Over the years, I’ve used many paid services designed to help investors make better decisions. From stock picking tools to technical analysis platforms, I’ve tried them all — some have proven useful, others have not.

My goal with this Chaikin Analytics review is to offer an honest, unbiased perspective on Chaikin Analytics and its highly promoted Power Gauge Report.

I’ll walk you through my personal experience and help determine whether Marc Chaikin’s offerings bring genuine value to your portfolio or if they’re just another overpriced service. Let’s go…

Is Chaikin Analytics Worth It? Key Takeaways:

I won’t keep you in suspense. While Chaikin Analytics has some strong points, I don’t believe it’s worth $499/year for most investors. Here’s why:

- Limited Value for Experienced Investors: While the Power Gauge simplifies stock analysis by combining 20 financial metrics into a single rating, experienced investors can find the same metrics on other platforms like Yahoo Finance or Seeking Alpha.

- Possibly Overhyped AI Focus: The newsletter heavily promotes AI-related stocks, which may seem like an attempt to capitalize on current trends rather than offering substantial analysis.

- Questionable Cost for Value Provided: At $499 annually, Chaikin Analytics may be overpriced for what it offers, especially when many of its tools are available for free elsewhere.

Ultimately, if you’re looking for a stock-picking service, I think there are better (and more cost-effective) alternatives out there, including WallStreetZen’s Zen Investor.

That said, I do think Marc Chaikin’s service is good for options education. It offers a comprehensive solution for beginners, integrating stock analysis with tools like OptionsPlay and the Chaikin Money Flow Indicator.

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Is Marc Chaikin Legit?

Yes, Marc Chaikin in legit. He is a seasoned financial analyst with over 40 years of experience, having worked a stockbroker and trader before transitioning into stock market tools and technical indicators.

Perhaps his most well-known contribution is the Chaikin Money Flow (CMF) Indicator, a tool which we’ll look at in the next section, which is used by traders to gauge buying and selling pressure in the market.

However, it’s worth noting that most of Chaikin’s carrer has been spent developing computerized stock picking models for money managers. As far as I can tell, he hasn’t spent significant time as a portfolio manager or hedge fund manager.

So a Marc Chaikin prediction in terms of stock performance may not be as helpful as you think. This isn’t necessarily relevant for this Chaikin Analytics review, but it does become important for his newsletter, the Power Gauge Report.

Chaikin Analytics Features: What You Get

The Power Gauge

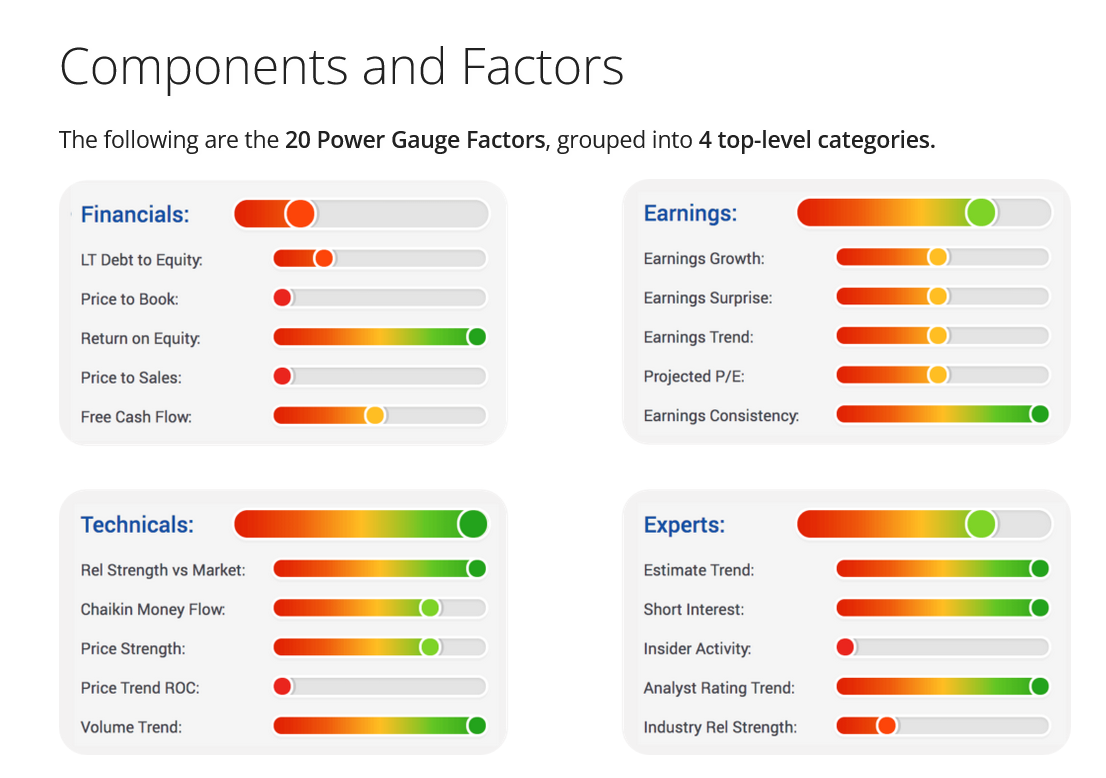

The Power Gauge Indicator is the cornerstone of Chaikin Analytics. What is the Power Gauge Report? A stock evaluation tool that distills 20 different factors into a simple “bullish” or “bearish” rating for each stock.

The 20 factors used in the Power Gauge are broken down into four key categories:

- Financial Metrics: This category includes traditional financial data such as price-to-earnings ratios, debt-to-equity ratios, and free cash flow. These metrics assess a company’s financial health and stability.

- Earnings Performance: This covers factors such as earnings growth, earnings surprises, and earnings consistency, offering insight into a company’s profitability and future prospects.

- Technical Indicators: These include trends and price movements, providing a picture of market sentiment and the stock’s recent performance.

- Expert Opinions: This category incorporates ratings and recommendations from analysts and institutional investors, offering a gauge of professional sentiment on the stock.

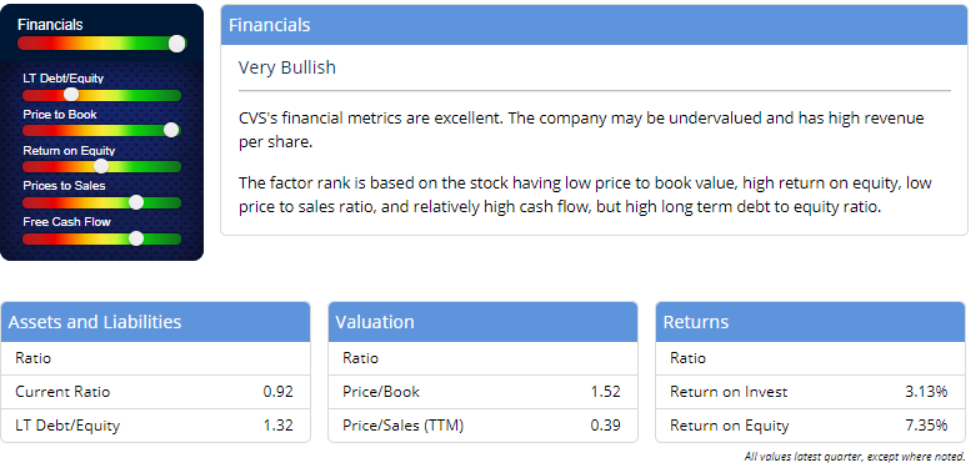

Here’s what the report looks like for Financials:

The goal of the Power Gauge is to help investors quickly assess whether a stock is likely to outperform or underperform in the near term.

Where the Power Gauge Report differs from traditional stock recommendations is in its predictive approach.

The tool is designed to give investors a forward-looking view of stock performance by identifying key trends in market sentiment and financial health. Investors can use this information to guide their stock picking strategies.

Chaikin Money Flow Indicator

One of Marc Chaikin’s earlier and widely-used tools is the Chaikin Money Flow (CMF) Indicator, which measures the flow of institutional money into and out of stocks. This indicator operates on the principle that institutions tend to accumulate or distribute stocks in a way that impacts price movements.

By measuring volume and price movement over a certain period, the CMF helps investors determine whether a stock is being bought or sold by large institutional investors.

Investors use the CMF to complement other tools, such as the Power Gauge, to better time their buy or sell decisions.

For example, if a stock has a bullish rating from the Power Gauge but the CMF shows a decline in buying pressure, it might signal caution; on the flip side, if the Power Gauge and CMF point in the same direction, it can strengthen the case for a trade.

OptionsPlay

OptionsPlay is a tool specifically designed for options traders which helps them assess the risk and reward of various options strategies, presenting the data in an easy-to-understand visual format. It offers recommendations for calls, puts, and spreads based on the user’s market outlook.

OptionsPlay can serve as a valuable educational resource for new options traders, breaking down strategies and providing risk-reward ratios at a glance. Experienced traders can use it to streamline their analysis and quickly find potential trades that align with their investment strategy.

Chaikin Analytics Pros + Cons

Let’s start with the good stuff.

Chaikin Analytics aims to be a true “one stop shop.” With the combined tools of the Power Gauge, Money Flow Indicator, and OptionsPlay, you have a resource for fundamentals, technicals, and options, all in one place. This comprehensive approach will be appealing for many.

I also like the fundamental metrics the Power Gauge relies on, especially for financials: metrics like price to book, assets to liabilities, and price to cash flow.

But that leads into the “cons.”

My critique of the Power Gauge is that the metrics are pretty easy to find out for yourself for free if you know what you’re doing … even with the free info available on something like Yahoo Finance or Seeking Alpha.

The Chaikin Money Flow indicator is a legit technical analysis method, and an interesting way of gauging institutional interest.

However, I think institutional buying or selling pressure can also be gauged with less advanced methods, like RSI or breakouts / breakdowns from common chart patterns like cup and handles, double bottoms, or ascending triangles.

You can also review 13Fs for free on sites like Dataroma or WhaleWhisdom to see what hedgefunds and super investors have bought in the most recent quarter.

Is Chaikin Analytics Worth It?

Who could benefit from Chaikin Analytics?

People who are new to fundamental analysis could use the Power Gauge as a way to learn what financial and earnings metrics are most important when valuing stocks.

It’s also a good platform for someone looking for an all-in-one solution, which provides fundamental and technical analysis, and options strategies.

Additionally, OptionsPlay makes it a great tool for someone new to the options world.

However… I don’t necessarily think it’s the best pick for everyone.

If you’re interested in indicators and technical analysis, something like TradingView premium is a much better deal. TradingView actually includes the Chaikin Money Flow (CMF) indicator for free … plus tons of other indicators, access to millions of instruments, hundreds of data feeds, and a free trial.

So in short, I think Chaikin Analytics is worth it for those new to fundamental analysis, those new to options trading, or beginner-intermediate investors looking for a comprehensive “all-in-one” solution/screener.

The Power Gauge Report: What You Get

Before we continue, a quick but important distinction: the Power Gauge as described above is a software stock screener tool included with the broader Chaikin Analytics software package.

Chaikin also offers a more comprehensive “Power Gauage Report” newsletter offer, which includes things like a model portfolio. This section will be on the Power Gauge Report newsletter.

Here’s what’s included:

Model Portfolio of the Best Stocks to Buy

Subscribers get a full year of access to Marc Chaikin’s hand-picked model portfolio, featuring the best stocks selected by the Power Gauge.

If you want a Marc Chaikin prediction for the best stocks, hese stocks are vetted through Chaikin’s system, offering investors the chance to focus on top picks with the potential for significant growth in volatile markets.

Power Pulse System

The Power Pulse System allows you to check the ratings of over 5,000 stocks, helping you know instantly whether a stock is rated a “BUY,” “SELL,” or “HOLD.”

These streamlined stock ratings make it easier for you to make quick, informed decisions, especially during periods of market turbulence.

Chaikin’s AI Power Picks

This exclusive research report highlights the best AI-related stocks identified by the Power Gauge, each with the potential to double or triple your investment within the next 12 months.

Tomorrow’s 10x Power Trends

In this special report, Marc Chaikin outlines key emerging trends identified by the Power Gauge that are poised for massive growth. According to Chaikin, it offers early investors the opportunity to capitalize on the next big market movements.

Top 5 Stocks to Avoid During the AI Boom

With this report, you get an analysis of the most dangerous stocks in the market today, as identified by the Power Gauge. Avoiding these stocks could save you significant losses, particularly as the AI boom causes swings in specific sectors.

Bubble and Bust Updates

Throughout the year, Marc Chaikin will provide ongoing updates on major shifts in the market, alerting trends and stocks that are poised for significant gains (and losses).

Daily Email Alerts

Power Gauge Report subscribers receive daily market updates from Marc Chaikin, offering insights on trends, threats, and opportunities.

Access to Marc’s Library of Special Reports

Subscribers gain access to a vast library of Marc Chaikin’s special reports, monthly newsletters, and daily insights.

Mystery Gift ($2,499 value)

With your subscription, you’ll receive a special mystery gift valued at $2,499. Though the specifics of this gift aren’t disclosed, it’s marketed as an exclusive bonus that enhances the overall value of the package.

30-Day Money-Back Guarantee

If you’re not satisfied with the Power Gauge Report within 30 days, you can claim a full refund, making this offer a relatively low-risk investment.

The Power Gauge Report: Pros + Cons

The main appeal of this newsletter service is the model portfolio, which gives subscribers access to hand-picked stocks selected by Marc Chaikin himself, vetted through the Power Gauge’s 20-factor system.

This curated portfolio is designed to highlight stocks with strong growth potential, allowing users to benefit from the expertise behind the Power Gauge without having to sift through the entire stock market on their own.

That said, as I noted earlier, while Chaikin is a legit financial figure, he’s primarily known as a developer of software tools and technical analysis methods … not necessarily as a portfolio manager.

The Power Gauge Report also focuses on AI stocks and emerging trends, which can be either a pro or con depending upon your stance on those things and what you’re looking for.

Chaikin has tailored his recommendations to take advantage of the growing interest in artificial intelligence, with reports like “Chaikin’s AI Power Picks” and “Tomorrow’s 10x Power Trends” specifically aimed at capturing the upside potential of the high-growth sector.

These reports offer subscribers insights into which AI stocks are poised to perform well, supposedly giving investors an edge in a sector that is often difficult to analyze.

Again, though, I’d offer the caveat that Chaikin is not necessarily hailed as a great fundamental analyst. This offering could just be an appeal to the current AI hype.

While the Power Gauge Report offers a curated portfolio and tools for stock selection, the service is heavily focused on stock recommendations.

For investors who are looking for a more diverse range of investment opportunities—such as bonds, crypto, commodities, or other alternative assets—the report might feel somewhat limited.

The Power Gauge Report Reviews

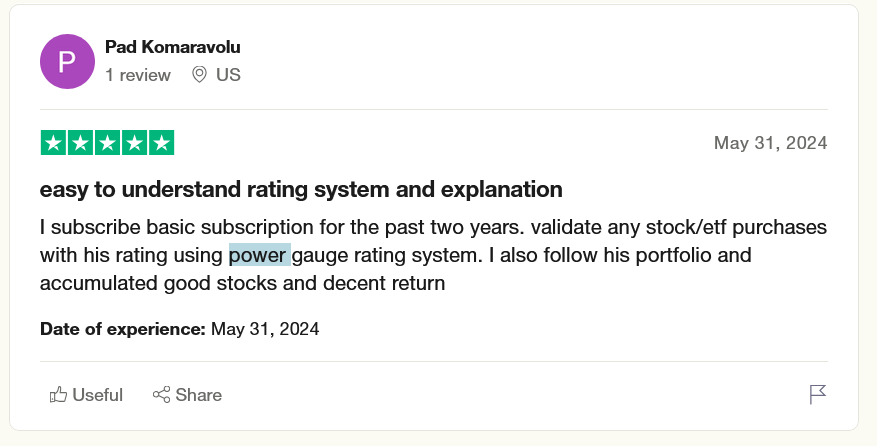

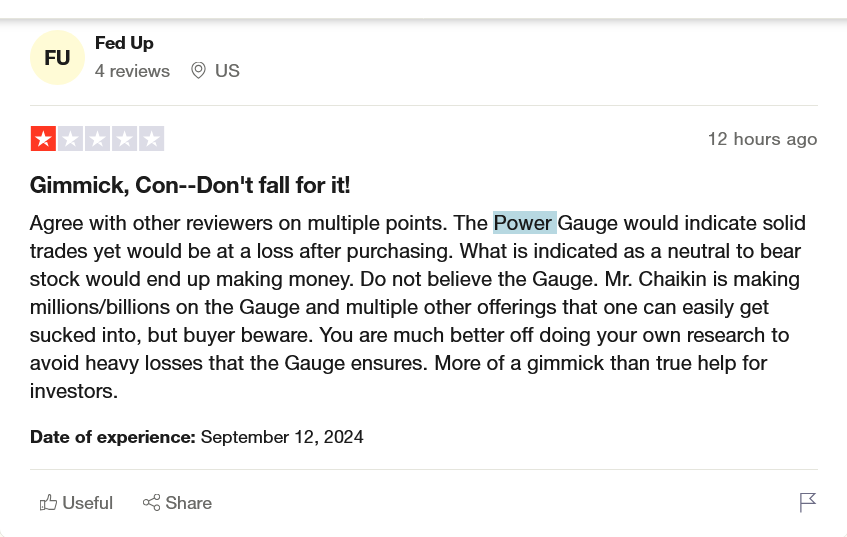

Overall, Chaikin Analytics and the Power Gauage have mixed reviews. Some are good:

But some reviewers don’t find the power gauge as reliable:

In my opinion, this is partly due to the marketing of the Power Gauge as an “end all be all” trade indicator.

At the end of the day, screeners like the Power Gauge can only provide a quick temperature check, and serve as a good starting point for further due diligence. If you go into the screener with these caveats and realistic expectations in mind,you might have a more positive experience.

Is The Power Gauge Report Worth It?

In my opinion, no. There are a lot of appeals to current AI trends and hype, which is a bit of a red flag, especially since Chaikin doesn’t really have a background as an analyst, portfolio manager, or long-time technology investor.

The focus on tech and growth stock recommendations could also make it less appealing to more seasoned investors or those seeking a more diverse range of investment options.

It seems best suited for beginners who want a hand-picked portfolio of tech stocks. However, these types of investors might be better served with a simple technology ETF or even a NASDAQ 100 index fund like QQQ.

Other Stock Picking Newsletters To Consider:

1. Zen Investor

- Cost: $79 for 1 year, $190 for 3 years, $197 for 5 years

- What You Get: Stock screeners, analyst insights, in-depth investment reports, and curated stock picks.

Steve Reitmeister, the brains behind Zen Investor, follows a disciplined and comprehensive method for selecting stocks. His strategy begins by closely tracking top-performing analysts to ensure that only high-quality recommendations make the cut.

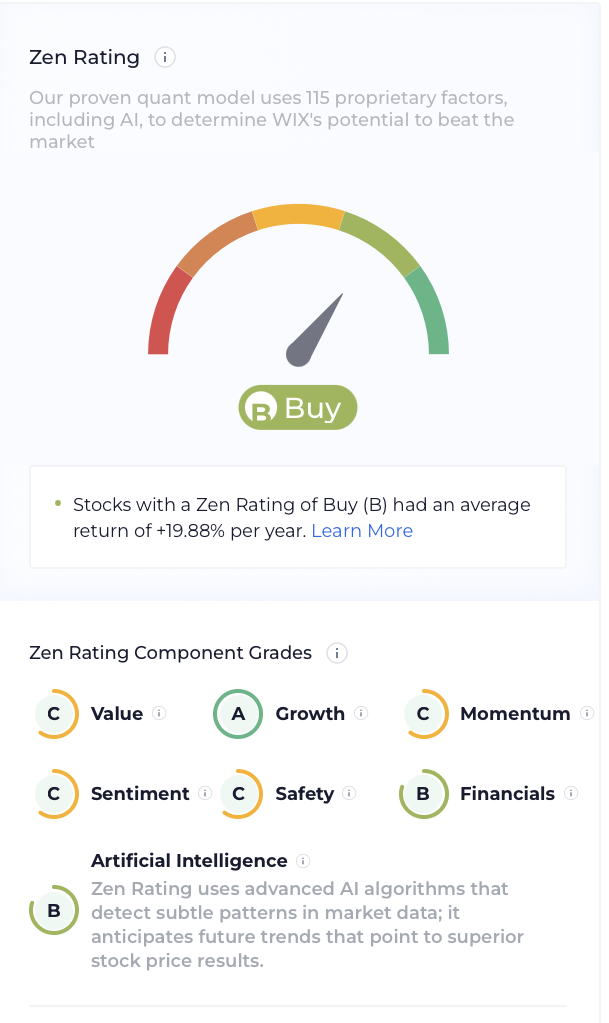

Each potential investment then undergoes a rigorous screening process through the Zen Ratings system, which distills 115 factors that drive growth into an easy-to-read letter score. In addition to an overall score, you can see how each stock scores in different areas, including value, growth, momentum, and more. For example, here’s the Zen Rating for a recent Zen Investor portfolio addition, Wix.com (NASDAQ: WIX):

Once a stock passes this evaluation, Reitmeister digs deeper to assess its growth potential, paying particular attention to companies with strong earnings surprises, attractive valuations, and robust growth prospects.

From this refined selection, he handpicks stocks, relying on over four decades of investment experience to navigate market conditions and identify opportunities that align with his long-term strategy.

Subscribers to Zen Investor gain access to regular market analysis, clear trading strategies, and a focused portfolio of 20-30 high-potential stocks.

2. The Motley Fool Stock Advisor

- Cost: $199 for one year / $99 using the links in this post*

- What You Get: Monthly stock picks, “Best Buys Now,” and access to a community of investors.

The Motley Fool Stock Advisor, led by Tom and David Gardner, is known for helping people find long-term winners in the stock market.

Each month, subscribers get two new stock picks, along with a “Best Buys Now” list, which highlights the top stocks to consider buying right now. This helps take the guesswork out of what’s currently worth investing in.

What makes it stand out is the strong community of investors that comes with it. It’s a place to share ideas, get advice, and learn from others. The Gardner brothers have a great track record of spotting stocks that go on to do really well, so it’s no surprise that so many investors trust their picks.

3. Stock Market Guides

- Cost: $69/month

- What you get: Real-time alerts with clear entry and exit instructions

If you’re interested in harnessing technology to locate high-quality investments, Stock Market Guides might be right up your alley. The service was borne of years of research and backtesting, resulting in the powerful algorithms possible for their service.

As a subscriber, you receive real time alerts by email or text when they find a trade setup with a strong backtested edge, which is the next best thing.

Every trade alert is based on automated trading rules. What does that mean for you? You get clearly defined instructions for the entry and exit of the trade. The trade alerts also show you the backtested track record of that specific trade setup, like this:

Best of all, you can choose between subscriptions for stock picks or option picks, or spring for both. At just $69 each, that’s not out of the question, especially considering the service’s track record. The average annualized return of their stock picks in backtests is 79.4%. For their option picks, it’s 150.4%.

If you’re looking for premium returns out of an algo software, then Stock Market Guides is definitely worth considering.

Their stock and option services are offered for $69 per month each.

Final Word: Chaikin Analytics Review

Overall, Marc Chaikin is legit and Chaikin Analytics provides some useful tools. However, it’s best suited to those who are either new to fundamental analysis or options trading.

Beyond that, I think intermediate or advanced investors can find a lot of what’s offered in Chaikin Analytics and the Power Gauge for free online, so if you’re looking for a paid product/service to invest it, there are better bang-for-your-buck options out there, such as Zen Investor.

FAQs:

What is Marc Chaikin’s Number One Stock?

Marc Chaikin number one stock pick varies throughout the year, depending on his analysis of market trends and stock performance.

His Power Gauge Report often highlights key stocks with high growth potential, such as those related to emerging sectors like AI, which were part of his 2023 stock picks.

How Accurate Are Marc Chaikin’s Stock Picks?

According to Power Gauge reviews, Marc Chaikin’s stock picks have seen mixed results, with some performing well, particularly in sectors like technology and AI.

However, like any stock-picking service, the accuracy of his picks depends on market conditions, and his predictions are not guaranteed to yield consistent returns.

Is Chaikin Analytics Legit?

Based on multiple Chaikin Analytics reviews, the platform is considered legitimate, offering a variety of tools like the Power Gauge to help investors evaluate stocks.

However, while the system provides useful insights, some Power Gauge reviews suggest that the platform isn’t always consistent at providing winning recommendations.

How Much Does The Power Gauge Report Cost?

The Power Gauge Report typically costs $499 for a year, but discounts may reduce the price to $199 for new subscribers.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.