Romeo Power is not publicly traded at this time. However, there are still ways for investors to gain exposure to the sector through other public companies.

Discover like-minded companies (and public companies with a connection to Romeo Power) below. If you choose to invest in any of them, consider one of our favorite brokers — eToro.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Batteries and electric vehicles (EVs) are so hot right now — is Romeo Power still publicly traded?

Sorry, but no. The battery technology company used to be public, but it was delisted following its 2022 acquisition by EV manufacturer Nikola (NASDAQ: NKLA). So you won’t find a Romeo Power stock price or stock symbol out there.

But don’t worry — there are still plenty of ways to gain exposure to the mega-hot EV sector. If you want to know how to buy Romeo Power stock, keep reading to learn about opportunities for both accredited and non-accredited investors…

Romeo Power: The Basics

Before we talk about how to buy Romeo Power stock, here are some things you should know about the company:

- Romeo Power is a battery technology company. Their specialty? High-density battery packs that can be applied in EVs.

- The company was founded in 2015 and went public via special purpose acquisition company (SPAC) in 2020.

- During its relatively brief stint as a public company, Romeo Power stock experienced some wild swings. In its early days, it traded for $20 or more per share; by the time it was delisted, it was trading at about $0.35 per share.

- Is Romeo Power going private? It already did. In 2022 it was acquired by manufacturer Nikola (NASDAQ: NKLA); at that time, Romeo Power stock ceased trading.

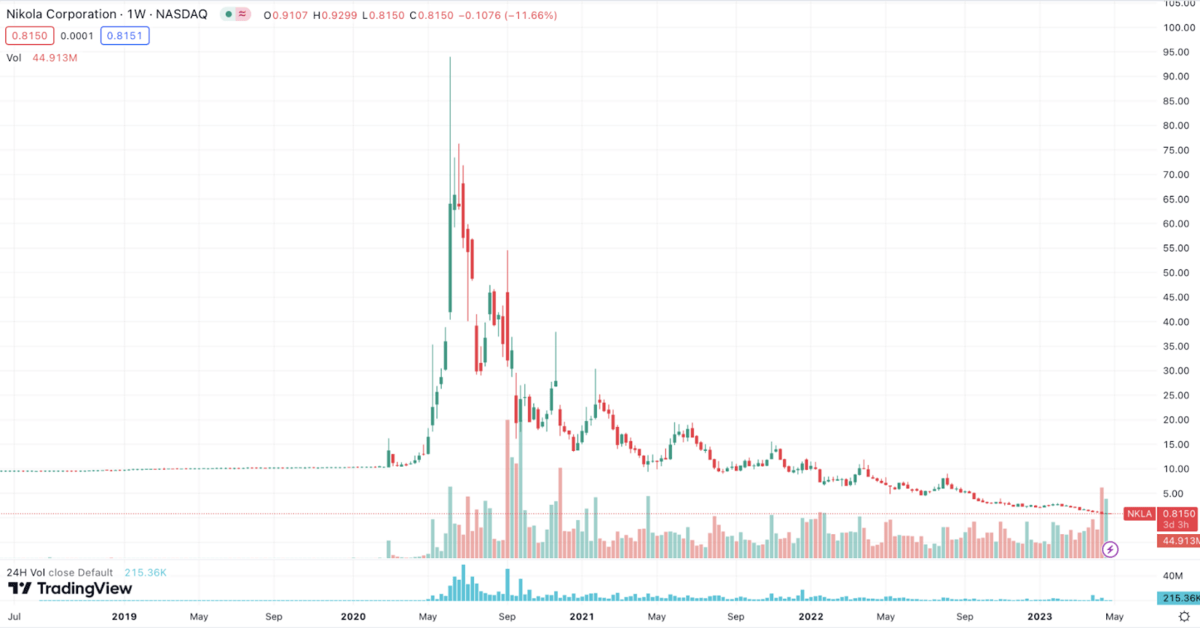

- NKLA has also experienced its fair share of price swings. There was a time when this EV manufacturer’s stock fetched $60 or more per share; following a scandal, the price has steadily declined.

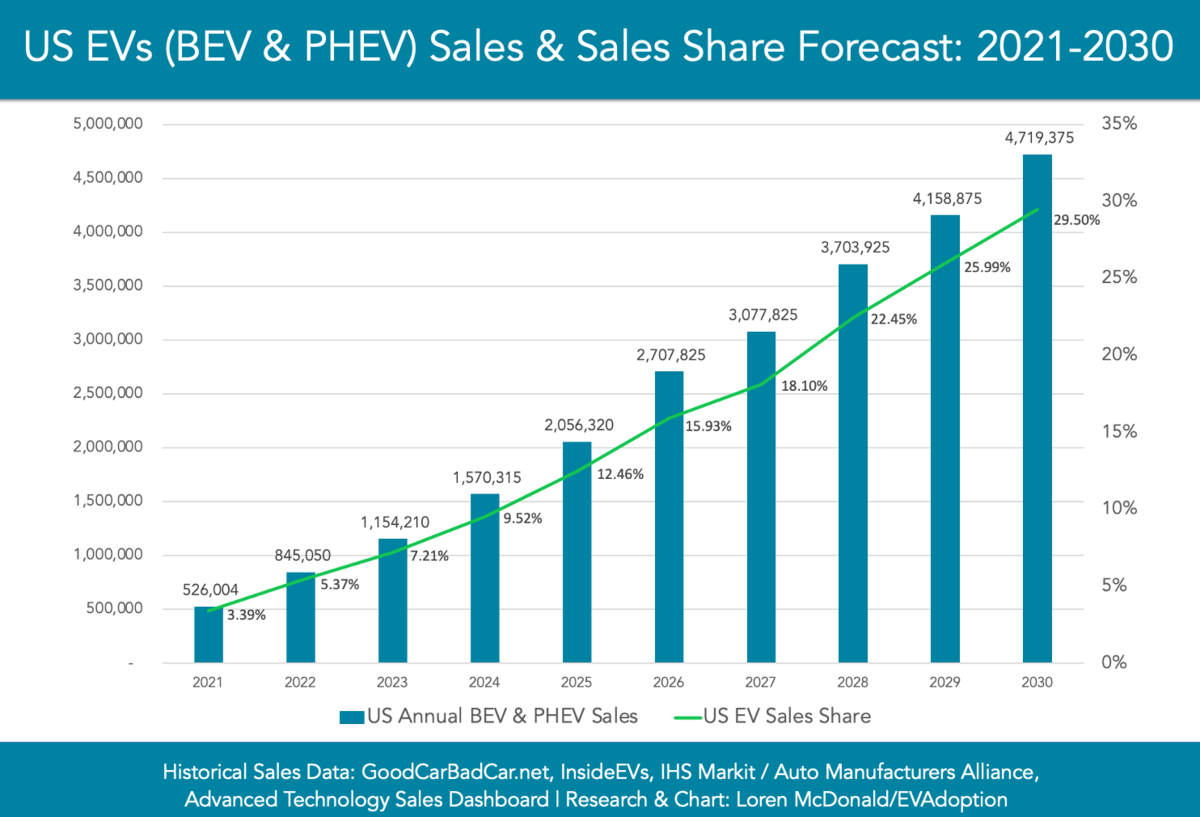

- However, there’s still reason to be optimistic. The EV market was estimated to be worth $163 billion in 2020, and is projected to grow to $800+ billion by 2030.

Can You Buy Romeo Power Stock? Is Romeo Power Publicly Traded?

Want to know how to buy Romeo Power stock? You can’t. (Sorry.)

Romeo Power used to be public, but it was acquired in 2022. Once the transaction came to a close, the company was delisted.

As a result, you won’t find a Romeo Power stock price chart or a Romeo Power stock ticker on your favorite trading platform.

But Romeo Power stock shares aren’t the only way for investors to get exposure. Let’s talk about it…

How to Buy Romeo Power as a Retail Investor

As a retail investor, you can’t buy direct shares of Romeo Power stock.

But don’t let that fizzle out any hopes of exposure to the EV market. First, a few important bits of info…

Ready to Invest? Limited-Time Deal for U.S. Residents!

eToro is one of the world’s most popular investing platforms with over 28.5 million users.

Right now, eToro is offering a $10 bonus* for U.S. residents who open and fund a new account.

$10 bonus for a deposit of $100 or more. *Only available to U.S. residents. Additional terms and conditions apply.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Who Owns Romeo Power?

Romeo Power was founded in 2015 by serial entrepreneur Michael Patterson. In 2022 it was acquired by manufacturer Nikola (NASDAQ: NKLA).

Does Nikola Own Romeo Power?

Yes indeed. Romeo Power is now a wholly-owned subsidiary of Nikola.

How to Invest in Romeo Power Stock as a Retail Investor

First, a word of warning.

Even when Romeo Power was trading publicly, it was more of a speculator’s stock than a buy-and-hold stock.

It experienced huge price swings:

- In the days before its SPAC merger, the pre-Romeo Power SPAC ticker traded for over $30…

- In the early days of Romeo Power’s public days, the stock traded for $20 a share or more…

- By the time the company was acquired in 2022, it was trading for about $0.35 per share.

That said, if you’re still interested in how to buy Romeo Power stock, the obvious choice would be to move on to its parent company, Nikola (NASDAQ: NKLA).

The problem? NKLA has been similarly volatile. Just look at its 5-year chart…

Much of the massive drop is due to a scandal involving the company’s CEO, Trevor Milton. But since Milton left the company and the EV sector is poised for more growth in the future, NKLA could be worth keeping an eye on.

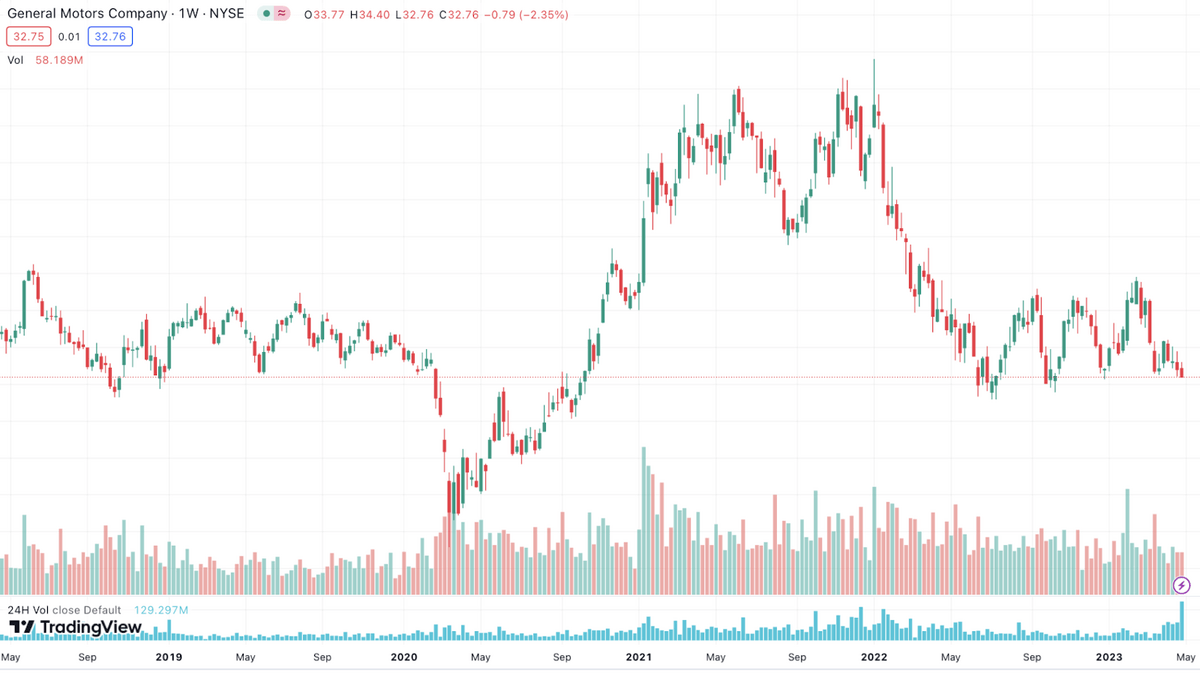

However, NKLA isn’t the only EV stock out there. You might also want to explore other options in the EV sector, including:

Other EV Stocks to Consider

- Chargepoint (NYSE: CHPT)

- Ford Motor Company (NYSE: F)

- General Motors (NYSE: GM) — chart below

- LCID (NASDAQ: LCID)

- Nio (NYSE: NIO)

- Tesla (NASDAQ: TSLA)

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

How to Buy the Romeo Power IPO

Here are the steps on how to buy Romeo Power stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Romeo Power

- Select how many shares you want to buy

- Place your order

- Monitor your trade

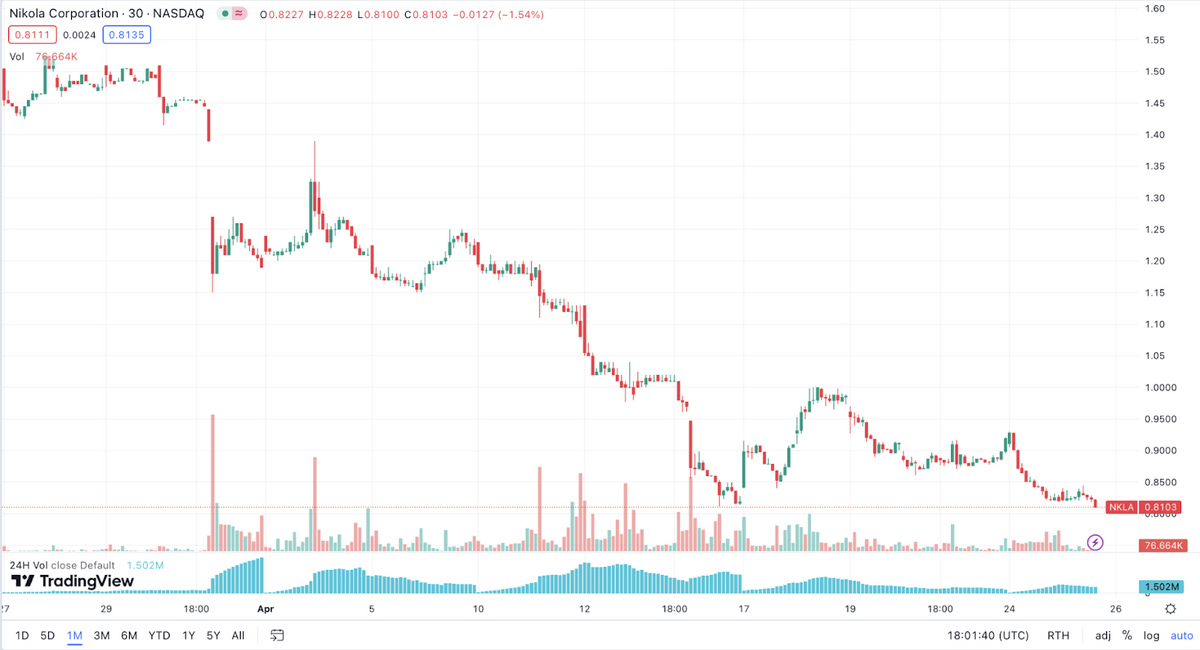

Romeo Power Stock Price Chart

There is no Romeo Power stock price chart, since the company is no longer public. However, here’s a price chart of its parent company, Nikola (NASDAQ: NKLA)’s performance for the past month or so. Not quite as dismal as the all-time chart above…

But still not great. However, this chart detailing the EV sector’s projected growth is a lot more optimistic:

The bottom line? Even if Romeo Power isn’t for you, there’s plenty to watch in the growing EV sector. If you’re a retail investor, consider some of the approaches in this article.

FAQs:

How to buy Romeo Power stock?

You cannot buy direct shares of Romeo Power stock. However, you can buy shares of its parent company, Nikola (NASDAQ: NKLA).

How much is Romeo Power stock?

Since Romeo Power is not listed on the stock exchange, there is no Romeo Power stock price. However, at writing, Romeo Power’s parent company, Nikola (NASDAQ: NKLA) is trading for under $1 per share.

What is Romeo Power stock symbol?

Since Romeo Power was taken off the stock exchange, there is no longer a Romeo Power stock symbol. However, Romeo Power’s parent company, Nikola, is public and trades under the following symbol: NASDAQ: NKLA.

Who owns Romeo Power stock?

Romeo Power was founded by Michael Patterson in 2015. In 2022, the company was acquired by Nikola (NASDAQ: NKLA).

Is Romeo Power still publicly traded?

No. Romeo Power is no longer publicly traded. But its parent company, Nikola, is public and trades under the ticker NASDAQ: NKLA.

Is Romeo Power going private?

Romeo Power is no longer publicly traded. It was removed from the stock exchange when it was acquired by Nikola (NASDAQ: NKLA).

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our April report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.