Can I trade options after hours? Yep. But just because you can doesn’t mean you should.

Don’t get me wrong — I see the appeal of after hours options trading. Jobs, time zones, weird sleeping rhythms — they can all keep you away from the market during regular hours.

The bottom line? If you want to buy options after hours, there are ways to do it. However, you should know a few things before you get started:

- Buying options after hours works differently than during market hours

- Trading volumes are limited and the overall risk is greater

- It requires a specific understanding of after-hours trading to stay safe and potentially profit.

In this article, I’ll explain everything above and more. By the time you’re finished reading, you’ll understand the ins and outs of after hours options trading so that you can make an informed decision about whether or not it’s right for you.

Let’s get started…

Options resources, day or night:

- Options alerts + educational resources: Benzinga Options

- At-your-own-pace digital options course: Selling Options for Income

- After hours options trading brokerage: TradeStation

- Our #1 charting platform: TradingView

What is After Hours Options Trading?

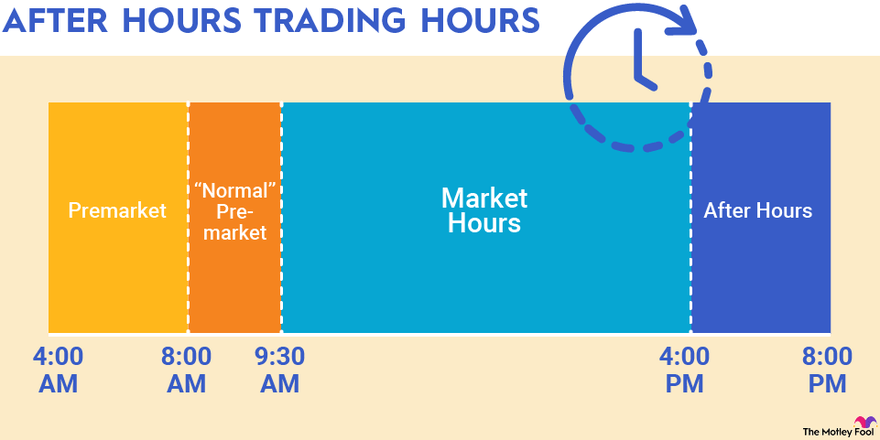

Most trading in the U.S. happens between 9:30 a.m. and 4:00 p.m. ET, during regular stock market hours.

After hours options trading happens after the markets have closed. Retail traders can sell and buy options after hours — between 4 p.m. and 8 p.m. ET — but special rules apply during this period.

How After Hours Trading Works

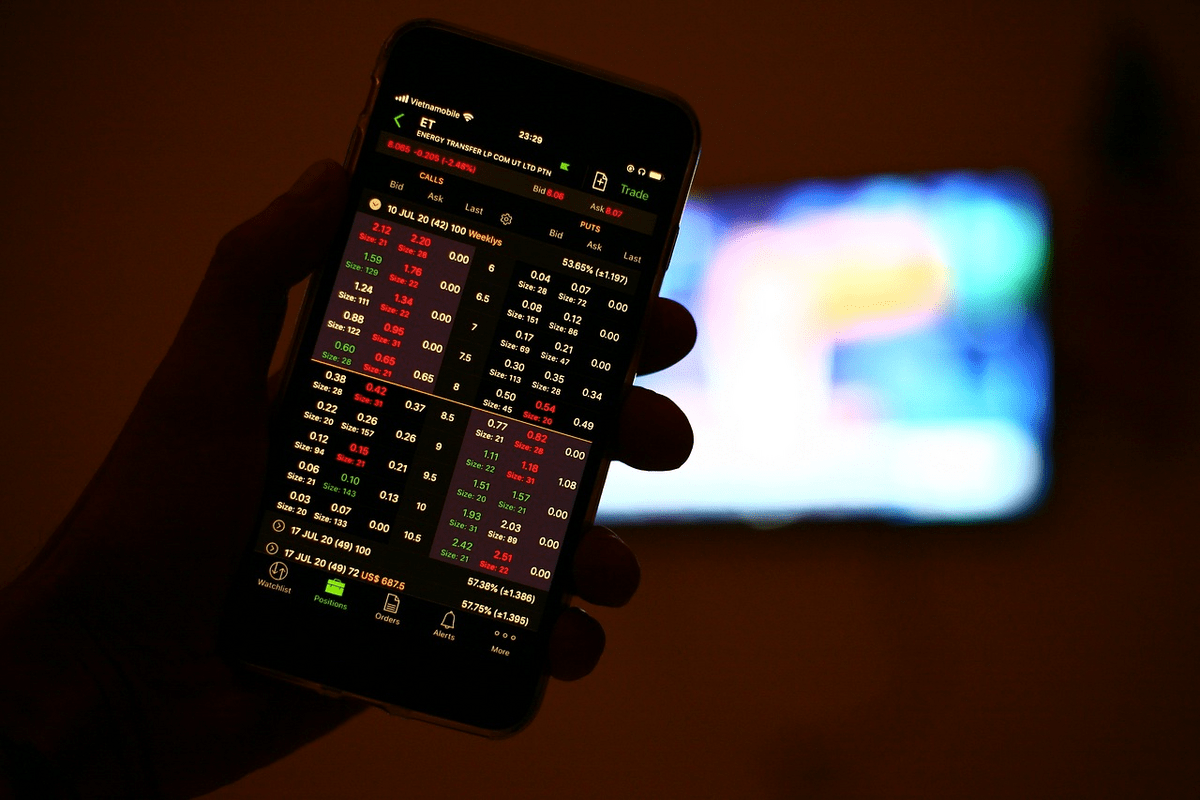

Can options be traded after hours? Yes. Here’s how it works:

- When you submit an order after hours, it is processed by the stock market’s electronic communication network (ECN).

- The stock market’s automated computer system looks for a match for your order—a trader who submitted an order to buy what you’re selling or to sell what you’re buying.

- If the ECN finds a match for you, the trade is executed.

- If your order remains ignored, it will be canceled by the time after-hours trading closes at 8 in the evening — in other words, nothing lost, nothing gained.

Warning: Buying options after hours at a price you like is very difficult due to lower liquidity and potentially inaccurate pricing information. Selling is even harder. Don’t carelessly rely on after-hours markets if you want to get out of a bad position at the last moment or make a quick hedge before the market reopens.

Options Trading Hours

So, when exactly are options traded after hours? Here is the trading schedule used by all major markets:

Bookmark this…

Options market | Regular trading hours (NYSE and NASDAQ) | After-hours trading (NYSE and NASDAQ) |

|---|---|---|

Stock options | 9:30 a.m. – 4 p.m. ET | 4 p.m. – 8 p.m. ET |

ETF options | 9:30 a.m. – 4 p.m. ET | 4 p.m. – 8 p.m. ET |

Index options | 9:30 a.m. – 4 p.m. ET | 4 p.m. – 8 p.m. ET |

Currency options | 9:30 a.m. – 4 p.m. ET | 4 p.m. – 8 p.m. ET |

Note: The following assets are considered “late close exceptions” and can be traded between 9:30 a.m. and 4:15 p.m. on both stock markets:

AMJ, DBA, DBB, DBC, DBO, DIA, EEM, EFA, GLD, IWM, IWN, IWO, KBE, KRE, MDY, MOO, NDX, NDXP, NQX, OEF, QQQ, SPY, SVIX, SVXY, UNG, UUP, UVIX, UVXY, VIXM, VIXY, VXX, VXZ, XHB, XLB, XLC, XLE, XLF, XLI, XLK, XLP, XLRE, XLU, XLV, XLY, XME, XND, XRT

Who Can Trade Options After Hours?

Can I trade options after hours, or is it just for pros? Fair question.

The answer? Everyone can trade options after hours. You don’t need to meet any special requirements.

This wasn’t always the case. Trading options after hours used to be a privilege reserved for hedge funds and institutions, but nowadays, all you need is an account with a broker that supports after-hours trading.

Brokerages that Offer After Hours Options Trading

Can you buy call options after hours? Yeah, if your brokerage offers after-hours options trading, and many of them do.

After-hour trading generally begins at 4 p.m. and ends at 8 p.m. ET but a few brokers here and there may have shorter sessions. Here are some popular examples:

Broker | After-hours session (Monday through Friday) |

|---|---|

Broker | After-hours session (Monday through Friday) |

4 p.m. – 8 p.m. ET | |

4 p.m. – 8 p.m. ET | |

E*Trade | 4 p.m. – 8 p.m. ET |

4 p.m. – 8 p.m. ET | |

TD Ameritrade | 4:02 p.m. – 8 p.m. |

4 p.m. – 8 p.m. ET | |

Vanguard | 4 p.m. – 5:30 p.m. |

If you’re a serious trader, I recommend TradeStation.

It’s one of the most popular brokers out there, and for good reason. With a robust selection of options trading tools, it’s worth exploring for your options trading needs — regular or after hours.

Pros & Cons of After Hours Options Trading:

If it’s riskier and more complicated, why are options traded after hours? It’s a niche trading sector that has it advantages if you can deal with the risks and other drawbacks:

Benefits of Trading Options After Hours

- Convenience and flexibility: If you aren’t able to start trading options full-time, you’ll probably be busy during regular hours. After-hours sessions give you the chance to trade at a more convenient time.

- Potential for price gaps: Overnight news or events can create significant price gaps between the market’s close and the next opening. After-hours trading allows you to take advantage of these price movements.

- Lower competition from institutional traders: Institutional traders and market makers are typically less active during after-hours trading. This can potentially create opportunities for retail traders, despite lower liquidity and wider bid-ask spreads.

Drawbacks of Trading Options After Hours

- Lower liquidity: Liquidity is much lower, so you may find it harder to execute trades, especially when it comes to less popular assets.

- Wider bid-ask spreads: Due to lower liquidity, bid-ask spreads can be wider during after-hours trading. This means you may pay more to buy shares and receive less when selling compared to regular trading hours.

- Increased price volatility: With fewer market participants and lower trading volume, price movements can be more volatile during after-hours sessions.

- Limited stock availability: Some stocks may be unavailable after hours depending on the broker you use.

- Additional fees: Some brokers may charge additional small fees for after-hours trading.

- Fragmented markets: After-hours trading takes place across multiple electronic communication networks (ECNs)—this often leads to fragmented markets and inconsistent price info.

Interested in learning more about options? Benzinga Options is our favorite platform to learn options in 2023.

This top-notch options alert service provides star option trader’s (Nic Chahine’s) high-conviction and highly profitable trades, along with analysis of the “why” behind the trade so you can learn in real-time.

Final Word: Can I Trade Options After Hours?

After hours options trading can be a tempting prospect if you don’t have time to trade during regular market hours. It can also give you the opportunity to react to timely news and get the jump on trades before institutions and the bulk of retail traders make their trades come morning.

But trading options isn’t for the faint of heart. It comes with a special set of rules, lower liquidity, and inconsistent price information. In short, it’s even harder and riskier than options trading during regular market hours.

While after hours options trading has the potential to be profitable in certain instances, it’s not recommended for new traders. After hours options trading is more appropriate for sophisticated options traders who have a strong understanding of options trading and the specific risks involved during this volatile period.

FAQs:

Can you buy options after trading hours?

Yes. After hours options trading is typically available from 4 p.m. until 8 p.m. ET. However, not all brokers offer access to the full after-hours trading session and it is generally harder to trade during this period due to lower liquidity.

What happens if you buy an option after hours?

Traders can place orders to buy options after market hours. However, these orders will be canceled at the end of the after-hours session if there isn’t a seller for the options you ordered. If the trade goes through and you manage to buy the option, you own the contract just as you would if you bought it during regular hours.

Can I trade options after hours on td ameritrade?

Yes, but this doesn’t apply to options on all the securities that are available during regular hours. Just like with any other broker, you should check if the securities you’re interested in are available after hours on TD Ameritrade before making any plans.

Why can't you trade options after hours?

Can options be traded after hours? Yes, but there are limits. Some brokers have limited after-hours trading windows and the lower liquidity in the afternoon session might make it impossible to fill your order at the desired price, which means your order will be canceled automatically when the session ends at 8 p.m. ET.

Can you buy call options after hours?

Yes, between 4 p.m. and 8 p.m. ET through an online broker that supports after-hours trading. However, making transactions during this period is much more difficult because relatively few traders and institutions are active after hours.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.