Note: ServiceTitan is now publicly traded under the ticker (NASDAQ: TTAN). Stay tuned for a rewrite of this article!

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies like ServiceTitan who want to sell their shares.

Sign up with Hiive here and get access to ServiceTitan before its IPO.

Whether it’s the garage door or the garbage disposal, something’s always on the fritz.

So, it’s safe to bet there’s always a need for home repair gigs.

Since ServiceTitan provides the software powering many of today’s field contractors, it makes sense why investors are going ga-ga for this Glendale-based gem.

As VC firms pour millions into ServiceTitan, retail investors are increasingly asking how to buy ServiceTitan stock.

While buying ServiceTitan stock isn’t straightforward, there are a few ways to own a piece of this hot software company.

What is ServiceTitan?

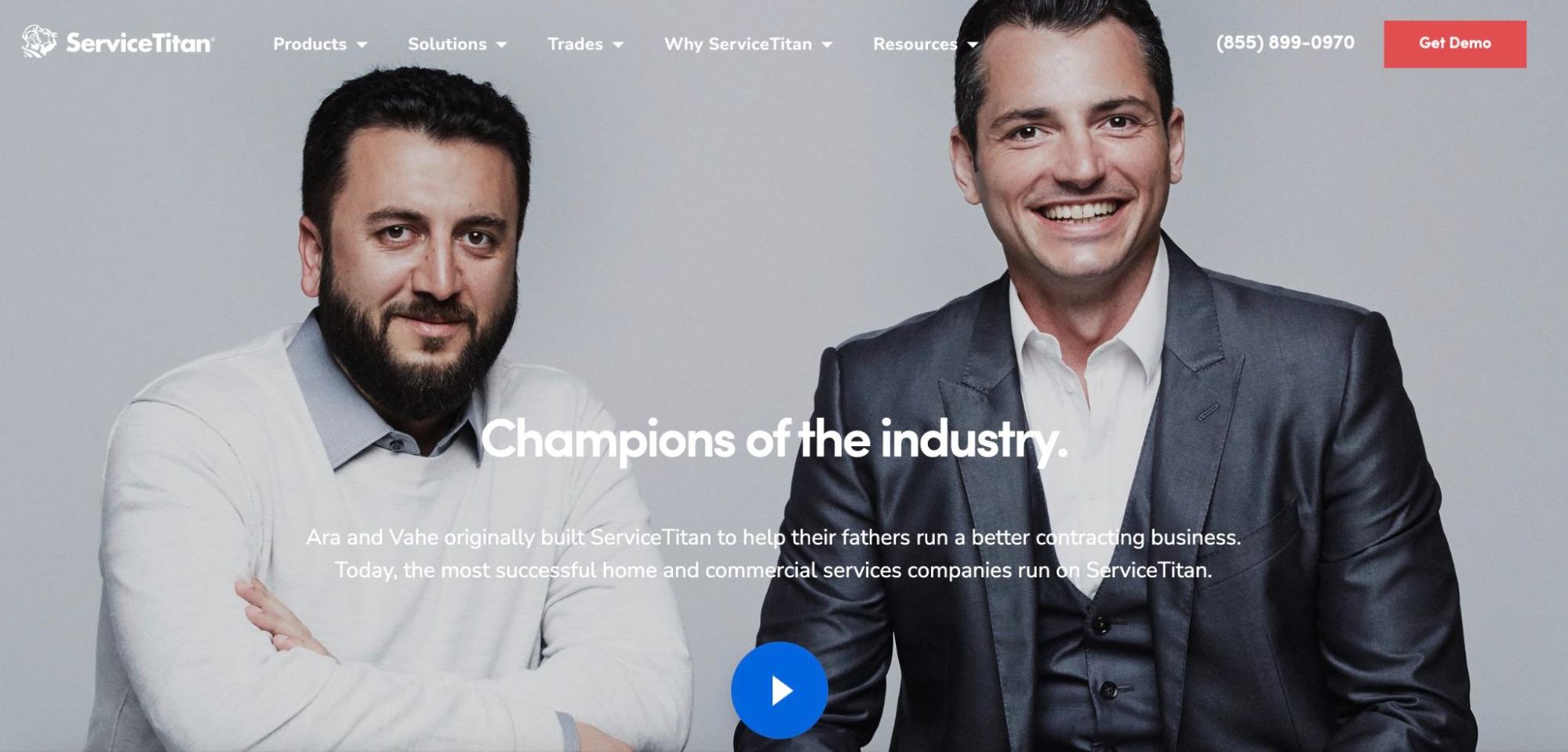

ServiceTitan is a Software-as-a-Service (SaaS) provider focused on helping home and commercial service businesses.

Co-founders Ara Mahdessian and Vahe Kuzoyan first discussed the idea for ServiceTitan in 2004 between skiing sessions, and the company launched its field service manager (FSM) cloud platform in 2012.

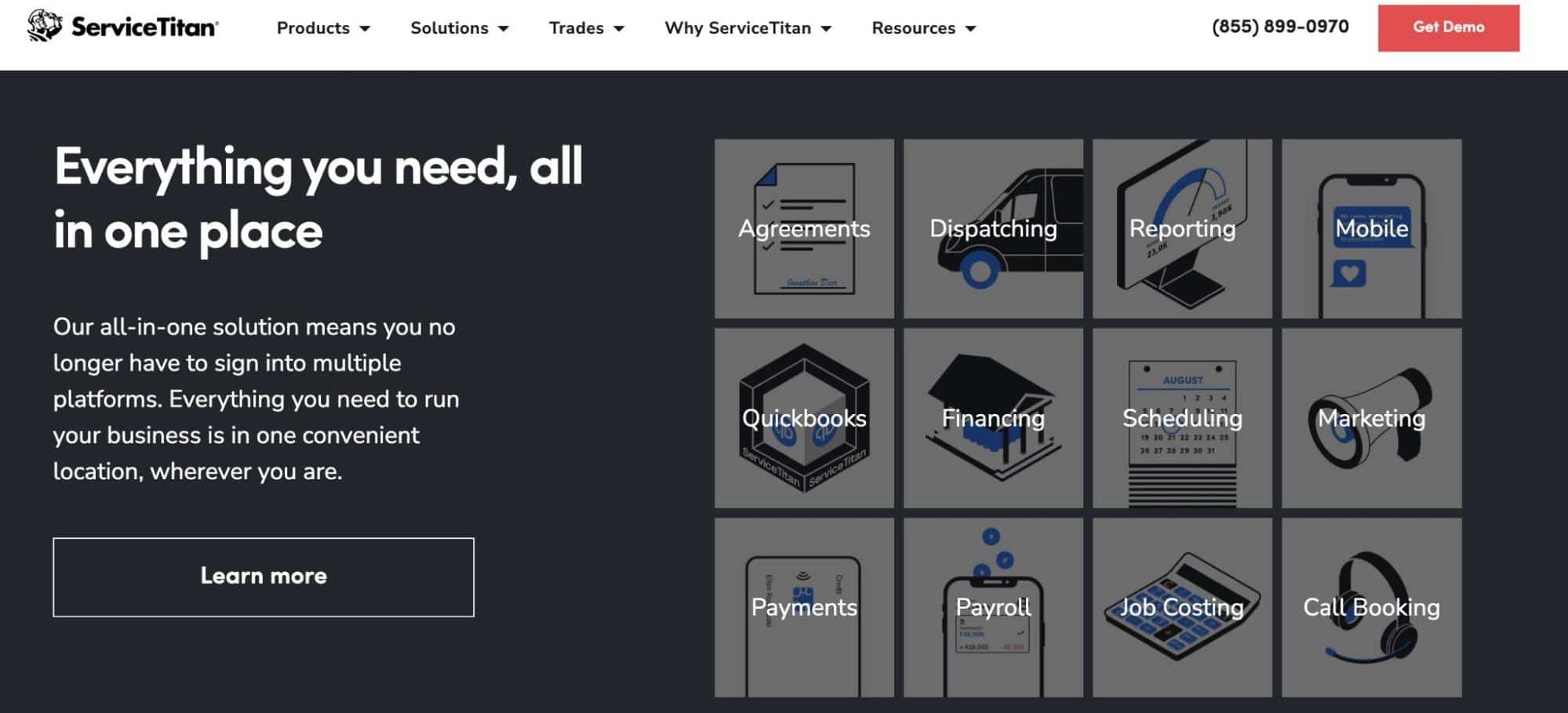

Today, ServiceTitan offers software tools for dozens of tasks — including scheduling, dispatching, and invoicing — for industries from HVAC and electric to landscaping and pest control.

According to ServiceTitan’s stats, it now has a roster of 11,800 customers, and it increased its annual recurring revenue (ARR) from $100 million in 2018 to $200 million two years later.

With such rapid growth, plenty of VC firms have already begun taking a stake in ServiceTitan, and the company has an estimated valuation of $18 billion.

Can You Buy ServiceTitan Stock? Is ServiceTitan Publicly Traded?

Now that you know the impressive numbers, you’re probably wondering how to invest in ServiceTitan stock.

Unfortunately, this company is private, so public exchanges don’t list a ServiceTitan stock symbol.

Although ServiceTitan reportedly explored an IPO in 2022, it didn’t follow through on this plan, and there’s no word on whether ServiceTitan stock will ever hit the market.

How to Buy ServiceTitan as an Accredited Investor

ServiceTitan is not publicly traded, but accredited investors can invest in private companies including ServiceTitan through Hiive.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares to accredited investors.

There’s a lot to like about Hiive: For investors, there are no buying fees, you have the ability to negotiate, and it has a robust marketplace with thousands of companies. The bottom line? Hiive is a great way to invest in companies before they IPO.

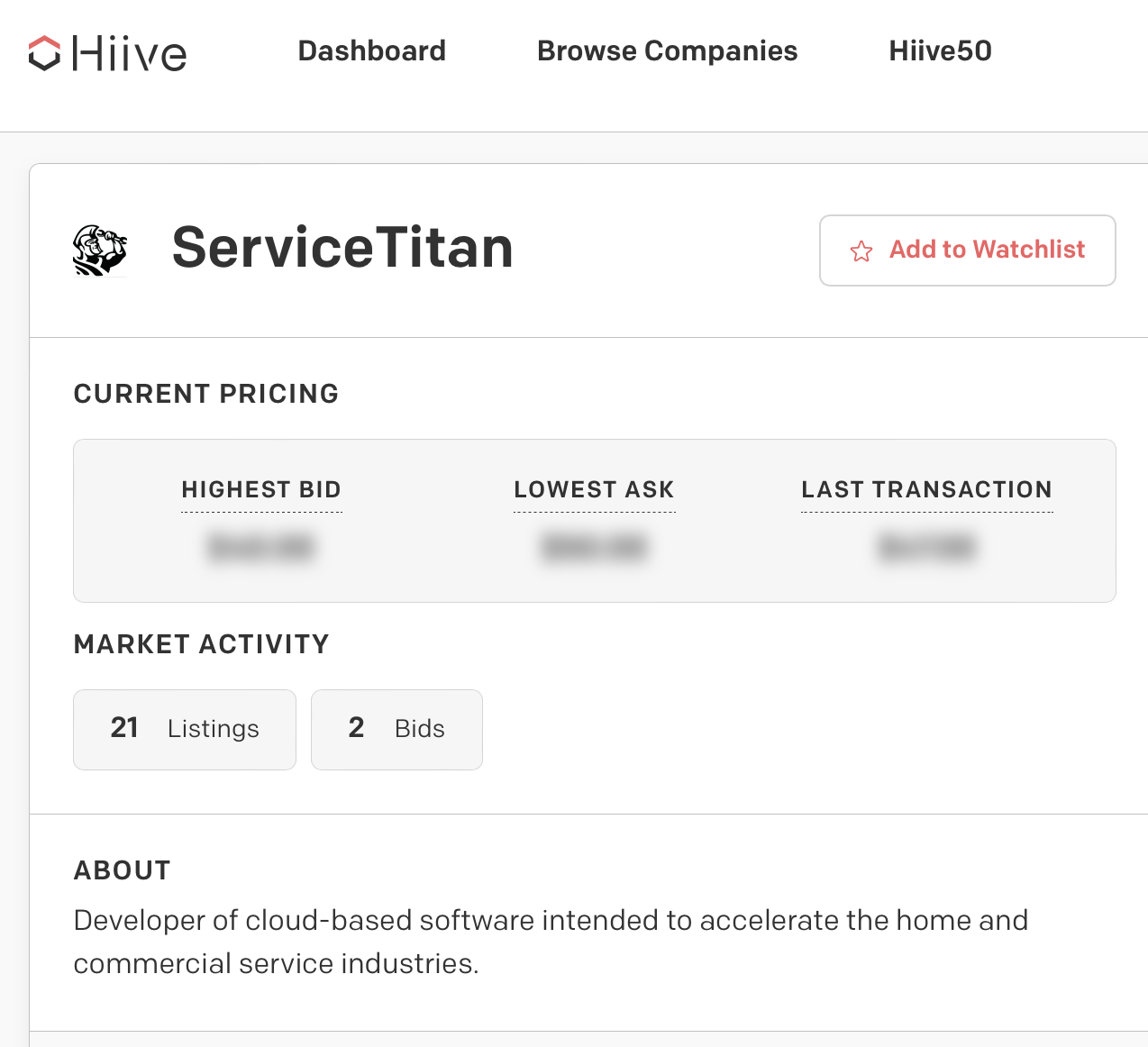

At writing, there are 21 listings and 2 bids for ServiceTitan on Hiive.

Sound interesting? Go ahead: Sign up with Hiive, check out ServiceTitan, add it to your watchlist, and get notified about any new listings and trades.

How to Buy ServiceTitan as a Retail Investor

Any retail investors scouring the Web to learn how to buy ServiceTitan stock will reach a dead end. (Sorry.) Currently, ServiceTitan is a private company, which means retail investors can’t get their hands on ServiceTitan stock.

On a positive note, there are a few reports that ServiceTitan is considering an IPO, but these stories have yet to materialize.

However, there may be ways to invest in like-minded companies, or companies that have a connection to ServiceTitan. Let’s explore, starting with some key info:

Who Owns ServiceTitan?

Without public records, we have to guess who owns how much ServiceTitan stock.

Considering co-founders Ara Mahdessian and Vahe Kuzoyan lead ServiceTitan’s team, they most likely hold the lion’s share of ServiceTitan stock options.

It’s also probable some of ServiceTitan’s VC backers — including Tiger Global Management, Battery Ventures, and Sequoia Capital — hold a significant stake in the startup.

Does Sequoia Capital Own ServiceTitan?

In the world of tech investment firms, Sequoia Capital is a big deal.

Founded in the 1970s, this venture capitalist team helped back some of the largest tech companies in their early innings, most notably Apple (NASDAQ: AAPL).

So, when news broke that Sequoia Capital took a stake in ServiceTitan stock, tech investors paid attention.

Although Sequoia Capital spent hundreds of millions on ServiceTitan, we don’t know what that translates to in terms of ServiceTitan stock ownership.

Sequoia Capital likely has a significant amount of ServiceTitan shares, but we won’t know the full details unless ServiceTitan goes public.

Alternatives to ServiceTitan for Retail Investors

Try as you might, you won’t find a ServiceTitan stock symbol or a ServiceTitan stock price chart on your favorite brokerage platform.

However, there are a few crafty ways to get indirect exposure to ServiceTitan’s unique FSM SaaS niche.

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

There are two angles to get indirect exposure to ServiceTitan stock. First, focus on other SaaS heavyweights with ties to the brand.

For example, ServiceTitan offers clients QuickBooks integrations, so it makes sense to investigate QuickBooks’ parent company, Intuit (NASDAQ: INTU).

Chart courtesy TradingView

Also, ServiceTitan has Leads Integration with the home repair jobs board Angi (NASDAQ: ANGI). So, investing in Angi (NASDAQ: ANGI) might also give investors exposure to ServiceTitan’s sector.

Alternatively, if you’d prefer to bet on ServiceTitan’s client base rather than its service, you could consider buying names in the home repair or construction sectors.

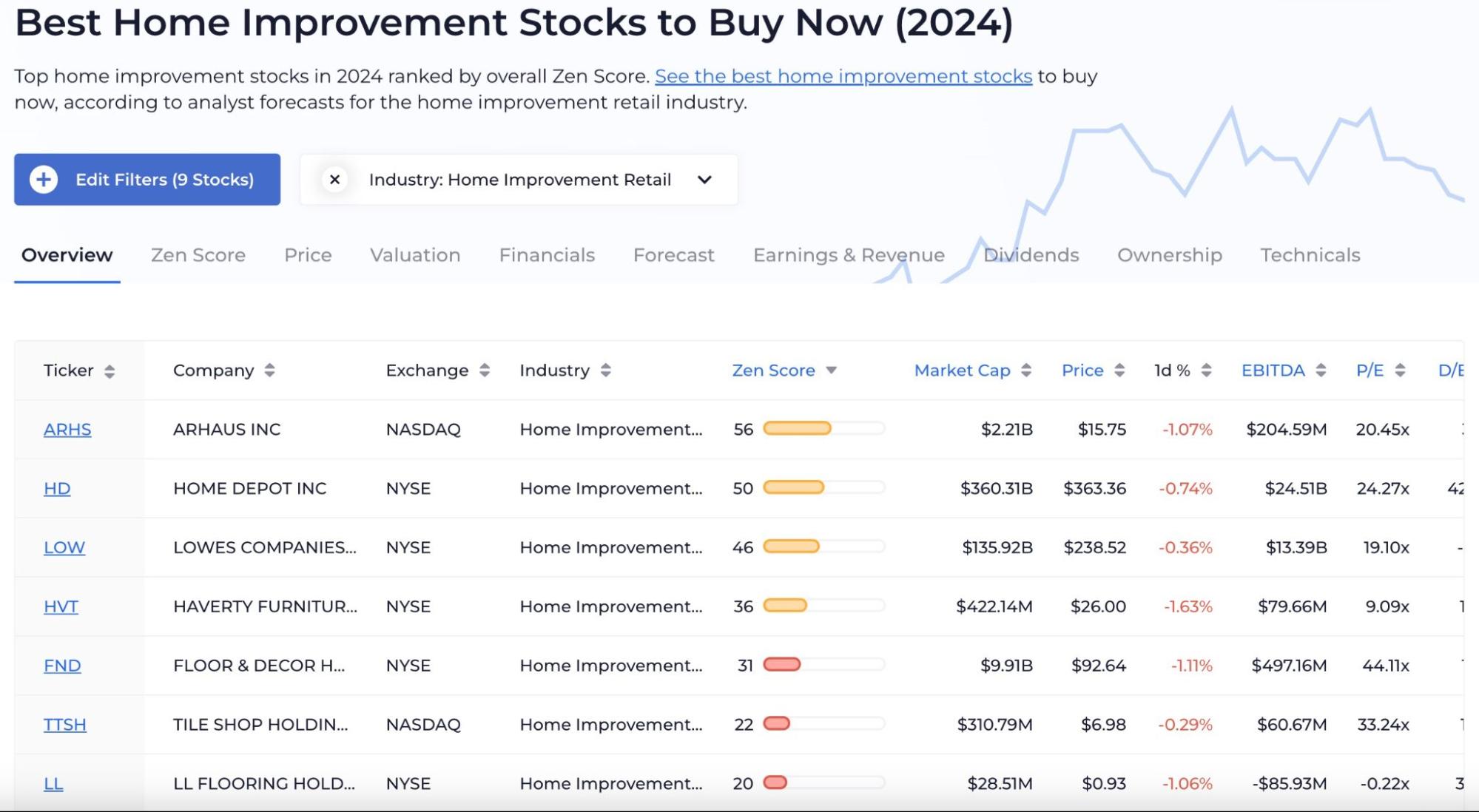

A few companies to consider in this camp include Home Depot (NYSE: HD) and Lowe’s (NYSE: LOW). You could also read through WallStreetZen’s “Best Home Improvement Stocks” for extra brainstorming.

Lastly, those who prefer diversification should look into homebuilder ETFs for indirect exposure to ServiceTitan’s industry.

The SPDR S&P Homebuilders ETF (NYSE: XHB) and Invesco Building & Construction ETF (NYSE: PKB) are a few examples of funds that focus on fields related to ServiceTitan’s client base.

How to Buy the ServiceTitan IPO

Here are the steps on how to buy ServiceTitan stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for ServiceTitan

- Select how many shares you want to buy

- Place your order

- Monitor your trade

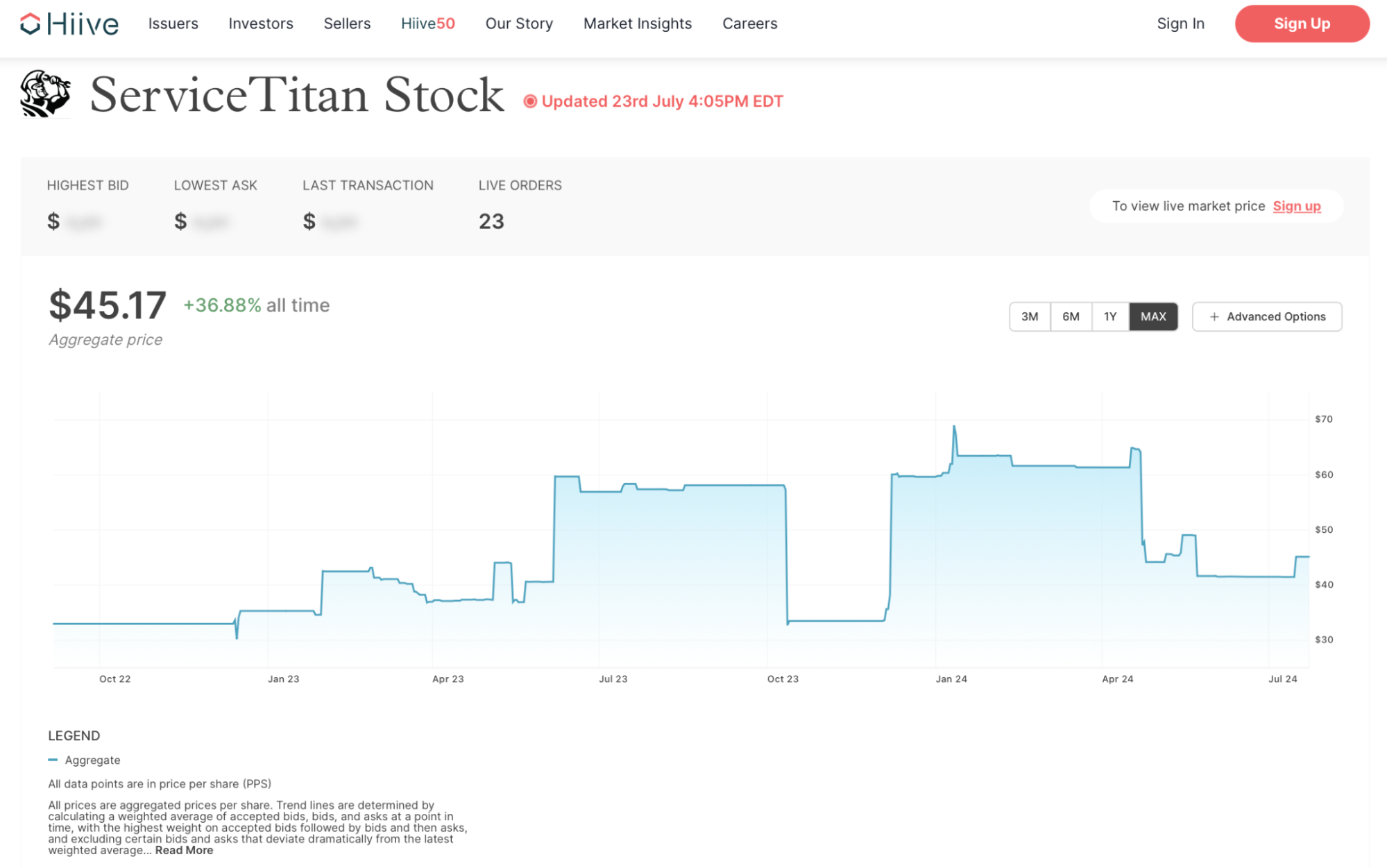

ServiceTitan Stock Price Chart

Accredited investors can access the current aggregate price for ServiceTitan on Hiive*:

But if you head over to your brokerage account, you won’t find a ServiceTitan stock price chart because all of this company’s shares are in private accounts.

You could only get an indirect sense of how ServiceTitan’s stock might be doing by watching public equities or ETFs related to SaaS and home repair.

For example, researching companies like Angi (NASDAQ: ANGI), Intuit (NASDAQ: INTU), and Home Depot (NYSE: HD) might give you a sense for ServiceTitan’s performance.

Chart courtesy TradingView

Conclusion

There are two answers to the question of how to invest in ServiceTitan stock.

For accredited investors, you can use Hiive’s platform to buy ServiceTitan stock on the private market.

For retail investors, however, you can only buy ServiceTitan stock if the company goes IPO.

If you can’t wait for ServiceTitan to go public, then you could research stocks and ETFs in sectors like SaaS, home repair, or construction to get an indirect slice of ServiceTitan.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How can I buy ServiceTitan stock?

Retail investors looking to buy ServiceTitan stock won't find shares of this company on the public market. The only people who can buy ServiceTitan stock are accredited investors on the pre-IPO platform Hiive.

How much is ServiceTitan stock?

There's no ServiceTitan stock price chart, so there's no ServiceTitan stock price per share. Unless ServiceTitan goes public, we won't know how much ServiceTitan's stock is worth.

What is the ServiceTitan stock symbol?

Similar to a ServiceTitan stock price chart, there's no such thing as a ServiceTitan stock symbol. We'll only see a ServiceTitan stock symbol after this company lists IPO shares.

Who owns ServiceTitan stock?

We don't know who owns the most ServiceTitan stock because this company is private. However, co-founders Ara Mahdessian and Vahe Kuzoyan and VC firms like Sequoia Capital likely have most of the shares.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.