I often get asked by users of our stock research tool: what is a good ROE? And why should I care?

A consistent return on equity (ROE) of 20% or higher is considered a good ROE.

However, there are some caveats, which I’ll dive into shortly.

Return on equity is so one of the crucial elements that play into our Zen Ratings system, which evaluates 115 factors proven to drive consistent, stable growth in stocks. You can see each stock’s Zen Rating on its individual ticker page, as well as scores for each of the seven components that play into the grade.

But I digress. Back to ROE!

In this article, you’ll learn:

- Why Warren Buffett called ROE his “most important number”

- What is ROE?

- Why 20%+ is a good ROE

- Some pitfalls associated with the ROE metric

- How WallStreetZen helps you can quickly screen for stocks with a good ROE

Long story short: Fundamental analysis will help you determine which stocks are currently undervalued and will increase in value in the future.

WallStreetZen is built to help long-term, fundamental investors find hidden investing opportunities, even if you don’t have a finance degree.

Start a 14-day trial of WallStreetZen Premium for just $1 with the link below:

Why should you care whether a stock has a good ROE?

In his famous letters to Berkshire Hathaway shareholders, Warren Buffett has consistently emphasized the importance of return on equity (ROE).

It’s the most important numbers he looks at when evaluating a company.

Why is it important to him? In his own words:

“If you earn high enough returns on equity and you can keep employing more of that equity at the same rate — that’s also difficult to do — you know, the world compounds very fast.”

Warren Buffett

A big part of Warren’s genius is his ability to identify stable, predictable businesses with long histories of producing above average returns on equity.

Identifying and holding these companies with exceptional returns is how Warren has managed to slowly and steadily become the most successful investor of all time.

Let’s take a closer look at return on equity and how you can use it in your own stock analysis.

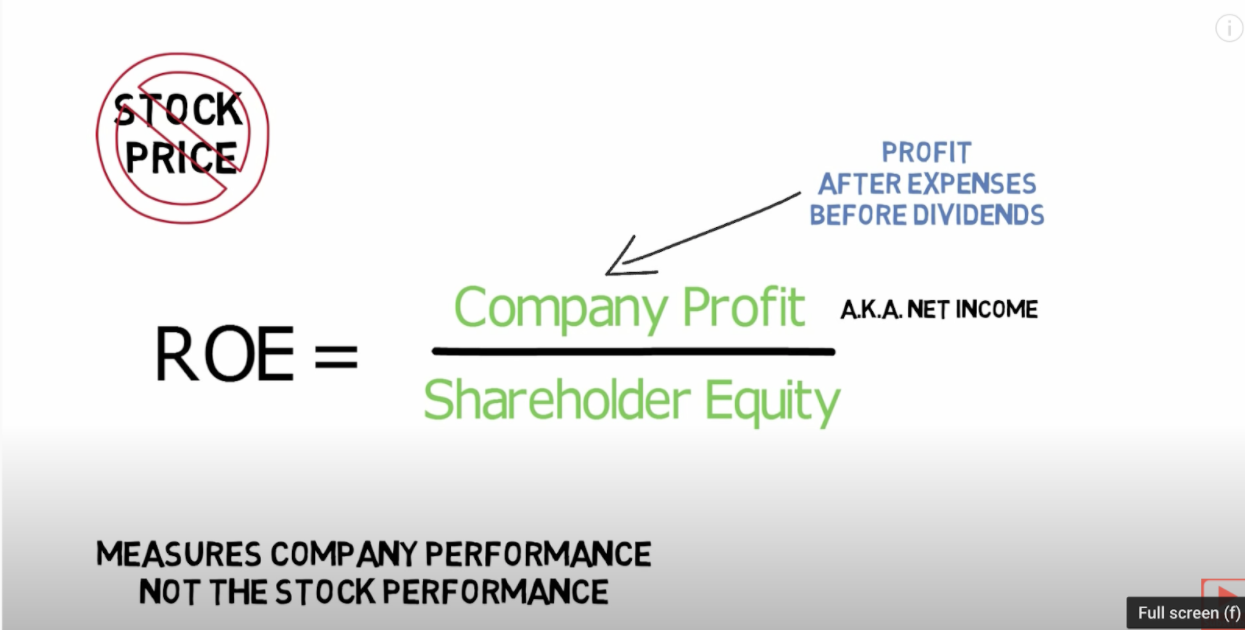

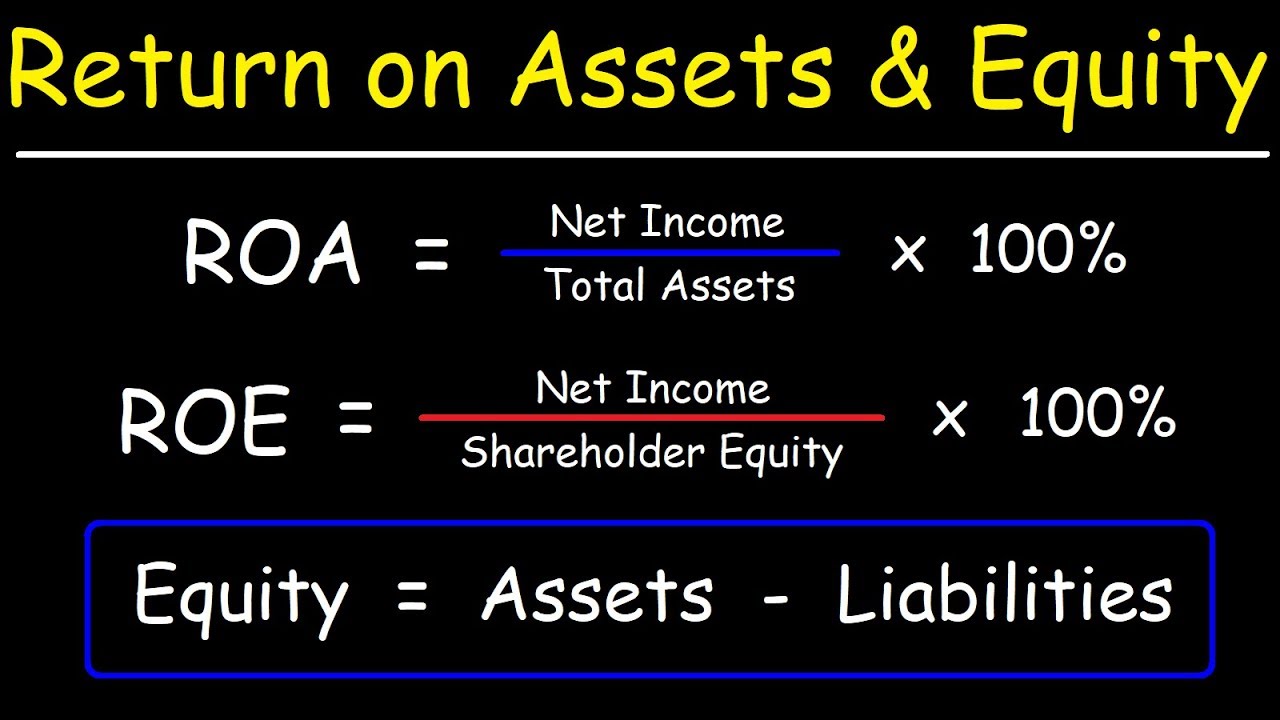

How To Calculate ROE

This is the ROE formula:

Net income / Shareholder Equity

Great, but what does this actually mean?

What is ROE (return on equity)?

Return on equity (ROE) is a measure of the company’s ability to generate profits for shareholders.

This is not the same as your “return” on investment based on stock price.

The stock price reflects your return based on what the market thinks about the value of the company, while the return on equity actually measures the performance of the company directly.

If a company’s stock price tumbles but its ROE stays constant, or even grows – it can potentially be a sign the company is undervalued.

ROE is important because it directly tracks the profits generated by the company on your shares.

It’s right there in the name:

- Return = the profits generated by the company

- on = divided by

- equity = your share of the company!

A high return on equity (20%+), generated consistently for many years – is often the sign of an exceptional company run by a great manager, operating a great business with an economic moat.

Successful companies have to constantly be looking at new ways to reinvest earnings profitably.

If they don’t increase earnings proportionally to their equity, ROE will go down.

So a company that has a consistent, or even growing RoE over many years – is a company where management is consistently finding effective ways to generate more profit on the earnings they generate.

It’s the sign of a good, long-term manager in a business with a durable competitive advantage.

So what is a good return on equity ratio?

What is a good ROE?

A return on equity (ROE) of 20+% is considered good, 30% ROE is considered exceptional.

You can use WallStreetZen’s stock screener to find companies with good ROE, or even exceptional ROE.

In his 1987 letter to Berkshire Hathaway shareholders, Warren quoted a study by Fortune magazine where Fortune looked at 1000 of the largest stocks in the US and found that:

Only 6 of the 1000 companies averaged over 30% ROE over the previous decade (1977-1986)

- Only 25 of the 1000 companies averaged over 20% ROE and had no single year lower than 15% ROE

- These 25 “business superstars were also stock market superstars” as 24 out of 25 outperformed the S&P 500 during the 1977-1986 period.

If you go to Wall Street Zen, you can see we have a due diligence check to see if the company’s ROE is over 20%.

This quickly tells you if a company is highly efficient at transforming shareholder equity into returns.

Average ROE by Industry

ROE is not only useful for assessing the profitability of individual companies, but it’s useful for assessing industries, too.

You can use WallStreetZen to see the average ROE of any stock market sector, or stock market industry.

Pros and Cons Of Return on Equity (ROE)

Return on equity (ROE) may be one of Warren Buffett’s most important financial ratios, but that doesn’t mean it’s perfect.

You should never use a single financial ratio to decide whether to buy or sell a stock. This rule applies to ROE as well.

(Read this article to learn how to know what stocks to buy.)

Understanding the strengths and weaknesses of ROE helps you use it correctly as a tool in evaluating stocks.

Pros of ROE

Here are some of the reasons return on equity is a good metric to look at.

ROE surfaces quality companies with good management

A high RoE does not mean that much if looked at as a snapshot in time.

You need to see consistently high ROE over many years to be able to use it as a gauge of management’s performance.

Exceptionally well managed companies demonstrate a high ROE, year over year, decade over decade. A good ROE is a sign of strong capital allocation, effective use of leverage, and an economic moat.

A manager can improve ROE by generating more profit with fewer assets, increasing profit margin, or effectively using leverage – all of which get captured in the ROE metric.

As a company generates earnings, those earnings are retained in the company and it increases shareholder equity. Thus it actually gets more difficult for mediocre companies to sustain ROE over time.

Keeping ROE steady or even increasing over many years is no small feat, and those companies that can achieve this are exceptionally well run companies able to consistently find opportunities to generate shareholder wealth.

ROE gives us a consistent way to compare companies

Out of all the profitability ratios, ROE most directly measures shareholder returns. While earnings can vary across sectors and industries, ROE makes it easy to directly compare earnings across sectors.

💡 On WallStreetZen, you can quickly see the average ROE across stock market sectors.

ROE helps us quickly screen out companies that are not generating returns for us, the shareholders.

Cons of ROE

While we’ve looked at some of the advantages of using ROE, let’s dive into some of the disadvantages:

Debt can heavily skew ROE

ROE can be artificially inflated by the use of debt.

This is because shareholder equity (ROE’s denominator) and debt are connected.

If you increase debt, equity decreases. And if the denominator decreases, the ROE formula produces a higher ROE.

Because equity = assets – liabilities, a company can actually increase ROE simply by taking on more debt!

That’s why it’s important to watch ROE over many years – a company that increases ROE by taking on debt may inflate ROE in the short term, but if it cannot effectively generate return from that debt, in the long term its ROE will suffer.

This is also why it’s important to look at metrics holistically – in this case, looking at debt to equity (D/E) and the company’s balance sheet alongside ROE can also help investors identify cases where high use of leverage is inflating ROE.

If you’re screening for high ROE companies, you may want to screen out companies with high D/E as well.

👉 Here is a link to a screener where you can screen for companies with high ROE, AND a reasonable Debt to equity ratio.

Another way you can quickly sanity check the RoE number is by looking at Return on Assets – which doesn’t include debt in the denominator – if you see a company with a good ROE but poor ROA, might be another sign company is drowning in debt.

ROE Is Not Effective For Growth Companies

Like all ratios that rely on earnings (P/E most famously), ROE cannot effectively measure loss-making companies. This rules out most growth companies.

Generally, ROE is better for evaluating stable, mature companies.

ROE is Subject to Earnings Manipulation

Earnings can be misleading. Whether intentionally or unintentionally, companies can paint a better picture by using accounting tricks to paint a rosier picture.

This is again why it’s important to analyze ROE over many years, and also combine quantitative indicators with a qualitative analysis of the business.

Past earnings is not a sign of future earnings.

How to Use ROE In Your Stock Analysis

Profitability ratios like ROE are a great way to screen for well-managed companies that are producing returns for you, the shareholder!

While there are some downsides to the ratio, like with all financial ratios, they are not magic – they are tools you can use to better understand a company.

And while ROE is a great metric for assessing a company’s efficiency at generating profits based on shareholder’s equity, if this efficiency is already baked into the price – the stock may not necessarily be good value.

A high ROE may help you identify a quality company, but you need to look at valuation metrics to determine whether or not it is at a fair price.

Here at WallStreetZen, we created Zen Score to try to make it as easy as possible for you to do fundamental analysis across all important aspects of a stock, so you can focus your time and energy on understanding the companies you invest in, rather than hunting for data and messing around with spreadsheets.

💡 Click here to sign up for a 14-day trial today, and see how WallStreetZen makes data-informed investing easier for part-time investors like you and me.

Interested in getting high-quality stocks picks delivered straight to your inbox? Read this review of the best investment newsletters in 2025.

Read more: What is a Good P/E Ratio?

FAQs:

Is a 20% ROE good?

A 20% ROE that is sustained for multiple years is usually a sign of a very strong company.

What is a too high ROE?

Technically, there's no such thing as a too high ROE. But if a company has a very high ROE, it was likely caused by abnormal circumstances - you should expect it to come back in to a normal range.

A company with a 20% ROE sustained for 10 years is better than a company with a 60% ROE for 1 year.

Is 10% a good ROE?

A 10% ROE is not great, though there may be external factors dragging it down and the underlying business might be better than the ROE indicates.

What is a good ROE for a business?

Any ROE of 20% or more is considered good, while a 30%+ ROE is considered exceptional.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.

![10 Investments That Earn A High Return [10% ROI or more]](https://www.wallstreetzen.com/blog/wp-content/uploads/2022/10/10-Investments-That-Earn-A-High-Return-10-ROI-or-more-scaled-e1666197396945.jpg)