Working a job isn’t the only way to make money.

Here’s how I look at it. My job (writing for WallStreetZen, which is awesome) helps me make money. I use a portion of that money to pay for my living expenses, travel, and the occasional fancy coffee. The rest I invest in income-generating assets.

By investing in assets that generate income, I flip the script so I’m not just working for money — I’m making money work for me. If I invest wisely, my money will continue to compound and generate passive income for me for years to come.

Sounds good, right? But remember: It’s not just about investing. It’s about investing wisely.

Not sure where to start? Below, I’ve detailed 10 of the best income-generating assets for beginners and beyond in 2025. Take a look, see what suits your vibe, budget, and risk tolerance, and start investing today.

1. Stocks

There’s a reason why stocks are the “60” in a classic 60/40 portfolio allocation: They’re accessible to most investors, and have incredible income generating potential.

I’ll share a textbook list of why stocks are an A+ income generating asset below, but let me start with a more anecdotal explanation from market expert: Phil Rosen, co-founder and editor of the excellent financial newsletter, Opening Bell Daily.

According to Rosen, “The reality is there’s never been a wealth- or income-generating machine as good as the stock market.”

As Rosen notes that two of the biggest benefits of stock investing are its flexibility and liquidity. “Stock picking is one thing but there can be a steep learning curve. Investing in index funds, like the S&P 500, are a reliable option that take out most of the guesswork.

Some people prefer real estate but to me, the liquidity of equities make them a more flexible option that can be sold on a moment’s notice.”

(I might add that stocks aren’t just more liquid, but are typically more affordable and easily accessible than, say, real estate investments as well.)

Here are some of the biggest reasons why stocks are the some of the best income-generating assets:

- Capital Appreciation: Stocks have the potential to increase in value, which means you can potentially make money.

- Liquidity: Stocks are among the more liquid assets out there.

- Accessibility: Easier to invest with online brokerages and fractional shares. (One of our top picks? eToro.)

- Diversification: Stocks give you access to a huge range of investment opportunities. you can diversify by investing in stocks in different sectors and themes: dividend stocks, utility stocks, AI stocks, etc. You can even invest in several stocks at once through ETFs (see #2).

- Dividends: Many stocks offer dividends, which can generate more regular income and/or compound your investment returns.

- Inflation Hedge: Historically, stocks outpace inflation.

- Ownership: You can share in the growth and profits of companies.

A tool every trader needs…

As noted above, you don’t need a lot to invest in stocks — but you do need a brokerage account. The brokerage I always suggest is eToro, which offers access to stocks, ETFs, and other assets including crypto.

There’s a reason why eToro has over 30 million fans — it’s easy to use, it offers customizable watchlists, technical analysis tools, and a range of educational resources can each make you a better trader. But what really puts it ahead of the competition is its many unique features, such as CopyTrading.

eToro’s CopyTrader offers a unique way to learn about the market by letting you follow and copy the trades of more established traders. It’s a great way to gain insight into the mechanics of trades, and can help you learn about the stock market in an active way.

eToro is the best online broker for both new and active traders looking for a unique social trading platform with a user-friendly interface and low fees.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

2. ETFs

Earlier, market expert Phil Rosen indicated that index funds are a stock-adjacent asset that’s worth your time. Let’s dig in a little more.

ETFs, short for “exchange-traded funds,” are baskets of stocks assembled within a single ticker. Often, they have a “theme” or track a particular index. For instance, you can invest in an ETF like the Vanguard Total Stock Market ETF (VTI), which tracks the stock market…

Or you could seek out a more niche one like the VanEck Gold Miners ETF (GDX), which invests in gold, or iShares Exponential Technologies ETF (XT), which focuses on international stocks that are driving exponential technological advancements with the potential to significantly disrupt their industries.

Here’s GDX’s 1-year chart:

Or you could play it safe and invest in the two index fund ETFs legendary investor Warren Buffett holds: SPDR S&P 500 ETF Trust (SPY) and the Vanguard S&P 500 ETF (VOO), which gives you access to all of the companies in the S&P 500 under one ticker. (Since 1950, the S&P 500 has had an average annualized return on investment of 11.14%).

To put this into perspective, $1000 invested in the S&P 500 in 1999 would be worth nearly $7,000 in early 2025. That’s a pretty good rate of return.

Like stocks, ETFs are liquid, highly accessible to investors, and have lower fees than actively-managed funds like mutual funds.

Or as Motley Fool puts it in this article, “One of the most attractive elements of ETFs is their cost structure. Because ETFs are based on indexes, there’s no need for a staff of two-dozen Porsche-driving Harvard MBAs, so a minimum of your hard-earned money is consumed managing the indexes.”

Like stocks, you purchase ETFs through a brokerage account. Once again eToro is our top pick, for many of the same reasons listed in #1 above.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

3. Bonds

I have to include bonds here, because they’re often seen as the yin to stocks’ yang. (They’re also the “40” in the 60/40 portfolio.)

What’s a bond? In the simplest terms: An IOU. A bond is a loan that you give to an entity (company, government, etc). In return for the loan you give them, they pay you back with interest over a set time period.

Say a company wants to build its new headquarters, but it doesn’t have enough money to do it up front. They might sell bonds to raise money for the project.

In return for this funding, you’ve eventually got to pay back the money with interest. In return, you get regular interest payments and promise to return your initial investment at the end of the bond’s term.

There are many different types of bonds — government, corporate, municipal — and many ways to invest in them. If you’re looking for a user-friendly way to start investing in bonds, consider Public’s high-yield bond account.

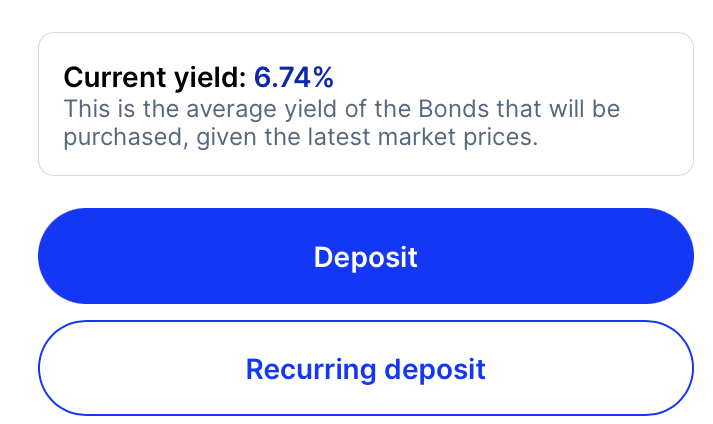

Public’s high-yield bond account gives you immediate access to a diversified set of 10 investment-grade and high-yield corporate bonds that span industries, durations and ratings.

Your Bond Account is scheduled to generate interest every month, and your income is reinvested once it reaches the amount to purchase another bond. Holding your bonds until maturity ensures the highest yield, but you can withdraw your cash early. It’s also easy to set up a recurring deposit if you’re bonded to bonds.

Currently, the yields on Public’s high-yield bond account are higher than most high-yield savings accounts — 6.74% at writing in January 2025.

Before we continue…

There’s something you need to know about the traditional 60/40 allocation. It might be dead.

Recently, investment giant KKR conducted a study examining the benefits of adding alternative investments into the traditional “60/40” portfolio over almost a century of returns.

They found that a 40/30/30 portfolio (including real estate, infrastructure, and private credit assets) offered both higher returns — with lower volatility — even during periods of high inflation.

With that in mind, let’s talk about some alternative assets to consider adding to your portfolio.

4. Real Estate

Real estate is the biggest alternative asset class out there. Here’s why: It’s always in demand. People need structures for shelter. People need housing and businesses do too.

There are also a ton of ways to invest in real estate. For instance, you could flip houses. Or you could buy an investment property and rent it out. But let’s be real: Those methods require a lot of up-front capital, and a lot of work.

I spent several years as a landlord, and I can attest that that life is not for everyone. If you like the idea of investing in real estate but prefer not to own property outright, there are other ways.

For one, you can invest in REITs. Short for Real Estate Investment Trusts, they are companies that own, operate, or finance income-producing real estate. They provide access to large-scale, income-producing real estate without actually having to invest in property.

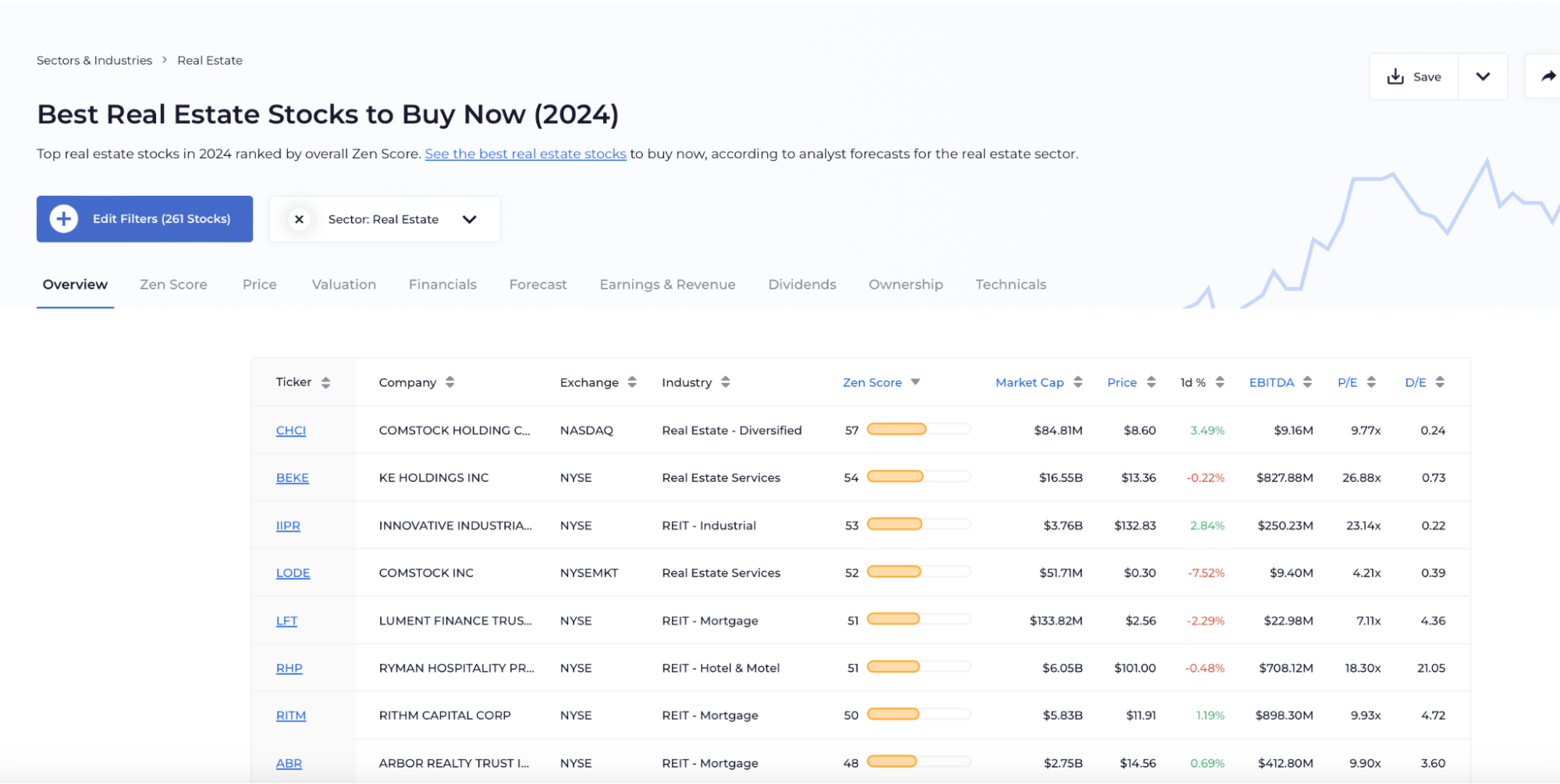

REITs trade on the stock market like regular stock tickers — if you want to get started with them, start by checking out WallStreetZen’s Best Real Estate Stocks to Buy Now screener.

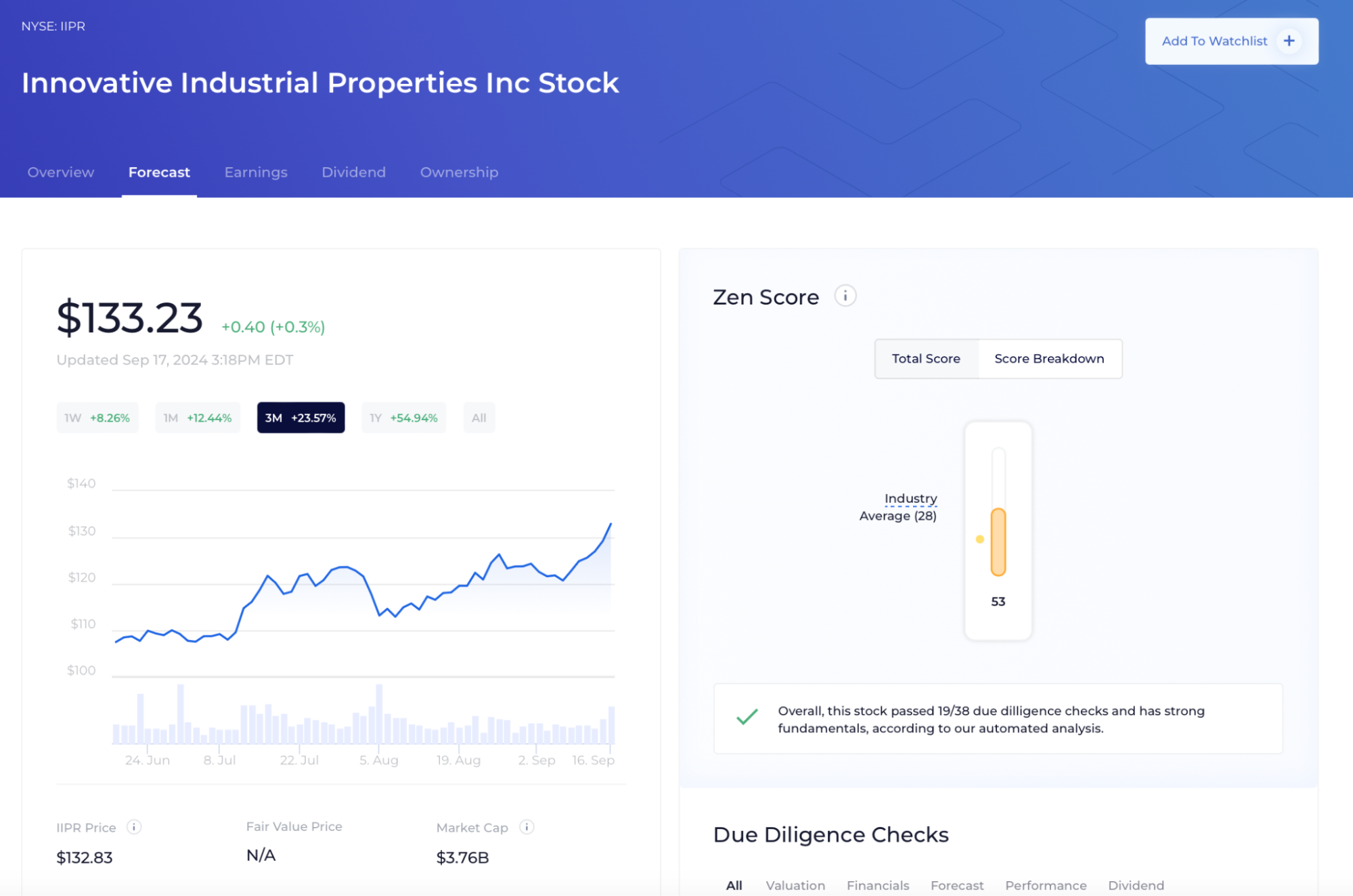

You’ll find a ton of high-quality REITs that you can research right on the platform, gaining access to the stock’s fitness through a series of 38 due diligence checks, plus access to analyst coverage, 1-year stock price forecasts, and more.

Here’s the WSZ page for an REIT: Innovative Industrial Properties, Inc. (NYSE: IIPR):

Another option? Explore fractional real estate investing.

If you’re an accredited investor looking to explore real estate investing? I highly recommend Yieldstreet.

YieldStreet is a fantastic investment platform that gives you access to real estate deals that you probably wouldn’t be able to access alone: Think office buildings, commercial real estate, high-rises, etc.

Yieldstreet offers curated private market offerings that have passed a four-step due diligence process. Out of the billions of dollars of opportunities submitted to Yieldstreet, only 9% of offerings make it to investors.

It doesn’t just have investments, it’s got the goods: Since inception in 2015, over $3.9 billion has been invested on the platform, and $2.4 billion has been returned to investors.

While many of the investments on Yieldstreet are only available to accredited investors, its Alternative Income Fund is a sparkling example of an opportunity for the rest of us. With a minimum investment of $10k, it’s not cheap. But does offer access to a wide variety of alternative assets within a single investment vehicle — as of December 31, 2024, the Fund reports $147M+ of AUM across real estate, private and structured credit, and legal finance investments, to name a few.

5. Private Credit

Private credit is an income generating asset that most people don’t even think about. That’s probably because until recently, investing in private credit was reserved for an elite population — you had to be super rich or super-connected.

Percent has changed that with a platform that gives accredited investors access to private credit investing for as little as $500.

Percent gives you exposure to a variety of debt and blended note portfolios. The company partners with high-quality corporate borrowers, many of which originate loans to small businesses and consumers.

Then, those syndicated loans are funded by you, the investor. You simply sign up, pick a private credit deal you like, and invest. With no fees for individual deals, it’s one of the best ways to diversify into private credit investing.

And if you’re undecided, or prefer not to commit to a single deal, you can invest in Percent Blended Notes, which include a range of different notes in different sectors within a single investment vehicle. I personally like this approach, because it allows you to diversify without investing in several different vehicles separately.

Is it worth it? I think the returns speak for themselves — as of January 2025, Percent has over $1.28 billion funded, an 18.13% weighted average APY, and an extremely low 2.41% default rate (compared to the 2.62% default rate at commercial banks).

P.S. Not accredited (yet)? Fundrise offers retail investors access to private credit investing through its Income Fund — learn more in our Fundrise review.

6. Art and Collectibles

Wondering how to diversify for a new era of market volatility? Here’s a reason to consider venturing into art + collectibles: a 5% allocation to art is proven to improve portfolio performance.

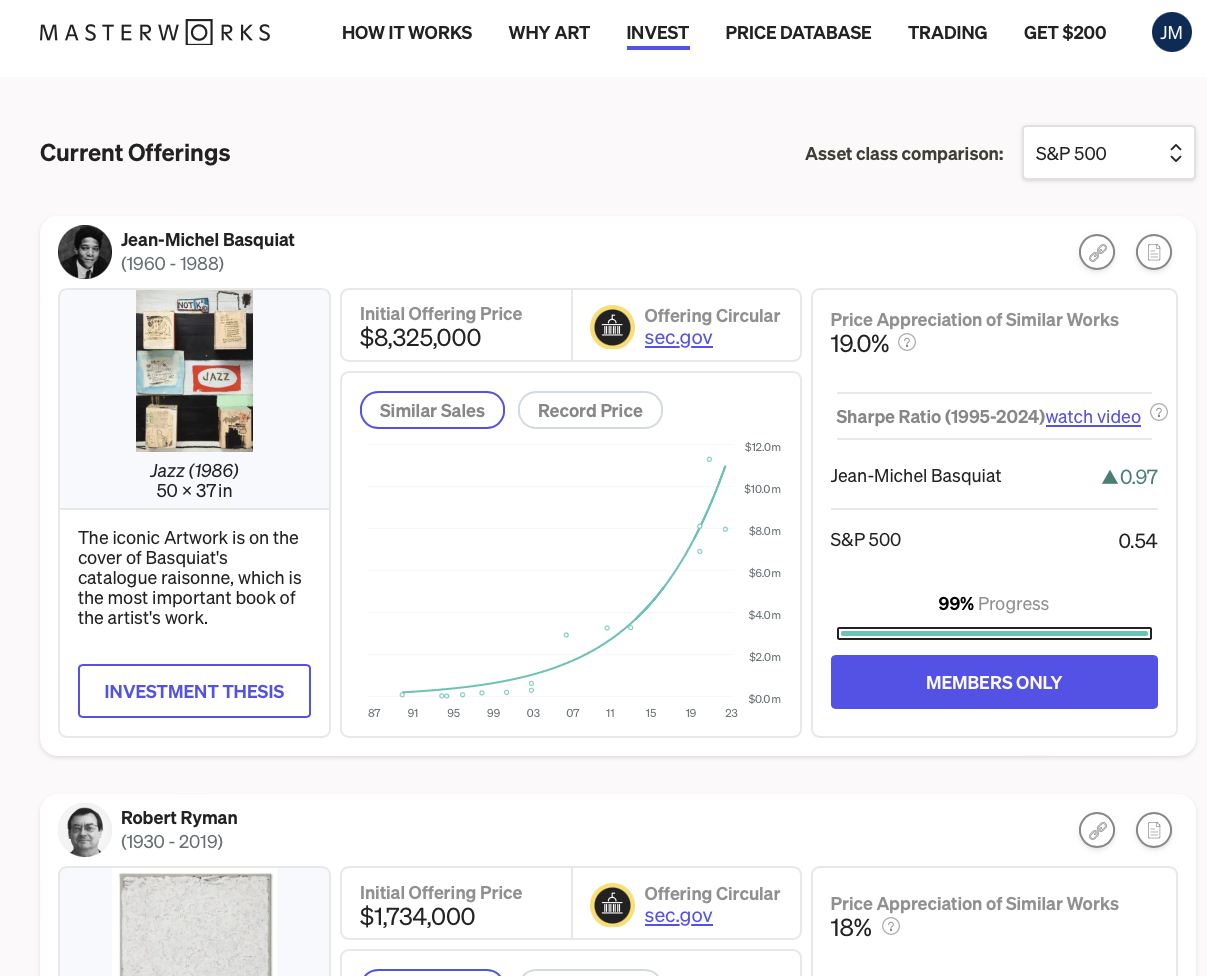

Adding just a 5% allocation to contemporary art can improve your long-term performance 98% of the time, according to new research from Masterworks. Their art investing platform breaks paintings into shares, with a collection approaching $1b.

You don’t need a degree in art history to invest in art on Masterworks — the platform does all the heavy lifting for you in terms of research, due diligence, and storage.

The platform is serious about who they let in “the club” — you’ll need to book a one-on-one call with their team before they green-light your account. But in the long run, it’s worth your time.

Masterworks has already sold +$45mm in art, distributing the net proceeds to everyday investors. Get priority access and skip the waitlist by clicking below.

7. Businesses

Businesses are some of the income-generating assets out there. Luckily, you don’t need to launch a start-up to unlock their income-generating potential.

If you ask me, one of the most exciting ways to invest in businesses is to gain access to pre-IPO companies through a platform like Hiive.

Hiive is a potentially great way for accredited investors to gain exposure to private companies like Groq, Tekion, and Waymo.

The platform connects accredited investors with thousands of high-growth, VC-backed startups. By buying shares from employees, venture capital firms, or angel investors, accredited investors can own stakes in private companies.

Another way to invest in cutting-edge companies for non-accredited investors…

If you like the idea of investing in innovative startups and venture capital but aren’t an accredited investor, you may be interested in Fundrise.

I already mentioned how you can invest in private credit, but you can also invest in up-and-coming tech companies through the Fundrise Innovation Fund. (You can read more about it in my Fundrise review.)

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

Note: We earn a commission for this endorsement of Fundrise.

8. A Professionally Managed Portfolio

There’s nothing wrong with wanting someone to manage your money for you.

Don’t just go for the first portfolio manager you find. Read the fine print to make sure the services and fees match your expectations.

I’m a huge fan of Empower (formerly Personal Capital), which offers wealth management services at significantly lower fees than a lot of “legacy” brokers out there.

Where big brokers like Fisher Investments charge a 1.25% fee, Empower’s fees start at 0.89% for up to the first million dollars invested, but go down to as low as 0.49% depending on account size.

That might not sound like a huge difference, but trust me, it is. If you have an account of $1 million, Empower, you could save as much as $36,000 over ten years in fees alone.

9. Cash and Cash Equivalents

Do keep some cash on hand … But don’t just keep it under your mattress. If you haven’t experienced the wonder that is a high-yield savings account, get one right now.

A high-yield savings account is like a regular savings account, but with a higher interest rate. Often, they have higher minimums than traditional savings accounts, but the rewards are much better.

High-yield savings accounts offer interest rates 20-25x higher than traditional savings accounts while still being FDIC-insured up to $250,000.

Currently, I hold two high-yield savings accounts: CIT Bank’s Platinum Savings account, which currently offers 4.85% APY for accounts of $5K or higher, and a high-yield cash account with Public.

The former is where I hold a bigger chunk of cash; the latter is where I keep some of my stock investing money in a high-yield holding pen.

Of course, it’s worth remembering that even the highest high-yield savings account probably won’t hold a candle to the potential of the stock market. Remember our market expert Phil Rosen of Opening Bell Daily, who weighed in on stocks in #1? He’s got opinions.

According to Rosen, “Much of the wealth inequality in the US stems from the gap between savers and investors. Saving money is great, but it doesn’t generate wealth as effectively as deploying cash in something like the stock market.

Two people making the same salary could have wildly different financial security if one keeps all their cash on hand and the other invests in markets.”

And remember: Rates could (and likely will) come down. So while finding the highest APY savings account is great for safety (and beating traditional savings accounts by a wide margin), you’ll need to make an investment with higher risk to keep pace with and exceed inflation.

10. Yourself

As the late, great Benjamin Franklin once said, “An investment in knowledge pays the best interest.” (Hey — we’ve got more great investing quotes here.)

Investing in yourself is perhaps a less tangible income-generating asset than the other options on this list, but no less important.

Here’s the good news: It’s easy to invest in yourself. Just keep learning. You’ve made a powerful step by reading this blog post and educating yourself on some of the best income-generating assets out there. To keep your education going, check out the links below.

Final Word: Income Generating Assets

Hey! You made it. Thanks for reading my post about the best income generating assets in 2025. Hopefully you feel smarter and better informed.

You might be ready to invest — or you might want to keep educating yourself to learn more before you start investing. We’ve got a ton of other great articles that might interest you.

Here are just a few to get you started:

- The 7 Best Stock Trading Courses for Beginners

- The 9 Best Investment Newsletters

- 10 Investments That Earn A High Return [10% ROI or more]

- How to Invest $40K

Happy investing!

FAQs:

What are examples of income generating assets?

Some examples of income generating assets are dividend paying stocks, real estate, alternative assets, and compounding interest bank accounts.

What are income generating assets?

Income-generating assets can be anything that you invest in that generates income. Also sometimes called passive income investments, they can include stocks, bonds, royalties, real estate and other alternative investments.

What is the best asset to make money?

Some of the best assets to make money include stocks, ETFs, bonds, real estate, private credit, and alternative assets. However, you should not overlook investing in yourself as a means to generate more income in the future.

That means that you, yourself, are potentially an income-generating asset!

What is the cheapest asset to buy?

These days, there are a lot of inexpensive / cheap assets available to buy. For instance, low-priced stocks, or fractional shares of higher-priced stocks, make stocks one of the cheapest and most flexible options for affordable assets.

However, fractional investment platforms allow you to invest in assets ranging from private credit to fine art for an affordable price.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.