In 2019, roughly 4% of Canadians indicated owning or using cryptocurrencies. Just four years later, in 2023, that rate had grown to 13%.

Want to join them? If you want to trade crypto, you need an exchange.

The problem? Some exchanges are untrustworthy or potentially downright criminal.

Calling it the “Wild West” may be hyperbolic, but the crypto space still possesses its fair share of questionable players. While the sector remains exciting and potentially lucrative, avoiding stepping on landmines as you navigate this still-burgeoning industry is critical.

So, what’s the best crypto exchange, Canada? Or, more importantly, what’s the best Canadian crypto exchange for you? In this article, we’ll explore just that.

Safety first: the safest and best crypto exchange Canada has to offer…

Crypto is volatile and can be risky. Wealthsimple recognizes that and does all it can to keep you safe.

In addition to $0 account minimums and extensive educational resources, the platform offers top-notch safety features. The platform even offers hacker bounties for identifying security flaws in their system! That’s peace of mind.

Best Crypto Exchange Canada: Top 5 Picks

Let’s dive in!

We scoured the competition to determine the best crypto exchange, Canada! We analyzed firms based on numerous criteria, including:

- Customer Service: Quality customer service is not a given. Anytime hype hits an industry; you can count on several opportunistic businesses to form quickly. We scoured the various options to ensure only those with exceptional customer service are recommended.

- Trading Features: Not all crypto exchanges are created equal. Ideally, the platform you decide upon has a variety of cryptocurrencies that can be traded. Some platforms even include advanced trading features, like more sophisticated trade order types.

- Fees: The costs to trade on platforms vary, so it’s critical to understand not only the costs you’ll potentially incur but the value you’ll receive for the cost.

- Educational Resources: Some of the best platforms include a vast library of resources to help level up your cryptocurrency trading understanding. Don’t discount the value these resources can have.

Keep your crypto safe…

With online crypto hacks happening on the regular, many investors prefer to keep their crypto safe and sound in a hardware wallet.

SecuX is a leader in crypto storage. The company is known for its security measures — notably, the Flash CC EAL5+ Secure Element chip that comes with most wallets in their lineup, a feature that helps protect your private key from potential threats.

1. Wealthsimple

- Overall rating: 5

- # of tradable coins: 57

- Minimums + fees: $0 account minimum

Tier | Asset Minimum | Management Fees | Crypto Trading Fees |

Core | $1 | 0.5% management fees on managed investment accounts | 1.5% – 2% |

Premium | $100,000 | 0.4% management fees on managed investment accounts | 1.5% – 2% |

Generation | $500,000 | 0.2%-0.4% management fees on managed investment accounts | 1.5% – 2% |

What makes it great is peace of mind; Wealthsimple is a trusted platform with an extensive user base protected by the Canada Deposit Insurance Corporation (CDIC) and the Canadian Investor Protection Fund (CIPF).

Wealthsimple is one of the most reputable crypto exchanges for Canadian investors. The platform, nearly a decade old now, was trusted with over $15 billion in assets under management as of November 2021.

All of Wealthsimple’s assets are held by Gemini Trust Company LLC. Gemini is one of the largest regulated crypto custodians globally. It’s also insured for $200 million on assets held in cold storage.

Moreover, with Wealthsimple, your assets are covered by Coincover’s crypto insurance, your data is encrypted, and your accounts can be accessed using two-factor authentication (2FA).

If that weren’t enough, Wealthsimple even offers white-hat hackers bounties for identifying security flaws in their system! Like a crypto Fort Knox!

Pros | Cons |

No account minimum ($0) | If used for stock trading, real-time pricing requires a $3 per month subscription |

Exceptional security and safety | |

Extensive educational resources |

2. Kraken

- Overall rating: 3

- # of tradable coins: 220

- Minimums + fees: $1 account minimum

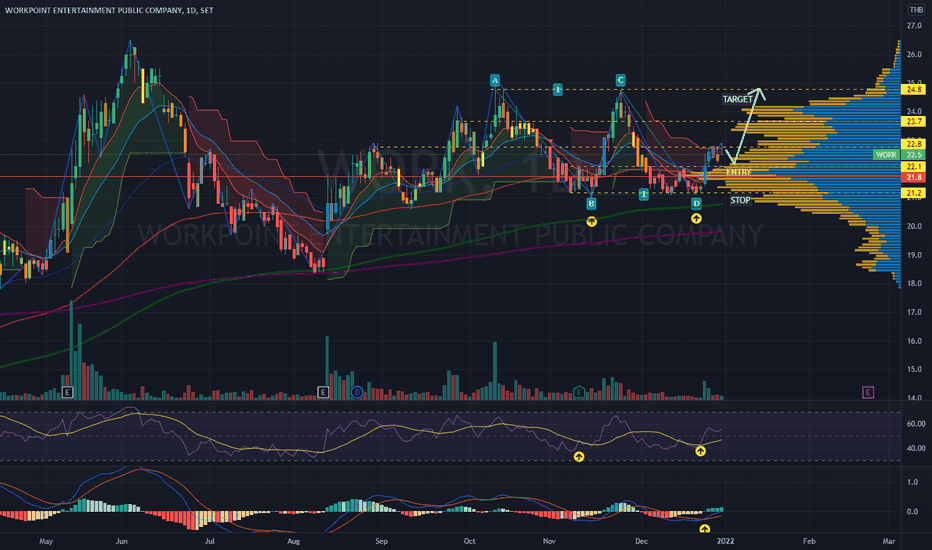

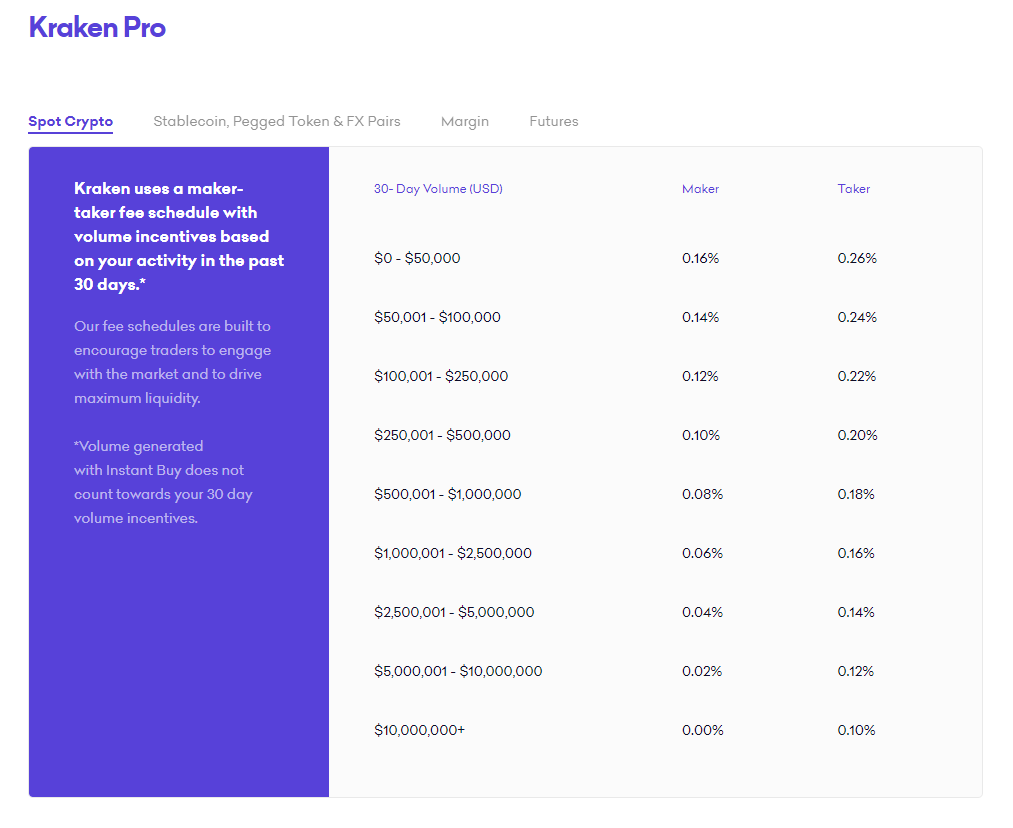

There are a few different levels on Kraken:

- Beginner tier (Instant Buy): 0.9% flat fee for stablecoins and 1.5% flat fee for all other cryptocurrencies.

- Advanced tier (Kraken Pro): Kraken Pro uses a maker-taker fee schedule, with rates dropping as you climb their nine individual tiers grouped by prior 30-day volume in USD.

- Maker fees start at 0.16% for volume up to $50,000, dropping to 0.00% for $10m+ in volume.

- Taker fees start at 0.26% for volume up to $50,000, dropping to 0.10% for $10m+ in volume.

What makes it great: Kraken excels as an advanced-crypto trader platform with a long history of exceptional customer service.

Kraken has stood the test of time, relatively speaking. As one of the oldest crypto exchanges — established just two years after Bitcoin’s inception — Kraken has thrived with a loyal customer base.

Kraken offers an excellent solution for advanced crypto traders at competitive pricing. The platform includes advanced trading features, like futures trading and margin trading, allowing for more sophisticated investment strategies.

The platform offers a wide selection of tradable coins, a user-friendly interface, and impressive customer support.

Kraken’s transparent fee structure and substantiation educational library make this platform an excellent choice for many investors.

That said, while it’s great for active and savvy crypto traders, for beginners, the platform is priced a bit high.

Pros | Cons |

Hundreds of tradable coins | Uncompetitive fees on Instant Buy, Kraken’s beginner trading platform |

Great for advanced traders looking to leverage the sophisticated platform | |

Good customer service |

Quick side note … Are you an accredited investor? Great news — there are all sorts of cool opportunities available to you.

One of the coolest ones? You can invest in pre-IPO companies by funding employee stock options through platforms like Equitybee.

Kraken just so happens to be one of those companies.

If you’re an accredited investor and interested in gaining crypto exposure in a different way than buying and selling coins, Equitybee could provide a very appealing investment opportunity.

Plus, be sure to check out our article about the best investments for accredited investors.

3. Crypto.com

- Overall rating: 3

- # of tradable coins: 250+

- Minimums + fees: $1 account minimum

Crypto.com applies separate fees for makers and takers and reduces fees as the 30-day trading volume rises.

- Maker Fees: Start at 0.0750% for under USD 250,000 of 30-day trading volume, rising to 0.0% for trading volume exceeding $10m.

- Taker Fees: Start at 0.0750% for under USD 250,000 of 30-day trading volume, rising to 0.0500% for trading volume exceeding $10m.

What makes it great: Aside from having one of the best domain names, crypto.com is an excellent platform for traders looking for a vast library of tradable coins coupled with advanced features like staking, NFTs, and more.

Crypto.com boasts a large selection of crypto-related products, making it an excellent option for crypto enthusiasts. Its over 250 tradeable coins mean you’ll have access to one of the largest repositories of cryptocurrencies available on any exchange.

Its 80 million global users also place crypto.com among one of the most popular exchanges in the world.

Crypto.com’s partnerships with numerous liquidity providers and exchanges mean the platform benefits from greater relative liquidity compared to many competitors.

Like Kraken, crypto.com has advanced trading features, like margin trading.

The platform also enjoys a substantial and active community via its social media channels.

The platform also boats certain unique features and services, including:

- Crypto wallets

- Visa debit card that allows users to spend their crypto balances

- Accounts that earn interest

- Decentralized finance (DeFi) capabilities

Pros | Cons |

Transparent fees | Higher fees unless you hold a substantial amount of CRO currency |

Advanced trading options | Unimpressive customer service |

Supports over 250 coins |

Knowledge is power!

If you want to increase your money-making potential in the fast-moving world of crypto, you’ve got to understand the basics. Check out these Udemy courses to expand your knowledge:

4. Gemini

- Overall rating: 4

- # of tradable coins: 100+

- Minimums + fees: $0 account minimum + a fixed fee for trades under $200 or 1.49% for trades exceeding $200

What makes it great: While the fees can be on the higher side, Gemini is still an excellent platform for beginners and boasts the ability to earn interest on stored cryptocurrency.

Gemini’s history goes back to 2014, when the Winklevoss twins of Facebook fame founded the platform. The crypto exchange has carved out a reputation as a simple, secure, transparent platform.

Gemini was the first crypto exchange to obtain the coveted SOC 2 certification, further entrenching the platform’s security and regulatory compliance.

Gemini was also one of the first crypto exchanges to be regulated as a trust. This means it must adhere to rigorous regulatory requirements.

The exchange complies with strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, further protecting its assets and clients.

As a bonus, the exchange also offers insurance coverage on the digital assets held in their custody.

Pros | Cons |

Ability to earn interest on stored crypto | High fees |

Secure, transparent, and compliant | |

Excellent user interface |

5. Bitbuy

- Overall rating: 3

- # of tradable coins: 23

- Minimums + fees: $50 minimum account balance + trading fees ranging from 2.00% to 0.15%.

What makes it great: This audited crypto exchange is registered with Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and offers investors a platform to quickly deposit Canadian dollars for investment in crypto assets, like Bitcoin.

Bitbuy is one of the largest crypto platforms operating in Canada. With a ten-year history, Bitbuy has laid a trusted foundation within the Canadian crypto space.

While its selection of tradable coins is limited compared to some competitors, its convenient funding options and excellent customer service justify including the platform on our list.

The platform is often cited for its ease of use, making it an excellent choice for beginners.

Bitbuy also includes an OTC desk which might be attractive to more active traders and institutional investors looking to engage in large-volume trades.

Most of Bitbuy’s crypto assets are held within cold storage, helping ensure your balance is kept safe. The platform also leverages 2FA for added security.

A reputation for responding to emails within 12 hours or less also helps this Canadian crypto exchange stick out.

Pros | Cons |

Easily fund the account with Canadian dollars through wire transfers or Interac | The relatively low number of tradable coins |

Decades-long track record | |

Excellent customer service |

What is a Canadian Crypto Exchange?

A Canadian crypto exchange is simply a cryptocurrency exchange firm based in Canada intended for Canadian investors.

It’s like a stock exchange where you can buy and sell cryptocurrencies, like Bitcoin, from your personal trading account.

Canadian crypto exchanges generally accept Canadian dollars for deposit, but sometimes other global fiat currencies can be used.

Canadian crypto exchanges often offer more than traditional buying and selling of digital currency. Some allow margin accounts permitting investors to borrow funds for investment. Other Canadian crypto exchanges offer derivative trading, like buying and selling cryptocurrency futures contracts.

Canadian Crypto Exchange Fees

Trading Fees

Exchanges typically charge a flat rate percentage on the crypto value being bought or sold. While some platforms may claim zero fees, in reality, they usually take an indirect fee by charging a spread, the difference between the price charged to the buyer and seller in a transaction.

In many cases, the cost of spreads can exceed a typical flat rate percentage.

Withdrawal Fees

Like in other countries, many exchanges will charge a fee to withdraw funds from the platform in Canada. Cryptocurrency platforms’ withdrawal fees can vary substantially.

If you expect to be engaging in frequent withdrawals, this is an important factor to consider.

Miscellaneous Fees

- You might also encounter fees for margin trading (i.e., the cost to borrow funds from the exchange).

- Some platforms charge fees for specific features, like the ability to execute trades quicker.

- Other fees may include additional charges for using a credit or debit card.

If you want to trade crypto, you need a place to store it. Hands down, SecuX makes our favorite hardware wallets.

There’s a reason why SecuX products have such great reviews. Their wallets are loaded with premium features, like QR code support, a simple USB connection port, EAL5+ security — and they support 1000+ cryptocurrencies. Plus, they’re good-looking.

If you want to keep your crypto safe and look good while doing it, SecuX is the perfect fit.

Final Word: Best Canadian Crypto Exchange

Canada’s evolving crypto sector means investors have a growing number of options for trading digital currencies. Of course, with any space undergoing a lot of hype, crypto has seen some less-desirable actors crash the party.

Luckily, we’ve done the legwork and determined some of the best exchanges Canadian investors should consider.

Whether you’re looking to make a small initial allocation to Bitcoin or you’re looking to engage in more sophisticated crypto trading strategies, Canada’s market now has something for everyone.

FAQs:

What is the best crypto exchange in Canada?

The best crypto exchange in Canada, in our opinion, is Wealthsimple. It strikes the best balance between trustworthiness, competitive fee structures, safety, and user experience.

Which crypto exchanges are available in Canada?

There are numerous crypto exchanges available in Canada, like Wealthsimple, Kraken, crypto.com, Gemini, and Bitbuy.

What is the most reliable crypto exchange?

Wealthsimple is considered one of the most reliable crypto exchanges. It boasted a track record spanning nearly a decade and held $15 billion in assets under management as of November 2021.

Are Canadian Bitcoin exchanges the same as Canadian cryptocurrency exchanges?

Yes, people will often use “Canadian bitcoin exchange” interchangeably with “Canadian cryptocurrency exchange.”

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.