Having spent several years writing about and living in the finance world, I’ve explored a lot of newsletters — I have a good understanding of what’s worth my (and your) time and what’s not. So is Eric Fry legit? Yes. Should you spend money on Fry’s Investment Report? That’s what we’re here to help you decide.

Below, we’ll take a look at the expertise of Eric Fry and his track record. Who is Eric Fry? What’s in the newsletter, and how do the picks perform? And a lot more. Let’s get going…

Is Eric Fry Legit? Key Takeaways:

Yes, Eric Fry is legit. Fry’s report is a solid choice if you’re a growth-oriented investor with healthy risk tolerance and an interest in technology stocks. Here’s what I like about Fry’s Investment Report:

- Proven Track Record: Fry has a 20+ year track record of identifying profitable investment opportunities.

- Project Omega and AI Focus: Project Omega, tied to AI advancements and Elon Musk’s companies, showcases Fry’s forward-thinking approach and ability to spot transformative trends early, especially in the tech space.

- Educational and Comprehensive: Fry’s Investment Report isn’t just recommendations. It includes in-depth market analysis, educational content, and special reports.

- Subscriber Satisfaction: The report has garnered positive feedback from subscribers for its actionable insights, robust research, and the added assurance of a 365-day money-back guarantee.

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What is Fry’s Investment Report?

Published by InvestorPlace Media and led by Eric Fry, Fry’s Investment Report is a comprehensive financial newsletter that’s been around at least since 2020. It’s designed to provide subscribers with strategic insights into global market trends and emerging investment opportunities.

The report emphasizes macroeconomic analysis and sector-specific trends, offering a blend of traditional stock recommendations and innovative investment ideas. (We’ll explore Eric Fry’s Project Omega below.)

Subscribers gain access to monthly newsletters, a model portfolio, special reports, and an archive of past picks, all aimed at maximizing their investment potential.

Who is Eric Fry?

Eric Fry is a seasoned financial analyst and portfolio manager with nearly two decades of experience in international equities and macroeconomic strategies.

Eric Fry is best known for his ability to identify significant market trends before they become mainstream. He’s built a reputation for making profitable investment calls.

Fry’s notable achievements include winning the Portfolios with Purpose competition in 2016, where he outperformed 650 financial professionals with a 12-month return of 150%.

His long-term track record includes successful investments in Asian and Russian stocks during financial crises, as well as early investments in commodities and electric vehicle-related stocks.

In short — you won’t find many Eric Fry reviews that criticize a lack of experience.

Eric Fry Project Omega

Eric Fry’s Project Omega: What is it?

Project Omega is the cornerstone of Fry’s investment strategy. It focuses on the potential of artificial intelligence (AI) and its transformative impact on various industries. The project is closely tied to advancements in AI technology and leverages the reputation of influential figures like Elon Musk to highlight its significance.

Eric Fry’s Project Omega aims to identify and invest in companies that are at the forefront of the AI revolution, offering substantial growth potential.

The strategy is designed to capitalize on the rapidly evolving tech landscape and provide investors with opportunities for significant returns.

In short, Project Omega aims to uncover tomorrow’s AI leaders today. It’s not just an investment strategy, but a way to get in on the ground floor before entire business sectors adapt.

Elon Musk, the renowned tech mogul and founder of companies like Tesla and SpaceX, plays a pivotal role in the Eric Fry Project Omega strategy. Musk’s ventures are seen as prime examples of organizations driving innovation in the AI industry.

Eric Fry’s strategy capitalizes on these opportunities by focusing on firms that parallel the innovative drive seen in Musk’s ventures, positioning investors to benefit from the next wave of AI advancements.

Overall, Project Omega illustrates how Fry’s report can be an especially good fit for investors heavily interested in AI, technology, and disruption.

About InvestorPlace — Reviews + Basics

Fry’s Investment Report is offered by InvestorPlace Media — is the outlet legit?

Yes.Founded by Tom Phillips over four decades ago, InvestorPlace serves as a central hub for investment professionals across various sectors. InvestorPlace has a long history of delivering insightful financial news and advice, and there are countless positive InvestorPlace reviews out there.

In addition to publishing newsletters, InvestorPlace also publishes insight pieces from respected hedge fund managers such as Louis Navellier of Navellier & Associates, which has nearly $1 billion in assets under management.

InvestorPlace’s commitment to providing sound market analysis aligns well with Eric Fry’s expertise in international equities and macroeconomic trends. Given the track record and abundance of InvestorPlace reviews, you can rest easy knowing Eric Fry InvestorPlace, and the services they offer are legit.

Eric Fry’s Investment Report: How it Works

Eric Fry’s Investment Report utilizes a 3-step process to optimize your portfolio and capitalize on emerging opportunities:

1. Portfolio Purge

Eric Fry is big on “trimming the fat” or purging your portfolio of outdated or underperforming stocks.

This step helps clear out companies with antiquated business models that are likely to be disrupted by new technological innovations. This is an important strategy for tech investors, as technology changes rapidly, so the sector and individual companies can be disrupted by competitors.

2. The 1,000% Portfolio

The next phase involves building the “1,000% Portfolio,” which includes high-growth “outsider” tech companies.

These firms are characterized by their innovative technologies and efficient business models, positioning them for substantial gains — the types of companies that could benefit from AI and Project Omega, for example.

3. Invest in Radical New Technology

The final step focuses on investing in new, radical technologies that have the potential to revolutionize industries but receive limited mainstream coverage. These investments offer significant upside potential for early adopters.

Fry’s Investment Report: What You Get

As a Fry’s Investment Report subscriber, you get a lot more than stock picks:

- Monthly Newsletter: Delivered after market close on the second Friday of each month, featuring detailed stock recommendations, market commentary, and analysis.

- Model Portfolio: Provides an overview of all open positions, allowing you to engage with investment recommendations without delay.

- Archive of Past Picks: Access to an extensive archive of past stock picks and special reports, which lets you get more insight into Fry’s investment strategies and historical performance.

Fry’s Investment Report: Cost

The standard annual subscription price for Fry’s Investment Report is $199, but you can often find offers online — I’ve seen offers as low as $49 for new subscribers.

Here’s a nice touch: The subscription includes a 365-day money-back guarantee, so you can test it out with relatively low risk to see if you like it.

Fry’s Investment Report: Pros + Cons

Pros | Cons |

|---|---|

|

|

|

|

| |

|

Fry’s Investment Report Reviews: What Are Actual Subscribers Saying?

Let’s take a look at what other people are saying about Fry’s Investment report. I scoured Eric Fry reviews and testimonials to give you a more well-rounded POV from actual subscribers:

Positive Feedback

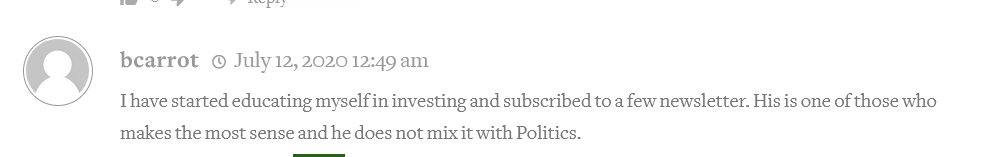

People who like Fry’s Investment report tend to like the thoroughness of Eric Fry’s market analysis and the practicality of his stock recommendations. One subscriber noted that they appreciated that Fry doesn’t mix his insights with politics, as is the case with other newsletters:

Subscribers also praise Fry’s Investment Report for its ability to break down complex financial concepts into understandable insights — meaning you don’t need a finance degree to understand what he’s saying.

People really love the special reports included with the subscription, which often include high-growth potential stocks in areas like AI, tech innovations, and international markets.

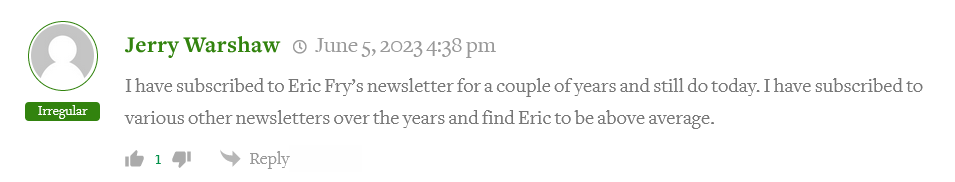

These reports delve into specific sectors and emerging trends, providing detailed analysis and investment opportunities that are often overlooked by other financial newsletter … which is why some multi-year subscribers like Jerry Warshaw find Fry’s newsletter be above average:

Criticisms

Not everyone loves Eric Fry; a lot of the criticism focuses on the speculative nature of certain predictions. For example, Project Omega’s reliance on AI advancements and the association with high-profile figures like Elon Musk are seen by some as leveraging popular trends to attract attention.

Critics argue that while these investments can be lucrative, they also carry higher risk due to their speculative nature.

Some users also feel that the newsletter occasionally relies too heavily on the reputations of well-known personalities such as Elon Musk to validate its predictions. While this can lend credibility, it may also lead to inflated expectations and disappointment if the investments don’t perform as anticipated.

There’s even a post on Reddit comparing Project Omega to Theranos:

However, many of these comments are hyperbolic and come from people who don’t actually pay for the premium service and research.

A less hyperbolic criticism is that there have been certain picks or plays that end up not going anywhere. But other commenters disagree:

It’s important to keep in mind that no newsletter will have a 100% success rate with its recommendations. Even the best investors and hedge fund managers are wrong or end up losing money on many of their investments.

So while these are valid criticisms, most of them are to be expected for a stock picking service focused on growth and speculative sectors like tech and AI.

Is Fry’s Investment Report Worth It?

Let’s consider what you get:

- A blend of investing insights

- Deep macro analysis

- Actionable recommendations (in the form of Eric Fry stock picks 2024).

Overall, if it aligns with your risk tolerance, it may be a valuable resource for navigating markets.

One important thing to keep in mind is that the focus on high-growth, outsider tech companies and radical new technologies suggests a high-risk, high-reward investment approach. This might not be suitable for all investors, especially those with a lower risk tolerance.

Emerging technologies can offer high returns, but they also carry significant uncertainty. These investments may be volatile and require a long-term investment horizon.

If the strategy fits your risk-reward profile, Eric Fry’s proven track record and the educational value of the report may make it a worthwhile investment.

3 Other Services to Consider

1. Zen Investor

- Cost: $79 for 1 year, $190 for 3 years, $197 for 5 years

- What you get: Stock screeners, analysts insights, detailed investment reports and stock picks

Steve Reitmeister, the brains behind Zen Investor, follows a disciplined and comprehensive method for selecting stocks. His strategy begins by closely tracking top-performing analysts to ensure that only high-quality recommendations make the cut.

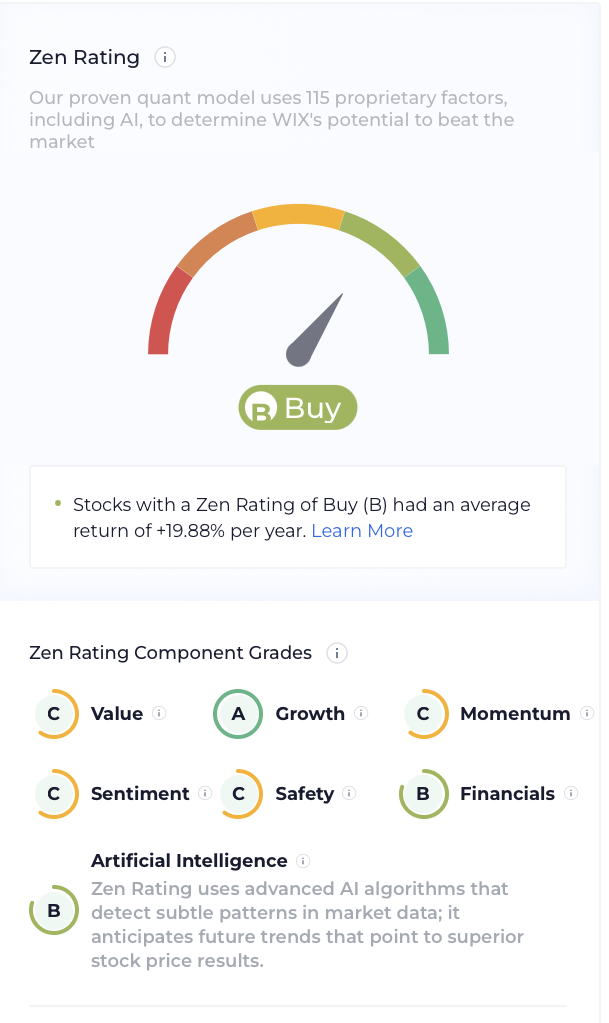

Each potential investment then undergoes a rigorous screening process through the Zen Ratings system, which distills 115 factors that drive growth into an easy-to-read letter score. In addition to an overall score, you can see how each stock scores in different areas, including value, growth, momentum, and more. Stocks rated “A” through the Zen Ratings system have produced an average annual return of +32.52% since 2003.

How does the Zen Rating look? Here’s the Zen Rating for a recent Zen Investor portfolio addition, Wix.com (NASDAQ: WIX):

Once a stock passes this evaluation, Reitmeister digs deeper to assess its growth potential, paying particular attention to companies with strong earnings surprises, attractive valuations, and robust growth prospects.

From this whittled-down selection, he handpicks stocks, relying on over four decades of investment experience to navigate market conditions and identify opportunities that align with his long-term strategy.

Subscribers to Zen Investor gain access to regular market analysis, clear trading strategies, and a focused portfolio of 20-30 high-potential stocks.

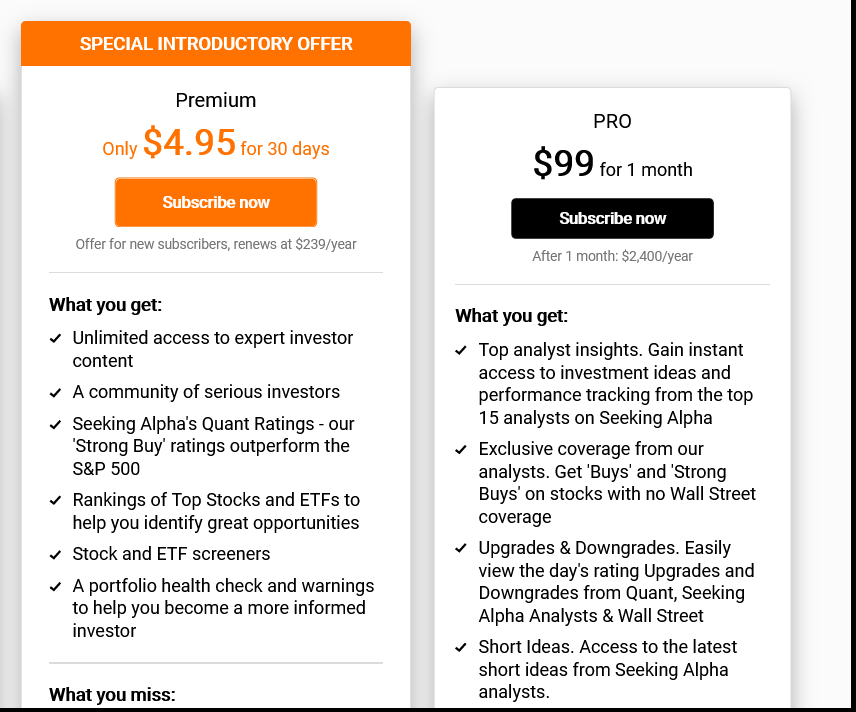

2. Seeking Alpha Premium

- Cost: Premium for $239/year

- What you get: Expert content, community access, quant ratings, screeners, portfolio checkers, and more

Seeking Alpha’s premium service includes access to exclusive articles, expert analysis, stock recommendations, and a robust community of investors.

Alpha Picks specifically provides curated stock picks, with detailed research and rationale behind each recommendation. This service aims to help investors identify high-potential stocks and make better investment decisions.

It also includes short ideas, which is somewhat unique, as most services are focused exclusively on finding companies with upside potential.

For more, see our review on whether Seeking Alpha is worth it.

3. Motley Fool Rule Stock Advisor

- Cost: $199 annually / $99 for your first year with this link*

- What you get: Stock picks, community support, bonus reports, and more

Motley Fool’s flagship service, Stock Advisor, uses a very specific strategy:

- Buy 25+ companies over time (in an equal-weighted portfolio)

- Hold stocks for 5+ years

- Add new savings regularly

- Hold through market volatility

- Let winners run

- Target long-term returns

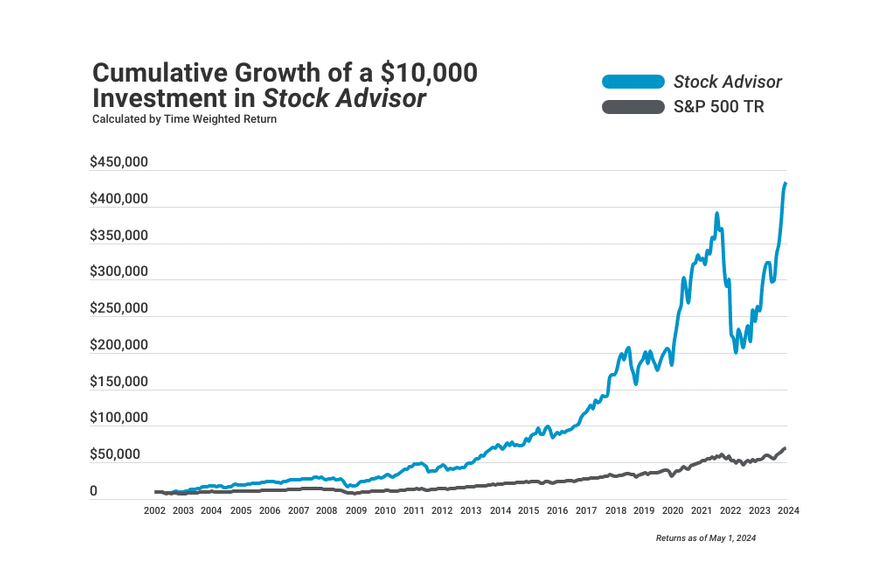

We think Stock Advisor is well worth the money if you’re looking for a service with an exceptional, S&P 500-beating track record:

By any measure, The Motley Fool’s services are performing exceptionally well, a testament to the company’s investment philosophy and the quality of its research.

Fry’s Investment Report Vs. The Competition: Which is Right For You?

Newsletter | What You Get | Best For | Cost |

|---|---|---|---|

Monthly newsletter featuring detailed stock recommendations, market commentary, and analysis, model portfolio, archive of past picks | Investors interested in disruptive technology who can stomach market volatility | $199/year | |

An actively managed portfolio of stock picks hand-selected by 4-decade stock market veteran Steve Reitmeister; stock screeners, analysts insights, detailed investment reports and stock picks; monthly webinars | Investors looking for solid investments with long-term growth potential. | $79 for 1 year (for a limited-time), $190 for 3 years, $197 for 5 years | |

Expert content, community access, quant ratings, screeners, portfolio checkers, and more | Investors looking for detailed commentary and a service with a proven track record | $239/year | |

2 stock selections per month, community support, bonus reports, and more | Investors looking for high-potential, long-term picks | $199 year — or just $99* using this link |

Final Word: Fry’s Investment Report Review

Fry’s Investment Report reviews consistently highlight the service for its detailed analysis, actionable recommendations, and educational value.

Eric Fry’s extensive experience and proven track record lend credibility to the service, while the comprehensive resources provided to subscribers enhance their ability to navigate the financial markets successfully.

But as with any investment service, it’s important to consider your own financial goals and risk tolerance.

Additionally, exploring other services like Zen Investor, Seeking Alpha, and Motley Fool, can provide further insights and options tailored to different investment strategies and needs.

By comparing these services, you can find the one that best aligns with your investment approach and helps you achieve your financial goals.

FAQs:

Who is Eric Fry the investor?

Eric Fry is a seasoned financial analyst and portfolio manager with nearly two decades of experience in international equities and macroeconomic analysis. He is known for his ability to identify profitable investment opportunities and has a proven track record of success, including winning the prestigious Portfolios with Purpose competition in 2016.

What is the Fry Report?

The Fry Report, also known as Fry’s Investment Report, is a comprehensive financial newsletter led by Eric Fry. The report, an Eric Fry InvestorPlace service, provides subscribers with detailed market analysis, actionable stock recommendations, and educational content, focusing on global trends and under-the-radar investment opportunities

What are Eric Fry’s stock picks for 2024?

While Eric Fry stock picks 2024 aren’t disclosed publicly, Eric Fry’s investment strategies typically focus on high-growth potential areas such as AI advancements, tech innovations, and international markets. Subscribers to Fry’s Investment Report receive up-to-date recommendations and detailed analyses through the monthly newsletter and special reports

Is InvestorPlace reliable?

InvestorPlace is a well-respected investment publishing firm with over four decades of experience delivering insightful financial news and advice. It serves as the publisher of Fry’s Investment Report and has a reputation for providing reliable and comprehensive stock market analysis

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.