Thinking about trading stocks or options? You’ve probably come across thinkorswim.

Since the late 1990s, thinkorswim has been a go-to platform for day and swing traders with its wealth of technical analysis features. Plus, now that Charles Schwab scooped up parent company TD Ameritrade, millions more traders will have access to thinkorswim’s trading suite.

Although thinkorswim has been the talk of the town in the trading community, it’s far from the only charting tool online. Despite all of the accolades thinkorswim has, some traders feel more comfortable “swimming” on other charting apps.

So, is thinkorswim the best choice for your trading style, or should you focus your attention elsewhere? Take a few moments to review thinkorswim’s features before taking the plunge.

Keep reading for our detailed thinkorswim review…

thinkorswim is great for stock research … But when it’s time to trade, we prefer eToro.

eToro is one of the largest “social trading platforms” with access to multiple assets such as stocks and cryptocurrencies. The “social” aspect of eToro’s design makes it easy for users to share spicy investment ideas or mirror other traders’ portfolios with the CopyTrader feature.

eToro also offers a Paper Trading feature similar to thinkorswim’s paper trading, which adds to its beginner-friendly appeal.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

thinkorswim Review: The Bottom Line

Overall rating: 4 out of 5

thinkorswim is a fantastic feature-rich platform, but it’s best suited for intermediate and advanced traders.

Although thinkorswim has loads of ways to analyze charts and place orders, it doesn’t have the most beginner-friendly interface. Even skilled traders admit to fumbling aimlessly through thinkorswim’s labyrinthine layout, so expect a steep learning curve.

However, if you jive with thinkorswim’s style, this is an excellent platform for setting up trades — especially considering thinkorswim is free with a TD Ameritrade account.

Although TradingView still wins the hearts of traders who prioritize UI/UX, thinkorswim may be a better option for experienced traders who want to avoid paying for a subscription plan.

At-a-Glance: 3 Top thinkorswim Competitors

We’ll dig into these options in more detail in just a little bit…

- eToro*: Best for multi-asset support and social trading.

- TradingView: Best for user-friendly charting and technical analysis.

- TradeStation: Best broker for traders interested in TradingView compatibility.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

What is thinkorswim?

thinkorswim is a software platform offering a plethora of technical analysis tools and trading services through the broker TD Ameritrade. With a thinkorswim account, traders can analyze and trade assets supported on TD Ameritrade, including:

- Stocks

- ETFs

- Options

- Mutual funds

- Futures

- Foreign currencies

- Bonds

- CDs

The history of thinkorswim dates back to 1999 when Tom Sosnoff and Scott Sheridan released the first version for options traders. TD Ameritrade bought thinkorswim in 2009, and Charles Schwab bought TD in 2019.

While the Charles Schwab acquisition is ongoing, press reports suggest Schwab will integrate thinkorswim into its future trading platform.

thinkorswim Platform: Account Types Offered

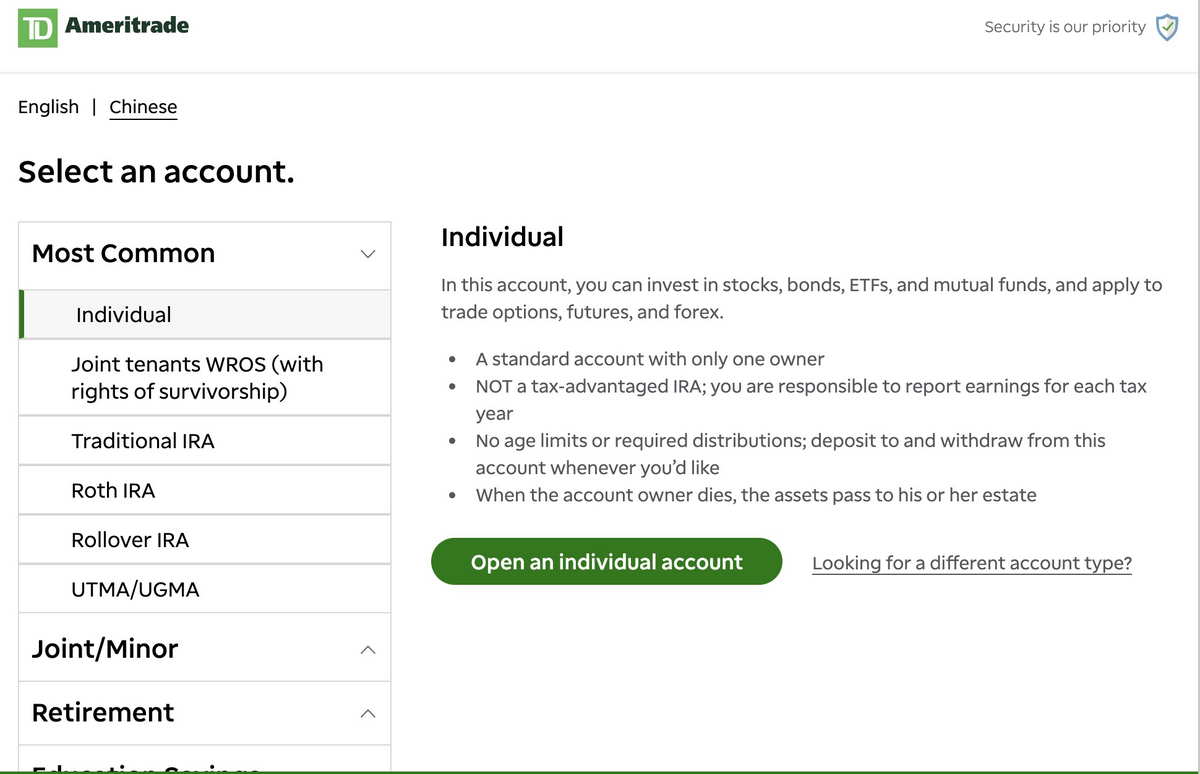

Since thinkorswim links to TD Ameritrade accounts, users have access to all of the account types offered at TD.

In addition to a personal trading account, you can use your thinkorswim to trade with retirement products (e.g., IRAs), educational accounts (e.g., 529 Plans), and a few other specialty categories (e.g., individual trusts).

TD Ameritrade also offers margin trading services via thinkorswim for traders interested in borrowing funds.

Whichever investment category you use, you need to meet TD Ameritrade’s Terms & Conditions to set up an account and get access to thinkorswim. Of course, these details may change once Charles Schwab takes the helm, so stay posted on the latest requirements for thinkorswim.

thinkorswim Key Features

Before logging in to thinkorswim for the first time, brace yourself for information overload.

The thinkorswim platform is well-known for offering many advanced trading tools and features. Here’s just a sampling of what you can expect with a thinkorswim account:

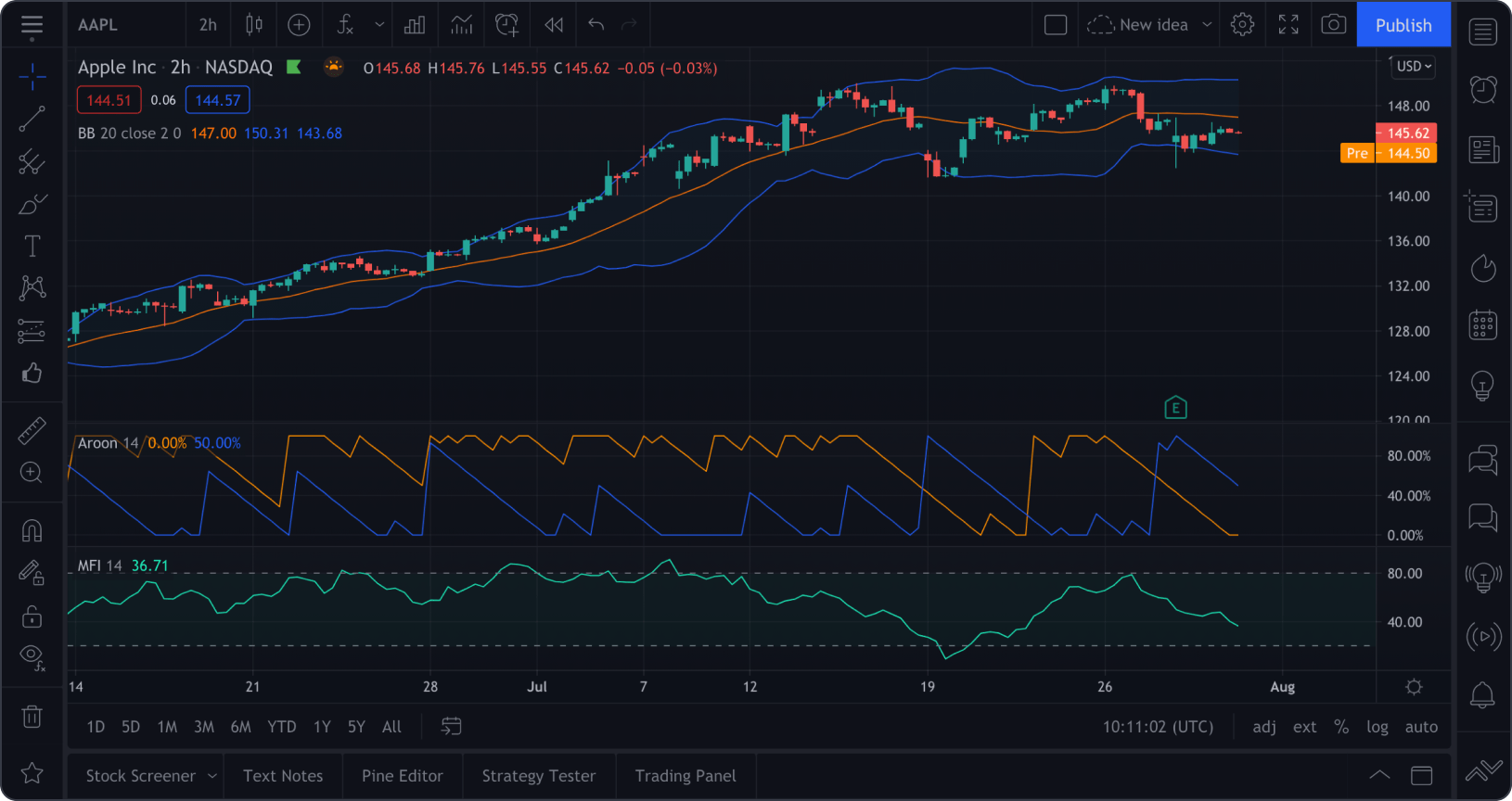

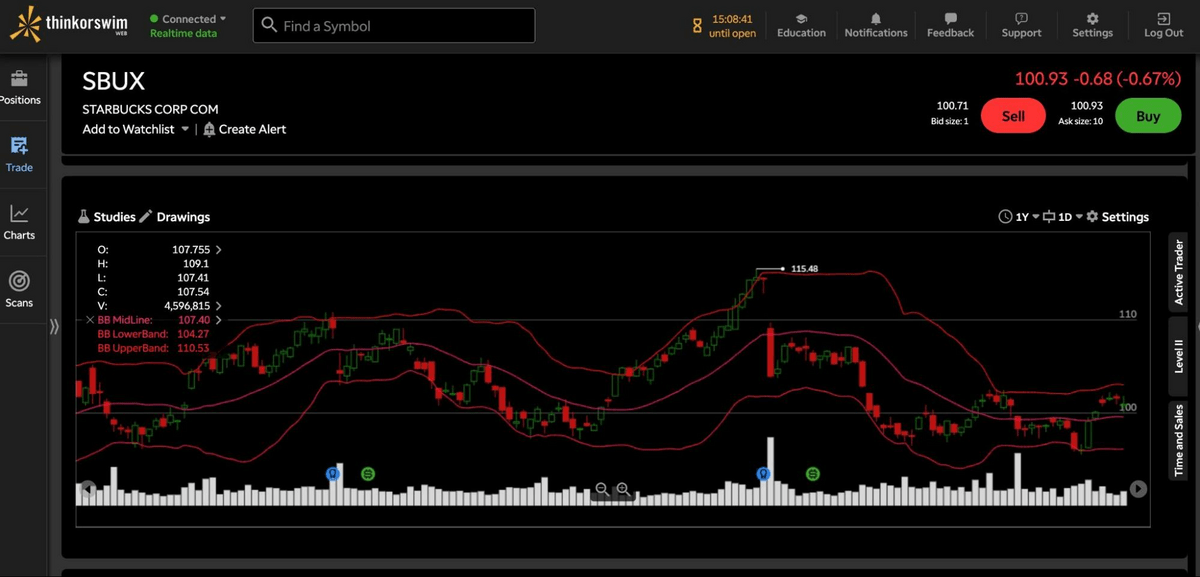

- Technical analysis and charting indicators: A major reason people cannonball into thinkorswim is to take advantage of its countless chart screening indicators. From moving averages and Bollinger bands to the RSI and MACD, there are hundreds of tools you can use to review candlestick charts on thinkorswim. You can also add personal drawings to make notes on patterns and compare them in “Grid” mode with other assets to inform your trading strategy.

- Place orders: After developing a trading strategy, put your plans into action through the thinkorswim trading portal. There are dozens of order types thinkorswim offers to automate your buying and selling, including limit orders, trailing stop-losses, and stop-limit orders.

- Personalized watchlist and news: On the left side of the thinkorswim page, users can set up a convenient watchlist for their favorite assets plus an up-to-date news feed. TD Ameritrade offers live video from its “TD Ameritrade Network” and CNBC for the latest alpha on market conditions.

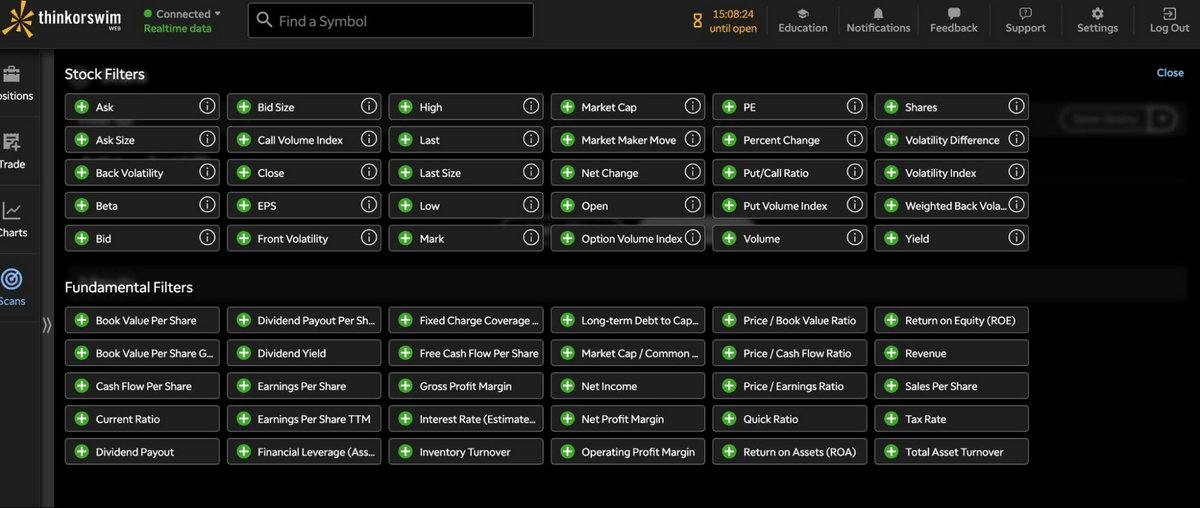

- Stock filter: If you’re hunting for new stock opportunities, check out the dozens of filters in thinkorswim’s “Scans” tab to find investment ideas. On this tab, you can choose the ideal level or range for metrics like P/E ratios, dividend yield, and average beta to see names with your preferred risk tolerance.

- thinkorswim paper trading: The “paperMoney” portal allows traders to place trades on thinkorswim without using the cash in their brokerage account. Since there’s no real money on the line, it’s way less stressful to test new strategies and get familiar with how thinkorswim operates. Even if you click the wrong button, you could just hit “redo!”

- thinkScript: For techie traders who love building algorithms, thinkorswim has a “thinkScript” function where you can use your programming chops to create customized watchlists and trading strategies.

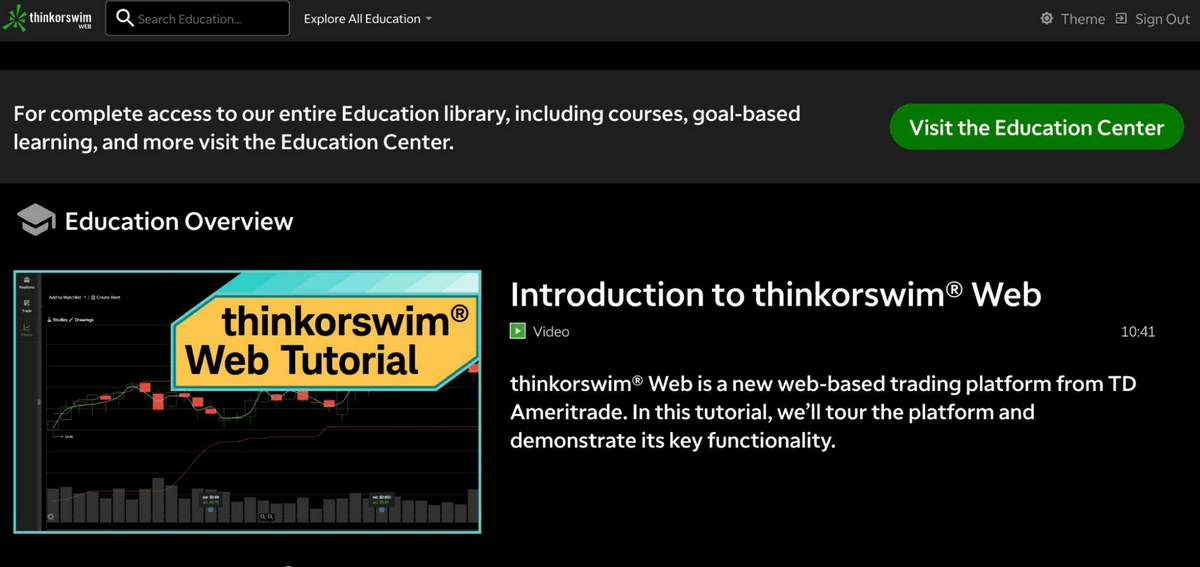

- Learning Center: To help you get acquainted with the thinkorswim platform, there’s an “Education” tab with access to plenty of written and video guides. In addition to thinkorswim-specific lessons, traders can gain insight into trading, investing, and economic news from TD’s tutorials.

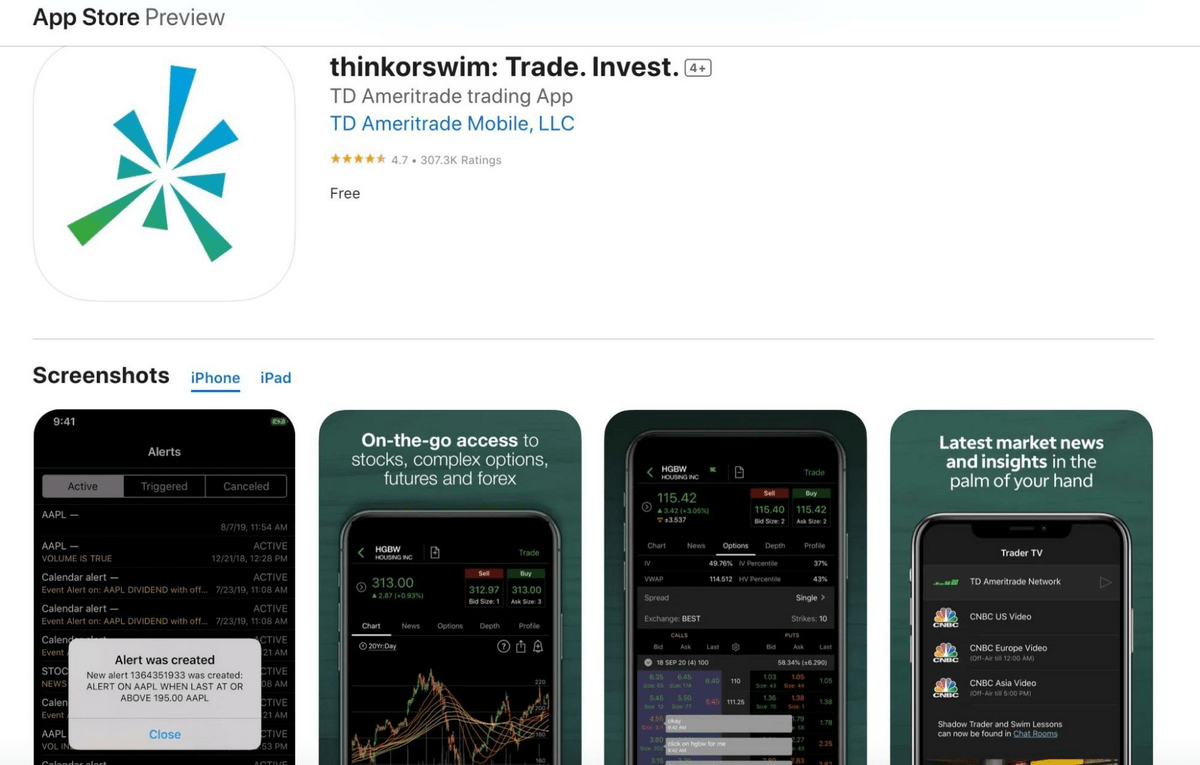

- thinkorswim app: If traders need to travel with thinkorswim, good news: There’s a mobile thinkorswim app for iOS and Android. Like the desktop setting, thinkorswim’s app gives trades countless ways to analyze charts and place orders.

Is thinkorswim Free? Pricing + Fees

If you already have a TD Ameritrade account, accessing the thinkorswim platform is free. There are no special fees to add thinkorswim to your account, nor are there minimum deposit requirements to use either TD Ameritrade or thinkorswim.

Understandably, all the fees for trading on thinkorswim are the same as on TD Ameritrade. While this fee schedule varies depending on different asset categories, TD is well-known for offering commission-free trades for US stocks, options, and ETFs.

Currently, options trades carry a $0.65 fee per contract, while futures have a $2.25 fee per contract. Costs for other assets like forex and fixed-income products have varying fees depending on what you’re trading.

thinkorswim Reviews: What are People Saying?

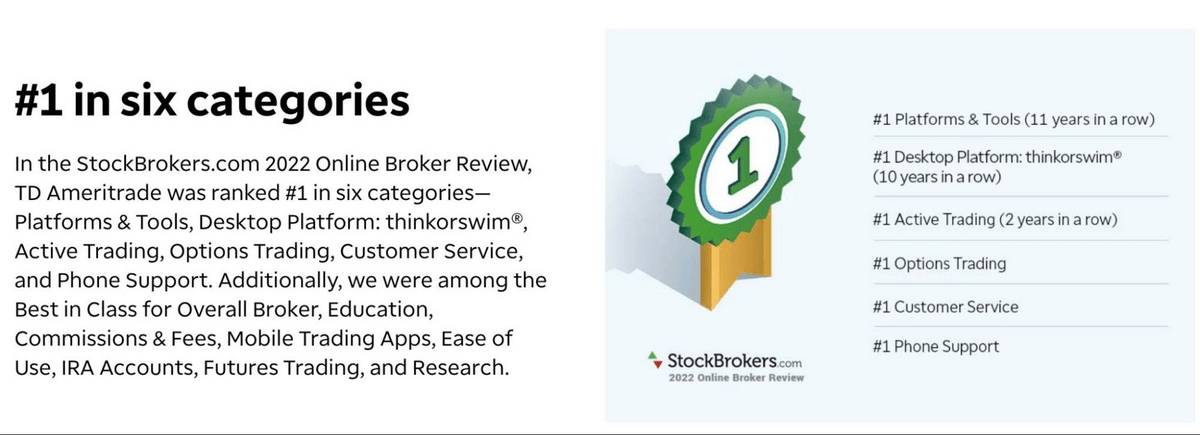

Positive vibes surround the thinkorswim platform. For instance, the site StockBrokers.com lauded thinkorswim as the top choice in its “Platforms & Tools, Desktop Platform” category for over a decade. TD Ameritrade also consistently wins awards for its dependability from publications like NerdWallet and Investopedia.

But it’s not just financial institutions who write glowing thinkorswim reviews. There are thousands of ratings for the thinkorswim app on Google Play and the App Store averaging between 3.7 – 4.7 stars.

People who review thinkorswim rave about its wealth of features, even though this can make using the platform a bit unwieldy and overwhelming.

Indeed, many of the complaints in thinkorswim reviews mention its clunky UI/UX, especially on the mobile interface. It’s also common to see reports of the thinkorswim app freezing up or taking a long time to confirm trades.

To TD Ameritrade’s credit, there are developer responses to most reviews on the App Store and Google Play.

How to Get Started With thinkorswim

All you need to start using thinkorswim is a TD Ameritrade brokerage account. You could either visit TD Ameritrade’s website or thinkorswim and click “Open New Account.”

From here, you’ll select the type of account you want to open and personal info like your name, home address, and phone number.

Once your account is approved, you can use your TD Ameritrade login credentials to get into thinkorswim. Best of all, you don’t need to fund your account to start tinkering with thinkorswim’s charting tools.

However, if you want to use thinkorswim to place actual trades, you must link a bank account to your TD Ameritrade account to send ACH or wire transfers. TD Ameritrade also accepts checks, account transfers from other firms, and physical stock certificates.

Is thinkorswim Safe + Worth It?

TD Ameritrade — and by extension thinkorswim — has a high reputation for security standards. Just a few safety features TD Ameritrade uses include multiple firewalls, 128-bit encryption, and SMS login procedures.

TD Ameritrade also insures cash in each user’s account with FDIC, and securities coverage with SIPC and “Excess SIPC” protection of up to $152 million.

Also, considering it’s free to use thinkorswim with a TD Ameritrade account, it’s hard to say it’s not “worth it.” While not every trader jives with thinkorswim’s layout and mobile app, it’s hard to argue with free.

thinkorswim: Pros and Cons

Pros | Cons |

|---|---|

Hundreds of charting tools, screening filters, and technical analysis features to analyze and compare assets. | Overwhelming user interface and amount of features, which often takes a few weeks to get used to. |

thinkorswim is free to join; all you need to do is sign up for a TD Ameritrade account. | There are multiple complaints over the unintuitive design of thinkorswim’s mobile app. |

No commission fees on stocks, ETFs, or options. | Traders most interested in cryptocurrencies won’t find access to digital assets like Bitcoin (BTC) or Ethereum (ETH) on thinkorswim. |

The thinkorswim paper trading feature lets users practice trading without putting real money at risk. | TD Ameritrade doesn’t offer fractional shares like many competing brokerage firms. |

Available on desktop and mobile settings for maximum convenience. | There are a few customer complaints about thinkorswim taking long to confirm transactions. |

Top thinkorswim Competitors

thinkorswim remains one of the industry’s most revolutionary trading platforms, but there are plenty of other brokerage sites and analytics tools to choose from. As your review thinkorswim, consider a few distinctions with its competitors.

eToro Vs. thinkorswim

Created in 2007, eToro is one of the largest “social trading platforms” with access to multiple assets such as stocks and cryptocurrencies. The “social” aspect of eToro’s design makes it easy for users to share spicy investment ideas or mirror other traders’ portfolios with the CopyTrader feature.

eToro also offers a Paper Trading feature similar to thinkorswim’s paper trading, which adds to its beginner-friendly appeal.

However, the UI/UX on eToro is more straightforward than thinkorswim — albeit the latter has more features for technical analysts.

So, eToro is better for beginner traders due to its simpler layout and a strong emphasis on community with social media functions. People who want crypto trading and aren’t technically inclined may get more out of an eToro account.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

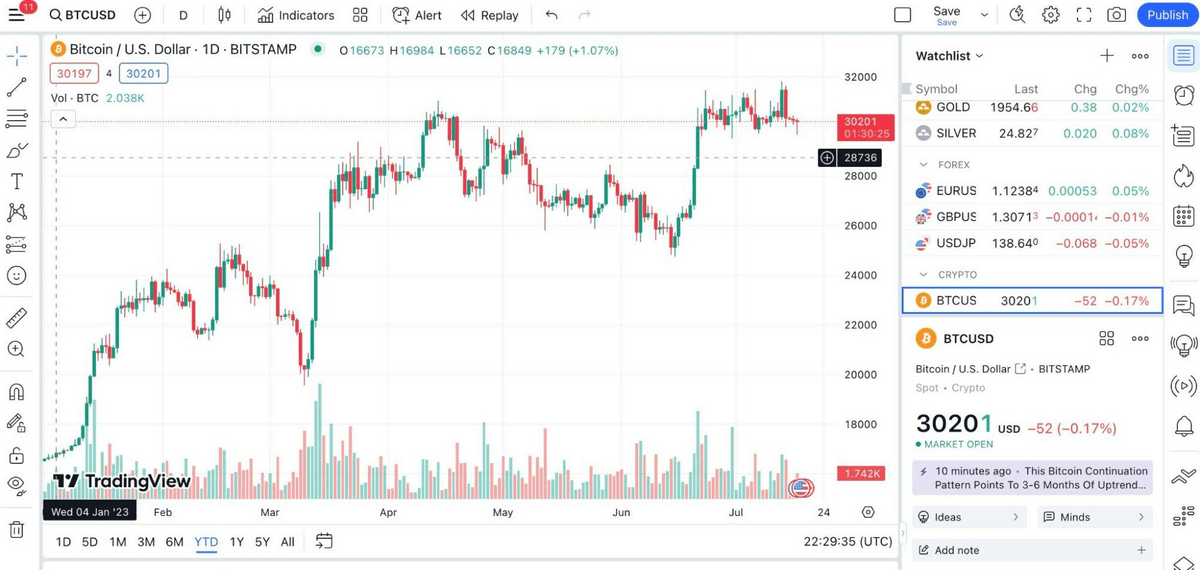

TradingView vs. thinkorswim

Trusted by over 50 million users, TradingView is the top-tier platform for technical analysis. Why is TradingView so successful? Well, a large part of TradingView’s success is its impeccable UI/UX.

While TradingView has many of the same tools on thinkorswim, users often find the layout is far more intuitive. On day one, you’ll get off the ground running analyzing stocks, crypto, and forex in your TradingView account.

Most day traders opt for at least a Pro or Pro+ subscription to enjoy more indicators and price alerts without annoying ads. However, if you’re on the fence about paying for TradingView, test the free account and see whether you feel it’s worth the money.

TradingView is the better pick for people who want all of the technical prowess of thinkorswim without its clunky UI/UX.

Check out TradingView on this link.

TradeStation vs. thinkorswim

Of these three competitors, TradeStation shares the most similarities with thinkorswim. Both thinkorswim and TradeStation are brokerage platforms with advanced charting for assets like stocks, ETFs, and futures.

One noteworthy difference, however, is TradeStation links with TradingView. So, even if you don’t care for TradeStation’s charting features, it’s easier to use as your broker if you’re already a TradingView fan.

If that didn’t tip the scales for you, take a peek at TradeStation’s latest fee schedule versus thinkorswim. While both sites offer commission-free trades, TradeStation now has lower contract fees for futures and options.

So, TradeStation may be the better choice if you’re looking for a brokerage firm with lower derivatives fees, advanced charting tools, and simple connections with TradingView.

Final Word:

If you can adjust to its noisy UI, thinkorswim is an excellent option for traders. Yes, this site isn’t as clean as TradingView, but it’s a legit platform with a wealth of charting indicators and tools.

It usually takes a few days or weeks to get the hang of thinkorswim, but traders who persevere in their “swimming lessons” often love the personalization of this platform.

As a bonus, since thinkorswim is accessible to TD Ameritrade users, there’s no way you can feel ripped off!

FAQs:

Is thinkorswim a good trading platform?

thinkorswim is a good platform for traders most interested in technical analysis and charting.

Is thinkorswim good for beginners?

Beginners often find thinkorswim's platform too overwhelming. Anyone new to technical analysis may feel more comfortable with competitors like TradingView.

Is there a monthly fee for thinkorswim?

There's no monthly fee to use thinkorswim. You just need a TD Ameritrade account to access this platform.

Should I use TradingView or thinkorswim?

TradingView is more popular than thinkorswim because it offers a simplified UI/UX without sacrificing advanced charting features. However, if you're okay with a steeper learning curve, thinkorswim may be the more affordable option.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.