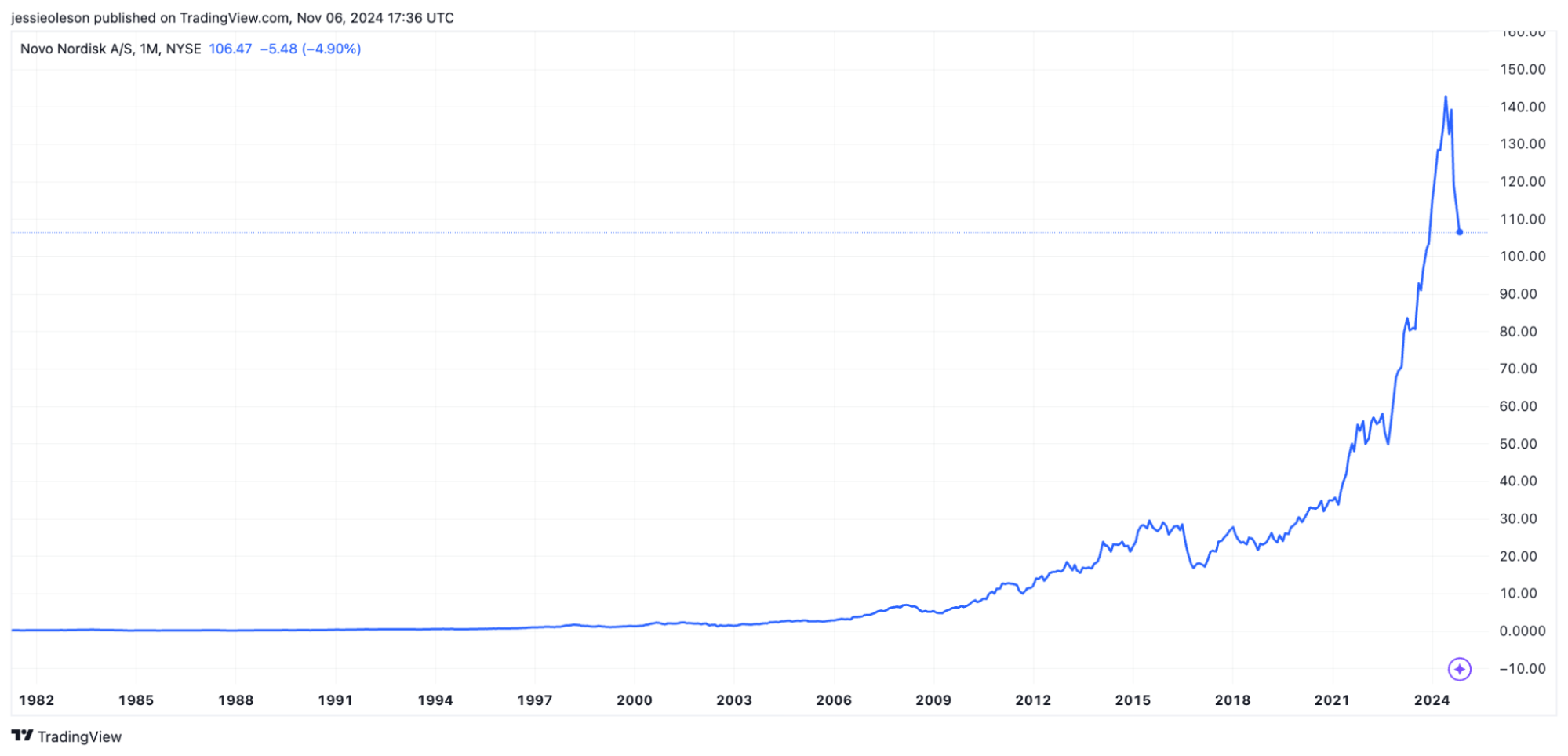

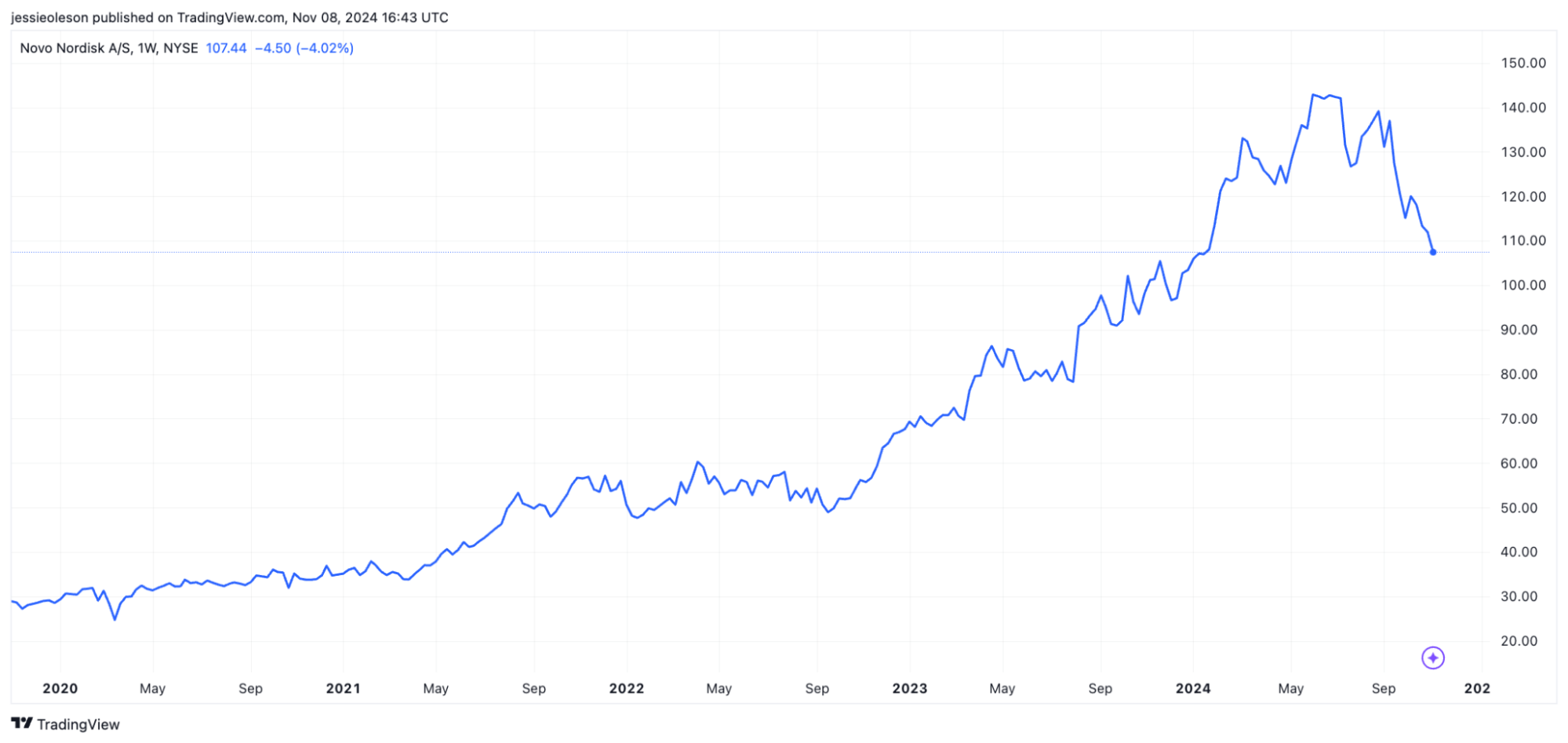

To illustrate the appeal of biotech investing, I invite you to take a look at this chart:

That’s the all-time chart for Novo Nordisk (NYSE: NVO), a manufacturer of medicines including Ozempic, the blockbuster weight-loss drug. NVO was once a penny stock; it has risen more than 88,000% since its IPO.

Investing in biotech stocks has the potential to deliver spectacular returns. But it’s crucial to know that results like NVO’s are not typical.

Biotechs are risky. You could lose everything that you invest.

However, educating yourself and gaining an understanding of the sector could potentially help you avoid unnecessary losses.

Below, I’ll explain the basics of investing in biotech companies, including how the sector works and the best resources for doing your DD (due diligence) on potential investments.

You need a brokerage account to buy shares of biotech stocks. If you don’t have one, we recommend eToro.

We reviewed 22 online stock brokerages and eToro came out on top. It is one of the world’s most popular investing platforms with over 30 million users.

Plus, as of July, eToro is offering a $10 bonus* for U.S. residents.

$10 bonus for a deposit of $100 or more. Only available to U.S. residents. New accounts only. Additional terms and conditions apply.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

What is Biotech Investing?

Biotech investing refers to investing in assets related to biotechnology (a mashup of “biology” and “technology”). These companies combine both of the aforementioned elements to research and develop new drugs, vaccines, therapies, diagnostic tools, and bioengineering solutions.

Here’s a key difference between biotechs and many other companies: Most biotechs are not profitable at first, and it can take years to become profitable (if at all).

Why? Because early on, biotech companies have massive costs associated with research and development (R&D) — but they aren’t necessarily making much money.

As such, biotechs are constantly raising cash or forging partnerships with bigger companies to continue their work.

Investing in biotech startups is typically cheap at this stage. This can be enticing to investors who want to get in “on the ground floor.”

Some biotechs will achieve great success. Many others won’t.

These stocks live and die by catalysts, particularly the results of clinical drug tests. They have the potential to appreciate based on the results, but can completely fizzle out too.

If you decide to buy stock in a biotech company, you must be prepared to stay on top of the company’s cash needs and cash expenditures for their trials from SEC filings.

List of Big Biotech Companies

Looking for a few examples of big biotech companies?

Here are 3 few examples of the largest market cap biotech companies from our Best Biotech Stocks to Buy Now screener:

Moderna (NASDAQ: MRNA)

- Market cap: $19.33 billion

- Latest price: Click here

- Current analyst consensus: BUY (See ratings here)

Moderna, Inc. is a biotechnology company that discovers, develops, and commercializes messenger RNA therapeutics and vaccines for the treatment of infectious diseases, immuno-oncology, rare diseases, cardiovascular diseases, and auto-immune diseases.

Its respiratory vaccines include COVID-19, flu, respiratory syncytial virus, Endemic HCoV, and hMPV+PIV3 vaccines, as well as public health vaccines consists such as Zika and Nipah.

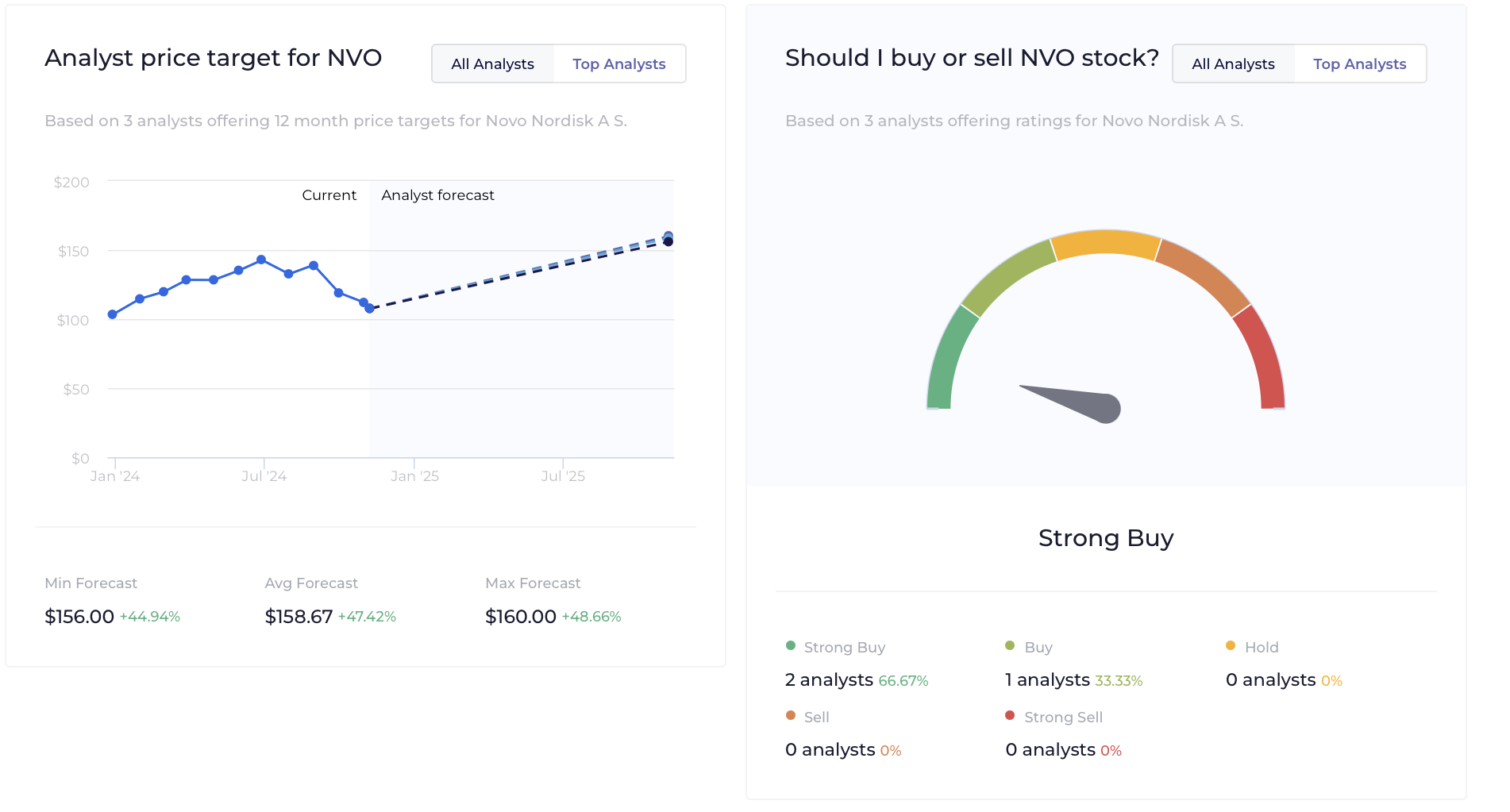

Novo Nordisk (NYSE: NVO)

- Market cap: $496.69 billion

- Latest price: Click here

- Current analyst consensus: STRONG BUY (See ratings here)

Novo Nordisk (NYSE: NVO) was founded in 1923 and is based in Denmark. It is perhaps best known as the producer of the weight loss drug Ozempic.

Its Diabetes and Obesity Care segment provides products in the areas of insulins, GLP-1 and related delivery systems, oral antidiabetic products, obesity, and other chronic diseases.

The Biopharmaceuticals segment offers products in the areas of haemophilia, growth disorders, and hormone replacement therapy.

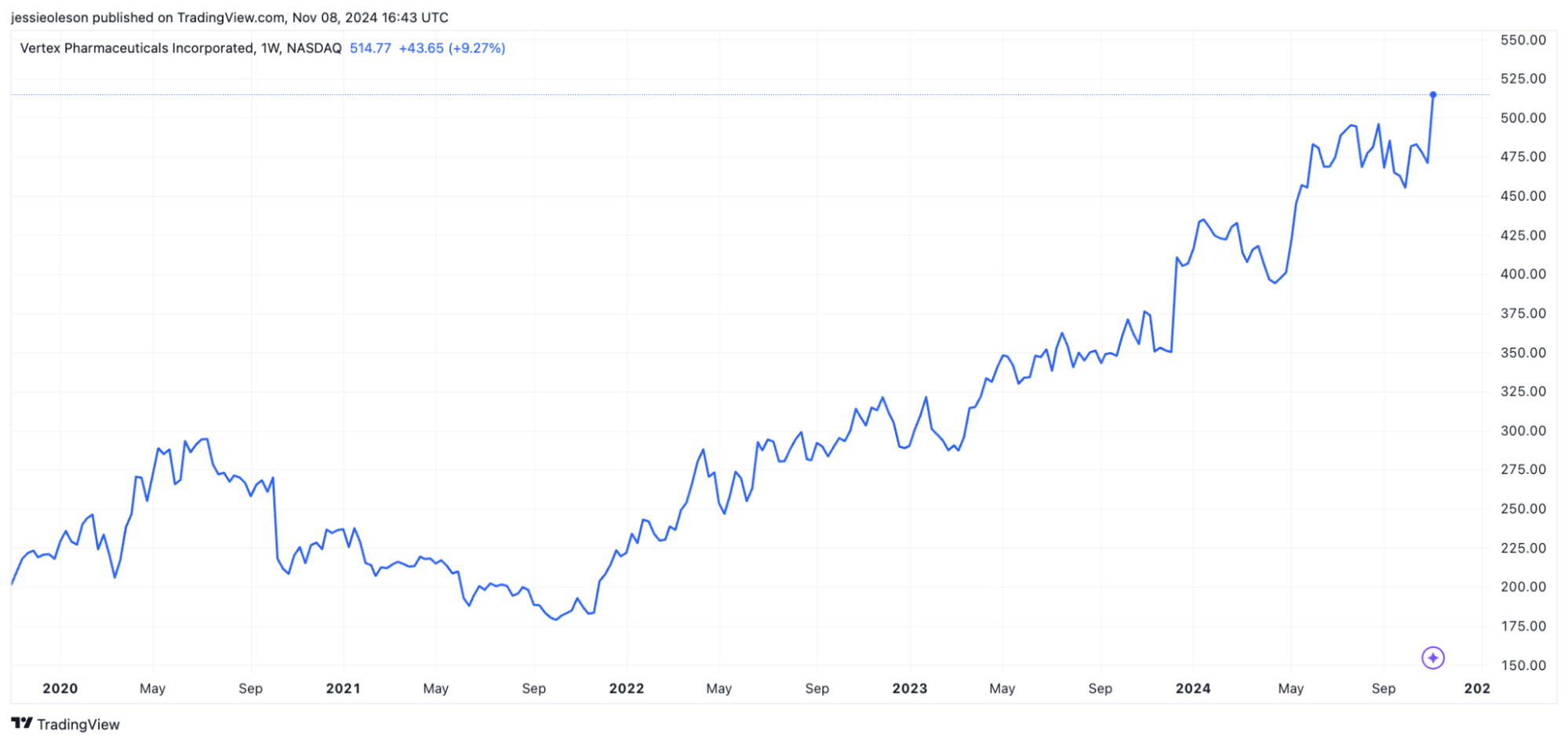

Vertex Pharmaceuticals (NASDAQ: VRTX)

- Market cap: $129.40 billion

- Latest price: Click here

- Current analyst consensus: STRONG BUY (See ratings here)

Vertex Pharmaceuticals Incorporated (NASDAQ: VRTX) engages in developing and commercializing therapies for treating cystic fibrosis.

The company markets medications such as SYMDEKO/SYMKEVI, ORKAMBI, and KALYDECO to treat patients with cystic fibrosis who have specific mutations in their cystic fibrosis transmembrane conductance regulator gene; its pipeline includes several new products.

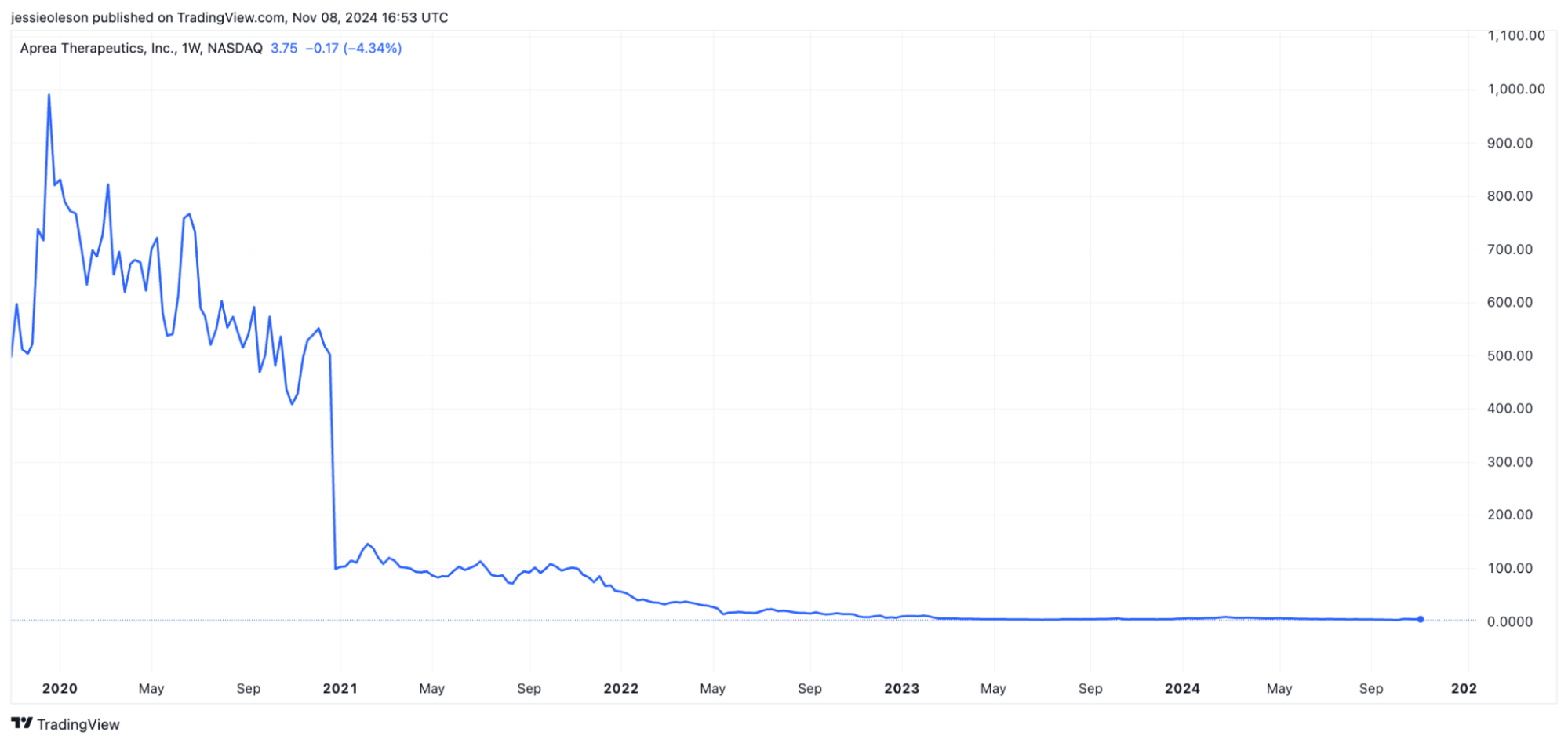

Biotech Penny Stocks

What about some of the smaller guys? Once again, I used the Best Biotech Stocks to Buy Now screener, but filtered by price and Zen Score to find a couple of biotech penny stocks that have some positive marks on WallStreetZen’s due diligence checks:

Apea Therapeutics (NASDAQ: APRE)

- Market cap: $21.63 million

- Latest price: Click here

- Current analyst consensus: BUY (See ratings here)

Aprea Therapeutics, Inc. (NASDAQ: APRE) is a clinical-stage biopharmaceutical company that focuses on developing and commercializing novel cancer therapeutics that target DNA damage response pathways.

Its lead product candidate is ATRN-119, an oral ATR inhibitor that is in phase 1/2a clinical trial to treat patients with advanced solid tumors. The company’s products pipeline also includes ATRN-Backup, an ATR inhibitor; ATRN-W1051 to treat anti-tumor activity.

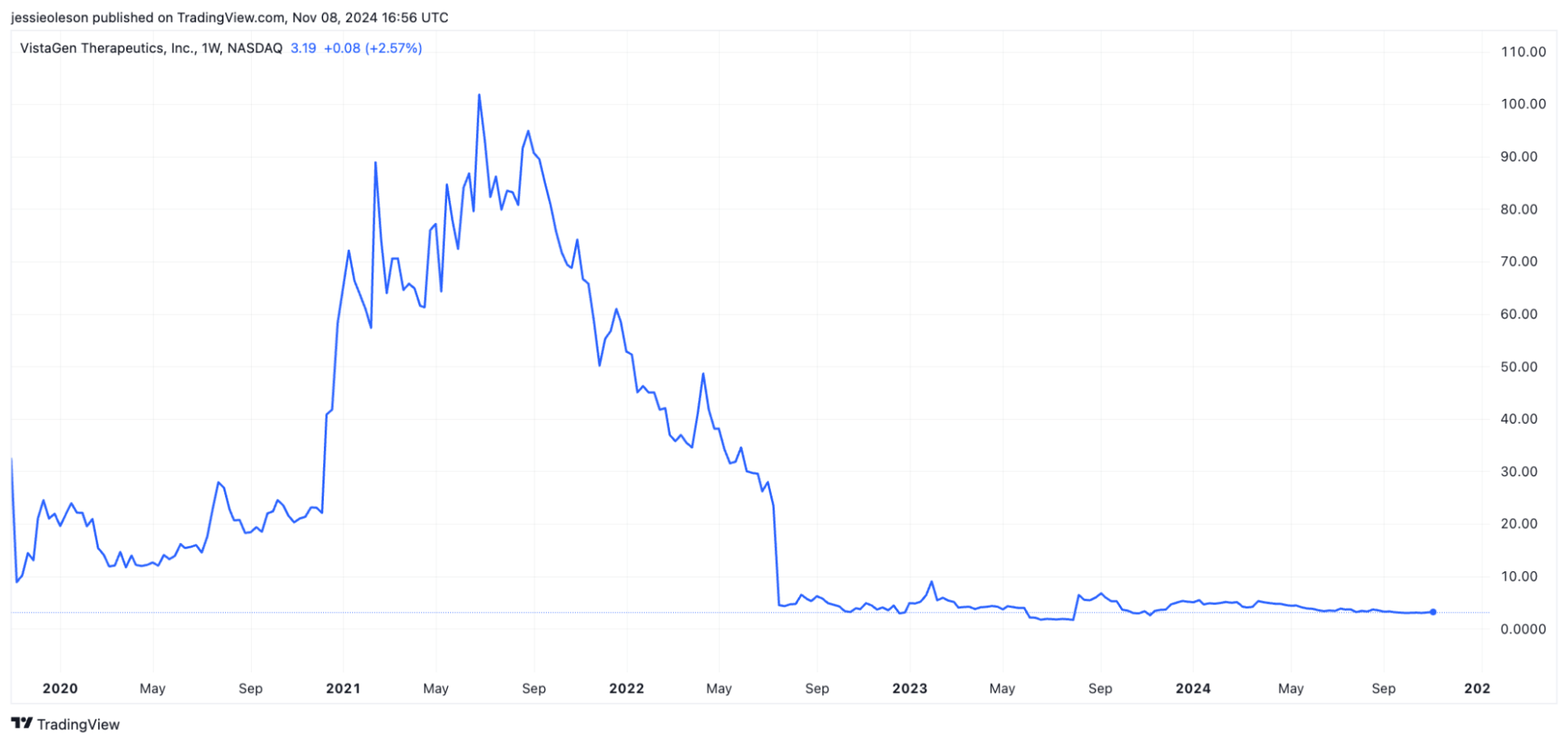

Vistagen Therapeutics (NASDAQ: VTGN)

- Market cap: $86.87 million

- Latest price: Click here

VistaGen Therapeutics, Inc. (NASDAQ: VTGN) is a clinical-stage biopharmaceutical company that engages in developing and commercializing various medicines with the potential to care for anxiety, depression, and other disorders of the central nervous system (CNS).

The company’s CNS pipeline includes PH94B, a rapid-onset neuroactive nasal spray, which is in Phase III development for the acute treatment of anxiety in adults with social anxiety disorder.

Drug Approval Process

The FDA approval process is a key factor in biotech stock price movement — both up and down. So it’s crucial to understand the different phases of the drug approval process and to keep track of what phase the company in question is currently in.

The drug approval process can provide insight to the risk involved with these stocks. The success rate for drugs to receive FDA approval is just about 10-20%. That means even after a years-long process of developing and testing a drug, only 1-2 in 10 drugs will ever get final approval.

Approvals along the way can create massive upward price movements, and failures can make stocks sink quickly.

Approvals along the way can make stock prices pop in a big way, where failures can make a stock sink in record time.

There are three phases of FDA approval process:

Phase 1 (Safety Testing)

This phase primarily involves testing the drug on 20–80 healthy individuals, although sometimes it also includes patients with the target condition.

(Animal testing usually occurs before Phase 1.) The primary aim here is to assess safety and determine the correct dosage for the drug. This phase typically takes a few months to one year.

What Investors Should Watch For

During Phase 1, investors should watch for early indications of safety. A successful Phase 1 can sometimes cause a stock price spike, but these spikes may be short-lived due to the limited scope of the study.

Phase 2 (Efficacy)

Phase 2 involves 100–300 patients living with the condition the drug is intended to treat. Researchers focus on the drug’s effectiveness and potential side effects. This phase generally takes 1–3 years, depending on the complexity of the study.

How Traders Can Win (or Lose) Big

This phase often garners more attention, as efficacy is demonstrated. Success in Phase 2 can result in larger, more sustained stock price increases, but outcomes are still uncertain.

As an investor, you should keep track of how long the phase is going to last for the company in question and stay up to date on the company’s fundamentals.

Phase 3 (Clinical Testing)

Phase 3 is the biggest and most rigorous phase. It involves 1,000–5,000 patients with the targeted condition.

This phase measures both long-term safety and effectiveness, often with one group receiving the drug and another receiving a placebo. Due to its high standards and extensive data requirements, this phase takes 2–4 years to complete.

What Traders Need to Watch During Phase 3

Passing Phase 3 is a major milestone that can lead to significant stock price spikes, but the company’s financial health is crucial here. Success in Phase 3 doesn’t guarantee profitability if the company is struggling financially.

A few more notes:

- Timing: The timelines for each phase can vary widely depending on the drug, the condition, and the FDA’s requirements.

- Post-Approval: Even after passing all three phases, a drug must gain FDA approval before it can be marketed, and the FDA may require a Phase 4 (post-market surveillance) to monitor long-term effects.

Important Biotech Conferences

As a biotech investor, you should also follow big conferences within the biotech industry. Often, announcements are made at these conferences that can move stock prices.

Some major conferences to follow include the ASCO conference and the JPMorgan Healthcare conference. Following news related to these conferences can alert you to potential investment opportunities.

Where to Find Biotech Stocks

If you’re interested in locating high-potential biotech stocks, I have two suggestions for how to find them:

For DIY Investors: WallStreetZen

As a biotech investor, it’s crucial to keep tabs on the fundamentals of the companies you’re considering and/or hold positions in.

WallStreetZen makes it easy to take the temperature of thousands of listed stocks — it’s as simple as entering your chosen ticker. From there, you can explore dozens of due diligence checks, see the analyst consensus for the stock, and see price forecasts for the coming year.

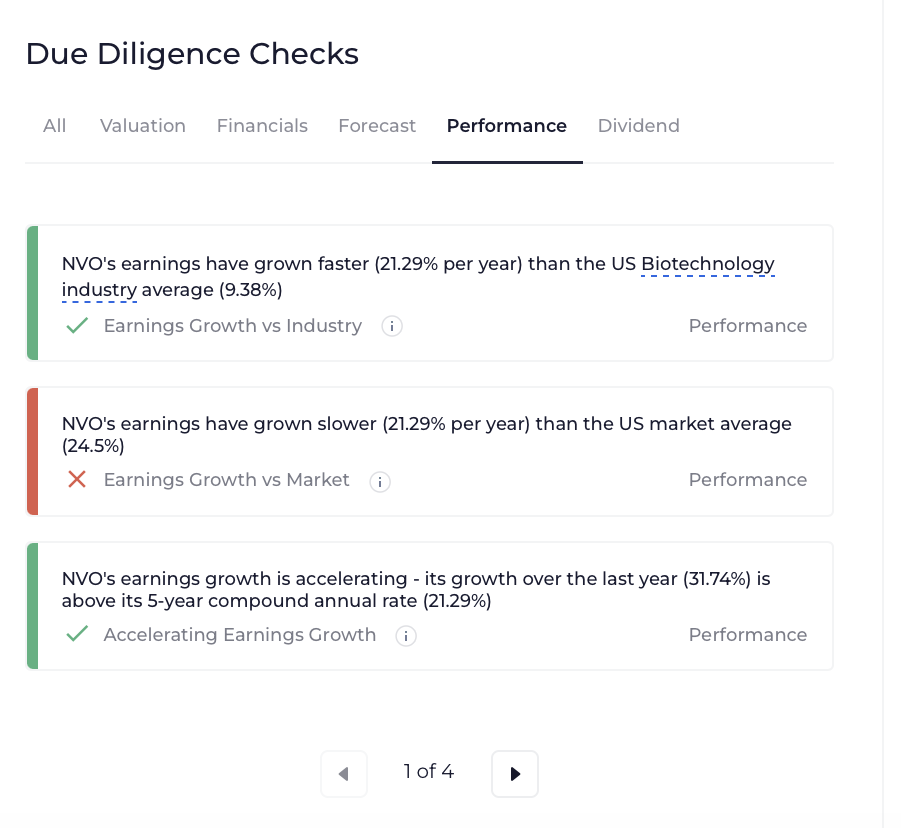

For instance, when you click over to the page for Novo Nordisk (NYSE: NVO), you can easily see how NVO stacks up against the market and within its industry with WallStreetZen’s due diligence checks on Valuation, Financials, Performance, and more:

And you can also see analyst ratings and forecasts:

As well as data on the company’s earnings, revenue, ownership, and more.

In short: WallStreetZen gives you an inside view of what makes the company tick, and what experts are saying about it. It’s just $1 to give the platform a test drive — give it a try today.

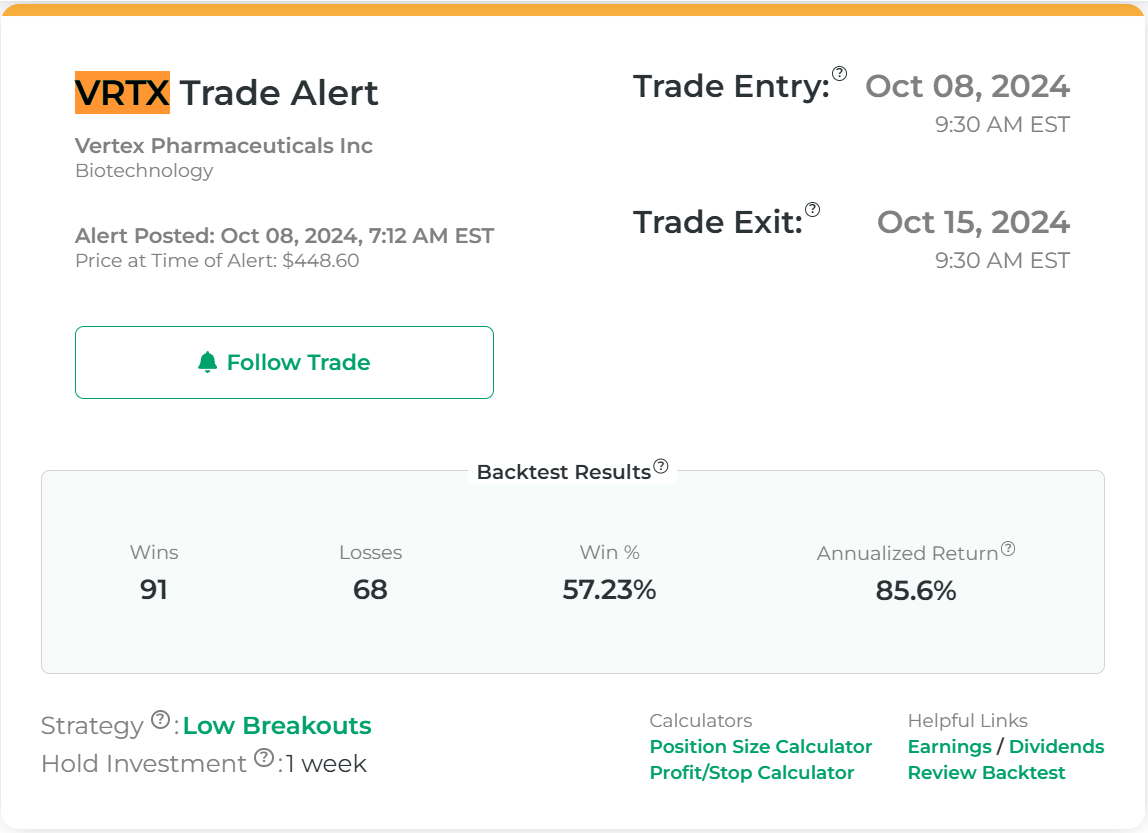

For High-Quality Stock Picks: Stock Market Guides

Stock Market Guides is one of my favorite stock alerts services. The software scans for trades based on numerous trading strategies that have been rigorously backtested through years of research and statistical analysis.

Not all of the alerts are for biotech companies — but several do come through, and when they do, I like knowing that they have a backtested edge.

Here’s a recent example of one of their recent alerts, for one of the stocks mentioned above:

This alert for Vertex Pharmaceuticals (VRTX) at the time of the trade entry was $452.03. The price at the prescribed exit time one week later was $487.01. That’s a return of 7.74% on a one-week trade.

10x your money? Not quite. But 7.74% is not bad for a week, considering most high-yield savings accounts offer 5% or less return per year.

Here’s how it works: Stock Market Guides scans for potential trade setups, and when they find one, they send it to you — and you can filter based on specific criteria.

For instance, you could focus on pre-market alerts or market hours stock picks, and further refine based on your preferred time horizon and other criteria.

For every trade setup, Stock Market Guides shows you how the setup has performed in the past. The system works — the average annualized return for the stock market hours alerts is a hefty 89.1%.

(Psst — interested in options trading? They also offer options trading alerts.)

Biotech Investing: Conclusion

Biotech investing isn’t an endeavor to be taken lightly. The inherent volatility of the sector can bring great rewards, but the risk level is quite high. That means that to avoid losses, it’s crucial to be on top of news catalysts and company fundamentals.

Tools like WallStreetZen and high-quality alerts from Stock Market Guides can help you locate and perform due diligence on potential investments.

Remember: You can never completely avoid risk in investing, but understanding the sector and arming yourself with the right tools can help improve your chances of success.

FAQs:

Is biotech good to invest in?

Biotech investing has the potential to deliver impressive results, but it comes with a relatively high level of risk. Always do your due diligence before investing.

What is a biotech investment?

A biotech investment means investing in assets related to the biotech industry. This might mean investing in biotech stocks like Novo Nordisk (NYSE: NVO) or Moderna (NASDAQ: MRNA), or investing in biotech startups.

What are the top 5 biotech stocks to buy?

According to WallStreetZen’s Best Biotech Stocks to Buy Now screener, some of the most promising biotech stocks as of November 2024 are Catalyst Pharmaceuticals, Corcept Therapeutics, Harmony Biosciences, Exelis Inc., and Krystal Biotech.

Did Bill Gates invest in biotech?

Reports indicate that since leaving Microsoft, Bill Gates has become a prominent biotech investor, reportedly maintaining positions in BioNTech (BNTX), Vir Biotechnology (VIR), and more.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.