Chime is not publicly traded, but accredited investors can still buy its stock.

Hiive is a marketplace where accredited investors can buy shares of private companies before they go public.

Sign up with Hiive and get access to Chime stock before its IPO.

Ding! Did you hear that? The chime of opportunity.

Just kidding. But seriously, let’s talk about opportunities with Chime, the fintech company.

Chime is one of the most popular banking apps out there. It has an estimated 14.5 million users, and it’s been named the “#1 Most-Loved Banking App.”

As a savvy investor, all of those bona fides might have you wondering how to buy Chime stock.

Chime is not yet public, so you won’t find the Chime stock symbol on your brokerage. However, that doesn’t mean you can’t potentially invest in the company and/or sector. Keep reading to find out more…

Chime: The Basics

Instead of leading with what Chime is, let’s talk about what it’s not: A bank. It says so right on the company website:

“Chime® is a financial technology company, not a bank.”

So what is it? Rather than a bank, Chime aggregates and provides banking services through a melange of FDIC members including The Bancorp Bank, N.A. or Stride Bank, N.A. From your POV on the app, things are condensed into a single app. But a lot is going on behind the scenes.

The company also offers The Chime Visa® Debit Card and the Chime Credit Builder Visa® Credit Card, which are issued The Bancorp Bank, N.A. or Stride Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit and credit cards are accepted.

The idea behind the company? A simpler banking experience with lots of banking services but no monthly fees, no overdraft fees, and a variety of tools to help users build credit.

Here are a few key things to know about Chime:

- Chime was founded in 2012 by Chris Britt (still the CEO) and Ryan King (still the CTO) in San Francisco. The goal? To provide an alternative to traditional banking.

- Britt had senior roles at Visa and Green Dot before starting Chime.

- While Chime is not a bank, members’ money is safe — account balances are held at regulated, FDIC-insured banks, The Bancorp Bank, N.A. and Stride Bank, N.A., Members FDIC.

- Chime was featured on Forbes’ “The Fintech 50” list in 2024 — as well as the two years prior. and for the past 2 years.

- Chime has been named one of the “best global fintech companies” by CNBC.

- How does Chime make money? The majority of the company’s revenue comes from collecting interchange fees on debit card transactions.

- In 2020, Chime partnered with the Dallas Mavericks in a multiyear deal as a jersey sponsor.

- The company reported 8 million members in 2020; that number has swelled to a reported 14.5 million members in 2024.

While these little factoids might have some thinking about moving their funds to Chime, others might be wondering how to buy Chime stock. Let’s get into it.

Can You Buy Chime Stock? Is Chime Publicly Traded?

Nope. You cannot buy shares of Chime stock on the stock exchange. (Sorry.)

Currently, there’s no Chime stock symbol or Chime stock price chart to reference. That’s because the company’s still private.

There has been talk of an IPO, but it hasn’t happened quite yet. But if you’re an accredited investor, here’s how to buy Chime stock before the company goes public…

Investing in Pre-IPO Companies as an Accredited Investor

Are you an accredited investor? If so…

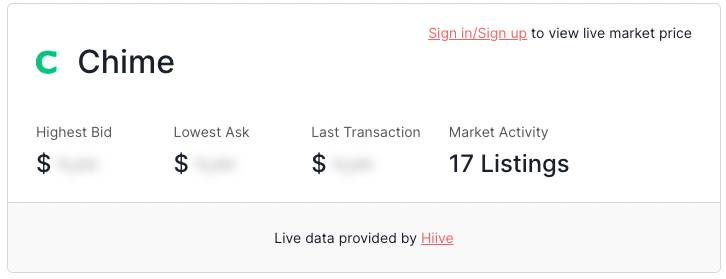

You can invest in Chime right now (before its IPO) on Hiive.

Hiive is a marketplace where shareholders of private, VC-backed companies can sell their shares to accredited investors.

There are over 2,000 pre-IPO companies on Hiive, including Chime:

On Hiive, each listing is created by a unique seller who sets their own asking price and volume offered. Buyers can place bids or accept the asking price as listed.

Register for Hiive and see all bids, asks, and the most recent transactions for Chime with the button below:

How to Buy Chime as a Retail Investor

As a retail investor, you cannot buy Chime stock … It’s still private, so it’s not available on the stock market.

That said, investing in Chime (at least indirectly) isn’t off the table. We’ll tell you more in a second. But first…

Who Owns Chime?

Chime was founded in 2012 by Chris Britt (CEO) and Ryan King (CTO). According to Crunchbase, Chime has 34 investors, including Vantage Legacy Capital and General Atlantic.

Does Visa Own Chime?

Chime’s debit cards have a Visa logo, so does Visa own Chime? Nope. Visa (NYSE: V) does not own Chime. As for the debit cards with the Visa insignia?

Chime’s banking partners, The Bancorp Bank, N.A., and Stride Bank, have a license from Visa U.S.A. Inc., and the cards can be used everywhere Visa debit and credit cards are accepted.

How to Invest in Chime Stock as a Retail Investor

If you’re a non-accredited retail investor, you cannot directly buy shares of Chime stock. But you can potentially gain access to the company in other ways. Let’s discuss.

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

Ready to Invest? Limited-Time Deal for U.S. Residents!

eToro is one of the world’s most popular investing platforms with over 28.5 million users.

Right now, eToro is offering a $10 bonus* for U.S. residents who open and fund a new account.

$10 bonus for a deposit of $100 or more. *Only available to U.S. residents. Additional terms and conditions apply.

Visa Stock

As noted earlier, Chime cards are provided courtesy of a licensing agreement with Visa. Ergo, if the company benefits, it could — potentially, and indirectly — provide Visa (NYSE: V) stock with a boost.

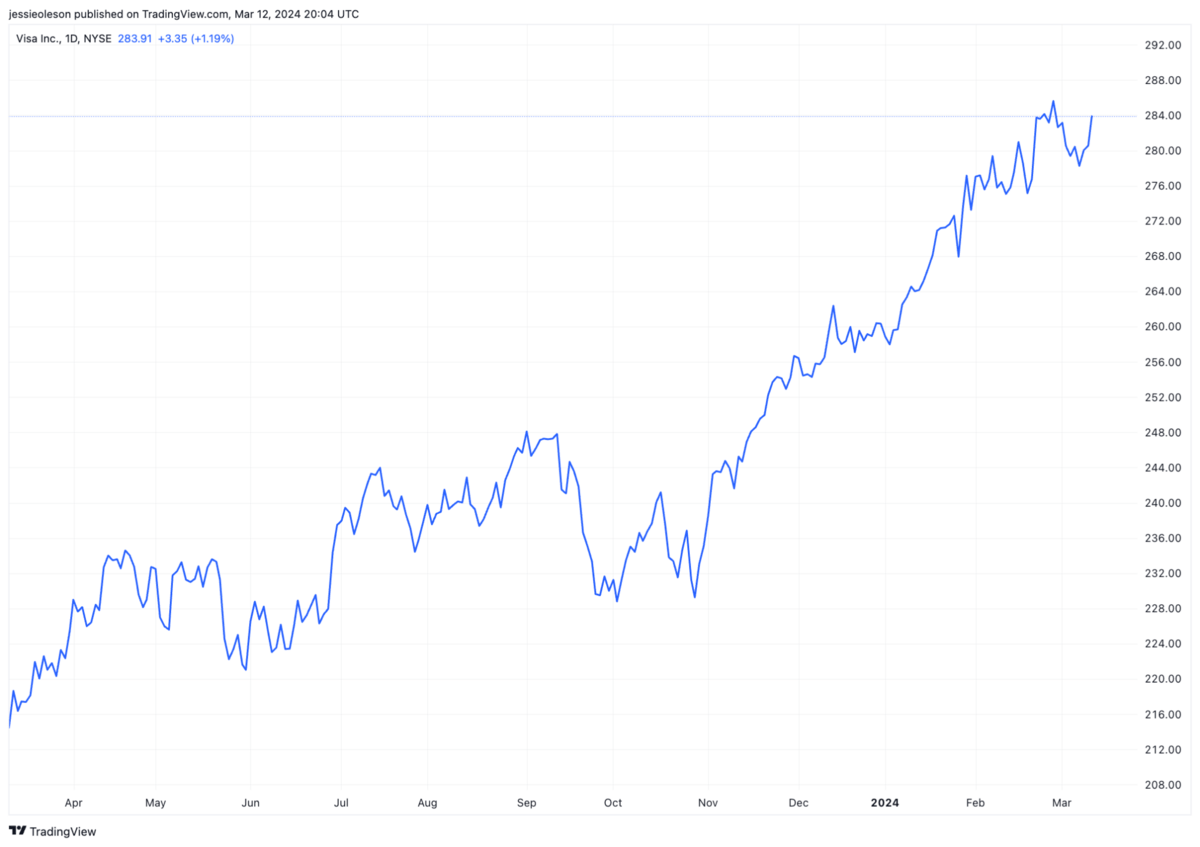

Of course, by investing in Visa stock, you’d also be investing in the whole business — not just a connection to Chime. Here’s V’s one-year chart:

Banking Stocks

Chime is not a bank, but it provides banking services. While it’s not a direct connection, it’s fair to assume that if Chime is doing well, it might be a good time for banks, too.

Here are some banks that are screening well on WallStreetZen’s Best Bank Stocks to Buy Now and Best Diversified Banks to Buy Now screeners:

Webster Financial Corp. (NYSE: WBS)

Bank of America Corp. (NYSE: BAC)

JPMorgan Chase & Co. (NYSE: JPM)

Fintech Companies

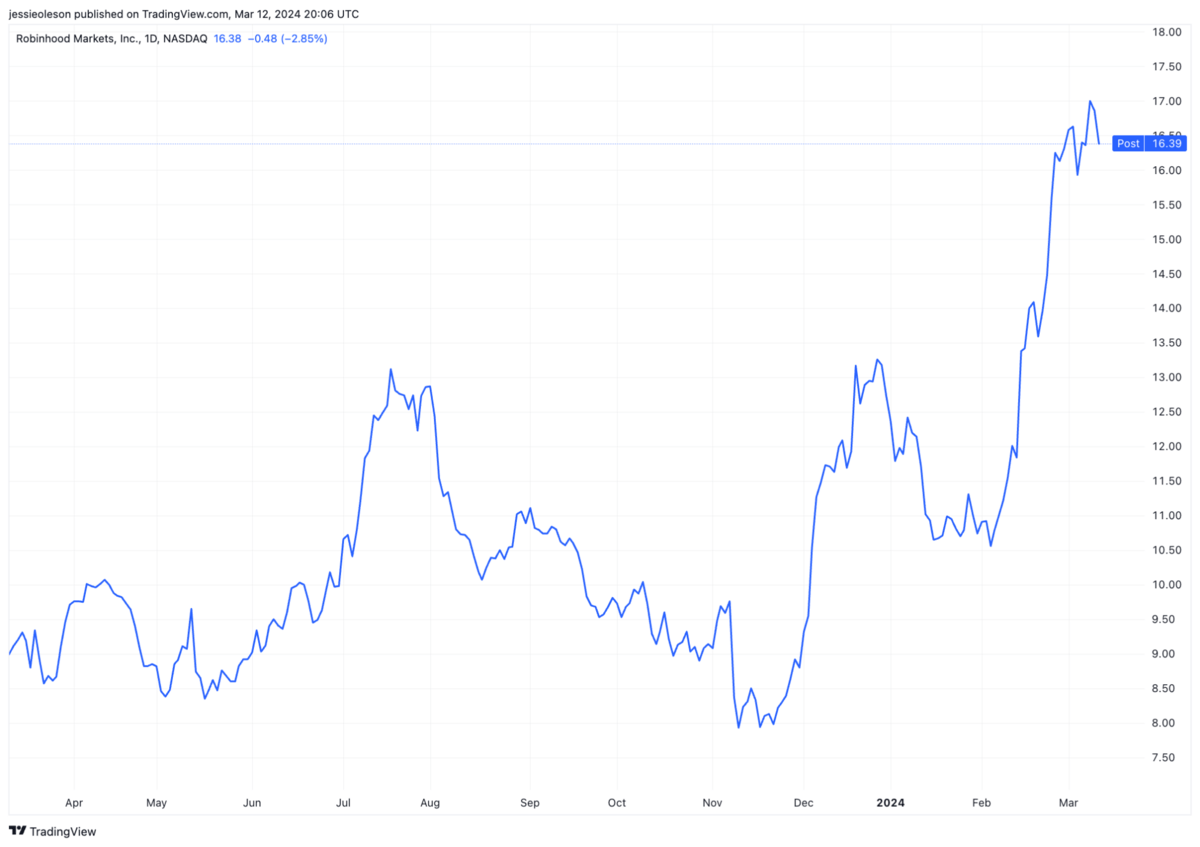

Finally, you could check out some of the other players in the fintech space. For instance, while it’s primarily known as a brokerage, Robinhood (NASDAQ: HOOD) also provides some services that are similar to Chime.

For instance, Robinhood has a debit card and offers a high-APY (5% at writing) cash account for subscribers to its Gold premium subscription.

How to Buy the Chime IPO

Want to wait for the IPO? Here are the steps on how to buy Chime stock when it goes public:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Chime

- Select how many shares you want to buy

- Place your order

- Monitor your trade

Chime Stock Price Chart

Sorry, but there’s no Chime stock price chart. In fact, there’s no stock price at all.

But there are other indicators of how the company’s doing.

First, let’s consider the company’s growth. In 2021, Chime raised $750 million in a funding round — a move that valued the company at about $25 billion. That was a huge jump from its $14.5 billion valuation just one year before.

Then again, the company did lay off a bunch of workers in 2022…

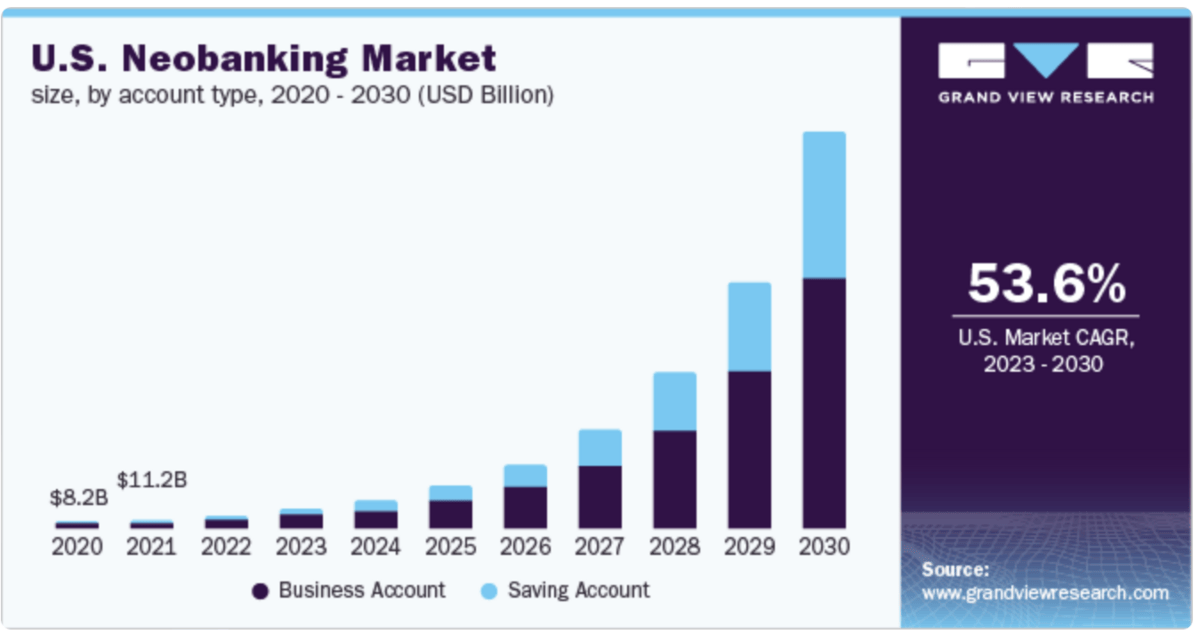

But on the flip side, the neobanking sector is forecast to grow exponentially in the coming years…

The bottom line? If Chime sounds of interest and you’re a retail investor, you can stay tuned for the IPO, or consider some of the indirect approaches discussed in this article. If you’re an accredited investor, check out Chime on Hiive.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How to buy Chime stock?

Since Chime is a private company, retail investors cannot buy stock shares. However, accredited investors can invest in Chime through Hiive.

How much is Chime stock?

There isn’t a Chime stock price, because the company is currently private.

What is the Chime stock symbol?

Since the company is private, there is no Chime stock symbol at this time.

Who owns Chime stock?

Chime was founded in 2012 by Chris Britt (CEO) and Ryan King (CTO). According to Crunchbase, Chime has 34 investors, including Vantage Legacy Capital and General Atlantic.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.