Ready to level up your options trading?

Consider adding the reverse iron condor to your toolbox — a neutral options trading strategy that offers peace of mind by determining the maximum profit and maximum loss from the beginning.

The reverse iron condor strategy is a high-probability trade with limited profit potential, but only if it’s executed properly.

Keep reading for an in-depth look at the reverse iron condor strategy. Not only will you learn the basics, but we’ll also dig into the nuances, including crucial tips for an intelligent iron condor exit strategy.

Want more? Check out these options trading resources:

- Options trading brokerage: eToro*

- Options alert service and education: Benzinga Options

- Our #1 charting platform: TradingView

- Low-cost digital options course: Selling Options for Income

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

What is the Reverse Iron Condor Strategy?

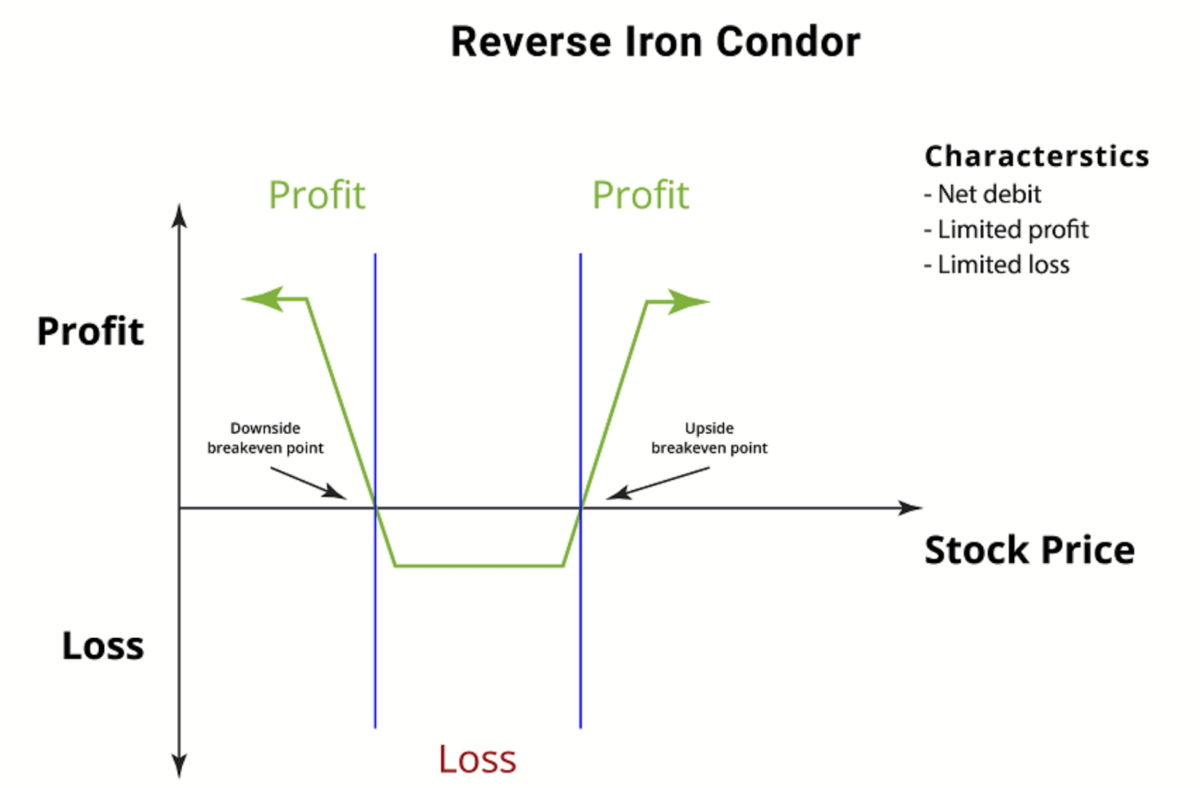

The reverse iron condor, also called inverted iron condor, inverse iron condor, or debit iron condor, is a trading strategy with limited loss and limited profit. It works best when you expect a security to make a sharp move, but you’re not sure of the direction.

With the reverse iron condor strategy, the direction of the price movement isn’t the most important thing, since transactions will be opened in both directions. What matters most is the size of the movement of the underlying asset price.

If the underlying stock moves far enough away from the center of your reverse iron condor (higher or lower), you profit.

The reverse iron condor is the opposite of Iron Condor, which is a more appropriate strategy when an underlying asset is trading in range. Rather than a net credit strategy, the reverse iron condor is a net debit strategy or debit iron condor.

That means you have to pay the difference between the premiums of your long and short positions up front to open the trades.

Key Points:

- Complex strategy.

- Volatile market.

- Multi-leg setup involving positions (buy put / sell put / buy call / sell call).

- Limited risk and limited profit known from the beginning.

- Net debit strategy (cost to open the four trades).

- The direction of the price movement doesn’t matter.

- Requires intermediate trading knowledge and experience.

Why Use the Reverse Iron Condor Strategy?

Trading options in a volatile market is difficult. Exceptionally high premiums make it difficult to profit from debit strategies, even when you get the direction of the move correct.

The reverse iron condor takes advantage of the high volatility by selling premium, but (because it’s a debit strategy) simultaneously keeps the max loss limited.

It’s also a great strategy to implement when you aren’t 100% sure which direction the underlying stock is going to move but are confident that a large price swing is coming.

Under these conditions, the reverse iron condor is a great low-cost, high-probability trade.

Want more? Check out these options trading resources:

- Options trading brokerage: eToro*

- Options alert service and education: Benzinga Options

- Our #1 charting platform: TradingView

- Low-cost digital options course: Selling Options for Income

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

How to Use a Reverse Iron Condor

As an options trader, to put in place a reverse iron condor you have to open the following transactions:

- Sell an OTM (out of the money) Put.

- Buy an OTM (out of the money) Put.

- Buy an OTM (out of the money) Call.

- Sell an OTM (out of the money) Call.

The reverse iron condor is just 2 debit spreads, 1 put spread and 1 call spread, mirroring each other around the current stock price.

Your buy orders should be equidistant from the current stock price and the spread should be wide enough to cover the debit for the trade.

Let’s say stock ABC is trading at $50/share and you’re expecting a $2.50 move in the next 2 weeks, but you’re not sure whether ABC will move higher or lower.

Here are the transactions you would take to set up your reverse iron condor:

- Sell the $46 put for $1.55

- Buy the $48 put for $2.10

- Buy the $52 call for $2.00

- Sell the $54 call for $1.50

Your total net debit for the trade is $1.05.

Max Loss

Your potential max loss is $1.05 (the total debit of the transaction) and will occur if ABC falls between $48 and $52 at expiration.

Max Gain

Your potential max gain is $1.95 and will occur if ABC is below $46 or above $54 at expiration.

Breakeven

Your breakevens are if ABC is at either $46.95 and $53.05 at expiration.

Reverse Iron Condor Exit Strategy

What’s the best reverse iron condor exit strategy? There isn’t a single answer — it depends on the price of the underlying asset evolves. But here are some potential scenarios:

- If the price moves as expected quickly, meaning quite a while before the expiration, you exit the strategy by closing all the positions to profit from the extrinsic value of the options since the maximum profit will be realized anyway.

- If the price doesn’t move as expected and has a flat move, you exit at the expiration date and it will be a loss.

- If the price has moved beyond one of the breakevens, but not enough to reach maximum profit, you will adjust it in function of how you estimate the price will evolve from now on. You can close some of the transactions or modify them.

Example Trade Using the Reverse Iron Condor Strategy

At the time of writing this article the most important fundamental event is the Silicon Valley Bank collapse, which took place at the end of last week. Needless to say, it’s the second most important bank bankruptcy in U.S. history and the U.S. banks’ market capitalization lost about $100 billion in two days.

President Biden is expected to give a speech concerning the measures to be taken to protect the American banking system.

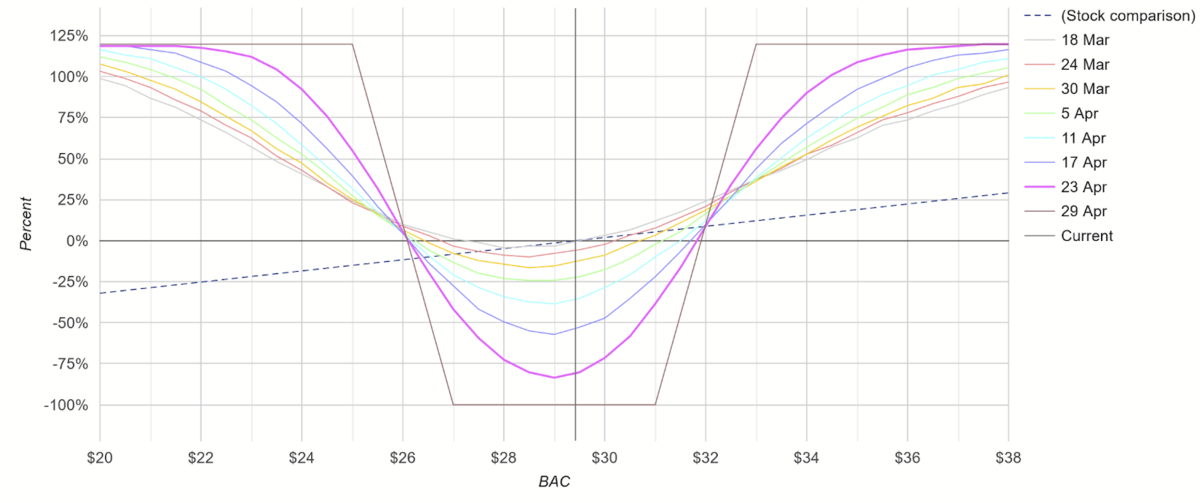

During and after the speech, a significant increase in volatility is expected. Let’s say you see this as an opportunity and plan on placing a reverse iron condor on Bank of America’s stock (BAC).

Say that you place one contract on each trade (100 options per contract), with the expiration date on April 28 (about 5 weeks from the launching moment).

The four transactions placed are:

- Sell 1 BAC April $25 Put option at $0.73

- Buy 1 BAC April $27 Put option at $1.22

- Buy 1 BAC April $31 Call Option at $0.85

- Sell 1 BAC April $33 Call Option at $0.43

At this moment the trading price of BAC shares is $29.42, between $27 and $31.

Placing the options trades resulted in a net debit of $91.

$73 – $122 – $85 +$43 = – $91

$91 is the amount that will be deducted from your trading account and is the maximum loss. With this reverse iron condor, there are four potential outcomes:

Scenario 1: On April 28th the BAC price is between $27 and $31

All the transactions will expire worthless and the reverse iron condor will result in a loss. I will lose the entire amount paid as an initial debit of $91.

Scenario 2: On April 28th the BAC price is below $25

Beginning value | Ending value | Profit(+) or Loss(-) | |

Sell April 25 Put | $0.73 | $0 | +$0.73 |

Buy April 27 Put | $1.22 | $2 | +$0.78 |

Buy April 31 Call | $0.85 | $0 | -$0.85 |

Sell April 33 Call | $0.43 | $0 | +$0.43 |

Overall profit | +$1.09 |

The maximum profit is reached and its value is $109 ($1.09 x 100).

Scenario 3: On April 28th the BAC price is above $33

Beginning value | Ending value | Profit(+) or Loss(-) | |

Sell April 25 Put | $0.73 | $0 | +$0.73 |

Buy April 27 Put | $1.22 | $0 | -$1.22 |

Buy April 31 Call | $0.85 | $2 | +$1.15 |

Sell April 33 Call | $0.43 | $0 | +$0.43 |

Overall profit | +$1.09 |

The maximum profit is reached and its value is $109 ($1.09 x100).

Scenario 4: On April 28 the BAC price is between $25 and $27 or between $31 and $33

The profitability of the setup will depend on where the strike price will be compared with the breakevens.

- Lower Breakeven Point = 27 – 91/100 = 26.09

- Upper Breakeven Point = 31 + 91/100 = 31.91

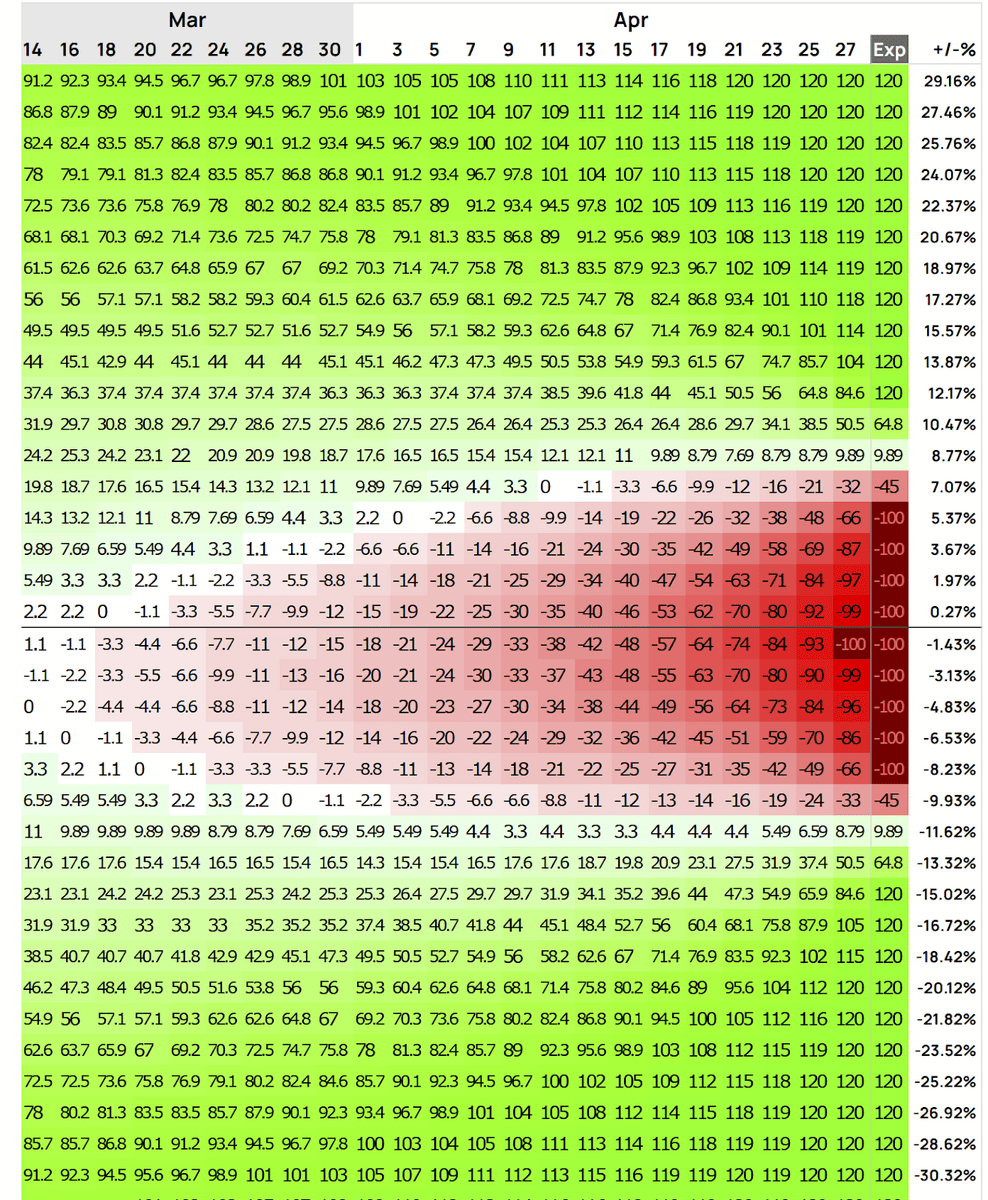

Below, you can see the numeric representation of the reverse iron condor on BAC, with the red area indicating the loss zone and the green one the profitability. These numbers are calculated in function of the date until expiration and the price movement.

You can see the smaller the move and the closer to the expiration date, the greater the loss.

How To Adjust a Reverse Iron Condor

This trading strategy has a limited interval to become profitable and a variety of factors that can destroy its success. If the underlying asset price doesn’t show a large enough movement in the indicated amount of time or if the volatility loses traction, the strategy will turn into a loss.

As a trader, you always have the option to adjust your strategy. Adjusting a reverse iron condor is possible but it comes with supplementary costs and risks.

If the underlying asset price doesn’t move enough to be profitable and the expiration date is close, you have the possibility to close the transactions before the expiration in order to recover a part of the premium.

Or you can wait for the expiration, accept the loss, and launch another reverse iron condor. But, this will require more capital and will probably require a more important price move.

You also have the choice to close either the put spread leg or the call spread leg, depending on how the price evolves. Learning what is vega in options will help you make informed decisions.

Final Word: Reverse Iron Condor

If you are interested in trading in a high-volatility market but can’t assess the direction of the price movement, the reverse iron condor is a perfect limited-risk, high-probability strategy.

It offers predictable levels of profit and loss, plus the possibility to determine how much you want to make on a trade by adjusting the strike price and the level of the expected movement.

It’s slightly more involved than other strategies, but when executed correctly it is easily worth the effort.

FAQs:

How do you set up a reverse iron condor?

To set up a reverse iron condor strategy, you need to place four transactions. Although it seems complicated, the strategy is really just a put debit spread and a call debit spread mirroring one another around the underlying’s current price.

Is the reverse iron condor always profitable?

No, the reverse iron condor is not always profitable. Your max loss will occur if the underlying trades in range, though your max loss is capped at the trade’s initial debit.

What is better than the reverse iron condor?

It depends on the conditions of the market you trade in. For example, it could be the long straddle strategy if you are willing to pay the expensive premiums or it could be the reverse iron butterfly if you want a higher profit but assume a larger risk.

What is the difference between reverse iron condor and reverse iron butterfly?

The primary difference is that the reverse iron butterfly buys ATM puts and calls whereas the reverse iron condor buys OTM calls and puts. This makes the reverse iron condor a higher-probability trade, though the maximum potential profit is lower.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.