When balanced appropriately and risks are considered, cryptocurrency can be a great investment that has the potential to provide phenomenal returns.

However, it is relatively new — so your favorite tax software might fall short when it comes to crypto reporting.

Enter crypto tax software, which specializes in taking your (possibly numerous) crypto transactions over the year, calculating your tax bill for your profits (or losses), and then providing a tax form for your use or directly sending the documentation to your main tax preparer (or software).

You might be wondering what the best crypto tax software is and how to get it.

There’s a lot to discuss — keep reading on to find the best crypto tax app to suit your specific needs.

Need a crypto trading platform?

Try eToro.

eToro excels in the crypto space, and not just because it’s easy to use (though yes, it’s got a very user-friendly interface).

It gives you peace of mind with real-time insights and access to crypto market research and news, customized risk management tools, and a high-caliber virtual portfolio to test strategies before you put real money on the line.

eToro is a rare platform in that it easily allows crypto newbies to track and analyze coins without sacrificing more advanced tools for experienced investors.

Did I mention that eToro has all the coins you probably want to trade, from the big guys like BTC and ETH to up-and-comers like ADA and SOL?

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

What’s the Best Crypto Tax App in 2025?

The bottom line: CoinLedger is my top pick for the overall best crypto tax service, but advanced traders and those in other situations may want to look at other options. (We’ll get into that in a bit.)

But it’s not the only option. Here are our top recommendations and reviews of popular services.

The Best Crypto Tax Software: Comparison and Review

Note that these are necessarily in order of recommendation, as each person will have different needs. Please read each summary with your factors and goals in mind.

1. CoinLedger

- Overall rating: ⭐⭐⭐⭐⭐

- Key features: Most Tax Software Connections; Ease-of-use; NFT and DeFi support

- Tax software integrations: TurboTax, TaxAct, H&R Block, Taxslayer

- Cost: Free to start, but downloading tax forms starts at $49 per year

I’m not necessarily one to pick general favorites, but CoinLedger beats out the rest of the competition for most crypto traders. It focuses on simplicity, reducing the user’s tax bill, and providing a wide array of integrations with popular software.

Importing all your transactions is typically easy and will take a few minutes. It will also track crypto losses, potentially allowing you to pay less with tax loss harvesting. You can also work with a professional through them if you need more specialized help.

Think of it as having almost everything a crypto trader might need, if not the highest-shelf option. Yet having everything in one place is a premium all in itself.

It’s not perfect for everyone, though. If I’m making a crypto tax software comparison, advanced traders who use DeFi applications or trade extremely frequently may want to consider more specialist or advanced tax software.

Pros | Cons |

NFT and DeFi support | Moderately expensive |

Free portfolio tracking | US-centric, despite international options |

Tax loss harvesting and tax reduction features | Highly advanced traders might find limitations |

Easy to use, with strong support options |

Knowledge is power!

If you’re just getting started in crypto, be sure to check out Skillshare’s low-cost course “Demystifying Cryptocurrency: Understanding Bitcoin and Beyond.” Bone up on the basics before you start putting money on the line!

2. Koinly

- Overall rating: ⭐⭐⭐⭐

- Key features: 350+ supported wallets/exchanges; comprehensive reporting, strong international support

- Tax software integrations: TurboTax, TaxAct

- Cost: Free (no tax reports); $49-$179 per year (includes tax reports and custom file importing)

Koinly is a crypto tax service that offers heavy support among service and transaction types, and there are also plenty of different types of tax reports available, for whatever is needed.

For many, the number of international options and tax reports will be the main draw, given that crypto trading is truly an international practice.

It integrates with most of the popular exchanges and wallets. While there were a few reports of difficulties with uploading or inputting a transaction history, these were in the minority.

Much like some other popular options, specialized traders (unless they’re international) might want to look at a more specialized piece of tax software. However, the general crypto trader will find a great fit with Koinly.

Pros | Cons |

Simplification and redundancy removal features | Some users report input or transaction history import errors |

Localized tax reports for 20+ countries; generalized reports for 100+ | No reports available in the free plan |

More affordable than many competitors | Lack of highly advanced options and features |

3. TokenTax

- Overall rating: ⭐⭐⭐

- Key features: tax expert support; margin trading features; supports every crypto exchange

- Tax software integrations: TurboTax

- Cost: $65+ per year

TokenTax is a premium option for traders who want a premium experience. It offers support for most, if not all, exchanges, potential direct support from tax professionals, and features you wouldn’t find elsewhere.

This comes at a price, and pound-for-pound TokenTax is the most expensive service I could find. Whatever you want from it, you can find a better deal elsewhere.

That said, I can find a few faults with the service itself. It will make tax preparation relatively easy. It works internationally and is secure. You can get tax loss harvesting and margin trading support.

TakenTax might not be the best option for the average trader, but it can work for advanced or wealthier traders who want more support and are willing to pay for it.

Pros | Cons |

Either API or CSV support for every exchange | Coinbase is the only API connection |

(Expensive) option to work with a tax expert for your crypto taxes | Expensive, with no free trial option |

Tax loss harvesting and margin trading support | TurboTax is the only integrated tax platform |

4. ZenLedger

- Overall rating: ⭐⭐⭐⭐

- Key features: Grand Unified Accounting; strong customer service; many supported integrations

- Tax software integrations: TurboTax

- Cost: Free; $49 – $999 per year

A leader in the industry, ZenLedger is likely one of the options you’ve heard of already.

It has free services if you’ve made less than 25 trades in a year. Though at that level, you might not need specialized software. Plans increase in price with the number of transactions.

The $149/year premium plan and up gets you access to DeFi, staking, and margin trading support. The $999 platinum plan gets you two hours of premium customer support on top of unlimited transactions.

It supports 400+ wallets and exchanges, and has tax-pro-prepared plans, though these are very expensive and not the best option.

Grand Unified Accounting (a full summary of all transactions and tax liability) also is offered with its standard plans, which other major crypto tax software options do not have.

However, being an industry leader, it thinks it can charge more (and does). Compared to other plans with similar offerings and opportunities, it’s more expensive.

Pros | Cons |

Grand Unified Accounting | Some potentially essential features are behind expensive plans |

Supports all crypto exchanges and wallets, though potentially by CSV | The only tax platform integration is TurboTax |

Option to work with a tax professional | Expensive for what’s offered |

Superior customer service |

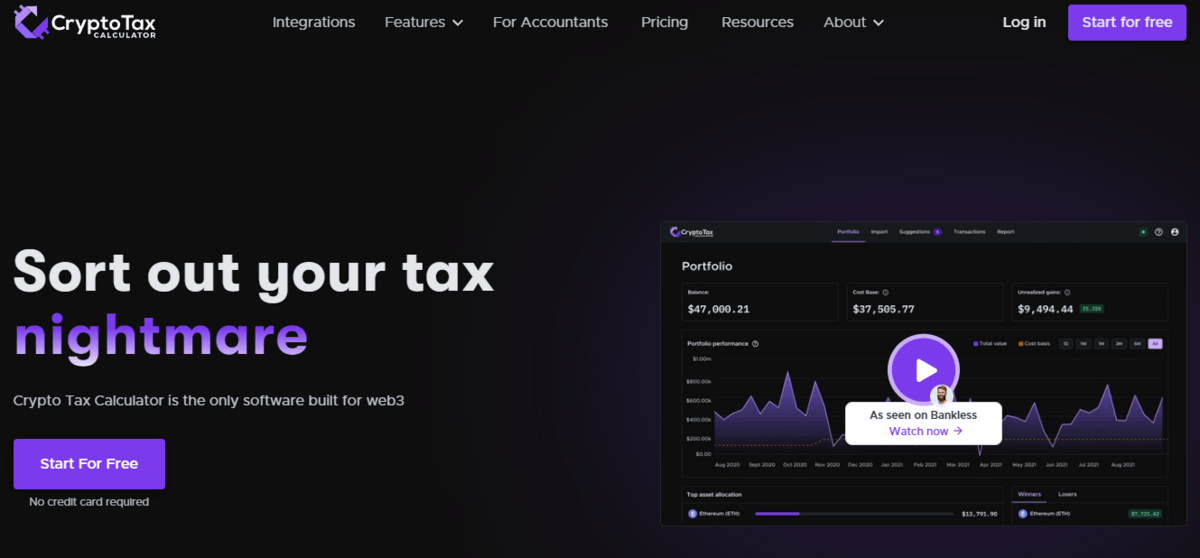

5. CryptoTaxCalculator

- Overall rating: ⭐⭐⭐⭐

- Key features: transaction auto-categorization algorithm; many integrations; DeFi and NFT support

- Tax software integrations: TurboTax

- Cost: Free to Start, $49+ per year for tax reporting

One might take pause at the fact that they call their customers “degens,” but don’t let that distract you from the fact that CryptoTaxCalculator is one of the most popular tools of its kind and an affordable option for extremely frequent traders.

And if its branding indicates it’s a tool for those who love all things crypto, its features back that up. They support nearly 3,000 integrations as of this writing.

It supports both NFT and DeFi transactions, and you can find support for nearly all the major chains and protocols.

The fact that it only directly integrates with TurboTax is a bit of a limitation, but it partially makes up for this by being able to prefill 1040 and 8949 forms for you.

Pros | Cons |

Many crypto-trading enthusiast integrations | Few integrations with popular tax software |

NFT and DeFi Support | Some advanced features locked behind more expensive plans |

More than 150 supported exchanges | Best suited for advanced or frequent traders only |

6. CoinPanda

- Overall rating: ⭐⭐⭐

- Key features: 800+ supported wallets and exchanges; free plan option; NFT support

- Tax software integrations: TurboTax; TaxAct

- Cost: $0 – $941; Depends on the number of transactions

CoinPanda has a lot going for it in terms of breadth and variety, supporting more than 65 countries and more than 800+ exchanges and wallets. You’ll also see many form types supported (including all the usual suspects).

If you’re in a niche aspect of crypto trading, CoinPanda might be your best bet for support. Even if you’re mining, yield farming, or something else, CoinPanda should have you covered.

Concerningly, though, CoinPanda doesn’t have the strongest reputation among its customers. If you look at customer reviews, you’ll find a fair share of people not happy about the customer support they received.

I cannot say conclusively whether this is an issue with the product or customer service, though it is a concerning metric nonetheless.

Pros | Cons |

800+ directly integrated exchanges and wallets | Potential customer service issues |

Free plan for low-frequency traders | Plans typically have lower transaction limits than competitors’ equivalent offerings |

Focused on reducing your tax bill | |

NFT support |

7. TaxBit

- Overall rating: ⭐⭐⭐

- Key features: Free; Automated Tax Forms; Decent Security

- Tax software integrations: TurboTax, TaxAct

- Cost: Free

The main thing to rave about Taxbit is that it’s free. If you are using one of the crypto exchanges within the TaxBit Network, you can get your tax forms for free. It has expanded its free features and offerings over the last year and should meet the needs of any basic trader.

Tax professionals designed Taxbit, and the platform provides real-time reporting, allowing you to get accurate tax information before you file. This can help you with your trading.

Additionally, there is no limit on the number of transactions, giving TaxBit a leg up over the free competition and even some premium options.

However, outside of this, it doesn’t offer as much as its competitors, nor is it significantly easier to use or add anything new.

Compared to previous years, it now works with fewer exchanges and has removed some features, making it less than the best crypto tax calculator.

Pros | Cons |

The free offering is strong for individuals. | Limited information available about the platform |

Easy-to-use | No premium option |

Real-time reporting | Fewer features compared to previous years |

What is Crypto Tax Software (and How Does it Work?)

Crypto tax software is just tax software that specializes in helping crypto traders. Unlike some other institutions, crypto exchanges might not have a requirement to file forms about your activity to your government.

However, it’s still income, and you must report it lest you run into trouble.

In the U.S., this means creating an IRS form 8949 from your records. This process can be messy if you want to do it yourself, especially if you aren’t the best recordkeeper.

Crypto tax software (or at least good crypto tax software) will get information together and help you fill out a form to make reporting your gains or losses from crypto trading easy.

This helps you avoid trouble and get the best return possible, and other tax software may not do this or do it well.

As for how it works, it can vary depending on the tax software. However, it generally compiles data from your exchange, calculates losses or profits, and provides relevant information and forms.

Unfortunately, I can’t give a much more detailed explanation than this due to those differences.

Do I Have to Pay Taxes on Bitcoin + Crypto?

If you made a profit, you need to pay taxes on it. It might be different from stocks or other assets, but in many ways, this is an investment vehicle like anything else and is legally treated as such (the IRS classifies it as property). That’s why it is important to use software and keep records.

Many if not most crypto exchanges report to the IRS. Your transactions can be and often are tracked. For the most part, cryptocurrency assets are subject to capital gains taxes.

Conversely, if you had losses (entirely possible, given how cryptocurrency trading is sometimes), you can claim those on your taxes and get a break. The best crypto tax calculator should help you with this.

Note that the exact amount you would owe on taxes depends on how long you hold onto your assets, with long-term gains typically getting taxed less than short-term gains. In that case, the holders win out.

Is Crypto Tax Software Free?

Typically not, unless it’s included as part of a subscription as part of a larger service.

Many services say they are free, but If it is free, there’s a catch.

If you aren’t the customer, then you are the product. Your information might be at risk, or you’ll find yourself with limited features, subpar service, or an endless array of misleading and potentially dangerous ads.

Many options discussed above are free until a certain point, though this is a way to get you interested. Their goal is to eventually upgrade to a premium plan (which, to be fair, is often perfectly worthwhile).

You want to invest in your time, get the best return possible, and remove stress from tax season. Get paid tax software for cryptocurrency if you’re a frequent trader and looking for the best crypto tax service.

However, if there is a free trial, take advantage of it first. Hands-on experience can help determine if a product is for you.

Still need a platform to trade crypto? Quick reminder: Our top pick is eToro.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Final Word: Crypto Tax Software Comparison

Getting crypto tax software can be a great investment. We recommend it to any serious crypto trader. Yet there’s a vast gulf between good and bad crypto tax software. And even the good, some will better suit you than others.

If you just want to know the best crypto tax software, CoinLedger is probably the answer, and you should go check them out.

However, remember that each trader has different needs; different services and pricing plans will appeal to them most.

Just don’t get caught by analysis paralysis – remember that having ok crypto tax software is miles better than having none. Act today to get yours and prepare for that dreaded tax day.

FAQs:

What is the best tracker for crypto taxes?

For general purposes, Coinledger is the best tracker for the average cryptocurrency trader. It also is among the easier-to-use options, making it great for the non tech- or tax-savvy.

However, your answer may vary depending on your situation, so do additional research.

How do I keep track of crypto taxes?

Some exchanges, brokers, and accounts can keep track of crypto taxes for you. More private trades will require you to keep a log of your transactions.

You’ll want to keep the asset names, dates, transaction type, number of units transferred, transaction value, additional statements, and other relevant information on hand.

Can TurboTax do crypto taxes?

Yes, TurboTax can do crypto taxes, though it might feel clunky and hard to work with compared to other tax problems specially designed around cryptocurrency. If you’re a heavy cryptocurrency trader, seek more specialized help.

Is Koinly the best crypto tax software?

Whether or not Koinly is the best crypto tax software is a matter of subjective opinion based on what you do, how much you trade, and the features you prioritize most. Many will swear by Koinly, while others will prefer another option.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.