There’s no shortage of stock investing newsletters. If you found this post, you’re probably wondering — is Luke Lango any good?

In this post, I’ll take a deep dive into Luke Lango’s Innovation Investor newsletter to help you decide if it’s worth your time and money.

I’ll review the pros and cons, share what customers are saying, and even share a few worthy alternatives, like Zen Investor.

Let’s start by taking a closer look at Luke himself.

Is Luke Lango Legit? Key Takeaways

Yes, according to Luke Lango reviews, news, and my experienced observations, I’d say he’s legit. Here’s why:

- Experienced Analyst: Luke Lango is a senior investment strategist at InvestorPlace who is known for identifying high-growth opportunities in technology and innovation sectors.

- Reputable Platform: InvestorPlace, founded in 1974, is a respected financial publishing company offering comprehensive market analysis and expert commentary.

- Innovation Investor: This premium newsletter, led by Lango, focuses on high-growth tech stocks and provides in-depth research reports, monthly recommendations, and unique strategies like the “ChatGPT Loophole.”

- Subscription Benefits: Subscribers receive detailed stock analyses, growth forecasts, and innovative investment tools, aiming to capitalize on early-stage tech opportunities.

Overall, Lango’s newsletter can offer valuable insights for tech-focused investors who appreciate a done-for-you service.

However, some may find the marketing claims hyperbolic, and others have critiqued Lango’s track record. We’ll cover these points in detail in the sections below.

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Plus, it’s a fraction of the cost of Luke Lango’s service. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Who is Luke Lango?

Luke Lango is a financial analyst and senior investment strategist at InvestorPlace, a leading financial publishing company. His reputation mostly revolves around identifying high-growth opportunities, particularly in the technology and innovation sectors.

Luke’s been writing and providing investment insights for InvestorPlace for over five years. His background includes a blend of experience in financial analysis, technology, and entrepreneurship.

Lango’s approach often involves identifying emerging trends and disruptive technologies that have the potential to deliver substantial returns. By focusing on early-stage opportunities, Lango aims to provide investors with insights that can lead to significant long-term gains.

According to InvestorPlace, the risk-reward profile for all of his stock-picking services is moderate-aggressive. So Luke’s approach is best-suited for growth-oriented investors with a healthy risk tolerance.

Related Reading: How to Invest in AI | Ultimate Guide

About Investorplace: Key Features

So Luke Lango’s a legit financial figure. But what about InvestorPlace?

Founded in 1974, InvestorPlace is a prominent financial publishing company that provides a wide range of investment advice, market news, and stock recommendations.

It has been publishing for 50 years and caters to both novice and experienced investors, offering insights into various market trends and investment opportunities. Here are some key features:

- Comprehensive Market Analysis: InvestorPlace offers in-depth market analysis, covering a broad spectrum of sectors and industries. This helps investors stay informed about current market conditions and future trends.

- Expert Commentary: The platform features commentary from seasoned analysts, including Luke Lango, providing expert perspectives on market developments and investment strategies.

- Regular Updates: Subscribers receive regular updates and actionable investment advice, helping them make informed decisions.

- Specialized Newsletters: InvestorPlace offers various specialized investment newsletters, such as Innovation Investor, each focusing on specific areas of the market.

In short, InvestorPlace is respected in the financial community and is widely used by investors looking for reliable information and investment strategies. Its long history and reputable contributors make it a trusted source for investment insights.

Related Reading: Who Has the Best Stock-Picking Record?

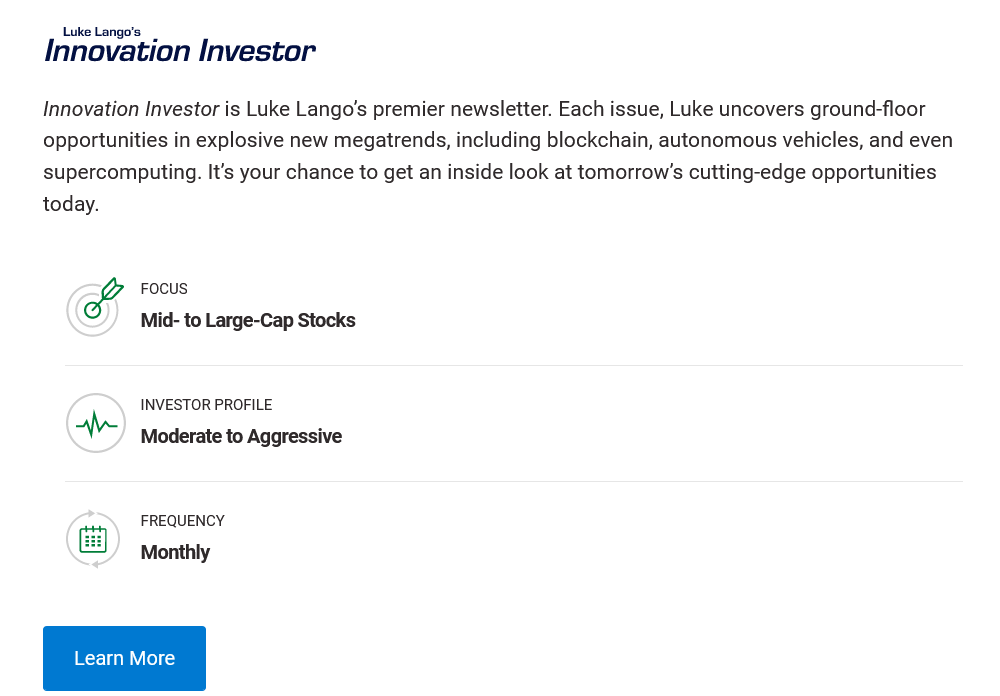

What is Innovation Investor?

Innovation Investor is one of InvestorPlace’s premium newsletters, spearheaded by Luke Lango. It focuses on identifying and recommending stocks poised to benefit from groundbreaking innovations and technological advancements:

The goal is to help investors capitalize on early-stage opportunities in high-growth tech-related sectors, like blockchain, EVs, and computing.

The newsletter leverages Lango’s expertise in spotting emerging trends and companies that are likely to experience rapid growth.

Subscribers to Innovation Investor get access to a curated list of high-potential stocks, along with detailed research reports and monthly recommendations. We’ll take a closer look at what’s included in the next section.

Innovation Investor Newsletter: What You Get

Obviously, a stock-picking newsletter includes stock picks. But what else do you get?

There are several other valuable resources Lango includes, designed to enhance your investment strategy.

Here’s what you can expect:

- “ChatGPT Loophole”: According to Lango and InvestorPlace, this unique strategy allows you to invest in ChatGPT and OpenAI directly, even though the company still isn’t publicly traded.

- Research Reports: In-depth analyses of emerging trends, industries, and individual stocks that offer significant growth potential. These reports provide detailed information and insights that help investors make informed decisions.

- Monthly Stock Recommendations: Every month, Luke Lango provides a curated list of stocks handpicked for their high-growth potential. Each recommendation is accompanied by detailed explanations and growth forecasts, helping subscribers understand the rationale behind each pick.

Overall, to me at least, these are pretty “table-stakes” inclusions. You get stock picks and reports related to those picks.

Related Reading: How to Buy ChatGPT Stock

The one big bonus that may interest people is the “ChatGPT Loophole” … especially since it’s been described as a “100x story.” According to Lango, major venture capital firms like Sequoia Capital and Andreessen Horowitz are heavily invested in ChatGPT, but there’s a way for everyday investors to get in on the action too.

Lango suggests that by leveraging his discovered loophole, you can claim a stake in ChatGPT now, potentially positioning yourself for substantial returns when the company eventually launches an IPO.

He argues that OpenAI’s ChatGPT could offer 100X returns, drawing parallels to past venture capital successes like YouTube and Google. The core idea is to buy into Microsoft (NYSE: MSFT), which has invested heavily in OpenAI, thus providing indirect exposure to ChatGPT’s growth.

Of course, savvy investors will note that Microsoft is already a $3.3 trillion market cap company. So a 100x from here is unlikely, and a hyperbolic “stretch claim” that newsletters are notorious for.

Personally, it’s not the kind of special report I’d pay for, nor that unique of an idea (I think many investors know by now that investing in MSFT is one of the few ways to get exposure to OpenAI and ChatGPT).

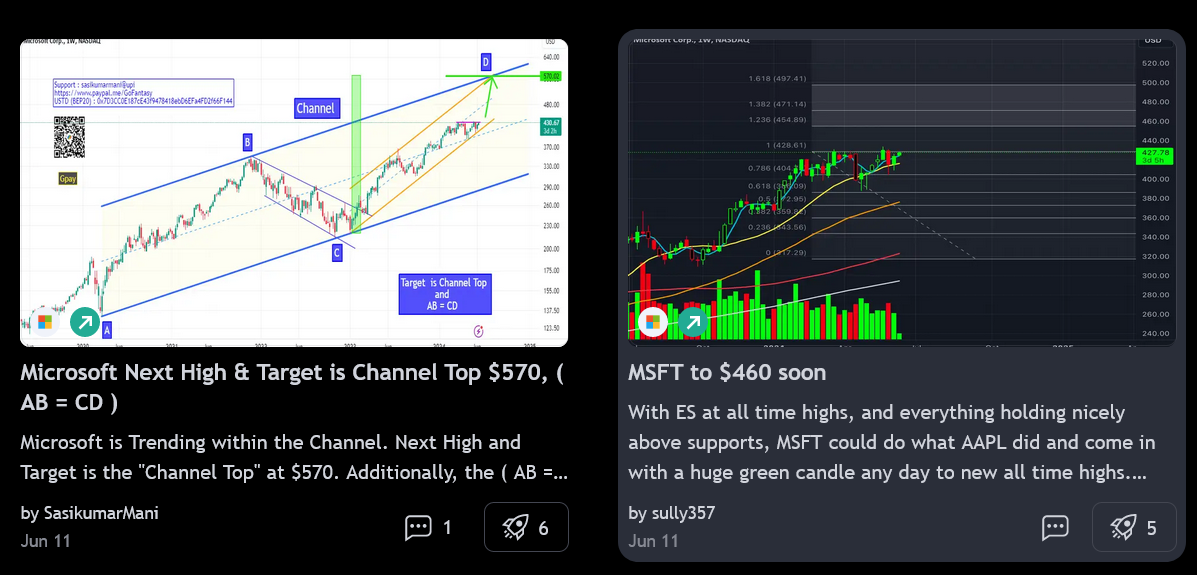

Investors looking for an alternative way to take their trading or investing to the next level would likely get more value from something like TradingView Pro. It offers advanced charting tools and real-time market data, allowing you to conduct your own analysis.

TradingView Pro provides sophisticated charting capabilities that allow you to visualize market trends and patterns clearly. So whether you’re a novice or an experienced trader, these tools can help you better understand market movements and potential entry and exit points.

Plus you get access to a community of other traders’ ideas. For example, here are some ideas on trading MSFT:

As you can see, it’s an especially great fit if you’re interested in technical analysis and chart patterns, or looking to learn.

Try TradingView Pro for FREE

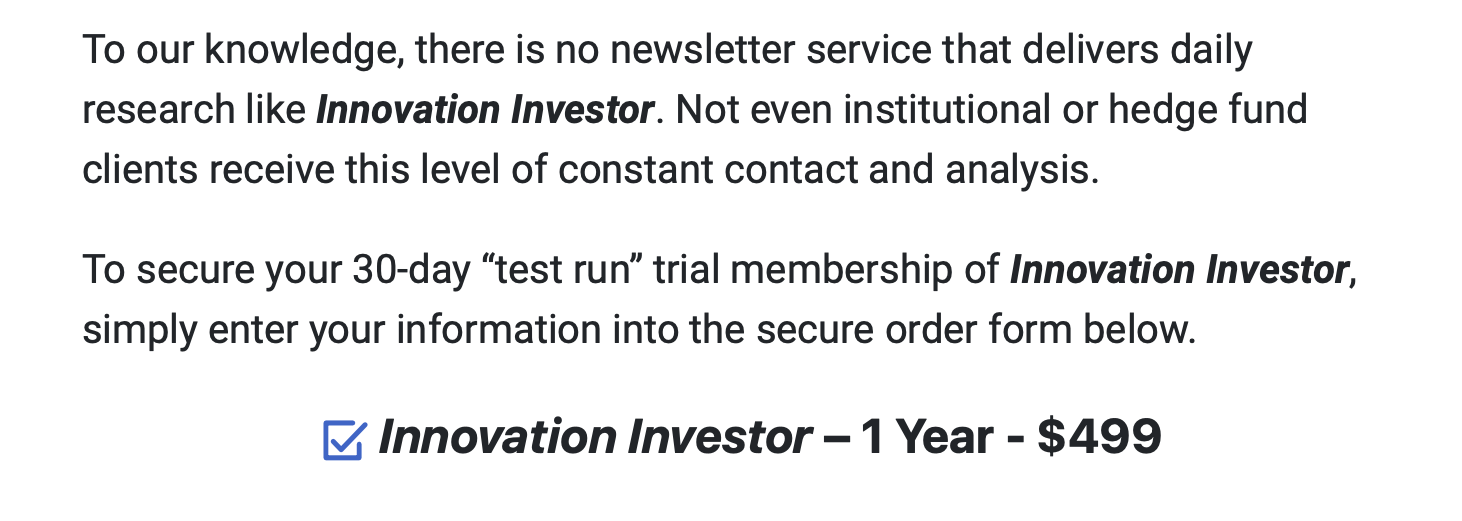

Innovation Investor: Cost

The current cost of Innovation Investor is $499. Personally, I find it kind of expensive — especially considering a service like Zen Investor (more on that in a minute) is a fraction of the price.

Innovation Investor: Pros and Cons

Overall, Innovation Investor is a bit of a mixed bag. On the pro side, it could be a good fit for investors interested in tech-heavy growth sectors who don’t have time to do their own research.

As for the cons, some readers might find the hyperbolic claims (like the ChatGPT loophole being a 100x opportunity) don’t quite add up to reality, which can lead to disappointment.

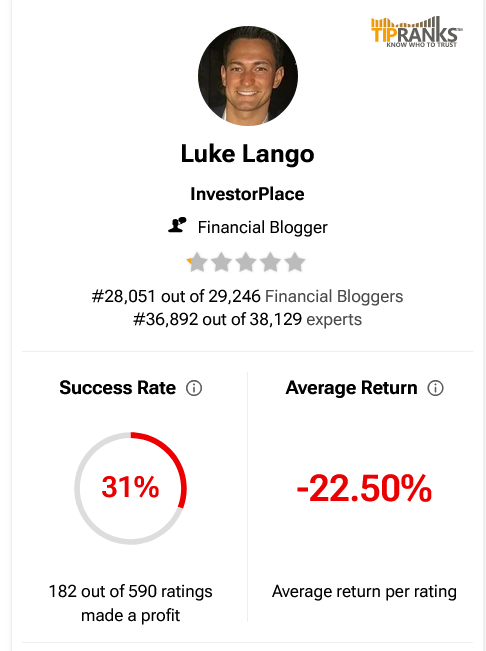

Other critics point out Lango’s poor TipRanks rating (a website that ranks analysts’ performance):

But even critics of Lango point out that TipRanks ratings are a snapshot in time from some point in the past, and not necessarily a great system for ranking folks when it comes to their investment ideas. It’s best to follow Luke Lango news to try and get a feel for his latest focus / performance.

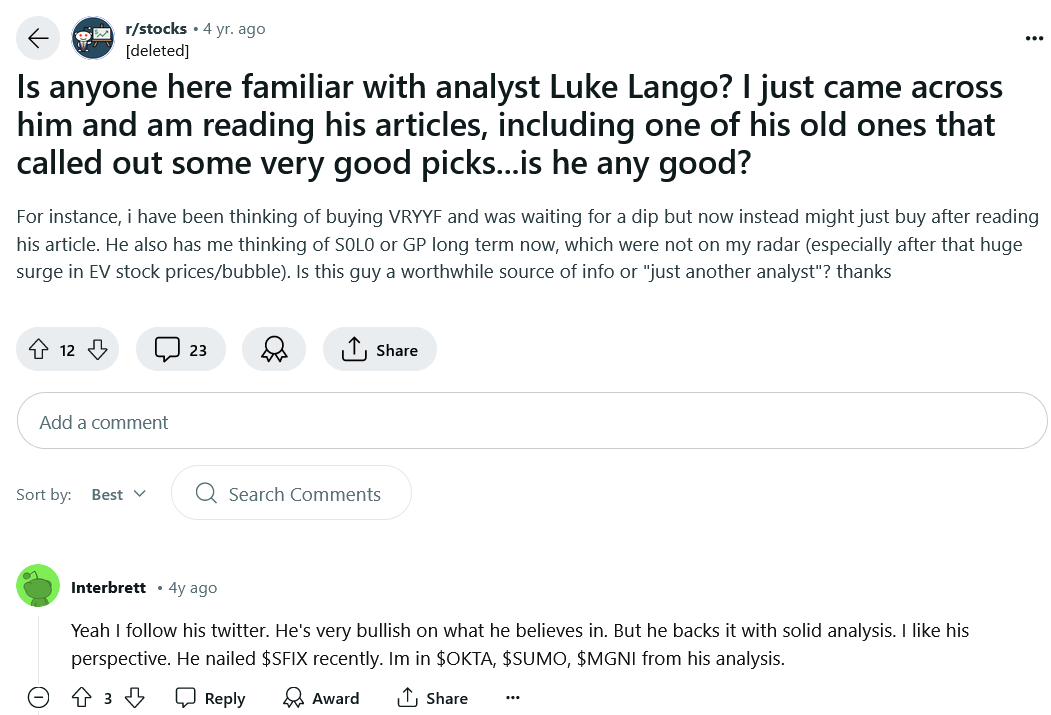

Other readers are much more constructive on Lango’s past picks:

Overall, I’d sum up the pros and cons with the following:

Pros:

- Focus on High-Growth Sectors: The newsletter emphasizes sectors with significant growth potential, such as technology and innovation. Not a lot of analysts are devoted to covering the latest in blockchain, EVs, or computing, so this could be unique research and save you a lot of time from trying to do your own reading around the internet.

- Comprehensive Resources: Subscribers get access to in-depth research reports, monthly stock recommendations, and innovative tools like the “ChatGPT Loophole.” It’s very much a done-for-you service, which some appreciate the convenience of.

Cons:

- Market Risks: Investing in emerging technologies and high-growth stocks carries inherent risks, including volatility and potential losses.

- Information Overload: Novice investors might find the volume of information overwhelming and challenging to navigate if they don’t have a background in these specific sectors.

Looking for Investment Ideas? Subscribe to our FREE Newsletter

Is Innovation Investor Worth It?

Innovation Investor could be worth it for investors who are particularly interested in high-growth tech sectors. It could also be a good fit for those who appreciate having a curated list of stock recommendations and in-depth research at their fingertips.

However, it’s really only suitable for those with a moderate to high-risk tolerance.

It’s also crucial to approach the service with realistic expectations. The hyperbolic marketing claims should be taken with a grain of caution, and you should be prepared for the inherent volatility and risks associated with high-growth investments.

That said, if you align with the growth-oriented, tech-focused investment philosophy and are comfortable with the associated risks, Innovation Investor could still be a valuable addition to your investment strategy.

More Stock-Picking Experts to Consider Following:

Steve Reitmeister (Zen Investor)

- Cost: $79 for 1 year, $190 for 3 years, $197 for 5 years

- What you get: Stock screeners, analysts insights, detailed investment reports and stock picks

Steve Reitmeister, via our service Zen Investor, has a methodical, multi-step approach to stock picking:

- His approach starts with monitoring only the top-performing analysts, ensuring that only the most profitable recommendations are considered.

- Next, each stock undergoes the rigorous Zen Ratings system, which distills 115 factors that drive growth into an easy-to-read letter score. In addition to an overall score, you can see how each stock scores in different areas, including value, growth, momentum, and more.

- Once a stock passes this evaluation, Reitmeister digs deeper to assess its growth potential, paying particular attention to companies with strong earnings surprises, attractive valuations, and robust growth prospects.

- Reitmeister then assesses the upside potential by focusing on stocks with strong growth prospects, reasonable valuations, and a history of earnings surprises.

- Finally, he handpicks the best stocks from this refined list, leveraging his 44 years of investment experience to navigate market conditions and select the most promising opportunities. Subscribers benefit from detailed market commentary, a decisive trading plan, and access to a portfolio of 20-30 high-potential stocks.

The process has unearthed some massive winners:

The Motley Fool Stock Advisor

- Cost: $99 for one year

- What you get: New stock picks each month, “Best Buys Now” list, and access to a community of investors

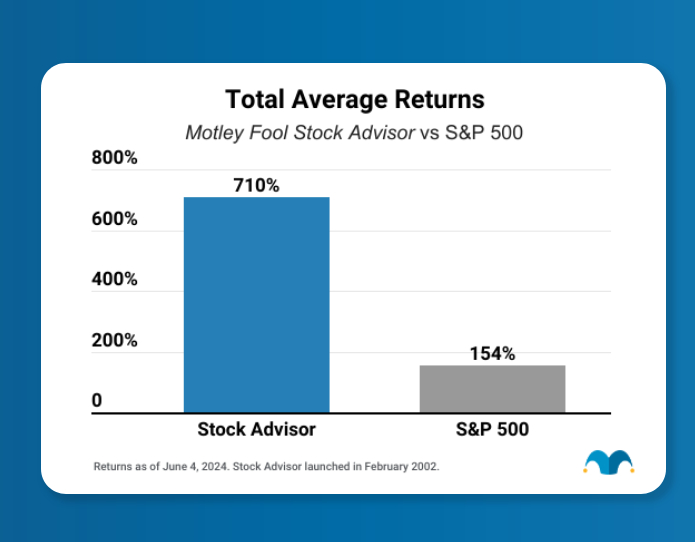

The Motley Fool Stock Advisor, led by Tom and David Gardner, is renowned for its impressive track record and focus on long-term growth opportunities. Subscribers receive two new stock picks each month, along with a curated list of “Best Buys Now” and access to a vibrant community of investors.

The Gardner brothers’ expertise in identifying market-beating stocks makes this service invaluable for those looking to enhance their portfolios with well-researched, high-potential investments.

It doesn’t hurt that they have a strong track record either:

Seeking Alpha (Alpha Picks)

- Cost: $499 for 1 year (note: $30 off with our link)

- What you get: monthly stock picks, real-time alerts, financial articles and in-depth reports

Seeking Alpha’s Alpha Picks service delivers top-tier stock recommendations based on extensive research and analysis from a diverse community of professional and individual investors.

Subscribers receive monthly stock picks, real-time alerts, and access to a wealth of financial articles and in-depth reports.

This service helps investors make informed decisions and uncover hidden gems in the market through a comprehensive approach to stock selection.

Market Chameleon

- Cost: $99 per month

- What you get: Pre-market movers, earnings analysis, unusual trading volume reports, and more

Market Chameleon is a great resource for active traders, especially those interested in options trading.

The platform offers a suite of tools including pre-market movers, earnings analysis, and unusual trading volume reports. These data-driven insights help traders identify profitable opportunities and refine their strategies.

Trade ideas and reports are also included.

Market Chameleon’s robust analytics and comprehensive market data make it an invaluable tool for anyone looking to capitalize on market trends and anomalies.

Newsletter | What you get | Best for | Cost |

|---|---|---|---|

Access to a curated list of high-potential stocks, along with detailed research reports and monthly recommendations. | Investors interested in tech-heavy growth sectors who don’t have time to do their own research. | $499 / year | |

An actively managed portfolio of stock picks hand-selected by 4-decade stock market veteran Steve Reitmeister; stock screeners, analysts insights, detailed investment reports and stock picks; monthly webinars | Investors looking for solid investments with long-term growth potential. | $79 for 1 year, $190 for 3 years, $197 for 5 years | |

Expert content, community access, quant ratings, screeners, portfolio checkers, and more | Investors looking for detailed commentary and a service with a proven track record | $239/year (Get a $25 coupon using this link) | |

2 stock selections per month, community support, bonus reports, and more | Investors looking for high-potential, long-term picks | $199 year — or just $99* using this link |

Final Word: Luke Lango Review

Overall, Luke Lango is legit, but most Luke Lango reviews online are mixed. His style might not be for everyone.

For example, the big claims made in promotions for reports like “the ChatGPT loophole” don’t necessarily match up with the actual strategies provided, or with the results of the average investor (nobody has 100x’d their money in the recent years by investing in Microsoft).

However, the service could still be a good fit for investors who are passionate about high growth tech investing, and who have an aggressive risk-reward tolerance.

It’s probably best to read what you can find of Lango’s free writing and recent Luke Lango reviews online to see if his style is a fit for you before signing up.

FAQs:

How Good are Luke Lango’s Stock Picks?

Luke Lango stock picks are known for focusing on high-growth sectors like technology and innovation, often identifying early-stage opportunities with significant potential. According to various Luke Lango reviews, his investments are best-suited for growth-oriented investors.

What is Innovation Investor?

Innovation Investor is a premium newsletter from InvestorPlace, led by Luke Lango, that provides in-depth research reports, monthly Luke Lango stock picks, and tools like the “ChatGPT Loophole.” It focuses on identifying stocks poised to benefit from groundbreaking innovations and technological advancements.

Is Luke Lango’s Innovation Investor Worth The Cost?

Based on numerous Luke Lango reviews, Innovation Investor can be worth the cost for those interested in high-growth tech sectors and seeking comprehensive investment guidance. The newsletter offers valuable resources, and it can be a good fit for investors with a moderate to high-risk tolerance.

What Are Luke Lango’s Stock Picks for 2024?

Specific Luke Lango stock picks for 2024 aren’t disclosed publicly and for free yet. But his focus typically includes emerging technologies and innovative companies in sectors like blockchain, electric vehicles, and computing.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.