When you first start learning about options, it can feel like you’re trying to drink through a firehose. There are a lot of moving parts, a lot of jargon, and I’d hardly call anything “intuitive”.

The best way to learn and improve your options trading is to get a deep understanding of the basics and terminology – strike prices, expiration dates, premium, etc.

Some of the most important components of option contracts are the Greeks. If you’re wondering, what is delta theta gamma vega in options, those are the Greeks.

The Greeks measure the sensitivity of an option’s price to quantifiable factors. If X happens, this is how the price of the option contract will change.

Volatility is one of the most important factors which influences the price of options. Vega is how you can measure the connection between implied volatility and an option’s price.

In this article, I’ll cover: What is vega in options? What is the vega options Greek? Why does vega matter, and how can you use it to your advantage?

Keep reading for an in-depth guide to vega options, including what vega is, how it’s calculated, and how you can use it to make more money trading options.

What is Vega in Options?

Although it’s not a letter in the Greek alphabet, vega is one of the most critical Greeks in the world of options, and probably the least understood.

What is vega in options? Vega measures the connection between implied volatility and an option’s price. It can work in your favor, but it can also kill the value of your options.

How?

When you buy options the way most speculators do, the aim is to profit from big moves in your favor. While these moves don’t happen as often as we’d like, they can be very profitable when they do.

But if vega is working against you, even if you’re right about the direction of the move (say, you bought calls and the stock price went up), the value of your options could still decrease.

Before we dive in deeper, I want to give a little more context…

The Greeks: What is Delta, Theta, Gamma, & Vega in Options?

Comparing stock price changes to option price changes is a bit like comparing checkers to chess:

- Stock prices can go up or down, driven solely by what prices buyers and sellers are willing to exchange shares at.

- Option prices are influenced not only by changes in the price of the underlying security, but also by the degree of future price moves anticipated, the number of days left to expiration, the change in expectations of future movement, and changes to interest rates.

Each of these variables is tracked by one of the option Greeks: delta, gamma, theta, vega and rho. Here’s a brief reminder of how the other variables work before I explain what is vega in option pricing:

- Delta measures the impact of security’s price change on a scale of zero to 1.00. A $1 move in the underlying stock triggers a delta-sized move in the option price. So an option with a delta value of .50 will increase by 50 cents if the underlying security rises by one dollar.

- Gamma measures the rate of change in the delta for each $1 move in the underlying stock. A $1 move in the underlying stock triggers a delta-sized move in the option price, and the delta will increase or decrease by a gamma-sized move.

- Theta (also known as time decay) measures how much an option price will change each day as it approaches its expiration date, assuming the underlying stock doesn’t change. Theta values are usually negative numbers and increase as the expiration date grows nearer.

- Rho measures the effect of a 1% change in interest rates on options contracts. Rho is usually ignored by most short-term option traders because interest rate changes happen so slowly, but investors who use options with a year or more to expiration (LEAPs).

What is delta theta gamma vega in options — it can all start to sound like, well, Greek. But it’s important to understand how they all work.

Before we get back to what is vega in options — there’s one more thing you need to understand. Let’s talk about implied volatility…

What is Implied Volatility?

Implied volatility is one of the most important variables to understand in options trading.

Implied volatility reflects the market’s expectation of how much the underlying asset’s price will move in the future – literally, how volatile investors think the underlying will be.

The more volatile the underlying, the more the options seller will charge for each contract. If implied volatility increases, the price of the option contract will also increase.

Vega measures an option’s sensitivity to changes in implied volatility. Specifically, vega estimates how much an option’s price will change for a 1% change in implied volatility.

For example, if an option has a Vega of 0.10, its price will increase by $0.10 for every 1% increase in implied volatility. Should implied volatility fall by 1%, the price of that option will fall by $0.10.

Keep in mind that implied volatility can change independently of the price of the underlying stock, solely based on market sentiment.

Optimize your options trading:

- Options trading brokerage: eToro*

- Options alerts + educational resources: Benzinga Options

- At-your-own-pace digital options course: Selling Options for Income

- Our #1 charting platform: TradingView

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Vega Options Example

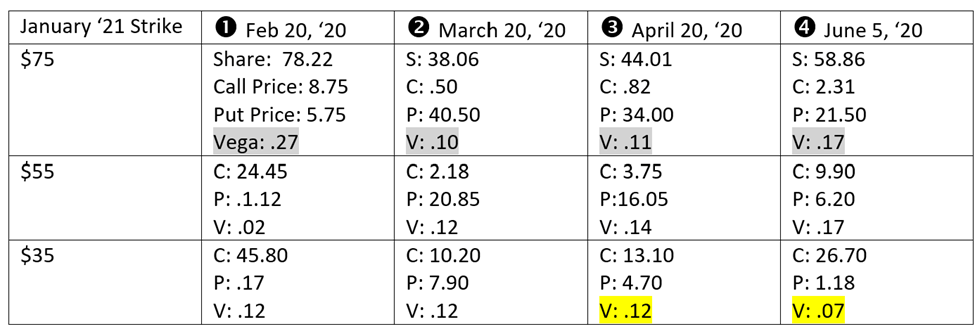

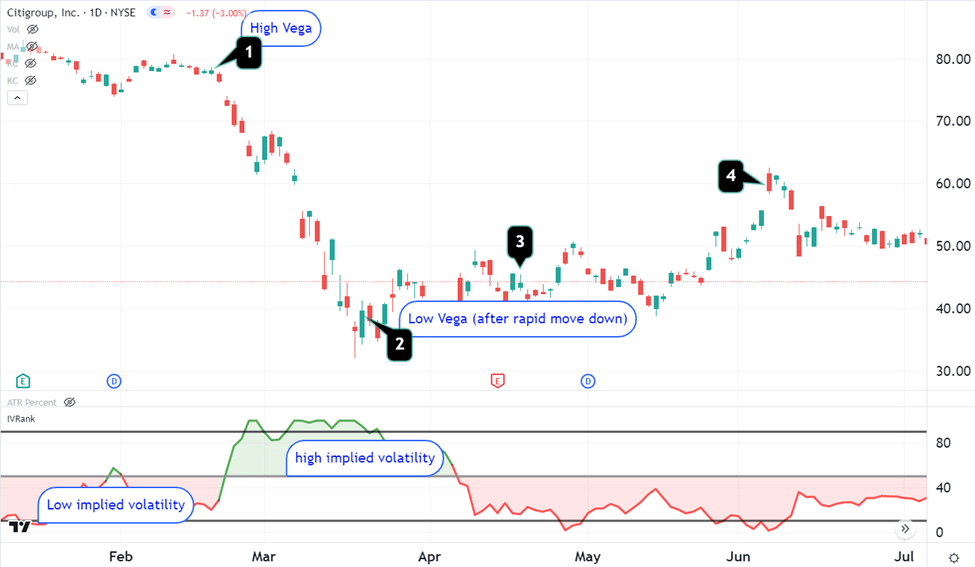

On February 20th, 2020, shares of Citigroup (NYSE: C) were trading around $78 per share and closed up mildly that day.

But within a few days, the world would be rocked by the pandemic. Securities prices saw dramatic changes during the weeks and months that followed.

In the table and chart below, compare the following changes to stocks, options, and vega values as Citigroup fell from its February highs to hit March lows, and then slowly rebounded.

Look closely at the vega values for the $75 strike option across the four months:

Price changes immediately after the announcement of the pandemic were anything but normal, but this data provides a good illustration of the relation between the changes in stock prices, option prices, implied volatility, and vega values.

When share prices were relatively high, even though implied volatility was relatively low, vega values were higher, reflecting the possibility of bigger moves later.

After the big move had occurred, even though implied volatility values were relatively high, vega values were much lower, reflecting the opinion of option sellers who did not expect implied volatility to continue rising further.

At-the-Money Strikes and Vega

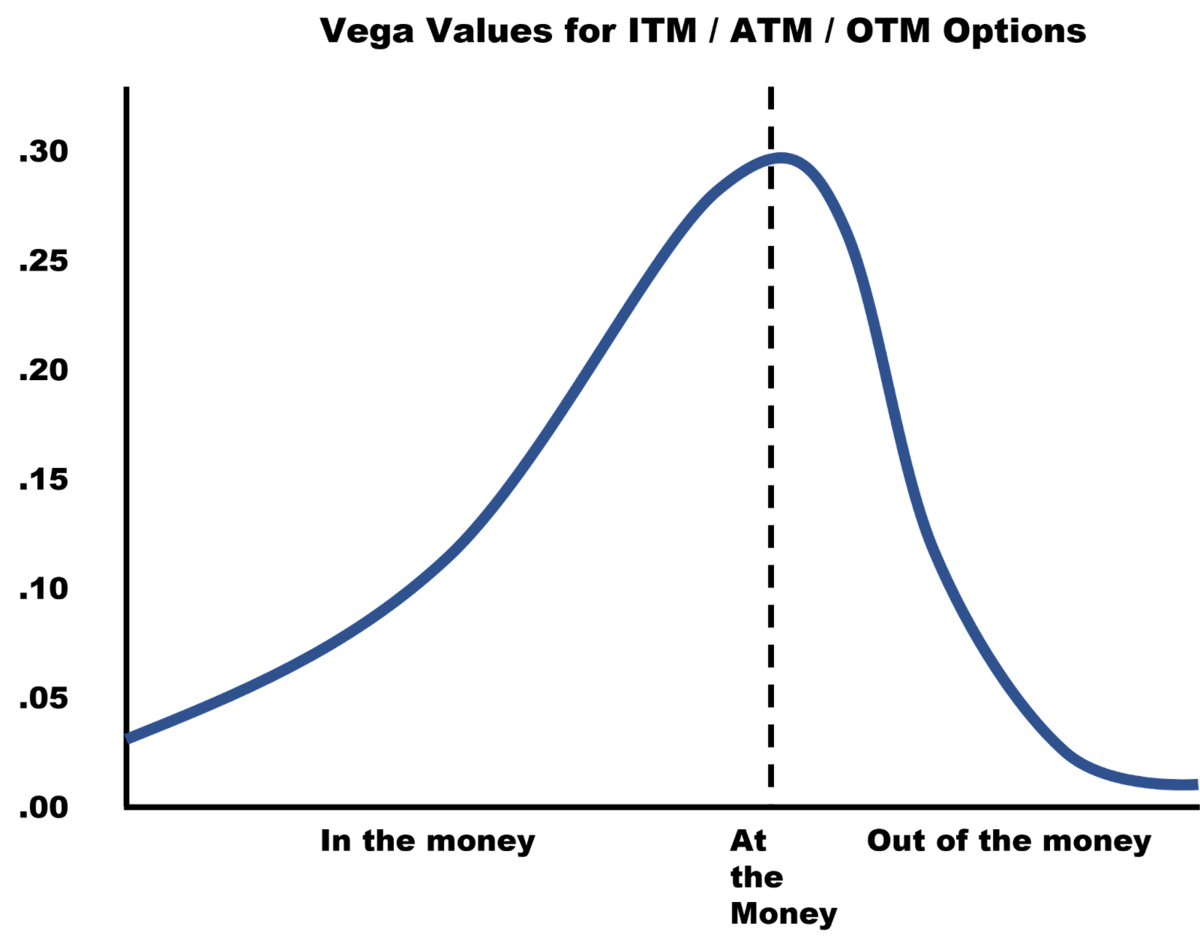

At-the-money (ATM) strikes, which are options with strike prices closest to the current market price of the underlying asset, generally have the highest relative vega values.

This is because ATM options are more sensitive to changes in implied volatility since the underlying asset’s price is more likely to reach the strike price by the time of expiration.

Conversely, out-of-the-money (OTM) and in-the-money (ITM) options tend to have lower Vega values.

OTM options have strike prices that are less likely to be reached, while ITM options already have intrinsic value. Both are less sensitive to changes in implied volatility.

Options that move from ATM to OTM will actually show a negative impact on vega values, regardless of the underlying stock price direction. As the underlying prices move an option strike from ATM to ITM, vega values also decline.

Vega in Bearish Markets

During bearish markets, when equity prices are falling, implied volatility typically rises. This increase in implied volatility is primarily due to the heightened uncertainty and fear among market participants.

But because vega reflects the sensitivity of options to implied volatility, vega values will spike (when fear and uncertainty strike) then fall during bearish markets (after fear “evaporates” from the market). Consequently, vega values will slowly rise in bullish markets (as fear slowly rebuilds).

Bearish option strategies, such as buying put options or selling call options, tend to benefit from rising vega values initially, but not after a strong downward movement in prices.

As implied volatility increases, the prices of these put options will rise, allowing traders to potentially profit from the market’s pessimism. However, that will eventually change, making the vega value less and less beneficial to the trade.

Vega in Bullish Option Strategies

Bullish option strategies, like buying call options or selling put options, can also be affected by changes in vega.

However, the relationship between vega and these strategies is more nuanced. The impact of vega on bullish option strategies largely depends on the time to expiration of the options being traded.

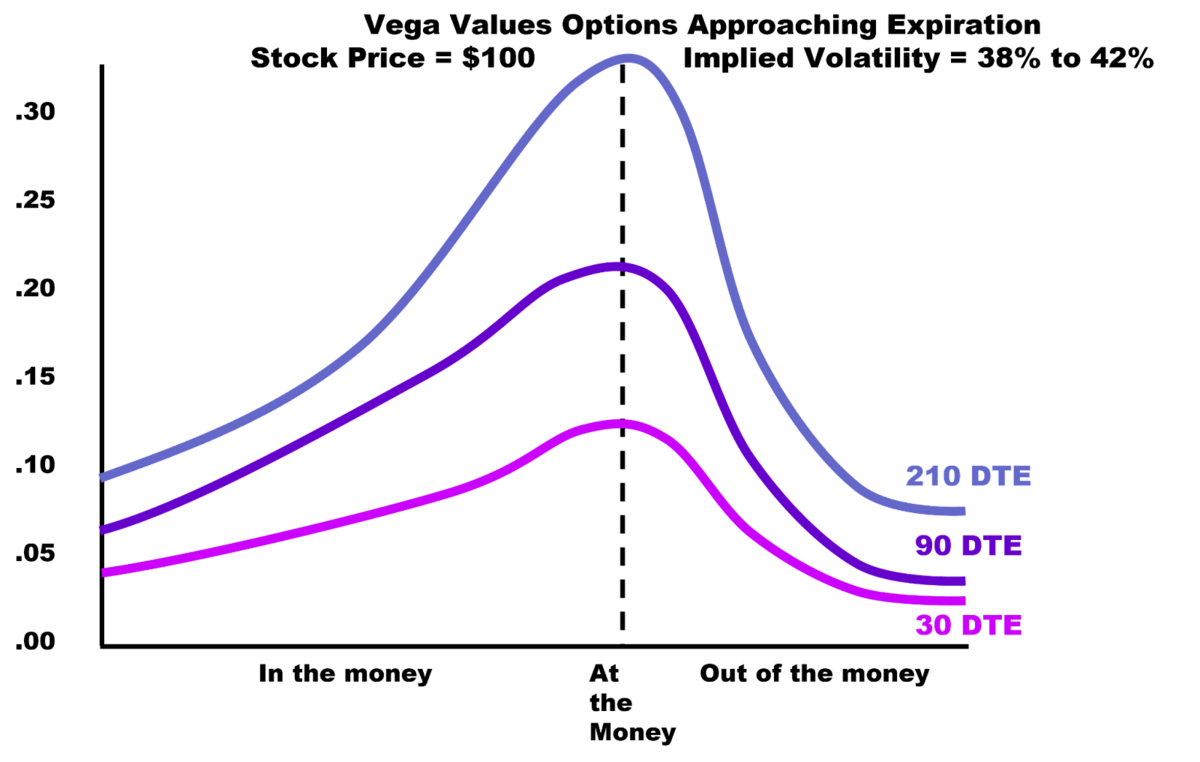

Generally, bullish option strategies tend to benefit if the number of days to expiration is longer than 60. This is because longer-dated options have higher vega values, making them more sensitive to changes in implied volatility.

As a result, when price increases, even though implied volatility decreases, the possibility that a surprising move could occur increases given enough time.

That’s how the value of longer-dated call options could rise, even if implied volatility falls. This situation could potentially lead to profits for traders with bullish positions and longer expiration dates, who capture an unusually strong move up or down.

Conversely, short-dated options have lower vega values and are less sensitive to changes in implied volatility. This means that traders looking to profit from bullish strategies will be more likely to get a boost from vega if they use longer-dated contracts.

How Does Time Affect Vega?

Vega values are part of the calculation for option prices because they represent the possibility of an unexpectedly large move occurring before expiration.

The less time an option has before it expires, the less likely it is that a large move will occur before expiration arrives. That’s why vega values decline as option expiration approaches.

Vega and the Bid-Ask Spread

Options contracts that are heavily traded usually have a narrow margin between the bid and ask prices.

A heavily traded ETF such as Standard & Poor’s S&P 500 Index ETF (SPY) or Invesco’s Nasdaq 100 Index ETF (QQQ) will typically have only a few cents difference between bid and ask prices.

However, a stock that only has a few option contracts traded every day may have a wider amount, perhaps even amounts greater than a dollar.

Even option contracts with a wide bid-ask spread will still have positive vega values. However, the combination of a purchased option and a sold option (especially one that creates a credit spread), is more likely to create a trade with negative vega values.

The wider the bid-ask spread, the more likely this is to occur. A trade with a negative vega value means that if implied volatility rises, the value of the trade will be negatively affected.

Optimize your options trading:

- Options trading brokerage: eToro*

- Options alerts + educational resources: Benzinga Options

- At-your-own-pace digital options course: Selling Options for Income

- Our #1 charting platform: TradingView

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Using Vega with Earnings Reports

Traders and investors who buy options to protect a position they intend to hold through earnings should pay attention to Vega values in their trades. Here’s what you need to know:

- During the period of time leading up to an earnings release, options on a given stock will tend to experience increasing implied volatility. This happens because the demand for options is on the rise.

- Once an earnings report is released, traders sell their option contracts, which creates a decline in demand and drop in implied volatility. As a result, option positions with positive Vega values will have more potential to boost profits during the time leading up to earnings, rather than the time following the report.

- Options traders looking to put Vega to use in their favor should look for longer-dated contracts they can hold leading up to an earnings announcement. Traders looking to benefit from a drop in implied volatility will look for spread trade they can hold through an earnings report, or initiate the trade shortly after the report.

IV Crush

Earnings reports and other corporate events lead to increased implied volatility (rising vega values) because a large price swing is expected.

After the news is released, implied volatility (IV) drops quickly because the unknown becomes known.

When the IV drops, even if you were right about the direction of the move (bought a call and the stock went up or bought a put and the stock went down), the value of the option can drop dramatically. This is known as IV Crush.

Implied volatility’s rise in anticipation of earnings is like inflating a balloon. All the buildup and activity leading up to the event is like blowing up the balloon. Once earnings are released, implied volatility drops rapidly like letting the air out of the balloon.

Final Word: Vega Options

The impact of implied volatility on option prices may seem subtle, but it can help you project the price trajectory of an option’s underlying stock. Since vega values can help you measure the impact of implied volatility changes, it’s crucial to understand how vega scores relate to your trade.

This is especially true as your strategies become more sophisticated and employ option spreads on or close to earnings reports. Plus, if you follow any option trading alert services, it can improve your results to know how they analyze vega values on their trades.

Whether you’re an options buyer or seller, a deep understanding of vega is critically important to your success.

FAQs:

Is high vega good for options?

High vega values can be beneficial for certain situations, but not all. Options traders looking for big moves, or for an increase in implied volatility want high vega values in their trades.

What is a high value of Vega in an option contract?

Anything above .20 would be considered a high vega value. However, vega values are often of greater importance in relative terms since the values can vary greatly from one security to another.

What does it mean when vega is negative?

A negative vega value means that if implied volatility increases, the price of the option trade will be negatively affected. Since each point of Vega value means that an option trade will increase by one cent for each 1% increase in implied volatility, negative values will decrease the option price when implied volatility rises.

How important is vega for option traders?

For many simple, short-term options trading strategies, vega is not critical. However, understanding vega is more important for options trades with more than 60 days until expiration, or for option spread trades (regardless of time left before expiration). For trades placed close to earnings reports, it is critical to be aware of the vega value to ensure your trading strategy won’t be undermined by vega.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.