Are you looking to trade options but don’t want to blow your money on lottery-type long shots?

If so, you have the right mindset – even though it is advertised as a way to get rich quickly, options trading is about strategy and consistency.

With a good set of strategies in your playbook, you can consistently maximize returns, minimize losses, and always have an answer to any market event.

To help you out with this, I made a list of some of the most popular bullish options strategies. All of these have their specific uses, so knowing the whole lot will help you make use of any bullish opportunity with minimal risk.

Read on and see how each strategy works, when it should be used, and what its risks are (with examples!).

If any of the concepts or jargon in this article are unfamiliar, consider checking out Skillshare’s Option Trading for Beginners course.

What is a Bullish Option Strategy?

Traders use bullish options strategies when they believe that the price of an underlying asset will go up over time.

Some bullish strategies seek to maximize returns, while others are geared towards minimizing potential losses.

Very bullish | Moderately bullish | Mildly bullish |

Simply buying call options, or multiple calls is the most profitable, but also the most dangerous way of profiting from a bull run. | Buying multiple long or short options to create a position with lower risks but capped maximum profit is a prudent strategy if you’re not extremely bullish on a stock. | When the underlying stock doesn’t seem like it will go up much, you can write and sell options to profit from the stock’s passivity and protect yourself from any significant downside. |

It’s really hard to make money with options.

That’s why we recommend Benzinga Options, an options alert service curated by Nic Chahine, a veteran (and very successful) options trader.

Why Use a Bullish Option Strategy?

There are several key benefits to using a bullish options strategy as opposed to trading stocks directly:

- Limited risk:

One of the biggest advantages of using options is that they offer limited risk—the highest potential loss is the price of the premium. - High potential returns with lower capital requirements:

Buying an options contract is cheaper than buying 100 shares of the underlying stock, and this means higher profit potential. - Flexibility:

Options traders can choose contracts with different strike prices, expiration dates, etc. This means traders can precisely tailor each trade to their specific market outlook and risk tolerance. - Hedging:

Options can also be hedging tools that protect against losses in other investments. For example, if you have an active long position on a stock and it seems like it will go south, you could purchase a put option on that stock to hedge your position.

Once you’re familiar with the strategies below, take a look at the best app for options trading.

The 7 Best Bullish Option Strategies:

1. Long Call (Buy a Call)

- When to use: Very bullish. The upside is unlimited.

- Max loss: Premium paid.

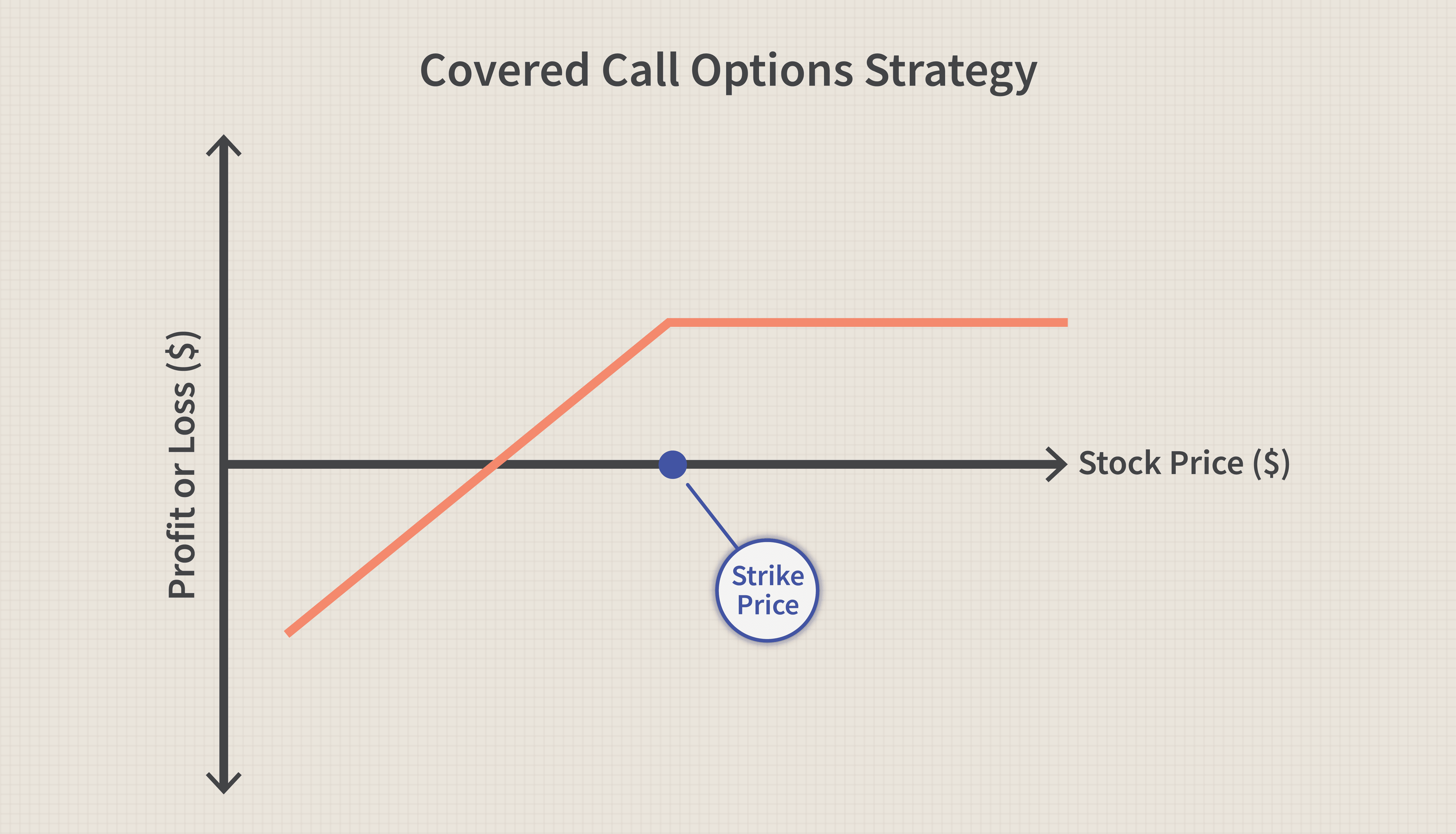

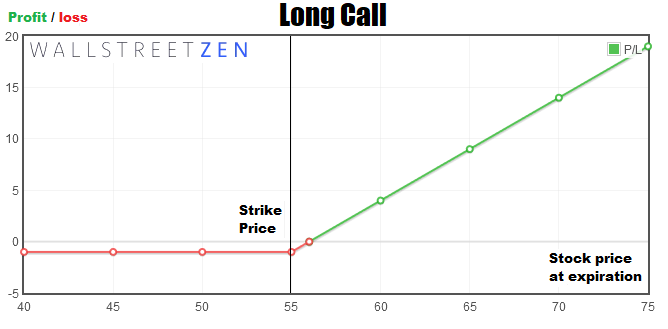

Buying a long call is the most bullish type of options trade. It is also the simplest to execute and one of the cheapest.

The idea is to buy a call option and exercise it (or sell it back) when the underlying stock goes up enough to make a profit while only risking the premium you paid.

Here’s how it works:

- The trader buys a call option.

- If the price of the underlying asset rises above the strike price before the expiration date, the trader can exercise the call option to buy the asset below the current market price and profit.

- If the price of the underlying asset does not rise above the strike price before expiration, the trader will lose the premium paid for the contract.

Long Call Example:

XYZ stock is currently trading at $50 per share but you expect it to go up. To make use of the opportunity, you:

- Buy one call option on XYZ with a strike price of $55 for a $1 premium ($100, since each options contract represents 100 shares)

The total cost of this trade is $100 ($1 premium x 100 shares per contract).

Breakeven |

|

Profit |

|

Loss |

|

2. Cash Secured Put (Sell a Put)

- When to use: At least moderately bullish on a stock both short- and long-term. Be prepared to buy the underlying shares.

- Max loss: Unlimited potential downside. You have to buy the underlying shares above market price.

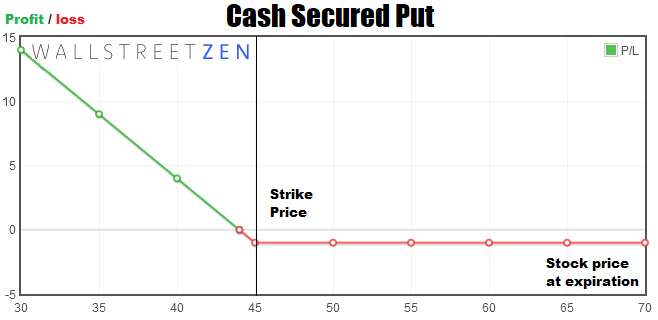

Second on my list of options bullish strategies is the cash-secured put.

The cash-secured put involves selling a put option on a stock that you are willing to own at a specific price (strike price).

You receive a premium for selling the put option and are obligated to buy the stock at the strike price if the option is exercised. You can use this strategy to trade options for income.

The underlying stock doesn’t even have to go up – as long as it is below the strike price, you get to keep the premium.

Here’s how the cash-secured put works:

- The trader sells a put option on a stock with a strike price at which they would be willing to buy 100 shares (if the option is exercised). By selling the put option, the trader collects a premium.

- If the underlying stock’s price remains above the strike price before the expiration date, it will expire worthless and the trader can keep the premium.

- If the underlying’s price falls below the strike price, the option may be exercised and the trader is obligated to buy the underlying asset at the strike price. The premium collected from selling the put option reduces this expense.

Cash Secured Put Example:

XYZ stock is currently trading at $50 per share and you don’t expect it to go down. To make a moderately bullish bet, you:

- Sell one put option on XYZ with a strike price of $45 for a $1 premium

- Have enough cash in their account to buy 100 shares of XYZ at the strike price of $45

The total credit you get from selling the put option is $100 ($1 premium x 100 shares per contract).

Breakeven |

|

Profit |

|

Loss |

|

Not all brokerages offer options trading.

Our top recommendation for the best options trading brokerage in 2025 is eToro.

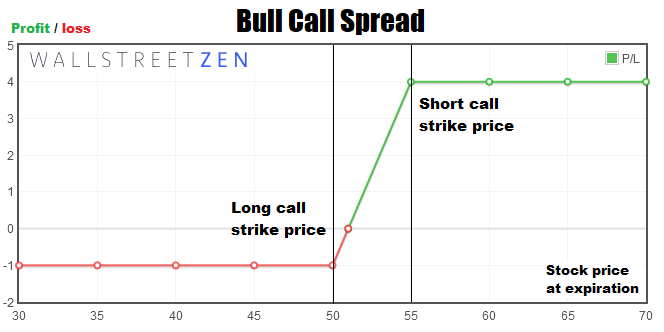

3. Bull Call Spread

- When to use: Moderately bullish—maximum profits are capped.

- Max loss: Premium paid minus the credit earned for selling another call option.

The bull call spread strategy involves buying a call option with a lower strike price and selling a call option with a higher strike price. The options must have the same expiration date and be on the same underlying asset.

The idea is, the premium you get from selling the higher strike price option lowers the potential cost of the trade, but your potential profits are capped.

Here’s how the bull call spread strategy works step-by-step:

- The trader buys a call option on a stock at a lower strike price.

- At the same time, the trader sells a call option on the same underlying stock with a higher strike price.

- The premium received from selling the higher strike price call option offsets the premium paid for the lower strike price call option.

- If the underlying’s price rises above the higher strike price, the trader can exercise the lower strike price call option to buy the asset at the lower price. Then, they can sell it at the higher market price when the higher strike price call is exercised—for a profit.

- If the underlying stock drops below the lower strike price, both options will expire worthless, and the trader’s losses will be equal to the difference between the two premiums.

Bull Call Spread Example:

Let’s say XYZ stock is currently trading at $50 per share. Expecting a modest price jump, you:

- Buy one XYZ call option with a strike price of $50 for $2 premium

- Sell one XYZ call option with a strike price of $55 for $1 premium

The total cost of the trade is $100 ([$2 premium x 100 shares per contract] – [$1 premium x 100 shares per contract]).

Breakeven |

|

Profit |

|

Loss |

|

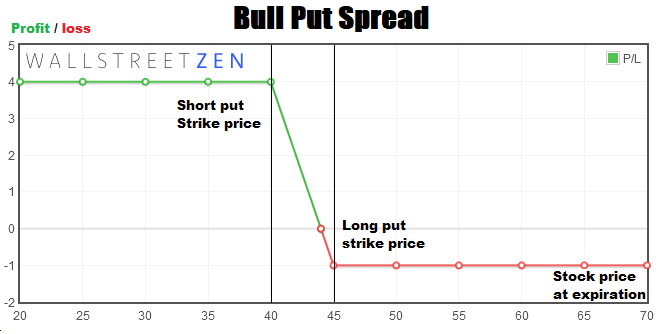

4. Bull Put Spread

- When to use: Mildly bullish. Works best on low-volatility assets. Be prepared to buy the underlying shares.

- Max loss: Potential losses are capped by the put option you buy as protection.

Next on my list of bullish option strategies is the bull put spread.

The bull put spread strategy involves selling a put option with a higher strike price and buying a put option with a lower strike price—the underlying stock and expiration date are the same.

The idea is to profit by selling an expensive option and buying a cheaper one as protection.

Here’s how the bull put spread strategy works:

- The trader sells a put option on a stock at a higher strike price (expensive option).

- At the same time, the trader buys a put option on the same stock with a lower strike price (cheap option).

- If the underlying stock rises above the higher strike price, both options expire worthless and the trader keeps the difference in the premiums as profit.

- If the underlying’s price is somewhere between the two strike prices, the trader loses because they have to buy shares above the current market price, and can’t sell them for a profit.

- If the underlying stock falls below the lower strike price, the trader can exercise the lower strike price put option to sell the shares they had to buy because of the contract they sold. This puts a cap on potential losses.

Bull Put Spread Example:

XYZ stock is currently trading at $50 per share and you expect the price to stay at the same level or go up slightly. To profit from XYZ’s stability, you:

- Sell one XYZ put option with a strike price of $45 for $1 premium

- Buy one XYZ put option with a strike price of $40 for $0.25 premium

The total credit received from the trade is $75 ([$1 premium – $0.25 premium] x 100 shares per contract).

Breakeven |

|

Profit |

|

Loss |

|

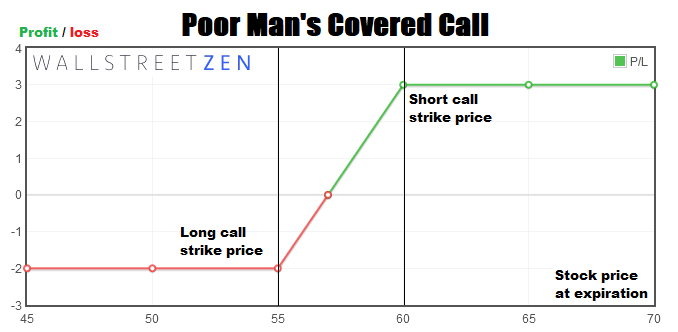

5. Poor Man’s Covered Call

- When to use: Moderately to very bullish. Use when you expect a stock to appreciate in the short and long term.

- Max loss: The maximum loss equals the premium minus the credit earned for selling the first short-term call option.

The poor man’s covered call involves buying a long-term call option and selling short-term call options against it. The options must have the same underlying asset and expiration date.

The idea is to sell a short-term option, and if it expires worthless, sell another one immediately, and so on. This lets you rake in as much premium money as possible while using the long-term call as insurance—the strategy doesn’t require much cash, hence the name.

Here’s how the poor man’s covered call strategy works:

- The trader buys an out-of-money long-term call option with a lower strike price.

- The trader then sells a short-term out-of-the-money call option with a higher strike price.

- The premium received from selling the short-term call options helps to offset the premium paid for the long-term call option.

- If the underlying’s price goes above the short-term call option’s strike, the trader can exercise the long-term call option to buy the stock cheap and sell it for a profit when the short-term option is exercised.

- If the underlying’s price ends up somewhere between the two options’ strike prices, the short-term options will expire worthless, and the trader can sell new short-term call options against the long-term call option to continue generating income.

Poor Man’s Covered Call Example:

Let’s say you own 100 shares of XYZ stock, currently trading at $50 per share, and believe the price will remain relatively stable or increase slightly over the next few months. To use the shares to make extra money, you could implement a poor man’s covered call strategy by:

- Buying a longer-term call option (e.g. a 6-month call option) with a strike price slightly above the current market price (e.g. $55 strike price) for a premium of $3 per share.

- Simultaneously selling a shorter-term call option (e.g. 1-month call option) with a higher strike (e.g. $60 strike price) for a premium of $1.50 per share.

The total cost of the trade is $150 ([ $1.5 premium – $3 premium] x 100 shares per contract).

Breakeven |

|

Profit |

|

Loss |

|

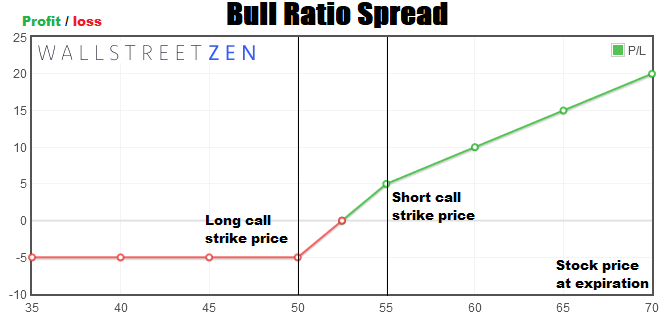

6. Bull Ratio Spread

- When to use: Moderately bullish. Max potential profit is capped by the higher strike price option you sell.

- Max loss: The maximum potential loss is equal to the difference between the premiums of the options you bought and sold.

The bull ratio spread strategy involves buying one or more call options at a lower strike price and selling one or more call options at a higher strike price. The options must have the same expiration date and be on the same underlying asset.

The idea is to offset potential losses by selling the higher strike price option—but this comes at the cost of limiting maximum potential profit.

Here’s how the bull ratio spread strategy works:

- The trader buys a call option at a lower strike price.

- At the same time, the trader sells a call option on the same underlying stock at a higher strike price.

- The premium from selling the higher strike price option helps to offset the premium paid for the lower strike price option.

- If the underlying stock stays below the lower strike price, both options expire worthless, and the trader loses money.

- If the stock rises between the lower and higher strike prices, the trader can exercise the lower strike price calls to buy the asset at a favorable price and the higher strike call option will expire.

- If the underlying stock goes above the higher strike, the trader can exercise the lower strike price call options to buy the asset, and then sell it for a profit when the higher strike price call is exercised.

Bull Ratio Spread Example:

XYZ stock is currently trading at $50 per share, and you expect it to go up by a lot. But you can’t be too sure about your prediction so you:

- Buy two XYZ call options with a strike price of $50 for $3 premium each

- Sell one XYZ call option with a strike price of $55 for $1 premium

The total cost of the trade is $500 ([$3 x 2 contracts] – $1 x 100 shares).

Breakeven |

|

Profit |

|

Loss |

|

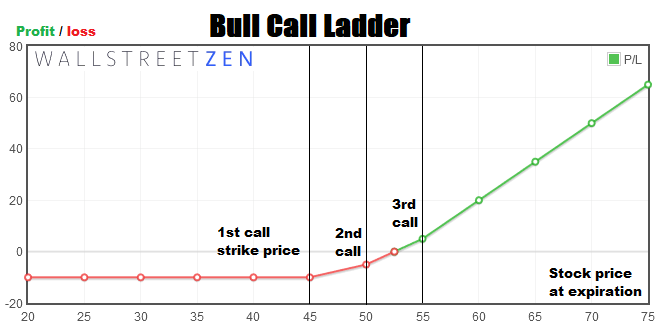

7. Bull Call Ladder Spread

- When to use: Very bullish. This strategy maximizes the potential upside.

- Max loss: Maximum losses are very high and equal to all the premiums paid.

Finally, the bull call ladder spread rounds out my list of options bullish strategies.

This highly bullish strategy involves buying multiple call options at different strike prices with the same expiration date. The strategy is called a “ladder” because the strike prices are spaced out at equal intervals, creating a step-like pattern on a graph.

Here’s how the bull call ladder spread strategy works step-by-step:

- The trader buys a call option with a lower strike price.

- At the same time, the trader buys a second call option with a higher strike price.

- The trader continues to buy additional call options at progressively higher strike prices, creating a ladder-like pattern of options.

- If the price of the underlying asset rises above the highest strike price, all of the call options expire in the money, and the trader can exercise them for a handsome profit.

- If the price of the underlying asset rises between the lower and higher strike prices, the trader may exercise the lower strike price call options to either offset the cost of the premiums or make a net profit.

- If the price of the underlying asset falls below the strike prices of the options, the trader may lose the premium paid for the options.

Bull Call Spread Example:

Let’s say you are very bullish on XYZ stock, currently trading at $50 per share, and want to use a bull call ladder spread strategy to profit from the expected rise in price. You buy:

- One XYZ call option with a strike price of $45 for $6 premium

- One XYZ call option with a strike price of $50 for $3 premium

- One XYZ call option with a strike price of $55 for $1 premium

The total cost of the trade is ($6 + $3 + $1) x 100 shares = $1,000.

Breakeven |

|

Profit |

|

Loss |

|

Final Word: Bullish Option Strategy

Each of the mentioned bullish strategies has its purpose – it all depends on your risk tolerance, trading balance, and the outlook you have for a specific underlying asset.

To choose which strategy to use, you should first look at the underlying asset and see which strategy works for that given situation. Trading isn’t about winning big as much as it is about winning consistently over long periods, so it is usually wiser to choose the strategy with the lowest odds of failure, rather than the one with the biggest potential payoff.

Ready to dive into trading options? Head over to eToro and set up an account.

FAQs:

What is the most bullish option strategy?

The long call strategy is the most bullish option strategy. It involves buying a call option with the expectation that the underlying asset's price will rise significantly. The downside is limited to the option’s premium while the upside is unlimited.

Which option strategy is most profitable?

An option strategy generally thought to have a high probability of success is a credit spread. A credit spread involves simultaneously selling and buying options at different strike prices to take advantage of differences in premiums.

Which option positions are bullish?

Call options, bull call spreads, bull put spreads, and long stock positions are all bullish options positions.

What is the bull spread options strategy?

A bull spread options strategy is a trading strategy that involves buying and selling options at different strike prices with the same expiration date, to profit from a bullish market outlook while limiting risk.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.