Advance your options trading journey faster…

Nic Chahine, Benzinga’s star options trader, created Benzinga Options – an options alert service that provides high-conviction and highly profitable trades.

Plus, he teaches strategies, shares market analysis, and helps you become an independent options trader.

“The two most powerful warriors are patience and time.”

So, what does this Leo Tolstoy quote have to do with options trading?

Well, with these two ingredients—patience and time (and maybe a bit of cash)—you can make a full-time income selling put options.

We often hear how risky options trading is, but this usually refers to traders who buy options, not the traders who write and sell them. With the right framework, selling puts can be a consistent stream of income.

In this article, I will explain how selling puts for income works, what kind of returns are realistic, and how to create a setup that can generate an income stream you can live on.

It’s surprisingly simple – much simpler than buying and trading options – so take a look and see how you can walk the path of an option writer.

What are Put Options?

A put option is a contract that gives its buyer the right to sell a stock at a predetermined price (strike price) within a certain period (on or before the contract’s expiration date).

The buyer pays a premium upfront to get this contract.

On the other side of the contract is the seller, who is obligated to buy the stock at the strike price on or before the expiration date if the buyer exercises their right.

In return, the seller gets and keeps the premium.

What Does Sell a Put Mean?

When you sell a put option, you’re taking on the obligation to buy an underlying asset at the strike price on or before the expiration date.

In return for this obligation, you are paid a cash premium.

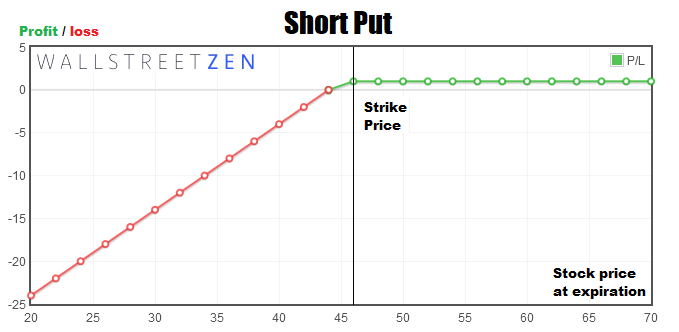

As a seller, you face 2 outcomes:

- The option expires worthless, and you keep the entire premium (if the underlying stock doesn’t go below the strike price). This is a good outcome.

- The option is exercised and you have to buy shares at the strike price. This is a “bad” outcome.

More precisely, the 2nd outcome can be profitable as well: If you write an option for a stock you are bullish on long-term, you get 100 shares of a good stock at a low price, plus, you get to keep the premium.

Therefore, selling put options the right way creates a win-win scenario. What is the right way to sell put options?

By following Lincoln’s Golden Rule: “When selling options, you should never fear assignment – you should be happy whether the option expires ITM (and you’re assigned) or it expires worthless.”

Check out Lincoln’s eCourse: Selling Options for Income.

Example of Selling a Put

Let’s say you want to buy 100 shares of ABC but you think it is expensive at the moment. You’d buy it at $45, but not at the current price of $50.

You sell a put option on ABC with a strike price of $45 and collect $100 in premium.

Here’s the trade:

- Stock: ABC

- Current stock price: $50

- Strike price: $45

- Expiration date: 1 month

- Premium: $1 per share x 100 shares per contract = $100 total premium

To enter into the trade, you would sell one put option contract, obligating yourself to buy 100 shares of the stock at the strike price of $45 if the option is exercised within the next 30 days.

This maneuver is called a cash-covered put trade because you need to have enough cash in your account to buy the stock at the strike price—your broker won’t let you sell the option without collateral, which is $4,500 in this case (100 shares x $45 strike price).

Now, let’s take a look at the 3 possible outcomes of this trade:

- Profit: If the stock price stays above $45, the option will expire worthless, and you will keep the entire $100 premium.

- Break-even: If the stock price decreases to $44, you will be obligated to buy the stock above the current market price at $45 per share, incurring a $100 loss. However, since you received a premium of $100 for selling the option, you will break even. You can then hold onto the stock or sell it at a profit later if the stock price increases.

- Loss: If the stock drops below $44, you have to buy the shares above the current market price, and will incur a loss greater than the premium you gained. You can still hold the shares, wait for them to go up, and profit or break even then.

Loss | Break-even | Profit |

Stock Price < $44 | Stock Price = $44 | Stock Price > $44 |

Requirements for Selling Put Options

First things first, to sell put options regularly, you need to meet a few requirements:

- Trading account: You’ll need a brokerage account with a firm that allows options trading.

- Trading experience: Brokers may require you to have some trading experience before they allow you to trade options. Some brokers don’t thoroughly check this, but others require you to complete an options trading course or provide other proof of your options trading knowledge.

- Collateral: You need to have enough money in your account to use as collateral for every contract you sell. The amount you need to sell a put option equals the strike price multiplied by 100 shares of the underlying asset.

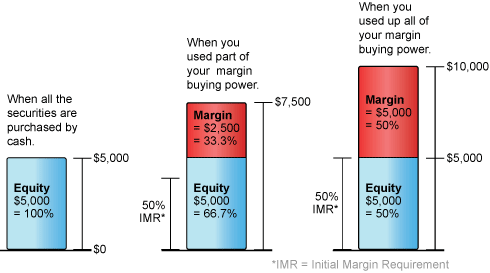

- Margin requirements (optional): A margin account allows you to borrow money from your broker to write more options. Brokers usually require users to have a few thousand dollars in their trading balance before giving them access to margin trading.

How To Sell Put Options

With all of that out of the way, you need to go through a process to make sure that each put you sell has a high chance of being profitable for you. Here is a framework for selling put options:

- Choose the underlying asset: The stock or ETF you want to sell an option on should be something you would like to own and are bullish on long-term. Then, if you’re forced to buy the stock, it might become profitable later on. On the other hand, if it is a bad stock and it crashes, you will be left owning a pile of shares you never really wanted.

- Determine the strike price: The higher your strike price, the more your put will be worth—but this also increases the chance of it being exercised. For starters, it is a good idea to place the strike price slightly below the lowest price you expect the underlying stock to reach.

- Pick the expiration date: Some options expire in a matter of days, while others are made to expire in a year or more. It is usually better to use shorter time frames (1 to 2 weeks) for this strategy because its upside is limited to the premium, whereas its downside is unlimited—a long wait period might exacerbate your losses and it can’t increase your profits.

- Only enter trades with a high probability of success: By making each trade less risky, you can more easily predict your monthly returns. If you want to sell puts for a regular income, try to stay away from high-risk, high-reward trades unless your budget allows you to take chances.

- Repeat and improve: If you find a system that works, just keep using it and make sure to make a record of all your trades. This will help you find out what you can change in your approach to make your strategy more profitable.

Selling Put Options for Income

First, you need to set income expectations—how much money do you intend to make every month? Let’s say that amount is $500.

Let’s see what you need to do to be able to generate this kind of income:

How Much is a Put Worth?

We can use the Black-Scholes method to roughly determine how much a hypothetical put option would cost and sell for:

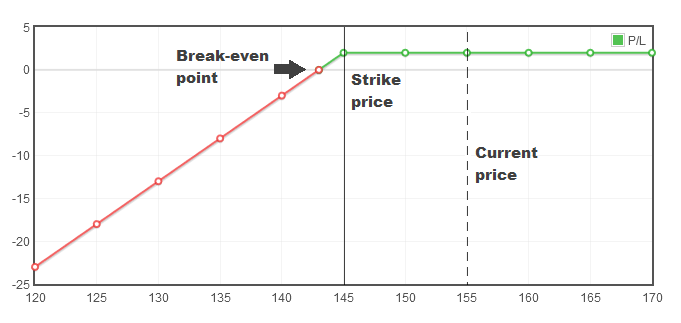

- Underlying stock: Apple (AAPL)

- Current price: $155

- Strike price: $145

- Volatility: 26% (historic average)

- Expiration: 2 weeks

- Premium: $2.2 per share ($220 per contract)

- Collateral required: $14,500 (strike price x 100 shares)

If this was a 1-week option, the premium would be somewhere around $1.24 per share.

So, if you are looking at an income of around $440 per month, it is possible to achieve it on a $14,500 budget by selling a put every 2 weeks—if your success rate is 100%.

However, things will not go very smoothly in reality so you should expect lower returns and always have extra money ready. Things can get complicated if you have to buy shares and then trade them for a profit later to free up money to sell your next put.

The example above gives a rough estimate of earnings for selling put options. Each stock is priced differently so make sure to do your research.

Prepare to Get Taxed

The premium you earn as an options seller is subject to short-term capital gains tax which is the same as your ordinary income tax. Depending on your tax bracket, this might be between 10% and 37%.

So, if you make $440 per month, you will be left with something between $396 to $277, depending on your tax bracket and the capital losses you can deduct.

Check Your Success Rate

To get an idea of your success rate, keep note of all your trades and then see what percentage of them are profitable.

For example, if 70 out of 100 options you sold in the past month let you keep the entire premium (on average), this means your strategy has a 70% success rate. You need to factor this into your plan.

If you need $14,500 to make $440 per month with a 100% success rate, this means you will only make $308 per month with a 70% success rate.

Using Margin (Optional)

By now, it’s obvious you need a lot of money to make a significant return from selling a put option. Luckily, most brokers offer margin trading—this lets you borrow money from the broker to make your position bigger.

Some of the best margin rates are offered by Charles Schwab at roughly 1.8%, so let’s use that as a benchmark.

Get ready for some math!

Say you have $14,500 on your account and your broker has a 50% margin requirement. This means you can borrow up to $14,500, making your total position $29,000. Then, this money doubles your position and you can make $440 on a trade instead of $220.

After the trade is done, you need to give back the $14,500 you borrowed plus pay the 1.8% interest, which is $216.

Total net profit = $440- $216 = $224

So, you earned an extra $4 by using margin. If this works and you can make more money consistently, you can just rinse and repeat. Even a tiny bump in returns like this can add up over time if you’re using a safe strategy with a high success rate.

However, note that using margin will also exacerbate your losses, so make sure you’re comfortable in your strategy before using debt. A small increase in returns like this isn’t worth it if your strategy is risky and has a low success rate.

Some options trades will have such low returns that they will be completely swallowed by your broker’s interest rate—make sure to do the math before each leveraged trade.

Selling Put Options for a Living: How to Make a Full-Time Income

Now, let’s see if it’s viable to trade options for a living and how much money you need to get started.

Using the above examples, if you only sold 2-week options on Apple stock, here is how much money you would earn every two weeks. The average premium is $220.

Puts sold per 2-week period | 1 | 4 | 10 |

Maximum potential credit gained | $220 | $880 | $2,200 |

Collateral needed (if strike price is $145) | $14,500 | $58,000 | $145,000 |

Taxes (short-term cap gains) | 10% – 37% | 10% – 37% | 10% – 37% |

Success rate | 70% | 70% | 70% |

Avg. profit every 2 weeks (premium / success rate – taxes) | $96 – $174 | $554 – $388 | $960 – $1,740 |

In this case, you need about $145,000 to be able to generate from $960 to $1,740 every two weeks. Each month, that would be a net profit of $2,000 to $3,400.

As we can see from this table, there are 3 ways to increase returns:

- Trade with more money—you might consider using a margin account for this.

- Increase your success rate by analyzing your trades, seeing what works and what doesn’t, and refining your strategy.

- Deducting your total capital losses from your taxable returns.

There are better and worse opportunities on the market. The example above is just to illustrate how selling put options for income works on Apple stock in specific.

That’s the math to show how you can start selling put options for a living!

Final Word: Selling Put Options for a Living

If done correctly and responsibly, selling put options is a reliable way to earn regular income. The key to selling puts successfully is to only work with underlying assets that you would like to own in the long run.

Set your target monthly income, then factor in taxes, your success ratio, and margin costs. With that out of the way, you need to pick the stock you want to work with and steadily refine your strategy.

You may be interested in Lincoln’s eCourse, Selling Options for Income, in which he will teach you 2 simple approaches to selling cash-secured puts and covered calls for remarkably consistent profits. It’s also incredibly low stress.

Or, to supercharge your portfolio, you may like Benzinga’s Options service for high-probability trade alerts, market analysis, and options education.

FAQs:

Do people sell options for a living?

Yes, many traders sell options for a living. However, whether an options writer can earn enough income selling options heavily depends on their portfolio size and risk tolerance.

Can you make a lot of money on puts?

Yes, you can make a lot of money selling put options, but it also comes with significant risk. To increase their ROI, options sellers can deal in more volatile stocks and write options with a more alluring strike price and expiry date—this makes each trade both risker and more valuable.

How much money do you need to sell puts?

For each put contract you sell, you need enough cash to purchase 100 shares of the stock at the strike price. If you sold 1 contract of a stock at the $50 strike, you need $5,000 in cash available.

How much money can you lose selling a put option?

When you sell a put option, the maximum potential loss is the strike price minus the premium received. For example, if you sell a put option with a strike price of $50 and receive a premium of $2, your maximum loss is $48 per share. However, this worst-case scenario can only happen if the underlying stock goes to zero.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.