Are you familiar with James Simons? He built one of the most successful hedge funds of the past decade, Renaissance Technologies, by specializing in algo trading based on math models.

Yes, Simons is a math whiz. (He was a tenured math professor prior to becoming a Wall Street legend.) But happily, you don’t need years of quantitative experience to succeed with algorithmic trading.

Thanks to a host of trading tools and platforms, many of the rigorous mathematical algorithms are pre-coded, allowing you to use them as you see fit.

But let’s back up. What is algorithmic trading? How does it work? What are trading algorithms?

You’re in the right place. In this article, we’ll cover:

- What is algorithmic trading, and how can you potentially make money?

- Types of algorithmic trading and stock market algorithm examples

- Benefits and limitations of using trading algorithms

- How to get started with algo trading

- And more.

Let’s talk algos.

What is Algorithmic Trading?

Algorithmic trading is rule-based trading. Typically, it refers to automated trades made on your behalf, which are executed according to specific criteria.

Algorithmic trading programs contain defined instructions that you’ll have set up before trading.

For example, you could create a trading algorithm that buys the S&P 500 index every time it drops 10% from a recent high and then automatically closes the trade when it reaches your profit target.

While this is a simple example, the power of algorithmic trading lies in its speed, scalability, and uptime. You could use the strategy across thousands of stock tickers, run it while you sleep, or trade smaller time frames (think 1 minute) where speed is paramount.

One of the best parts? Once you create the algorithm, it’s a fairly passive method of trading.

Need to hone your coding skills?

While many programs can help with pre-coding algorithms, your odds of success are far higher if you understand coding basics.

Skillshare is an educational hub that’s loaded with courses on coding — including Coding 101: Python for Beginners, a course that guides you from the basics to more advanced coding strategies with one of the most popular programs for creating trading algorithms.

Plus, you can get started with Skillshare for FREE! Check out the catalog now.

Can you Make Money with Algorithmic Trading?

It’s possible to make money with algorithmic trading, but it’s not a golden goose.

Algorithmic trading is just a way for you to automate the trading process, so the algorithm you use must have an edge.

Many traders also run into issues with input optimization (such as choosing the period of a moving average). They over-optimize their strategies and subsequently curve fit their strategy to past history, meaning it’s not a strategy that will work live.

There are also issues to consider such as technical errors, coding bugs, and WiFi issues.

These can all turn an otherwise profitable strategy into one that drains your trading balance so it’s vital that you plan for them if you want to trade this way.

How to Get Started With Algorithmic Trading

While there are tools and platforms that can speed up your algo trading journey, getting started still requires a hefty dose of self-study and preparation.

Here’s a potential plan for you to follow:

1. Learn About Financial Markets

Unless you’ve already been trading for a while, it’s a good idea to start by learning the fundamentals of financial markets.

Learn about the markets you want to trade — stocks, bonds, commodities, forex, options, or a combo. You want to understand how these markets operate and the factors that influence price movement in your chosen markets.

For example, stocks tend to revert to the mean after a large move while interest rate futures tend to trend for a long time due to global monetary policies.

Skillshare’s Stock Market Fundamentals course is a great place to learn the ropes. Instructor Zac Hartley, a seasoned investor and financial YouTuber, promises that he will “ teach you everything you need to know in order to feel confident making your first investments in the stock market” — a lofty goal, but he delivers on this promise with 70 (yes, 70) lessons that start with foundational lessons and progress to advanced techniques for choosing investments, including how to decipher company financial statements and more.

Best of all, Skillshare has a promo where you can try it out for 1 month for free — so you don’t even have to invest right away to learn about investing!

2. Build a Solid Foundation in Finance

Next on the list is to build your specialized finance knowledge that will set the foundation for successful strategies.

Some of the topics you should cover include:

- Risk and portfolio management.

- Technical and fundamental analysis.

- The Efficient Market Hypothesis.

- Macro- and microeconomics.

- Diversification.

Depending on how you like to study, you can enroll in a formal university program, take a course on a platform like Skillshare, or self-study using textbooks.

The Stock Market Fundamentals course I mentioned above will cover a lot of what you need to know about financial markets. There are also a variety of other courses that might be of interest too depending on your area of interest, including:

Learning about a variety of different financial topics and markets can help give you direction as you dive deeper into creating trading algorithms.

Another way to learn about the financial markets and what makes stocks tick is to sign up for a stock research/picking service like Seeking Alpha. Since its inception in 2004, Seeking Alpha has become one of the most popular stock research websites in the world with more than 20 million visits per month.

Not only do you get well-researched stock picks, but you also get regular market updates that can help you get a feel for the markets in a real-life way that clicks better for some investors than taking a more general course.

No, Seeking Alpha won’t directly set you up for algorithmic trading success. But it can help you understand market movements in a way that can help give you an edge once you do start creating algorithms.

3. Learn Programming and Data Analysis

Programming and data analysis lies at the heart of algorithmic trading.

Many traders rely on programming languages such as Python and R for their ease of use and rich libraries for data analysis and trading.

However, there are alternatives like EasyLanguage which was specifically developed to reduce the level of coding knowledge necessary for algorithmic trading.

Once you know how to program, you then need to learn how to work with and manipulate data. Some topics that are staples for traders include:

- Statistical analysis.

- Time-series analysis.

- Mathematical modeling.

With these skills, you’ll have a solid foundation that you can use to create and test your trading theories.

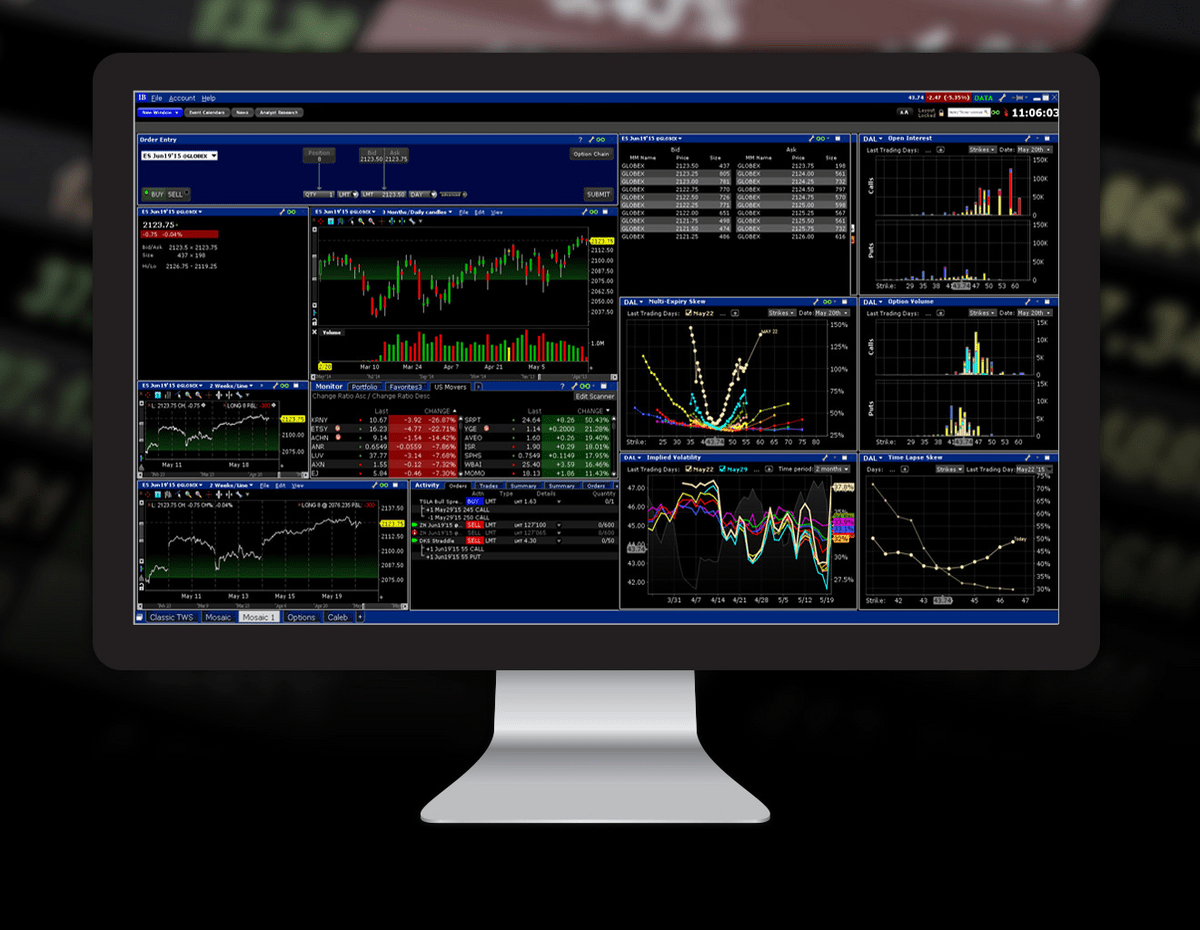

4. Familiarize Yourself with Trading Platforms and APIs

APIs are a way for different applications to communicate with each other.

Many brokerages and financial data providers offer APIs for algorithmic trading which you can use to automatically retrieve data for your algorithm to process.

You can also use these APIs to execute trades from an algorithm running on your computer or a virtual private server (VPS).

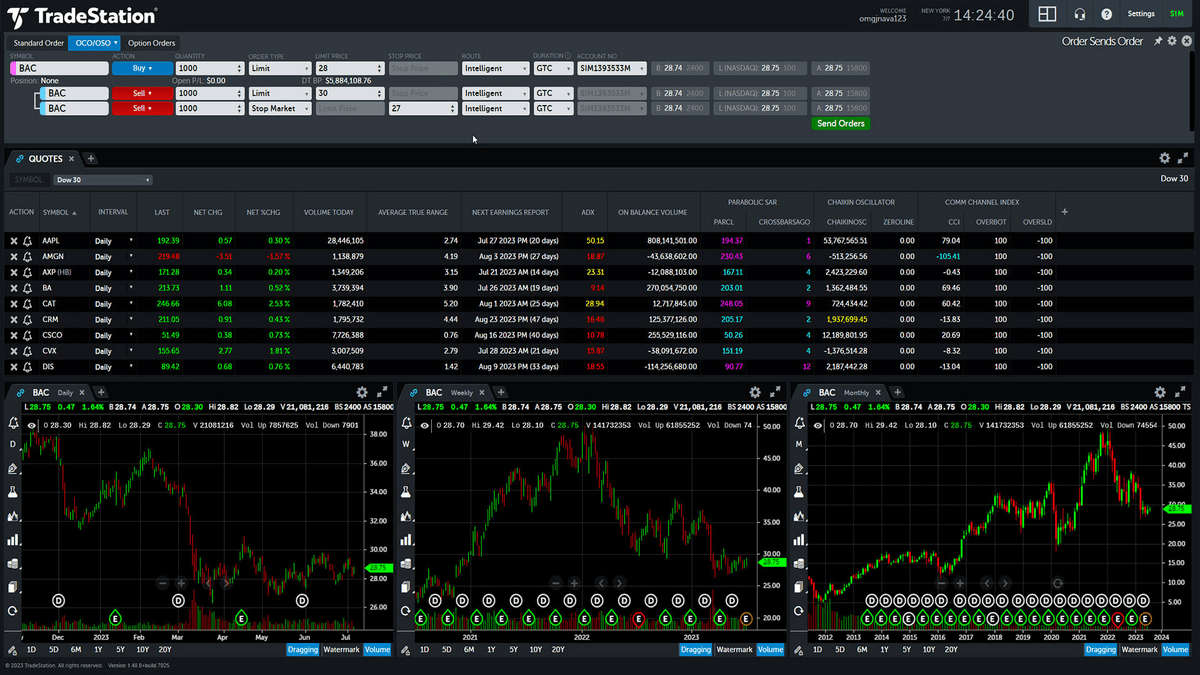

On the other hand, some trading platforms like TradeStation integrate algo trading and backtesting right into their platform, simplifying the process for traders.

The platform allows you to trade a host of markets from stocks to crypto as well as offering decades of historical market data for backtesting and a range of analysis tools. However, one of TradeStation’s best features is the integration of their proprietary programming language, EasyLanguage.

The programming language offers thousands of built-in keywords and functions that are useful to traders, making strategy generation incredibly efficient.

5. Develop and Test Trading Strategies

As an algo trader, you’ll spend most of your time developing and testing trading strategies using historical market data.

Without first developing an idea and testing it as a trading strategy, you’re effectively trading with your eyes closed. The first step is to develop a hypothesis based on a market’s tendencies.

For example, if the stock market tends to revert after a large move, you can test what happens after a large bar or a sequence of bars in one direction.

If this shows promise you then need to create an actual trading system that involves entry and exit rules and applies sound risk management.

For example, if the market prints a bar three times the size of the average recent range, I will enter on the close with a stop and profit target x distance (percent, points, etc.) away while risking a maximum of 1% of my trading account.

Besides coming up with ideas on your own, you can use tools like TrendSpider which offers a host of pre-made scanners (such as the MACD or Golden Cross), or come up with your own criteria to test using the platform.

Additionally, you can use TrendSpider to test your strategies without any coding knowledge and then deploy successful strategies into a trading bot with just one click.

Stay safe — paper trade first

When it comes to trading algos, relying on backtesting alone won’t cut it.

It’s vital that you start paper trading before you risk real money as it’s all too easy to over-optimize and curve fit strategies to the past, so the real test happens in live market conditions. For this, you can use a platform like TradeStation which offers paper trading with real-time data feeds.

While it’s tempting to skip this step once you’ve found a profitable strategy, it could save you thousands of dollars if you decide to live trade an algo with undiscovered bugs.

6. Live Trading with Real Capital

Once you’ve done the hard work of developing your strategy and testing it in a simulation environment, it’s time to graduate to trading with real capital on the line.

However, one thing to consider is your appetite for risk. When you’re risking real money it’s easy to become emotional after a few losses which can cause you to overthink the quality of your strategy.

If not kept in check, this leads to traders shelving otherwise profitable strategies or manually changing trades.

To combat this it’s a good idea to trade with an amount that you can afford to lose without disrupting your mental state then slowly scale up as your confidence grows.

Types of Algorithmic Trading

There are many different approaches you can take with algorithmic trading as all you have to do is code your desired strategy inputs into a computer program (or trading platform) and it becomes an algorithm.

Market Making

Market making is where a trader provides liquidity to the market by simultaneously quoting buy and sell prices for an asset.

Traders who use this strategy seek to profit from the bid-ask spread (the difference between the buying and selling prices spread of an asset.

Important note: This strategy isn’t for most retail investors. It’s commonly used in liquid markets and relies on high-frequency trading, significant capital, and fast order execution so it’s favored by Wall Street professionals as retail participants often lack the technological and capital requirements to implement it successfully.

Trend Following

Trend-following strategies aim to capitalize on established price trends in financial markets.

Traders who use this approach buy when they believe an asset’s price is in an uptrend or sell when it’s in a downtrend with a goal to ride the trend for as long as it persists and exit when signs of a reversal appear.

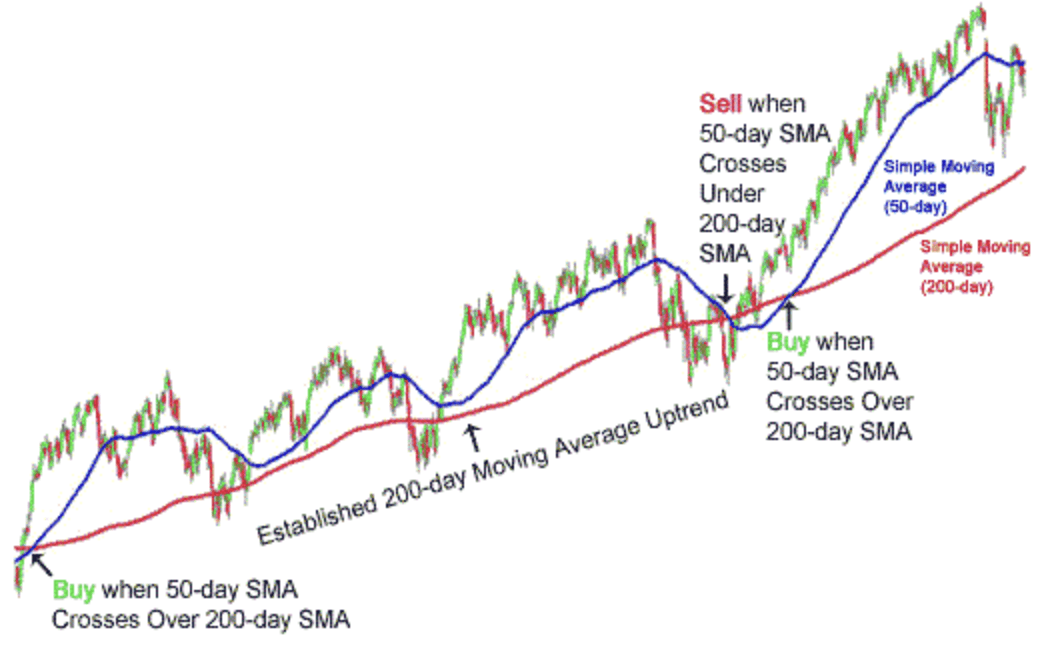

A common trend following strategy involves moving average (MA) crossovers:

(Source)

Moving averages are simply smoothed averages of an asset’s price over a specific time period. Many traders employ this type of strategy with two moving averages — one being a short-term average and one being a longer-term average. However, there are systems that use five or even ten moving averages.

A two-moving average system is relatively simple: Buy when the short-term MA crosses above the long-term MA and then exit and reverse the position once the opposite happens.

Mean Reversion

Mean reversion is a form of statistical arbitrage that seeks to profit from the mispricing of an asset.

In essence, mean reversion strategies are based on the idea that asset prices revert to the average over a period of time so they aim to find areas where price is far away from the average and bet on its return.

In an opposing fashion to trend following, mean reversion strategies seek to buy when an asset’s price is below its historical average and sell when it’s above.

Examples of Stock Market Algorithms

Since we already covered a trend following example with moving average crossovers above, let’s focus on some simple mean reverting stock algos since they’re common in the stock market.

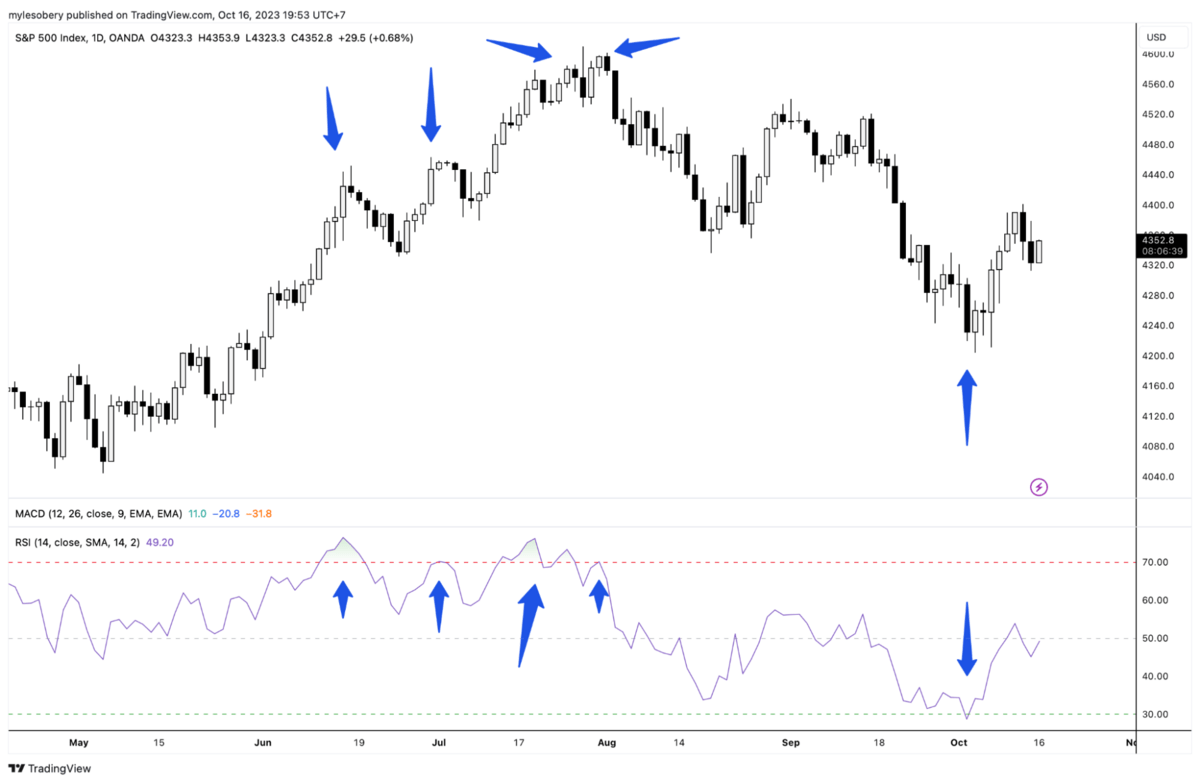

First, we have the RSI which signals overbought (above the red line) and oversold (below the red line) prices. A simple strategy is to sell when the RSI goes above the red line and then dips back below it and buy when the reverse happens to the green line.

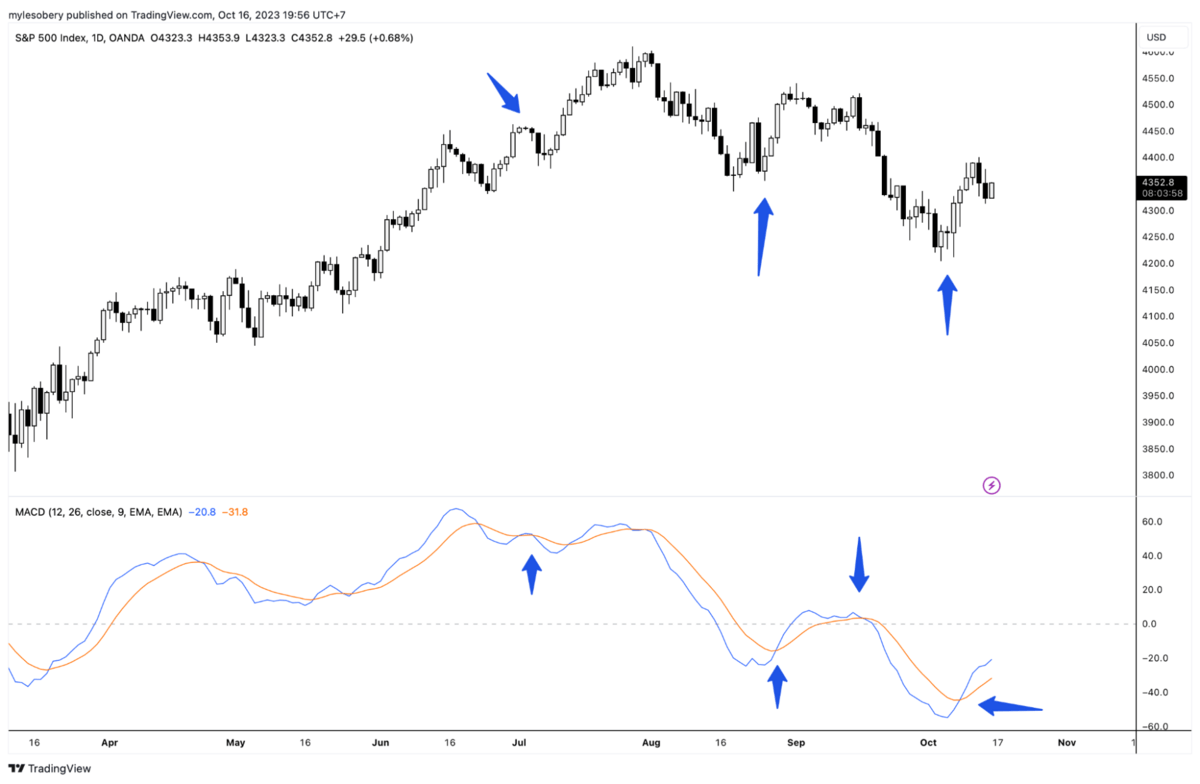

Next up we have the MACD which some traders use to signal divergences, but here we’ll focus on the lines instead and use it to show points where price may start reverting.

The blue one is actually the MACD line itself and the orange one is the signal line. When the lines are both positive and the blue one then dips below the orange, you go short. When the lines are both negative and blue travels above the orange you go long.

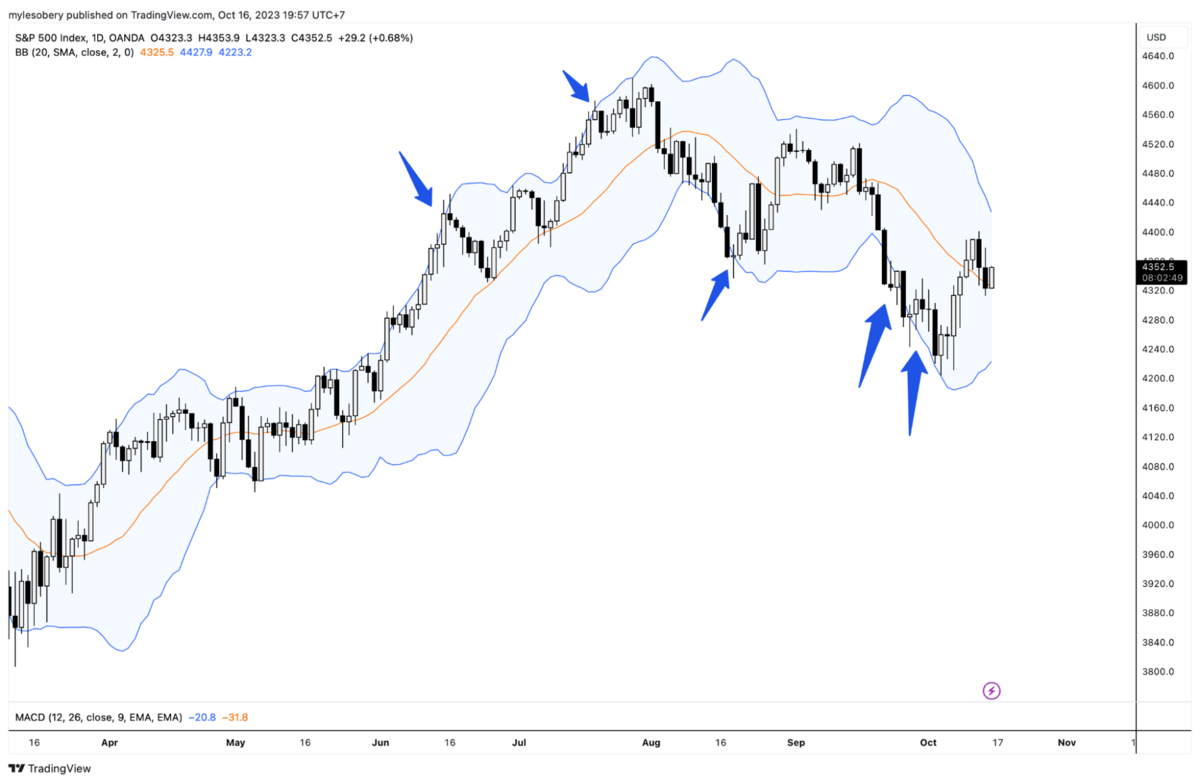

Finally, we have Bollinger Bands. These are calculated based on standard deviation, which highlights areas where price is far from the mean. With this strategy, you look for areas where the price closes outside the bands, then enter once a bar closes back inside.

You go short when the price closes back inside the top band and go long when it closes back inside the bottom band.

Keep in mind that these are basic versions of mean reversion strategies and are unlikely to be profitable without some tweaks and personalization.

Advantages of Algorithmic Trading

I briefly mentioned some of the advantages of algo trading above, but let’s cover them in a bit more detail. They are:

- Speed and Efficiency: Algorithms can execute trades at speeds much faster than human traders. While this is less relevant on longer timeframes, this speed is critical for taking advantage of short-term opportunities and minimizing slippage.

- Accuracy: Computer programs execute trades with extreme precision and consistency since they follow the same rule set for every trade. This reduces the potential for human error.

- Backtesting: While you can certainly backtest strategies manually, this is time-consuming and introduces discretion which can cause your backtesting results to vary from reality. Instead, using algorithms to backtest can give you a more accurate picture of your strategy’s performance while allowing you to test multiple inputs quickly.

- Diversification and Scalability: Algorithms can simultaneously handle multiple assets, markets, and strategies, enabling you to easily diversify your portfolio once you find a profitable strategy. Additionally, algos allow you to trade every second the markets are open, enabling scalability far beyond manual trading.

- Reduced Emotional Influence: Automated systems do not experience fear, greed, or other emotions that can cloud your judgment. By removing these emotions with algos you can enjoy more consistent and profitable trading.

- Data Processing: Algorithms can efficiently process and analyze vast amounts of market data, enabling you to make informed decisions based on a wide range of information sources.

Risks and Limitations

While there are plenty of advantages that come with trading an algorithmic system, there are also some risks and limitations to be aware of:

- Technical Failures: Algorithmic trading systems are vulnerable to technical glitches, software bugs, and hardware failures that can result in significant losses.

- Algorithmic Errors: Errors in the algorithm’s coding or logic can lead to unintended trades which is why it’s important to thoroughly forward test your strategy in live conditions before risking actual money.

- Overfitting: Overfitting or curve fitting happens when a trading algorithm is too finely tuned to historical data. This makes it perform poorly in real-world conditions that differ from the historical dataset used for testing.

- Market Manipulation: While not limited to algorithmic trading, high-frequency and algorithmic traders can be accused of market manipulation or “spoofing” if they engage in unfair or deceptive practices. Most algos won’t fall into this category but it is something that you should keep in mind.

- Black Swan Events: Black Swan events are unforeseen market crashes, such as flash crashes. Since these happen out of nowhere algorithms will struggle to adjust to the new market state.

Tools for Algorithmic Trading

Leveraging the right tools for algorithmic trading can be the difference between making and losing money.

Here are some tools I recommend to help you succeed:

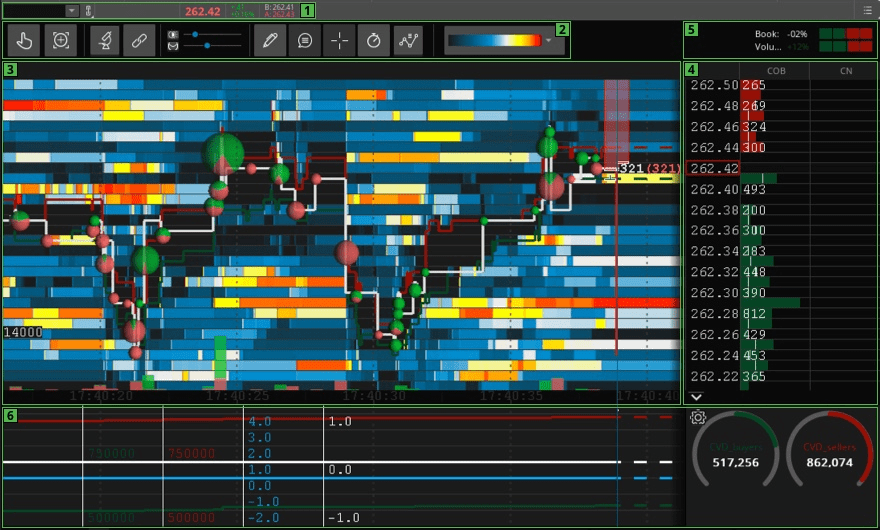

1. TrendSpider

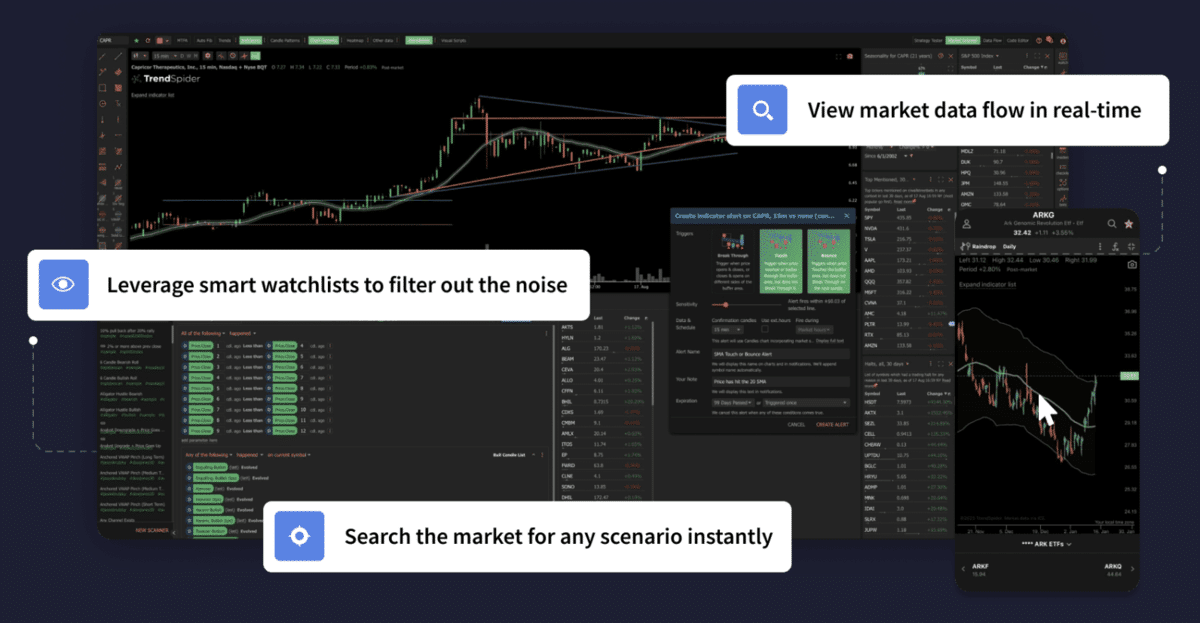

TrendSpider is an essential tool for algo trading. It provides a wide range of features that help you generate trading ideas and consistently develop new strategies with the tool’s powerful scanning software.

You can also create complex scans by combining both technical and non-technical parameters as well as multiple timeframes and data sources into a single scan.

Additionally, TrendSpider provides you with automated technical analysis and pattern recognition capabilities to help you tease out even more profitable ideas from the market.

Then you can convert any profitable strategies into a live trading bot with just a few clicks. There’s no coding necessary as TrendSpider automates code generation for you, all you have to do is set up a webhook so the tool can communicate with your trading platform and you can start trading.

2. TradeStation

When trading with algos you need to leverage a powerful trading platform that facilitates smooth trading while ensuring maximum uptime so your strategies perform as they should—and TradeStation is the platform we recommend.

TradeStation offers all the features you need for successful algo trading from a wide range of markets (stocks, ETFs, futures, crypto, and options) to reliable algo execution.

Additionally, the platform’s proprietary coding language, EasyLanguage, makes it easier and faster to code your own strategies compared to something like Python or R.

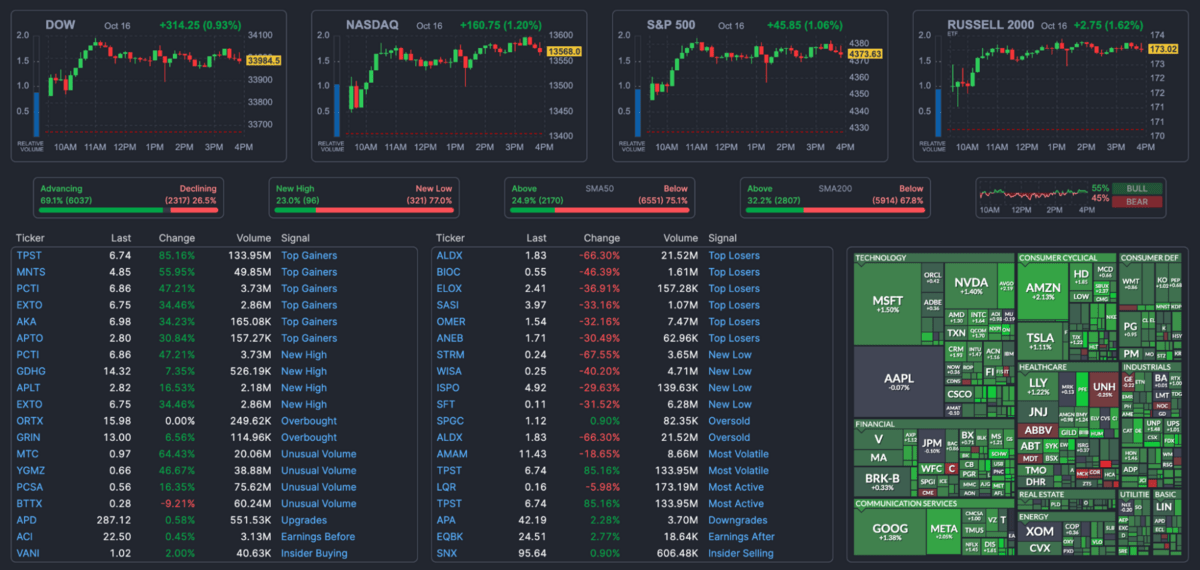

3. Finviz

Finviz is one of the best tools you can find when it comes to backtesting and advanced visualizations — especially for stock algos.

You can test 100 technical indicators to discover which ones should have a place in your algorithm and then compare how they perform against the SPY’s benchmark performance.

With Finviz you can leverage various visualizations from insider trading, relative performance, and portfolio overviews to proprietary correlation algorithms and performance comparison charts.

4. Radical X13 Trading Computer

The final piece of the puzzle is a cutting-edge trading computer that keeps your algos running smoothly as they work overtime in the market and interact with all the tools at your disposal.

We recommend the Radical X13 Trading Computer, the world’s fastest Intel trading computer. It comes with 64GB of RAM and a 1TB solid-state drive to ensure top performance no matter how many algorithms and markets you trade simultaneously.

Additionally, the computer comes with lifetime tech support, a five-year warranty, and several other bonuses.

Final Word:

With advancements in technology, algorithmic trading has become more accessible to retail traders, unlocking a host of opportunities to profit in the market.

Algos allow you to remove the human element from your trading, something that keeps many traders from consistently making money. On top of that, you can enjoy speed, scalability, and diversification far beyond what is possible with manual trading.

But most importantly, you can analyze vast data sets and backtest strategies, increasing your confidence in the strategies you’ve developed.

However, it’s important to keep in mind the risks of algorithmic trading—namely, coding errors, black swan events, and overfitting your strategies to historical data.

All in all, algo trading is certainly a viable way to profit from financial markets as long as you do the required study and follow best practices when developing your algos.

FAQs:

How does algorithmic trading work?

Algorithmic trading works through computer programs that automate the process of trading financial securities such as stocks, bonds, options, or commodities. As a trader, you code these strategies beforehand and then run them through a trading platform or API so they can automatically scan the market and execute trades based on your defined criteria.

What is an example of algorithmic trading?

An example of an algorithmic trading strategy is using the RSI to highlight areas where the price is overextended and primed to reverse. The RSI signals both overbought and oversold prices and when a stock reaches these levels, traders open positions as soon as the RSI dips back into normal territory.

Does anyone actually make money with algorithmic trading?

Yes, it is possible to make money with algorithmic trading. In fact, one of the most profitable hedge funds of the last decade runs algo strategies based on mathematical models. You’ll also find plenty of examples of successful algo traders with a quick Google search.

Is algorithmic trading illegal?

Algorithmic trading in and of itself isn’t illegal. However, there are certain trading practices that are associated with algorithmic trading such as “order spoofing” which are illegal as they attempt to manipulate the market for profit.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.