Kraken is not publicly traded.

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies like Kraken who want to sell their shares.

Sign up with Hiive here and get access to Kraken before its IPO.

Kraken, a leading cryptocurrency exchange, has garnered attention for its user-friendly platform, extensive range of cryptocurrencies, and robust security features. Unsurprisingly, with the growing popularity of digital assets, many investors are curious about the potential of Kraken as an investment opportunity.

Despite its appeal, investing in Kraken stock is not as straightforward as it may seem. However, by the end of this article, you’ll understand precisely how to gain exposure. Not only that, but we’ll also share alternative options you can consider.

The Growing Significance of Kraken in the Cryptocurrency Market

Kraken has positioned itself as a significant cryptocurrency player that caters to novice and experienced traders. The platform’s ability to offer diverse digital assets and maintain stringent security protocols has made it a preferred choice for many.

As the cryptocurrency market evolves, platforms like Kraken are at the forefront of this financial revolution, providing innovative solutions and reliable services.

What’s Interesting About Kraken

- Market Leader: Kraken is one of the oldest and most established cryptocurrency exchanges, known for its reliability and strong market presence. Its longevity speaks volumes about its ability to adapt and thrive amidst the volatility of the cryptocurrency world.

- Wide Range of Cryptocurrencies: The platform supports many cryptocurrencies, catering to diverse investor interests and trading strategies. Whether you’re interested in well-known coins like Bitcoin and Ethereum or exploring lesser-known altcoins, Kraken provides a comprehensive selection to meet your needs.

- Strong Security: Kraken has a reputation for robust security measures, including advanced encryption and two-factor authentication, making it a trusted platform for users. In an industry where security breaches can have severe consequences, Kraken’s commitment to protecting user assets is paramount.

- Global Reach: Kraken operates in numerous countries worldwide, offering a broad user base and significant market penetration. This global presence enhances Kraken’s market influence and allows users to trade in multiple fiat currencies.

- Innovative Features: Kraken continually enhances its platform with new features, such as staking, futures trading, and margin trading, providing more opportunities for users. These innovations keep Kraken competitive and appealing to a wide range of traders.

- Regulatory Compliance: The exchange is known for its adherence to regulatory standards, which can instill confidence in investors regarding its long-term viability. By complying with international regulations, Kraken ensures a level of transparency and reliability that is crucial for its sustained success.

- Growth Potential: With the growing adoption of cryptocurrencies and digital assets, Kraken is well-positioned to benefit from the industry’s growth and expansion. As more individuals and institutions embrace digital currencies, Kraken’s role as a leading exchange is likely to grow even further.

Can You Buy Kraken Stock? How to Invest in Kraken

Before diving into the investment strategies, it’s essential to clarify that Kraken is not a publicly traded company. This means you cannot purchase Kraken stock on public stock exchanges like the NYSE.

Does that mean you’re out of luck?

Nope. While it may not be available on public exchanges, there are ways for accredited investors to invest in Kraken privately.

How to Buy Kraken Stock as an Accredited Investor

Kraken is not publicly traded. However, accredited investors can invest in private companies, including Kraken, through Hiive.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares to accredited investors. The platform provides accredited investors with a unique opportunity to acquire shares of Kraken before it potentially goes public.

With no buying fees, the ability to negotiate, and a robust marketplace with thousands of companies, Hiive is a great way to invest in companies before they IPO.

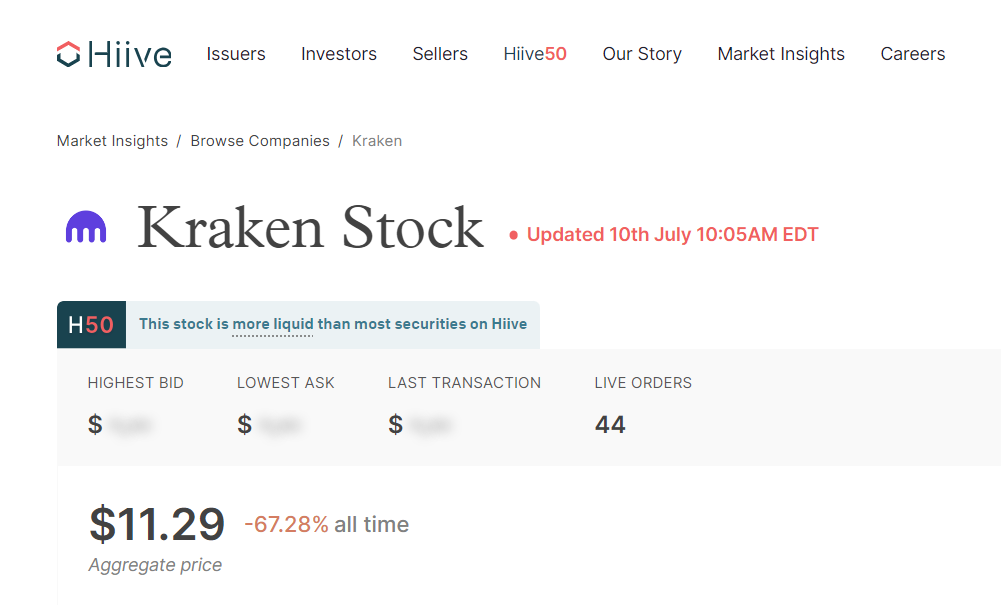

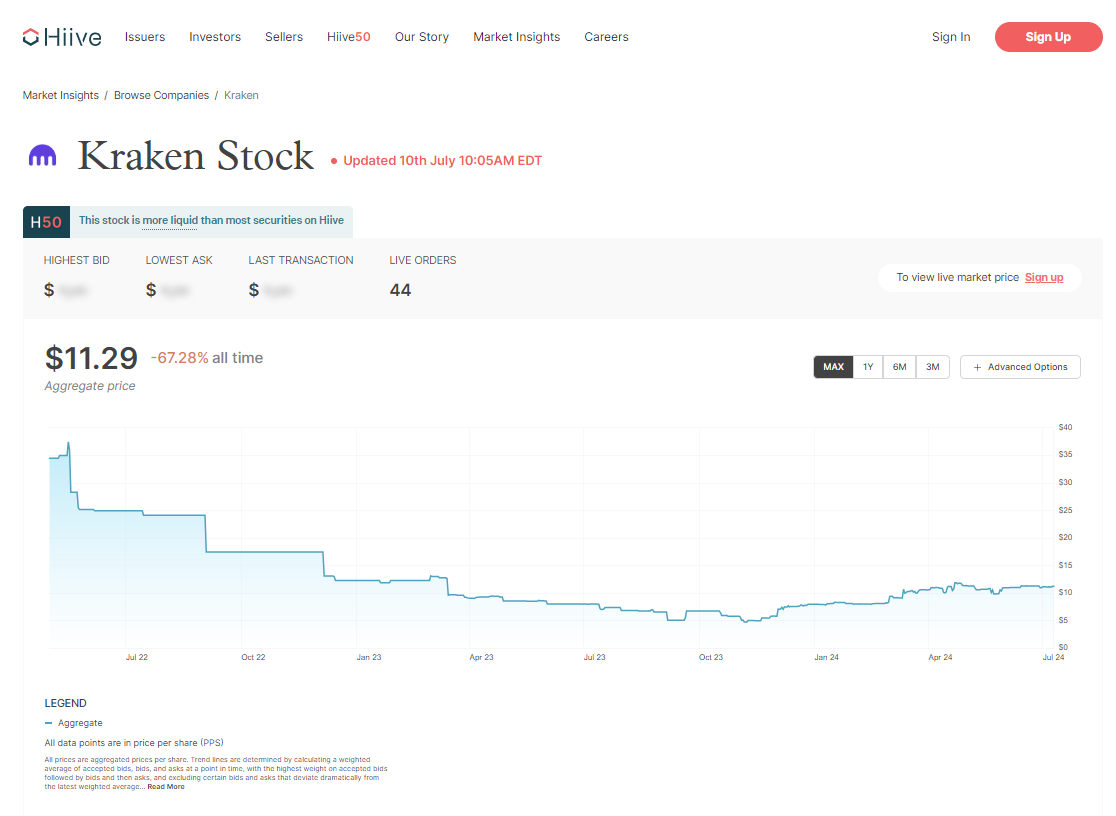

At writing, there are 44 live orders for Kraken on the platform, and it’s one of the most liquid stocks on Hiive.

To explore Kraken listings, sign up with Hiive, check out Kraken, add it to your watchlist, and get notified about any new listings and trades.

Beyond Kraken stock, Hiive’s intuitive interface offers access to other hot VC-backed private companies, such as Binance, Juul, and OpenAI.

Investing in Kraken as a Retail Investor

For retail investors, the situation is a bit different. Since Kraken stock is not available on public markets, direct investment is not possible.

However, understanding the landscape of private investments and exploring alternatives can still provide exposure to the cryptocurrency market and companies like Kraken.

Who Owns Kraken?

Kraken was founded by Jesse Powell in 2011 and has since attracted significant venture capital funding.

- January 2013: Kraken raised $200K during its seed stage from undisclosed investors.

- April 2016: Around three years later, $12.32M was raised during Kraken’s series A funding round. Key investors included Blockchain Capital, Digital Currency Group, Hummingbird Ventures, SBI Investment, Trammell Venture Partners, and Money Partners Group.

- May 2020: Kraken secured $52.4M in investor funding during their Series B round in 2020. Key investors included Tribe Capital, Blockchain Coinvestors, GE Ventures, Soul Capital, MyAsiaVC, Tachi.ai Ventures, and bloom.CAPITAL.

Does Elon Musk Own Kraken?

It’s no surprise that the Tesla (NASDAQ: TSLA) and SpaceX founder is quite fond of digital currencies. Not only that, he appears to be a fan of Kraken founder Jesse Powell and how he runs his exchange.

Still, there is no evidence that Musk owns a stake in the private cryptocurrency exchange at this time.

Alternatives to Kraken for Retail Investors

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

While Kraken may not be available on public exchanges, you have other options. Here are some public companies to consider watching:

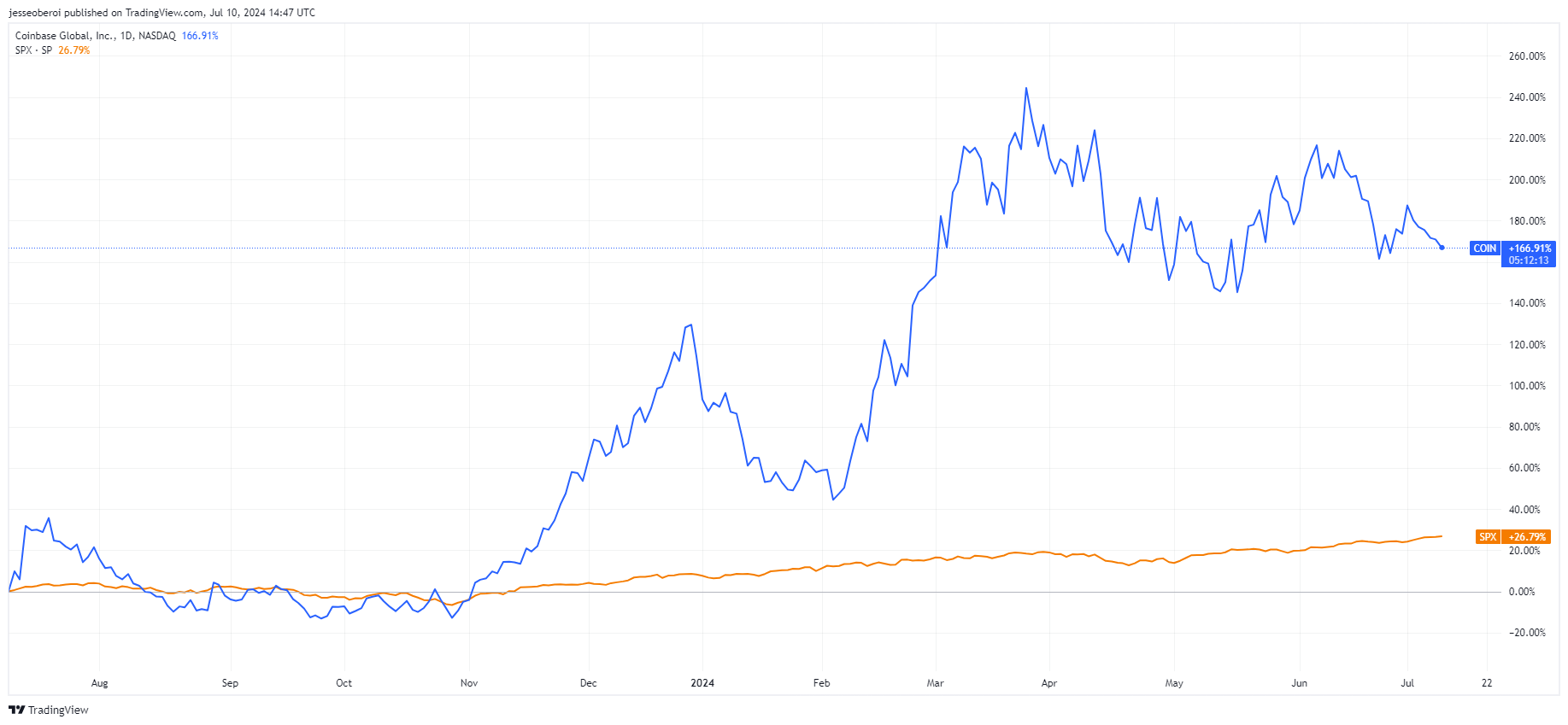

Coinbase Global Inc. (NASDAQ: COIN)

Coinbase is a leading cryptocurrency exchange platform enabling users to buy, sell, and store a wide range of cryptocurrencies. While its Zen Rating (an assessment of a company’s potential based on 115 factors) is dismal, it may hold appeal to more speculative retail investors exposure to an established player in the digital currency exchange space.

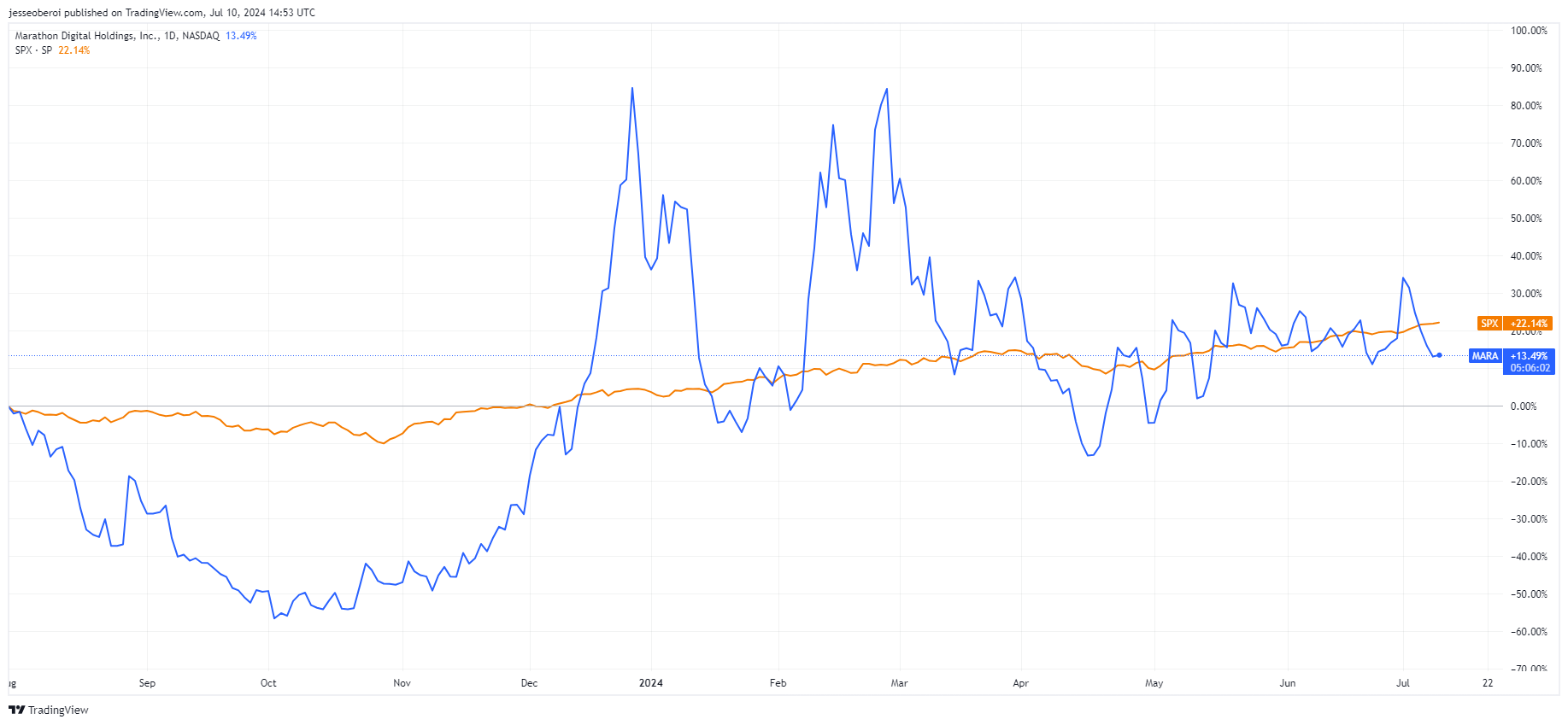

Marathon Digital Holdings Inc. (NASDAQ: MARA)

MARA operates as a digital asset technology company that mines cryptocurrencies. The publicly traded company focuses on the blockchain ecosystem and digital asset generation in the United States.

While MARA is not a crypto exchange, it does offer retail investors another avenue to gain exposure to the cryptocurrency industry.

But be warned: MARA’s Zen Rating is F — meaning it’s considered a Strong Sell based on 115 factors. While it scores high in growth, the rest of the scores are quite low — meaning this is for speculative investors only.

How to Buy the Kraken IPO

Here are the steps on how to buy Kraken stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Kraken

- Select how many shares you want to buy

- Place your order

- Monitor your trade

Kraken Stock Price Chart

While Kraken has no publicly traded stock price chart, the company is still valued as a private entity. Below is the Kraken stock price chart taken from Hiive.com. As of July 10, Hiive.com valued Kraken at $11.29 per share.

Conclusion

Kraken presents a compelling investment opportunity, but the lack of public trading options means that only accredited investors can buy Kraken stock through private marketplaces like Hiive.

Fortunately, not all is lost for the rest of us.

Retail investors should consider alternative strategies to gain exposure to the cryptocurrency market. Whether through publicly traded crypto companies or direct cryptocurrency investments, there are multiple pathways to participate in the exciting world of digital assets.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How can I buy Kraken stock?

Kraken stock is not available on public markets. Accredited investors can buy Kraken stock through private marketplaces like Hiive.

How much is Kraken stock?

The Kraken stock price is not publicly available as it is not traded on public exchanges. Prices for private shares can vary based on negotiations and market conditions. As of July 10, 2024, private shares of Kraken were valued at $11.29 according to Hiive.

What is the Kraken stock symbol?

There is no Kraken stock symbol as it is not publicly traded. If you wish to invest in a publicly traded cryptocurrency exchange, consider researching Coinbase.

Who owns Kraken stock?

As a private company, Kraken is owned by its founders, employees, and venture capital investors who have invested in it through various funding rounds. Accredited investors can buy Kraken stock through private marketplaces like Hiive.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.