History doesn’t repeat, but it rhymes. Stock Market Guides takes this idea and leverages it into high-quality stock and options alerts with a backtested edge. And it’s less expensive than a lot of other alerts services out there.

Stock Market Guides has a proprietary scanner that finds trade setups and sends you alerts in real-time. The software scans for trades based on numerous trading strategies that have been rigorously backtested through years of research and statistical analysis.

As a subscriber, you get trade alerts based on historically-profitable setups.

It sounds great. But is it great? Yes.

To write this Stock Market Guides review, I test-drove the app myself — and was very pleased with the results. Below, I’ll cover my experience, how profitable the alerts have been, and everything else you should consider before you sign up.

The Bottom Line: Is Stock Market Guides Worth It?

In my opinion, yes. Stock Market Guides offers clean, easy-to-read trade alerts that are timely, actionable and backed with extensive backtesting.

Within a week of subscribing, I had already made 3 profitable short-term trades. For me, this quickly made the $69/month fee worthwhile.

But remember — even a high-quality alerts system like this isn’t infallible. It’s always a smart idea to do your own due diligence. I didn’t just trade Stock Market Guides alerts blindly — I added a layer of due diligence using WallStreetZen stock research tools before executing any orders.

What is Stock Market Guides?

Stock Market Guides is a scanning software company including an algorithmic trade alert service. It lets you enjoy the benefits of a carefully honed trading system without doing any of the heavy lifting.

🌈 The more you know: A “trading system” refers to the specific combination of charts, indicators, and due diligence checks that you use to determine what a stock might do next.

The team at Stock Market Guides spent years running hundreds of thousands of simulations to find what trading systems performed the best, and narrowed it down to those with the highest win percentages and annualized returns.

From there, they created software based on these winning systems to trigger automatic alerts when a high-quality trade setup occurs. This enabled them to take high-percentage trades without sitting around and waiting for them all day.

Now, you can benefit from their hard work. The aforementioned software is the basis of Stock Market Guides.

The technology behind the alerts is complicated, but the actual alerts are incredibly simple and easy to read. It’s easy to understand what the stock is, why the alert was triggered, and the suggested action.

For this reason, I believe Stock Market Guides is appropriate for traders and investors of all levels:

- Beginner and intermediate traders will benefit from seeing the alerts, suggested time frames, and becoming familiar with different strategies.

- More seasoned investors will appreciate the time-saving aspect of Stock Market Guides, as well as the peace of mind that comes from trade alerts that have a backtested edge.

What Are the Different Stock Market Guides Subscriptions?

Stock Market Guides offers two core service types:

- Do-It-Yourself Scanners: See every trade setup their scanner finds, and do your own research to pick your favorite ones. Filter the scan results based on their historical backtested performance, among other things.

- Stock and Option Picks: Sit back and let their scanner do all the work to pick trades for you. Get up to three trade alerts per day. This is ideal for people who don’t want to put time into researching.

Here’s a breakdown of the two service types:

Do-It-Yourself Scanners

What makes Stock Market Guides different from other scanner companies is that they don’t just find trade setups, but they tell you how that trade setup has performed historically.

Instead of just finding out a given stock has a low PE ratio, or a low RSI value, they also tell you how the stock has performed in the past when it’s exhibited that same characteristic. That’s the secret sauce they infuse into each scan result, and it’s what sets them apart.

Here’s an example of how you can see the historical performance of each scan result:

Here are the scanning services that Stock Market Guides offers:

- Stock Investing Scanner: Designed for buy-and-hold investors, this scanner allows you to search for stocks based on fundamental metrics like PE ratios and earnings growth.

- Swing Trading Scanner: Designed for active stock traders, this scanner allows you to search for stocks based on technical analysis metrics like chart patterns and stock indicators.

- Option Scanner: Same idea as the Swing Trading Scanner, but with options. Each scan result indicates a specific option including strike price and expiration date.

With each scanning service, you can use filters to fine-tune your scan results. The cool thing is that you can filter trade setups based on their historical performance to ensure that you’re only considering trade ideas that have a very strong track record of success.

Here’s an example of how the filter looks:

You can see in that image that we filtered the scan results to only show us trade setups with at least a 100% historical annualized return.

Their scanning services alert you in real time when there are new scan results. You can get alerts by text or email.

Another great thing about the scanners at Stock Market Guides is that they have a free version. You won’t get access to the historical performance of each trade setup and you won’t get real-time alerts from the free version, but there might still be plenty of value.

Their free scanner allows you to find stocks that exhibit popular charts patterns, stock indicators, and even candlestick patterns. Some of those scans are unique to Stock Market Guides.

For example, you can scan for stocks in a Cup and Handle chart pattern. There might not be any other scanner companies that offer such a scan, and you can access it for free.

Stock and Option Picks

If you don’t like the idea of spending time manually reviewing scan results and want someone else to do the research needed to boil it down to just a couple of trades per day, then you might like the stock and option picking services offered at Stock Market Guides.

With these services, you’re not combing through data. Instead, they pick trades for you, and they send you a simple trade alert when your attention is needed.

Here are the stock and option picking services that Stock Market Guides offers:

- Stock Investing Picks: These picks are designed for buy-and-hold investors, and the trades can last up to a year. These strategies generated a 43.1% annualized return in backtests.

- Swing Trading Picks: These picks are designed for active stock traders and feature a handful of their favorite high-performing strategies. These strategies generated a 79.4% annualized return on nearly 300,000 backtests.

- Options Picks: Same idea, but with options. This time, the strategies generated a 150.4% annualized return in backtests. That said, they also came with more volatility than their stock trades.

The SMG team has 2 general categories for the Swing Trading Picks and Option Picks: 1-week and 1-month trades:

The most popular is the 1-week trades.

Here’s a look at the recent active trades in this category for the option picking service:

The maximum contract price for this filter is $15, though most are below $5 per contract (or $500 per trade). You can also see the recommended position size for each trade – which varies based on the type of trade being recommended – posted with the trade alert.

Here’s a look at the performance of this filter over a one-week period:

5 trades, 5 winners. While not every week is like this, it’s nice to see the service performing exactly as it was built to perform.

What Do Stock Market Guides Trade Alerts Look Like?

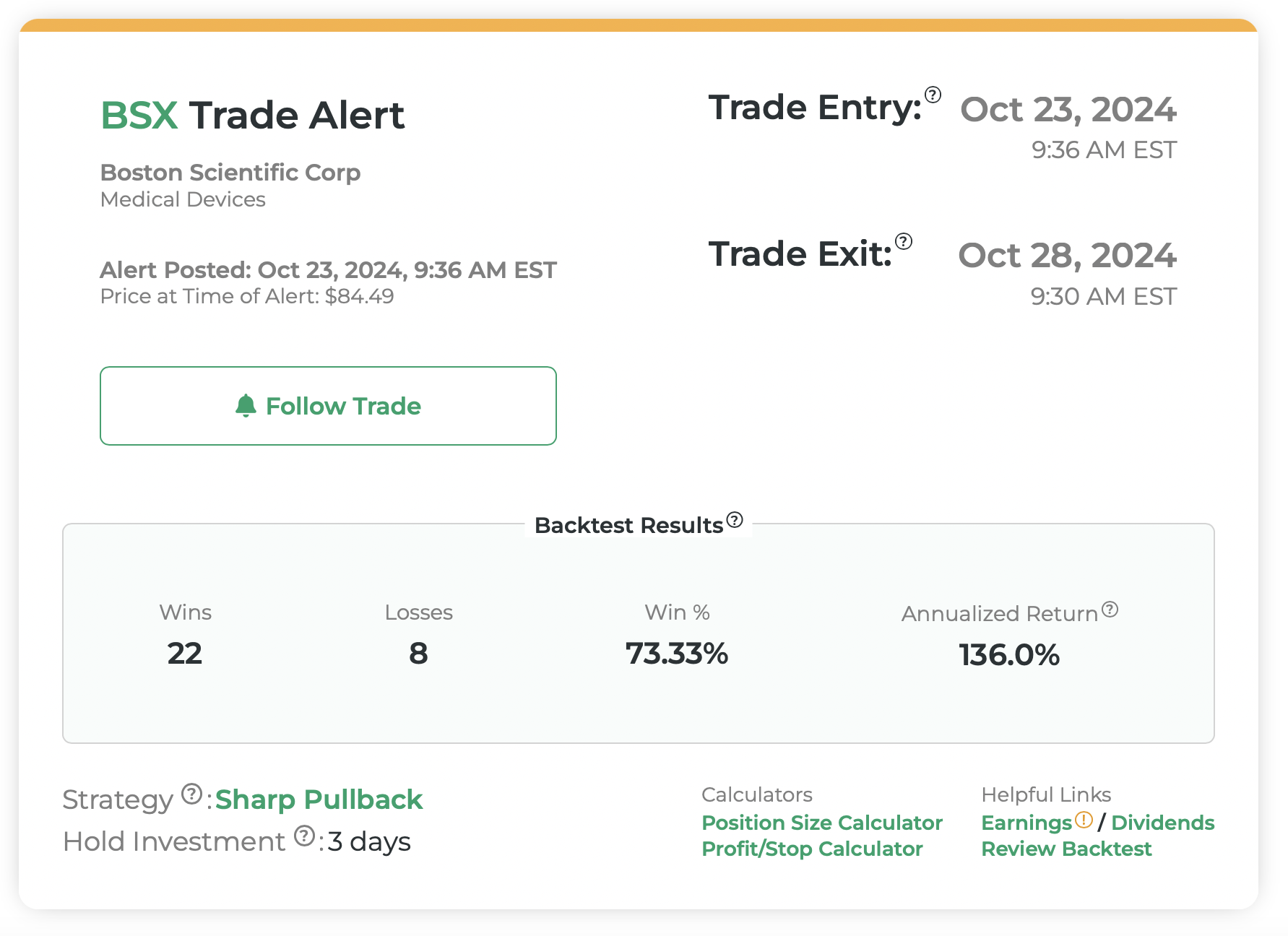

The trade alerts from Stock Market Guides, which are included in their stock and option picking services, look like this:

They’re generated by Stock Market Guides’ proprietary scanning technology, which scours the markets for trades using the team’s top-performing trading systems. When a trade is identified, you get a cute little alert like the one above.

Each alert tells you:

- The strategy it employs

- A profit target

- An exit date (if the profit target isn’t reached first)

- A summary of how this exact stock has performed in the same conditions in backtests

As you can see from the alert, the trade setup is buying Boston Scientifics (NYSE: BSX) stock via SMG’s “Sharp Pullback” strategy, which has the “best backtested returns on a per-trade profitability basis.”

When this strategy has been run on BSX in backtests, it resulted in a 73.3% win rate and a 136.0% annualized return.

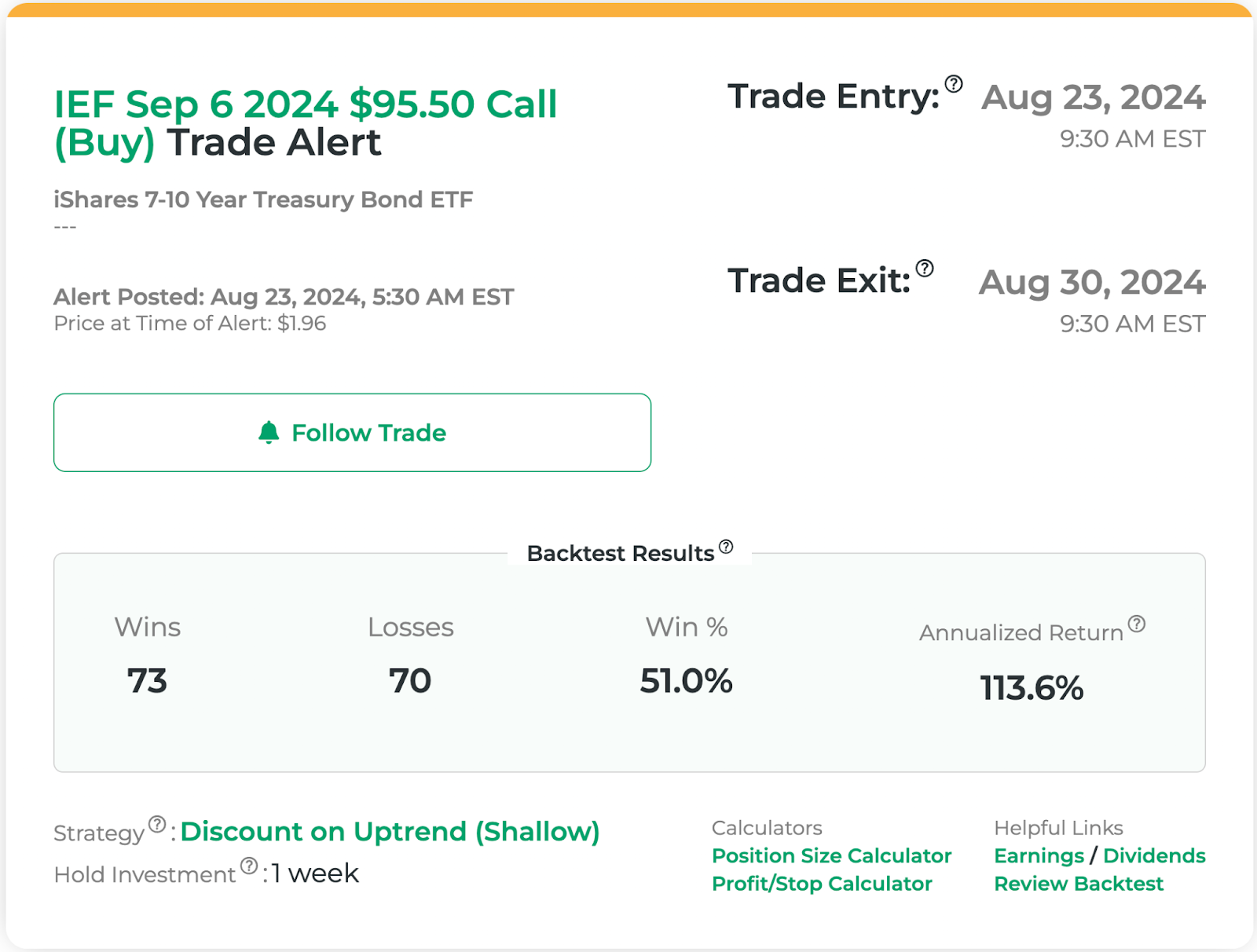

I should also mention that Stock Market Guides offers options alerts, too.

Here’s an example:

The above alert is on IEF, the iShares 7–10 year Treasury Bond ETF. It recommends the $95.50 call at $1.96 per contract. The trade will last a week unless it hits the $2.58 profit target (not pictured) before then.

This is the essence of Stock Market Guides: A trade alert is posted alongside the backtested results of how that trade has performed historically. You never have to trade without a backtested edge again.

Need a broker?

Stock Market Guides can lead you to potential trades, but you can’t execute without a brokerage.

If you’re in the market for a new brokerage, I suggest Public. It’s fast, reliable, and you can create customized investment plans — so, for instance, say you wanted to do something like invest in several of the alerts from Stock Market Guides at once, you could create a customized investment plan where you invest a fractional amount in several tickers at a time.

In addition to stocks and options, Public also offers access to crypto, treasury bills, and a new Bond Account that lets you buy investment-grade bonds without fuss.

How Much Does Stock Market Guides Cost?

As mentioned above, Stock Market Guides has six total services.

They have three DIY Scanner services. The Stock Investing Scanner is $19/month, the Swing Trading Scanner is $39/month, and the Option Trading Scanner is $59/month.

As you can see, they offer a nice discount if you bundle all the scanner services together.

They also have three services covering stock and option picks. The Stock Investing Picks are $29/month, the Swing Trading Picks are $49/month, and the Option Picks are $69/month.

They offer discounted bundles for those services, too. They also offer significant discounts if you sign up for a full year of any given service.

Is it worth the money? It depends on the performance of the trade alerts. The service should pay for itself. If it doesn’t, it’s not worth your money.

In my experience, it’s worth the money.

Personally, I am more comfortable with stocks than options. I took modest positions in three of the short-term (1-week) trades, and made $145 in a week.

How about options? A colleague and options trader I know took 4 of the 5 1-week options alerts featured in the screenshot above, buying 1 contract each time. He earned $375.

In both cases, our profits were well above the $95 cost of the dual subscription.

Other Stock Market Guides Features

Here are a few more things you should know about Stock Market Guides:

User Experience

Stock Market Guides is web-based, but the email alerts make it easy to trade on the go. For example, when I saw an interesting stock alert pop up via email, I simply opened the Public app on my phone and executed the trade.

I found the Stock Market Guides site very easy to navigate. Upon signing in, it only took a few minutes to familiarize myself with the platform and find recent alerts.

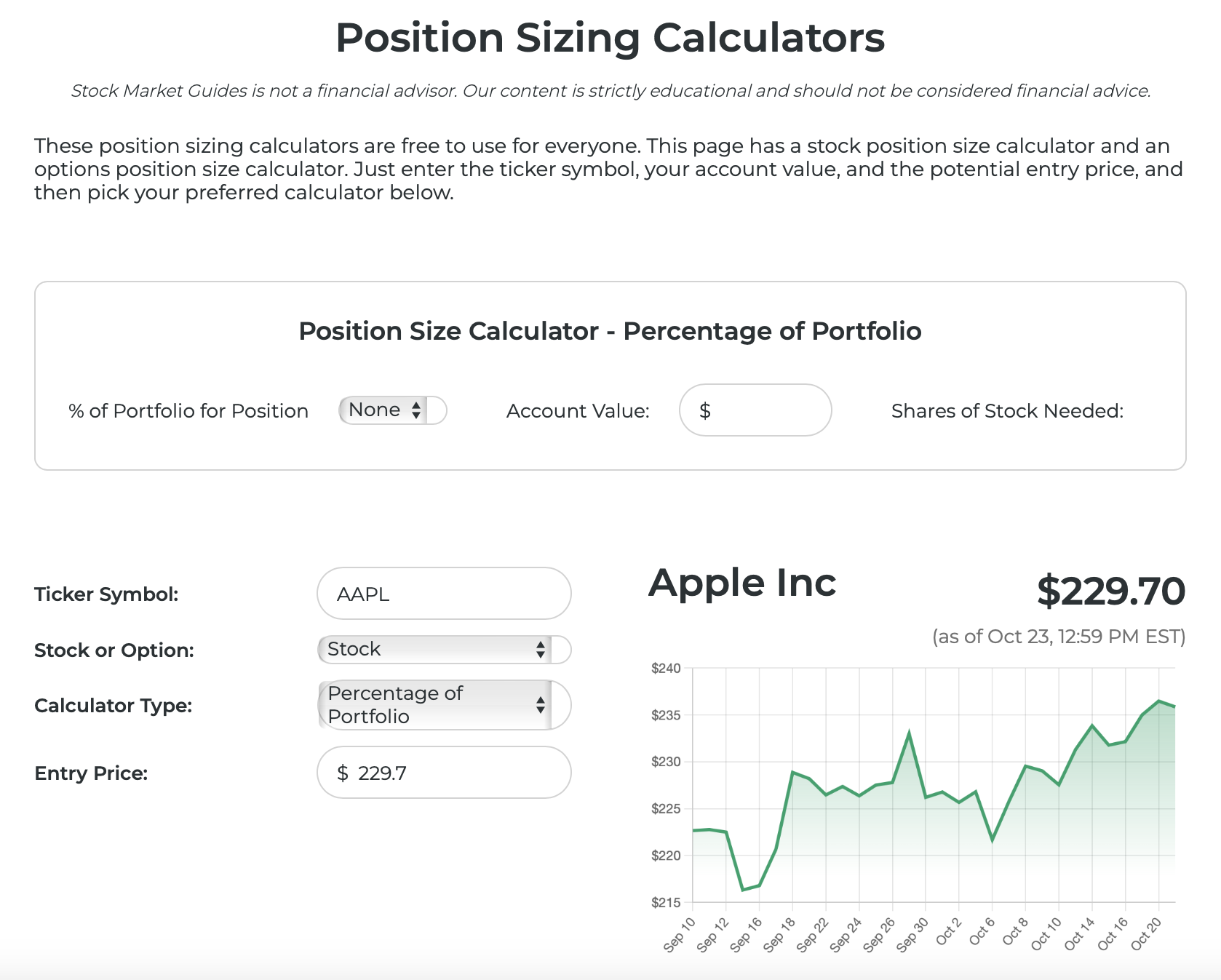

Position Size and Profit/Stop Calculators

Stock Market Guides offers helpful tools including a Position Size Calculator and a Profit/Stop calculator, that can help you fine-tune position size and entry and exit points.

Learning Tools

They offer free resources designed for beginners to explore stock and options trading. It’s comparable to getting access to a complimentary trading course, even if you don’t subscribe to their paid services.

This includes a wide selection of video tutorials available on their YouTube channel.

Transparency

They steer clear of exaggeration and focus on delivering practical insights. They clearly outline what their service provides and openly communicate its limitations.

As for customer support — that deserves its own heading.

Customer Support at Stock Market Guides

Stock Market Guides has excellent customer service. The experts behind the service, Eric Ferguson and Andy Yuda, are extremely present — and from the moment I signed up, I felt that they genuinely cared about my experience and wanted me to be profitable.

For one, they want to make sure users are aware of the risks associated with trading. You must sign off on two disclaimers before signing up for the service which remind you of the risk involved with trading and making sure you know that this isn’t a way to “Get rich quick.”

They also post commentary each week about the trades they’re taking and what’s going on in the markets:

I’ve found these messages to be motivating and helpful, especially during tough stretches.

Additionally, both Andy and Eric respond very quickly to emails and are eager to help with any questions you may have. If you’ve ever been a customer of another trade alert service, you know how rare all of this is.

Stock Market Guides: Pros and Cons

Pros | Cons |

|---|---|

Affordable price, ability to bundle services | No mobile app |

Free version of scanner available | May not be suitable for short sellers or day traders |

Frequent alerts | |

Ability to filter what alerts you get based on historical trade setup performance | |

Superb customer support |

An Alternative to Consider

As you’ve gathered from this review, I’m a big fan of Stock Market Guides. I think it’s well worth the price.

However, most of the services are particularly valuable to investors who can check the updates and act on them quickly. If you prefer a more laid-back approach with 1-2 high-quality stock picks per month (and an overall cheaper price tag), you may want to consider Zen Investor.

- Cost: $79 for 1 year, $190 for 3 years, $197 for 5 years

- What You Get: Stock screeners, analyst insights, in-depth investment reports, and curated stock picks.

Steve Reitmeister, the brains behind Zen Investor, follows a disciplined and comprehensive method for selecting stocks. His strategy begins by closely tracking top-performing analysts to ensure that only high-quality recommendations make the cut.

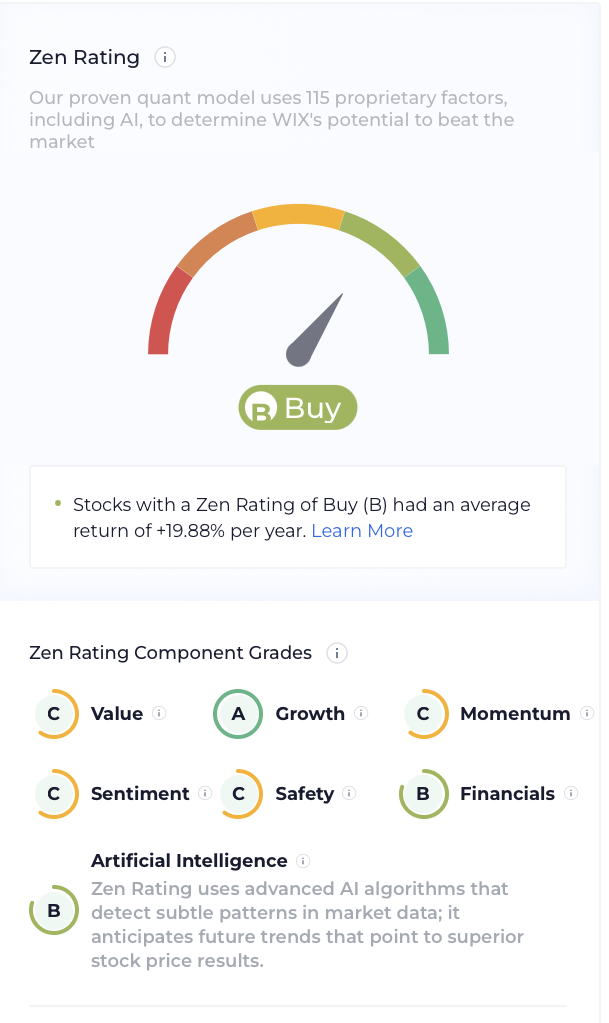

Each potential investment then undergoes a rigorous screening process through the Zen Ratings system, which distills 115 factors that drive growth into an easy-to-read letter score. In addition to an overall score, you can see how each stock scores in different areas, including value, growth, momentum, and more. For example, here’s the Zen Rating for a recent Zen Investor portfolio addition, Wix.com (NASDAQ: WIX):

Once a stock passes this evaluation, Reitmeister digs deeper to assess its growth potential, paying particular attention to companies with strong earnings surprises, attractive valuations, and robust growth prospects.

From this refined selection, he handpicks stocks, relying on over four decades of investment experience to navigate market conditions and identify opportunities that align with his long-term strategy.

Subscribers to Zen Investor gain access to regular market analysis, clear trading strategies, and a focused portfolio of 20-30 high-potential stocks.

The Final Word: Stock Market Guides

Stock Market Guides is a data-centric, objective, and hype-free scanning and trading alert service built on years of experience and research. I believe it is a valuable service for investors of all levels, from beginners/intermediate traders to advanced traders.

While the service features 1-week and 1-month alerts that are suitable for swing traders and, in some cases, longer-term investors, they may not be appropriate for day traders.

And I do strongly suggest doing some additional due diligence on any trade you take (As for a research platform, may I suggest WallStreetZen?)

While there’s certainly no guarantee you won’t lose money with Stock Market Guides, you can be sure every trade you take has a backtested edge. History doesn’t repeat, but it rhymes; as a result, this unique feature can help tip the odds in your favor.

FAQs:

Does Stock Market Guides have a mobile app?

At this time, Stock Market Guides does not have a mobile app. However, the alerts are delivered via email, so if you have a brokerage app on your phone, they are actionable from your smartphone.

How much does Stock Market Guides cost?

Stock Market Guides offers two services: stock alerts and options alerts. Each cost $69/month, or you can get both for $95/month. You can also save 40% by purchasing the annual bundle subscription for $675/year, the equivalent of $56.25/month.

Is Stock Market Guides worth the money?

In our opinion, yes. After personally using the service, our team has found it to be profitable, high-quality, and worth the money. However, individual results may vary. Investing is risky — never invest more than you can afford to lose.

Is Stock Market Guides legit?

Yes. The service will not ask for any of your personal information or access to your investment account — what you do with the alerts is up to you.

As for the alerts, all alerts on Stock Market Guides have been backtested using the service’s proprietary technology. Based on our analysis, the alerts are high-quality and easy to use.

Who is Stock Market Guides best for?

Because of the duration of the trades, Stock Market Guides is suitable for swing traders and some long-term investors.

The easy-to-read alerts are particularly beneficial for new traders who are still learning the ropes, as well as traders who want a high-quality alerts system that will save them time.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.