The investing and brokerage app landscape is constantly growing.

Firstrade is one broker that’s become popular due to its low fees, but is it really worth your time? More importantly: is it safe and legit?

The answer might surprise you. I’ll share all the pros and cons you need to know in this Firstrade review.

But let’s get right to the most important question: is Firstrade safe?

Firstrade Review: Is it a Safe and Legit Investing App?

The Bottom Line: When it comes to investing apps, Firstrade shines as a safe and legitimate option that caters to a diverse range of investors.

Here’s why:

- They charge $0 commissions on trading stocks, ETFs, and options, making Firstrade one of the best low-fee options out there

- They offer no-fee mutual funds, which allow you to invest in a diversified portfolio without incurring transaction fees

- They offer modern features, like a robust mobile trading app and cryptocurrency trading

So if you’re wondering “is Firstrade safe?” or “is First Trade Legit?” the resounding answer is YES. Whether you’re a seasoned trader or just starting your investment journey, the First Trade app offers a reliable platform to meet your needs.

So what’s the catch? While Firstrade is great for traders, if you’re more of an investor than a trader, there are better options out there.

In my opinion, M1 Finance is a superior platform thanks to its clean user interface, easy visualization, and similarly low fees. It offers the best of both worlds with robo-advising or self-directed investing capabilities. That said, everyone’s needs are different.

Simply stated…

- A platform like M1 Finance is more suited to long-term investors.

- If you’re a trader, the First Trade app is a solid pick.

With that said, let’s take a deeper dive into Firstrade’s pros and cons…

What is Firstrade?

Before we get to the First Trade review, let’s clear something up. Don’t call it First Trade Securities — it’s Firstrade (all one word) Securities. (I know. It’s confusing.)

Firstrade is an established brokerage firm that has been serving investors for over three decades. Picture it as your go-to companion in the world of finance, providing an accessible and user-friendly app to facilitate your investment journey.

With a solid track record and a commitment to customer satisfaction, they’ve garnered a reputation as a trusted and reliable player in the industry.

But what really sets Firstrade Securities (not First Trade Securities) apart? An unwavering dedication to offering a seamless investing experience while keeping costs low.

Firstrade achieves this by eliminating commission fees on stocks, options, and exchange-traded funds (ETFs), allowing investors to maximize their returns without unnecessary expenses eating into their profits.

The company has also made significant strides in keeping pace with technology. It offers a robust mobile app that puts the power of investing right at your fingertips:

With intuitive features, real-time market data, and a range of investment options, the First Trade app ensures that you have all the tools you need to make informed investment decisions.

Whether you’re a beginner investor looking to dip your toes in the market or an experienced trader seeking a reliable platform, Firstrade has something to offer. Its commitment to security, low fees, and a user-friendly experience make it a noteworthy contender.

Firstrade Review

Let’s dig into the Firstrade review. Here’s what you need to know:

Minimums and Fees

Rating: ⭐⭐⭐⭐⭐

With $0 commissions on trading stocks, ETFs, and options, Firstrade is one of the best low-fee options out there.

Even better, Firstrade also doesn’t charge trading commissions on mutual funds, nor does it charge a per-contract fee on options trades. Plus, there’s a $0 minimum deposit required to get started.

Tradable Securities

Rating: ⭐⭐⭐⭐⭐

Firstrade offers a wide range of tradable securities:

- Stocks

- Options

- Exchange-traded funds (ETFs)

- And mutual funds.

The platform’s comprehensive selection of securities makes diversification a breeze.

Crypto

Rating: ⭐⭐⭐⭐

The First Trade app allows users to trade cryptocurrencies, including popular options like Bitcoin and Ethereum.

Investors can take advantage of the growing crypto market and potentially benefit from price fluctuations in these digital assets. However, there are only 8 available cryptos, so hardcore crypto devotees may be disappointed. You can see the available coins here.

Keep your crypto safe…

If you want to get in the crypto game, you’ve got to have a safe spot to stash your cryptocurrencies.

SecuX is one of the undisputed leaders in safe crypto storage. The company has made a name for itself owing to top-level security measures — notably, the Flash CC EAL5+ Secure Element chip that comes with most wallets in their lineup, a feature that helps protect your private key from potential threats.

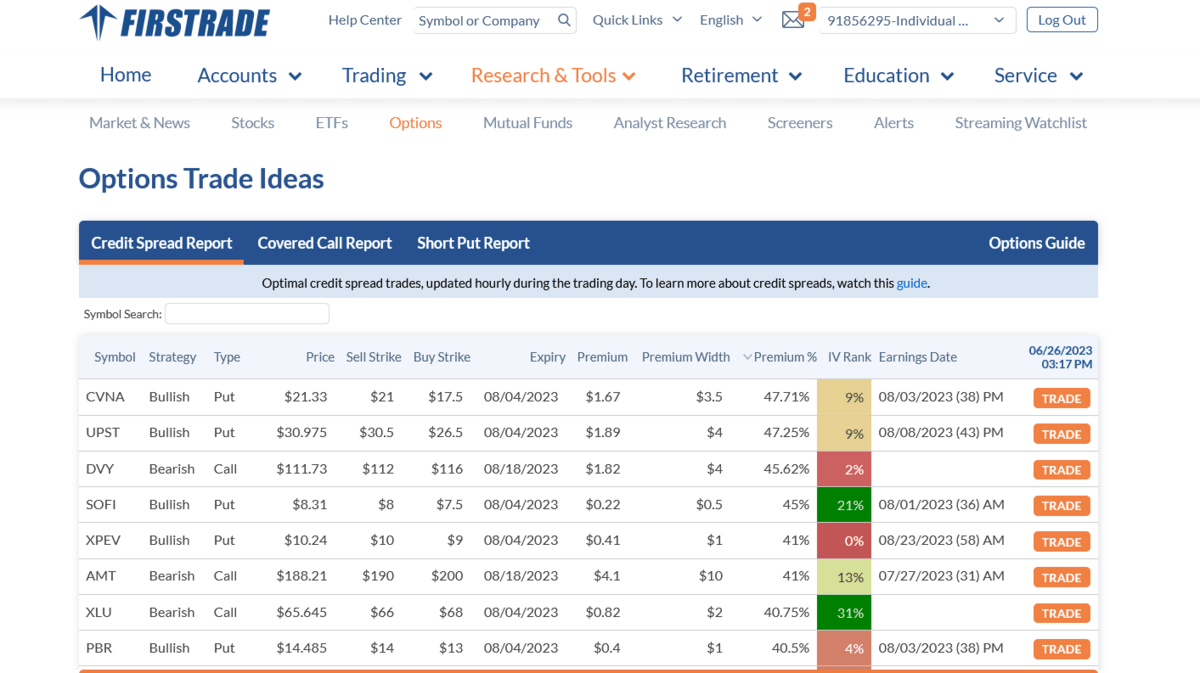

Trading Platforms + Technology

Rating: ⭐⭐⭐⭐

Firstrade provides trading platforms and technology designed to enhance the investing experience. With user-friendly interfaces, real-time market data, and advanced trading tools, you have everything you need to make informed decisions and execute trades efficiently.

However, I personally find their desktop interface a bit clunky and old-school compared to platforms like Robinhood or M1 Finance:

Unique Features

Rating: ⭐⭐⭐⭐

Firstrade offers unique features that set it apart from other brokerage firms.

These include no-fee mutual funds, which allow you to invest in a diversified portfolio without incurring transaction fees. Firstrade also publishes a lot of educational content about stocks, options, ETFs, mutual funds, and more.

Videos are available on everything from how to place an option trade to an overview of margin accounts, so it’s easy to learn how to use the platform.

Firstrade App

Rating: ⭐⭐⭐⭐

The Firstrade mobile app provides you with a convenient and user-friendly platform to manage your investments on the go.

The app offers a seamless experience, including:

- Smart Menus for Faster Trades

- Consolidated Portfolio Dashboard

- Enhanced Trading Workflow

- Fast Options Trading with Advanced Strategies

- Watchlists with Pre-defined Top Lists

- Upgraded Research with Advanced Charts

- Order History

- Easy Account Funding

Data and Research

Rating: ⭐⭐⭐⭐⭐

Firstrade provides users with access to a wide range of data and research tools to assist in making informed investment decisions. This includes market news, analysis, and research reports, empowering you with valuable insights and information to guide your investment strategies.

Customer Service

Rating: ⭐⭐⭐⭐⭐

The company is committed to delivering excellent customer service and support. That’s why Firstrade offers various channels for users to reach out for assistance, including phone, email, and live chat. Their knowledgeable customer service representatives are available to address inquiries, provide guidance, and resolve any issues that may arise.

Firstrade Promos?

Rating: ⭐⭐⭐⭐

Firstrade occasionally offers promotional offers and incentives to new and existing customers. These promotions can include commission-free trades, cash bonuses for account funding, or referral rewards. To stay updated on any ongoing promotions, it’s best to visit Firstrade’s official website or reach out to their customer service.

Is Firstrade Safe? Is it a Legit Investing App?

Before you hand over your money to Firstrade, you still have to ask: Is Firstrade Safe?

Luckily, when it comes to the safety and legitimacy of Firstrade, you can have peace of mind. Firstrade is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

These regulatory bodies provide protection for investors in case of brokerage failures or other unforeseen circumstances.

And if you’re still wondering: Is First Trade legit? Hopefully, this First Trade review has answered that! The answer is yes — Firstrade utilizes industry-standard security measures to safeguard all your personal and financial information.

So by all accounts and measures, Firstrade is a safe, secure, and legit investing platform.

Who is Firstrade Good For?

Firstrade caters to a wide range of investors, making it suitable for various kinds of individuals:

- It can be an excellent choice for beginner investors who are just starting their investment journey. However, if you’re a “true beginner” you may find the platform a bit less intuitive than M1 or Robinhood.,

- Firstrade is also a good choice for experienced traders looking for a reliable brokerage platform with low fees.

- Despite having “trade” in the name, it’s also a solid platform for investors, especially with its commission-free mutual funds.

Bottom line? With its user-friendly interface, educational resources, and competitive pricing, Firstrade provides a solid foundation for investors of all levels of experience.

Firstrade Pros & Cons

Pros | Cons |

|---|---|

Offers no-fee mutual funds, allowing for cost-effective diversification | May not offer as extensive a range of research tools and analysis compared to some other brokerage platforms |

Diverse range of tradable securities, including stocks, options, ETFs, and cryptocurrencies | Advanced traders may find that Firstrade’s trading platforms and technology lack certain customization features that they desire |

App provides a seamless and intuitive mobile trading experience | |

Responsive customer service, with multiple channels available for assistance and support |

Final Word: First Trade Review

At this point, it’s clear Firstrade is a safe and legitimate investing app that caters to a diverse range of investors. With its commitment to low fees, a wide range of tradable securities, and a user-friendly interface, Firstrade offers a solid foundation for both beginner investors and experienced traders.

While Firstrade excels in many areas, it may not be the optimal choice for long-term investors seeking advanced customization features, robo-advising/automated investing capabilities, or extensive research tools.

At the end of the day, you always need to consider your individual investment goals and preferences when choosing a brokerage platform. Don’t make any decisions solely based on this First Trade review. Look into several brokers, conduct thorough research, compare features, and weigh the pros and cons to make an informed decision that aligns with your investment strategy.

FAQs:

Is Firstrade legit?

Yes, Firstrade is a legitimate brokerage firm that is regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Is first trade good for beginners?

Yes, First Trade (Proper name: Firstrade) is a good option for beginners as it offers a user-friendly platform, low fees, and educational resources to help beginners navigate the world of investing.

Is my money safe in Firstrade?

Yes, your money is safe with Firstrade. They are a member of SIPC, which provides protection for investors in case of brokerage failures, and they utilize industry-standard security measures to safeguard your personal and financial information.

How does first trade make money?

First Trade (Actual name: Firstrade) makes money primarily through trading commissions, although they offer $0 commissions on stocks, options, and ETFs. They may also generate revenue from other sources such as interest on cash balances and lending securities.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.