How do people get rich? Typically not from a single income source.

Despite that fact, most people have just one income stream — their job. The problem? If you don’t invest in other assets and learn how to diversify your income, you could lose everything if you lose your job.

In the book, “Rich Habits, Poor Habits,” author Tom Corley found after surveying 233 wealthy individuals, 65% had three streams of income. Generally, these are ordinary people with disciplined saving and investing habits.

When it comes down to it, if you’re looking to grow your wealth like a self-made millionaire, you’ll need to learn how to create multiple streams of income. Here are 11 of our favorite different income streams.

Best Multiple Streams of Income Ideas in 2025

The bottom line: Curious about how to have multiple streams of income? The short answer is that real estate investing produces the best method for building multiple streams of income.

Within the real estate scope, investors can choose among a wide variety of strategies to generate different income streams.

Don’t have the cash to buy investment property?

Real estate isn’t off the table if you don’t have enough money to buy a building or land. You can still invest — even with a small account (as low as $10 in some cases!). Here are some of our favorite platforms for alternative real estate investing:

- Arrived Homes – Buy shares in rental homes and vacation properties

- Fundrise – Invest in a wide array of commercial projects around the country

- Yieldstreet – Access asset classes like art, crypto, transportation, private credit

And let’s not forget REITs. My favorite platform for trading them is Public, because you can also gain access to other alternative assets on the same platform.

Keep reading — we’ll discuss the benefits of these platforms in greater detail below. Plus, be sure to check out our article about fractional real estate investing.

Note: We earn a commission for this endorsement of Fundrise.

Diversify Now: 11 Multiple Streams of Income Ideas

Below, you’ll read several ideas for potentially generating multiple streams of income. Everyone’s needs will be different; consider your financial situation, goals, and risk tolerance.

1. Real Estate Investing

Purchasing rental property is a great way to add an extra income stream. You get income from the cash flow left over each month after expenses like the mortgage, utilities, and repairs.

When discussing multiple streams of income you also need to consider where it falls on the ‘scale of passivity.’ I’ve experienced firsthand how active real estate investing can be. If you’re trying to save money on expenses by doing the work yourself, you’re limited to the time you have to dedicate to the project.

Real estate investing includes a wide variety of strategies, including but not limited to:

- Private lending

- House hacking

- Wholesaling

- House flipping

- Multifamily

- Single-family

- Crowdfunding

While a more active approach to real estate investing may take more sweat equity, owning the asset will increase the equity in your portfolio and you can enjoy benefits like appreciation, depreciation, mortgage paydown, and cash flow.

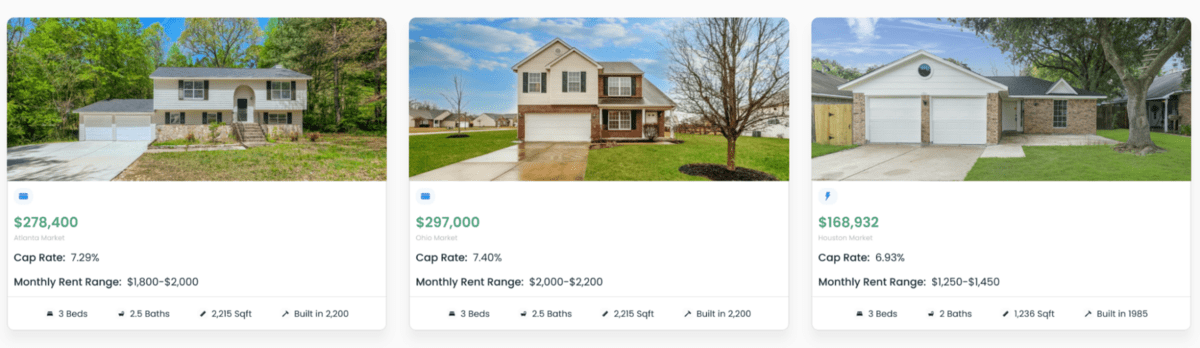

If you want the benefits of ownership and have the cash to buy a house but don’t have or want to devote the time, you can try an investing platform like Doorvest.

They help you own high-yield single family homes without requiring the knowledge or experience. You select investment criteria, close on the property, then reap the benefits of real estate ownership. Doorvest will source the property, complete renovations and manage on your behalf.

2. REITs

Real Estate Investment Trusts (REITs) can be an attractive method to generate extra income. They are companies that own and operate income-producing real estate. REITs are required by the IRS to pay out 90% of their taxable income to shareholders in the form of a dividend.

REITs invest in assets including commercial real estate, storage, senior facilities, office space, and hospitals. This can help you diversify outside of a traditional stock and bond portfolio with potentially high dividends.

The main drawback to keep in mind is some REITs don’t meet the IRS ‘qualified dividend’ definition and therefore, could be taxed at a higher rate.

Remember: It’s important to look at historical success, industry, sector, and fees before making investment decisions.

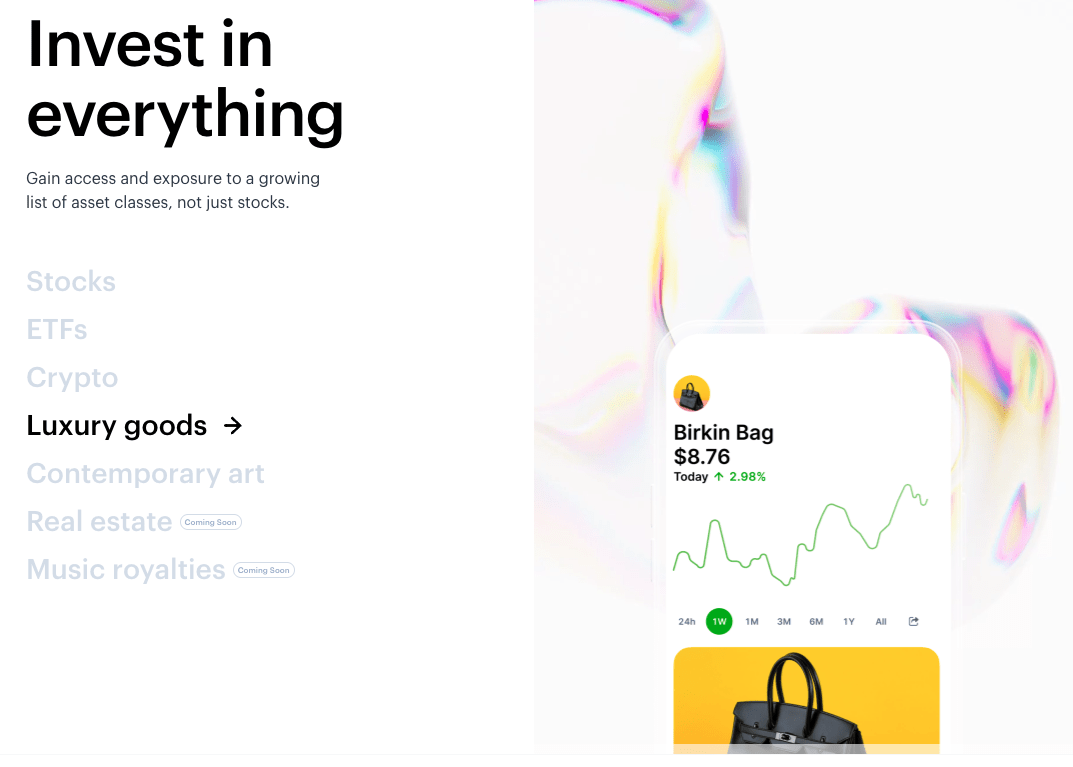

REITs can be purchased through most brokers — I really like Public, because beyond stocks and REITs, you can also diversify into other assets like collectibles or even luxury goods — areas you may not have considered investing in but that have amazing potential returns.

Also worth noting? If you need help finding REITs, WallStreetZen has a ton of tools to help you filter out the best opportunities. You can choose specific sectors to search so that you can focus on the REITs that are aligned with your investment strategy.

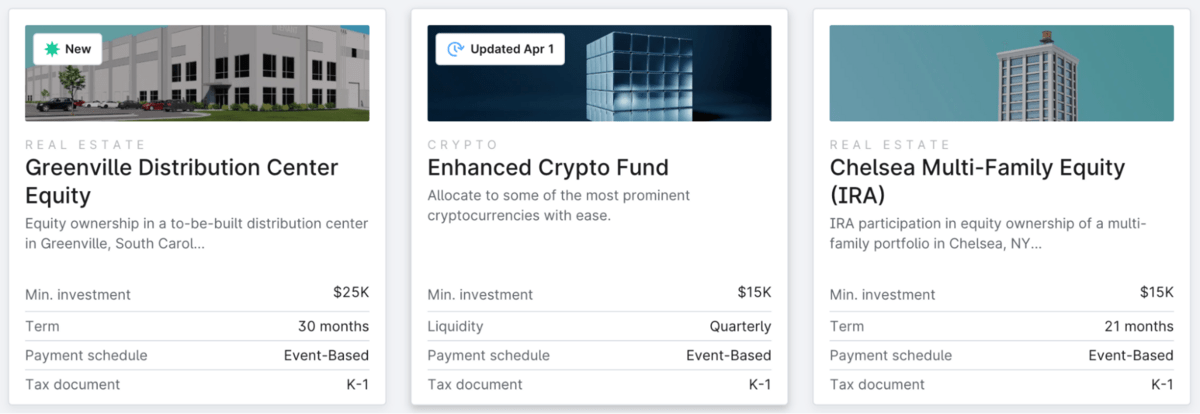

3. Fractional Real Estate

Alternative ways to invest in real estate have transformed the investing landscape over the past decade. Investors now can access assets that used to be set aside for the ultra-wealthy — large multifamily projects, equity in commercial distribution centers, or buying shares in vacation rentals.

The biggest draw to fractional projects is access to unique assets for minimums — as little as $10 on a platform like Fundrise. Fees typically range from 1-3% annually and minimums range from $10-$5,000.

Here’s what you DON’T have to worry about: Sourcing the deal, maintenance, or management.

However, crowdfunded investing isn’t perfect. The main drawback of crowdfunding? Lack of liquidity and control.

Unlike a stock, it may take longer to pull money out of a crowdfunding project like you would by choosing to sell a stock. In addition, you do not have a say in how real estate assets are developed and managed.

Want to explore? Here are our top picks to utilize crowdfunding to develop multiple streams of income:

- Arrived Homes – Buy shares in rental homes and vacation properties

- Fundrise – Invest in a wide array of commercial projects around the country

- Yieldstreet – Access asset classes like art, crypto, transportation, private credit

4. Invest in Small Businesses

Starting a small business can be extremely rewarding. Owning a local establishment like a restaurant, ice cream parlor, dance studio or salon can not only serve the community but also grow into a profitable family business.

While this type of business can be rewarding, it takes a lot of time and money to be successful. Capital outlay for a physical location, advertising, marketing, hiring, and inventory requires money and expertise.

Out of all these factors, the biggest headaches result from hiring turnover.

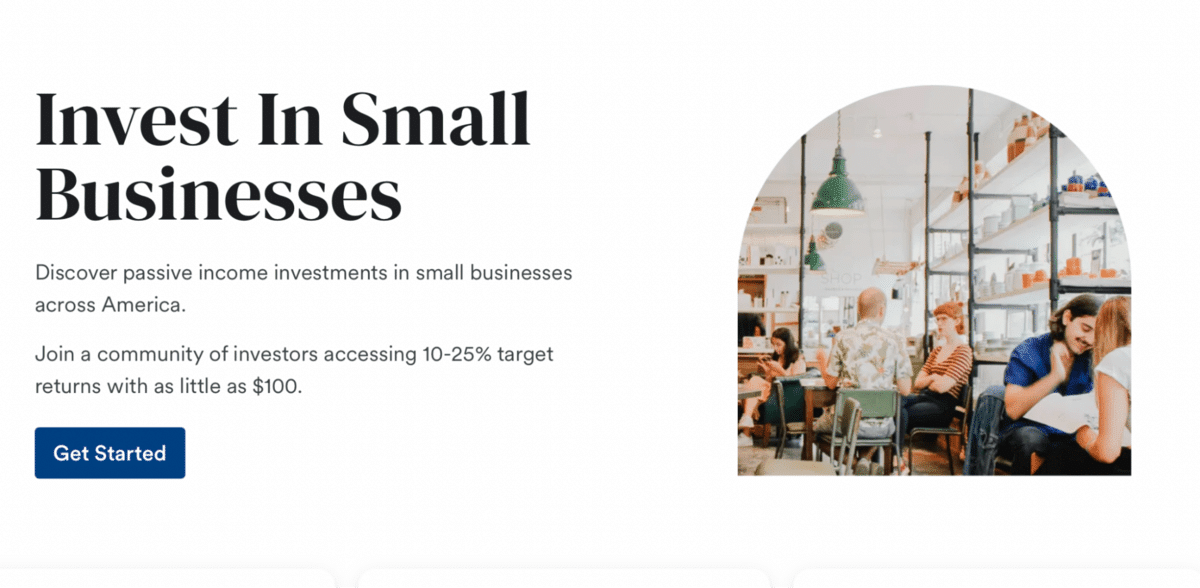

Alternatively, you can reap the benefits of small business ownership without the headaches. Just like real estate crowdfunding platforms, there are small business investing platforms.

Do you love cooking or want to own a restaurant? You can either spend $40,000-$50,000 to start your own food truck.

Or, you can use platforms like Mainvest to invest in a small business like this for as little as $100.

Mainvest lets you invest in these businesses, so you can live the small business dream without the hardest parts, like making a business plan or dealing with bank loans or leasing a space.

Mainvest discovers and properly vets small businesses. As an investor, you can help raise money to fund their business and then potentially get a portion of their revenue as a return.

5. Invest in CDs

Growing up, if you asked me if a certificate of deposit (CD) is a good investment I would’ve called you crazy and said ‘Maybe in the 1980s.’ Now in 2023 it is not uncommon to see average returns at 5%.

A CD is a savings product that pays a stated interest rate based on a lump sum of money. Your bank or credit union will typically hold your money for terms of 1-5 years and pay interest in return. While a savings account is liquid and pays low interest, a certificate of deposit is the next step up, paying higher interest with slightly less liquidity.

Overall, CDs are low-risk and passive on the overall income stream spectrum. Just make sure if you’re investing in them to be aware of the features, terms, and minimum required. Companies like CIT Bank allow you to lock in a 5% annual rate. This type of CD is held for 6 months with $1,000 invested.

But CDs aren’t the only banking product that can potentially generate income…

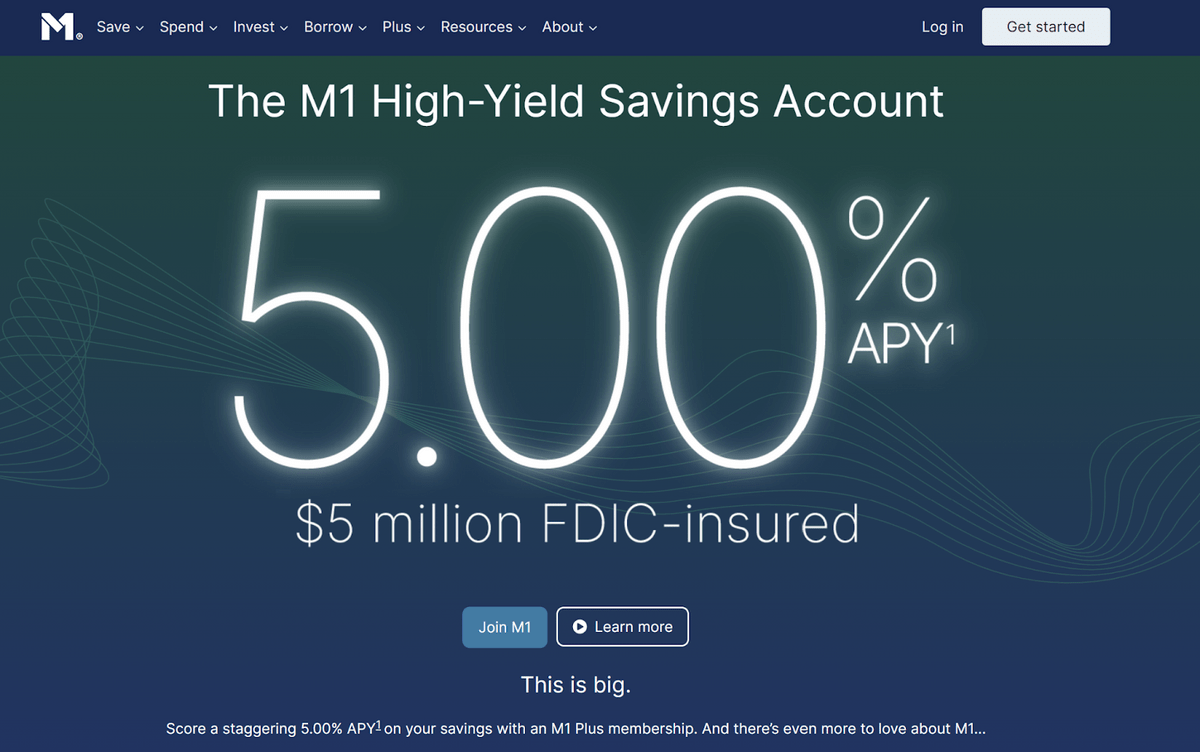

6. Invest in a High-Yield Savings Account

Another financial product available at most banks and credit unions is a high-yield savings account. If it’s ‘high-yield’ then what’s the difference from a CD?

In exchange for a lower interest rate, high-yield savings accounts do not have liquidity restrictions. CDs have maturity dates and therefore, withdrawal penalties if money is removed prior to maturity.

High-yield accounts are better for emergency funds or any unexpected expense where the funds need to be accessed. If you have $10,000 sitting in your bank, for example, you could put $2,000 into a CD, knowing it can sit for 6-12 months without being touched.

M1 Finance is one of the best platforms for high-yield savings accounts. They currently offer a 5% annual rate — more than 12x higher than the FDIC-reported national average of 0.40%.

7. Dividend Stocks

Dividend stocks are associated with public companies that share profits with shareholders in the form of dividends.

Reinvested dividends over time can be one of the most passive ways to create multiple streams of income. For instance, Coca-Cola Co (NYSE: KO) is a notable long-standing dividend-paying company.

Dividend-paying companies are typically more established compared to start-ups and early-stage public companies. They tend to have steady prices and consistent dividends.

On the other hand, younger companies choose to reinvest profits back into the business as opposed to paying dividends to shareholders. In this case, you’ll see no dividends but a possible increase in stock price.

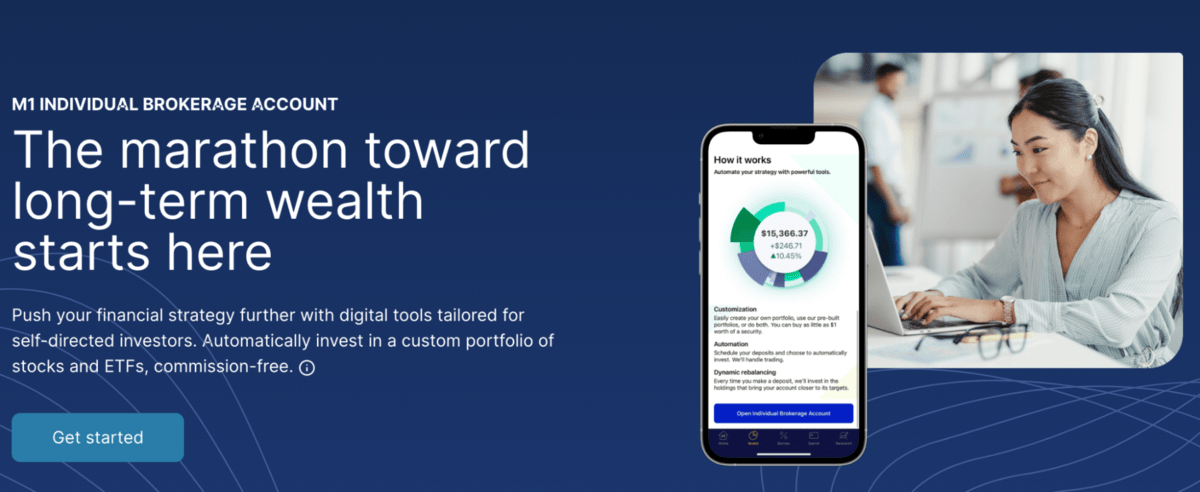

M1 Finance isn’t just good for HYSAs … It’s one of the best platforms to research, choose, and invest in dividend stocks.

On M1 Finance, you can create a customized “pie” of different stocks that includes dividend companies and/or ETFs, or you can simply invest in an expert M1 Dividend Pie.

Plus, with M1 Finance, you can automatically reinvest your dividends for individual stocks or your entire portfolio.

8. Invest in Funds

In the investing world, “funds” refers mainly to ETFs and mutual funds. Both are funds that include a collection of securities. This strategy will offer more diversification compared to individual stocks.

The biggest difference between the two is how they are managed:

- Mutual funds are actively managed

- ETFs are passively managed

Minimum investments vary for both types but overall, ETF expense ratios are cheaper due to their management structure.

More often you may hear about robots or indexes performing the same, if not better, than actively managed funds.

In my opinion, for a long-term strategy, I’d prefer to invest in an ETF that tracks an index like the S&P 500. You can also invest in ETFs that focus on different sectors, like energy, technology, healthcare or real estate.

Get started with online investing platforms like eToro. Their social investing platform allows you to see what friends are buying and selling and learn from their expertise.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

9. Invest in Art

Want to learn how to create different income streams that have no correlation to the stock market?

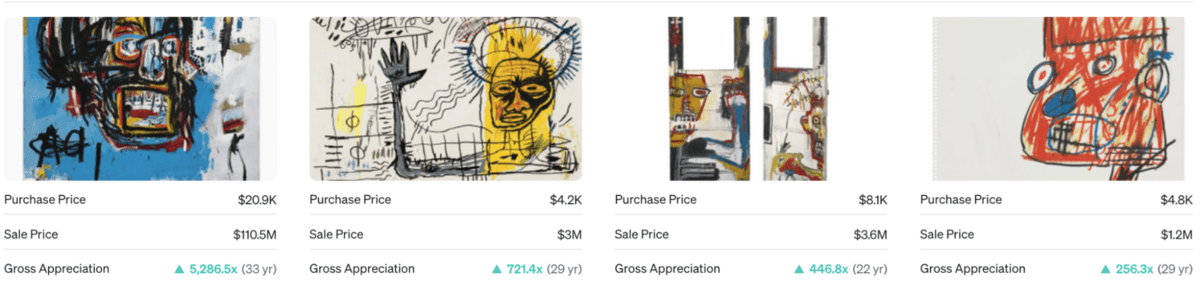

The art world has a market of its own. Historically art as an investment steadily appreciates in value. However, it is hard to value and can depend solely on the reputation of the artist.

Physical art pieces can be purchased online or through live auctions, usually at a heavy price tag.

However, there are other options.

For one, ETFs. Just like you can purchase real estate, tech, or energy ETFs, you can also buy art ETFs through a brokerage account.

If you’re familiar with crowdfunding real estate platforms, you may be interested in a platform like Masterworks.

Here you can leverage the power of a unique asset class to purchase fractional shares of art. The process works similarly to other crowdfunding platforms. They vet the asset, purchase it, securitize it, then sell it in the form of shares.

10. Invest in Wine

Typically when I hear the word ‘wine’ I think of ‘buy and drink,’ not ‘buy and hold.’ Similar to contemporary art, wine is a newer alternative investment that should be purchased with caution.

Investing in wine can carry some of the following risks:

- Potential theft

- Counterfeiting

- Poorly stored product

- Too old of a product

- Purchasing wine whose price doesn’t increase over time

To reduce your risk, some of the same investing principles apply in the wine world – diversify by buying different types, don’t resell too quickly, and look for quality wines with strong ratings and brand equity.

Another way to reduce your risk is to check out platforms like Vinovest. This is an investing platform that helps you build a portfolio of wines. You own 100% of the wines and they take care of the storage. Buy, sell, or even drink your wines and enjoy ‘liquid assets.’

11. Invest in Collectibles

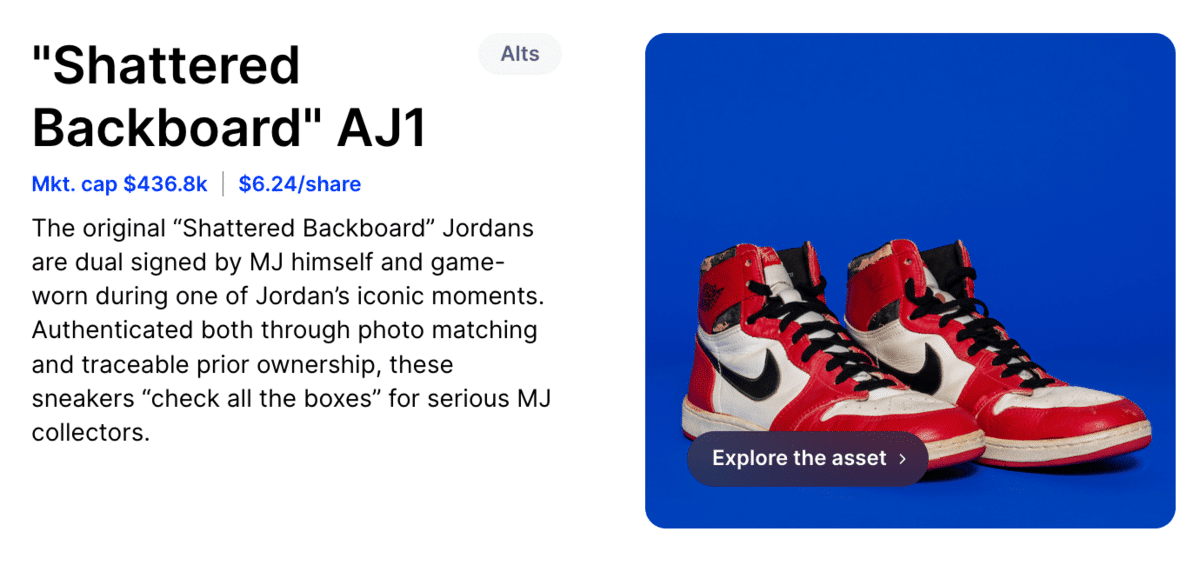

The ‘Shattered Backboard’ Air Jordan shoes from August 25, 1985, are a 1-of-1 piece of sports memorabilia worn by Michael Jordan himself during an iconic moment in basketball history. These shoes and other collectibles are available to buy and sell as fractional shares.

You may have heard of famous collectible items over the years including sneakers, signed jerseys, and rookie trading cards being sold for obscene amounts of money. Now you can get a piece of the action on platforms like Public.

Although collectibles can be speculative in nature, the asset class can add diversity to your portfolio. Dividend stocks or REITs may be more traditional in terms of different income streams, but if you get a hold of a Mickey Mantle rookie card, you might want to hold on to it for a while.

Final Word:

There are many methods for creating multiple streams of income. To figure out what’s best for your situation, consider the following factors:

- Amount of research involved

- Where does it fall on the scale of passivity

- Time required to get started

- Investment required to get started

- Alignment with long-term goals

Overall, the most important concept is to understand how to diversify your income sources. The best income streams will depend on the financial goals of each individual. The best thing you can do is take action and remain patient along the way.

FAQs:

How can I make $1000 a month passively?

The most realistic way to $1,000 per month passively is to purchase a multifamily rental property. Multiple units create economies of scale by having one mortgage payment with multiple units producing rental income. Working up to $1,000 per month is a tall task but it can be done with action and patience.

What are the 7 streams of income?

The 7 streams of income are earned income, capital gains, interest income, dividend income, rental income, business income, and royalty income. Each income stream listed falls into one or more of these categories.

What are 4 types of income?

The 4 types of income come from being an employee at a company, self-employed, big business owner, and investor. These 4 income types are also known as Robert Kiyosaki’s cashflow quadrants.

How do I get multiple streams of income?

In addition to a W2 job, you can get started with little time and money by purchasing dividend stocks and investing on a crowdfunding platform. Depending on your expertise, interests, and financial goals, these 2 methods can get you started with different income streams in familiar asset classes.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.