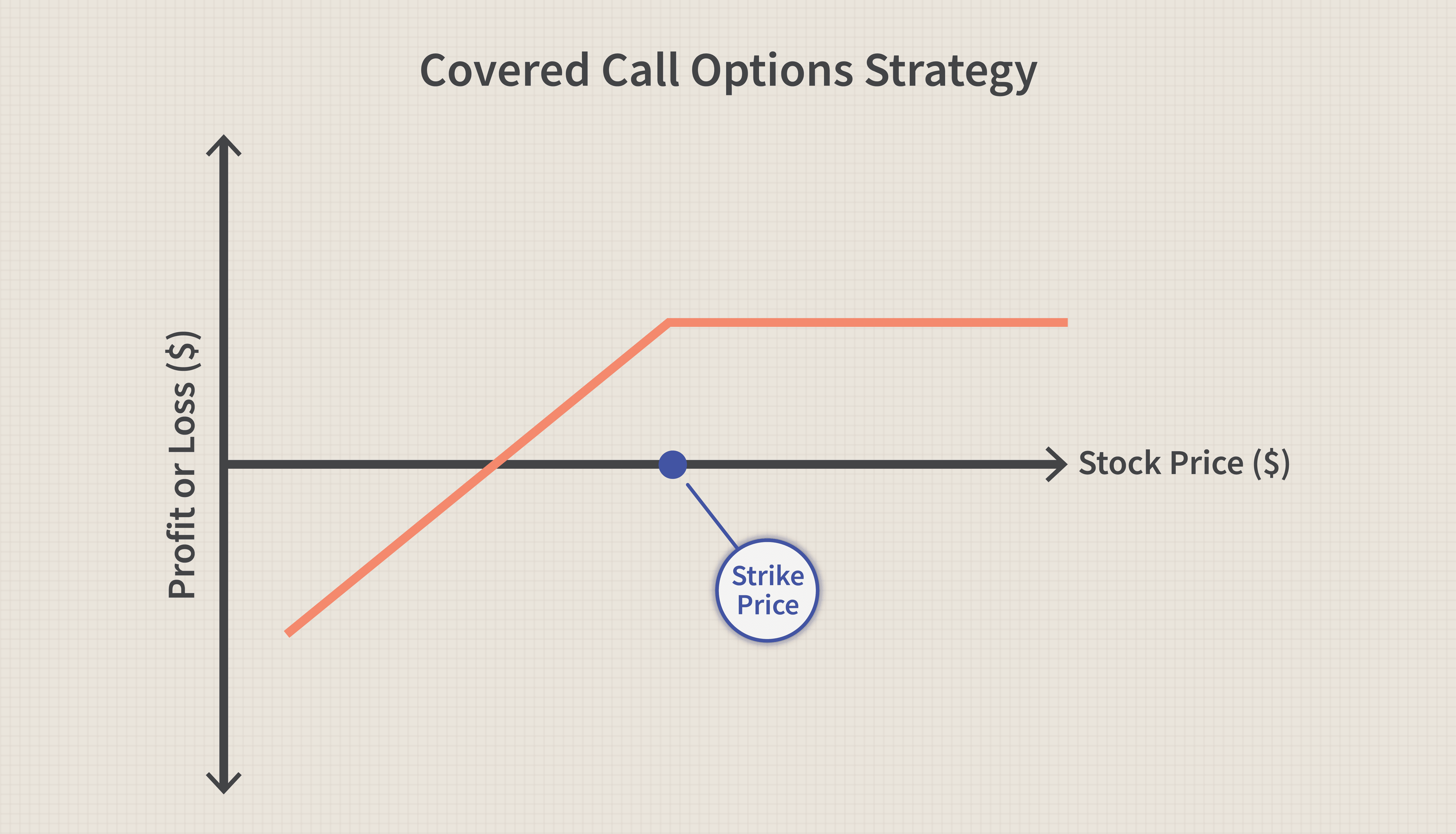

Every option contract includes a strike price. When the underlying stock price rises above the strike price, the call option is considered in-the-money and can now be exercised.

Alternatively, the call option is considered out-of-the-money when the underlying stock price is below the strike price.

The call option contract is deemed at-the-money when the strike and stock price are the same.

The stock price actually isn’t the only thing that plays into the profitability of your options contracts though. Learn about the vega options Greek and bearish options strategies to broaden your understanding before you dive in.

Now that you’ve got it, let’s move on to the sell call option meaning…

What Does it Mean to Sell a Call?

What is sell call option? Well, when you put it that way, you sound like a caveman. So let me put it in simple terms for you:

Selling a call option is selling the choice to purchase shares of an underlying stock at a specified price if the following criteria are met:

- The stock price reaches or surpasses the strike price.

- The strike price is reached before the option contract expires.

Call options are denoted as contracts. Each contract represents 100 shares of a particular equity. For example:

- One call option contract on Apple represents 100 shares of the company.

(Ex: If the call is exercised before expiration, the call seller must sell 100 shares of Apple to the call buyer at the strike price.)

- Five call option contracts on Apple represent 500 shares of the company.

(Ex: If the call is exercised before expiration, the call seller must sell 500 shares of Apple to the call buyer at the strike price.)

Why Sell Calls?

Moving beyond what is sell call option, let’s talk about the why behind this trading strategy.

Selling calls can provide the seller with a consistent and recurring additional source of income in their portfolio. Traders sell calls if they believe they can profit from the trade.

In many instances, buyers of call options are making far out-of-the-money bets. The likelihood of these far out-of-the-money options being exercised may be extremely low, thereby delivering frequent profits to the seller.

Selling call options is a widely used trading approach. In fact, some full-time traders focus exclusively on this strategy.

Of course, stocks may appreciate sufficiently in some instances, placing the option in-the-money.

What is sell call option: basics

How is selling calls like an insurance company?

Insurance providers will guarantee a larger payout in return for recurring small monthly payments (premiums) should certain conditions be met.

Most of the time, the insurance provider will simply collect premiums, month after month, year after year, and never pay money to the insurance holder. Occasionally, however, an event, like a car crash, will require the insurance company to make a payout.

What Happens When You Sell a Call?

What is selling a call option? Here’s what happens when you sell a call…

You open an active contract with a buyer.

This buyer immediately pays you a premium.

The premium is the cost to the buyer of obtaining the call option.

Here’s what happens next…

- If the underlying stock price fails to rise above the strike price, the option will expire worthless. That is, the call option seller keeps the premium, and the contract is no longer active.

- The buyer may exercise the contract if the underlying stock price reaches the strike price. If they do, the call option buyer has the right to purchase shares of the underlying stock at the strike price. The option seller must fulfill this obligation by providing the buyer with the agreed-upon number of shares.

If the latter happens…

- In some cases, the call options seller already owns the underlying stock. In this instance, the seller is selling a “covered call.”

- When the call seller doesn’t hold the security, it’s called a “naked call.”

With a naked call, the seller, in theory, has to go out to the open market to buy the shares at whatever price they’re currently trading. In practice, buyers and sellers are often settled monetarily based on the current market value of the shares.

In other words, the call option seller would immediately deliver the buyer the equivalent amount of selling the shares on the open market.

What is sell call option: basics

Naked calls have an unlimited potential for loss. If the option is exercised, the call seller must purchase the shares in the open market, no matter how high the price might be.

How to Profit from Selling Calls

Selling a call option nets the seller a premium. Often, the option will expire worthless, and the option seller pays out nothing while still earning the income from the premium.

Even when the option is exercised, the seller can still earn a net profit on the trade if the value of the exercised option settlement is less than the premium paid.

Many traders focus on selling call options as a matter of strategy. When markets are flat or falling, this strategy can prove especially lucrative.

Example of Selling a Call

Imagine you believe the price of Apple’s (NASDAQ: AAPL) stock will remain flat or potentially fall over the coming two months.

As a result, you decide you can earn some additional income (premiums) through selling call options.

You choose to sell one call option contract on Apple shares with the following details:

- Number of call option contracts: 1 (represents 100 underlying shares of Apple)

- Premium: $3 per share

- Total premium received for one contract: $300 ($3 x 100 shares)

- Current Apple share price: $165

- Strike price for option contract: $175

- Expiration: 60 days from now

SCENARIO #1: Apple stays relatively flat, never reaching the strike price. The call option expires worthless after 60 days.

- Now imagine 60 days have passed, and the call option expires worthless.

- In this case, the call option holder (buyer) is out of their original $300.

- You (the call option seller) pocket the original $300.

Therefore you profited $300, your max gain.

SCENARIO #2: Apple is trading at $185 per share 40 days into the option contract.

- Imagine the price of Apple has risen to $185, and the option holder (buyer) exercises the option.

- Now, you owe the option buyer 100 shares of Apple at $175 per share.

- If you don’t already own the shares, you’d have to buy them in the open market for $185, losing $10 on each of the 100 shares or $1,000.

- After it’s all said and done, you received a $300 premium and paid $1,000 as part of your obligation.

Therefore you lost $700.

Pros and Cons of Selling Call Options

Pros | Cons |

|---|---|

Source of added income | Profit is limited to the premium amount |

Premium is guaranteed, regardless if the option is exercised | Loss potential is unlimited (unless you’re selling covered calls) |

Selling OTM calls leads to a high win rate |

Where Can You Start Selling Calls?

Without a doubt, eToro is our preferred platform for selling call options.

The platform only requires a minimum balance of $50 USD for UK and US users and charges no commissions on option contracts.

Moreover, eToro provides access to their CopyTrader feature, allowing one to follow and mirror the trades of experienced trades. This makes eToro great for beginners and advanced traders alike.

eToro is one of many platforms to choose from. We’ve compared all the best option trading platforms here.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Final Word: What is Selling a Call Option?

Selling call options has the potential to provide investors with a lucrative and recurring additional source of income. It’s the primary strategy for many options traders.

But while selling call options can be profitable, it can also be risky. The potential for loss is limitless when selling naked calls.

Instead of jumping in without a plan, take the time to get educated on how selling call options works and start with strategies like covered calls to limit risk and cap potential losses.

FAQs:

What is sell call option example?

Selling a call option involves selling the right but not the obligation to purchase assets should specific criteria be met. For example, you could sell a call option giving the buyer the right to purchase shares of Apple if the share price crosses a threshold (“strike price”) before the contract expires.

When should you sell a call option?

In many instances, a call seller is counting on the fact that buyers are making far out-of-the-money bets. The likelihood of these far out-of-the-money options being exercised may be extremely low, thereby delivering frequent profits to the seller.

What is the risk of selling a call option?

One of the biggest risks of selling a call option is the unlimited potential for loss when you don’t own shares of the underlying stock (a “naked call”). This is because if the option is exercised, you must purchase the underlying shares, regardless of how high the price has risen.

How do you make money selling call options?

You make money selling call options by receiving premiums (income). Each option contract will have a premium amount, say $5. That means selling one option contract would net you $500 ($5 x 100 shares).

What does selling a call mean?

Sell call option refers to selling another trader the right but not the obligation to purchase shares of an underlying stock at an agreed-upon price should specific criteria be met.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.