Is StocksToTrade Worth the Cost?

I won’t keep you in suspense. While StocksToTrade has its strengths, it’s very expensive — nearly $2k per year — and it’s really only suited for active day traders. If you don’t mind holding overnight or longer, DIY research using quant ratings systems like Zen Ratings, and/or subscribing to a stock-picking newsletter like Zen Investor, are a whole lot cheaper — and potentially more effective.

Let’s talk about it. In this detailed StockstoTrade review, I’ll walk you through everything the platform has to offer, from its Lead Trainer, Tim Bohen, to the much-discussed Oracle tool and the educational offerings from StocksToTrade University.

StocksToTrade is expensive, and best suited to active day traders.

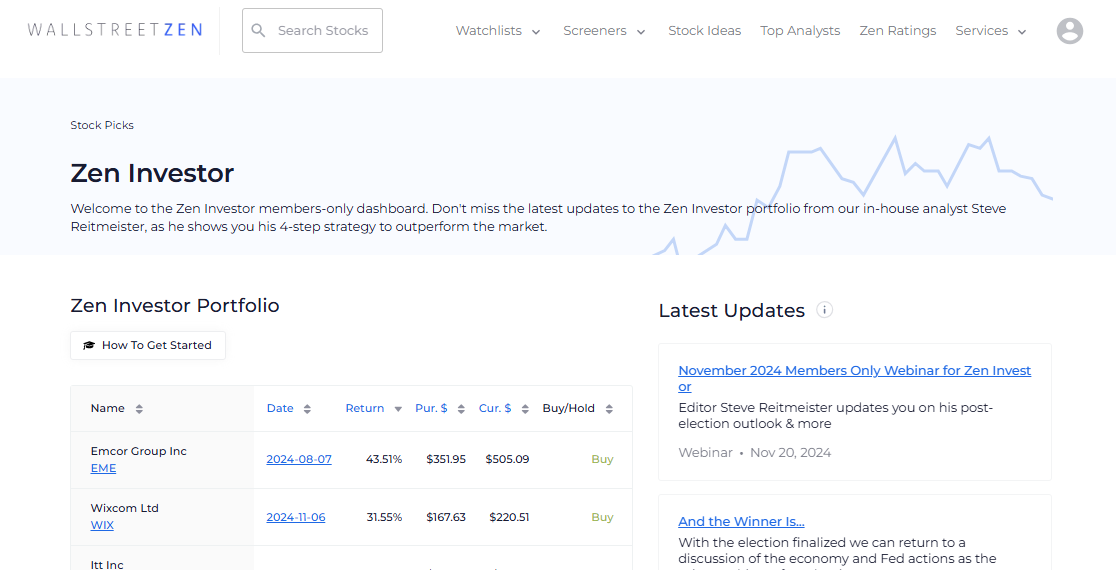

Zen Investor is a stock-picking newsletter focused on long and medium-term investments — and it’s a fraction of the cost of StocksToTrade. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com

✅ 4-step process for stock selection using WallStreetZen tools, notably our Zen Ratings system (Stocks rated “A” through this system have historically generated 32.52% annual returns)

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What Is StocksToTrade?

StocksToTrade is an all-in-one stock screener and community for day traders. The platform was launched in 2009 and co-founded by popular penny stock trader Tim Sykes. (Check out our Tim Sykes review too, if you’re interested.)

Sykes is responsible for developing the platform’s primary feature: The scanner. (Some people simply refer to it as the “Tim Sykes stock scanner,” as it’s Sykes’ primary tool for finding stocks.)

Over the years, StocksToTrade has evolved into more than just a scanner — it’s a comprehensive platform featuring advanced charting, news integrations, and even broker connectivity.

One of the platform’s leading figures is another Tim — Tim Bohen, the Lead Trainer who advocates a “KISS” (Keep It Simple, Stupid) approach to trading.

Bohen is known for his no-nonsense yet warm and welcoming Midwestern style, and his ability to distill complex trading concepts into digestible bites.

Bohen is the force that elevates StocksToTrade from another trading tool to a full-fledged educational ecosystem.

Key Features of StocksToTrade

StocksToTrade positions itself as an all-in-one solution for active traders. So, for this StocksToTrade review, I’m breaking down everything you can expect:

Market Scanners

The platform’s scanning tools are its bread and butter, helping traders filter thousands of stocks for actionable opportunities.

- Built-in Screeners: Pre-set screeners for stocks, illustrating breakouts, earnings movers, and more. ”

- Customization: You can tweak parameters like price, volume, and news catalysts to match your strategy. You can quickly create screeners to make watchlists for multiple strategies.

- Speed: The scanner updates in real-time, ensuring you don’t miss potential plays.

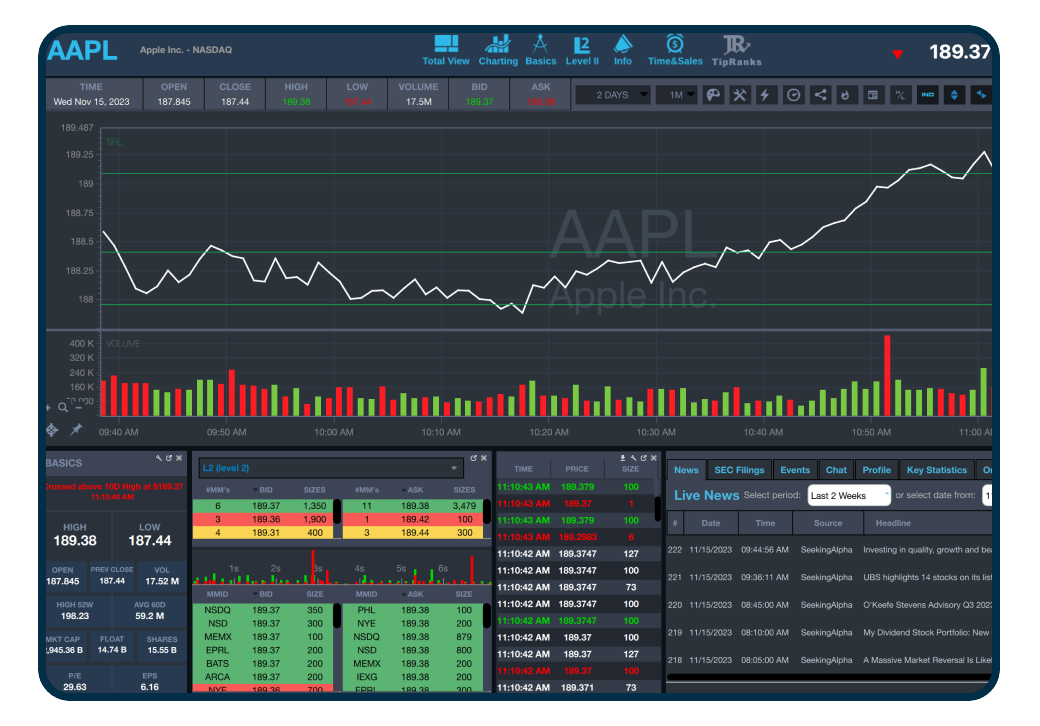

Stock Charts

Real talk: In my opinion, StocksToTrade’s charting tools don’t have anything that TradingView doesn’t offer — and STT costs a lot more than TradingView. (Plus, you can get a 30-day free trial on TradingView — click here to get started)

Related Reading: TradingView Review: Is PRO Worth It?

That said, they do have a lot of features for technical analysis:

- Customizable indicators and overlays for identifying trends.

- Multi-timeframe analysis to spot intraday or long-term setups.

- Easy-to-use drawing tools for marking support, resistance, and trendlines.

- Easy and instant access to Level 1 stock data, like price quotes, press releases, and social feeds.

News Feeds

Having real-time news at your fingertips is critical for active traders. StocksToTrade integrates live news feeds so you can act fast when a stock makes a move.

- Real-Time Updates: StocksToTrade has real-time news feeds that gather data and information from multiple sources, like press releases, SEC filings, social media updates, and articles from mainstream financial news outlets.

- Customizable Content: You can customize the StocksToTrade news feed based on your desired criteria. For example, you might want to a feed to monitor specific companies, sectors, or even keywords, like “artificial intelligence” or “semiconductor.” This feature helps cut down on noise, so you’re left with pertinent details you actually care about.

- Integrated Platform: The news feeds are integrated directly into the StocksToTrade platform. This allows for seamless analysis, as you can view news items alongside stock charts, level 2 data, and other analytical tools that you decide to leverage.

- Advanced Filtering: The platform provides advanced filtering options to sort news by categories such as market cap, volume, price range, and more. This helps quickly identify news that could impact stock performance.

Alerts

- Customizable Alerts: StocksToTrade allows you to set up personalized alerts based on various criteria, including price movements, volume spikes, technical indicator signals, and news events.

- Multiple Notification Methods: Alerts can be delivered through in-platform pop-ups, email notifications, or SMS messages. This ensures you stay informed even when you’re not actively monitoring the platform.

- Real-Time Notifications: The alert system is designed for speed, providing real-time notifications that enable you to react promptly to market changes. This is particularly valuable in the modern trading world, where first movers can have a significant advantage.

- Technical Indicators and Scanners: You can set alerts based on specific technical indicators or scanner results. For example, you might set an alert for when a stock crosses above its 50-day moving average or when a stock appears on a custom scanner list you’ve created.

Broker Integration

StocksToTrade is not a broker. However, it does support broker integration.

This means instead of completing your research, analysis, and education in one platform (StocksToTrade) and executing your trades in another (i.e., Robinhood), you can actually do everything, start to finish, in StocksToTrade.

In other words, StocksToTrade lets you connect directly with certain brokers, enabling trades without switching platforms. (This is a feature that another powerful stock scanner, TradingView, shares.)

This means you won’t have to stress over multiple screens while doing research, switching back and forth between StocksToTrade and your broker.

StocksToTrade supports multiple broker integration, including:

- Just2Trade

- E*Trade

- Robinhood

- Interactive Brokers

- Ally Invest

- Tradier

Paper Trading

Paper trading, or simulated trading, prepares you for live trading, increasing your potential for success without putting real money on the line. StocksToTrade offers a robust paper trading feature that allows traders to practice and refine their trading strategies without risking real money. This simulated trading environment replicates real market conditions, enabling you to gain hands-on experience with the platform’s tools and features before committing capital.

Key Features of StocksToTrade’s Paper Trading

StocksToTrade’s paper trading platform is loaded with features to make the experience as realistic as possible, including:

- Real-Time Market Data: You’ll gain access to real-time quotes and market data (including Level 2 data)

- Comprehensive Trading Tools: Advanced charting, custom scanners, and news feeds and alerts

- Virtual Funds: Start with a configurable amount of virtual capital to manage your trades.

- Order Types: Practice placing various order types, including market, limit, stop-loss, and stop-limit orders.

- Portfolio Management: Monitor your virtual portfolio’s performance, including unrealized and realized gains or losses.

A more versatile paper trading platform…

If you prefer a paper trading account that’s linked directly with your brokerage (so that you can toggle between paper trading and IRL trading with ease), check out eToro’s Demo Account.

You can buy stocks, ETFs, and cryptocurrencies, and test various buy-and-hold or technical trading strategies.

At the same time, you can experience all of the features eToro offers in its simple, intuitive platform.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

STT Pro Subscription

The STT Pro Subscription is the premium offering from StocksToTrade, designed for traders who seek an immersive, educational, and interactive trading experience.

This subscription tier provides access to advanced trading tools, real-time market insights, and mentorship from experienced traders, aiming to enhance your trading skills and performance.

Here’s what you get with your membership:

- Live Trading Chat Room: This is one of the big selling points of STT Pro — access to the robust community and chat room, which is moderated by professional traders during market hours. This is where information gets exchanged: Get ideas, learn about strategies, and connect with other traders.

- Daily Mentorship with Expert Traders: Live webinars with seasoned traders who share their screens and discuss market moves can help amplify your education and experience — and allow you to connect directly with gurus during Q+A sessions.

- Real-Time Trading Alerts: You’ll gain access to curated watchlists highlighting potential trading opportunities for the day, as well as instant notifications on significant market events, price movements, and breaking news that could impact your trades.

- Advanced Trading Tools: As a Pro member, you can access sophisticated scanning tools to find stocks that meet specific criteria tailored to your trading strategy. You’ll also gain access to advanced charting features with multiple technical indicators, drawing tools, and customization options … And Level 2 data.

- Educational Resources: You’ll also get access to an extensive library of educational videos covering various trading topics, from basics to advanced strategies as well as guides, eBooks, and other resources to supplement your learning.

Once again, I’d be remiss if I didn’t mention that you can access WallStreetZen’s tools for a fraction of the cost:

- Zen Ratings is our proprietary quant ratings system. With it, you can enter any ticker on our website and immediately see 115 factors proven to drive stock growth distilled into an easy-to-read letter grade. It’s FREE to get started; you can unlock more features with a Premium subscription, which is $19.50 per month (compared to StocksToTrade’s $179/month price tag)

- Zen Investor is our stock-picking newsletter, which features a portfolio of stocks and regular new stock alerts from veteran investor and former Editor-in-Chief of Zacks.com, Steve Reitmeister. The cost? $79/year for a limited time. Recent picks have soared 60%, 50%, and 38% — gain access now.

Even if you got a Premium subscription AND a Zen Investor Subscription, you’d still be paying a fraction of the cost of StocksToTrade.

StockstoTrade Oracle Review

One of StocksToTrade’s flagship features is the Oracle, an AI-powered tool designed to predict market moves.

Let’s dive into this feature with a StocksToTrade Oracle review.

What is the Oracle?

Oracle is essentially an advanced scanner that identifies high-potential trades based on proprietary algorithms. Think of it as a shortcut for narrowing down your watchlist, saving you time while increasing precision.

Advantages for Traders

- Speed: Oracle quickly scans the market for opportunities.

- Efficiency: Reduces analysis paralysis by offering clear trade ideas.

- Actionable Insights: It’s ideal for traders looking for high-conviction plays.

How You Might Use It

A trader using Oracle might get alerted to a small-cap stock showing a breakout pattern. Instead of manually scanning the market, Oracle serves up the trade idea on a platter, complete with entry and exit points.

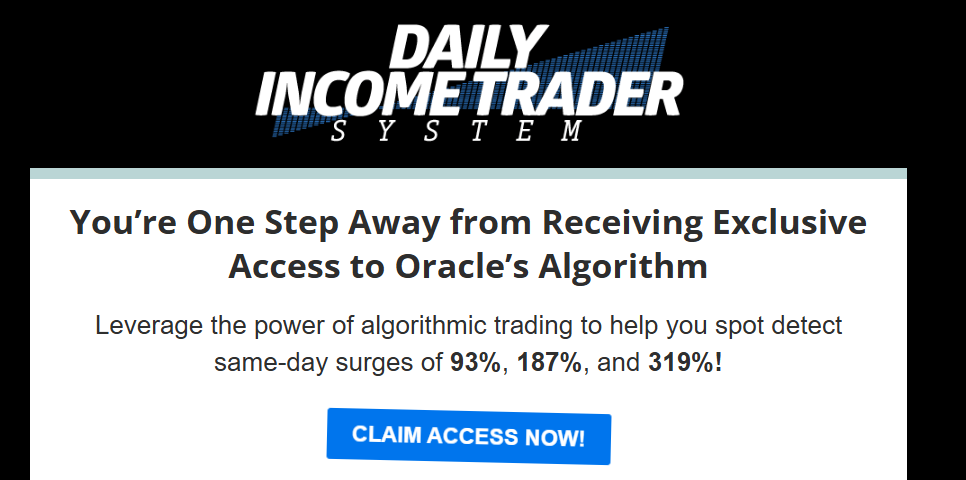

How Much Does It Cost?

Oracle is not cheap.

To access the Oracle Scanner, you must pay a one-time fee of $10,485 to join the Daily Income Trader System.

A Cheaper Alternative to Oracle

If you’re looking for high-quality alerts, I suggest skipping Oracle and fast-forwarding to Stock Market Guides, which costs $69/month — a lot cheaper than $10,495.

High-quality alerts are the name of the game here. Stock Market Guides is built on a proprietary backtesting algorithm that reviews historical performance on various setups, and delivers the most promising alerts for either stocks or options (you can choose which alerts you receive, or get a combo subscription for a little extra $$).

The alerts are clear and easy to read — you get the ticker, what strategy it aligns with, a suggested time duration, and entry and exit suggestions.

Members of the WallStreetZen team are also avid fans of this service — just read our Stock Market Guides review to see how well the alerts perform.

If you’re looking for a cheaper, yet very high-quality alternative to Oracle, Stock Market Guides is well worth your time.

StocksToTrade University

StocksToTrade isn’t just a platform—it’s also an educational hub.

Overview of Educational Content

StocksToTrade University is an educational program offered by StocksToTrade. It’s designed to help traders enhance their knowledge and skills in the stock market. The program provides a structured learning environment with courses that cover a wide range of topics, from basic trading concepts to advanced strategies.

Whether you’re a beginner or an experienced trader, StocksToTrade University aims to equip you with the tools and understanding needed to navigate the complexities of the financial markets effectively.

Key Topics Covered

- Technical Analysis: Understand chart patterns, indicators, and other technical tools used to predict market movements.

- Fundamental Analysis: Learn how to evaluate a company’s financial health, industry position, and market conditions to make informed trading decisions.

- Trading Strategies: Explore various strategies such as day trading, swing trading, momentum trading, and how to apply them effectively.

- Risk Management: Gain insights into managing risk through position sizing, stop-loss orders, and portfolio diversification.

- Trading Psychology: Address the emotional and psychological aspects of trading to develop discipline and improve decision-making.

Who Should Enroll?

Beginners who want to learn the fundamentals of trading will benefit most from StocksToTrade University. However, intermediate and advanced traders might find some lessons repetitive or too basic.

StocksToTrade University is a potentially helpful resource for those who want to engage in practical assignments and simulations alongside expert instructors.

StocksToTrade’s Lead Trainer: Who is Tim Bohen?

Background and Expertise

Tim Bohen is a seasoned stock trader and the Lead Trainer at StocksToTrade. With over a decade of experience in the stock market, Tim has become a prominent figure in the trading community, mainly known for his expertise in penny stocks, day trading, and momentum trading.

Teaching Style

Bohen’s strength lies in his ability to simplify complex ideas. Whether you’re learning how to spot patterns or manage risk, his lessons are designed to be actionable and easy to understand.

- Practical and Hands-On: Tim believes in learning by doing. He often uses live market scenarios to teach trading concepts, allowing students to see real-time application of strategies.

- Interactive Sessions: Encouraging active participation, Tim invites questions and discussions during his webinars and live training sessions. This interactive approach helps clarify complex topics and fosters a collaborative learning environment.

- Simplifying Complex Concepts: He excels at breaking down intricate trading strategies, making them accessible even to beginners.

- Focus on Risk Management: Tim emphasizes the importance of managing risk, teaching traders how to protect their capital through stop-loss orders, position sizing, and disciplined trading practices.

- Mentorship and Support: Provides personalized feedback and guidance to help traders identify and overcome their weaknesses. Encourages the development of a trading plan tailored to individual goals and risk tolerance.

- Passionate and Motivational: Tim is known for his enthusiastic teaching style, inspiring confidence and self-reliance in his students.

Tim Bohen Net Worth

While Tim Bohen’s exact net worth isn’t public, his successful trading career and role at StocksToTrade suggest a solid financial foundation. According to his website, Tim Bohen used $12,415 of bar mitzvah money to turn himself into a multi-millionaire by the age of 22.

If that trend persisted, the Tim Bohen net worth is likely quite high.

Pros and Cons of StocksToTrade

Pros | Cons |

|---|---|

Powerful market scanner | High cost |

Advanced charting tools | Steep learning curve for beginners |

Real-time news integration | Limited broker compatibility |

Paper trading for practice | Better suited for day traders than swing/long-term investors |

Educational resources via STT University | Limited asset class exposure, with a focus on stocks |

Comprehensive tools in a single platform | |

User-friendly interface |

Pricing and Subscriptions

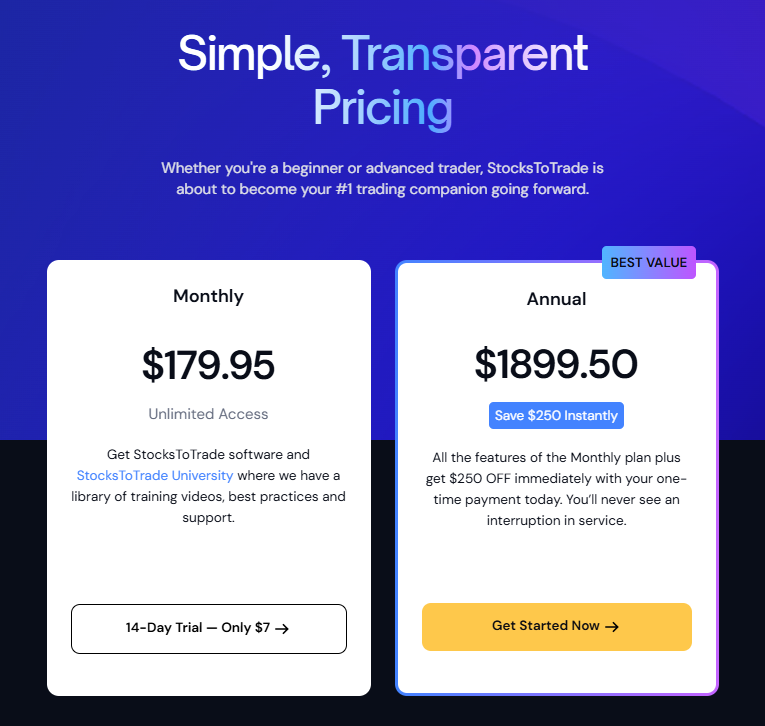

StocksToTrade isn’t cheap. The base subscription is $179.95/month or $1.899.50 if you pay annually.

Critically, it’s important to note that many additional features require further payment.

For example, StocksToTrade offers a service known as ‘Alpha Scanner,’ an algorithm built by trainer Matt Monaco that matches his trading strategy, which has separate pricing.

There is also a service known as ‘IRIS Analytics,’ an AI system built by Tim Bohen based on his trading style, aimed at forecasting potentially bullish names.

This essentially gives users Tim Bohen stocks to trade. However, to get Tim Bohen stocks to trade, you’ll have to pay a separate fee for IRIS Analytics, over and above the base membership.

At the extreme end of the scale, StocksToTrade offers the ‘Daily Income Trader System,’ a platform that includes access to the Oracle Scanner, daily market profit alerts, daily webinars, and more. While the system includes numerous features, it will run you an eye watering $10,495!

User Reviews and Testimonials

Positive Reviews

Many users praise StocksToTrade for its powerful scanning tools and the mentorship provided by Tim Bohen. Success stories often involve traders who capitalized on breakout plays identified by the platform.

Common Complaints

- High Pprice: The high cost is a recurring criticism.

- Upselling pressure: Many users complain they need to shell out more money than expected to access features they thought would be included.

- ComplexSteep learning curveity: New traders often find the platform overwhelming.

- Limited long-term focuseLong-Term Focus: StocksToTrade is tailored for day trading, leaving long-term investors underserved.

Alternatives to Consider

Investors Underground – If You Want a Full-Fledged Trading Community

Cost: $297/month, $697/quarter, or $1,897/year + $1,000 for trading courses (optional)

Investors Underground is perhaps the most direct alternative to StocksToTrade on this list. It’s a fantastic resource for burgeoning day traders, with a clear educational path and lessons that build upon one another at a good but accessible pace.

At the helm is Nathan Michaud, a world-class trader and educator. Since its founding in 2004, it has grown into a premier provider of stock trading courses and resources.

With a membership, you gain access to more than 1,000 video lessons, pre-market broadcasts, trade recaps, and IU’s Live Trading Floor. IU also has a Trading Encyclopedia to teach new traders the basics of trading.

And if you’re a beginner who wants to kick-start a day trading career, IU offers 3 trading courses with over 25 hours of educational content. It includes:

- Textbook Trading – An 8-hour course for new traders that will take you from complete beginner to trading on your own.

- Tandem Trader – A 12-hour advanced trading course which includes screenshots of live trades along with live commentary. It feels like you’re in the room with Nathan Michaud.

- Swing Trader – A 6-hour course on all things swing trading, taught by a 20-year veteran. This is one of the best swing trading courses on the market.

These courses are top tier … But they have a top-shelf price tag. It’s an extra $1,000 to gain access to these 3 stock trading courses, on top of your membership fee.

It’s expensive, but IU reviews show countless evidence of brand-new traders just like you who quit their jobs and started trading full time after the investment. To them, the cost of membership was the best investment they ever made.

eToro CopyTrader – If You Want to Watch and Learn from Experienced Traders

If you’re mainly interested in a “watch and learn” approach and want to learn from experienced traders, you may want to consider eToro‘s CopyTrader tool.

- Cost: Free to use, though trading fees apply.

- What it is: A platform that lets you mirror the trades of successful investors.

- Best for: Beginners seeking low-cost exposure to active trading strategies.

In addition to a wide variety of tradable assets, a user-friendly platform, eToro has a truly unique feature in its CopyTrader tool. This tool allows users to replicate the strategies of successful traders, it’s not hard to see why this inimitable platform is beloved by millions of traders, ranging from beginner to advanced day traders. Plus, as of July, eToro is offering a $10 bonus* for U.S. residents.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Zen Investor – If You Want to Spend Less Time on Your Computer

StocksToTrade is mostly geared toward day traders. Day trading requires a serious time commitment — you’ve gotta be glued to your computer. If that doesn’t sound like a life you want, you may prefer the more relaxed pace (and less shocking price tag) of Zen Investor.

- Cost: $199/year

- What it is: A long-term-focused stock-picking service curated by experienced analyst Steve Reitmeister. With it, you get a portfolio of the best 30 stocks, identified using WallStreetZen’s 4-step process, monthly commentary and portfolio updates, members-only webinars, and 24/7 access to the Zen Investor website.

- Best for: Investors prioritizing steady growth in attractive companies instead of short-term gains.

First, let me point out the superior price — a full year of Zen Investor is only slightly more than one month of StocksToTrade, let alone the cost of the Daily Income Trader.

And you get a lot of bang for your buck. When you subscribe, you gain access to a portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools, notably our Zen Ratings system (Stocks rated “A” through this system have historically generated 32.52% annual returns).

In addition to Reitmeister’s expertise through monthly commentary, portfolio updates, and members-only webinars, you also get sell alerts if the thesis changes — so you’re never left in the dark.

With full access to the portfolio’s archives and past trades and commentary, you can also benefit from the idea that history “rhymes” — and continue to learn lessons from the past that could inform your investing future.

The Bottom Line: Is StocksToTrade Worth It?

This StocksToTrade review wouldn’t be complete without a definite answer to the question: is StocksToTrade worth it?

StocksToTrade is undeniably a powerful platform for day traders. Its market scanners, real-time news, and mentorship programs make it a valuable tool for those focused on short-term trades.

However, the high cost and steep learning curve may deter beginners or budget-conscious investors. While the base plan may offer sufficient tools for most traders, many past members complain of upselling and the lack of certain features that require additional payments to be unlocked.

For long-term investors or those seeking a more affordable option, Zen Investor offers a compelling alternative. While it lacks StocksToTrade’s flashy tools, it provides a proven framework for steady portfolio growth—at a fraction of the price.

At the end of the day, most people want to make money and don’t care how flashy a platform is. Performance is performance. Period.

FAQs:

Who is Tim Bohen?

Tim Bohen is the lead trainer at StocksToTrade and a seasoned small-cap trader.

Who created StocksToTrade?

StocksToTrade was co-founded by Tim Sykes, a prominent penny stock trader.

How much is StocksToTrade a month?

The base subscription costs $179.95/month, with numerous add-ons possible.

Who is the owner of StocksToTrade?

Tim Sykes is one of the co-founders, but the current ownership structure includes a broader team.

Is StocksToTrade a trading platform?

Yes, StocksToTrade is a comprehensive trading platform with tools for market scanning, charting, and broker integration.

Does StocksToTrade include Oracle?

No, Oracle is a feature that is part of the Daily Income Trader System, which costs $10,485 to join.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.