Can a stock go to zero? The answer is yes — and for many investors, there’s no scarier thought.

But what happens if a stock goes to zero? What does it mean for the company? Can you lose all your money in stocks? Further, what happens when your stock goes negative?

In this article, I’ll answer all of these burning questions and more — plus, I’ll offer some proactive ways to help avoid getting burned.

Stocks go up and down … You can’t control that. But you can avoid the costly mistake of going with the wrong broker.

Traders of all experience levels love eToro for its user-friendly platform and its CopyTrader feature, a social trading feature that allows you to watch and follow the trades of successful traders. Plus, it offers all this:

- Stocks, ETFs, Options, 70+ Crypto Coins

- Low Fees

- Free Virtual Portfolio

- 19,500+ Positive Reviews

- 2FA & Secure Crypto Storage

- Social Investing – Network & Collaborate In a Community

- and more…

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

The Bottom Line: What Happens if a Stock Goes to Zero?

Can a stock go to zero? Simple answer: Yes.

Sadly, it’s entirely possible for this to happen. But what happens if a stock goes to zero?

When a stock’s value falls to zero, or near zero, it typically signals that the company is bankrupt. The stocks are frozen and unless the company restructures, it’s likely you will lose your investment.

A few notable examples include now-defunct Blockbuster Inc (NYSE: BBI), Eastman Kodak Company (NYSE: KODK), and RadioShack (NYSE: RSH).

Can Stocks Go Negative?

If you’re wondering what happens when your stock goes negative or asking, “can stocks go negative?”

The answer is no.

While a stock’s value can fall to zero, it cannot go negative.

You will never owe money on a stock that drops to zero, though, sadly, you can lose more money than you initially invested.

Advanced techniques such as short selling, margin (leveraged) trading, and buy put options could cause you to lose more money than you invested, since it involves borrowing money.

How do investors borrow shares? It’s an advanced technique, but it’s maybe not as difficult as you may think. Click the link to learn more.

What Happens if a Stock Goes to Zero? What are Your Options?

If a company’s stock gets low, they typically go into bankruptcy. Once that happens, the government puts a freeze on the stock.

But, what happens if a stock goes to zero? Does this mean a total loss?

Maybe … Maybe not…

The company could file Chapter 11 Bankruptcy, restructure, and re-release the stocks. If this happens, you can reevaluate and develop an updated strategy with your newly unfrozen stocks. Unfortunately, this process could take several months to a year.

If it doesn’t restructure, you still might have some options…

- File a Tax Write Off for Your Loss

- Get Compensation From Bankruptcy Payoff (This is unlikely to be much as shareholders get paid last…)

- File a Lawsuit

Attempting to force compensation can be challenging and complex. I highly recommend talking to a lawyer or accountant.

What Makes Stocks Go to Zero?

Several things (or a combination of things) can cause a stock’s value to plummet, including:

- Poor Corporate Management (Like Toys ‘R’ Us NYSE: VNO)

- Weak Financial Performance (Like Blockbuster Inc. NYSE: BBI)

- Corporate Fraud or Major Scandal (Like Enron Corporation NASDAQ: ENE)

- Economic Downturns/Industry Disruption (Like Eastman Kodak Company NYSE: KODK)

- Regulatory Freezes Due To Illegal Activity or Regulation Breaches (Like PG&E Corporation NYSE: PCG)

How Companies Keep a Stock Price From Going to Zero

There are few things worse for a company than going bankrupt. Fortunately, that means most companies will do everything they can to course-correct. This includes:

- Reverse stock split (decreasing the number of outstanding shares and increasing the price per share)

- Repurchasing Undervalued Shares

- Increasing sales & Revenues Without Increasing Costs

- Raise Money

Case Study: What Actually Happens if a Stock Goes to Zero?

Learning the theory is ok, but what happens if a stock goes to zero in real life? Can you lose all your money in stocks?

Let’s look at some real-life examples.

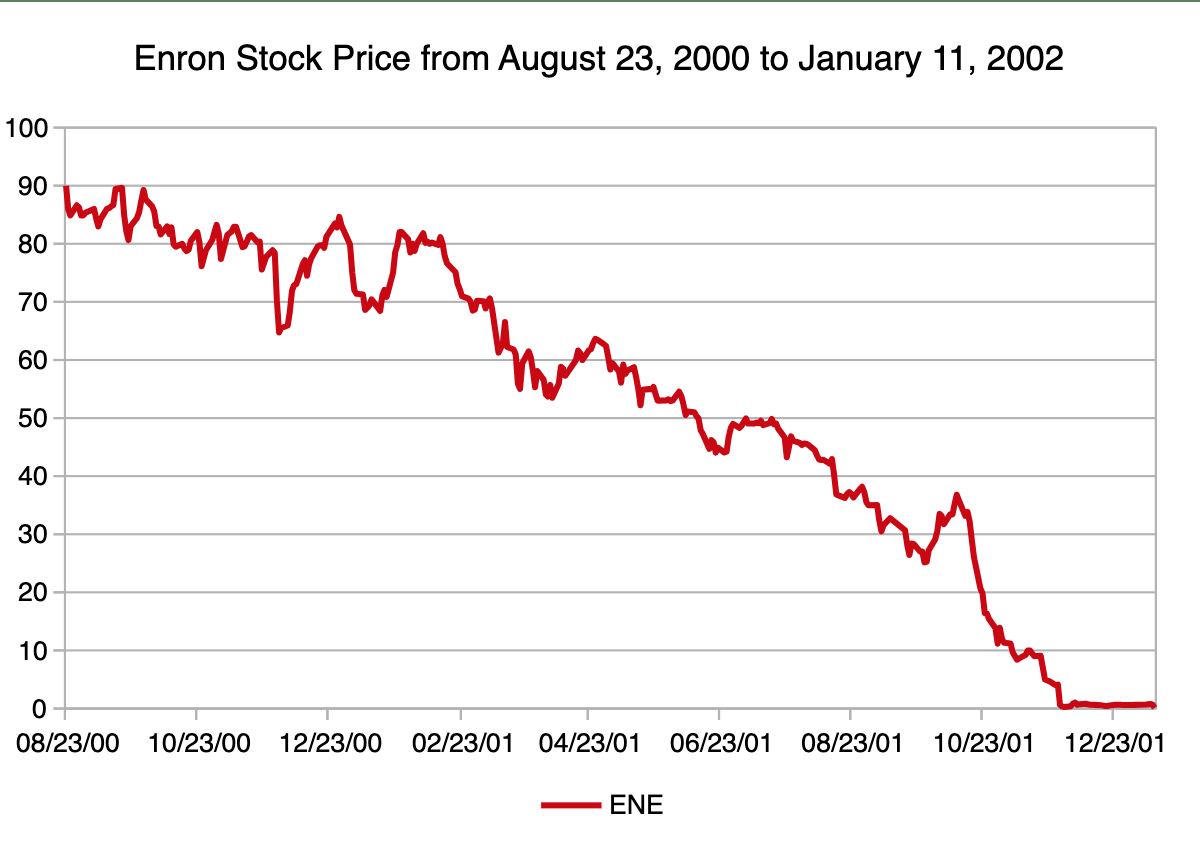

Enron

Few examples are as infamous as the energy company Enron (NASDAQ: ENE).

In the early 2000s, Enron, a seemingly high-flying stock, was priced at $90.75.

But, its attempt to conceal massive losses and toxic assets came to light, making investors and analysts suspicious. Their stock price plummeted.

By the time Enron declared bankruptcy in December 2001, its stock was trading at just $0.26 and investors lost everything invested in the company. However, the SEC awarded $7.2 billion to shareholders, since the fraud was so prevalent.

More Positive Examples

Thankfully, Enron is an anomaly. Here are some other examples with happier endings:

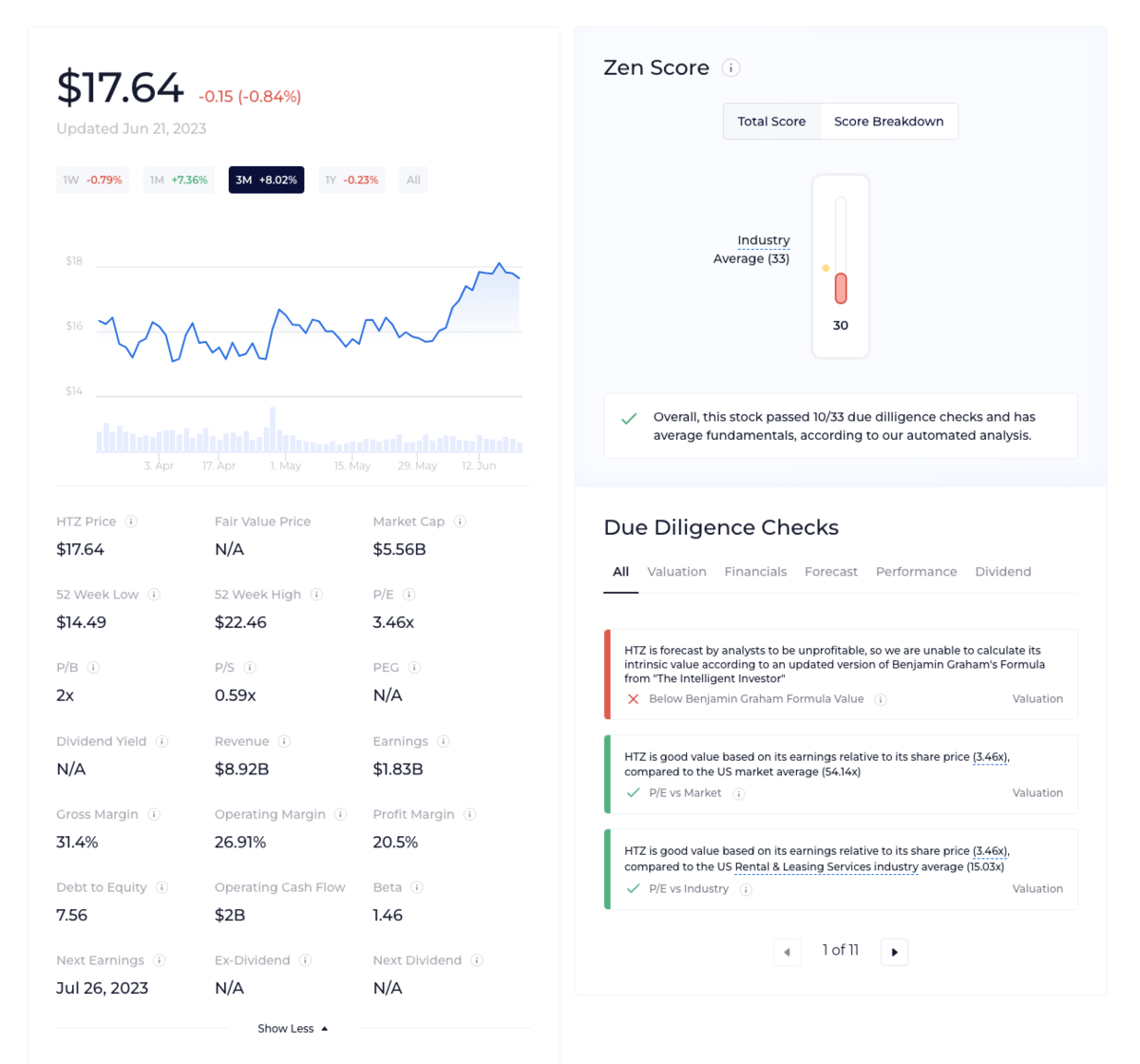

Hertz

Hertz (NASDAQ: HTZ) filed for bankruptcy in 2020. But it reemerged a year later.

They received more than $5.9 billion of new equity from investors, reduced corporate debt by nearly 80%, and got back on track for investors. Today, its stock trades at roughly $17/share.

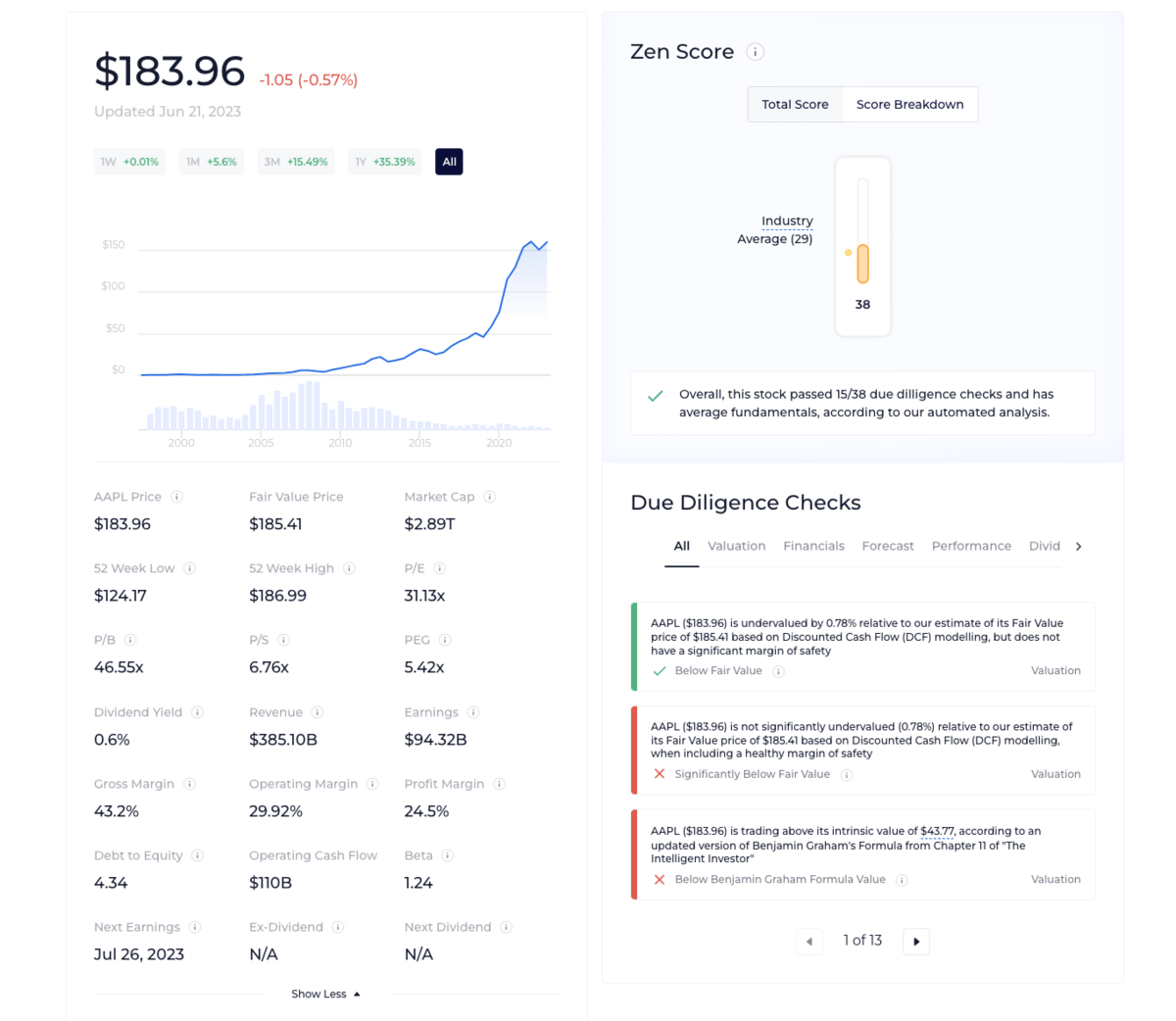

Apple

Apple (NASDAQ: AAPL) nearly went bankrupt in 1997, but its biggest rival, Microsoft, of all companies, gave them a $150 million investment. It turned the company around and helped it become the $180+/stock it is today.

Can You Profit on Falling Stock Prices?

Yes … But it can be risky. In fact, you could end up owing more than you initially invested.

Let’s talk about buying puts and short selling.

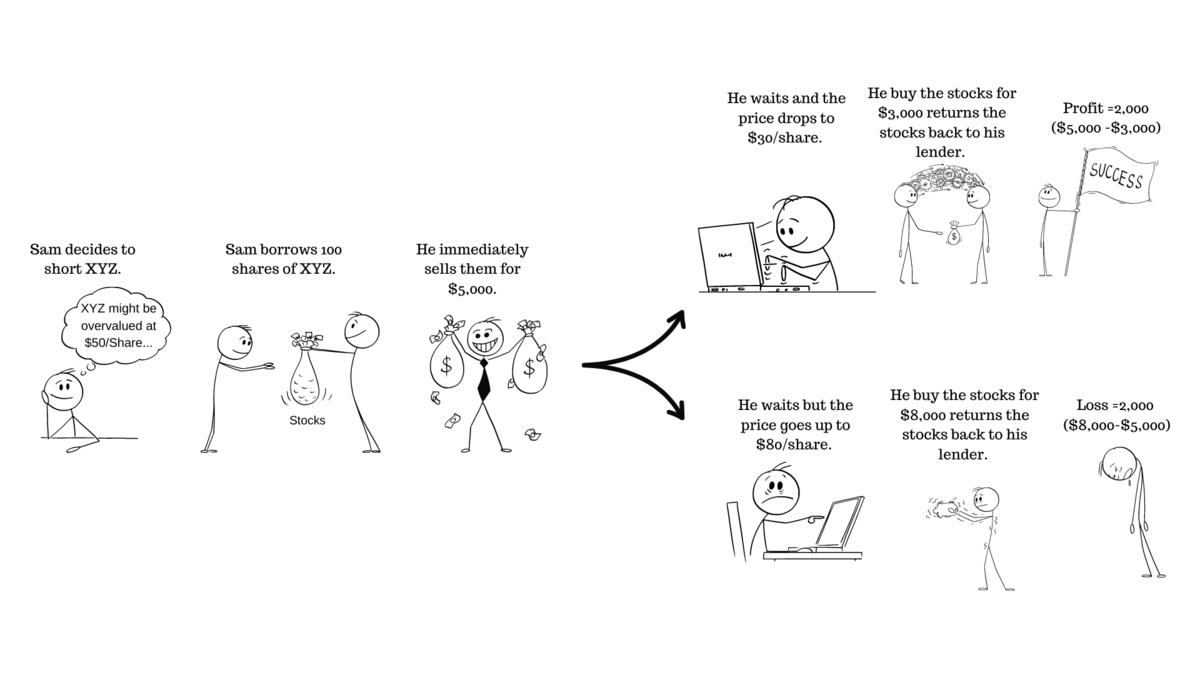

Short Selling

Short selling is a strategy that involves borrowing shares of a stock and selling them, hoping the stock’s price will fall.

If the price falls, the short seller can buy back the shares at a lower price, return them to the lender, and pocket the difference as profit.

Keep in mind, not every broker is created equal. Choosing the best broker for short selling could make a world of difference in your profits and experience.

One of our favorite brokers for short selling? moomoo. The platform offers no-commission trades regardless of whether you go long or short, and the platform’s advanced tools make it easy to execute orders quickly. And if you’re also interested in going long, moomoo is currently offering FREE stocks for new account holders. Terms and conditions apply. Click here to learn more.

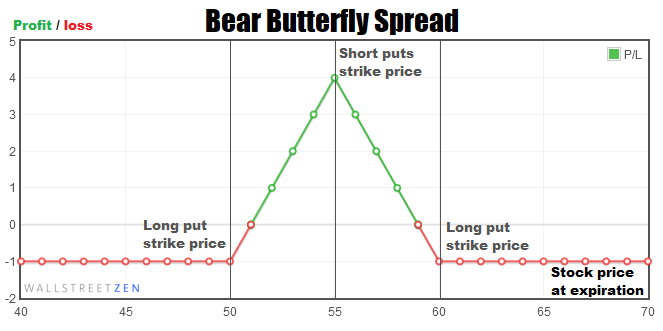

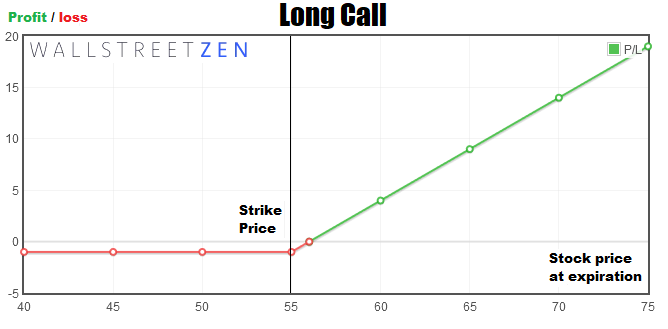

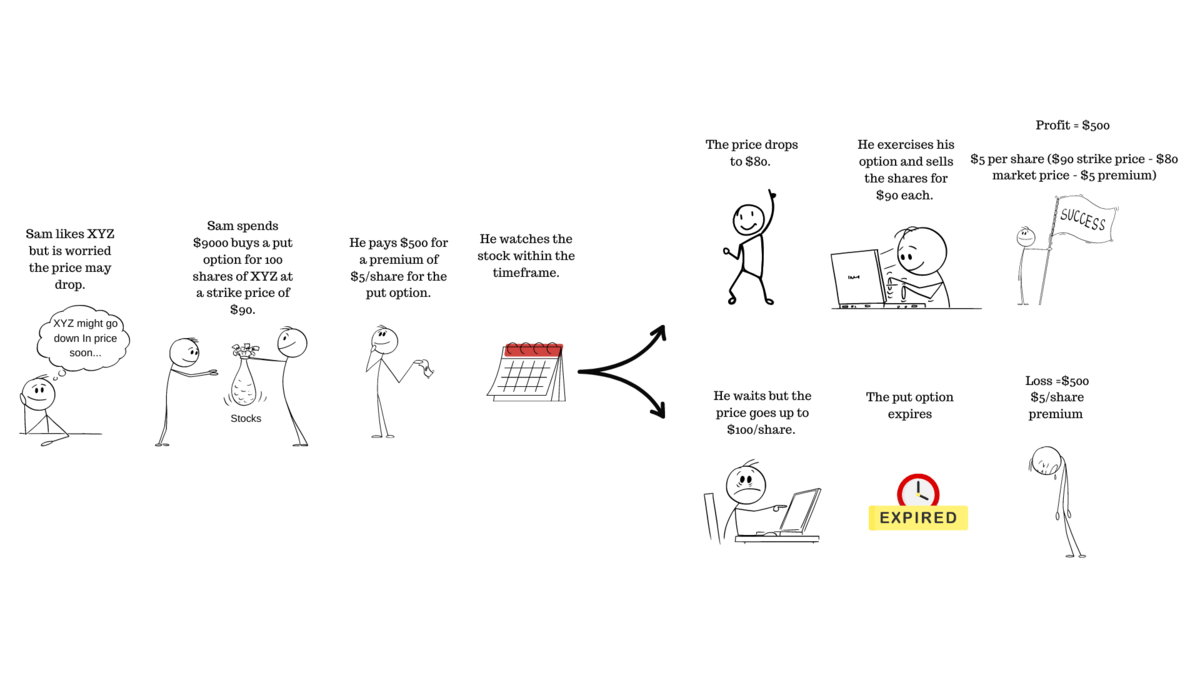

Buying Puts

A put option gives the holder the right to sell a certain number of shares at a predetermined price within a set time period.

If the stock’s price falls below the strike price, the holder can exercise the option and sell the shares at the higher strike price, making a profit.

How to Avoid Losing Money When a Stock Goes to Zero

Can you lose all your money in stocks?

Sure. But, it’s unlikely if you know what you are doing and choose the right strategy. These resources could help:

Courses and Education

There are no guarantees, but education can make a tremendous difference in the success or failure of your investment portfolio.

Finding a quality educational source can answer questions like: Can a stock go to zero? What happens when your stock goes negative? Can stocks go negative? How can I avoid investing in stocks that lose money?

…and more.

Fortunately, you don’t have to spend the $40,000+ it costs to get a degree in college to learn how to invest successfully.

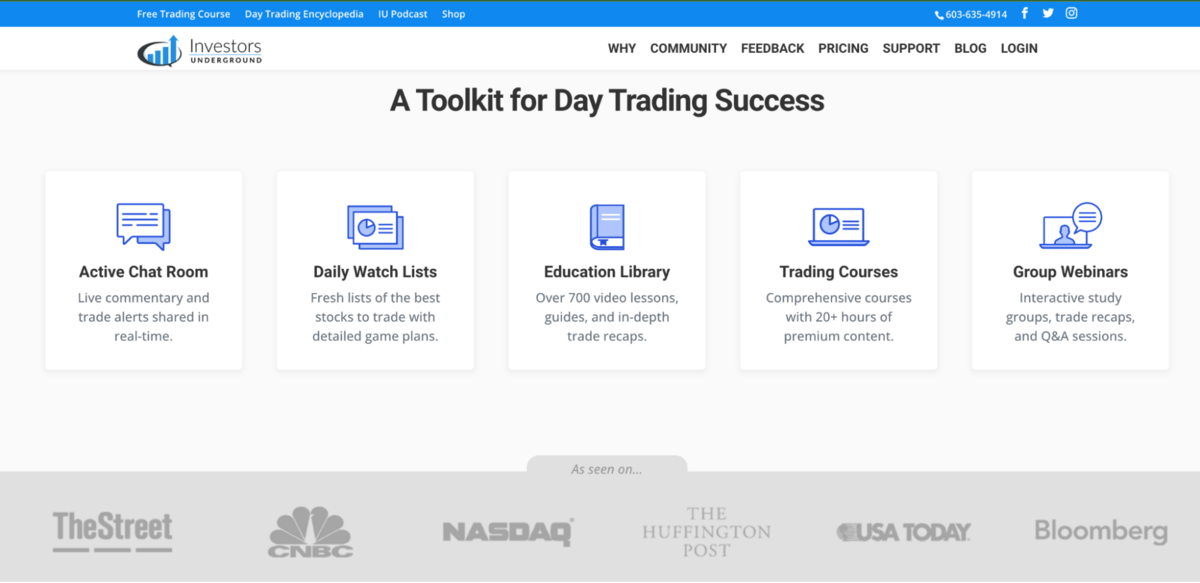

Investors Underground – Best Day Trading Course

- Rating: 4.5/5

- Cost: $297/month or $1297

Who it’s good for: If you’re a beginner and busy, you’ll probably love this course. It covers so much of the basics in punchy, easy-to-learn (and remember) ways.

If you’re an experienced trader but you want to branch into day trading, you may also find a lot of value in the course.

Who teaches it: The course is taught by veteran trader Nathan Michaud, who has over a decade of experience in the field.

What you’ll learn: The course covers everything from basic trading concepts to advanced strategies, but focuses particularly on day trading techniques.

Learn:

- Investing Basics

- Comprehensive Day Trading Skills

- How to Understand & Use Watch Lists, News, & Trade Alerts

- How to Create Game Plans

- Tips From Top Traders

- and more

TD Ameritrade- Best Free Course

- Rating: 4.7/5

- Cost: Free

Who it’s good for: This free course is perfect for newcomers to the stock market who want to learn the basics of trading without breaking the bank.

Who teaches it: The experienced TD Ameritrade team teaches this course.

What you’ll learn: You’ll learn about different types of investments, how to analyze stocks, and essential trading strategies.

Learn:

- Investing Basics

- Retirement Options & Strategies

- Tax Strategy

- Reading the Market

- and more

WallStreetZen Blog – Best Free Resource

- Rating: 4.5/5

- Cost: Free

Who it’s good for: This blog is perfect for those who are new to the stock market and too busy to spend hours analyzing stocks and market trends.

Who teaches it: Financial experts with lots of experience, like myself, write these high-quality, peer-reviewed blogs. Each comprehensive post is carefully fact-checked and updated when there are relevant market changes.

What you’ll learn: The blog covers a great deal, including breakdowns on stock performance, analysis, the best brokers, product reviews, and more.

- How to Get Rich off Stocks

- When to Buy and Sell Stocks

- How to Buy Stocks Online

- How to Know What Stocks to Buy

- and more

WallStreetZen is way more than a blog! It offers one of the top stock-picking services out there.

WallStreetZen’s Top Analysts is our most frequently visited page — here’s why:

Other stock-picking services constantly brag about their winning stock picks — but fail to mention when they’re wrong.

Instead of providing direct picks, we built a service that aggregates the research and recommendations from nearly 4,000 Wall Street analysts — then backtests their performance over multiple years.

Based on this research, analysts are ranked based on average return, frequency of ratings, and win rate — so you can rest assured you’re only following top performers.

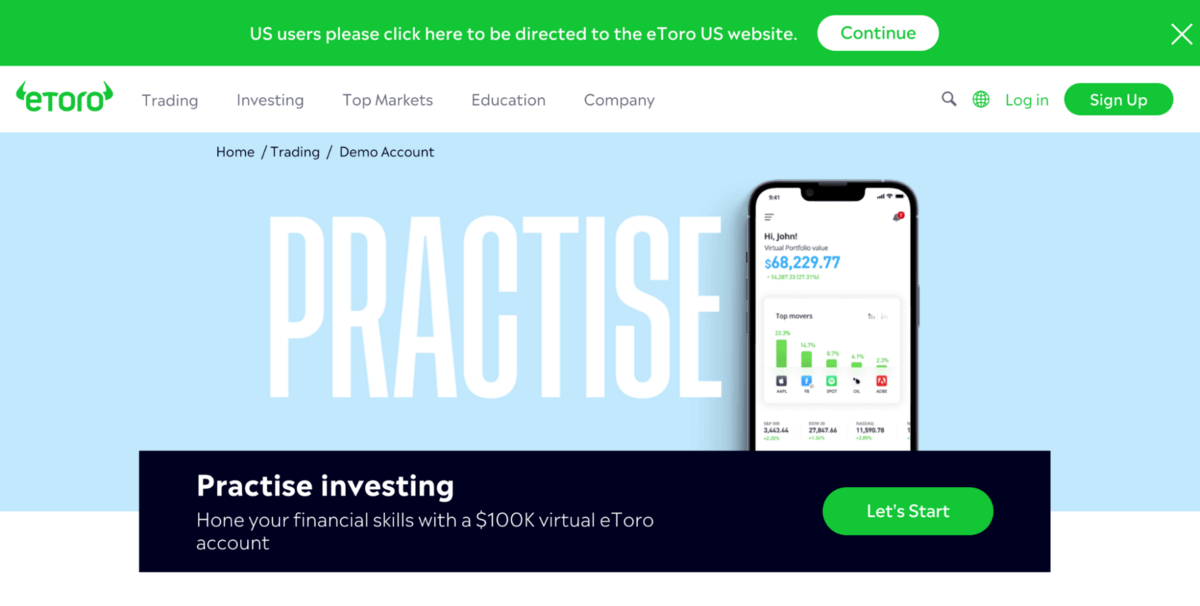

BONUS: eToro Demo Account – Best Way to Practice Trading

- Rating: 5/5

- Cost: Free

Who it’s good for: Anyone, on any trading level, wanting to practice their trading skills in a risk-free environment will want to download this free tool.

This includes those who are brand new, those who want to test out an investment strategy or theme, or those who want to test their analytical or screening skills.

What it does: The eToro demo account lets you trade with virtual money and replicates actual market conditions. This allows you to practice your trading strategies without risking real money.

Practice:

- With $100,000 of Virtual Paper Currency

- Creating Investing Strategies

- Investing in Stocks, Crypto, Commodities, & More

- Following Real-Time Trends & News

- Analyzing Stocks & Markets

- and more

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Tools

If you talk to any seasoned trader, they will swear by having the right investment tools. If you want to save money, time, and stress, partner with the right virtual equipment.

TradingView Pro+ – Best Charting Software

- Rating: 4.8/5

- Cost: $29.95/month or $299.40/year

Who it’s good for: Anyone who needs a reliable, in-depth charting tool will love this software.

What you’ll get: Accurately analyzing stocks is one of the most important skills you can have to predict market swings and trends. TradingView Pro+ offers a wide range of charting tools and indicators to help you do that.

To make things convenient, the company allows you to trade directly from charts.

Features:

- Advanced Charting Tools

- Customizable Watchlists & Alerts

- Access to Real-Time Data From Global Markets

- Collaborative Community

- Real-Time News & Economic Calendar

- Ai-Powered Trading Ideas & Signals

- and more

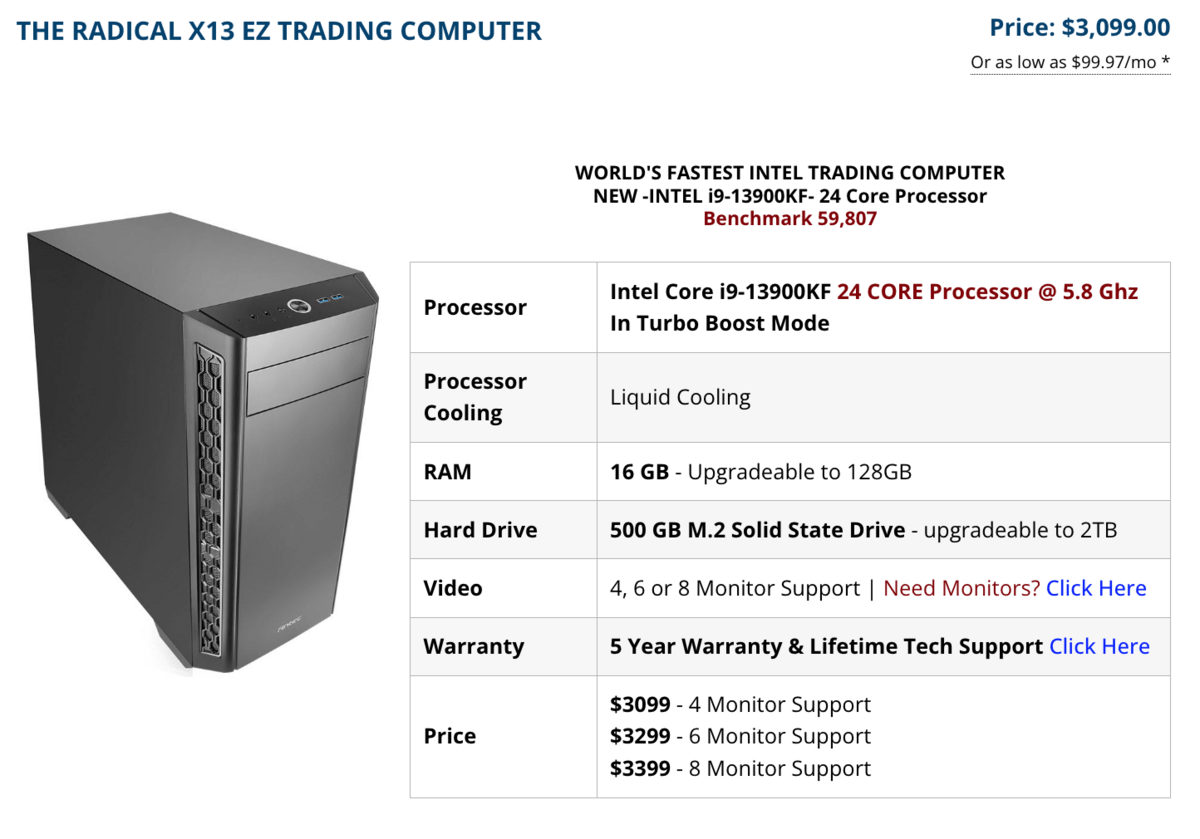

Radical X13 EZ Trading Computer – Best Trading Computer

- Rating: 5/5

- Cost: $3,099

Who it’s good for: This computer is perfect for serious traders who need a high-performance machine for their trading activities.

What you’ll get: The Radical X13 EZ Trading Computer comes with a powerful processor, plenty of RAM, and multiple monitors, making it ideal for multi-tasking and keeping an eye on multiple markets at once.

With fast processing speeds, you don’t have to deal with lag times when trying to process orders.

- 16+ GB RAM

- Liquid Process Cooling

- Up to 8 Monitors

- 500 GB M.2 Solid State Drive

- Upgradability Customization

- and more

Benzinga Pro – Best Real-Time News

- Rating: 4.6/5

- Cost: $27/month Basic, $197/month Essential

Who it’s good for: Benzinga Pro is perfect for traders who need up-to-the-minute news and analysis.

What you’ll get: With them, you get real-time news updates, advanced screening tools, and actionable trading ideas.

- Real-Time News Alerts

- Stock Recommendations & Screeners

- Customizable Watchlists & News

- Audio Squawk Financial Research Tool

- Analyst Ratings & Price Targets

- Earnings Calendars

- Chat Rooms for Traders

- Educational Resources

- and more

Brokers

Choosing the right broker can make a big difference in your trading experience. A bad broker can be expensive, unsecure, and too slow to allow you to buy/sell at the price you want.

Don’t make the costly mistake of going with the wrong broker.

eToro – Best for Beginners

- Rating: 4.6/5

- Cost: 1% Fee | $10 minimum deposit

Who it’s suitable for: Beginners especially love eToro for its user-friendly platform and social trading features.

What you’ll get: eToro offers a wide range of trading options, including stocks, commodities, cryptocurrencies, and more. Its claim to fame is Copytrader, a social trading feature that allows users to copy the trades of successful traders.

- Stocks, ETFs, Options, 70+ Crypto Coins

- Low Fees

- Free Virtual Portfolio

- 19,500+ Happy Reviews

- 2FA & Secure Crypto Storage

- Social Investing – Network & Collaborate In a Community

- Copytrader – Copy the Trades Of Successful Trading

- and more

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Tradestation – Best for Advanced Traders

- Rating: 4.7/5

- Cost: $0/month or $99/month + Misc. Fees | $0 Minimum Deposit

Who it’s good for: If you’re an advanced trader, consider Tradestation.

What you’ll get: Tradestation is great for its wide range of trading options, advanced charting tools, and robust trading simulator for backtesting strategies.

- Pro-level, Intuitive Platform with Fast Execution

- $0 Trade Commissions

- Trade ETFs, Stocks, Futures, Options, Futures Options, & Crypto

- Educational Resources

- Advanced Order Types (Limit, Market, Stop-Market, etc.)

- Order Actions (Including Buy/Sell, Sell Short, Buy to Cover, etc.)

- Advanced Scanning Tools

- and more

Nightmare Scenario: Can You Lose All Your Money in Stocks?

So, the real question arises: What happens if a stock goes to zero for each of your investments? Can you lose all your money in stocks?

Technically, yes.

There are no guarantees when investing, but with the right education, tools, and hedging and diversification strategies, it’s very unlikely.

Final Word

The prospect of a stock’s value falling to zero can be a daunting one.

Investing is not without risks, but with the right education, the right broker, and tools such as eToro Demo Practice Platform or Benzinga Pro, you can dramatically lower the risk of losing money in your investments.

FAQs:

Can a stock recover from zero?

Yes, it is possible for a stock to recover from zero. The company can file Chapter 11 bankruptcy, restructure, and continue operating. At that point, the stock will unfreeze and you can trade it like normal again.

Can a stock go below zero?

No, it is not possible for a stock to go below zero. You don’t have to worry about owing money on a stock unless you use leverage, such as in margin trading or short selling.

What happens if a stock goes negative?

A stock cannot go negative. However, while a stock's price cannot go below zero, you can still lose more than your initial investment through margin trading or short selling.

Do you owe money if a stock goes negative?

No, you will not owe money on a stock unless you are using leverage, such as shorts, margin trading, etc., to trade.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our April report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.