Swing trading vs day trading – which is more profitable?

The short answer is “It depends.” Both strategies can be highly profitable when matched to the right trader’s personality, schedule, and risk tolerance.

So which trading style has higher profit potential for you? Let’s explore.

A Secret Weapon For Traders…

WallStreetZen’s Zen Ratings system simplifies your due diligence by allowing you to quickly see how any stock fares on a review of 115 factors proven to drive stock growth. The review is expressed as an overall letter grade, with several Component Grades that can give you more insight into a stock’s specific strengths and weaknesses.

A-rated stocks using this proprietary quant rating model boast a track record of average annual returns of 32.52% .

It’s free to get started — enter any ticker here.

Swing Trading Vs. Day Trading: Key Differences

When it comes to swing trading vs day trading, the differences go far beyond just timeframes. These two strategies require different mindsets, tools, and levels of commitment.

Definitions

- Day trading is like sprinting — intense, fast, and over quickly. You’re opening and closing all positions within the same trading day, never holding overnight.

- Swing trading is more like a marathon with strategic bursts. You’re holding positions for several days to weeks, riding the “swings” in price momentum. While day traders might make 5-10 trades per day, swing traders might make 5-10 trades per month.

Frequency of Trades

- Day traders might execute dozens of trades daily, scalping small profits from each move. (Related reading: How Soon Can You Sell a Stock After Buying It?)

- Swing traders play the patience game. You might only take 2-3 positions per week, but you’re aiming for larger percentage gains on each trade.

Tools and Indicators Used

Day traders live and die by their tools:

- Level 2 market data for real-time order flow

- One-minute and five-minute charts

- Volume indicators and momentum oscillators

- Lightning-fast execution platforms

Swing traders rely on different weapons:

- Daily and weekly charts

- Moving averages and trend lines

- Fundamental analysis mixed with technicals

- Pattern recognition software

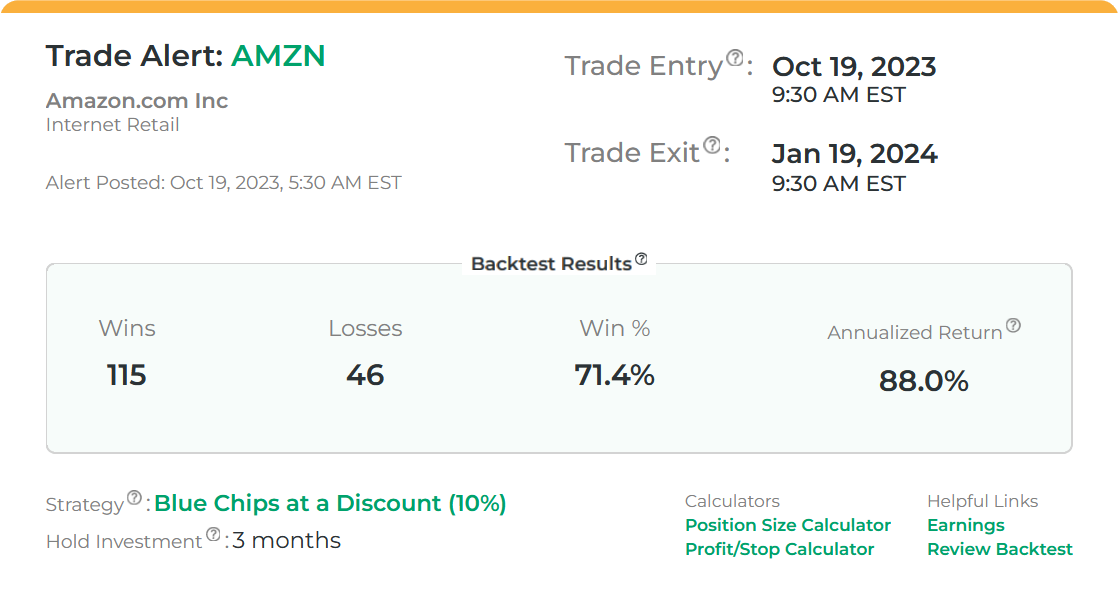

The Best Swing Trading Alerts

We’ve tested dozens of swing trade alert systems. Stock Market Guides is the best. Here’s why:

- Intelligent use of tech. It leverages advanced algorithms to identify the highest-potential swing trades based on backtested strategies — a system that has delivered a 79.4% average annual return on swing trading stock picks.

- Highly customizable. You can either manually find swing trade ideas with their scanner, or customize what types of alerts you receive based on your preferred setups or strategies.

- It’s affordable. Subscriptions start at just $29 per month — making it one of the more affordable options on the market.

Capital and Margin Requirements

These days, you can get started with most brokers with no minimums. However, there are some specific rules for day traders.

If you’re day trading in the U.S., the Pattern Day Trader (PDT) rule (FINRA) applies when you execute 4 or more day trades within 5 business days AND those day trades represent more than 6% of your total trades in a margin account. Once flagged as a PDT, you must maintain at least $25,000 in equity.

PDT rules apply to margin accounts. Cash accounts avoid PDT restrictions but face good-faith and free-riding violations due to T+1 settlement rules — meaning you can’t trade with unsettled funds.

Margin Requirements

For any margin trading, U.S. brokers typically require a minimum of $2,000 in equity to access margin — this is separate from the PDT requirement.

Day traders often use 4:1 intraday margin, while swing traders typically get 2:1 overnight margin.

Time Commitment and Lifestyle Compatibility

Day trading demands your full attention during market hours. Many day traders are glued to their screens from 9:30 AM to 4:00 PM ET.

Swing trading offers flexibility. You can check positions during lunch breaks, analyze charts after dinner, and still keep your day job.

$1000 in NVDA stock + more…

Regardless of whether you want to be a swing trader or day trader, you need a brokerage. Here’s a broker that works for both trading styles: Moomoo. And they have an amazing promo running right now: You could get $1k in NVDA shares.

moomoo couples powerful tools with an extremely friendly user interface, making it accessible to newbies but built out enough to appeal to veterans. Top features include:

- A variety of commission-free assets including stocks, ETFs, and options

- FREE real-time Level 2 Market Data

- A proprietary Earnings Calendar and Earnings Hub

- Plus, tools like paper trading, institutional tracking, heat mapping, and stock screening.

Is Swing Trading Profitable?

Absolutely — but like any trading strategy, success depends on your approach, discipline, and risk management.

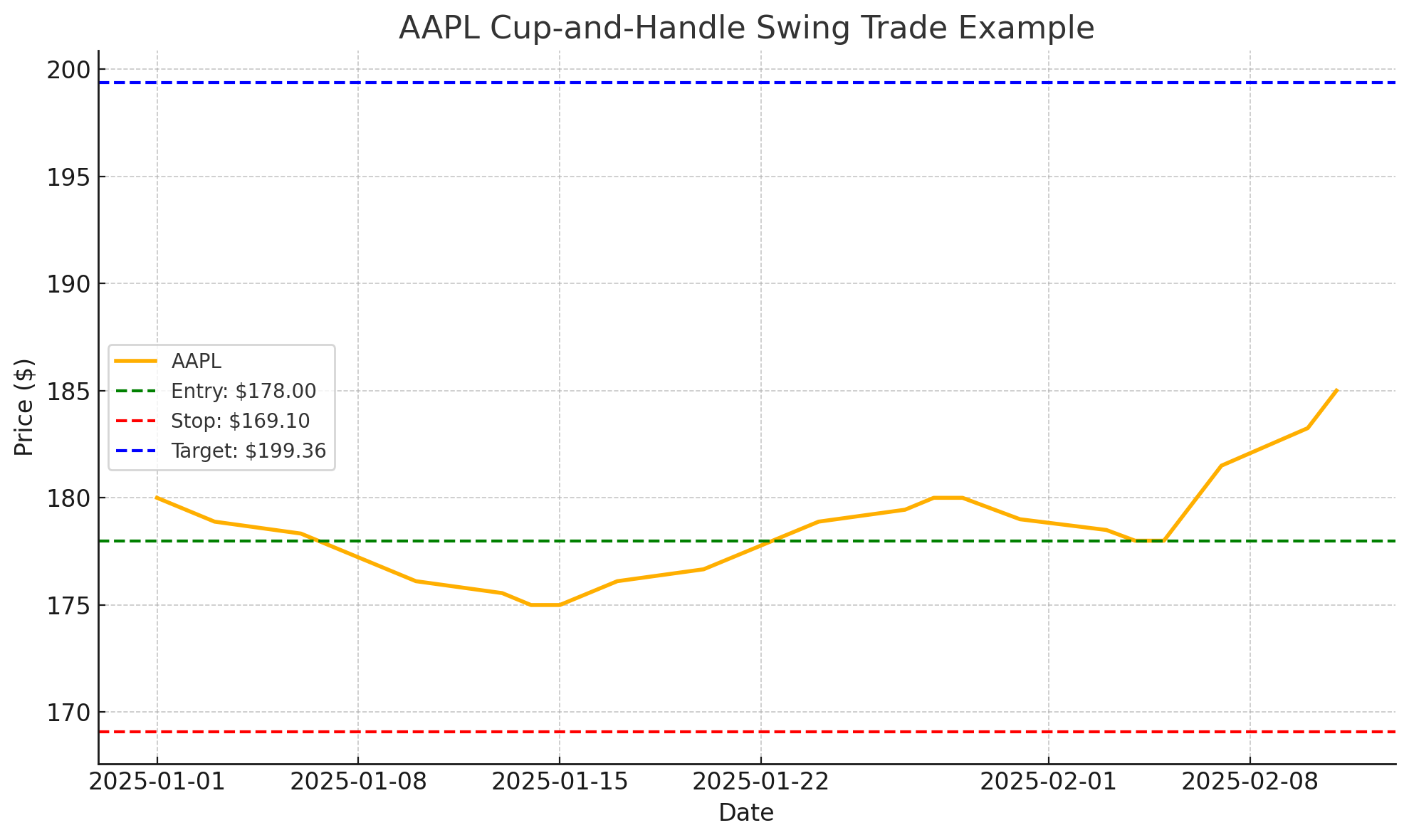

Example of a Swing Trade*

*This is a hypothetical swing trade example on Apple (NASDAQ: AAPL), modeled to illustrate how the setup works.

The stock formed a cup-and-handle pattern on the daily chart — a bullish continuation signal.

Trade setup:

- Entry: $178.00 on a breakout above the handle’s resistance with strong volume

- Initial Stop: $169.10 (about 5% below entry, under recent support)

- Target: $199.36 based on the pattern’s measured move (about 12% above entry)

- Hold Period: 2–3 weeks depending on momentum

- Typical Result: Around 12% gain if target is reached

As you can see in this swing trade example, we didn’t need to watch every tick. We set our alerts, managed our position size, and let the trend work in our favor.

Common Swing Trading Strategies

- Trend Following: Riding established trends using moving averages as dynamic support and resistance. The 20-day and 50-day moving average crossover is often used as a filter for identifying potential trends, though it’s a lagging indicator.

- Breakout Trading: Identifying stocks breaking out of consolidation ranges or key technical levels with above-average volume.

- Chart Pattern Breakouts: Trading classic patterns such as cup-and-handle (as in our example), ascending triangles, or flags when price breaks the pattern’s resistance or support with conviction.

- Reversal Patterns: Catching oversold bounces or overbought pullbacks using RSI divergences and candlestick patterns for mean-reversion setups.

Related Reading: THIS Is How to Find Stocks for Swing Trading in 2026

Pros and Cons of Swing Trading

Pros | Cons |

Less time-intensive than day trading | Overnight gap risk |

No PDT rule restrictions | Requires patience and discipline |

Lower stress levels | Fewer trading opportunities |

Time to analyze and plan trades | News events can impact positions |

The Best Swing Trading Alerts

Finding quality setups can be time-consuming. Alerts can help you identify stocks that align with your trading style without spending hours scanning charts.

After testing dozens of services, Stock Market Guides stands out for their swing trading alerts. They show you exactly how each setup has performed historically. For example:

Their system is brilliant. Every alert includes:

- Entry and exit points

- Historical win rate for that exact pattern

- Average return when the setup works

- Optimal holding period

They provide detailed stats for each setup, including entry and exit points, historical win rate, and average return.

The alerts arrive before the market opens, giving you time to evaluate and plan your entry.

For more details, check out our full Stock Market Guides review and see why they’re topping our list of best swing trading alerts.

Is Day Trading Profitable?

Day trading can be profitable for a small percentage of highly skilled, well-capitalized traders — but research in multiple markets shows the majority of retail day traders lose money after costs.

- A 2019 study of Brazil’s futures market found that 97% of traders who persisted for more than 300 days lost money net of costs.

- Research in Taiwan’s equity markets similarly showed that the large majority were unprofitable after commissions and fees.

Success typically requires:

- Significant starting capital (often $50,000+ for U.S. margin accounts)

- Full-time dedication and rapid decision-making skills

- Years of deliberate practice

- Strict risk management

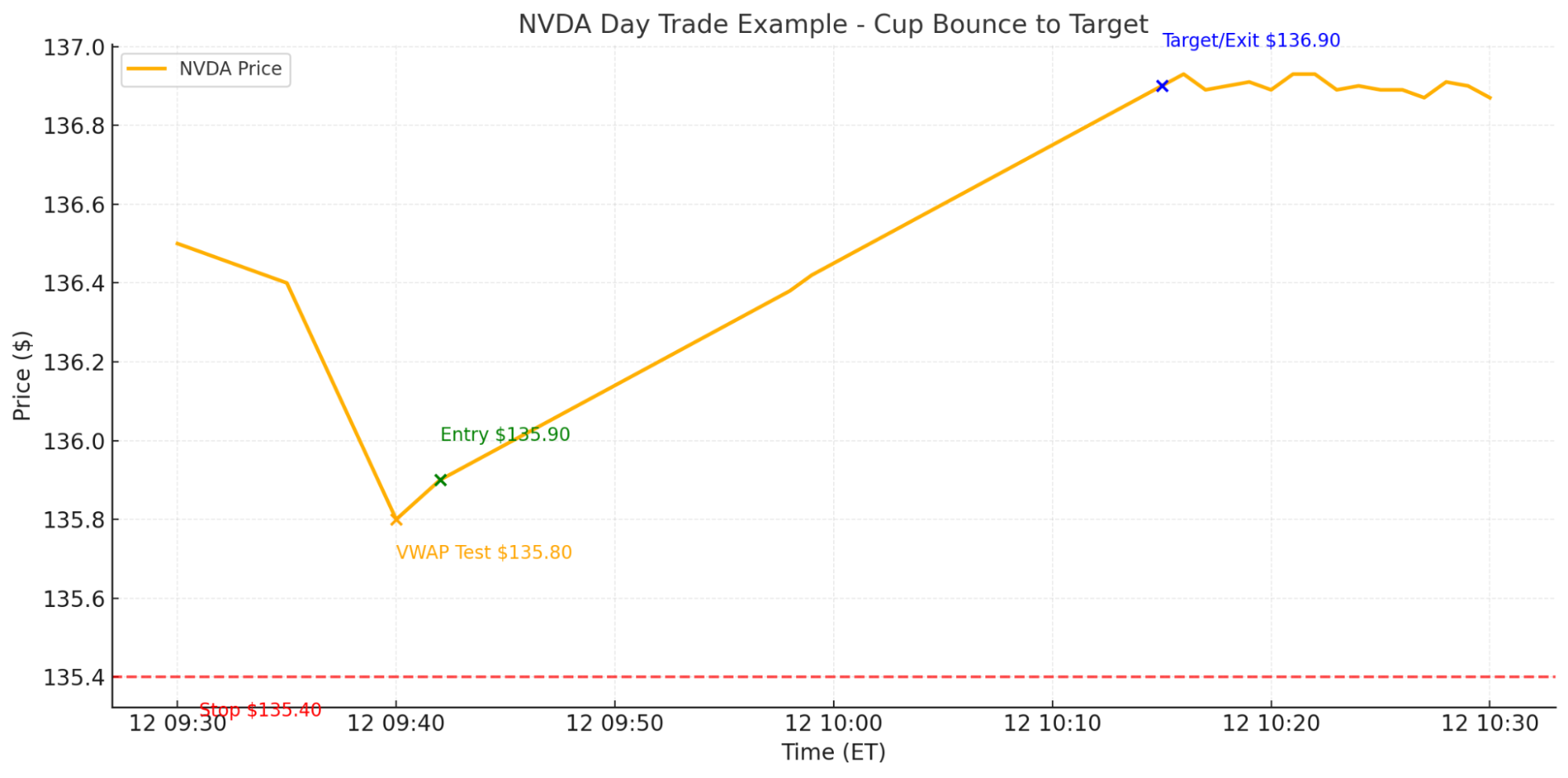

Example of a Day Trade with $10,000 and 4:1 margin*

*This is a hypothetical intraday trade example on Nvidia (NASDAQ: NVDA), modeled to illustrate how the setup works.

After the open, the stock pulled back to test its VWAP – a common support level for active traders.

Trade setup:

- 9:40 AM: Nvidia (NVDA) tests VWAP at $135.80, holding above with slowing downside momentum.

- 9:42 AM — Entry: Buy 294 shares at $135.90 as price bounces off VWAP with increasing volume.

- Stop Loss: $135.40 (risking $0.50 per share, ~$147 total risk).

- Target: $136.90 based on a 2:1 risk/reward ratio.

- 10:15 AM — Exit: Price reaches $136.90, target hit.

Result: $1.00 per share profit × 294 shares = $294 profit in 33 minutes (~2.94% account gain before commissions/fees).

If you traded the same setup without margin in a cash account, you’d only be able to buy 73 shares ($135.90 × 73 ≈ $9,929). At $1 profit per share, that’s $73 instead of $294 — still solid, but with less risk and less reward.

Even so, this is just one trade — in reality, a day trader will see a mix of winners and losers over a session.

Common Day Trading Strategies

- Scalping: Taking dozens of trades for tiny profits, often just pennies per share.

- Momentum Trading: Riding stocks making significant moves on news or unusual volume.

- Gap and Go: Trading opening gaps, either fading them or riding the continuation.

- VWAP Bounce/Break: Using the Volume Weighted Average Price as a dynamic support or resistance level (see our example above). Traders buy near VWAP on a bounce in uptrends or short near VWAP on a rejection in downtrends, often with tight stops.

- Technical Setups: Using patterns like bull flags, ascending triangles, and breakouts for quick intraday moves.

Related Reading: Tried and Approved: The Best AI Day Trading Apps

Day Trading Considerations

Intraday Volatility Advantages: The constant price movement creates numerous opportunities.

Liquidity Benefits: You’re trading the most liquid times of day, ensuring tight spreads and easy entries/exits.

Barriers to Profitability:

- Commissions add up fast (even “free” brokers have hidden costs)

- Slippage eats into profits

- Emotional stress leads to poor decisions

- Technology requirements are expensive

- The learning curve is steep

The right education can speed up your learning curve.

Our top pick for day trading classes? Investors Underground. The lessons start fairly simple, but become more complex as you progress. There are both interactive and non-interactive courses available — while the former is more expensive, as you’ll see in our Investors Underground review, it’s worth it if you want top-level education and one-on-one guidance.

Risk of Capital Loss: Day trading can destroy accounts quickly. The combination of leverage and rapid-fire decisions creates a dangerous environment.

Burnout Factor: The intensity is exhausting. Many successful day traders eventually transition to swing trading.

Pros and Cons of Day Trading

Pros | Cons |

No overnight risk | Requires $25,000+ to avoid PDT rule |

Quick profits possible | Full-time commitment needed |

Immediate feedback on trades | High-stress; risk of burnout |

Exciting and engaging | Steep learning curve |

Risky – most day traders lose money |

Gaining An Edge as a Day Trader

Success in day trading isn’t just about strategy — it’s about having the right tools. The difference between profitable and losing day traders often comes down to execution speed and information quality.

Essential Tools for Day Trading Success

A Great Broker

You need instant fills and minimal slippage. Moomoo stands out with their extended hours trading (4:00 AM to 8:00 PM ET, covering pre-market and after-hours sessions). Plus, moomoo has the best new-account promo out there:

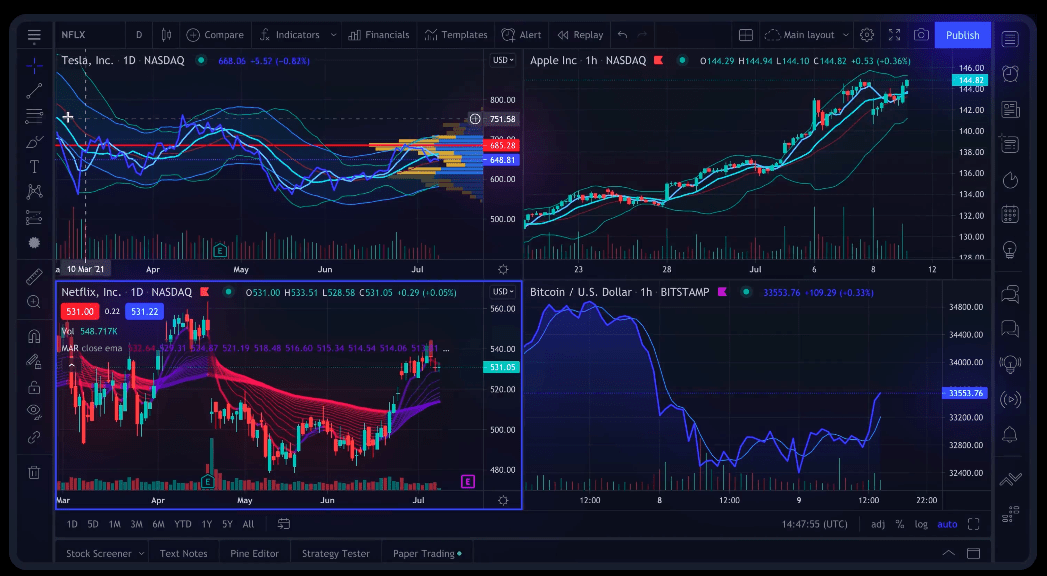

Professional Charting

TradingView Pro is non-negotiable for serious day traders. You get:

- Real-time data across all markets

- Custom indicators and alerts

- Multi-chart layouts

- Cloud-based, so your setups follow you everywhere

It’s free to get started with TradingView, but the best features for day traders are unlocked with the Plus membership tier – if you’re a day trader, you’ll need at least this level of power (extra drawing tools and charts per display).

Automated Pattern Recognition

TrendSpider takes your analysis to the next level with:

- Automated trendline detection

- Multi-timeframe analysis

- Backtesting capabilities

- Real-time alerts

Swing Trading Vs. Day Trading: Which is More Profitable?

Let’s get to the heart of it: swing trading vs day trading – which is more profitable?

Side-by-Side Profitability Comparison

Day Trading | Swing Trading | |

|---|---|---|

Typical Holding Time | Minutes to hours (no overnight holds) | Several days to weeks |

Typical Risk per Trade | 0.25–0.5% of account | 1–2% of account |

Typical Reward-to-Risk (R:R) Ratio | 1.5:1 to 2:1 | 2:1 to 3:1 |

Average Gain per Winning Trade | 0.5–2% | 5–15% |

Number of Trades | 5–50 per day | 5–20 per month |

Expected Monthly Drawdown* | 5–15% | 3–10% |

Capital Requirements (U.S.) | $25,000+ (PDT rule) | $5,000+ recommended |

Margin Leverage | Up to 4:1 intraday | 2:1 overnight |

Time Commitment | Full-time (market hours) | Part-time (analysis after hours) |

Factors Affecting Profitability

- Market Conditions: Day trading thrives in volatile markets with clear intraday trends. Swing trading performs best in trending markets with clear support and resistance levels. The question “is swing trading more profitable than day trading” often depends on current market conditions.

- Experience Level: Beginners typically find more success with swing trading. The slower pace allows time to think and learn from mistakes.

- Risk Management: Day traders might risk 0.25% per trade but take 20 trades, potentially losing 5% on a bad day. Swing traders might risk 2% per trade but only take 3 trades per week, limiting drawdowns.

- Costs: Day trading costs add up quickly. Typical ranges include market data (from ~$15/mo per exchange for non-pro real-time data such as Nasdaq Level 2 (Note: moomoo offers free Level 2 data), but $100–$300+/mo if you stack multiple depth-of-book and options feeds), platform fees (~$100–$150+/mo for direct-access software like DAS), while commission-free brokers may still pass along regulatory/exchange fees and slippage can materially erode edge in high-frequency trading.

- Swing trading costs are usually lower — you don’t need as many bells and whistles and will execute far fewer trades, so commissions/fees have less impact.

- Taxes: In the U.S., profits on positions held 1 year or less are classified as short-term capital gains and are taxed at your ordinary income tax rate. Profits on positions held more than 1 year qualify as long-term capital gains, which are taxed at generally lower rates (0%, 15%, or 20% depending on your taxable income). Be mindful of wash-sale rules, which can defer or disallow losses if you repurchase the same or substantially identical security within the 30 days before or after a sale.

Which Strategy Is Right For You?

Choosing between swing trading and day trading isn’t just about potential profits — it’s about aligning with your life. So ask yourself these questions:

1. How Much Time Do You Have?

Full-Time Available? If you can dedicate 6-8 hours daily to trading, day trading might work. But remember, this means no other job, no meetings during market hours, no distractions.

Part-Time Trader? Swing trading wins here. You can analyze charts in the evening, place orders before bed or before work, and check positions during breaks.

Save Time With a Great Stock-Picking Service

If finding time to research swing trades or longer-term investments is challenging, Zen Investor lets a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

2. What’s Your Tolerance for Volatility and Stress?

Ask yourself honestly:

- Can you handle losing money every single day? (Common in day trading)

- Are you comfortable making split-second decisions with real money?

- Can you sleep knowing you have positions open? (Required for swing trading)

- Do you get emotional after losses?

3. What’s Your Starting Capital?

Starting Capital:

Technically there’s no minimum for either trading style; however, your frequency will be limited as a day trader if your account is under $25K. That said, these are generally considered base minimums if you want to get serious about either trading style:

- Day Trading: $25,000 minimum (U.S. PDT rule), ideally $50,000+

- Swing Trading: $5,000 minimum, ideally $10,000+

4. Are You Willing to Learn?

Day trading requires months of education and practice before going live. Swing trading concepts are simpler to grasp, though mastery still takes time.

Test Both Approaches Through Paper Trading

Before risking real money, practice with paper trading. eToro’s paper trading is perfect for this — you get $100,000 in virtual funds to test strategies without risk.

One idea to try? Spend at least one month paper trading each style. Track your results meticulously:

- Win rate

- Average gain/loss

- Time spent trading

- Which felt more natural?

Final Word:

When comparing swing trading and day trading, the question isn’t which strategy is objectively “better,” but which one aligns best with your personality, schedule, and risk tolerance.

For most beginners and part-time traders, swing trading often provides a more sustainable route. The slower pace allows for thoughtful analysis, larger profit targets per trade, and a trading schedule that fits around other commitments — all without the high stress and constant monitoring required by day trading.

Day trading can deliver rapid results for a skilled, well-capitalized trader with the discipline and focus to handle its intensity. But research consistently shows that the majority of retail day traders lose money, making it a high-risk endeavor.

Ultimately, the best choice is the one you can execute consistently and manage with discipline. Start with paper trading, measure your results, and honestly evaluate which style suits your lifestyle and temperament.

FAQs:

Is it better to swing trade or day trade?

It depends on your lifestyle and personality. Swing trading is better if you have a full-time job, prefer less stress, and can handle overnight risk. You'll make fewer trades but aim for larger gains per trade.

Day trading can fit if you have the time to monitor markets throughout the session, thrive under fast decision-making, and want to avoid holding positions overnight.

In the U.S., the Pattern Day Trader (PDT) rule applies to margin accounts making 4+ day trades in 5 business days when those trades are more than 6% of your total activity — this requires at least $25,000 in equity to continue day trading without restriction.

If you have less than that, you can still day trade using a cash account, but you must stay within settled-fund limits to avoid “good faith” or “free-riding” violations under T+1 settlement.

Is day trading profitable?

Day trading can be profitable, but research shows the vast majority of day traders lose money. Studies from Brazilian futures markets found 97% of persistent day traders lost money, while research in Taiwan showed similar results.

The successful minority typically have:

-Significant capital ($50,000+)

-Full-time dedication

-Years of experience

-Strict risk management

-Professional-level tools

Returns vary dramatically based on skill and market conditions. There's no reliable data on typical annual returns across all retail day traders, but success requires treating trading as a serious business, not a hobby.

Is swing trading profitable?

Swing trading can be profitable — but it’s not an automatic money machine. The reality is that many beginners struggle at first.

Some experts claim that as many as 9 out of 10 new swing traders may not end their first year with a profit. That’s usually because they jump in without a clear plan, risk too much on single trades, or don’t stick to their rules.

On the other hand, traders who take the time to learn, practice, and manage risk carefully often see much better results. Experienced swing traders sometimes report win rates around 35–50%, with individual winning trades delivering double-digit percentage gains in strong market conditions.

What is the 2% rule in swing trading?

The 2% rule states you should never risk more than 2% of your account on a single trade. Here's how it works:

With a $10,000 account:

-Maximum risk per trade: $200

-If your stop loss is $2 from entry, you can buy 100 shares

-If your stop loss is $1 from entry, you can buy 200 shares

This rule ensures that even a string of losses won't destroy your account. Ten consecutive losses would only draw down 20% — painful but recoverable. Without this rule, a few bad trades could wipe you out.

Is swing trading still profitable?

Yes — especially now. Modern technology has leveled the playing field. Tools like automated scanners, robust backtesting frameworks, AI-powered alert systems, and powerful charting platforms (such as TrendSpider, TradingView, TC2000) make identifying high-probability swing setups faster and more efficient than ever

How much money do day traders with $10,000 accounts make per day on average?

Day trading results vary widely, but for most traders starting with $10,000, the typical outcome is a net loss.

For experienced, disciplined traders, a realistic range is around $100–$200 per week. For beginners, the odds strongly favor losing money, especially in the early learning phase.

For many, swing trading may provide a more sustainable and less stressful path to profitability over time.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.