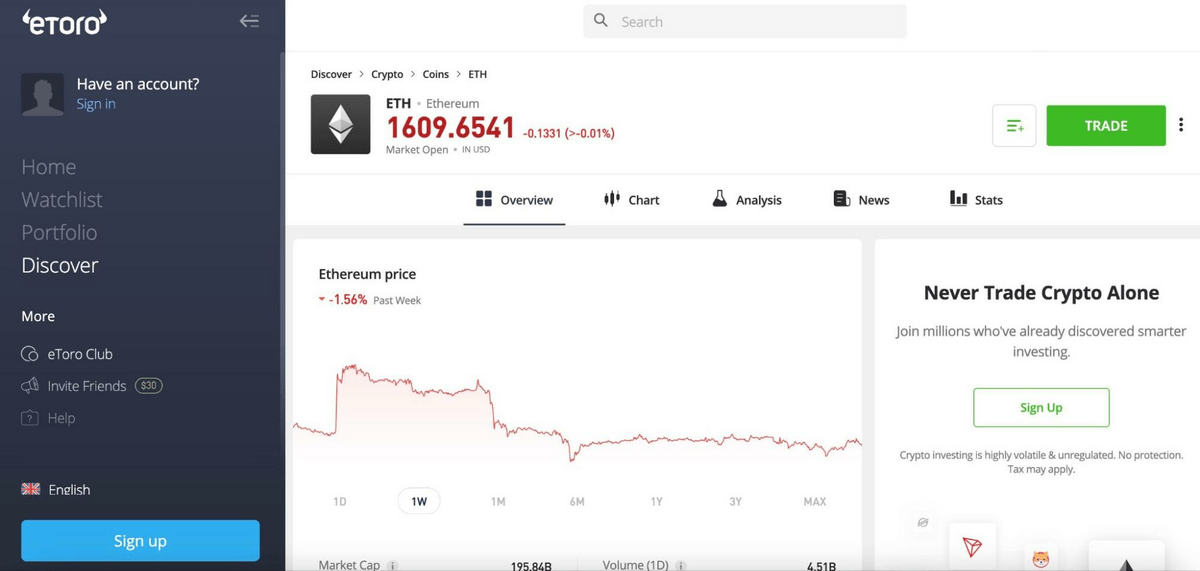

When researching the best investment options, stocks are a standard pick. Not only are they one of the oldest financial products, but they’re liquid, well-regulated, and easily accessible online (FWIW, our favorite brokerage is eToro).

However, just because stocks are super popular doesn’t mean they’re the only way to put your money to work.

Sure, buying equities has attractive features, but there are many exciting stock market alternatives in today’s investing landscape.

If you want to walk away from Wall Street, take a peek at the best non-stock investments.

At-a-Glance: 13 Best Things to Invest in (That Aren’t Stocks)

Asset Class / Investment | Suggested Platform |

|---|---|

Private credit | Percent (Accredited investors only) |

Residential real estate | |

Commercial real estate | |

Farmland | AcreTrader (Accredited investors only) |

Art + Collectibles | |

Gold | |

High-yield savings | |

Fine wine | |

Startups + private companies | Hiive (Accredited investors only) |

Money Management | |

Yourself | |

Peer-to-Peer Lending | |

Crypto |

Now, let’s look at the best investment options (that aren’t stocks).

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Note: We earn a commission for this endorsement of Fundrise.

1. Explore Private Credit Investing

Buying bonds is a “bread and butter” stock market alternative, but did you know you could rake in more interest with private credit investing?

Indeed, private credit might be one of the best alternative investment strategies for consistent cash flow — provided you’re OK with extra risk.

Since private credit isn’t as regulated as standard bonds, there are usually higher odds of a default.

On the flip side, private credit gives borrowers and lenders more flexibility when setting up terms, which could mean higher interest rates and shorter repayment schedules.

So, how do you put your money into private credit?

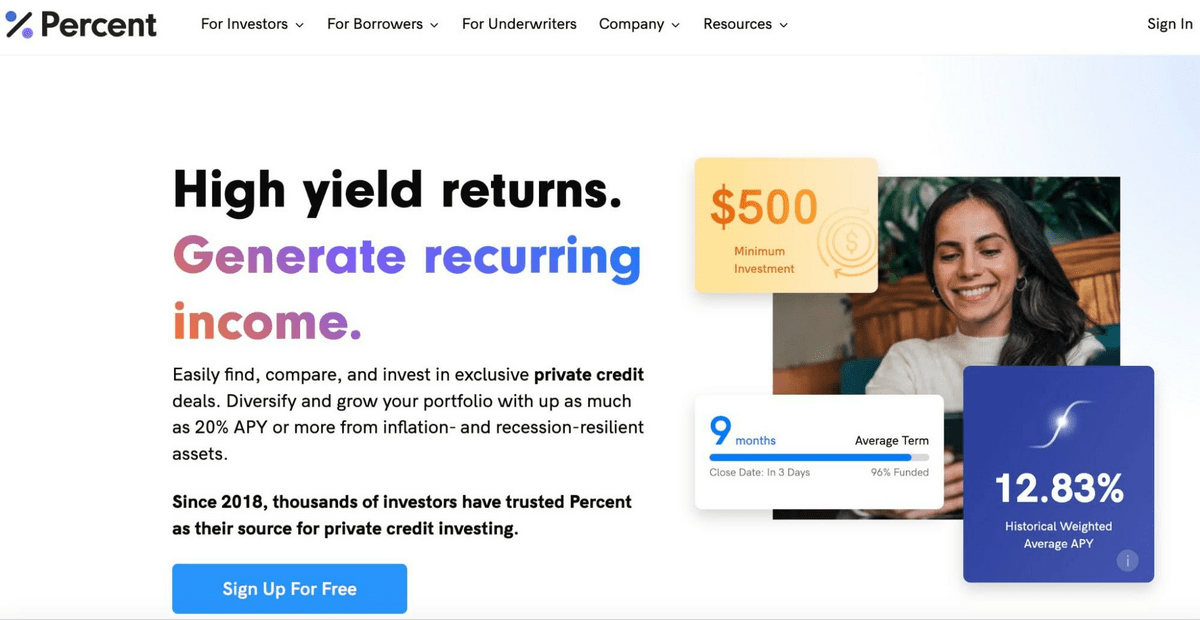

Simple: Provided you’re an accredited investor, you can sign up for Percent.

With a Percent account, you’ll have access to hundreds of private debt opportunities — including diversified “Blended Notes” — to suit your investment strategy.

Interested in this interest strategy?

2. Invest in Residential Real Estate

Like bonds, residential real estate is a traditional stock market alternative.

People are always in the market for homes, and the prices of properties have been trending up for decades.

While there’s never a guarantee the condos, vacation houses, or single-family homes you choose will move up and to the right, they are valuable and reliable assets.

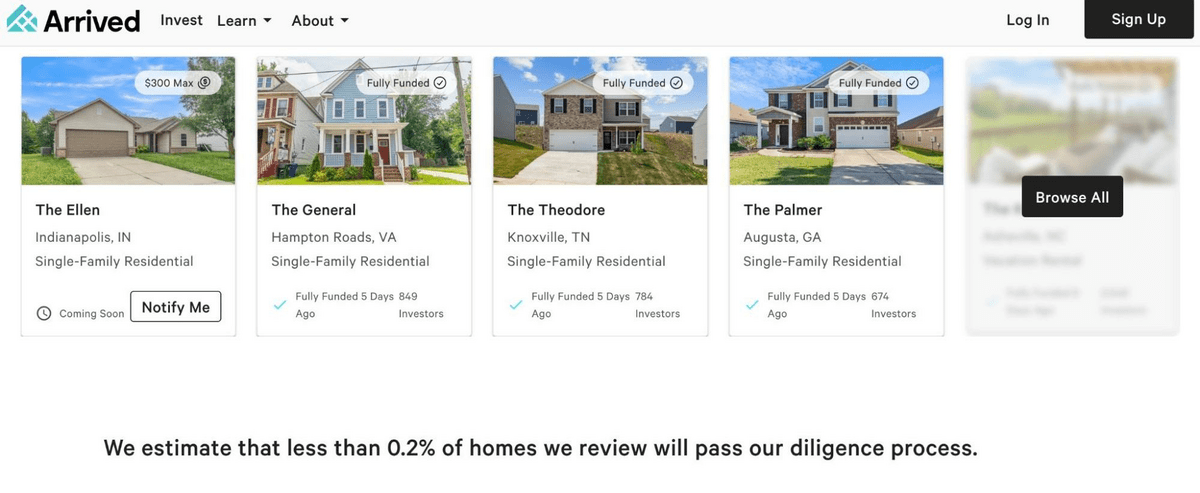

Plus, with crowd-funding sites like Arrived Homes, you don’t have to take care of properties to generate tenant revenue.

With an Arrived Homes account, you’ll own shares in residential properties throughout the USA and get dividend payouts straight to your account.

Learn more about how this platform works on WallStreetZen’s Arrived Homes Review, or visit the link below.

3. Invest in Commercial Real Estate

Like residential property, commercial real estate is a stock market alternative with a long history of favorable returns. However, there are unique risks associated with going the commercial rather than residential route.

Although commercial real estate may offer higher revenues, it might be more volatile due to business turnover.

Also, since commercial properties are tied to consumer spending, they’re more vulnerable to economic shocks like recessions.

Another downside of commercial real estate is it’s difficult for average investors to break into this field — that is, until crowd-funding opportunities like RealtyMogul hit the scene.

With a RealtyMogul account, you can choose from various commercial, industrial, or mixed-use properties and collect dividends. There are also residential properties on RealtyMogul to diversify your real estate portfolio.

While many real estate investing sites are only available to accredited investors, RealtyMogul is open to both accredited and non-accredited investors.

For some of the best real estate investment opportunities out there, click the link below.

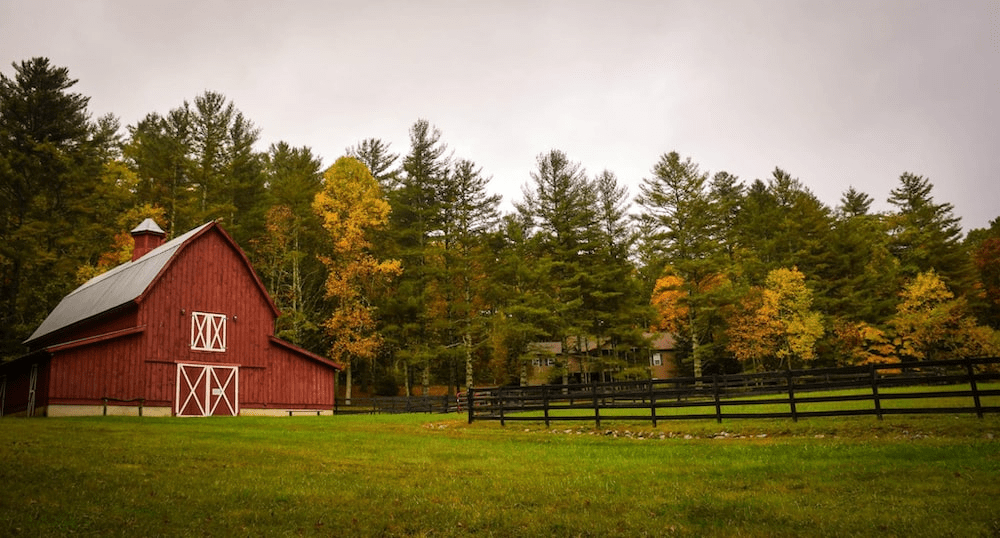

4. Invest in Farmland

Residential and commercial properties aren’t the only hot options in the real estate market. For instance, did you know farmland is one of the best things to invest in right now?

Get this: The value of arable acres hit an all-time high in 2022, making it one of today’s most attractive stock market alternatives.

While there’s no guarantee farmland will continue to post record-shattering returns, it’s a conservative option considering how significant farmland is for, you know, food!

And don’t worry about studying different soil types or tractor safety guidelines. There are ways to add acreage to your portfolio without managing a farm.

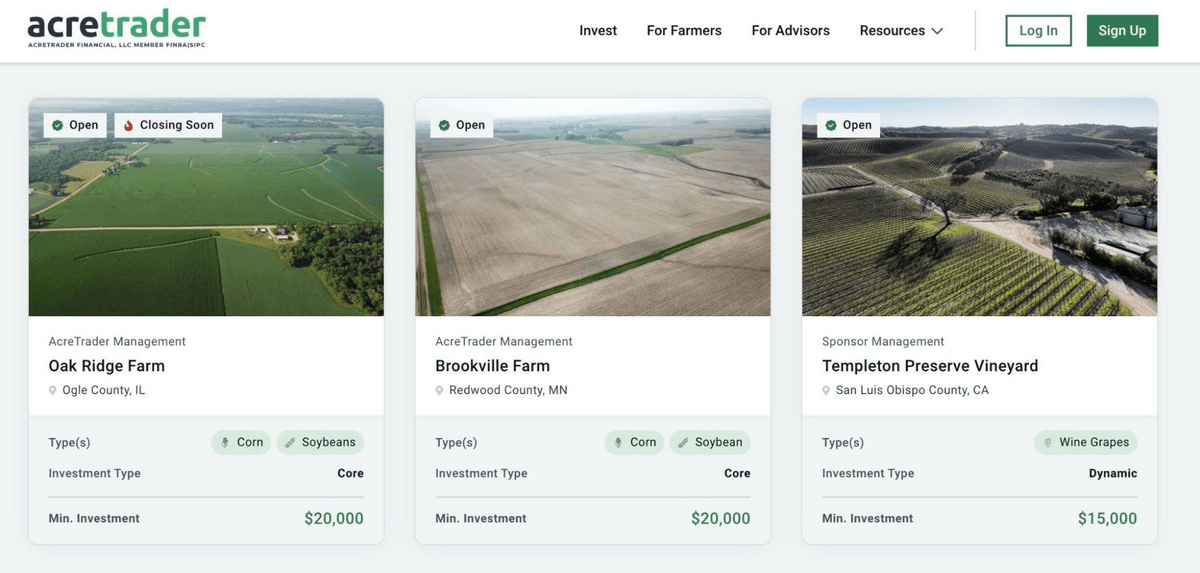

For example, on the crowd-funding site AcreTrader, accredited investors can buy shares of farmland and monitor their value over time.

Are you an accredited investor? Great news — there are all sorts of cool opportunities available to you. Check out our article about the best investments for accredited investors.

5. Explore Art + Collectibles Investing

It used to be that art investing was reserved to billionaires and investors with monocles. (Kidding. Sort of.) Masterworks, an art investing platform, has changed that.

On Masterworks, 64,000+ investors have started buying into a market that used to be restricted to the billionaire class: postwar and contemporary art. What do they know that you don’t?

- Until now, prices haven’t declined for 2 years in a row in nearly 30 years

- Trends can change, but when prices last “dipped” in 2009 they shot up 132% over the next 5 years

- Postwar and Contemporary art prices have outpaced the S&P by 64% (1995-2023)

Now, anyone can easily invest in blue-chip art with Masterworks. Masterworks’ team scours the art market for the best deals, buys them at a discount, and offers shares to members.

Want to get in before the art market comes roaring back? As a trusted partner, WallStreet Zen readers can use this exclusive link to skip the waitlist.

Related Reading: What is Blue-Chip Art Investing?

In related news, investing in collectibles is a fun way to diversify your portfolio, but it’s also one of the riskiest stock market alternatives.

Sure, there are always some collector’s items superfans are willing to splurge on — but there are also some fads that never came back in style.

Remember Beanie Babies? Yeah, those plushies aren’t so priceless anymore.

However, if you choose a rare and authenticated item with a global fan community, it could be a lucrative addition.

Just keep in mind collectibles aren’t liquid assets, and they’re usually in the “high-risk” investment category.

Luckily, you don’t have to buy, store, and authenticate collectibles to get price exposure to this market.

On Public.com, you can invest in shares of alternative assets like vintage Marvel comics, holographic Pokémon cards, and CryptoPunk NFTs.

Find out more about investing below.

6. Invest in Gold

There are never guarantees in investing, but buying gold is about as close as it gets to freezing your capital.

From Ancient Egypt to the present day, this precious metal remains a quintessential conservative asset. While you won’t get the most volatility with gold, it’s also less likely you’ll have to deal with sharp price corrections.

Gold’s relative stability also preserves your purchasing power from the insidious inflation monster.

Bottom line: If you can’t stand risk, park your funds in precious metals.

For those new to the precious metals market, we’d suggest taking a peek at Birch Gold Group‘s offerings.

In addition to buying physical metals, Birch Gold Group offers a Self-Directed IRA to invest your tax-advantaged retirement money in gold or silver.

Interested in gold IRAs? Here are some other top picks to explore:

7. High-Yield Savings

High-yield savings accounts are the best non-stock investments for consistent cash flow.

You could think of this stock market alternative as a sneaky way to get “dividends” without taking on the risks of owning equities.

Everything about high-yield savings works like a run-of-the-mill bank account, except these accounts have above-average interest payouts.

As long as you’ve verified your bank has FDIC accreditation, you don’t have to worry about losing your principal up to $250,000.

Just remember the rates in high-yield accounts fluctuate month-by-month, so it may not always be the most lucrative option — especially in low-interest rate environments.

If you’re shopping for a spectacular high-yield savings opportunity, consider researching Empower’s “Personal Cash” option. Empower now offers clients attractive yields and generous FDIC protection of up to $5 million.

To get started with Empower, use the link below. You’ll also get access to Empower’s FREE dashboard, which includes handy (and did I mention free) tools like a budget planner, investment check up tool, and more.

8. Fine Wine Investing

Like fine art and rare collectibles, fancy wine usually ages well in an investor’s portfolio.

In fact, most estimates suggest fine wines increase by 9 – 10% per year.

Wine enthusiasts might even pay more if you have a premium bottle produced in a good year.

Ironically, a big downside with this asset is that it’s not super “liquid.” You also need to keep these bottles in pristine condition and ensure safe shipping when you make a sale.

There are, however, a few ways to get your feet wet in these green grape fields without literally owning wine.

For instance, with a Vinovest account, you can invest in a curated portfolio of fine wines or spirits and monitor their price performance.

The Vinovest team secures all your wines, and you can “liquidate” your assets when your term expires.

Thirsty for more info?

9. Invest in Startups + Private Companies

One of the annoying things about investing in stocks is you’re never early to the game.

Even if you buy a company’s shares on IPO day, people behind the scenes always get in before the opening bell.

Since stocks sometimes shoot up exponentially on the first trading day, it’s understandable why many investors want to buy pre-IPO shares. (Though it’s also worth noting that stocks sometimes fall significantly upon IPO – so always do your due diligence.)

While buying a ticker on the private market is trickier, it’s not impossible for non-insiders.

For instance, Hiive gives accredited investors access to shares in some of the world’s leading private companies, including Discord, Grammarly, and Open AI.

Just keep in mind private shares aren’t as regulated as public equities. Even if a private company seems like a home run, it’s always riskier due to the lack of liquidity and transparency.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

10. Invest in Money Management

If you’re still struggling to answer “How should I invest my money,” maybe it’s best to let pro money managers make the tough decisions.

When you work with a money management firm, all you have to do is specify your goals, send your money, and track your portfolio.

Yes, their approach might involve stocks, but you won’t have to be directly involved in choosing them.

Whether you want stock exposure or not, you don’t have to worry about the nitty-gritty of asset investing. A money management team takes care of all that hard work so you can concentrate on living your life.

While money management isn’t good if you enjoy a hands-on approach, it’s a great way for passive investors to put money to work without thinking too much about it.

If you’re looking for a money manager with competitive fees and decades of experience, check out Empower. Since 1891, Empower has helped millions of Americans take control of their financial destiny.

One of the best things about Empower is its reasonable fee structure. Empower (formerly Personal Capital) offers wealth management services at significantly lower fees than “legacy” firms like Schwab or Fisher Investments.

Just as an example, the latter (Fisher Investments) charges a 1.25% annual fee for professional money management, whereas Empower charges 0.89% for up to the first million dollars invested (fees are lower above that point).

Say your account is $1 million. With Empower, you could save as much as $36,000 over ten years in fees alone.

11. Invest in Yourself

When we ask, “Where should I invest my money,” we typically think of tradable assets in a marketplace.

However, some of the best investment ideas aren’t so easy to quantify.

As corny as it sounds, the best non-stock investments are often intangible qualities like skills, education, and accreditations.

Sure, it’s difficult to measure the ROI of these self-improvement investments, but they can strengthen your resume and open innumerable professional opportunities.

If you don’t know where to start your professional development journey, consider checking out the courses on Skillshare.

From photography and graphic design to directing and podcasting, Skillshare gives you direct access to expert mentors in tons of marketable subjects.

For example, you could learn what it takes to build a professional YouTube channel from the popular tech YouTuber Marques Brownlee (aka MKBHD).

12. Diversified Funds

Who needs brokers or bankers when you can invest right in diversified funds that are available outside of the stock market?

Whether you’re into real estate, private credit, or venture capital, Fundrise has many ways to lend money for passive income via its variety of funds.

When you create an account on Fundrise (a process which, I might add, takes mere minutes), you can quickly gain access to a variety of funds and investment approaches.

One of the first things you do is select a strategy: Balanced Investing, Supplemental Income, Long-Term Growth, or Venture Capital.

From there, Fundrise does the investing for you. On your Home Screen, you can easily see your portfolio breakdown, and returns. You can also do one-time investments in any of the different areas of your portfolio. (For a deep dive into all of them, check out my Fundrise review)

Oh, and for those with a long-term POV, Fundrise also offers retirement accounts.

Note: We earn a commission for this endorsement of Fundrise.

13. Invest in Crypto

Cryptocurrency presents an excellent high-risk/high-return opportunity if you aren’t scared by speculative assets.

Even though coins like Bitcoin (BTC) have become household names, there’s still considerable potential (but also regulatory uncertainty!) in this volatile market.

As long as you can stomach wild price swings, investing in cryptocurrencies offers a unique way to bet on the future of finance and blockchain technology.

Want to get started “stacking sats?” Consider setting up an account on eToro.

On top of eToro’s intuitive crypto trading portal, you’ll have access to beginner-friendly features like CopyTrading (where you can follow and/or mirror top investors’ trades) and SocialTrading (where you can see what your peers are doing) to get a pulse on the investment community’s sentiment.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Final Word: Best Investment Opportunities That Aren’t Stocks

One of the biggest questions most investors have is “Where should I invest my money?”

Stocks are viewed as the golden standard, but everyone has a different investment journey.

If you don’t feel stocks are the right fit for you, explore some of the alternative markets and crowd-funding platforms we’ve discussed in this article.

Take some time to review your goals and risk preferences to see how different stock market alternatives fit your ideal portfolio.

FAQs:

Is there an alternative to the stock market?

There are many alternatives to the stock market. Dozens of markets focus on non-stock assets, including cryptocurrency, forex, and precious metals.

How to make money without the stock market?

To make money without the stock market, focus on online trading platforms specializing in stock market alternatives like real estate, private credit, or crypto. Remember that returns are not guaranteed.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.