Investor’s Business Daily claimed to create a tool that could help new swing traders beat the market. Since 90% of new swing traders fail to make a profit, that claim sparked a lot of interest…

But, do they actually deliver? Is IBD SwingTrader worth it?

I decided to answer those questions, and more, in this thorough Swing Trader review.

Stick around to learn what IBD SwingTrader is, how it operates, if it delivers, and if not, what alternatives are out there to help you swing trade with confidence.

The Bottom Line: Is IBD SwingTrader Worth It in 2025?

IBD SwingTrader is the brainchild of Investor’s Business Daily, a company that provides a curated list of stocks, complete with trade plans, alerts, and annotated charts through a simplified beginner-friendly platform for swing traders.

However, as you can see below, there’s some stiff competition out there in the market that may have more to offer to investors with more flexible time horizons, including Motley Fool Stock Advisor, Seeking Alpha, and WallStreetZen’s Premium and Zen Investor Services. We’ll dig deeper into these alternatives later on in this Swing Trader review.

A more affordable alternative…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get for just $99 ($79 for a limited time, using links in this post):

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Swing Trader Review

Rating: 3.5/5

What is IBD SwingTrader?

IBD SwingTrader was developed by the renowned finance publication, Investor’s Business Daily. They designed it to take the complex world of swing trading and distill it down to a simplified process fit for beginners.

They provide basic swing trading educational resources and services, including 1:1 coaching calls, something that is rare in this industry. They also give stock picks along with recommended trade schedules and alerts.

How Does SwingTrader Work?

IBD SwingTrader curates a list of stock picks. Each pick comes with a trade plan, alerts, and easy-to-read charts.

The company targets gains within 5-10%. Trades typically last for around 3-10 days with stop losses set at 3-5% below the entry point.

Their claim to fame is that they follow the CAN SLIM® Investing System, a systematic approach to using criteria to find potential stocks that uses a combination of fundamental and technical analysis infused with momentum investing principles.

SwingTrader Features

- Access to Long and Short Trades

- Trade Setup for Every Trade, Including Buy Zone, Profit Goal, and Stop Loss

- Detailed Charts With Buy and Sell Points Clearly Marked on Each Chart

- Push Notifications and Email Alerts That Link Directly To Trading Ideas

- Live Quotes

- Easy Swipe Functionality For Quick Stock Idea Browsing

- Access to Past Trades and Chart Notes

- IBD’s Market Analysis Customized for a Swing Trading Environment

- Can Slim® Investing System Specially Curated by Long Time, Successful Investor and IBD® Founder William O’Neil

- Access To Scorecard, a Market Masters Monthly Virtual Meetup

- Quick Access to Free Coaching & Support Calls

- Curated Stock Recommendations

- Trade Management Tools

- Real-Time Alerts

- Educational Resources

IBD Swing Trader Performance

Regrettably, the IBD Swing Trader performance has been inconsistent — this remains a complaint in many a Swing Trader review.

- In 2020, the platform averaged 1.2% profit per trade; over 40% of trades closed at a loss.

- In the first half of 2021, IBD SwingTrader returned 11.7% — better than the year before, but lacking compared to the S&P 500’s 17.0% performance.

The company aims for profits around 5-10% — well below the S&P 500’s 11.8% historical returns. The only benefit to this I can think of is SwingTrader is a learning tool for those trying to break into the world of swing trading.

Roughly 90% of swing traders stop trading in their first year, making very little, and often losing money. If you could learn how to swing trade with relative ease — while earning steady returns of 7%-10%, I can see why that might be appealing.

In fact, I am surprised that they do not highlight that in their marketing. I feel doing so might mitigate some of the negative IBD Swing Trader reviews out there.

SwingTrader Pricing

IBD SwingTrader offers two transparent pricing plans and an optional trial period.

- 5-Week Trial: $50

- Monthly: $69/month

- Annual: $699/year

IBD Swing Trader Review: What are Customers Saying?

Unfortunately, most customers left a Swing Trader review that veered towards disappointment, expressing their dissatisfaction with its lackluster performance results, especially when compared to the S&P 500, which it consistently trailed.

Negative IBD Swing Trader reviews aside, the platform seems to shine as a simplified, easy-to-use platform with robust educational resources.

SwingTrader Customer Service

The platform really shines with its customer support. In fact, that is noted repeatedly in most Swing Trader reviews.

They offer regular webinars and customer coaching support via phone and email, something that is very rare in this industry, and often only provided with expensive pro plans.

Some people will hire experts to make trades for them, but those services rarely come with coaching support and usually have high commissions.

Is SwingTrader Legit?

Yes. IBD SwingTrader is a 100% legitimate trading platform developed by a reputable company.

What raises eyebrows among potential users is the IBD Swing Trader performance and data analysis rarely align with their projection timeline, negating the effectiveness of their alerts and trading plans.

SwingTrader Vs. the Competition…

Earlier, I shared a chart comparing SwingTrader and some of its competitors. Let’s dig a little deeper:

Service | Pricing | What You Get | Who It’s Best For |

|---|---|---|---|

SwingTrader | $69/Month Or $699/Year |

| Beginner Swing Traders Looking for a Simple Platform |

$199/Year (Special Limited-Time $99 Offer For New Members) |

| Long-Term Investors Seeking Well-Researched Stock Picks | |

$29.99/Month Or $239.88/Year For Premium |

| Investors Seeking In-Depth Analysis and a Variety Of Investment Ideas | |

$20/Month Or $180/Year |

| Busy Beginner and Experienced Investors Looking for Data-Driven Insights and Tools for Stock Research |

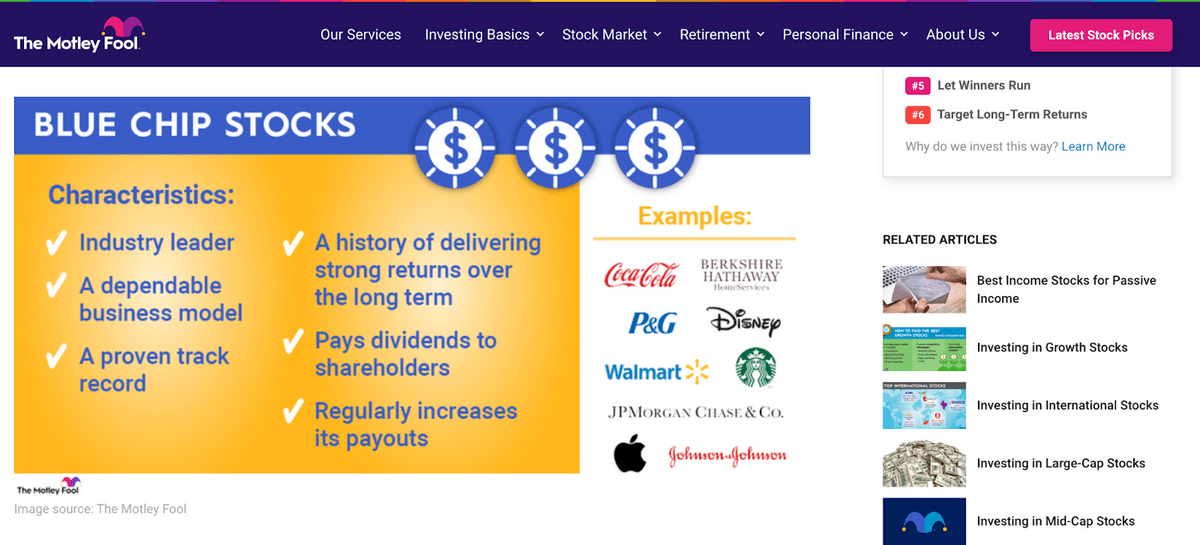

SwingTrader Vs. Motley Fool Stock Advisor

Motley Fool Stock Advisor is a premium stock recommendation service offered by The Motley Fool, a highly respected financial and stock recommendation company.

Though it does not specifically cater to swing traders, the company offers expert advice backed by extensive research, transparency, and a long-term investment approach.

Many investors opt to use them, including some swing traders, but they gear their recommendations to stocks you want to hold for a longer period.

Usability

The Motley Fool is celebrated for its ease of use, educational content, in-depth analysis, and spot-on advice on various stocks and investment themes. Since their recommendations can be trusted to perform close to expectation, they really save investors time on research and analysis.

Features

They offer comprehensive educational resources, including articles, videos, and podcasts, to build a strong investing foundation. Its supportive community allows you to interact, ask questions, and learn from others’ experiences.

Their stock picks are more long-term, high-quality stocks, and come with easy-to-follow analysis.

Comparison

In contrast, SwingTrader focuses on short-term trades typically more appealing for swing traders.

Though the platform offers coaching calls and meetups, it doesn’t seem IBD SwingTrader offers the same caliber of educational resources as the Motley Fool Stock Advisor since SwingTrader focuses on a lot of the basics.

While the IBD SwingTrader performance has been inconsistent, Motley Fool Stock Advisor boasts a solid track record of outperforming the market, with its average stock pick returning over 500%* since 2002. (As of 1/25/24)

Head-to-Head: SwingTrader Vs. Motley Fool Stock Advisor

SwingTrader | Motley Fool Stock Advisor | |

|---|---|---|

X | Cost | Winner |

Winner | Good For Beginners | X |

Tie | Ease Of Use | Tie |

X | Best Analysis Tools | Winner |

X | Best Hand-Picked Stocks | Winner |

X | Education Resources | Winner |

X | Stock Recommendation Performance | Winner |

Winner | Specifically Geared toward Swing Trading | X |

The Verdict?

SwingTrader is best for beginners looking for a simple platform to get started with swing trading.

Simplifying things, especially in the beginning, can really help with things like decision paralysis, so if you are new to swing trading and this is a typical problem for you, definitely consider SwingTrader.

Motley Fool Stock Advisor is best for long-term investors and swing traders willing to hold onto stocks longer term. It’s great for those seeking well-researched, accurate stock picks with growth potential.

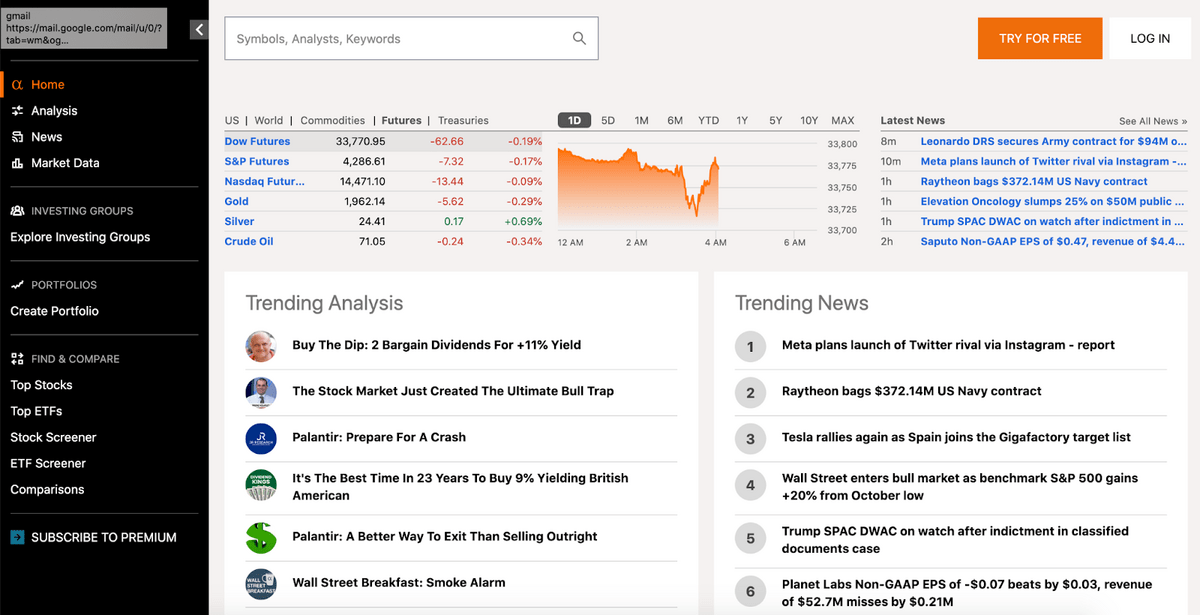

SwingTrader Vs. Seeking Alpha

Seeking Alpha is a comprehensive financial market analysis platform that offers investors access to a vast library of expertly curated content, including research articles, earnings call transcripts, and stock ratings, as well as a suite of portfolio management tools.

Usability

Seeking Alpha stands out with its crowdsourced approach, providing access to numerous vetted opinions and insights for all investment levels.

The comprehensive nature of the platform may feel like a lot for beginners, but their consistent performance makes their recommendations reliable, which is ideal for an investor of any experience.

Features

They offer a wide range of analysis tools, including fundamental and technical analysis, as well as various metrics and indicators. Its comprehensive portfolio tracking feature allows users to monitor investments and receive relevant news and analysis.

They also have helpful features such as stock screeners, Strong Buy stock picks, relevant market updates, and more.

Comparison

SwingTrader is a beginner-friendly platform focused on curated, swing trading opportunities, while Seeking Alpha offers a more comprehensive and diverse approach to investing.

The educational content quality of Seeking Alpha surpasses that of IBD SwingTrader’s more fundamental and basic knowledge base.

Performance-wise, SwingTrader pales next to Seeking Alpha, whose back-tested strategy has consistently outperformed the S&P 500 12 years in a row.

Head to Head: SwingTrader Vs. Seeking Alpha

SwingTrader | Seeking Alpha | |

|---|---|---|

X | Cost | Winner |

Winner | Good For Beginners | X |

Winner | Ease Of Use | X |

X | Best Analysis Tools | Winner |

X | Best Hand Picked Stocks | Winner |

X | Education Resources | Winner |

X | Stock Recommendation Performance | Winner |

Winner | Specifically Geared toward Swing Trading | X |

The Verdict?

SwingTrader is best for beginners looking for a way to get started with swing trading while lowering risk and earning losses.

Seeking Alpha is best for investors seeking a wide range of investment ideas backed by thorough research and analysis.

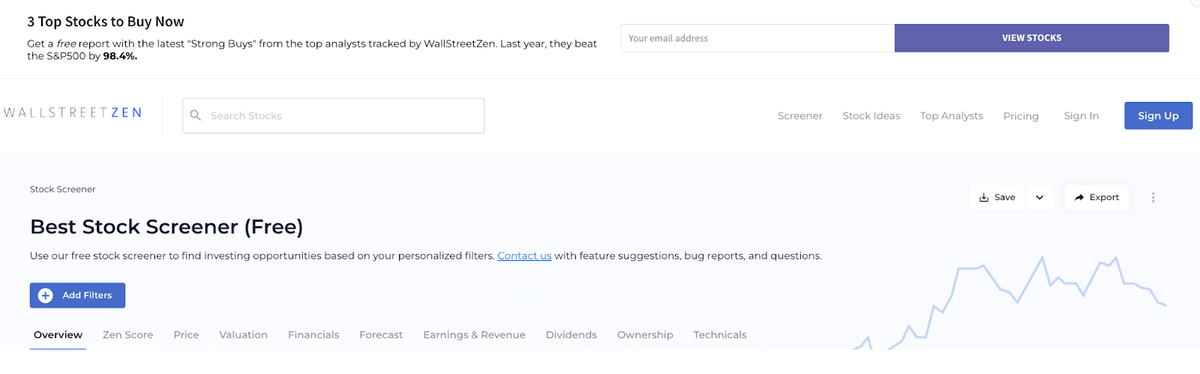

SwingTrader Vs. WallStreetZen Premium

WallStreetZen is an innovative platform designed to empower investors by providing them with insightful financial data and easy-to-understand analytics.

Using the latest technology to create user-friendly tools such as the Advanced Stock Screener, the platform offers stock comparison tools, in-depth financial analysis, expert-curated content, and more.

Usability

WallStreetZen has an intuitive interface and focuses on the modern investor, something that many platforms forget about.

Instead of narrowly focusing on outdated investing practices that might be better suited for institutions or those with an unusually large income, they provide tailored advice to investors who may not be experts in the industry, are busy with other priorities, and have a somewhat limited budget.

As a result, their recommendations use everyday terminology, are easy to follow, make sense for most budgets, and have your goals in mind.

Features

WallStreetZen Premium includes unlimited access to due diligence checks, their stock evaluator, stock and market forecasts, recommendations from top-performing analysts, enhanced stock screener tools with customizable filters, and a sleek and user-friendly platform.

Comparison

Though both platforms focus on educating investors, ultimately, IBD SwingTrader and WallStreetZen Premium are two distinct investment platforms, with WallStreetZen concentrating on fundamental analysis and SwingTrader targeting swing trading strategies.

Using a specific stock analyst performance methodology WallStreetZen was able to beat the S&P 500 98.4% of the time, while SwingTrader consistently trailed it.

Head to Head: SwingTrader Vs. WallStreetZen Premium

SwingTrader | WallStreetZen Premium | |

|---|---|---|

X | Cost | Winner |

Tie | Good For Beginners | Tie |

Tie | Ease Of Use | Tie |

X | Best Analysis Tools | Winner |

X | Best Hand Picked Stocks | Winner |

X | Education Resources | Winner |

X | Stock Recommendation Performance | Winner |

Winner | Specifically Geared toward Swing Trading | X |

The Verdict?

SwingTrader is best for beginners looking for a way to have their hand held through their first year or so of swing trading while limiting their losses.

WallStreetZen Premium is best for investors looking for data-driven insights and easy-to-use, advanced research tools.

Is A Good Swing Trade Platform All You Need?

Short answer: Probably not.

Swing trading is a more advanced form of trading than long-term trading. Since you turn over a stock quicker than once every 1-5 years, swing trading is fast pace, requires more time analyzing, and has more opportunities to lose (and make) money.

That said, it really is a good idea to get a solid foundation under you. The good news is, you don’t have to go back to university to learn the basics of investing.

In fact, you can finish the Complete Foundation Stock Trading Course by Udemy in as little as 9 hours.

Taught by Mohsen Hassan, a highly experienced trader and the founder of Bloom Trading, there is a lot to learn in the short course, including how the stock market works, the difference between exchanges, trading psychology, and more.

After that, you will want to learn, at a minimum, the best swing trading indicators as well as the best timeframe for swing trading to really succeed in this endeavor.

Need more swing trading resources? Click the link to find the best platform for swing trading.

Final Word: Swing Trader Review

IBD SwingTrader proves itself as a beginner-friendly platform. Their curated list of stocks, trade plans, trade alerts, and easy-to-read charts are definitely designed to make new swing traders’ lives easier.

But, my Swing Trader review would be negligent if it did not hold stock to its inconsistent historical performance.

Again, the platform performs better than 90% of swing traders getting started — something that should not be ignored for those wanting to branch into the world of swing trading — but it appears most traders will quickly outgrow the platform, at least if you want to improve your stock performance.

If you’re seeking better returns and more comprehensive research tools, explore alternative platforms, such as Motley Fool Stock Advisor, Seeking Alpha, or WallStreetZen Premium.

FAQs:

Does swing trading really work?

Yes, swing trading can work for those well-versed in the world of investing. Swing trading is an advanced investment skill that requires time, expertise, and some seed money.

Do swing traders actually make money?

Some swing traders can make money consistently, while others struggle to achieve consistent profits. Success depends on factors such as the trader's skill level, risk management, and market conditions.

How much does the average swing trader make?

The average swing trader makes a range of money. 90% do not make a profit at all, but the 10% who do have an income range from $19,000 to upwards of $100,000+. Those who earn any income, make an average of about $30,000.

How much money do you need to be a swing trader?

The money needed to be a swing trader will vary with your budget, risk tolerance, strategy, and choice of stock, but it is a good idea to start with $5,000-$10,000 and limit each trade to roughly $100. Each trade should ideally be under 1-2% of the total balance to mitigate risk.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.