The concept of borrowing shares to short a stock doesn’t really make any sense.

How does an investor borrow shares? Who is lending them their shares? How does the whole process of short selling work?

Whether you’re looking to profit during a bear market or just curious about how borrowing stocks works, I’ve got you covered.

Below I’ll explore the ins and outs of short selling, the pros and cons involved, and even some alternative ways to get exposure to short positions that you might not have considered.

The best brokerage for short sellers…

TradeStation is one of the best brokers for short selling in 2025.

Unlike other brokerages, TradeStation was built by traders, not software engineers with design mockups from business executives. And it shows.

TradeStation is ideal for shorting thanks to competitive margin rates and powerful tools, including customizable charts and real-time market data, which are essential for short sellers who rely on precise timing. Additionally, TradeStation provides access to an extensive list of stocks available for shorting, including harder-to-borrow stocks, making it a strong option for active traders focused on short strategies.

What Does It Mean to Short a Stock?

Before we dive into how to borrow stocks, let’s get clear on what it means to short a stock.

Perhaps the most famous example of shorting is Michael Burry’s bet against the housing market, depicted in the film “The Big Short”:

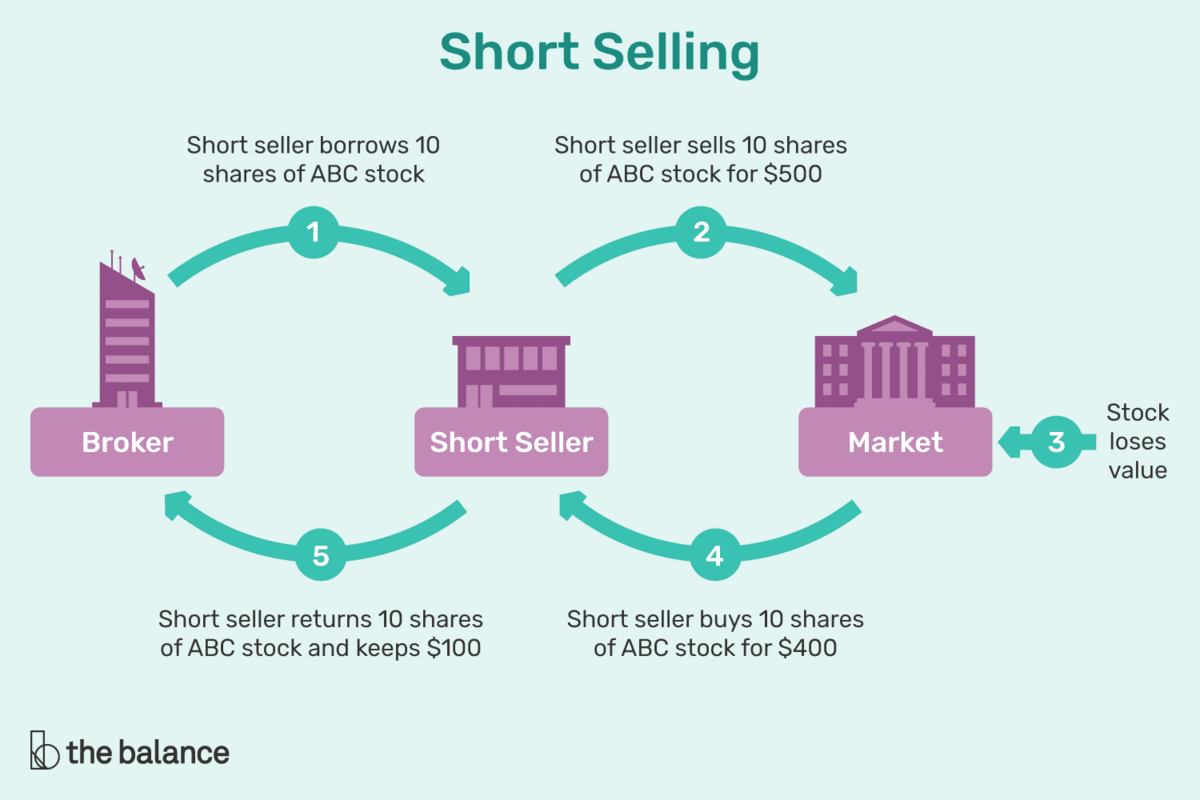

But for most short sellers, short selling is on a much smaller scale. It works like this:

- An investor who shorts a stock borrows shares from someone who owns them, typically a broker.

- Then, they sell them immediately in the market hoping that the share price will fall. In other words, an investor who “shorts” a stock essentially bets that the stock’s price will go down in the future.

- If the price does go down, the investor can buy the stock back at the lower price, return it to the broker they borrowed it from, and pocket the difference as profit.

As you can see, the process of short selling differs from the more traditional approach of buying and holding a stock, AKA “going long.” Going long on a stock means the investor buys the shares hoping that the price increases over time, allowing them to sell the shares for a profit.

It’s easy to understand how buying stock makes money, but how does short selling work?

Shorting is selling stock you don’t own, then buying it back after it drops in price.

Let’s say ABC is trading for $50 but it just formed a triple top pattern and you think it will fall to $40. Your broker lends you 10 shares which you sell at $50 each. Then, ABC falls to $40 where you buy 10 shares, return them to your broker, and keep the $100 profit.

Short selling can provide investors with more opportunities to profit in a bearish market, but it also comes with risks.

An investor who goes long can only lose up to 100% of their invested capital (assuming they’re not investing on margin). So if you invest $2000 going long Apple (AAPL), you can only lose up to $2000 in the scenario that Apple goes to $0.

With shorting, it’s not so simple. There’s theoretically no limit to how high a stock can trade. So if you short AAPL and the stock price continues rising, your downside is potentially infinite. You could lose even more money than you invested in the short.

What Every Trader Needs…

Whether you go long or short, you need great charting software.

TradingView is our #1 recommended platform for charting. It’s fast, intuitive, and powerful.a great place to start.

How Do Investors Borrow Shares?

How does an investor borrow shares? First, you need to find a broker who has the shares available to lend.

Brokers like TradeStation, TradeZero, TD Ameritrade, and Interactive Brokers will lend shares to investors who are looking to short sell a stock. They usually charge a fee for the transaction.

Borrowing shares is technically a loan because the broker lends shares to the investor. This means the total value of the shorted stock counts as a margin loan against your account. It also means you pay interest on the borrowing.

In a way, it’s like borrowing from a bank. The bank gives you money, but you have to pay it back with interest over time. Similarly, when you borrow shares from a broker, you have to pay them back with interest according to the terms of the loan agreement.

For all these reasons, when you as an investor borrow shares, your broker will require an agreement that specifies important details to keep both parties on the same page.

So in addition to asking “how do investors borrow shares?”, you should be sure to also consider these things:

- How many shares will you borrow?

- How much interest will you as the investor pay on the loan?

- How long will the loan last?

How Can You Borrow a Stock?

To borrow a stock, you need to open a margin account with a brokerage firm that has a stock lending program. If you already have a broker and are not sure whether they offer stock lending, you can simply call them and ask how to borrow stocks and if they offer short selling.

Once you’ve opened the account, the broker will lend you the shares you need. You can then sell these shares in the market.

More must-have tools for short sellers:

- Our favorite day trading brokerage with short selling capabilities: TradeStation

- Our #1-rated charting software: TradingView

- The best day trading computer: Radical X13

- The best day trading ecourses & community: Investors Underground

Example of How to Borrow Stocks (Shorting)

Let’s take a look at how to borrow stocks with an example of a potential short trade. Let’s say you think the stock price of a hypothetical company, ABC, will decrease in the future…

- You borrow 100 shares of ABC from your broker and sell them for $50 each, receiving $5,000 in cash.

- A few weeks later, the price of ABC drops to $40 per share, and you decide to buy back the 100 shares.

- You’d only need to pay $4,000 to buy back the shares, leaving you with $1,000 of profit (minus fees).

In this example, keep in mind that if the stock price of ABC had increased to $60 per share, you would have lost $1,000.

Short Selling Risks

It’s important to note that short selling comes with risks.

If the stock price goes up instead of down, you’ll be responsible for buying the shares back at a higher price rather than a lower one. You’ll need to have enough money in your account to cover this potential loss.

Otherwise, you run the risk of being “margin called.” This happens when the capital in your margin account is no longer sufficient to cover your loss.

If this happens, your broker may require you to deposit more funds into your account in order to cover the loss or risk liquidating your position to cover the loss.

Alternative Ways to Short Stocks

It’s worth noting that the above method of borrowing shares is not the only way to short stocks. There are two other methods you can consider…

1. Short / Inverse ETFs

Short ETFs or inverse ETFs are investment products that aim to deliver the opposite return of a particular index or asset. These allow you to bet against a particular market or sector without the need to borrow stocks or margin accounts.

When you invest in a short ETF or inverse ETF, you profit if the index or asset it tracks declines in value. However, these ETFs may not be suitable for all investors, and you should understand their unique risks and characteristics before investing.

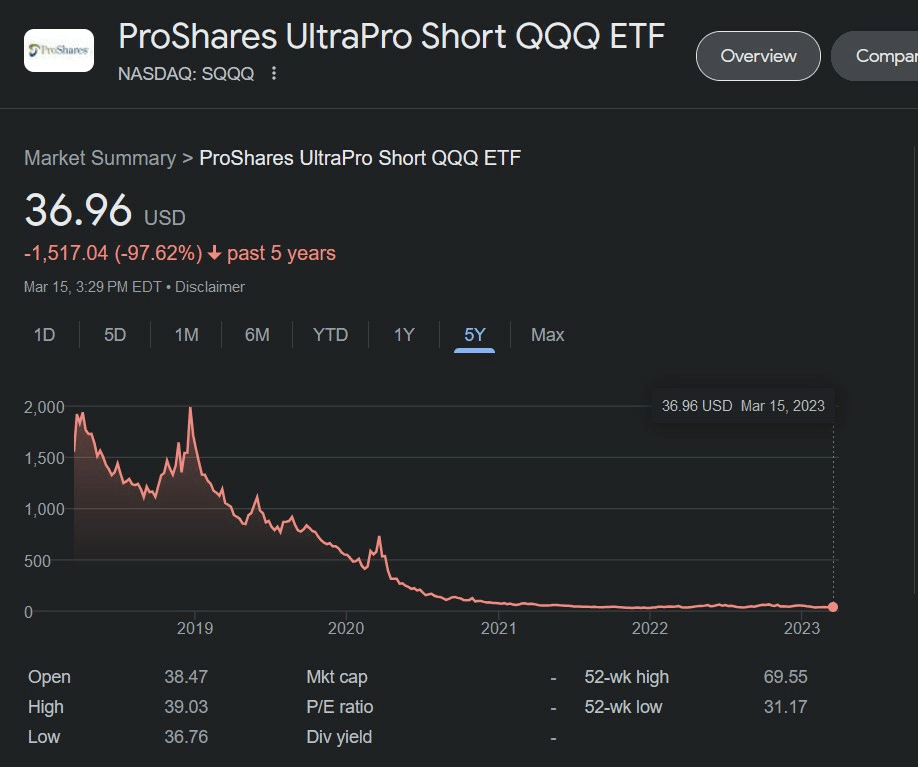

For example, two popular inverse ETFs are SDOW and SQQQ. These are used to short the Dow and Nasdaq, respectively. However, they’re also triple-leveraged. So if the Dow or Nasdaq declines 1%, these ETFs would be in the green by 3%.

This can make them useful trading tools in the short term, but over the long term, they’re poor investments due to their decay risk. This decay is also commonly known as “volatility drag.”

These ETFs can easily compound negatively against you over long periods of time. If you look at the long-term chart of SQQQ, this trend is pretty clearly illustrated:

2. Long-Short Hedge Funds

If you’re a high-net-worth individual or accredited investor, you can also consider long-short hedge funds. They allow you to add some short positions to your portfolio without having to worry about putting on the trades yourself.

A long-short hedge fund invests in both long and short positions to hedge against market risks and generate returns. Unlike traditional mutual funds, long-short hedge funds can take both long and short positions in the market.

These funds use complex strategies and techniques to identify undervalued and overvalued stocks, but typically require a high minimum investment. They also come with unique risks, such as higher fees and lower liquidity.

For example, one of the biggest long-short hedge funds in the world is Greenlight Capital, led by David Einhorn. The firm charges a fee of 0.375% of the market value of each fund each quarter, adjusted for withdrawals and redemptions. Greenlight also takes a performance allocation, or performance-based fee, of 20%.

Before investing in a long-short hedge fund, it’s important to carefully read its prospectus and understand if the investment strategy and risks align with your own goals. Hedge funds’ fees and strategies are disclosed in their form ADV.

Should You Borrow Shares and Short Stocks?

Short selling can be a powerful tool for investors looking to make a profit, but it also comes with plenty of risks. Here are some pros and cons to consider:

Pros:

- Short selling allows you to potentially profit from a decline in stock price.

- You can use short selling to hedge against other long positions in your portfolio.

- Short selling can be a way to take advantage of overpriced stocks or companies with poor fundamentals.

Cons:

- Short selling involves unlimited risk, as the stock price can continue to increase indefinitely.

- You’ll need to have enough capital in your account to cover any losses that may occur.

- There is a potential for high borrowing fees and interest charges.

The More You Know…

Interested in expanding your trading know-how? Check out Investors Underground, a day trading community that includes a highly-rated chat room and top-notch educational materials.

IU offers several courses with a track record of transforming brand-new traders into full-time trading professionals.

Final Word: How Do Investors Borrow Shares?

Short selling can be a valuable tool for investors looking to profit from a decline in stock price. However, it’s important to understand the risks involved and to have a solid understanding of the borrowing process before you start shorting stocks.

By working with a reputable broker and doing your research, you can make informed decisions about when and how to borrow shares for short selling. If your broker doesn’t allow you to borrow shares or you’re not willing to take on the risk of being margin called, you can consider other options, like inverse ETFs.

FAQs:

How can shares be borrowed?

To borrow shares, investors open a margin account with their broker and initiate a short position — a process also known as “short selling.”

What happens when shares are borrowed?

When shares are borrowed, they are sold in the market in the hope that the price will decrease, allowing the investor to buy them back at a lower price and return them to the broker.

How much does it cost to borrow shares?

The cost to borrow shares can vary depending on the broker, the number of shares being borrowed, the interest rate, and the duration of the loan.

What does it mean to borrow shares?

Borrowing shares means that an investor is temporarily taking ownership of shares from a broker, with the expectation that they will be returned at a later date.

How does borrowing stocks work?

Borrowing stocks involves an investor agreeing with a broker on the terms of a loan, including the number of shares, the interest rate, and the duration of the loan. The investor can then sell the borrowed shares in the market, with the hope of buying them back at a lower price in the future and returning them to the broker.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.