Let’s cut to the chase: Is Louis Navellier’s InvestorPlace platform legit? Are the Louis Navellier Portfolio Grader service, and the many newsletters offered by InvestorsPlace, worth your time and money?

The short answer is that many of these services do have value. However, for some, the investing guru’s checkered history, which I’ll explain in detail in this post, may serve as a red flag — and motivation to seek out other stock research and stock-picking services.

My personal take? Upon taking a deep dive into Navellier’s offerings, I’ve determined that there are alternatives (many of them cheaper than Navellier’s) that may be a better fit for the majority of investors.

Keep reading to learn more…

A high-quality alternative for a fraction of the cost…

Louis Navellier’s newsletters cost hundreds (or in some cases, thousands) of dollars. With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you for a fraction of the price. For just $99 per year (or $79 for a limited time, using this link), you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Each selection undergoes a careful review of 115 factors proven to drive growth in stocks, including proprietary AI algorithms, using our Zen Ratings system

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary

Who is Louis Navellier?

Louis Navellier has developed a reputation as a leading growth investor on Wall Street, managing over one billion dollars in assets from this firm in Reno, Nevada.

In particular, Navellier is known for his platform, InvestorPlace. The platform offers several services, like an investment newsletter, market analysis, and stock recommendations. Over time, Navellier and his platform have garnered substantial popularity among retail traders.

How did Navellier’s storied career start? After studying at Cal State Hayward and taking a liking to statistical analysis, Navellier began developing a toolset to help identify inefficiencies in the stock market.

This period would lay the foundation for what would become Navellier’s lifelong pursuit of his investment philosophy: using data to uncover stocks set for above-average growth.

Navellier gained a strong following among traders and investors following the publication of his first newsletter, MPT Review. He would eventually expand to offer the Louis Navellier Portfolio Grader, a quantitative stock ranking system that assesses equities using traditional valuation metrics, like earnings growth, sales growth, and return on equity.

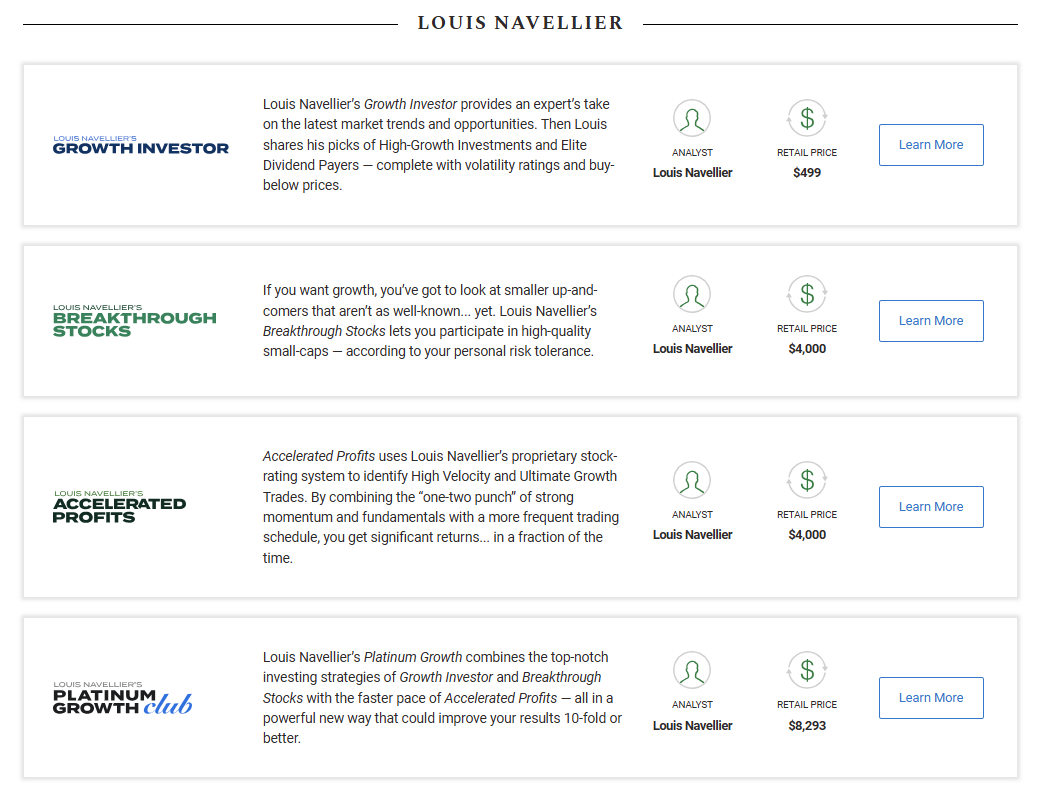

He would later launch additional newsletters:

- Growth Investor: Focused on identifying large-cap stocks with high growth potential.

- Breakthrough Stocks: Highlights small-cap companies with significant upside potential.

- Accelerated Profits: Aimed at revealing shorter-term momentum opportunities.

- Platinum Growth Club: A combination of the first three services with claims of potentially improving your results by “10-fold or better.”

In particular, Navellier is well known for his investment research platform, InvestorPlace. Through it, he’s reached thousands of retail investors who navigate markets using data-driven approaches.

Reputation as a “Growth Investor”

Navellier’s niche is growth investing. He attempts to find stocks with high earnings and revenue potential, focusing on sectors characterized by innovation, like technology, healthcare, and consumer goods.

The idea is that Navellier uses quantitative analysis coupled with a forward-looking perspective to locate potentially lucrative investments before they become well known.

Of course, his approach isn’t without criticism.

Growth investing, especially momentum trading, can be risky and open investors to significant losses during rapid downturns. Not only that, Navellier’s stock-picking history isn’t flawless. His recommendations sometimes underperform despite having some high-profile wins under his belt.

Critically, Navellier has been involved in questionable activity that raises serious red flags.

On June 4, 2020, the U.S. Securities and Exchange Commission posted the following memo on their website:

“The Securities and Exchange Commission has obtained a final judgment and more than $30 million in monetary relief in its action against Navellier & Associates, Inc., a Nevada-based investment advisory firm, and its founder and chief investment officer, Louis Navellier, of Florida. The Commission charged the defendants in federal district court in Massachusetts in August 2017 alleging that they breached their fiduciary duties and defrauded their advisory clients and prospective clients through the use of marketing materials that included false and misleading statements regarding the past performance of the firm’s Vireo AlphaSector investment strategies.”

Ultimately, the SEC penalized Navellier & Associates and its founder, Louis Navellier, for misleading clients, claiming marketing materials exaggerated past performance and successes.

The result?

Nearly $30 million in ill-gotten gains and interest was ordered to be returned, and a $2.5 million penalty was applied.

Does this mean you shouldn’t trust Navellier or his services? Not necessarily.

People can change and improve. However, for some, this historical fact may be a red flag.

What is the Louis Navellier Portfolio Grader?

The Louis Navellier Portfolio Grader (which has since been updated and renamed Stock Grader) is a tool designed to help investors identify stocks with high growth potential using a data-driven methodology.

Using different fundamental and quantitative factors, Stock Grader provides each stock with a letter grade (A through F).

The Louis Navellier Stock Grader (formerly Portfolio Grader) provides two grades: a fundamental grade and a quantitative grade.

The fundamental grade is determined by assessing the following metrics:

- Sales Growth

- Operating Margin Growth

- Earnings Growth

- Earnings Momentum

- Earnings Surprises

- Analyst Earnings Revisions

- Cash Flow

- Return on Equity

The quantitative grade looks at stocks’s buying pressure. In other words, it assesses how much money is flooding into the name. “The more money that floods into a stock, the more momentum a stock has, and the higher the Quantitative Grade,” reads a description on the service’s website.

Using these metrics, a composite score ‘Total Grade’ is calculated.

- A (Strong Buy): This means a stock possesses excellent growth potential and favorable market sentiment.

- B (Buy): Suggests a solid investment with slightly less upside than an A-rated stock.

- C (Hold): Neutral rating, implying limited growth or uncertainty in performance.

- D (Sell): Signals a stock with underwhelming fundamentals or unfavorable market conditions.

- F (Strong Sell): Highlights a stock with significant downside risks or poor performance metrics.

With its letter grading system, the Navellier Portfolio Grader might seem a lot like WallStreetZen’s Zen Ratings system. However, there are some key differences:

Feature | Portfolio Grader (Louis Navellier) | Zen Ratings (WallStreetZen) |

|---|---|---|

Focus | Growth investing with a focus on quantitative analysis of individual stocks. | Long-term investing with a focus on the stocks with the highest potential. |

Stock Selection Criteria | Evaluates stocks based on fundamentals (e.g., earnings growth, ROE) and quantitative factors (e.g., momentum, volatility). | System of evaluating stocks by distilling 115 factors proven to drive growth into a simple, easy-to-read letter score |

Portfolio Composition | Provides stock grades (A to F) but no pre-constructed portfolios or explicit recommendations for diversified portfolios. | Provides stock grades (A to F) and offers insight to 7 Component Grades that play into each rating. |

Transparency | Limited visibility into the weight of individual factors. | You can easily see the overall grade as well as the 7 Component Grades that factor into the overall rating, giving you greater insight into a stock’s strengths. |

Updates & Commentary | Users independently track stocks and adjust based on grades. Limited ongoing market commentary. | Users can add stocks to their watchlist for daily updates, and can access the latest analyst upgrades and commentary. |

Educational Resources | No significant educational resources, primarily a tool for grading stocks. | Regular no-cost webinars and educational blog posts to inform investors. |

Ease of Use | Requires the user to analyze individual stock grades and build their own portfolio. | Easy to read grades with guidance (Strong Buy, Buy, Hold, Sell, Strong Sell) |

Best For | Investors who prefer individual stock selection and are comfortable managing their own portfolios based on grading tools. | Investors who want expert-curated portfolios with clear guidance and consistent updates suitable for long-term wealth building. |

Subscription Includes | Access to stock grades and ratings on various companies. Newsletters / stock picking services are an added fee. | Free to view Zen Ratings; for access to more tools, you can upgrade to WallStreetZen Premium and gain access to analyst ratings, an unlimited watchlist, and more. |

Additional Tools | Portfolio Grader is standalone; no integrated portfolio tracking or risk management tools. | Combines stock ratings with comprehensive due diligence tools and market tracking via WallStreetZen’s platform. For a portfolio curated by an expert using Zen Ratings, WallStreetZen also offers a stock-picking service for $99 ($79 for a limited time, using links in this post) a year — Zen Investor. |

Philosophy | Focuses on individual stock growth potential, with less emphasis on overall portfolio strategy or risk balancing. | Emphasizes realistic expectations, long-term growth, and a “slow and steady wins the race” philosophy for investing success. |

Track Record (Performance) | Portfolio Grader does not provide comprehensive performance results, only highlighting cherry-picked performance wins. | ‘A’ rated (Strong Buy) stocks from Zen Ratings have seen an average annual return of 32.52% going back more than 20 years. |

Growth Investor Reviews: Is Louis Navellier’s Newsletter Worth It?

The Growth Investor newsletter is one of Navellier’s flagship services. It’s directed toward retail investors who want to uncover large-cap companies with strong fundamentals, solid earnings potential, and favorable momentum.

The problem?

Growth Investor isn’t cheap. A one-year subscription to the newsletter will run you $499.

Of course, if the newsletter results in your achieving outperformance beyond that fee, then it’s potentially a worthwhile investment. However, it’s uncertain how likely a subscriber’s success can be. While Navellier promotes his winning positions, there are scant details about the positions that did not fare as well.

This newsletter is for individuals who:

- Are focused on large-cap growth names with high earnings potential.

- Value detailed stock analysis.

- Comfortable with the higher volatility characteristic of growth investing.

- And, crucially, believe Navellier’s newsletter can produce enough winning recommendations to justify the subscription cost.

However, if you’re looking for a more balanced approach to investing or prefer diversification with lower risk, you may want to look elsewhere.

Alternatives to Louis Navellier’s Newsletters

Ease of use, affordability, and performance are crucial when choosing an investment service. Louis Navellier’s Portfolio Grader and Growth Investor cater to growth-oriented investors but may not meet every investor’s needs. Here are some worthy alternatives to consider:

1. Zen Investor

- Focus: Hand-picked stocks using a combination of WallStreetZen tools + insights from a 40+ year market veteran

- Cost: $99 / year (PROMO: $79/year for a limited time, Using this link)

- Key feature: Leverages the proprietary Zen Ratings system (Stocks rated “A” have historically delivered 32.52% annual returns)

Zen Investor offers a modern alternative with a streamlined, data-driven approach that simplifies investing while delivering transparent value at an affordable price.

Here are some of Zen Investor’s highlights:

- Ease of Use: Zen Investor focuses on providing clear, actionable insights. Powered by Zen Ratings, which evaluate stocks using data-driven metrics like fundamentals, upside potential, and top analyst opinions. Stocks are labeled from “Strong Buy” to “Strong Sellm” for simplicity, making it accessible even to novice investors.

- Affordability: At $99 for the entire year ($79/year for a limited time, using this link) Zen Investor offers a highly competitive subscription cost.

- Performance: Using a four-step stock selection process that combines rigorous data analysis and human expertise, Zen Investor delivers curated portfolios of up to 30 stocks, balancing growth opportunities with risk management. Stocks with an A rating through Zen Ratings, a key tool used to evaluate stocks for Zen Investor, have returned over 32% annually since 2003!

2. Motley Fool Stock Advisor

- Focus: Stock recommendations for long-term investors.

- Cost: ~$99/year with promotions.

- Key Feature: Two new stock picks each month with a history of strong returns.

Motley Fool Stock Advisor is one of Motley Fool’s flagship services.

Each month, subscribers get two new stock picks, along with a “Best Buys Now” list, which highlights the top stocks to consider buying right now. This helps take the guesswork out of what’s currently worth investing in.

One standout feature? A strong community of investors that comes with it. It’s a place to share ideas, get advice, and learn from others. That, plus the service’s historical returns, make it a perennial favorite of serious, part-time investors.

3. Stock Market Guides

- Cost: $69/month

- What you get: Real-time alerts with clear entry and exit instructions

Stock Market Guides is a fantastic pick for investors who want stock picks with a backtested edge. The service was borne of years of research and backtesting, resulting in the powerful algorithms possible.

As a subscriber, you receive real time alerts by email or text when they find a trade setup with a strong backtested edge, which is the next best thing.

Every trade alert is based on automated trading rules. That means you get clearly defined instructions for the entry and exit of the trade. The trade alerts also show you the backtested track record of that specific trade setup, like this:

Best of all, you can choose between subscriptions for stock picks or option picks, or spring for both. At just $69 each, that’s not out of the question, especially considering the service’s track record. The average annualized return of their stock picks in backtests is 79.4%. For their option picks, it’s 150.4%.

If you’re looking for premium returns out of an algo software, then Stock Market Guides is definitely worth considering.

Their stock and option services are offered for $69 per month each.

The Verdict

While Navellier’s Portfolio Grader and Growth Investor cater to growth-focused investors, there are plenty of alternatives that offer more bang for your buck.

We may be biased, but we believe Zen Investor stands out for its simplicity, affordability, and focus on diversified portfolios. Unlike many services that overwhelm users with technical analysis or complex strategies, Zen Investor simplifies investing by offering a curated portfolio of up to 30 top-rated stocks. These stocks are selected using a transparent and rigorous 4-step process powered by Zen Ratings.

Final Word:

There is no doubt that Louis Navellier has established quite the reputation, good and bad, in his decades long history in financial markets. His services, like Portfolio Grader and Growth Investor, have helped to elevate Navellier’s reputation, while his actions, like deceptive marketing tactics, have undoubtedly hurt it.

Nevertheless, these services may still be suitable for the right investor who can overlook Navellier’s history and gain value from some of the attractive tools he offers. Many Louis Navellier reviews sing the praises of his services.

Still, the lack of transparency and higher price tags of services like Growth Investor means the hurdles may be insurmountable for some.

On the other hand, Zen Investor offers investors a comprehensive, transparent, and data-driven alternative at a fraction of the cost. It does not promise outrageous performance; instead, it relies on tried and tested methodologies emphasizing realistic expectations, portfolio balance, and long-term growth.

If you’re after a transparent, affordable, and user-friendly investing solution with an attractive track record, Zen Investor may be your best bet.

FAQs:

Is Louis Navellier’s Portfolio Grader accurate?

Yes, Louis Navellier’s Portfolio Grader is accurate and can be a valuable tool for identifying high-growth potential stocks, but like any system, it is not foolproof.

What is Louis Navellier’s investment strategy?

Louis Navellier’s investment strategy is focused on growth investing, focusing on stocks with strong earnings growth, revenue growth, and market momentum.

How much does Portfolio Grader cost?

Portfolio Grader, or Stock Grader, is an add-on feature that comes with a subscription to one of Louis Navellier’s premium services, which start at $499.

What are the best alternatives to Louis Navellier’s Growth Investor?

The best alternatives to Louis Navellier’s Growth Investor newsletter are Zen Investor, Motley Fool Stock Advisor, Seeking Alpha Premium, and Stock Rover.

How much is Louis Navellier’s Net Worth?

While we don’t know the exact Louis Navellier net worth, we have some ideas of what it might be. Navellier has reportedly claimed his net worth places him among this one percent. If that’s true, that implies he possesses a household net worth of at least $13.6 million.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.