The market has seen its fair share of volatility over the past few years. For some people, the turbulence is anxiety-inducing. For volatility option traders, it’s hunting season.

What are volatility options strategies, and how can you use them in your daily trading to increase profits?

In this article, I’ll dive into my four favorite volatility trading strategies and explain how to leverage them in practice.

While no strategy guarantees success, understanding the mechanics behind volatility options strategies will provide you with an effective tool in your trading toolbox. If nothing else, you’ll learn these strategies can be as risky as they are lucrative.

An important question for you…

What’s the difference between an option trader who takes intelligent, calculated risk versus one who just takes risks?

Education.

Option Alpha is an incredible resource for options traders that uses live market data to calculate the probabilities for millions of potential options positions, helping you find new ideas with less guesswork.

The platform is also loaded with an impressive suite of FREE courses for option traders at every level.

Whether you’re a beginner, intermediate, or advanced option trader, there’s always something to learn — and among Option Alpha’s numerous courses, you’re bound to find a topic that speaks to you.

Volatility + Options Strategies: The Bottom Line

An options volatility strategy can produce outsized gains but has corresponding outsized risks. In some cases, the risk can be unlimited. Before undertaking any options trade, ensure you fully understand the risk involved.

Ultimately, understanding the risk and reward characteristics of an options volatility strategy is valuable. Far too many traders engage in options volatility trading with little understanding of the inherent risks. If you respect the instrument’s power, it can potentially help you increase income and hedge positions.

Refresher: Call vs. Put Options

While a detailed explanation is beyond the scope of this article, it might be helpful to recap the difference between the two main types of options; calls and puts.

- Call Options: Call options give the buyer the right, but not the obligation, to buy the underlying security, like a stock, at a predetermined price should specific criteria be met (i.e., a strike price reached before expiry). Sellers of the call option must fulfill the requirements should the criteria be met.

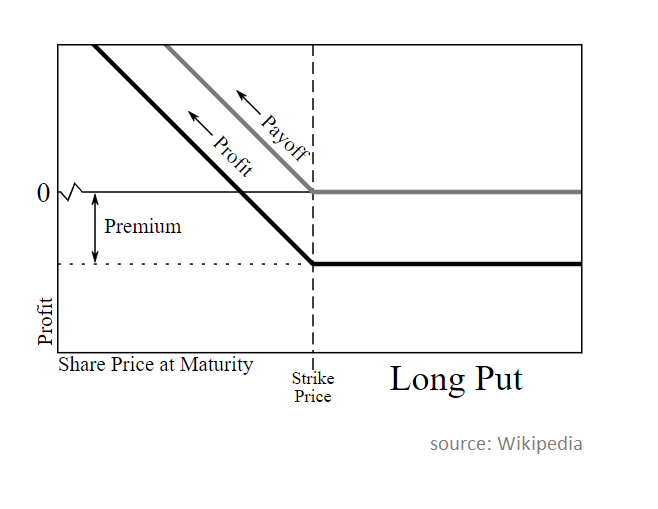

- Put Options: Owners enjoy the right, but again, not the obligation, to sell the underlying security at a predetermined price should specific criteria be met.

What Determines the Price of an Option?

Six main factors determine an option’s price (typically called a premium).

- Underlying Asset Price: The price of the option’s underlying asset typically moves in correlation with the option price. When the stock price rises, the price of a call option usually rises, while the put option value falls. Alternatively, the call cost typically drops when the stock price falls while the put value increases.

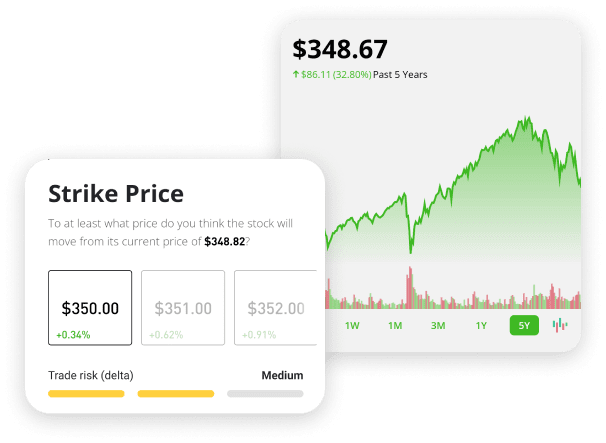

- Strike Price: The strike price is the price at which the option buyer can buy (call options) or sell (put options) the underlying asset. With calls, higher strike prices mean lower options premiums. With puts, higher strike prices typically equate to higher option premiums.

- Time to Expiration: The longer the time before the option expires, the higher the option premium. This is because the option contract has a greater opportunity to meet the criteria needed to be exercised.

- Volatility: Both calls and puts tend to rise in price as volatility increases.

- Risk-Free Rate: Higher interest rates lead to higher call prices and lower put prices.

- Dividends: All else equal, dividend payments will decrease the price of calls and increase the cost of puts. This phenomenon is because dividends reduce a stock’s price on the ex-dividend date, benefiting put holders and harming call holders.

Still not sure how options work?

If you still need help with the basics, here’s a resource that’s both free and high quality…

Option Alpha’s free courses including beginner courses like “Options Basics” and “Entries and Exits” will get you started on the right foot. Get started today!

What is Volatility and Why Does it Matter?

In finance, volatility refers to the rate a security increases or decreases.

In finance, volatility is crucial. It’s arguably the most popular risk metric on Wall Street. Higher volatility is synonymous with higher risk.

Volatility is the bedrock behind traditional portfolio management theory. You may have heard that younger people tend to be more suited to holding stocks versus bonds because they can absorb more risk, but why?

Since stocks are considered riskier (more volatile) than bonds, younger investors have a longer time horizon to allow them to rise. However, older investors have a shorter time horizon, so they don’t want to risk their portfolio falling dramatically just as they need money for retirement.

Bonds are considered less volatile, and therefore as we age, the theory stipulates that the proportion of bonds in an investor’s portfolio should grow relative to equities.

Historical Volatility Vs. Implied Volatility

Historical volatility is the actual volatility that a security underwent in the past. While its calculation is beyond the scope of this article, it’s produced using the standard deviation of the logarithmic returns of a security.

In other words, it measures how much a stock’s historical price has varied – on average – from its mean price.

Unfortunately, past performance is no guarantee of future results. As a result, historical volatility does not necessarily tell us how volatile an asset will be in the future.

Implied volatility, on the other hand, is driven by the underlying implied volatility of the current option price. When trading options, it’s the implied volatility that will be most relevant since it’s a forward-looking metric. Think of implied volatility as the expected future volatility.

While implied volatility is often influenced by historical volatility, it’s also affected by the market’s expectations of how volatile the underlying security will be.

Therefore, when implied volatility is high, it often reflects expectations from the market that the underlying security will experience a wider trading range. Since the underlying is expected to trade in a wide range, it’s more likely the option will end in the money. As a result, more volatile underlying assets drive higher-priced options.

Do you want to trade options for a living? It will take hard work — but these resources could help you work toward your end goal faster…

- A great trading platform. Our top pick: eToro*

- Great charting software. Our top pick: TradingView.

- Trading alerts. Our top pick: Benzinga Options.

- Education. Be sure to check out Option Alpha.

Plus, check out our article about the best options trading analysis software.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Volatility Trading Strategies

1. Long Puts

What: This strategy involves going long (purchasing) put option contracts. If volatility increases, the contracts will ostensibly rise in value. If volatility pushes the underlying stock price sufficiently lower, the puts can end in-the-money.

When: When volatility spikes, some traders may wish to purchase puts in anticipation the stock price could drop.

How: Imagine a stock trading at $100 per share and experiencing high volatility. You believe the share price could fall substantially over the next few weeks, so you decide to purchase put options to take advantage of this potential move.

You decide to buy one put option contract on the stock for $4 with a strike price of $95, expiring in one month. Recall each options contract represents 100 shares of the underlying stock. As a result, the put’s total cost (or premium) is $400 ($4 x 100 shares).

The option is considered in-the-money if the underlying stock price falls below $95. An in-the-money option means the buyer (you) can exercise the option. No matter how much further the price falls, the put option seller must buy the shares from you for $95.

Two weeks into the option contract, the underlying security price is trading at $80; how much money did you gain or lose by purchasing the put option?

While the underlying stock is trading at $80, you have locked in a sell price of $95, a gain of $15 per share. At 100 shares, this represents a gain of $1,500. However, you also had to pay $400 for this benefit, so your actual profit is $1,100 ($1,500 less the $400 put option premium).

Learn more about bullish and bearish options trading strategies with Option Alpha’s free suite of options trading courses.

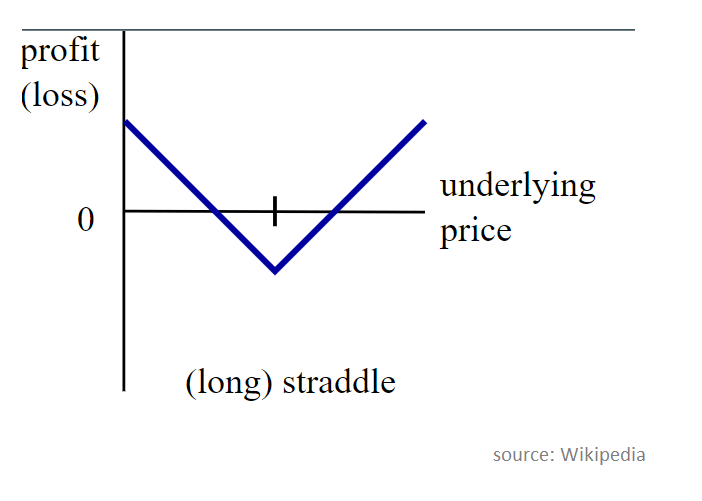

2. Long Straddle

What: A long straddle involves the purchase of both a call option and a put option with the same strike price and expiration date. While this may seem pointless, I assure you it’s not.

When: This strategy could be used when a trader expects heightened volatility but is unsure of the direction it will take. Since volatility increases the price of both calls and puts, the trader will profit if volatility rises sufficiently.

How: Imagine you expect stock XYZ to experience substantial volatility following its earnings announcement. The problem? You aren’t sure whether the earnings results will positively or negatively impact the share price.

XYZ is currently trading at $100. You decided to buy a call option and a put option, both with a strike price of $100, both trading with premiums of $5 per contract, and both expiring in 30 days.

It’s now two weeks later, and the earnings results hit the market. XYZ’s earnings growth was far better than the market predicted. As a result, the stock skyrockets nearly 20% higher over the next two days.

With the stock price at $120, you decide to exercise the call option. Since options contracts represent 100 shares, you purchase 100 shares of XYZ off the call seller for $10,000. You immediately turn around and sell the shares on the open market for $12,000 ($120 x 100). Therefore, your call option profit is $1,500 ($2,000 less the premium of $500).

At the end of the 30 days, the put option expires worthless. As a result, your total overall profit is $1,000 ($1,500 call option profit less the $500 put premium).

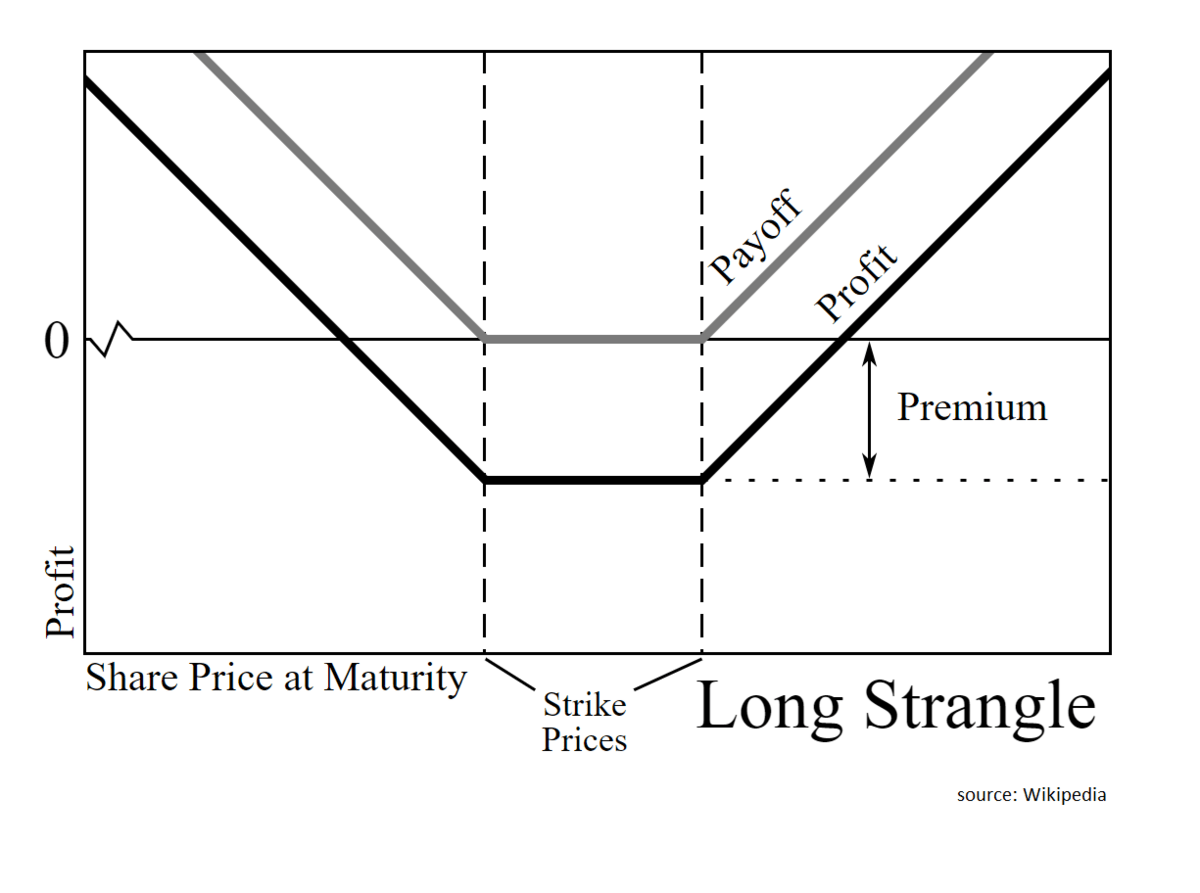

3. Long Strangle

What: A long strangle is similar to a long straddle. The only difference is in a long straddle, the strike prices are different. As a result, the underlying share price must make a more dramatic move to become in-the-money. Because of this, the strategy is cheaper (the option premiums are lower because the underlying share price is further from in-the-money).

When: A long strangle would be used when a trader expects substantial volatility but is similarly uncertain about the direction the stock will go. As a result, the trader will buy puts with a strike price lower than the current underlying stock price and calls with a strike price higher than the current underlying stock price.

How: Like the example above, imagine you expect stock XYZ to experience substantial volatility following its upcoming earnings announcement. However, you expect the price swings to be even more significant in this instance. Once again, you aren’t sure whether the earnings results will positively or negatively impact the share price, only that large swings are likely.

XYZ is currently trading at $100. You decided to buy a call and put options but with different strike prices.

- You purchase a call with a $3 premium, both with a strike price of $90 and;

- You purchase a put with a $3 premium and strike price of $110.

- Both contracts expire within 30 days.

A couple of weeks later, the earnings results are released. It turns out XYZ’s earnings growth was far worse than expected. As a result, the stock slips nearly 20% on the day.

With the stock price at $80, you decide to exercise the put option. First, you purchase 100 shares of XYZ in the open market for $8,000 ($80 x 100). You then sell those shares to the options seller for $9,000, giving you a profit of $1,000. However, the put option costs $300 ($3 x 100), so your profit on the put option after expenses is $700.

At the end of the 30 days, the call option expires worthless. As a result, your total overall profit is $400 ($700 put option profit less the $300 call option premium).

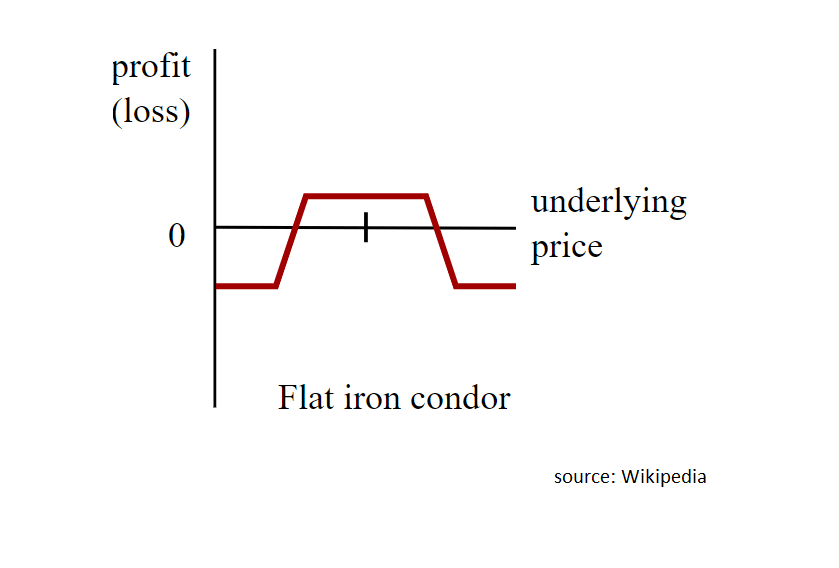

4. Iron Condor

What: The iron condor option strategy involves selling an out-of-the-money put and call and buying an even further out-of-the-money put and call. Selling out-of-the-money put and call contracts provides the trader with additional income while buying even further out-of-the-money put and call options locks in any potential losses should the trade go against you.

When: The iron condor is a strategy that can be used when a trader expects the underlying security to trade within a desired price band with low volatility. In fact, it’s my favorite option strategy for low volatility.

How: XYZ stock is currently trading at $100. Over the next two months, you expect the share’s volatility to be relatively low and don’t expect the price to fall below $90 or increase beyond $110.

Armed with this conviction, you decide to pursue an iron condor. Since numerous contracts are involved, let’s break down the known revenue and cost (premium) of each.

- Sell an out-of-the-money call: You obtain $300 in premiums ($3 x 100 shares) to sell a call option expiring in 60 days with a strike price of $110.

- Sell an out-of-the-money put: You obtain another $300 in premiums ($3 x 100 shares) to sell a put option expiring in 60 days with a strike price of $90.

- Buy a further out-of-the-money call: You pay $100 in premiums ($1 x 100 shares) for a call option with a strike price of $120—recall, the further from the strike price, the cheaper the option contract.

- Buy a further out-of-the-money put: You pay $100 in premiums ($1 x 100 shares) to buy a put option with a $80 strike price.

After 60 days, the underlying stock price is $104, and it never rose above $110 or below $90 during that period. As a result, all four options contracts expire worthless, and you profit $400.

Related reading: Check out our article on the reverse iron condor pattern.

Managing Risk with Volatility Options Strategies

There are volatility options strategies you can employ to manage risk. Here are a couple of common examples:

- Hedging: You can purchase put contracts if you expect volatility to spike. The puts will appreciate if volatility increases sufficiently and the puts lock in a floor price on your shares.

- Straddle or strangle: These strategies profit from large swings in volatility regardless of the direction of the underlying shares. These can be used when you expect heightened volatility (risk) but are still determining whether the price will increase or decrease.

Keep learning…

I already mentioned Option Alpha courses, but here are two other great ecourses to try:

eToro: The Best Platform for Options Trading

You can’t trade options without a broker. My favorite platform is eToro, and here’s why:

- Commission-free trading on options, stocks, and ETFs.

- A user-friendly platform that is great for beginners.

- An entire suite dedicated to the ins and outs of option trading.

- Plus…

If that weren’t enough, eToro crushes the competition with CopyTrader, which allows you to mirror pro traders on the platform and even set up automatic trading using a predetermined amount of capital.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Final Word:

Employing an options strategy for high volatility can seem daunting, but it’s actually much simpler than it first appears. Regardless, it’s critical to remember that not all options volatility trading exposes you to the same risk. Ensure you fully understand your risk exposure before embarking on any options trading.

That said, with the proper knowledge and strategy, an options strategy for high volatility can help protect your portfolio and potentially deliver superior returns.

FAQs:

What is the best option strategy for high volatility?

There is no one best option strategy for high volatility, but some of the most common volatility trading strategies include the iron condor, long straddle, and long strangle.

What are volatile option strategies?

Volatile options strategies likely refer to options strategies for high volatility. Options strategies for high volatility employ options contracts to profit off increased or decreased volatility in the underlying stock.

What are the four 4 types of volatility?

The four types of volatility are historical volatility, implied volatility, local volatility, and stochastic volatility.

What options strategies are good when volatility is low?

The iron condor is an excellent option strategy for low volatility. Its maximum profits occur when the underlying stock price remains within a narrow band.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.