Real estate is one of the oldest asset classes out there — after all, shelter has pretty much always been a necessity.

But these days, real estate isn’t just about shelter — it’s a popular investment vehicle that continues to gain in value due to land scarcity and people’s desire to own productive physical assets.

But real estate investing can be intimidating for investors. Here’s why:

- It’s expensive and typically requires financing.

- It’s an incredibly illiquid asset that’s tough to sell in an unfavorable market.

These significant roadblocks are the reason why many would-be investors turn to other assets and miss out on the benefits of real estate.

However, Groundfloor, the first of its kind fractionalized real estate investment platform, aims to change that.

In this comprehensive Groundfloor review, I’ll answer:

- What is Groundfloor?

- How does Groundfloor work?

- Is Groundfloor legit?

- How is fractionalized real estate different from traditional investments?

Let’s talk property.

Groundfloor Review: Is Groundfloor Legit?

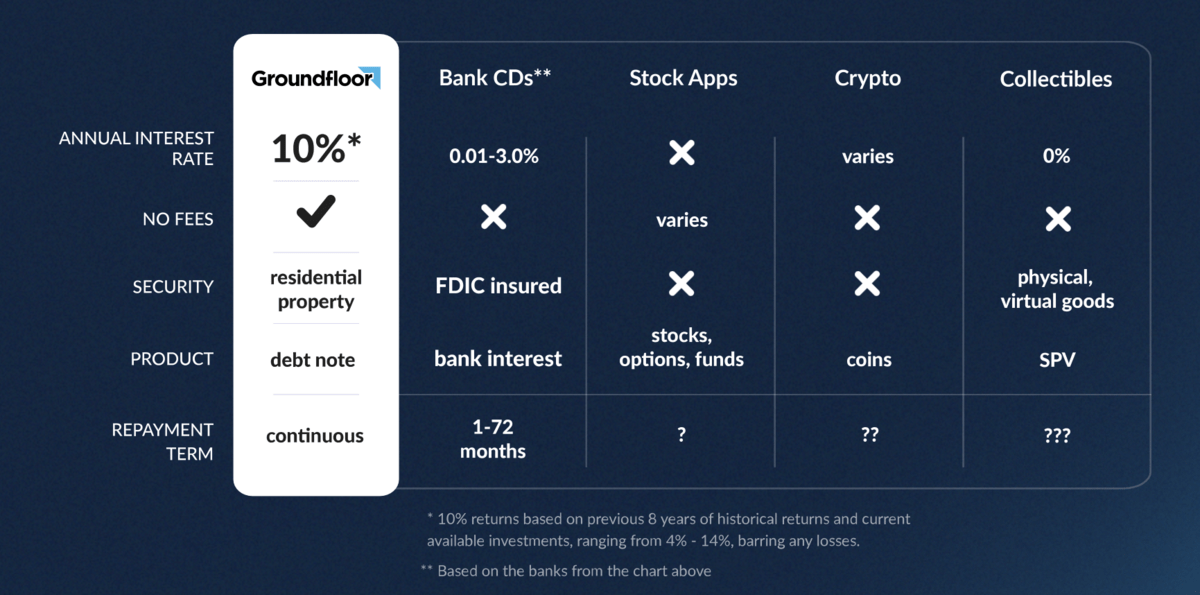

The Bottom Line: Yes, Groundfloor is legit. The platform has been a player in the fractionalized real estate game since 2013, boasting an average investor return of 10% per annum since inception.

What is Groundfloor?

Groundfloor is a fractionalized real estate investment platform that reduces the roadblocks to investing in property.

It was founded by Brian Dally and Nick Bhargava and became the first firm in the industry to receive SEC qualification — a major selling point in terms of the platform’s legitimacy.

Unlike traditional real estate crowdfunding platforms, Groundfloor isn’t equity-based. Instead, it focuses on providing financing for real estate development projects through a loan-based model — essentially serving as the bank.

That means you earn returns based on the interest that developers pay on their loans, rather than relying on rental income or increasing property prices.

It also means that you don’t need to have a significant amount of capital or sink all your money into one opportunity to get involved in real estate. Through their award-winning real estate investing platform, both accredited and non-accredited investors get the opportunity to pool funds and invest in real estate projects. These investors earn repayments in properties relative to their investment amount.

With this approach, you can diversify your investment portfolio without the hassle and complexities involved in property ownership, especially with their latest product, the Flywheel Portfolio.. With the Flywheel, your funds automatically get invested and diversify into 200–400 loans at once, with even fractions of the dollar going toward any single loan in the collection. This hyper-fractionalization and diversification helps investors mitigate risk.

However, Groundfloor’s offerings can also help you balance an existing real estate portfolio with additional revenue streams.

Groundfloor Features:

- Asset Class: Real Estate

- Accreditation Required: No

- Account minimum: $10

- Minimum Investment: $1

- Minimum Holding Period: Depends on loan terms, see repayments within as little as seven days

- Fees: None upfront; minimal 0.5% to 1% asset management fee per disbursement for the Flywheel Portfolio

- Notes: Groundfloor’s Notes give you the opportunity to diversify your portfolio with short-term, stable investments that are backed by a pool of loans that haven’t been matched with a borrower. Groundfloor then uses your Notes investment as lending capital to generate a return which they pay you at a fixed date. Groundfloor also offers Rollover Notes, which have 30- and 90-day terms and are liquid, allowing you to cancel your investment within the first 30 days. Rollover Notes will reinvest your principal investment into another Note of the same term length upon repayment while you keep the accrued interest.

- Projected Returns: Historic annualized 10%, but returns vary between 4% – 14%

- App: Groundfloor’s app allows you to view your portfolio and account details at any time. However, if you want to invest in a new project, you must use their website.

How Does Groundfloor Work?

Groundfloor works like a loan marketplace where you can own fractionalized pieces of approved loans.

While the platform requires a minimum initial investment of $100, each individual project only requires a minimum investment of $1, so you can easily diversify your portfolio across several loans.

Groundfloor takes a mobile-first approach to make investing easy and accessible for everyone, especially with the Flywheel Portfolio, which released in October 2024. Here’s how this true set-it-and-forget-it product lets you sit back while Groundfloor handles the work:

- Groundfloor packages 200–400 short-term, high-yield loans into a portfolio (the Flywheel Portfolio), offering instant hyper fractionalization and diversification. Groundflooor originates and pre-funds these loans, and the Flywheel receives SEC qualification.

- Accredited and non-accredited investors alike can transfer funds on a one-time or recurring basis at a $100 minimum. These funds automatically invest and get diversified across this portfolio of hundreds of loans. Users pay no fees upfront, but there is a 0.50% to 1% management fee assessed at the time those funds are disbursed back to investors, along with their share of the interest. Groundfloor’s historic 10% annualized returns are included in this fee.

- Investors can see repayments in as little as seven days.

- Groundfloor boasts a strong record with over 5,800 loans successfully being repaid to date, indicating its dependability and stability as an alternative investment avenue.

Within the Groundfloor mobile app, you can see your portfolio’s breakdown and overall health, including your average realized returns, repayment details, how diverse your portfolio is, and more. You can get the Groundfloor mobile app for iOS and Android.

Important note: Groundfloor offers weekly payment terms. Weekly repayments mean that you’ll receive a steady stream of income.

Important note: Groundfloor offers both monthly and deferred payment terms. Monthly repayments mean that you’ll receive a steady stream of income whereas deferred payments mean you’ll receive a lump sum upon maturity.

Groundfloor Loans

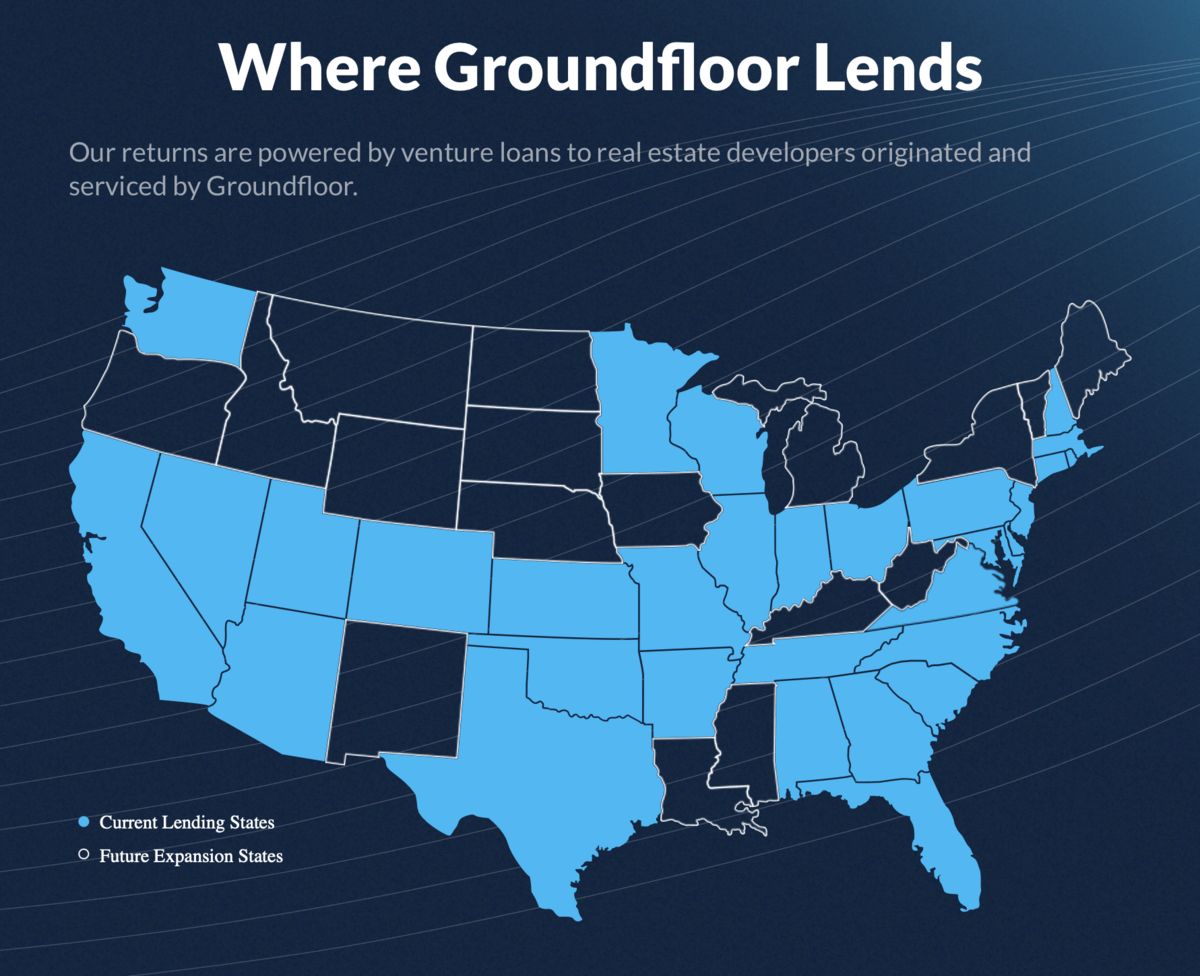

When it comes to the loans themselves, Groundfloor focuses on residential properties and single-family homes or units. They also offer new construction loans.

The platform is willing to fund up to 100% of the project’s cost and up to 70% of the estimated after-flip value based in experience. That way, if the borrower defaults, there’s still room for Groundfloor to recover investor capital and even pay out a return in most instances.

Additionally, Groundfloor prides itself on its commitment to due diligence.

The platform conducts extensive research on the developer and the real estate project before making the loans available to you. Every loan is also qualified with the U.S. Securities and Exchange Commission, offering a lot of transparency.

Consequently, over 5,800 loans have been successfully repaid to date at an average investor return of 10% per annum, further demonstrating the platform’s track record.

Important note: During the loan term, the money you invest becomes illiquid, with deferred payments locking up your funds until maturity. This means you can’t cash out or sell it to another investor as you can with other crowdfunding platforms.

Important note: During the loan term, the money you invest becomes illiquid, with deferred payments locking up your funds until maturity. This means you can’t cash out or sell it to another investor as you can with other crowdfunding platforms.

Now that you know how Groundfloor works, let’s talk about setting up your account.

The process is relatively straightforward. Head to the Groundfloor website, click sign up and follow the prompts. (It’s very easy.) Or head to the App Store or Google Play Store to download the Groundfloor mobile app.

Once that’s complete, Groundfloor will send you a few emails explaining how to get started which simply involves adding a bank account and funding your Groundfloor account.

Once you transfer funds and they reach your account, they’ll be instantly and automatically invested in dozens, or even hundreds, of available loans on the platform. This cycle is set to repeat upon repayment, as your investments are automatically reinvested in order to help you grow your wealth even further.

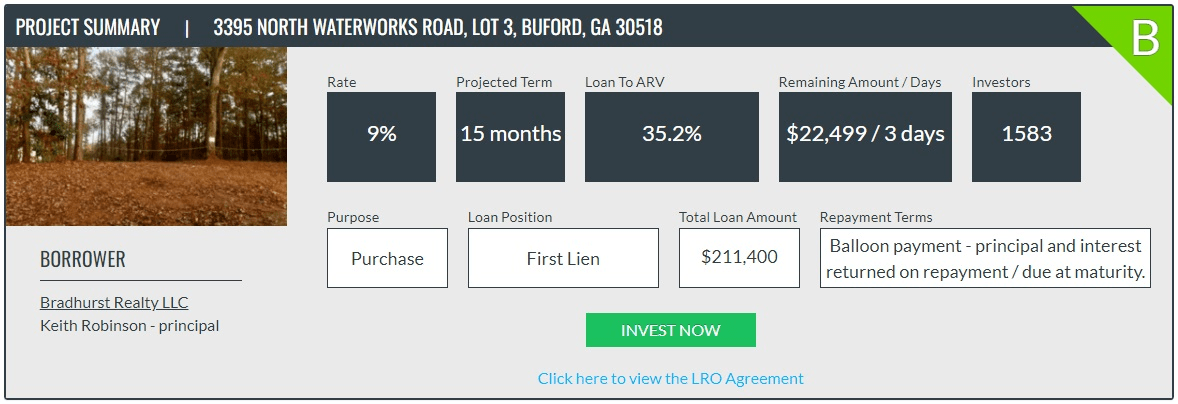

Example Investment: Groundfloor Investing

Groundfloor provides investors with detailed property information, including:

- Loan grading reports based on borrower commitment and experience, property location, and more.

- A financial overview including future valuation estimates.

- Property photos

- Terms and conditions, including risk factors, closing conditions, and SEC filings.

- Borrower summary which covers completed projects and other financial information.

There are usually dozens or over a hundred of these opportunities available on Groundfloor.

Groundfloor also offers Notes to its investment options, which function similarly to CDs and bonds in that they’re short-term, stable investments with fixed repayment schedules. There are standard Notes and Rollover Notes. Rollover Notes come in two term lengths: 30 days and 90 days. Once the term is over, your principal investment amount is automatically reinvested into another Note of the same term. The accrued interest is put back into your account. If at any time you want to cancel your investment and receive your funds, you can do so within the first 30 days.

The minimums investment for Notes starts at $1,000 and goes up to $25,000 with rates varying from 5% to 10%. Term lengths are 30 days, 90 days, or 12 months.

Groundfloor Fees

Groundfloor charges minimal fees to investors, making it an attractive alternative to other platforms like Fundrise, which charges 1%.

Instead, Groundfloor charges borrowers between 2.75% to 4.25% of the loan’s principal.

Pros and Cons of Groundfloor

Pros | Cons |

|---|---|

No accredited investor rules (except for Anchor loans) | Bankruptcy and default risk |

Low fees for investors | Your investment often becomes illiquid until maturity (but there is a liquid product for investors: Rollover Notes) |

You can regularly expect new investment opportunities | Investors receive no long-term equity in the projects |

Strong returns of annualized 10% | |

You can invest as little as $1 in a project | |

Groundfloor provides you with extensive due diligence information | |

Short investment timeframes |

Should You Use Groundfloor?

While it’s certainly possible to make money by investing through Groundfloor, you should consider the negative aspects of the platform before you make your choice.

In particular, it’s important to note that defaults are a real risk when purchasing loans. However, Groundfloor does have procedures in place to help recover investor funds. This involves issuing a court complaint which results in the borrower receiving a Notice of Sale.

If everything goes well, you receive your money once the sale is complete. Additionally, if no bidder meets Groundfloor’s minimum bid, the property itself is awarded to Groundfloor.

It’s also important to note that loan defaults don’t always result in a loss.

Groundfloor’s analysis shows that historically, defaulted loans have still returned an average interest of over 6%. Additionally, Groundfloor holds the first lien position on the homes, increasing the likelihood of some or all of the principal being returned to investors in the event of a loss. The company will always try to resolve a situation to get the loan paid back with foreclosure being a last resort.

Besides defaults, you should also consider that your investment becomes locked in the platform until loan maturity.

While this time period is less than a year in most cases, you should only invest funds that you won’t need in the immediate future.

One way to get around this is by diversifying the length of your investments so that you constantly have a stream of funds available on the platform.

Groundfloor Vs. Fundrise

How does Groundfloor compare to Fundrise?

Ultimately, Groundfloor offers automatic investing with the Auto Investor Account for those who want a true set-it-and-forget-it experience.

With Fundrise, you don’t have a say in your investments unless you sign up for their paid Pro membership.

Groundfloor offers to do the work for you with the Flywheel Portfolio in their Auto Investor Account. Funds automatically invest in a collection of 200–400 loans, offering instant diversification and fractionalization to help mitigate risk. With the Flywheel, investors can sit back and enjoy weekly repayments while Groundfloor handles the rest.

(Want to know more about Fundrise? Check out our Fundrise review.)

Ultimately, the decision to use Groundfloor should be based on your individual investment goals, risk tolerance, and preferences.

But the platform may be a suitable choice if you are looking for shorter-term investments, have limited capital to invest, and prefer investing in debt rather than equity.

Note: We earn a commission for this endorsement of Fundrise.

Final Word: Groundfloor Review

Groundfloor is a legitimate and reliable option if you want to invest in real estate loans.

An industry pioneer, the platform has a strong track record with numerous successful loan repayments and an average annual return of 10%.

One of the biggest advantages of using Groundfloor’s investing platform is that you have access to predictable investing returns within short timeframes.

This means that your portfolio has the potential to generate cash flow in a relatively short period, often as little as six months. You can even start seeing repayments in as little as seven days.

And, by diversifying your real estate investment portfolio with different property types, locations, and varying levels of risk and return potential, you can create a well-rounded investment strategy that generates a steady stream of income.

However, as with any investment, it’s crucial to conduct thorough research, understand the risks involved, and align your investment strategy with your financial goals and risk tolerance.

FAQs:

Can you make money with Groundfloor?

Yes, it is possible to make money with Groundfloor. Since its inception, investors on the platform have generated an average return of 10% per annum but this varies between 8% - 15%.

Can I trust Groundfloor?

Yes, Groundfloor is a trustworthy and accredited business that’s been operating since 2014. The company also works with the SEC in order to offer its various investment products. It has been recognized in Forbes Fintech 50.

What are the cons of Groundfloor?

While Groundfloor is a fantastic investment platform, there are some cons to be aware of.

Namely:

Anchor loans are only available to accredited investors.

Investments can’t be sold, so most of its products are illiquid until maturity. Only one product, Rollover Notes, is liquid.

The risk of defaults.

No access to property equity.

How does Groundfloor pay you?

Investors can expect to see weekly disbursements with the Flywheel Portfolio whereas with the Investor Account, you’ll get paid on maturity.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.